Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Key medium to longer-term financial market impacts of coronavirus shock include: lower for longer interest rates; a further blow to globalisation; another leg up in the US/China cold war; bigger government and public debt; a long-term risk of higher inflation; consumer & investor caution; faster embrace of technology; bad for airlines; another test for the Eurozone; and lower immigration.

Some of these will constrain economic growth but the faster embrace of technology is positive for growth.

This article was original post on the AMP Capital website 25 May 2020 by Dr Shane Oliver: Head of Investment Strategy and Economics, Chief Economist. You can view the original article here.

Introduction

There has been much debate about the short-term financial market impacts of coronavirus – on economic activity, unemployment, interest rates, house prices, shares, etc.

However, the magnitude of the shock means there will be medium to longer-term financial market impacts of Coronavirus as well. Of course, there is a danger in placing too much weight on current circumstances in assessing the future. Given this, we need to be a bit cautious, but here are 10 medium to longer-term impacts.

Lower interest rates for even longer

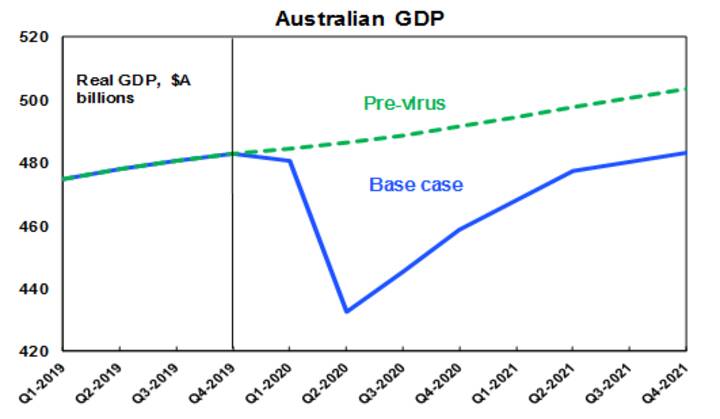

The hit to economic activity has been huge, resulting in a lot of spare capacity that will take years to be used up. We don’t see global and Australian economic activity getting back to pre-coronavirus levels until late next year or 2022.

Unemployment will take even longer to fall – it tends to go up via the lifts and down via the stairs. This will mean low inflation or deflationary pressure for the next three years at least. Which will mean central banks will be biased towards low interest rates for several years which will keep bond yields ultra-low.

Another way of looking at this is that given the hit to economic activity, interest rates would normally fall a lot further. In the GFC the Australian cash rate was cut by 4.25%. But because rates are already at or near zero, they can’t – so monetary easing is being achieved by quantitative easing. But an unconstrained cash rate for Australia would see it fall to around -3% not getting back to 0.25% until 2023 at the earliest. In the meantime, it means several years of very low rates. It’s little wonder the RBA is targeting a 3-year bond yield of 0.25% and its low-cost funding rate for banks is also 0.25% for three years.

Implications– Low rates mean very low returns from bank deposits and ultimately bonds but they make higher yielding shares and assets like property and infrastructure relatively attractive to investors once the hit to earnings and rents passes.

A further blow to globalisation

Recent years have seen a backlash against globalisation evident in the rise of Trump, Brexit and a backlash in some countries against immigration. The coronavirus disruption has added to this. Worries about the supply of medical items have led to pressure for their domestic supply. This could move on to food security and looks to be morphing into a push to bring supply chains “back home”. Borders have been closed for health reasons and it is unclear when they will all reopen.

Implications– While the outcome may simply be a diversification in reliance away from China to other emerging countries, the risk is that this all leads to reduced growth potential for the emerging world generally. Longer term it could reduce productivity if supply chains are managed on other than economic grounds and could remove a key source of disinflationary pressure from the global economy.

Another leg up in the US/China “cold war”

The trade war of 2018 and 2019 turned into a truce with the mini Phase One deal signed in January. However, with the coronavirus-driven shutdown, China is behind in its agreed purchases of US goods. What’s more, President Trump now faces a difficult task in winning the November presidential election – US presidents have not been re-elected when there is a recession and rising unemployment. This has been made worse by Trump’s inept handling of the crisis. This has left Trump keen to shift the blame over the virus and China is an easy target. He has already made some threats on this front and imposed some minor sanctions on China.

At present Trump’s approval rating is around where it’s always been and is not weak enough for him to conclude that he has nothing to lose by taking big risks on this front (such as tearing up the trade deal and imposing more tariffs). But if his prospects start deteriorating dramatically, he may conclude that he has nothing to lose, particularly with 66% of Americans now having a negative view of China, up from 48% in 2018. The latter also suggests a Democrat president may also take a tough stance with China – although likely with more of a diplomatic focus. The point is that the US/China trade war risks ramping up.

Implications– this could act as a negative for growth, work against multinationals and become a rising negative for shares. It also poses a threat to Australia but if Australia remains broadly neutral it may be minor (despite recent tensions around barley and beef) given that most Australian exports to China are for domestic use, not for reexport to the US.

Bigger government and bigger public debt

The GFC brought an end to economic rationalism and support for smaller government and was associated with a leg up in public debt levels. Fading memories of the problems of too much government intervention added to this. The coronavirus crisis has likely added to support for bigger government intervention in economies and the tolerance of higher levels of public debt. Particularly given that it may have enhanced perceptions of inequality with well-paid white-collar workers being able to isolate and work at home whereas lower paid workers have been stood down or have to continue working in less safe conditions. Safety regulations to ensure distancing will also add to business costs, although hopefully this will just be for the short term if a medical solution to coronavirus is found.

Implications– bigger government and aggressive measures to address inequality could reduce productivity growth and hence economic growth. Although it’s worth noting that if the Australia adopts a productivity enhancing agenda it may buck this trend.

Higher inflation with money printing

While it’s hard to see inflation becoming an issue in the next three years, the combination of rising public debt, money printing and more protectionism risks a longer term pick-up in inflation to say above 4%, particularly if central banks don’t reverse easy money quickly once spare capacity is used up.

Implications– a resurgence in inflation to high levels would be bad for productivity and negative for assets that benefited from the “search for yield”. But it’s a much longer-term issue.

Consumer and investor caution reinforced

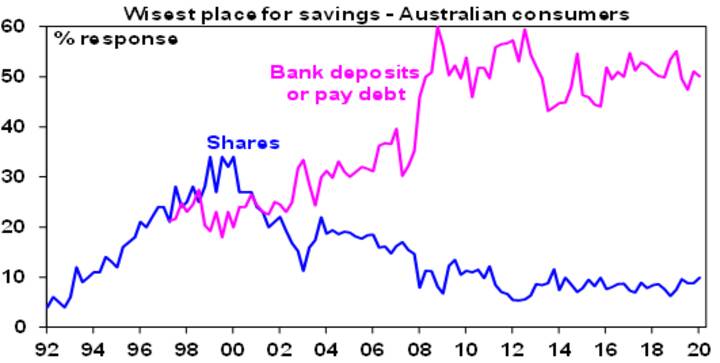

The GFC led to a wariness and a degree of investor caution on the part of households. This has been evident in around 50% of Australians nominating bank deposits and paying down debt as the “wisest place” for their savings compared to around 30% before the GFC, and scepticism of shares.

The pandemic and its hit to incomes and job security has likely reinforced this caution as one of the key financial market impacts of Coronavirus. Some even argue that the period of self-isolation will drive a rethink in terms of what’s important in life resulting in more mindful consumers focused on “do I really need it?” I am not so sure about the latter beyond the short term as people have short memories, but it is likely that household caution will remain, resulting in higher precautionary saving and more conservative investment strategies.

Implications – this will weigh on discretionary retailers, banks and wealth managers.

Faster embrace of technology

Self-isolation has dramatically accelerated the move to a digital world. Workers, consumers, businesses, schools, universities, health professionals, young & old have been forced to embrace new online ways of doing things. Many more have now embraced on-line retail, working from home & virtual meetings.

Implications – there are six big implications from this:

- The challenge to traditional retailing has been ramped up dramatically putting more pressure on traditional retailers and shopping centre owners to improve their offering.

- Less office space demand – but this may be offset if more space per person is needed in the absence of a vaccine.

- A shift from cities to suburbs/regions – as the shutdown shows that a “sea or tree change” is viable for many.

- This in turn may mean the beginning of the end for peak hour traffic congestion (although it could spike in the short term as people prefer to drive as long as Covid is still a risk).

- Virtual meetings may see less demand for business travel.

- This is positive for IT tech stocks facilitating online activity.

Bad for airlines

Which brings us to airlines. Less business demand for travel points to lasting damage. Some say the same may apply to tourists – but if a medical solution is found or the virus just dies out I suspect tourism will bounce back but based on the experience after 9/11 it may take a decade to fully recover.

Implications – airlines have already taken a big hit, but they are likely to be the slowest industry to recover.

Another test for the Eurozone?

Slow progress towards providing support for Italy has led to renewed concerns that the Euro area may break up. Populist anti Euro leaders may get a boost from the crisis, particularly if there is a new wave of migrants from Libya. However, Europe seems to be doing what it always does – gradually heading towards a solution with Germany agreeing with France for the common issuance of bonds and shifting in favour of fiscal stimulus. The pressures to keep the Eurozone together (safety in numbers, a high degree of identification as Europeans, solid public support for the Euro, Germany benefitting from the EU and Germany’s huge exposure to Italian bonds via the ECB) remain far stronger than the forces pulling it apart.

Implications – I wouldn’t bet on the Euro breaking apart.

Lower immigration

This is already a reality in Australia with travel bans and since immigration normally accounts for around 1 percentage point of population growth in Australia its absence knocks up to 1% off economic growth. The issue is how long immigration remains low. Australia would likely be a popular destination for migrants and students given its success in limiting coronavirus. And a rigorous testing/quarantine regime could allow both back sooner rather than later. That said I suspect while students will return faster, political pressures associated with higher unemployment will allow only a gradual recovery in immigration.

Implications – this is bad for home building & home prices as the hit to immigration has cut underlying dwelling demand by 80,000pa. But I suspect it creeps back over the next five years.

Concluding comments on financial market impacts of Coronavirus

Several of these longer-term implications will constrain economic growth and hence potential investor returns – notably the reversal of globalisation, bigger government, consumer caution & lower immigration. The faster embrace of technology will work in the other direction though to boost productivity and lower for longer interest rates are positive for growth assets.

Finally, a word of caution – anyone who got too negative for the long term in the last really major pandemic of 1918-19 might have missed out entirely on the “Roaring Twenties!” It’s much easier to think up negative things.

You can read more our our financial market updates here.

The Queensland Government has activated a new $10,000 COVID-19 Small Business Grants scheme to assist small and micro businesses impacted by Coronavirus to access funding for the purposes of “business adaptation”.

IMPORTANT: This grant is now closed, but Round 2 opens 1 July 2020:

Round 2 of the QLD Small Business COVID-19 Adaption Grants will open 1 July 2020

Apply for round 2 of the grant

Eligibility Criteria

To be eligible for the $10,000 COVID-19 small business grants, the business must:

- have been subject to closure or otherwise highly impacted by current shutdown restrictions announced by Queensland’s Chief Health Officer on 23 March 2020

- demonstrate that business revenue has been significantly impacted since 23 March 2020 over a minimum 1-month period due to the onset and management of COVID-19

- employ staff and have fewer than 20 employees at the time of applying for the grant

- have a valid Australian Business Number (ABN) active as at 23 March 2020

- be registered for GST

- have a Queensland headquarters

- have an annual turnover over $75,000 for the last financial year

- have a payroll of less than $1.3 million

- not be insolvent or have owners/directors that are an undischarged bankrupt.

Only 1 application will be accepted from an individual ABN or a financial beneficiary of a business.

Successful applicants cannot reapply for funding under this grant program.

What The Grant Must Be Spent On

The $10000 COVID-19 small business grants can be used towards the following

- financial, legal or other professional advice to support business sustainability and diversification

- strategic planning, financial counselling or business coaching aligned to business development and diversification

- building the business through marketing and communications activities, for example, content development (web pages, mobile apps, visual and audio media etc.)

- digital/technological strategy development

- digital training or re-training to adapt to new business models

- capital costs associated with meeting COVID-19 SAFE requirements

- specialised digital equipment or business specific software to move business operations online (e.g. logistics program for online ordering)

- meeting business costs, including utilities, rent.

Note: Grant funds can also be used towards any of the above activities occurring from 23 March 2020 onwards, keeping in mind the project must be completed within a maximum of 6 months from the date of approval.

Once the program budget has been fully allocated, applications for the program will close. It is estimated that approximately 10,000 small businesses will be supported through this program.

Applying small and micro businesses must meet the eligibility and assessment criteria to be considered for funding.

Applying for the $10,000 COVID-19 Small Business Grants

To apply, complete the following steps:

- read the eligibility criteria

- read the application guidelines, terms and conditions and frequently asked questions (FAQs)

- apply using the SmartyGrants link.

Assessment Process

In addition to meeting the eligibility criteria, applications will be assessed against the following:

- funding availability – applications will be processed on a ‘first come, first served’ basis, and therefore not all applications will be successful

- submission of a complete application form, with all requested supporting documentation included (i.e. your application must contain the requested supporting documentation, otherwise you will be contacted to provide appropriate evidence and this may delay your application’s progress)

- value for money, as determined by the Department of Employment, Small Business and Training (DESBT).

Grant Payments

Funding will be paid upon approval of your grant application. Within 1 month of completing the project, applicants must:

- complete and submit an acquittal report through SmartyGrants

- submit copies of supplier invoices and proof of purchase for the total project cost.

Grant recipients may be subjected to a random audit by DESBT to ensure that the information provided is true and correct. Where it is found that false or misleading information has been provided, penalties may apply, including refunding to DESBT some or all of the grant funding.

Next Steps

If you need assistance with the application for the QLD Government $10,000 COVID-19 Small Business Grants scheme please contact your Quill Relationship Manager for more information.

In order for your business to continue to receive payments under the JobKeeper scheme, you must lodge a “JobKeeper business monthly declaration” report with the ATO.

Importantly, the JobKeeper business monthly declaration report is NOT a reassessment of your businesses eligibility for the JobKeeper scheme, it’s purely for statistical purposes to enable Treasury and the Government to track and report key details about the scheme.

Once your business is eligible for the JobKeeper scheme, you remain eligible until either the scheme finishes or you voluntarily exit the scheme, for example if you decide to close your business or if you no longer have any eligible employees or business participants.

Information Included in JobKeeper Business Declaration Monthly Report

The following information is included in the monthly report:

- Actual and projected GST turnover

- Confirmation of the eligible employees covered by the scheme

- Confirmation of your contact details

- Confirmation of your financial institution details to receive the JobKeeper payments

Deborah Jenkins, Deputy Commissioner from the ATO has said that businesses need to stay on top of their monthly reporting obligations under the JobKeeper scheme, explaining “Each month, you need to make sure that you are paying eligible employees the relevant $1,500 per fortnight and we also understand things change over time.

“You may find that some employees depart the country (if they’re able to) or they may not wish to remain on your books.

“That’s the purpose of the monthly declaration. It’s to make sure your business still exists and to check who your employees are that are employed for that period of time.”

Businesses are encouraged to use the ATO’s business portal or their registered tax or BAS agent to lodge the reports.

“We need information for the current and projected turnover, but that is not to retest the businesses eligibility.”

“It is statistical information; we need to understand how this JobKeeper scheme is playing out and whether it is meeting what it was set out to do.”

Lodging the Report

Where your business is registered for Single Touch Payroll (STP) you can lodge via:

- The Business Portal via your myGovID

- Through your Tax agent (i.e. Quill Group)

More information on the monthly JobKeeper declaration report can be found on the ATO website: JobKeeper Payment – Step 3: Make a business monthly declaration.

Other Articles Related to JobKeeper

The following are other articles related to the JobKeeper scheme:

- How to Apply for the JobKeeper Payment

- JobKeeper: Employer Eligibility

- JobKeeper Payment FAQs

- How the JobKeeper Payments Work

If you have any questions or require assistance with your JobKeeper Monthly Declaration Report please contact our team.

This article on business interruption insurance and COVID-19 has been provided by Berren Hamilton from Stone Group Lawyers.

Introduction

In the last few weeks we have certainly seen more stability return to investment markets along with many countries, including Australia, talking about a return to work and some easing of restrictions which have plagued investment markets over the last three months.

In some recent communications we discussed the “Light at the end of the Coronavirus tunnel” and then the sharp rise in the ASX200 during the month of April.

However, in our view there is certainly still the need to remain cautious despite this recent optimism.

In Europe and in particular the UK we are still not seeing a significant drop in Coronavirus cases. In some cases we are also seeing a so called “second wave” of cases appear and therefore whilst everyone would like to see a return to normality as soon as possible, it could still be some time off.

Likelihood of a recession in Australia

Markets have almost certainly already priced in the expectation of a recession, in the USA, Australia and most other countries. Nevertheless, the question still remains as to how bad and how long a recession will last?

The answer will most likely depend on the availability of new antiviral drugs and ultimately a vaccine. In the mean time it is most likely we will continue to see small improvements on the path to recovery and likewise in some sectors of the market we will see V-shaped recovery whilst in others it will be a slower U-shaped recovery.

What investors need to focus on

Given these market conditions are so unusual, in that they are completely dependent on a health crisis, what can investors do?

During volatile periods like we are experiencing, investors can sometimes make sub-optimal decisions when emotions take over, tending to buy out of excitement when the market is going up and sell out of fear when the market is falling. Markets do ultimately normalise, and when they do, those who stay invested may benefit more than those who don’t.

Therefore for those already invested the message is to stay invested and try limit the draw-down of capital so that when market conditions improve you are best placed to participate in that growth.

For those looking to invest, the strategy of “dollar cost averaging” is worthwhile considering. This is where the amount you are looking to invest is divided into smaller parcels and invested over a period of time rather than all at once.

Disclaimer

This article contains general information only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Before acting on any information in this report, you should seek financial advice taking into consideration your own personal objectives, financial situation and needs.

The ASX 200 just had its best month ever, up 8.8%. The rise in April, together with the last week of March has the Australian market up 21.5% from the low that was made on 23 March. In some terminology that might constitute a new bull market – though it may not yet feel like it since Australian shares are still 23% below the high point in February.

The fact that the ASX 200 just had the best month in in 28 years, (that specific index commenced in May 1992) illustrates how financial markets tend to price to where we might be in 6 to 12 months, rather than where we are right now. Who would have thought we could see this in the midst of the biggest ever spike in unemployment.

The month of April saw the release of all manner of dire economic data – none more dire than the news that claims for unemployment benefits have topped 30 million in the USA since mid March. Yet in spite of that, the S&P 500 index has risen by 12.7% in April, and a total of 30% in the 27 trading days since 23 March.

These strong market moves were in a large part due to the fast moving government fiscal responses. However, we also need to recognise the fact that the normal alternative to equities – government bonds – bear almost a guarantee of inflation adjusted losses if held to maturity. This means that bonds appear very unattractive compared to previous share market downturns, and this may also be a big factor in shaping investors responses in this downturn. Investors are virtually forced to take on risk if they wish to make some kind of return that exceeds inflation.

What the month of April has reinforced is that market bottoms are usually made when the outlook is the most pessimistic and gloomy. Similarly market tops are made when economic outlooks are rosy. The economic reality is that we will no doubt have more gloom to come, however there appears to be reasonable hope that our freedom to work and move about may be getting back to normal soon.

Preface by Peter Kirk – Executive Director

The below article from Dr Shane Oliver, head of investment strategy and chief economist at AMP Capital looks at whether there are some signs of a light at the end of the Coronavirus tunnel and what this may mean for investors?

This happens to be a lengthy article but for those that are interested and have the time, we think that it is a worthwhile read.

However, for those that are time poor these are the key points:

- After a strong share market rally in April from their March lows, shares in the short-term are vulnerable to bleak economic and earnings news as has been evident in the last week.

- However, positive news on the coronavirus outbreak is starting to get the upper hand – with evidence of curve flattening, an easing in lockdowns and massive policy stimulus pointing to a possible return to growth in the second half of the year, which should ultimately underpin a rising trend in share markets beyond short-term uncertainties.

This article was original published on the AMP Capital website 22 April 2020: Light at the end of the coronavirus tunnel – what does it mean for investors?

Introduction

The blanket coverage of coronavirus and its impact on the economy can lead to a lot of confusion right now. Some reports are hopeful of anti-viral drugs, others say a vaccine is at least a year away. There is talk of curve flattening but still rising cases and deaths. There is news of an easing in lockdowns but also worries about “second waves”. All this against a backdrop of collapsing economic data and surging unemployment.

Some prognosticators say now is a great buying opportunity for investors whereas others see more financial pain ahead. This is a horrible time for humanity and particularly those directly affected by coronavirus, but I must say if ever there was a time to turn down the noise and listen to The Carpenters or Taylor Swift, this is it. Here is a summary of where we are currently at. First the bad news and then the good. I will keep it simple.

The bad news

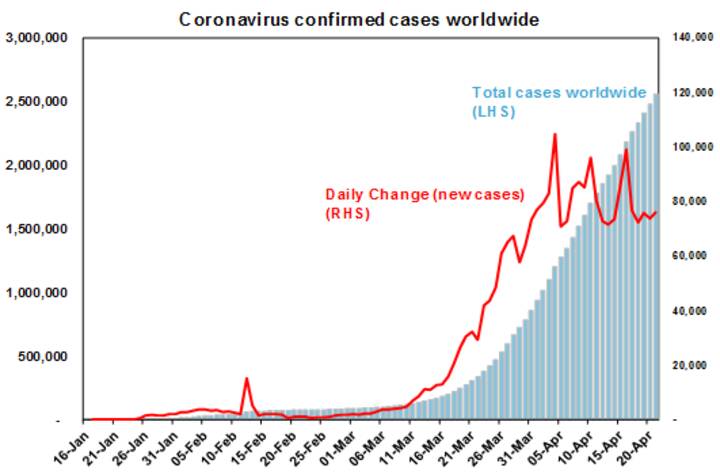

- The reported number of coronavirus cases globally is still rising and has now gone through 2.5 million.

- The reported death rate is still rising and is now up to 6.9%.

- Many worry about a “second wave” of cases. This occurred in the 1918 Spanish flu outbreak, and Singapore and Japan which had been cited as models for containment are now cited as examples of this (although they really still seem to be in part of a first wave as their quarantining efforts failed).

- Most medical experts still say a vaccine may be a year or more away. I remember around 1984-85 constantly hearing a vaccine for HIV was a year away – but we are still waiting.

- In the absence of a vaccine some worry about coronavirus outbreaks every winter as it migrates around the world.

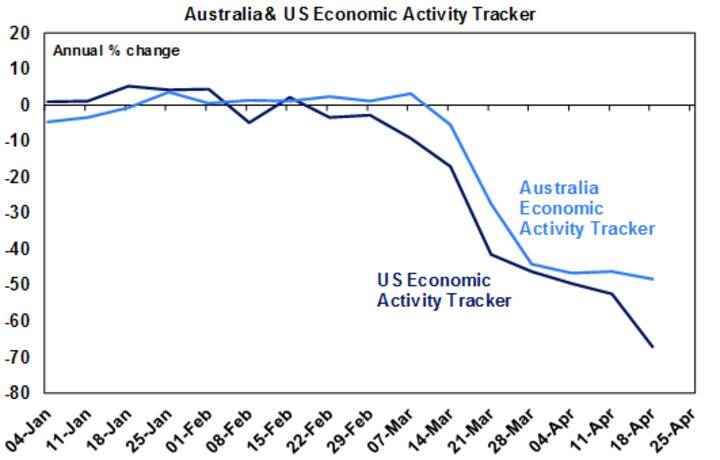

- Economic activity data is literally falling off a cliff. This was highlighted last week by the IMF’s forecast for a contraction in the global economy of 3% this year and in advanced economies of around 6%. And this masks a likely 10 to 15% slump in GDP centred on the June quarter. Falls of that magnitude have not been seen since the Great Depression. The collapse in economic activity in the US and Australia is highlighted by weekly economic activity trackers we have constructed based on data for things like restaurant bookings, energy usage, confidence, foot traffic and jobs.

- We are constantly hearing forecasts of unemployment going to 10%, 15% and maybe even 30% in the US (which does not have the benefit of Australian JobKeeper wage subsidies – if you are having a salary paid by JobKeeper then you will not be unemployed).

- This in turn is creating much consternation around whether there will be an economy left once the shutdowns end and/or how governments will get their debt down.

- Finally, the blame game is on. While partly politically motivated, US China tensions seem on the rise again.

The good news

- While the total number of Coronavirus cases is rising, new cases appear to be leveling off or in decline.

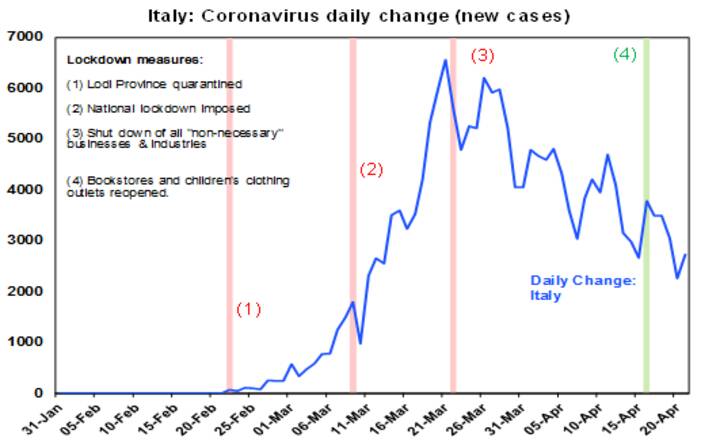

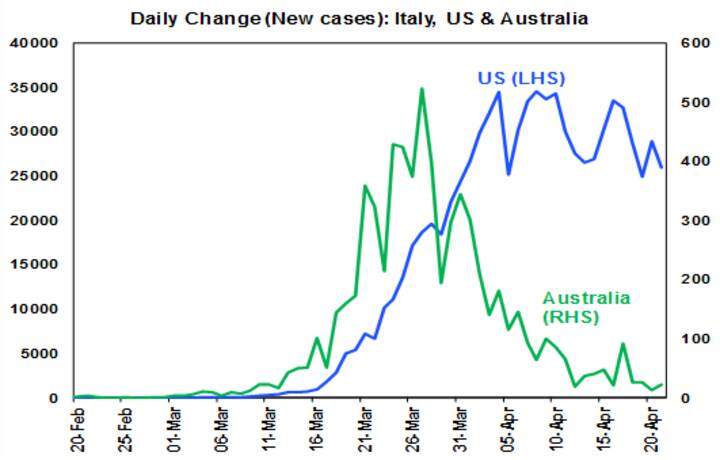

- Numerous European countries, led by Italy, look to be following the same path as China which saw a blowout in new cases, a lockdown followed 2-3 weeks later by a peak in new cases and then falling new cases. Australia appears to have been very successful in following this path (with the peak coming faster) and the US now seems to be following the same path, albeit its yet to show a decent downtrend in new cases. Social distancing clearly works! (Just out of interest – with various countries following the same pattern China has reported it makes me think the Chinese data on new cases is roughly right despite emerging skepticism.)

- Following this, the focus is shifting towards an easing of lockdowns. Various European countries and New Zealand have already announced some easing, allowing some shops to open/activities to occur. The US has released guidelines for states to move through a three phased reopening if they meet various criteria (in terms of falling new cases & hospitals coping) before moving to each new phase.

- While Australia’s PM Scott Morrison has indicated that current restrictions will remain broadly in place for another few weeks, he has indicated three criteria for an easing in restrictions: better testing; better contact tracing; and confidence in containing outbreaks all of which makes sense given the risks Australia faces coming into winter. Of course, successful anti-virals and/or a vaccine would make it all a lot easier, but we can’t rely on either just yet.

- Most countries talking of easing are well aware of the risk of a second wave (although President Trump’s bravado about “liberating” states is worrying). Hence a focus on phased easing only once certain criteria – around testing, new cases and quarantining – have been met. This is very different to what happened in relation to Spanish influenza where there really wasn’t any testing. For Australia this is likely to mean a gradual opening up from May. In the absence of a vaccine, full international travel is likely to be the last thing to return. That’s not great but given that in net terms its worth less than 0.5% of GDP to the Australian economy, it’s trivial compared to the 10-15% hit that’s come from shutting or partially shutting about 25% of the economy as it would be this mainly domestically driven activity that would bounce back as the shutdown is eased.

- Fiscal and monetary stimulus has been ramped up to the point that they should help minimise second round effects on economies enabling them to bounce back faster. This is particularly the case in Australia where the focus has been on job subsidies to preserve jobs, support businesses and low-cost RBA funding has enabled banks to offer loan payment holidays. Yes, there may be longer term issues in paying down debt, but they are small compared to the cost of allowing a bigger and deeper hit to the economy from not protecting businesses and incomes through the shutdown.

If, as appears likely, an easing of the lockdowns becomes common place in May/June, then April or maybe May should be the low point in economic data much as February was in China. This does not mean that things will quickly bounce back to normal – some businesses will not reopen, uncertainty will linger, debt levels will be higher and business models will have to adapt to different ways of doing things around working and shopping. On our forecasts it will look like a deep V recovery in terms of growth rates, but looked at in terms of the level of economic activity it will take a lot longer to get back to normal and this will mean that it will take a while to get unemployment down – from a likely peak in Australia of around 10%. But at least growth will be able to return and spare capacity and high unemployment will mean that it will take a while for inflation to pick up and so low rates will be with us for a long time.

This is all very different to five or six weeks ago when there was talk of six-month lockdowns, no confidence as to whether they would work and the policy response was seen as inadequate.

What does it mean for investors?

From their high in February to their low around 23 March, global shares fell 34% and Australian shares lost 37% as all the news was bleak. Since that low to their recent high, shares have had a 20% plus rally helped by policy stimulus and signs of coronavirus curve flattening. But this strong rally has left them a bit vulnerable in the short term – particularly as we have now entered a period which is likely to be see very weak economic data and news on profits. The ongoing dislocation in oil prices – to a “record low” of -$40 a barrel for West Texas Intermediate – has added to this, although lower petrol prices are ultimately more of a help than a hindrance to a recovery in economic activity. So, the very short-term outlook for shares is uncertain and a re-test of the March low cannot be ruled out.

However, shares are likely to be higher on a 1-2 year horizon as evidence of curve flattening, easing shutdowns combined with policy stimulus ultimately see a return to growth against a background of still very low interest rates and bond yields.

From a fundamental investment point of view the historical experience that covers recessions, wars and even pandemics (in 1918) tells us that the long-term trend in shares and other growth assets is up and that trying to time bottoms is always very hard. No one will ring the bell at the bottom, which by definition will come at a time of maximum bearishness when all the news is horrible. Maybe the low was back in March, maybe it wasn’t. To borrow from John Kenneth Galbraith’s famous quote on forecasters I will admit that I know that I don’t know1. So a good approach for long-term investors is to average into markets after bear market falls over several months.

As many employees and businesses have migrated to working from home in the interests of employee safety as a result of the enforced Government shutdown, the Australian Taxation Office (ATO) has announced special arrangements this financial year due to COVID-19 to make it easier for people to claim working from home tax deductions for costs and expenses incurred due to remove work.

Maximise your working from home tax deductions

The ATO has released a short-cut method to more easily enable people working from home to more easily calculate running expenses that can be claimed as working from home tax deductions.

The short-cut method allows people to claim a rate of 80 cents per hour for all their running expenses, rather than needing to calculate costs for specific running expenses. Multiple people living in the same house can claim this new rate. For example, a couple living together could each individually claim the 80 cents per hour rate. The requirement to have a dedicated work from home area has also been removed.

This new simplified arrangement does not prohibit people from making a working from home claim under existing arrangements (see below).

Claims for working from home expenses prior to 1 March 2020 cannot be calculated using the shortcut method and must use the pre-existing working from home approach and requirements.

For more information on claiming running expenses, refer to the ATO’s website: Working from home tax deductions during COVID-19.

Working from home tax deductions for 1 March 2020 to 30 June 2020

There are three ways that you can choose to calculate your additional running expenses for the 1 March 2020 to 30 June 2020 period:

- claim a rate of 80 cents per work hour for all additional running expenses;

- claim a rate of 52 cents per work hour for heating, cooling, lighting, cleaning and the decline in value of office furniture, plus calculate the work-related portion of your phone and internet expenses, computer consumables, stationery and the decline in value of a computer, laptop or similar device;

- claim the actual work-related portion of all your running expenses, which you need to calculate on a reasonable basis.

The ATO is also reminding people that the three golden rules for deductions still apply. Taxpayers must have spent the money themselves and not have been reimbursed, the claim must be directly related to earning income, and there must be a record to substantiate the claim.

Working from home tax deductions prior to 1 March 2020

Claims for working from home expenses prior to 1 March 2020 should be calculated using the existing approaches and are subject to the existing requirements.

Records you must keep

If you use the simplified method, you only need to keep a record of the hours you worked at home, for example timesheets or diary notes.

If you use the other methods, you must also keep a record of the number of hours you worked from home along with records of your expenses

Working from home expenses you can’t claim

If you are working from home only due to COVID-19, you:

- cannot claim occupancy expenses such as mortgage interest, rent and rates

- cannot claim the cost of coffee, tea, milk and other general household items your employer may otherwise have provided you with at work.

The ATO will review the special arrangement for the next financial year as the COVID-19 situation progresses. If you have any further queries please do not hesitate to contact us.

More information:

ATO example

Bianca is an employee who works as a copywriter and editor. Bianca starts working from home on 16 March as a result of COVID-19 and replaces her face-to-face meetings with online video conferencing.

Bianca has just bought a new laptop, desk, chair and stationery. She also wants to claim some additional gas, electricity, phone and internet costs due to working from home.

Under the shortcut method, Bianca can now claim all her expenses under a rate of 80 cents per hour. All she needs is her timesheets.

Bianca can also decide to claim using existing working-from-home calculations. Under that method, she can claim the desk, chair, gas and electricity under the 52 cents per hour, but she would need to work out the decline in value of the laptop and calculate the work-related portion of the laptop, stationery, phone and internet.

The Queensland Government has recently announced that property owners will be given land tax relief where their tenants have been impacted by Coronavirus.

Land tax relief Queensland measures

There are three Coronavirus land tax relief measures property owners may be eligible for:

- a land tax rebate reducing land tax liabilities by 25% for eligible properties for the 2019-20 assessment year

- a waiver of 2% land tax foreign surcharge for foreign entities for the 2019-20 assessment year

- a 3-month deferral of land tax liabilities for the 2020-21 assessment year.

Property owners do not need to apply for the foreign surcharge waiver or the 3-month deferral however the 25% Queensland land tax rebate must be applied for by 30 June 2020.

25% Land Tax Rebate

The land tax rebate will only apply to each property that meets the eligibility requirements and conditions.

Where there are multiple tenants for a single property, including mixed-use developments, if the eligibility requirements and conditions are met for at least one tenancy, then the whole property is eligible for the land tax rebate.

Property owners may be eligible for the land tax rebate if at least the following circumstances applies:

- Property owner is a landowner who leases all or part of a property to one or more tenants and all the following apply.

- The ability of one or more tenants to pay their normal rent is affected by the coronavirus (COVID-19) pandemic.

- The property owner will provide rent relief to the affected tenant(s) of an amount at least commensurate (in proportion) with the land tax rebate.

- The property owner will comply with the leasing principles even if the relevant lease is not regulated.

- Property owner is a landowner and all the following apply.

- All or part of the property is available for lease.

- The ability to secure tenants has been affected by the COVID-19 pandemic.

- Relief required to meet financial obligations.

- The leasing principles are complied with even if the relevant lease is not regulated.

If you are eligible for the land tax rebate under both the above circumstances, it is expected you will apply the rebate paid firstly to provide rent relief to your tenants. You can then apply any remaining rebate to your own financial obligations (e.g. in relation to debt and other expenses).

Please find below the leasing principles referred to in the criteria lists above:

Relief package for landlords and tenants – leasing principles for a commercial landowner

To be eligible for land tax relief, a landowner must commit to comply with the principles set out below. These principles will also be introduced into Queensland law.

If you are a commercial landowner, the principles are as follows:

- You will negotiate in good faith with your tenant to seek a mutually agreeable resolution if their ability to pay is impacted by COVID-19;

- You will not evict your tenant if they are in financial distress and unable to meet their commitments due to the impact of COVID-19;

- You will not increase rent, except where rent is linked to turnover;

- You will not penalise a tenant who stops trading or reduces opening hours;

- You will not charge any interest on unpaid or deferred rent; and

- You will not make a claim on a bank guarantee or security deposit for non-payment of rent.

In addition to these principles, the Prime Minister announced a mandatory code of conduct for small and medium enterprise commercial tenancies on 7 April 2020. The Palaszczuk Government will consult with stakeholders on the development of systems and implementation of the code in Queensland. Compliance with this code is not a requirement to receive land tax relief, but landowners with small and medium enterprise commercial tenancies are advised to familiarise themselves with the code. Visit www.australia.gov.au for further information.

There has not yet been a lot of guidance as to whether or how, you need to show you have passed the land tax rebate on to your tenants. Until further guidance is provided by the OSR/Qld Government we would suggest the following:

For properties where you as landowner pay the land tax – We suggest that when providing the rent reduction to your tenants, you clearly state the rent reduction is partly due to the Queensland land tax relief package. This should then be evidence you have passed on the rebate to your tenants by way of rent relief.

For properties where the tenant already pays the land tax – If you determine each property is eligible and you claim the land tax rebate of 25%, as your tenant pays the land tax directly, by applying for this rebate you are effectively giving them a rent reduction by reducing their outgoings to an amount equal to the land tax rebate you get.

If you meet the criteria and would like to apply for the rebate, please find below the link and information from the OSR website:

How to apply

Your 2019–20 land tax assessment notice will have the details of your land holdings. (If you have not received your notice, you can find it under the Assessments tab once you log onto OSR Online).

- Select My Land.

- Select Manage details.

To receive the rebate, you must include or update your contact details (including email and telephone number) and bank details so that we can contact you if necessary and pay the rebate into your nominated bank account.

- Select Manage exemptions then Lodge new exemption.

- Select COVID-19.

- Complete the application by certifying your eligibility and selecting the applicable land parcel(s).

- Complete the declaration.

To access future assessment notices electronically through OSR Online (rather than by post), select Assessments. If you select this option, you will receive an email when an assessment is available.

If you have not yet paid your land tax assessment for 2019-20 or are paying by instalments, and are eligible for land tax relief, we will issue a reassessment and adjust your instalment payments.

Please take the time to read our other articles relating to COVID-19.

Most people are now aware that scammers are unfortunately ever present in our modern-day life and the frequent use of the internet has only served to increase this risk. We noticed an increase in this activity during the initial roll out of the NBN and other Government programs or initiatives. Covid 19 is yet another opportunity for increased scam activity including scams targeting superannuation.

ScamWatch, a division of the Australian Competition and Consumer Commission (ACCC) that helps protect Australians from scams, has recently reported an increase in scams since the Coronavirus crisis began.

The ACCC has advised that scammers are taking advantage of people financially impacted by the Coronavirus crisis by falsely selling products or services online and using fake emails or text messages to try and obtain personal data.

There are also reports of scammers offering to check if a person’s superannuation account is eligible for various benefits (such as the early release of superannuation) or claiming new schemes will lock people out of their accounts.

In 2019, Australians lost over $6 million to superannuation scams with people aged 45–54 losing the most amount of money.

Please remember, never give any personal information about your superannuation, bank accounts or other financial information to anyone who has contacted you by phone or email. You should first confirm who has contacted you and make sure they are a legitimate company or government representative. Hang up and call the organisation directly by doing an independent search for their contact details. Better still, check with your relationship manager if you have any doubts to their legitimacy.

Steps you can take

If you think you may have provided information about your superannuation account to a scammer, please contact our office immediately. You can also contact www.idcare.org, a free Government-supported service which will work with you to develop a specific response plan to your situation and support you through the process.

More information on Coronavirus scams is available on the Scamwatch website (https://www.scamwatch.gov.au).

Quill is here to support you if you have any further questions, please contact our office.

About COVID-19 scams

Scamwatch has received over a thousand coronavirus-related scam reports since the outbreak. Common scams include phishing for personal information, online shopping, and scams targeting superannuation.

If you have been scammed or have seen a scam, you can make a report on the Scamwatch website, and find more information about where to get help.

Scamwatch urges everyone to be cautious and remain alert to coronavirus-related scams. Scammers are hoping that you have let your guard down. Do not provide your personal, banking or superannuation details to strangers who have approached you.

Scammers may pretend to have a connection with you. So it’s important to stop and check, even when you are approached by what you think is a trusted organisation.

Visit the Scamwatch news webpage for general warnings and media releases on COVID-19 scams.

Below are some examples of what to look out for.

These are a few examples, but there are many more. If your experience does not match any of the examples provided, it could still be a scam. If you have any doubts at all, don’t proceed.

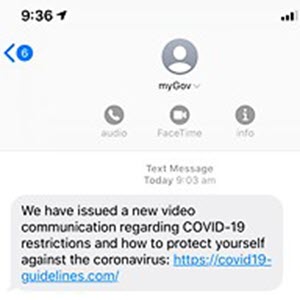

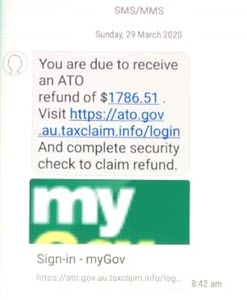

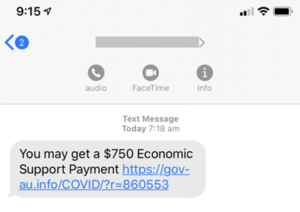

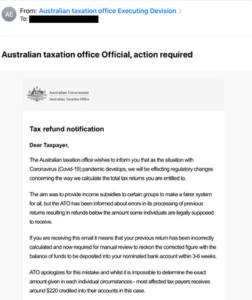

Phishing – Government impersonation scams

Scammers are pretending to be government agencies providing information on COVID-19 through text messages and emails ‘phishing’ for your information. These contain malicious links and attachments designed to steal your personal and financial information.

In the examples below the text messages appear to come from ‘GOV’ and ‘myGov’, with a malicious link to more information on COVID-19.

Examples of phishing scams impersonating government agencies

Scammers are also pretending to be Government agencies and other entities offering to help you with applications for financial assistance or payments for staying home (Click for larger version).

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if it appears to come from a trusted source.

- Go directly to the website through your browser. For example, to reach the MyGov website type ‘my.gov.au’ into your browser yourself.

- Never respond to unsolicited messages and calls that ask for personal or financial details, even if they claim to be a from a reputable organisation or government authority — just press delete or hang up.

Scams targeting superannuation

Scammers are taking advantage of people in financial hardship due to COVID-19 by attempting to steal their superannuation or by offering unnecessary services and charging a fee.

The majority of these scams start with an unexpected call claiming to be from a superannuation or financial service.

The scammers use a variety of excuses to request information about your superannuation accounts, including:

- offering to help you access the money in your superannuation

- ensuring you’re not locked out of your account under new rules.

- checking whether your superannuation account is eligible for various benefits or deals.

Example of a scam targeting superannuation

A scammer will call pretending to be from a superannuation or financial service. They may refer to the government’s superannuation early release measures, and ask questions such as:

- Have you worked full time for the last 5 years?

- Are you going to apply for the $10 000 superannuation package?

Or falsely claim:

- Inactive super accounts will be locked if not merged immediately.

Tips to protect yourself from these types of scams:

- Never give any information about your superannuation to someone who has contacted you — this includes offers to help you access your superannuation early under the government’s new arrangements.

- Hang up and verify their identity by calling the relevant organisation directly — find them through an independent source such as a phone book, past bill or online search.

- See our Scamwatch media release warning about superannuation scams.

- For more information on superannuation scams visit ASIC’s MoneySmart website.