Many of us save and plan for retirement, ensuring we have enough money to live the type of lifestyle with the aged care that we want. Although this is an important aspect of planning ahead, another key consideration is planning where we will live during our retirement.

The answer to this question will depend on a number of factors, the major one being your ability to live independently. Knowing what options are available will help you or your loved ones move into the next phase of retirement. By planning ahead, you can lessen the impact of a situation that can be emotional, stressful and uncertain. There are three categories of retirement living:

Retirement villages

Retirement village living offers those 50 or over a convenient lifestyle and a community. They offer flexible services so, as your needs change, you can adjust the services that you receive. The services and costs vary. Sometimes upfront payments may be required as well as ongoing fees and exit fees.

Accommodation options may include independent living units and serviced apartments. Serviced apartments generally have one or two bedrooms and some daily living assistance.

Home and community care

If you prefer to stay in the comfort of your home, but require support, there are a number of services available. You can get assistance with domestic chores such as cleaning and laundry, personal care, meals, home maintenance and modification, nursing care and transport assistance.

This help is available through Federal Government subsidised services or private businesses that offer home care services. Costs for home support services and home care packages vary according to each provider but if the provider is approved to receive Commonwealth funding then there are limits on the amount they can charge. Before you can access these services, you need to be formally assessed.

Residential aged care

If you can no longer live at home, perhaps due to illness or an emergency, residential aged care may be the next step. Living or staying in an aged care home provides 24-hour nursing care. The operation of aged care homes, including the maximum costs that you may have to pay, are regulated by the Australian Government.

If you are living in a retirement village but are then assessed as needing residential aged care, you may be able to move to aged care accommodation that is located in the same retirement village — making moving much easier. However, you may need to make a separate accommodation payment.

Don’t leave it until it is too late

Don’t wait until your health starts to fail, or when your mobility starts to deteriorate as there may be a waiting list. Wherever you choose to live, as you require more support the costs will increase. How you choose to fund your accommodation may affect your Centrelink entitlements so it is important that you understand the choices you are able to make.

To find out more and plan for the complexities of aged care, give us a call. We have experts in-house who can help you to navigate through this maze.

Introduction

In the last few weeks we have certainly seen more stability return to investment markets along with many countries, including Australia, talking about a return to work and some easing of restrictions which have plagued investment markets over the last three months.

In some recent communications we discussed the “Light at the end of the Coronavirus tunnel” and then the sharp rise in the ASX200 during the month of April.

However, in our view there is certainly still the need to remain cautious despite this recent optimism.

In Europe and in particular the UK we are still not seeing a significant drop in Coronavirus cases. In some cases we are also seeing a so called “second wave” of cases appear and therefore whilst everyone would like to see a return to normality as soon as possible, it could still be some time off.

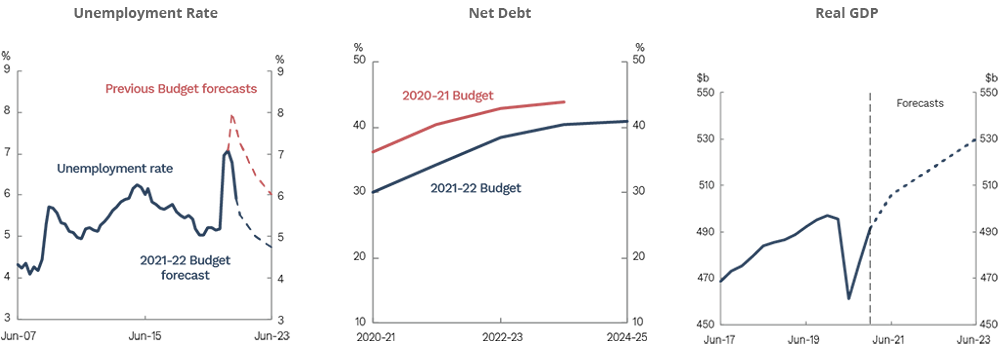

Likelihood of a recession in Australia

Markets have almost certainly already priced in the expectation of a recession, in the USA, Australia and most other countries. Nevertheless, the question still remains as to how bad and how long a recession will last?

The answer will most likely depend on the availability of new antiviral drugs and ultimately a vaccine. In the mean time it is most likely we will continue to see small improvements on the path to recovery and likewise in some sectors of the market we will see V-shaped recovery whilst in others it will be a slower U-shaped recovery.

What investors need to focus on

Given these market conditions are so unusual, in that they are completely dependent on a health crisis, what can investors do?

During volatile periods like we are experiencing, investors can sometimes make sub-optimal decisions when emotions take over, tending to buy out of excitement when the market is going up and sell out of fear when the market is falling. Markets do ultimately normalise, and when they do, those who stay invested may benefit more than those who don’t.

Therefore for those already invested the message is to stay invested and try limit the draw-down of capital so that when market conditions improve you are best placed to participate in that growth.

For those looking to invest, the strategy of “dollar cost averaging” is worthwhile considering. This is where the amount you are looking to invest is divided into smaller parcels and invested over a period of time rather than all at once.

Disclaimer

This article contains general information only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Before acting on any information in this report, you should seek financial advice taking into consideration your own personal objectives, financial situation and needs.

Preface by Peter Kirk – Executive Director

The below article from Dr Shane Oliver, head of investment strategy and chief economist at AMP Capital looks at whether there are some signs of a light at the end of the Coronavirus tunnel and what this may mean for investors?

This happens to be a lengthy article but for those that are interested and have the time, we think that it is a worthwhile read.

However, for those that are time poor these are the key points:

- After a strong share market rally in April from their March lows, shares in the short-term are vulnerable to bleak economic and earnings news as has been evident in the last week.

- However, positive news on the coronavirus outbreak is starting to get the upper hand – with evidence of curve flattening, an easing in lockdowns and massive policy stimulus pointing to a possible return to growth in the second half of the year, which should ultimately underpin a rising trend in share markets beyond short-term uncertainties.

This article was original published on the AMP Capital website 22 April 2020: Light at the end of the coronavirus tunnel – what does it mean for investors?

Introduction

The blanket coverage of coronavirus and its impact on the economy can lead to a lot of confusion right now. Some reports are hopeful of anti-viral drugs, others say a vaccine is at least a year away. There is talk of curve flattening but still rising cases and deaths. There is news of an easing in lockdowns but also worries about “second waves”. All this against a backdrop of collapsing economic data and surging unemployment.

Some prognosticators say now is a great buying opportunity for investors whereas others see more financial pain ahead. This is a horrible time for humanity and particularly those directly affected by coronavirus, but I must say if ever there was a time to turn down the noise and listen to The Carpenters or Taylor Swift, this is it. Here is a summary of where we are currently at. First the bad news and then the good. I will keep it simple.

The bad news

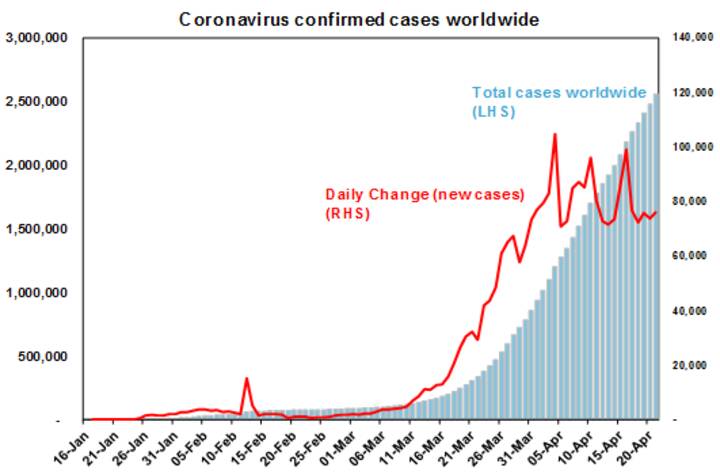

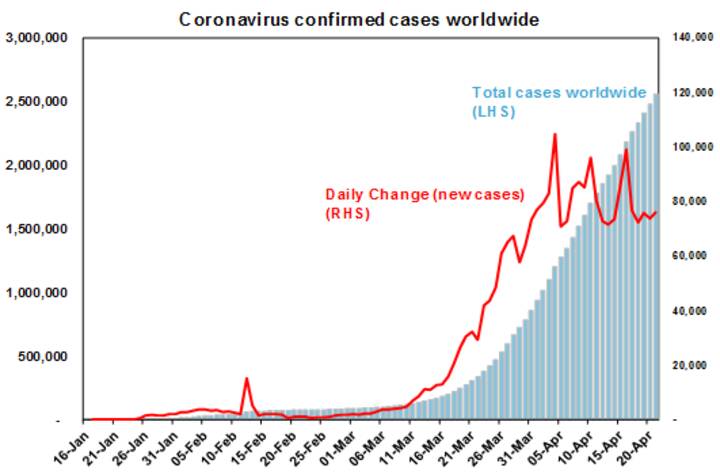

- The reported number of coronavirus cases globally is still rising and has now gone through 2.5 million.

- The reported death rate is still rising and is now up to 6.9%.

- Many worry about a “second wave” of cases. This occurred in the 1918 Spanish flu outbreak, and Singapore and Japan which had been cited as models for containment are now cited as examples of this (although they really still seem to be in part of a first wave as their quarantining efforts failed).

- Most medical experts still say a vaccine may be a year or more away. I remember around 1984-85 constantly hearing a vaccine for HIV was a year away – but we are still waiting.

- In the absence of a vaccine some worry about coronavirus outbreaks every winter as it migrates around the world.

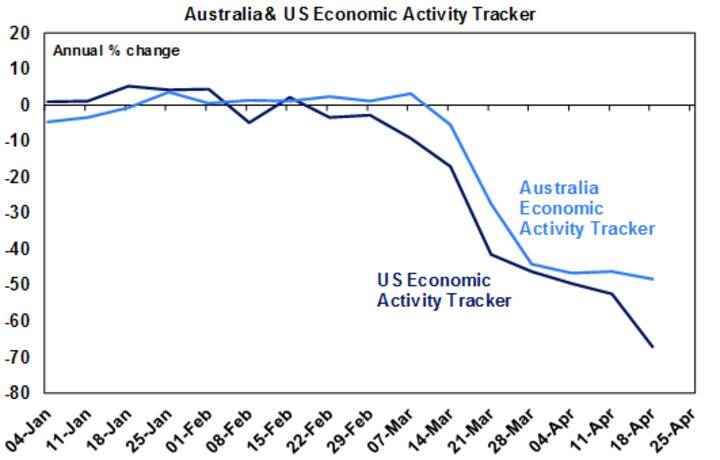

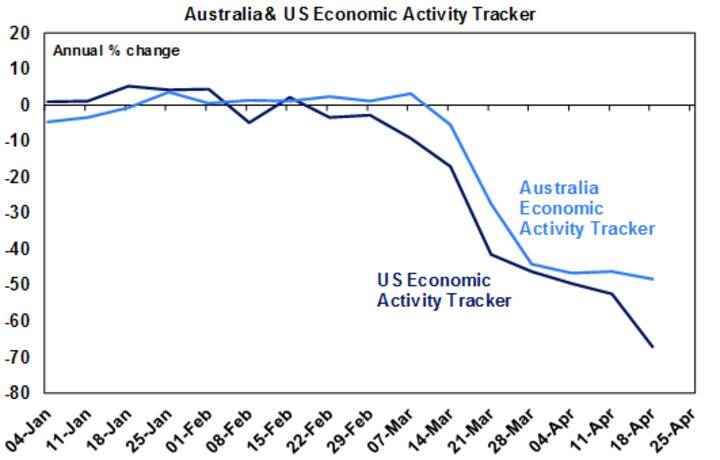

- Economic activity data is literally falling off a cliff. This was highlighted last week by the IMF’s forecast for a contraction in the global economy of 3% this year and in advanced economies of around 6%. And this masks a likely 10 to 15% slump in GDP centred on the June quarter. Falls of that magnitude have not been seen since the Great Depression. The collapse in economic activity in the US and Australia is highlighted by weekly economic activity trackers we have constructed based on data for things like restaurant bookings, energy usage, confidence, foot traffic and jobs.

- We are constantly hearing forecasts of unemployment going to 10%, 15% and maybe even 30% in the US (which does not have the benefit of Australian JobKeeper wage subsidies – if you are having a salary paid by JobKeeper then you will not be unemployed).

- This in turn is creating much consternation around whether there will be an economy left once the shutdowns end and/or how governments will get their debt down.

- Finally, the blame game is on. While partly politically motivated, US China tensions seem on the rise again.

The good news

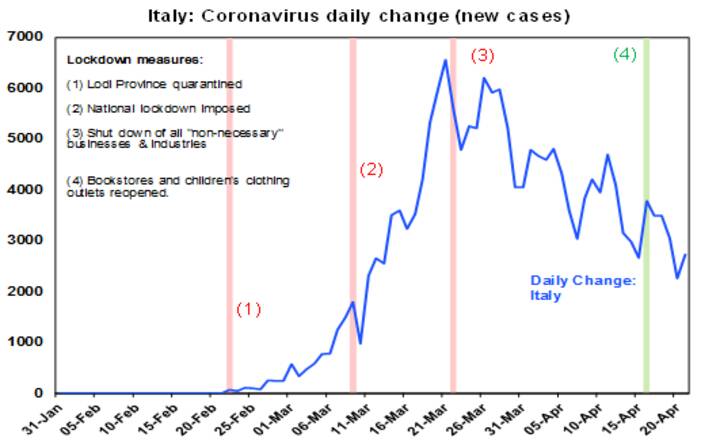

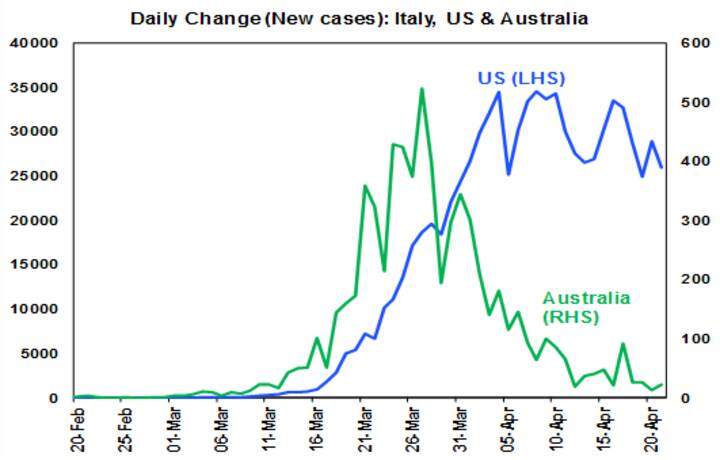

- While the total number of Coronavirus cases is rising, new cases appear to be leveling off or in decline.

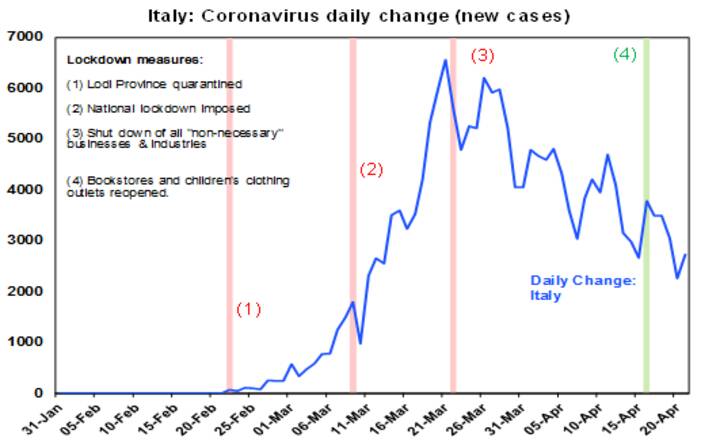

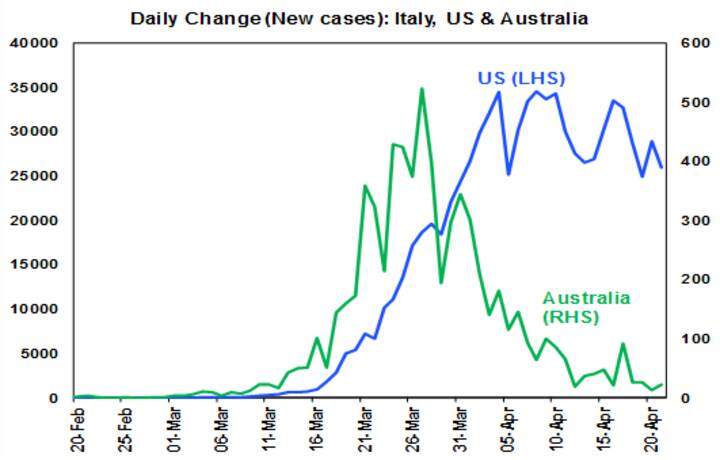

- Numerous European countries, led by Italy, look to be following the same path as China which saw a blowout in new cases, a lockdown followed 2-3 weeks later by a peak in new cases and then falling new cases. Australia appears to have been very successful in following this path (with the peak coming faster) and the US now seems to be following the same path, albeit its yet to show a decent downtrend in new cases. Social distancing clearly works! (Just out of interest – with various countries following the same pattern China has reported it makes me think the Chinese data on new cases is roughly right despite emerging skepticism.)

- Following this, the focus is shifting towards an easing of lockdowns. Various European countries and New Zealand have already announced some easing, allowing some shops to open/activities to occur. The US has released guidelines for states to move through a three phased reopening if they meet various criteria (in terms of falling new cases & hospitals coping) before moving to each new phase.

- While Australia’s PM Scott Morrison has indicated that current restrictions will remain broadly in place for another few weeks, he has indicated three criteria for an easing in restrictions: better testing; better contact tracing; and confidence in containing outbreaks all of which makes sense given the risks Australia faces coming into winter. Of course, successful anti-virals and/or a vaccine would make it all a lot easier, but we can’t rely on either just yet.

- Most countries talking of easing are well aware of the risk of a second wave (although President Trump’s bravado about “liberating” states is worrying). Hence a focus on phased easing only once certain criteria – around testing, new cases and quarantining – have been met. This is very different to what happened in relation to Spanish influenza where there really wasn’t any testing. For Australia this is likely to mean a gradual opening up from May. In the absence of a vaccine, full international travel is likely to be the last thing to return. That’s not great but given that in net terms its worth less than 0.5% of GDP to the Australian economy, it’s trivial compared to the 10-15% hit that’s come from shutting or partially shutting about 25% of the economy as it would be this mainly domestically driven activity that would bounce back as the shutdown is eased.

- Fiscal and monetary stimulus has been ramped up to the point that they should help minimise second round effects on economies enabling them to bounce back faster. This is particularly the case in Australia where the focus has been on job subsidies to preserve jobs, support businesses and low-cost RBA funding has enabled banks to offer loan payment holidays. Yes, there may be longer term issues in paying down debt, but they are small compared to the cost of allowing a bigger and deeper hit to the economy from not protecting businesses and incomes through the shutdown.

If, as appears likely, an easing of the lockdowns becomes common place in May/June, then April or maybe May should be the low point in economic data much as February was in China. This does not mean that things will quickly bounce back to normal – some businesses will not reopen, uncertainty will linger, debt levels will be higher and business models will have to adapt to different ways of doing things around working and shopping. On our forecasts it will look like a deep V recovery in terms of growth rates, but looked at in terms of the level of economic activity it will take a lot longer to get back to normal and this will mean that it will take a while to get unemployment down – from a likely peak in Australia of around 10%. But at least growth will be able to return and spare capacity and high unemployment will mean that it will take a while for inflation to pick up and so low rates will be with us for a long time.

This is all very different to five or six weeks ago when there was talk of six-month lockdowns, no confidence as to whether they would work and the policy response was seen as inadequate.

What does it mean for investors?

From their high in February to their low around 23 March, global shares fell 34% and Australian shares lost 37% as all the news was bleak. Since that low to their recent high, shares have had a 20% plus rally helped by policy stimulus and signs of coronavirus curve flattening. But this strong rally has left them a bit vulnerable in the short term – particularly as we have now entered a period which is likely to be see very weak economic data and news on profits. The ongoing dislocation in oil prices – to a “record low” of -$40 a barrel for West Texas Intermediate – has added to this, although lower petrol prices are ultimately more of a help than a hindrance to a recovery in economic activity. So, the very short-term outlook for shares is uncertain and a re-test of the March low cannot be ruled out.

However, shares are likely to be higher on a 1-2 year horizon as evidence of curve flattening, easing shutdowns combined with policy stimulus ultimately see a return to growth against a background of still very low interest rates and bond yields.

From a fundamental investment point of view the historical experience that covers recessions, wars and even pandemics (in 1918) tells us that the long-term trend in shares and other growth assets is up and that trying to time bottoms is always very hard. No one will ring the bell at the bottom, which by definition will come at a time of maximum bearishness when all the news is horrible. Maybe the low was back in March, maybe it wasn’t. To borrow from John Kenneth Galbraith’s famous quote on forecasters I will admit that I know that I don’t know1. So a good approach for long-term investors is to average into markets after bear market falls over several months.

Most people are now aware that scammers are unfortunately ever present in our modern-day life and the frequent use of the internet has only served to increase this risk. We noticed an increase in this activity during the initial roll out of the NBN and other Government programs or initiatives. Covid 19 is yet another opportunity for increased scam activity including scams targeting superannuation.

ScamWatch, a division of the Australian Competition and Consumer Commission (ACCC) that helps protect Australians from scams, has recently reported an increase in scams since the Coronavirus crisis began.

The ACCC has advised that scammers are taking advantage of people financially impacted by the Coronavirus crisis by falsely selling products or services online and using fake emails or text messages to try and obtain personal data.

There are also reports of scammers offering to check if a person’s superannuation account is eligible for various benefits (such as the early release of superannuation) or claiming new schemes will lock people out of their accounts.

In 2019, Australians lost over $6 million to superannuation scams with people aged 45–54 losing the most amount of money.

Please remember, never give any personal information about your superannuation, bank accounts or other financial information to anyone who has contacted you by phone or email. You should first confirm who has contacted you and make sure they are a legitimate company or government representative. Hang up and call the organisation directly by doing an independent search for their contact details. Better still, check with your relationship manager if you have any doubts to their legitimacy.

Steps you can take

If you think you may have provided information about your superannuation account to a scammer, please contact our office immediately. You can also contact www.idcare.org, a free Government-supported service which will work with you to develop a specific response plan to your situation and support you through the process.

More information on Coronavirus scams is available on the Scamwatch website (https://www.scamwatch.gov.au).

Quill is here to support you if you have any further questions, please contact our office.

Scamwatch has received over a thousand coronavirus-related scam reports since the outbreak. Common scams include phishing for personal information, online shopping, and scams targeting superannuation.

If you have been scammed or have seen a scam, you can make a report on the Scamwatch website, and find more information about where to get help.

Scamwatch urges everyone to be cautious and remain alert to coronavirus-related scams. Scammers are hoping that you have let your guard down. Do not provide your personal, banking or superannuation details to strangers who have approached you.

Scammers may pretend to have a connection with you. So it’s important to stop and check, even when you are approached by what you think is a trusted organisation.

Visit the Scamwatch news webpage for general warnings and media releases on COVID-19 scams.

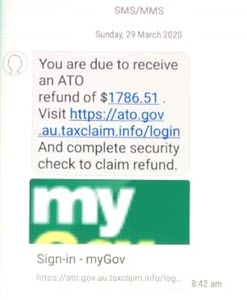

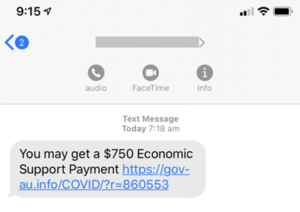

Below are some examples of what to look out for.

These are a few examples, but there are many more. If your experience does not match any of the examples provided, it could still be a scam. If you have any doubts at all, don’t proceed.

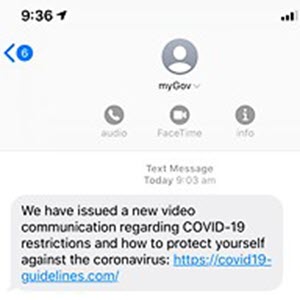

Phishing – Government impersonation scams

Scammers are pretending to be government agencies providing information on COVID-19 through text messages and emails ‘phishing’ for your information. These contain malicious links and attachments designed to steal your personal and financial information.

In the examples below the text messages appear to come from ‘GOV’ and ‘myGov’, with a malicious link to more information on COVID-19.

Examples of phishing scams impersonating government agencies

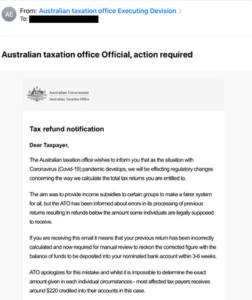

Scammers are also pretending to be Government agencies and other entities offering to help you with applications for financial assistance or payments for staying home (Click for larger version).

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if it appears to come from a trusted source.

- Go directly to the website through your browser. For example, to reach the MyGov website type ‘my.gov.au’ into your browser yourself.

- Never respond to unsolicited messages and calls that ask for personal or financial details, even if they claim to be a from a reputable organisation or government authority — just press delete or hang up.

Scammers are taking advantage of people in financial hardship due to COVID-19 by attempting to steal their superannuation or by offering unnecessary services and charging a fee.

The majority of these scams start with an unexpected call claiming to be from a superannuation or financial service.

The scammers use a variety of excuses to request information about your superannuation accounts, including:

- offering to help you access the money in your superannuation

- ensuring you’re not locked out of your account under new rules.

- checking whether your superannuation account is eligible for various benefits or deals.

Example of a scam targeting superannuation

A scammer will call pretending to be from a superannuation or financial service. They may refer to the government’s superannuation early release measures, and ask questions such as:

- Have you worked full time for the last 5 years?

- Are you going to apply for the $10 000 superannuation package?

Or falsely claim:

- Inactive super accounts will be locked if not merged immediately.

Tips to protect yourself from these types of scams:

- Never give any information about your superannuation to someone who has contacted you — this includes offers to help you access your superannuation early under the government’s new arrangements.

- Hang up and verify their identity by calling the relevant organisation directly — find them through an independent source such as a phone book, past bill or online search.

- See our Scamwatch media release warning about superannuation scams.

- For more information on superannuation scams visit ASIC’s MoneySmart website.

If you are thinking about switching your super to cash due to recent market volatility, it’s important to understand that doing so locks-in losses and that even the savviest investors will have trouble figuring out when to re-enter the market so as to fully capture the rebound.

(more…)

For the second time this year, sharemarkets are making major headlines for all the wrong reasons.

There is never any news coverage that tells you stocks are getting expensive.The only time that you hear about sharemarkets in popular news channels is when there have been some sizeable falls by which time it is usually too late to do anything.

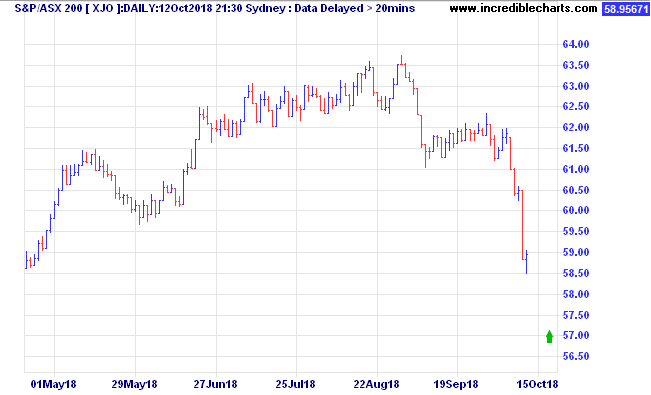

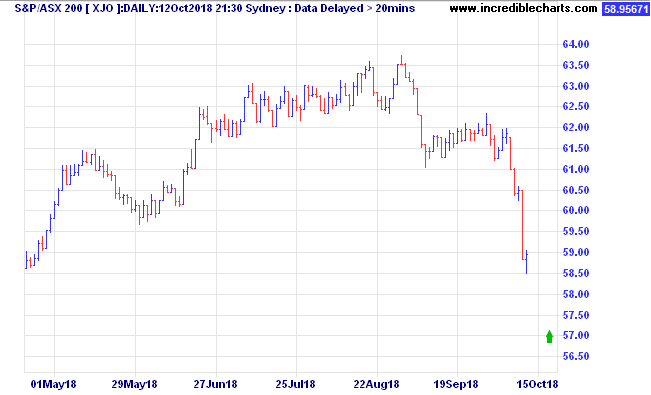

From Wednesday October 3rd, through Thursday October 11th, the US sharemarket as measured by the S&P500 Index fell by 6.9%. Over the same period the Australian market fell by 3.9%.

While the magnitude of the declines is nothing special, the speed of these falls was unusual. It was reminiscent of the falls back in February, which were also triggered by fears that interest rates in the US were going up faster than expected. The trigger then was a much better than expected jobs report card.

While the falls have generated plenty of headlines the fact is that no-one knows what next week will bring. We do know, and we have taken a view when setting asset allocations that equities are getting into the expensive territory, and also that this economic expansion is getting long in the tooth. Both of these factors make us inclined to have lower than normal allocations to sharemarkets.

However, even though markets have fallen suddenly, that doesn’t mean they will continue to fall, and in all probability, a bounce higher is more and more probably each day.

Many of you may have heard Warren Buffett’s folksy saying:

‘whether it’s socks or stocks, the Buffett family loves to go shopping when things are on sale’.

Of course the question that we all want to know is, will this be a 5% off sale, or a 50% off sale?

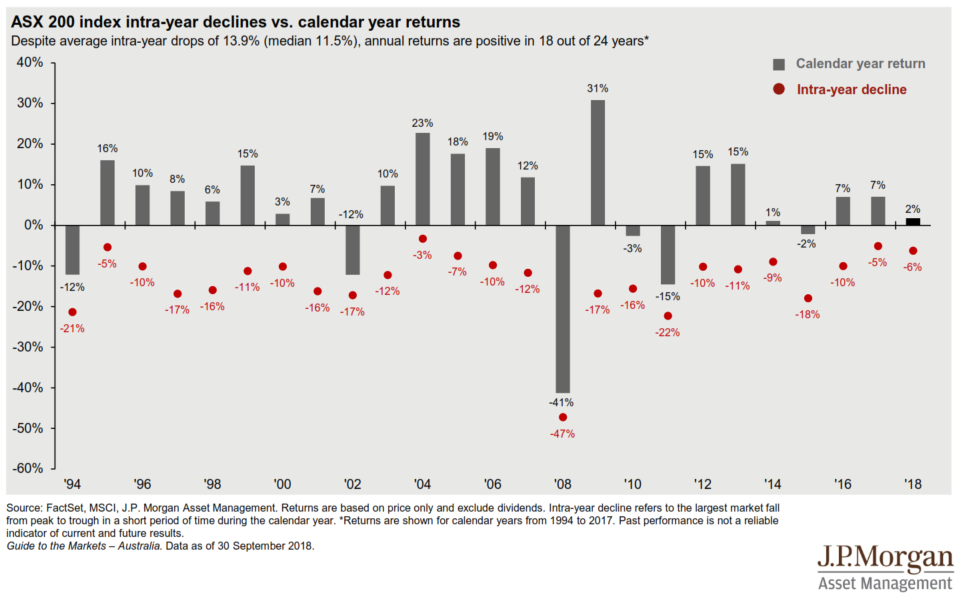

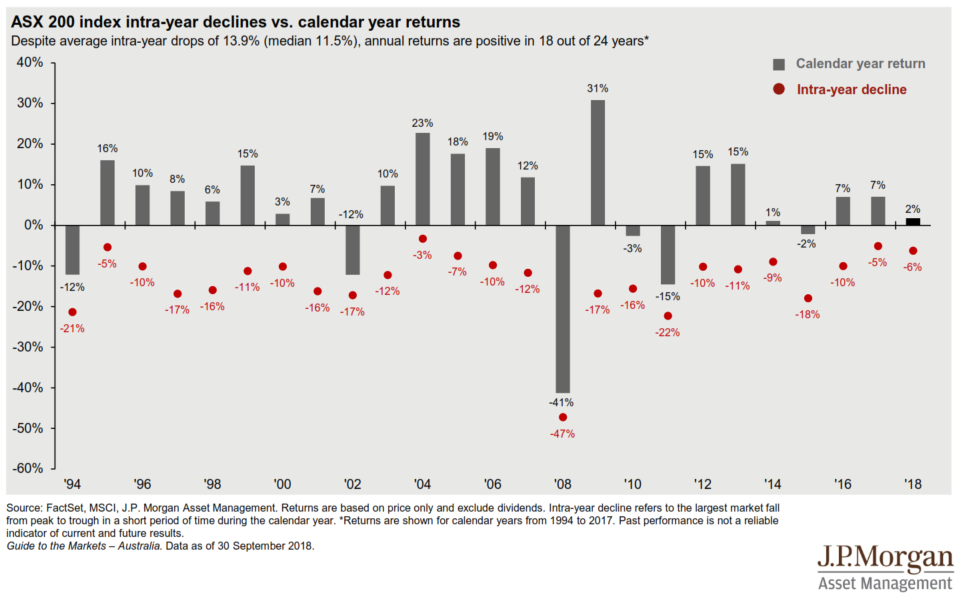

Reverting to history, it is worth re-visiting the chart below, thanks to JP Morgan, that shows how often Australian stocks go on sale, and how much ‘discount’ we can expect.

Note that the average sell-off is 13.9% at some point during a financial year. Only in five of the last 24 years has the decline in markets been less than 10% at some point during the year. That means the odds of a fall of 10% or more during any given calendar year are 80%.

Therefore, if this is a normal year, (and we are overdue for a 10% decline) there is probably more downside to come at some point.

At the 5883 points mark (ASX/S&P200) from last Thursday (11 October) we are down 7.38% from the 6352 high that we made on August 29th.

To make the typical 10% sell-off we would need to see the ASX/S&P200 down another 2.8% downside to 5,716 points. If this is a typical ‘correction’ that would be your buying point.

Of course, there is a risk that the sell-off may go much deeper.

In the US, this is now the longest ‘bull run’ in history. The market has been rising for 114 months without a bear market (fall of more than 20%). The longest prior bull market was 113 months from October 1990 to March 2000. One fund manager who is represented in many of our portfolios believes there is a 50% probability on a fall in US markets of between 20% to 30%.

We take the view that unless you can commit to holding shares for at least five years then you ought not be in that asset class at all. Discuss this with your adviser if you are not sure that you are positioned correctly.

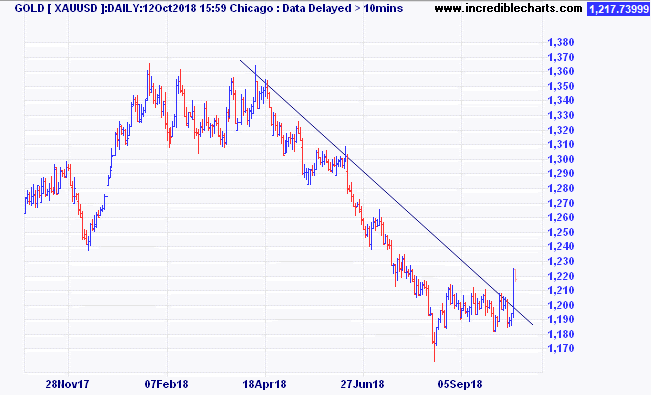

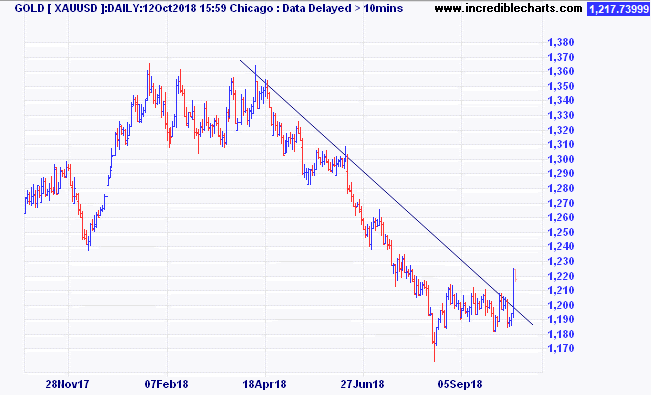

Another little fact that may be useful (and has not been mentioned in the media) is that during the last four US bear markets, (falls of more than 20%) the one asset that has done well every time was gold. It is also relevant that gold has just last week broken up through a six-month downtrend line. Normally a strong US dollar is bad for gold and that has been a drag on the performance of gold while stocks were doing well. But gold, along with the US dollar is also seen as a safe haven in times of stress in other assets and they may just start to rise in unison.

As an antidote to expensive sharemarkets, the Quill Group Investment Committee has recommended Equity Market Neutral funds and Hedge Fund exposures in our portfolios. We believe that although they have not performed as well as shares during the bull market, they will provide meaningful diversification in the event of further downside.

No one has the ability to accurately predict tops or bottoms in the market. Never act in haste. Today’s news is tomorrows fish and chips wrapper. Always discuss your feelings and fears with an adviser to ensure that your strategy is right for your circumstances.

Contact Quill Group today

Get in contact with Quill Group today to discover how we can help you navigate through your finances. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.

Most people get to a stage in their lives when they think they may need some professional guidance, like a financial adviser, in helping them navigate their financial path and lay out what some people refer to as a financial journey map.

Like any successful journey in life, this is often preceded by a well thought-out plan of where you want to be at different stages of your journey (goals and objectives), what means do you have to get there (income, assets and liabilities), what risks if any are you prepared to take in order to get there sooner(risk tolerance) and the strategy and vehicle required to help you get there, taking into consideration all that could go wrong (insurance, tax structure, investment and retirement product, estate plan and well documented advice document).

Unfortunately, our industry is riddled with jargon and terms people find difficult to understand, and this does nothing to allay fears of what to expect when seeing a financial planner or financial adviser for the first time.

So, what are the 4 simple questions you could ask yourself in order to help determine whether you could benefit from seeing a financial planner in the first place?

Are you concerned that if things don’t go to plan due to sickness or injury you and your family will be adequately protected?

Do you earn a relatively good salary but seem unable to save on a regular basis and concerned that any investment is structured in such a way as to minimise tax?

Would you like to ensure that when you are no longer around, your assets pass on those people or organisations you really care about?

Are you planning to retire on an income above that of the current single or combined age pension (currently $23,597pa or $35,568pa respectively) and unsure whether you will have sufficient savings to achieve this?

Whilst this list does not cover many of the other complexities often looked at in comprehensive advice such as tax structures, Centrelink benefits, and aged care solutions, it does provide you a starting point. Many people go through life without too much consideration for the future but one simple step that anyone can use to improve their current financial position is to take account of their existing financial position and then write down the things that you would like to achieve and timeframes to achieve these. This simple step can go a long way to helping you on your way toward financial success and would be essential to consider before a financial planner could assist you map out your future.

You decide to engage the services of a financial planner but unsure how the process works?

Typically, a financial planner will offer a complimentary first appointment to determine whether you could benefit from the services they offer. This gives you the opportunity of asking questions regarding their experience, qualifications, services and ownership interests. It also allows them to determine whether you are a right match for the planner and their organisation, as many planners now specialise in particular areas and may refer you to others who would be better suited to your circumstances.

Once both parties agree to proceed to the next stage then they would collect information from you relating to your goals and objectives, assets, liabilities, income and expenditure as well as your risk tolerance. This is an important step as the planner needs to ensure they know and understand your circumstances before providing any advice. This will also assist the planner with scoping their advice to suit your requirements as well as determine an appropriate fee for advice.

So how much will financial advice cost?

This is ultimately something agreed on between the financial planner and yourself and will depend on the scope of work involved but as a rule of thumb, the initial advice fee is typically between $3000 and $6000 depending on the scale and complexity involved.

What about ongoing advice?

To ensure that you remain on track to meet your objectives, and provide additional advice on any new developments, the financial planner will generally offer a choice of ongoing advice packages to regularly review your circumstances and hold everyone accountable. These fees are typically paid in monthly instalments, and the cost depends upon the level of service you want.

How do I find the right financial planner near me?

Many clients rely on the advice of friends, family or other professionals to guide them. Finding the right planner is a bit like finding a good doctor. Sure, they need to be qualified, but qualifications alone are not good enough. They also need to be good communicators, listen to your concerns, have some experience in dealing with similar issues and have a specialist support team around them. This is especially important, particularly to busy people who like to have all their financial affairs catered for by one person (trusted advisor) with a team of specialist professionals supporting them. In the case of a financial planner acting in the role of trusted adviser the support team may consist of an accountant, bookkeeper, insurance specialist, mortgage broker, estate planning lawyer and even an SMSF specialist.

Contact Quill Group today

Get in contact with Quill Group today to discover how we can help you navigate through your finances. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.