Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Working here at Quill as the Accounts Assistant for the last 4 years and having previously owned a successful bookkeeping business and supported my husband with his business accounts for over 15 years, I know first-hand how important a disciplined approach to your accounts is for a sound and healthy business.

Here are my Top 5 tips for successful account keeping practices:

1. Get automated

Invest in a professional online Accounting Software program. The monthly subscription costs can be claimed as an expense to your business and far out-weigh the value of your time and resources. This will give you back valuable time to re-invest into your business and focus on the big picture, and not spend your precious time on the small stuff.

I would also recommend you investigate some of the add-on apps available too. These apps can upload your small receipts on the go, so no more crumpled up pieces of paper in your car or handbag.

I will include some links below that I use and recommend. There are many more on the market and it is a personal choice as to which work best for you and your business.

2. Be organised

Spend time getting your accounts in order and set up a schedule for bookkeeping duties. Put aside time either weekly, fortnightly or monthly to record your business expenditure and review your accounts payable and receivable.

If you are time poor, think about hiring a professional bookkeeper for a few hours per week/month to help with these tasks. Your expertise in your business can be better spent on productive and income producing activities. Outsource the small stuff.

3. Utilise Supplier payment terms

Ask your suppliers for payment terms rather than COD. Set up 30 day accounts where you can and utilise these terms to free up cashflow.

4. Follow up your Debtors

Don’t be afraid to follow up overdue invoices owed to you. Most times it is simply a forgotten invoice and a quick call is all it takes to get paid.

Some online accounting software programs have in-built invoice reminder features, or use an add-on app that sends automated reminders, meaning you don’t have to be on the phone chasing money and can help take the stress out of these tasks.

5. Align your business with an experienced Accounting Practice

It’s important to have a professional accounting practice you can trust, so ask colleagues or business associates for recommendations. Seek out a firm who has experience with your type of business. Take the time to build a trusted relationship with your accountant to gain the very best financial outcome for you and your business. Need help with this? Get in contact with Quill Group today.

Here are some links that I use and recommend:

Xero Accounting Software – https://www.xero.com/au/

Receipt Bank – https://www.receipt-bank.com/

Invoice Sherpa – https://www.invoicesherpa.com/

If you run a business, it’s more than likely you have desires to grow. But this probably comes with mixed emotions, one of which is usually fear.

Not a fear of growing, more a fear of what it will bring. Will you lose control of your processes? Do you have to invest in more hardware? And will you require a larger team, which can bring a whole new set of worries.

A larger team means more training and management. You’ll be faced with challenges finding the ideal people and building the right team, not to mention keeping your existing team happy and valued. There is a reason acquiring and retaining the right team members has been identified as a major barrier for all businesses.

And it’s no wonder that despite your yearning to grow, you might be tempted to stick with running your business the way you do now.

But why should you settle?

There is a better way.

Growing your business doesn’t always require a bigger team. You don’t need to turn your back on the reasons you built your business in the first place, spending endless hours recruiting and training, or create a whole set of new problems for yourself. Not if you are smart about how you approach your growth.

Be clever about the way you utilise your existing resources. Improve your efficiencies in every possible way by redesigning, defining, and documenting your processes. Automate wherever possible. Look at where you are making the most revenue and make changes that will empower your team to boost their output. If you can do this properly, growing your business will be a certainty. And this can be without any increase to your staff overheads.

Some of the essential steps to help you achieve this are:

-

- Focus On Output – look at process refinement. Improving the method your team delivers output will lead to big gains – you will be able to produce more in less time.

-

- Standardisation – You can’t improve a process if your team are doing the same tasks in a different manner to each other.

-

- Improve Your Process – Explore every option to speed up the way every task is performed.

-

- Automation – When you find ways to automate processes that were previously manual, you will start to see big gains in efficiency.

-

- Look at where the revenue comes in—and where it doesn’t – look at the areas of your business where time and money is spent but takes a longer period of time to convert into sales. Explore avenues to reduce this time and standardising the process, or alternatively decide if this revenue stream is worth keeping.

Growth doesn’t have to be scary, it can be exciting and rewarding in more ways than one.

With the 30 June 2018 fast approaching now is a great time to discuss possible tax savings strategies for your business.

Below are several strategies to think about prior to 30 June 2018:

1. Pay Employee Superannuation

To secure a tax deduction for your June 2018 quarterly superannuation owing, you will need to pay this amount prior to 30 June 2018. This payment must clear your bank account prior to 30 June 2018 for it to be considered a tax deduction in the 2018 tax year. We recommend you make these payments by 20 June 2018 to ensure there is sufficient time for the contributions to clear in the employee’s super fund.

2. Concessional Contributions Cap of $25,000

As a business owner you may wish to contribute extra superannuation into your super fund to obtain a tax deduction. Please note: that the contributions cap includes compulsory super guarantee (SG) payments made by your employer and salary sacrificed amounts. For the 2018 financial year the concessional contributions cap is $25,000 for all age groups. Please ensure you do not exceed this cap as it could be a costly mistake.

3. Defer Income

If possible, delay issuing invoices to your customers until after 30 June 2018. This will push that income into the following financial year.

4. Bring forward expenses

If possible, you could incur expenses for business use prior to 30 June. This way these expenses will be included in the 2018 financial year rather than 2019 financial year, reducing your tax payable in the 2018 financial year. (Examples include: consumables, repairs, and office supplies).

5. Prepayment of expenses (Small Business Entities only)

If possible, you could review your expenses to determine if any of your 2019 expenses (i.e. rent, insurance or subscriptions) could be prepaid. As a Small Business Entity (SBE) you can get a tax deduction in the 2018 financial year for expenses you prepay relating to the 2019 financial year as long as the prepayment was made prior to June 2018 and it is not for a period of more than 12 months. To qualify as a small business entity (SBE) for the 2018 financial year, you need to be operating a business and have aggregated turnover of less than $10,000,000.

6. Small business instant asset write-off of $20,000 (Small Business Entities only)

For SBE’s the instant asset write-off threshold is $20,000 for the 2018 financial year. This instant asset write-off applies to most assets but there are some exclusions so if you are unsure please check with us before you purchase your business assets. If you are an SBE and you purchase an eligible business asset with a value of $20,000 or less prior to 30 June 2018, you can get a deduction for the full amount in the 2018 financial year. To qualify as a small business entity (SBE) for the 2018 financial year, you need to be operating a business and have aggregated turnover of less than $10,000,000.

7. Review of your debtors

You could review all of your debtors to determine if you have any outstanding debtors that are unlikely to pay? If so, you should consider writing these off prior to 30 June 2018 so you are not paying tax on money you are not going to receive.

8. Review of your depreciation schedule (Non-Small Business Entity clients only)

You could review your depreciation schedule for any assets that should be written off (because they are obsolete, no longer used in business or have been stolen) prior to 30 June 2018. This could enable you to get a tax deduction for the closing book value of the asset written off in the 2018 financial year.

9. Motor Vehicle Expenses

To maximise your motor vehicle tax deductions please ensure you have a valid logbook. Having a valid logbook gives us more options to choose from when we are selecting an ATO calculation method for your motor vehicle claim each financial year. For a logbook to be valid it needs to be kept for a period of 12 continuous weeks and it should be no more than 5 years old.

10. Stock take

If you hold stock on hand, you should complete your stock take as close to the 30 June 2018 as possible. Once completed, you should review your stock take to identify any obsolete/worthless items that need to be written off. By writing off these items prior to 30 June 2018 you will receive a tax deduction for the cost of this stock.

11. Reducing the corporate tax rate

From the 2018 financial year a company that qualifies as a Base Rate Entity (BRE) will be taxed at the lower corporate tax rate of 27.5%. For a company to qualify as a BRE, they must meet the following three criteria:

- Have an aggregated turnover of less than $25,000,000 and

- Be carrying on a business, and

- Have no more than 80% base rate entity passive income (This last one is currently a proposed amendment to the law but if it is passed will take affect from the 2018 financial year).

12. Trust Distribution Minutes

Have you completed your Trust Distribution Minutes? Your Trust Distribution Minute records the Trustee’s intention to allocate the Income of the Trust to the beneficiaries in a specific manner. The 2018 Trust Distribution Minute needs to be completed and signed by 30 June 2018.

If you would like to discuss any of these tax saving strategies with us please feel free to get in touch with our experienced team at Quill Group. It would be our pleasure to assist you with any of your business accounting needs.

The Fringe Benefits Tax (FBT) year ends on 31 March. We’ve outlined the key hot spots for employers and employees:

- Motor vehicles – using the company car outside of work

- New safe harbour for utes and commercial vehicles

- Car parking – are you really declaring the true cost of parking?

- The living away from home allowance – the common errors

- Salary sacrifice or employee contribution – where employers are getting it wrong

- Housekeeping essentials – FBT rates and how to save some time

- Not registered for FBT – the areas where the ATO’s view might differ

- Crackdown on salary sacrifice calculations

Motor Vehicles – using the company car outside of work

Just because your business buys a motor vehicle and it is used as a work vehicle, that alone does not mean that the car is exempt from FBT. If you use the car for private purposes – pick the kids up from school, doing the shopping, use it freely on weekends, garage it at home, your spouse uses it – FBT is likely to apply. While we’re sure the old, “what the Australian Tax Office (ATO) doesn’t know won’t hurt them” mentality often applies when the FBT returns are completed, it might not be enough. The private use of work vehicles is firmly in the sites of the ATO.

Private use is when you use a car provided by your employer (this includes directors) outside of simply travelling for work related purposes.

If the work vehicle is garaged at or near your home, even if only for security reasons, it is taken to be available for private use regardless of whether or not you have permission to use the car privately. Similarly, where the place of employment and residence are the same, the car is taken to be available for the private use of the employee.

Finding out that a car has been used for non work-related purposes is not that difficult. Often, the odometer readings don’t match the work schedule of the business. These are areas the ATO will be looking at.

Utes and commercial vehicles – the new safe harbour to avoid FBT

When an employer provides an employee with the use of a car or other vehicle then this would generally be treated as a car fringe benefit or residual fringe benefit and could potentially trigger an FBT liability.

However, the FBT Act contains some exemptions which can apply in situations where certain vehicles (utes and other commercial vehicles for example) are provided and the private use of the vehicles is limited to work-related travel, and other private use that is ‘minor, infrequent and irregular’.

One of the practical challenges when applying the exemption is how to determine if private use has been minor, infrequent and irregular. The ATO recently released a compliance guide that spells out what the regulator will look for when reviewing the use of the exemption.

The ATO has indicated that in general, private use by an employee will qualify for the exemption where:

- The employer provides an eligible vehicle to the employee to perform their work duties. An eligible vehicle is generally a commercial vehicle or one that is not designed mainly for carrying passengers. The requirements are very strict and guidance on this is published on the ATO website.

- The employer takes reasonable steps to limit private use and they have measures in place to monitor this – this might be a policy on the private use of vehicles that is monitored using odometer readings to compare business kilometres and home to work kilometres travelled by the employee against the total kilometres travelled.

- The vehicle has no non-business accessories – for example a child safety seat.

- The value of the vehicle when it was acquired was less than the luxury car tax threshold ($75,526 for fuel efficient vehicles in 2017-18 and $65,094 for other vehicles).

- The vehicle is not provided as part of a salary sacrifice arrangement; and

- The employee uses the vehicle to travel between their home and their place of work and any diversion adds no more than two kilometres to the ordinary length of that trip, they travel no more than 750 km in total for each FBT year for multiple journeys taken for a wholly private purpose and, no single, return journey for a wholly private purpose exceeds 200 km.

If you meet all these specifications, the ATO has stated that it will not investigate the use of the FBT exemption further. However, the employer will still need to keep records to prove that the conditions above have been satisfied and to show that private use is restricted and monitored.

If these conditions are not met then this doesn’t necessarily prevent the exemption from applying, but you can expect that the ATO would devote more time and resources in checking whether the conditions have actually been met. Employers who do not take active steps to check the way commercial vehicles are being used are at high risk of significant FBT liabilities.

Car parking

We all know how expensive commercial car parks can be. The ATO has noticed that where car parking benefits are being declared (that is, where an employer provides parking to an employee), the value of what is being declared is significantly less than what you would expect to pay.

Common errors include:

- Market valuations that are significantly less than the fees charged for parking within a one kilometre radius of the premises on which the car is parked;

- Using parking rates or facilities not readily identifiable as a commercial parking station;

- Rates charged for monthly parking on properties purchased for future development that do not have any car parking infrastructure; and

- Insufficient evidence to support the rates used as the lowest fee charged for all day parking by a commercial parking station.

Living away from home allowances

Living Away From Home Allowances (LAFHA) continue to cause confusion for both employers and employees.

A LAFHA is an allowance paid to an employee by their employer to compensate for additional non-deductible expenses they incur, and any disadvantages suffered, because the employee’s job requires them to live away from their normal residence.

As a starting point, FBT applies to the full amount of the allowance that has been paid. However, if certain strict conditions can be satisfied the taxable value of the LAFHA fringe benefit can be reduced by the exempt accommodation and/or food component.

Common errors include:

- Mischaracterising an employee as living away from home when they are really just travelling in the course of their work. The ATO has released updated guidance in this area in TR 2017/D6.

- Failing to obtain the declarations required from employees who have been provided with a LAFHA.

- Claiming a reduction in the taxable value of the LAFHA benefit for exempt accommodation and food components in circumstances that don’t meet the criteria.

- Failing to substantiate accommodation expenses and, where required, food or drink. Verifying accommodation expenses is important as the ATO will look closely for scenarios where employees are paid an allowance but go and stay with friends or relatives or stay somewhere cheaper and pocket the difference. The expense actually has to be incurred and substantiated.

Salary sacrifice or employee contribution?

One issue that frequently causes confusion is the difference between the employee salary sacrificing in order to receive a fringe benefit and making an employee contribution towards the value of that fringe benefit.

Salary sacrificing for a fringe benefit

To be an effective salary sacrifice arrangement (SSA), the agreement must be entered into before the employee becomes entitled to the income (e.g., before the period in which they start to perform the services that will result in the payment of salary etc.).

Where an employee has salary sacrificed on a pre-tax basis towards the fringe benefit provided – laptop, car, etc., they have agreed to give up a portion of their gross salary on a pre-tax basis and receive the relevant fringe benefit instead.

As a starting point, the taxable value of the fringe benefit is the full value of the expense paid by the employer. The salary sacrifice arrangement doesn’t actually reduce the FBT liability for the employer.

The employer recognises a lower cost of salary and wages provided to the employee as their ‘cost saving’, which results in lower PAYG withholding and superannuation contribution obligations, but they still recognise the full value of the fringe benefit as part of their taxable fringe benefit which is subject to FBT.

The employee recognises that they have a reduced amount of salary and wages, and a non-cash benefit in the form of the fringe benefit.

What is an employee contribution?

An employee contribution is made from post-tax income and will often form part of arrangements relating to car fringe benefits. The employee recognises the gross salary and wages as income in their tax return. However, the payment of an after-tax employee contribution would generally have the effect of reducing the taxable value of the fringe benefit that was provided to them by the employer.

The employer would still be subject to the ‘standard’ PAYG withholding and superannuation contribution obligations in relation to the gross salary and wages amount.

The ATO is looking for discrepancies with contributions paid by an employee to ensure that these have been treated consistently for income tax and GST purposes as well as on the FBT return. This is really an issue for the employer and a discrepancy may mean that there is an FBT exposure or that the employer has paid less GST or income tax than what they should have.

Housekeeping

If your business has cars and you need to record odometer readings at the first and last days of the FBT year (31 March and 1 April), have your team take a photo on their phone and email it through to a central contact person – it will save running around to every car.

FBT rate change

The FBT rate decreased on 1 April 2017 when the 2% debt tax on high income earners ended on (Temporary Budget Repair Levy) 30 June 2017. The FBT rate was brought into line with the Debt Tax to discourage high income earners from using the FBT system to lower their taxable income.

Remember to review salary packaging arrangements to ensure they remain effective.

| FBT year | FBT Rate | Type 1 Gross Up rate | Type 2 Gross Up rate |

| 1 April 2017 onwards | 47% | 2.0802 | 1.8868 |

Should I be registered for FBT?

If you have employees (including Directors of a company) then it’s possible your business needs to register for FBT. Generally, your business needs to register for FBT if you are providing any benefits to employees that are not exempt from FBT. So, if you provide cars, car spaces, reimburse private (not business) expenses, provide entertainment (food and drink), employee discounts etc., then you are likely to be providing a fringe benefit.

There is a list of exemptions that are considered exempt from FBT, such as portable electronic devices like laptops and iPads (although there are rules around how many), protective clothing, tools of trade etc. If your business only provides these exempt items, or items that are infrequent and valued under $300, then you are unlikely to have to worry about FBT.

Crackdown on salary sacrifice calculations

A loophole in the superannuation guarantee legislation allows unscrupulous employers to reduce their superannuation guarantee (SG) obligations when employees salary sacrifice contributions into superannuation. The loophole occurs when employers calculate SG on the post salary sacrifice earnings base. This method of calculation may reduce the contribution being made by the employee.

Legislation currently before Parliament will prevent contributions made as part of a salary sacrifice arrangement from satisfying an employer’s SG obligations by specifically including salary sacrificed superannuation in the base for calculating an employer’s SG obligations.

For many, the New Year is a chance to make resolutions and goals. Are you perhaps one of those people that make a resolution each year to improve the financial viability of your business, but you’re not quite sure where to start?

We have compiled a list of key tips in order to assist you in analysing your business spending and improve the viability of your business in 10 minutes.

Keep your bookkeeping up to date

Keeping your bookkeeping up to date is one of the most important things you could do within your business.

On a regular basis, be it once a week or more regularly if required, allot time to enter in your transactions. Many accounting packages now have bank feeds that make keeping your accounting up to date easy.

Once you have your accounting system up to date, you will be able to produce meaningful reports.

Here are some tips on what reports you should be running and how to analyse these reports.

Balance Sheet

Each month run a Balance Sheet report from your accounting package. This report details your assets, liabilities and equity over a period of time. The main reason you will be running this report will be to ensure that everything is coded correctly.

1. Bank and Loan Accounts

It is important to ensure that your bank and loan accounts balance to your statements each month. Even if you have bank feeds this is an important check as sometimes bank feeds drop out.

Bank Statement balance doesn’t match to your Balance Sheet?

Run a bank reconciliation report. This report will show if you have any outstanding receivables or payables. If you have bank feeds, these may have dropped out so some transactions may be missing.

2. Suspense and clearing accounts

Ensure that there are no balances in the suspense and clearing accounts, if there are, drill down and review the items coded to these accounts, and recode as necessary.

Aged Receivables and Aged Payables Reports

Your Aged Receivables and Aged Payables reports detail the money that you currently are owed by your customers and the money that you owe your suppliers. It is very beneficial to you and your business to regularly review these reports.

1. Aged Receivables Report

• Have all the invoices been entered?

• Do you need to chase up any customers who are running behind on their payments?

2. Aged Payables Report

• Have all the invoices been entered?

• Are you running behind on your bills? Can you make any payment arrangements?

Profit and Loss

Lastly, once you have reviewed the above reports, you will want to analyse your Profit and Loss. This will be the most important report to review. This report details your income and expenses over a period of time. We recommend that this report is run with comparatives. Most businesses run monthly, quarterly, bi-annual or annual reports. We would recommend that you run these reports as frequently as required, however, run whichever reports make the most sense for your business.

1. General Expenses

If you have any expenses coded to the general expense code in your file, drill down and review the transactions. Are any of these transactions better placed in a different allocation, i.e. printing and stationery?

2. Patterns in your expenses

Look for patterns in your expenses. If your rental income is the same each month and there is a variance in a month, review the expense and see why.

3. The right questions to ask yourself when reviewing your profit and loss.

• Is this expense necessary?

• Do my suppliers offer any discounts that we are missing out on?

Don’t forget that we are always here to assist. If you are unsure or would like someone from our office to assist you, please contact us. We love to hear from you, and help wherever we can.

What is the difference between cash flow and profit?

As a business owner, it is imperative to be aware of the difference between your profit and your cash flow. Both are important measures of how your business is performing.

While profit and cash flow are closely related, they are very different measures of your business.

Below we outline how profit and cash flow will affect your business.

Cash flow

Cash flow is the difference between the actual cash you receive and the actual cash used in the process of doing business. It is based on when the money has actually moved in and out of the business. Cashflow can come from net sales, debt or money injected into the business by a shareholder.

Profit

Profit is the revenue from the sale of products or services, minus your expenses.

Profit indicates whether a business is earning income (making more than it is spending), even if the cash hasn’t actually moved in or out of the business.

For this reason, businesses should not rely on their profit and loss statement to assess their cash flow position. The profit and loss statement may indicate a business is making a fortune, but leave owners wondering where all the cash is.

A business can also incur non-cash expenses such as depreciation, which reduces the profit without affecting the cash flow of the business. Conversely, investment in business assets, such as plant and equipment or motor vehicles, will decrease the cash available to the business, however, will not immediately affect profit.

Why cash flow is king

Without cash flow, a business may be unable to pay its bills.

Profitable businesses can suffer from poor cash flow, and can even go bankrupt from cash flow problems. For example, if a business needs equipment in February but won’t be paid until June and cannot get a loan, they may go out of business.

A company can also have a great cash flow, but not be profitable.

In the long-run, you must either become profitable or find investors to provide cash to make up for your losses.

What businesses can do

Where possible, collect payments sooner rather than later, pay suppliers slower (but on time) and cut costs where possible.

Most importantly, invest in a good accountant and business advisor who can help you remain financially on track.

Dealing with cash flow problems

Below are some suggestions for unlocking funds without affecting your operational capacity. Keep in mind that you should always seek professional guidance before making changes to your business if you are unsure of the repercussions or potential issues.

Hidden sources of finance

Most business owners immediately think of the bank or loans when they’re short of money. But there are many more resources you can tap before you ask for that expensive overdraft or for an overdraft extension. You can often free up funds from within your business by re-examining your business systems, and these funds might in themselves be sufficient for your immediate needs.

To free up funds from within your business, you could look closely at the following.

Assets

Your assets include debtors, stock, pre-paid expenses, vehicles, plant and equipment, fittings and property. Each of these is a possible source of funds.

Debtors

Are you letting some customers have the free use of your money for months?

Here’s how you fix the problem.

- Get invoices out promptly.

- Send the invoice with the goods, and date the invoice from the day the service was completed rather than following the standard ‘last day of the month’ date for invoices.

- Consider changing the terms for some of your customers, or for new customers.

- Follow up promptly when invoices aren’t paid by the due date.

- Establish the average age of your Accounts Receivable and set yourself the goal of reducing this age by a set target every month. It’s amazing the impact this will have on your cashflow, even collecting one day quicker.

- Consider offering a discount for prompt payment.

Stock

Do you have excessive capital tied up in stock? This can occur in two ways:

- Carrying high levels of items that you could obtain from suppliers at short notice.

- Having too many slow-moving items (and too few fast-moving items).

You need to regularly review your stock levels, your stock turnover rates and your purchasing policies. Can you free up money by reducing stock? What about moving out of the slow-moving lines or having a quick sale of the slow-moving stock? It might pay you to reduce some items quite heavily to get some money in quickly.

Pre-paid expenses

These pre-paid expenses often relate to services. For example, you might have always paid your insurance bill for the year all in one hit, but could you instead arrange to pay small monthly amounts?

Fixed assets

Fixed assets can often be the source of a significant amount of cash. Are your assets fully utilised? You might be able to sell off little-used assets and hire suitable replacements when you require them.

Suppliers

Finally, consider your suppliers as a possible source of funds. Ask for extended payment terms for a short period to give you the opportunity to sell the goods first before you have to pay. If the supplier won’t budge, try splitting the order in two and offer to pay normal credit terms (30 days) on one half of the order and 90 days on the other half. Your suppliers will be more likely to agree to this kind of arrangement if you’ve paid them promptly in the past.

Your customers

Don’t forget that your customers can be a source of business funds. In addition to the good debt collection tactics already discussed, consider the following:

- Ask some of your credit customers if they would be willing to use their bank credit cards for purchases from you, instead of using the account facility they have with you. They will more than likely have a credit card that offers 55 days interest free terms.

- If you’re starting a new business, consider establishing it on a cash-only basis to keep the funds inside your business rather than locked up in Accounts Receivable.

- If you supply goods over a period of time or if you’re a service business, ask if you can invoice for progress payments.

Next steps

- Identify exactly how much additional cash you’ll need – this is especially important if you decide you need additional finance from a lender.

- Seek professional help from an accountant, business mentor, or your bank manager.

- Reduce your expenses and tighten your credit policies based on the steps above.

- Research additional options for increasing your cash position, from low-interest bank loans and overdraft facilities, to equity assistance.

We have all heard the saying “Cash is King”. This phrase is often used to describe the amount of notes and coins that we carry in our wallets. However, how does this phrase now sit in our world with the increasing reliance on new payment technologies such as “Tap & Go” and “Apple Pay” to make cashless payments?

In recent times, we have seen the growth and success of a number of business models that only deal in “cashless” payment systems. A great example of how successful a business can be using the “cashless” business model is evidenced by the success of “Uber”. In 2016 Uber generated revenue of 6.5 billion (USD). Who would have thought that hiring an on-demand driver could be done at the press of a button on a smart phone device?

How has the importance of cash declined with the push towards a cashless society and how far away is Australia from being a truly “cashless” economy?

Australian consumers appear to be embracing the move towards a cashless society. The use of smart phones and tablets to enable transactions has resulted in around 82% of Australian payments being made using non-cash dollars. It is estimated that more than three out of four face-to-face transactions are tap-and-go.

This year the Reserve Bank plans to launch technology to facilitate the move towards enabling more cashless transactions. The New Platform System (NPP) will allow money to be transferred almost instantaneously, even when the payer and payee are with different banks.

The whole process of paying for services will become simpler and the transactions will be based on an email address or phone number.

The debate continues about Australia’s end date towards achieving the end goal of being cashless. Some commentators have touted that we may see a cashless society sometime after 2020.

What lessons can be learned from this?

Although “Uber” is often used to promote the success of the cashless business model it is interesting to note that they have not always strictly adhered to their cashless business model. One example of Uber deviating from their cashless business model is in India, where Uber introduced a country-specific initiative to accept cash. This initiative was driven partly by India’s banking regulations but also by understanding the cash economy in that country. Across all of India the cash method is the preferred method of payment by users and drivers. Uber’s understanding of the economic landscape in India lead them to adjusting their cashless business model.

How does this apply to you?

All businesses need to be flexible nowadays. It is important to look at the impact of how a cashless economy would impact on profitability and ultimately survivability.

- Does your business have the technology to handle cashless payments?

- Cash is still an important draw card for consumers around the world – How is your business placed to handle this?

- Most customers appear to adapt to cashless payment platforms but it’s important to educate them about the cashless platforms available within your business.

Main Benefits for Small businesses:

- Time saving in not having to handle cash and making physical deposits at banks; and

- The reduced risk of not having to keep cash on business premises.

How does this apply to your customers?

- The key benefits for consumers is the pure convenience of using these new payment platforms;

- No credit card fees for using a credit card to make purchases; and

- The main concerns for consumers is centred around privacy and fraud risk. Transaction history can be tracked in a cashless payments system.

How will this benefit the Australian Government?

The major advantage for governments operating in a cashless economy is the significantly reduced risk of tax evasion.

Only time will tell how successful the push towards a cashless economy will be in Australia. Will the concept of carrying cash be a dim memory of the past?

Sometimes you need to take the risk.

Recently, I had the opportunity to head to New Zealand for a holiday. It was definitely a holiday full of high adrenaline adventures. The ultimate experience for me was jumping from a canyon wall and free falling 60 metres down a rocky cliff face, to then swing 200m above a river. Sounds scary, doesn’t it?

I can tell you, during those few seconds when I was falling, it was incredibly scary. I was screaming the entire time, then as I reached the swing above the river I realised I had survived, and began giggling with joy!

Suddenly, after the major shock and thrill of the experience was gone, I could take in the birds’ eye view. The feeling took my breath away… so much so that I did it again! And the next time, I was strapped to a chair and fell backwards. It was exhilarating, and like nothing I had ever experienced in my life.

Do the research.

Before the trip, during the planning stage, I had researched the most thrilling jumps you could do in New Zealand. I researched the equipment and safety measures, the costs involved, history of the locations and even read reviews from previous customers about their experiences. Taking all this information into consideration, I then compiled my wish list for adventure.

However, if I hadn’t prepared myself to understand how the jump would work, how the swing operates, and the ins and outs of the entire jump, there is no way I would have enjoyed the experience as much as I did. Being able to understand everything and trust the people that would be operating the jump was very important to me as it meant I could relax into the process.

Here’s the photo evidence of me jumping into the canyon. See? I really did do it.

Doing the research meant that I was able to make the right choice in who to partner with to help me take the risk – and have the best outcome.

Whether it be jumping off a canyon, or taking a risk for your business, there can be many rewards and benefits. It is important to identify and evaluate potential risks, and of course to seek professional advice to develop a detailed plan before you take the leap of faith.

As in life, in business it is necessary to take calculated risks to uncover new possibilities, new markets, new directions and further success. And sometimes it’s about taking that risk to fulfil that business passion or dream you have.

Remember, today is a new day and a new opportunity for you to take ‘harness’ of your professional or business goals. All the best with your ‘jump’… Just as I did in New Zealand!

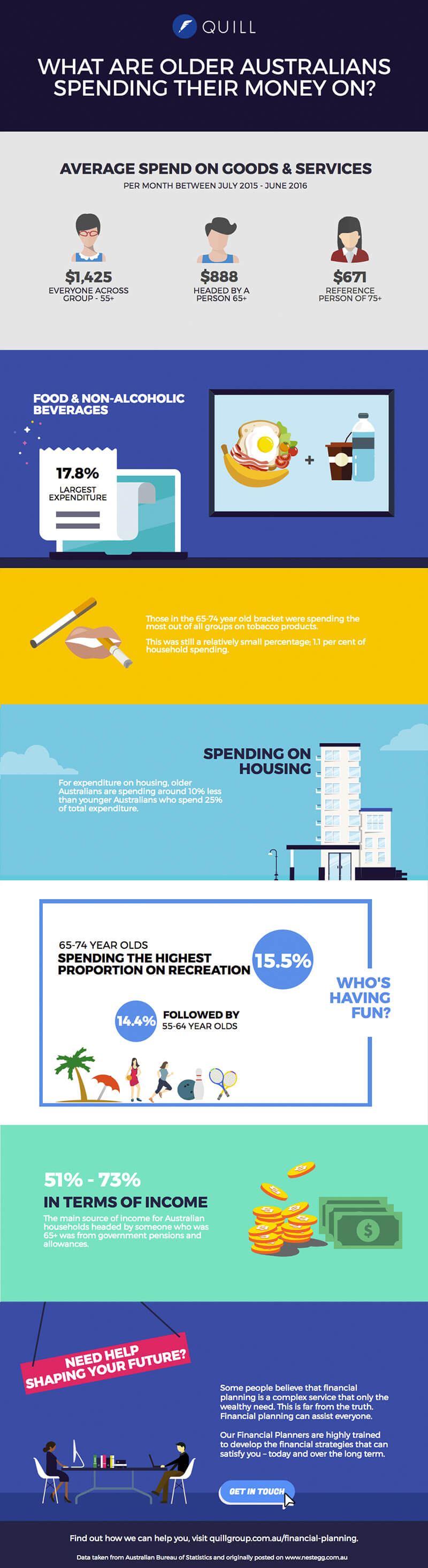

According to Australian Bureau of Statistics (ABS) figures, goods and services spending grew by 21 per cent in 2015-16 over the 2009-10 figure for households with a reference person between 55-64. In the same period, households headed by someone over 65 years of age saw a spending increase of 22 per cent.

So, what are they spending their money on?

The below infographic demonstrates some interesting findings from the ABS data as summarised by nestegg.com.au.