Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

If you’ve been wondering how to set up a family trust correctly, you are not alone. Thousands of new family trusts are set up in Australia each year for a variety of reasons including asset protection, tax optimisation or to act as the legal structure for a business.

How to set up a family trust in Australia

The following steps outline how to set up a family trust. The exact structure of a family trust is best determined by seeking advice from both an accountant and lawyer who can explain everything and help determine what will work best for you and your family.

1. Choose the trustee

The most important decision when setting up a family trust is to ensure you select the correct trustee. A trustee could be one person, a group of people or a company set up specifically to act as trustee.

A trustee of a family trust does not have to be a professional, it can be a family member or another trusted individual such as a close relative. The person (or persons) selected as trustee(s) need to be someone of integrity who can understand their trustee obligations such as acting in good faith. They need to be able to carry out their duty to act in the best interest of beneficiaries (not themselves).

Where a company is used, the company should be a newly set up company that ONLY acts as trustee of the trust. An existing company that is trustee of an SMSF or a company that operates a business should not be used. The director or directors of the trustee company should be selected with same criteria as above in regards to an individual trustee.

In most cases, the most suitable trustee structure for a family trust will be a newly incorporated proprietary company (Pty Ltd). One of more individuals will be appointed as directors of the trustee company.

A trustee company must issue shares – typically as little as $2 (hence the expression “$2 company” or “shell company”). Legal advice should be sort on who should only the shares in the trustee company, as the shareholders can vote the directors in and out of the company, and the company legally holds and controls the assets of the trust.

Ideally the shares in the corporate trustee of the trust should be held by a person who is ‘safe’ – i.e. not likely to go bankrupt and hand control of the trustee company to creditors who would then control the assets of the trust.

At this time its also important to consider who the ‘appointor’ of the family trust is. An appointor (also sometimes called the principal) is defined as a person with the ultimate power of appoint and remove trustees.

The appointor of a trust is not involved in the day-to-day administration of a family trust as this power and control is given to the trustee(s) or trustee company and its directors. The succession of the appointor (i.e. what happens on their death) is also best determined at this early stage to ensure ultimate control of the trust passes smoothly to the next generation.

2. Draft the trust deed

Once the key decisions around selecting the trustee and appointor of the family trust is made, the next step is to engage a lawyer with expertise in trust law to create the trust deed.

Many accountants will provide family trust set up services, however they are not themselves drafting the trust deed, they outsource it to a legal document provider (i.e. they use a legal template).

Ideally a lawyer should be involved with overseeing the trust establishment structure with the assistance and advice of an accountant. Quill Group can provide this service through our legal business Intello Legal.

3. Settle the trust

A key aspect of setting up a family trust is settlement. Settlement of a family trust involves an independent person unrelated to the beneficiaries transferring a settlement sum (typically $10) to the trustee.

There should be a physical transfer of the settlement sum from the settlor to the trustee and this amount should be the first deposit into the bank account when the family trust bank account is set up (refer Step 5 below).

The settlor must hand over the settlement sum to the trustee to be held on the terms of the trust (as per the trust deed) for the benefit of the beneficiaries.

The trustee must issue a receipt to record this has occurred. This is the point at which the trust is created because, by executing the trust deed and providing the settled sum:

- the settlor has put the trustee in charge of trust property;

- the settlor has defined for the trustee which persons fall within the class of beneficiaries, as stated in the trust deed; and

- the trustee has agreed to act.

The settlor then steps out of the picture.

From a legal perspective it is advisable to limit the settlor’s role in a trust to the initial establishment of the trust and payment of the settled sum. To avoid the perception that the settlor’s declaration of trust is revocable (i.e. they can make changes to the trust, beneficiaries or even close the trust down), the settlor should be unrelated to the trustee and the beneficiaries of the trust.

At this time the trustee(s) of the family trust (as determined in Step 1 above) sign the trust deed to accept the appointment of trustee(s) of he trust. By signing the deed they agree to be bound by the rules contained within the trust deed.

4. Stamping of the trust deed

Whether a family trust deed needs to be stamped and pay stamp duty or not is dependent on the State or Territory the trust is established in.

The table below outlines the stamp duty payable for the stamping of a family trust in each State and Territory:

State / Territory | Stamping Instructions and Costs |

| NSW | Needs to be stamped by a registered OSR lodger within 3 months from date of execution. $500 ($10 per additional stamped copy). |

| VIC | Needs to be stamped by a registered Duties Online Agent within 30 days from the date of execution. $200 (No charge for additional copies). |

| ACT | Stamping not required. Stamp duty is not payable. |

| QLD | Stamping not required. Stamp duty is not payable. |

| SA | Stamp duty is not payable, but deeds may still be stamped ‘exempt’. |

| WA | Stamping not required. Stamp duty is not payable. |

| NT | Stamping via NT Commission of Taxes within 60 days from the date of execution. $20 ($5 per additional copy). |

| TAS | Stamping by SRO Tasmania within 90 days from the date of execution. $50 (no charge for additional copies). |

5. Apply for the ABN and TFN

Once the family trust has been set up, the Australian Business Number (ABN) as well as the Tax File Number (TFN) need to be applied for.

These applications are completed online via the Australian Business Register (ABR) and typically completed by an accountant. If all correct details of the trustee and associated parties are provided, the ABN should be issued instantly with the TFN shortly after.

It can however take up to 28 days for the ABR to issue the ABN for a family trust if they need to undertake any manual checks of the details provided as part of the registration.

6. Set up trust bank account

We are often asked how to set up a trust account at a bank for a family trust. A bank account should be opened in the name of the trustee (e.g. Trustee Company Pty Ltd) as trustee for the family trust.

A bank will typically require the ABN and TFN for the trust as well as a copy or certified copy of the family trust deed. In addition a bank or other institution may also want to see a copy of the constitution, ASIC extract or Certificate of Incorporation for the trustee company.

The settlement sum (as discussed in Step 3) should be the first deposit into the bank account of the trust.

An often overlooked aspect of setting up a family trust is choosing the correct bank account. Trustees of a family trust need to ensure main bank account is fit for purpose. They need to consider what it is going to be used for and who will need access.

For example will it be used to execute investment purchases, or is it going to be an transacting account for a business. Does the bank account provide a data feed into the Trusts online accounting software like Xero?

Once the bank account is set up and active the family trust is officially operational and can received additional capital via borrowings (including loans from beneficiaries), purchase investments and operate a business.

Benefits of setting up a trust

Is it worthwhile setting up a family trust? Before setting up a family trust it’s important to understand the benefits and ensure it’s worthwhile for your family and your situation.

What is a family trust?

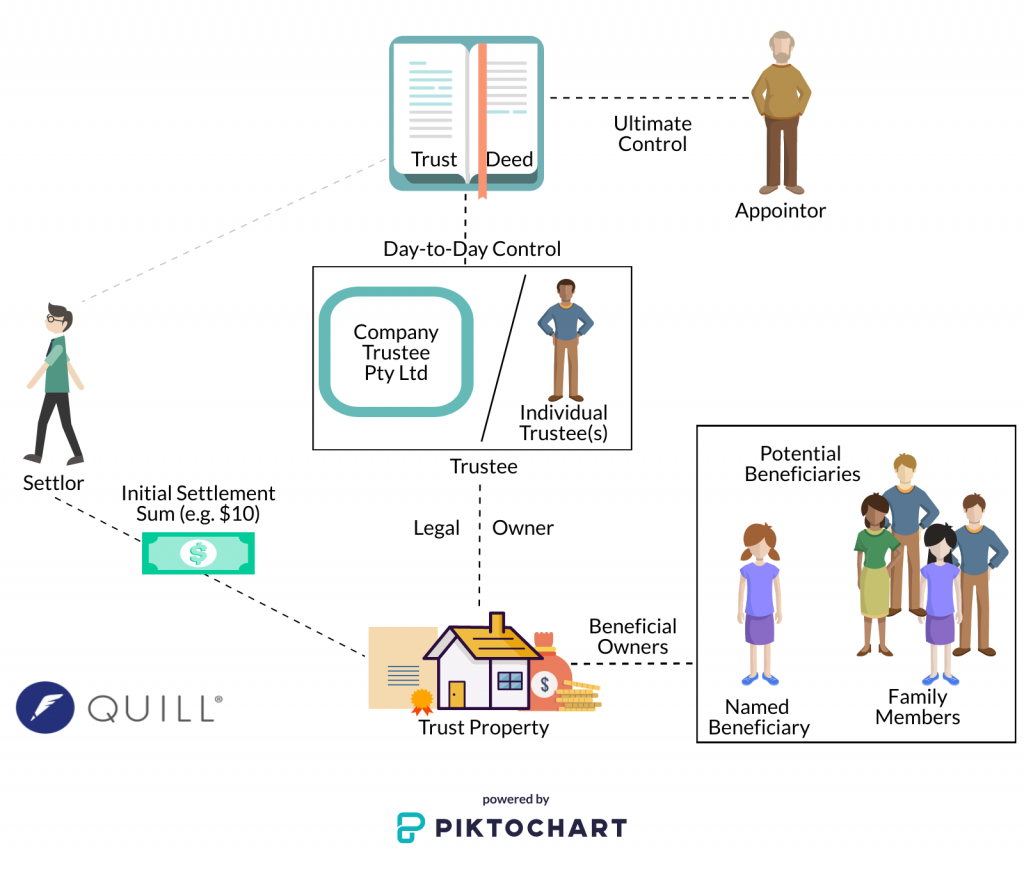

A family trust is also known as a discretionary trust. A trustee (either a person, group of people or a company) holds assets on behalf of beneficiaries. A trust deed is a formal legal document that names the parties (trustee(s) and beneficiaries) and contains the rules on how the trust should be operated.

Family trust structure

The following structure diagram illustrates the key parties and relationships in a family trust:

Family trust definitions

| Term | Definition |

Trustee | The trustee of a family trust is the legal owner of trust assets and has control of the day to day operation of the trust including managing the assets. The trustee can be an individual, group of individuals or a company. |

Trust Deed | A trust deed is a document that contains the rules of how the trust is to be operated (terms and conditions) as well as the relationships between the parties. A trust deed will name the trustee, settlor, beneficiaries and appointor (where applicable). |

Appointor | The appointor of a family trust is also sometimes known as the principal and has ultimate control of the trust. An appointor is a person named in the trust deed who can change or remove the trustee of the trust. |

Settlor | The settlor of a family trust creates the trust by providing the trustee with an asset or assets to be held for the benefit of the trust beneficiaries. The settlor should not be a beneficiary of the trust and should be unrelated to the beneficiaries. The role of the settlor is to provide property (the settlement sum) to the trustee, sign the trust deed and then have no further involvement in the trust. |

Settlement Sum | The settlement sum is the initial trust property used to create the trust. A settlement sum is usually $10 which is held as cash by the trustee then deposited into the trust bank account (although it can be kept on hand or even stapled to the trust deed). A settlement sum can be different amounts or be other assets or property, however duty might be payable where the settlement sum is NOT cash. It’s also possible to have multiple settlement sums. |

Beneficiaries | Beneficiaries are the ‘real’ owners, or the persons or group of people or entities who benefit from the assets in the trust. Beneficiaries can be specifically named in the trust deed or be defined through the terms of the trust deed. The trustee decides on the income and capital of the trust to be distributed to the beneficiaries. |

When to set up a family trust?

Deciding when to use a family trust can be tricky, however the following are examples of reasons for a family trust to be set up:

- To hold a family business

- To own family assets (including buying property in a trust name)

- To protect family assets

- To (legally) minimise tax by sharing income and capital gains across family members

- Estate planning and management

Another important aspect is looking at how much does it cost to set up a family trust and comparing the set up and ongoing costs against the advantages of the trust.

Family trust advantages and disadvantages

Family Trust Advantages | Family Trust Disadvantages |

Asset Protection: When someone it at risk of bankruptcy their personal assets are at risk and can be seized by Court Order or judgement and made available to creditors. When structured correctly (with appropriate legal advice) a trust may provide protection. This requires the bankrupt individual not being the appointor or trustee and also if they’ve not used the trust with the intention of hiding assets from creditors. | Disputes: Where a trust builds up a significant amount of assets and becomes and important vehicle holding a significant portion of a family’s wealth, the operation of the trust can become a challenge. Control over the trust and the trusts assets becomes very important, as does succession if the appointor or trustee loses capacity of dies. Gina Rinehart found this out in regards to her family trust. |

Family Trust Tax Benefits: When a family trust purchases investments (including shares, ETFs, managed funds, property or a business) the trust itself is entitled to the income. The trustee then decides how the income and capital gains of the trust is to be distributed (given on paper) to the beneficiaries each tax year. This enables the income from the investments and assets of the trust to be streamed through to beneficiaries in the most tax effective way. Families need to be careful however if making distributions to minor beneficiaries under 18 as higher tax rates apply on trust distributions paid to minors. | Tax Losses: When a trust makes a loss for tax purposes during the financial year that loss stays in the trust. Tax losses typically cannot be distributed meaning the individual beneficiaries can’t use the losses from those investments to reduce their personal income and personal tax bill. The losses are carried forward however and therefore can be applied in future financial years to reduce the taxable income that has to be distributed. |

Passing Down Assets: A trust is a useful way of legally moving assets from one generation to another without triggering capital gains and stamp duty. | Not Part of Estate: The trustee of a trust is legally separate from the beneficiaries meaning assets held by a trustee do not become assets of the estate when a beneficiary dies. However, if the trust owes money to a deceased beneficiary (beneficiary loan or unpaid present entitlement) the loan owed becomes an estate asset which could create issues for the trust if the loan has to be paid out. |

Borrowing: Banks will typically lend money to a family trust and there is no restriction on using the assets of the trust as security for a loan or mortgage. | Social Security: Depending on the structure, Centrelink may deem a share of the assets or income of a family trust (private trust) as being controlled by an individual an therefore included those assets and income (or a percentage of them) as part of the means testing for the age pension. |

Protection of Vulnerable Beneficiaries: When structured correctly a family trust can be a great tool to protecting vulnerable beneficiaries who may make unwise spending decisions if they controlled assets in their own name. For example, a child or grandchild who is not good with money or has other health or addiction issues. | Upfront and Ongoing Costs: A family trust has both the upfront cost to set up the trust as well as ongoing costs to manage the trust including preparing the annual accounts, tax returns and family trust distribution minutes. The amount of ongoing annual accounting fees for a family trust will vary depending on the complexity of assets in the trust as well as the level of service delivered by the accountant. A trust with basic investment assets such as shares, managed funds or investment properties may cost under between $1,500 and $2,500 per year, whereas a larger and more complex trust with more assets may cost between $3,000 and $5,000 per year. There are many variables that can impact ongoing accounting fees. |

How much does it cost to set up a family trust?

Costs involved in setting up a family trust include:

- Legal and taxation advice on the best structure including selection of the appointor, trustee, settlor and beneficiaries of family trust

- Establishment of the corporate trustee for the family trust

- Drafting of the trust deed

- Attending to the meeting of the settlor and trustee(s) to settle the trust

- Preparation and lodgement of the ABN and TFN applications with the ATO

- Establishment of the family trust bank account

For example, as of July 2023 the costs for set up a family trust with a newly incorporated company trustee from Quill Group is $2,666*

*Includes $576 ASIC company incorporation fee. Please note that ASIC indexes this fee and increases it each year on 1 July.

Please also note that the above fees are purely for the establishment of the family trust structure – it does not include any legal, accounting or taxation advice on the recommended structure of the family trust.

How much is needed to set up a family trust?

How much is needed to set up a family trust is dependent on the needs of the beneficiaries and the purpose of the family trust.

If the family trust is going to be operating a business, enough capital needs to be injected to commence trading of the business.

If the family trust is being used as an asset protection vehicle, it’s best to speak to a lawyer to help determine how the trust can be used to protect assets and provide guidance on the most cost-effective means or doing so. The ongoing annual costs of keeping the family trust active and lodging tax returns might be a comparatively small amount for the peace of mind a correctly structured family trust may provide.

If the family trust is being set up to legally reduce tax payable on investment income and capital gains, an accountant can provide a strong recommendation based on estimated tax savings as well as asset protection in comparison to the annual ongoing fees.

The annual ongoing accounting, tax and ASIC fees relating to a family trust will be one of many factors in determining how much is needed to set up a family trust, but its not the only factor and competent legal and tax advice should be sought.

Frequently Asked Questions – FAQs

The following are some common questions relating to setting up a family trust.

Who can set up a family trust?

A lawyer with expertise in trust law is the best placed to legally set up a family trust. An accountant is prohibited from providing a legal service. The majority of accountants who provide a family trust set up service to their clients are simply facilitating the establishment through a legal document provider who provides legal sign-off on the documents.

Accountants are very well placed to advice on the use of a family trust from a taxation perspective, however they may overlook important legal considerations – especially where there a complex or specific legal outcomes that are needed.

Quill Group in conjunction with our legal business Intello Legal are uniquely placed to provide comprehensive legal and taxation advice under the one roof.

How to set up a trust?

The following 6 steps can be used to set up a family trust:

- Choose the trusee

- Draft the trust deed

- Settle the trust

- Stamp the family trust deed

- Apply for the ABN & TFN

- Set up family trust bank account

Refer to above for the detailed steps.

How to set up a trust fund?

The term ‘trust fund’ is generally used in the United States and most people in Australia use the term ‘trust fund’ to describe a family trust / discretionary trust. To set up a trust fund, refer above for the detailed steps.

It’s important not to confuse a trust fund with a self-managed super fund (which is also a type of trust!). If you would like to set up a self-managed super fund, please visit our specialist SMSF business Intello Private.

How to set up a trust company?

A trust and company are two very difficult legal structures. You can set up a company or set up a trust – they are different.

A trust may (and in many cases should) have a company as the trustee as this provides longevity and administrative efficiency as control of a trust can be moved to different persons through transferring the shares (ownership) and directorship (operational control) to the new individual(s) who will control the trust.

Using a company as trustee of a family trust avoids the need to legally change the ownership and title of assets when control transfers, so there is no need to undertake title transfers of properties, close and re-open bank accounts in the name of the new trustee(s) or transfer shares or other investments to the new trustee(s).

Setting up a family trust to buy property (for buying property in a trust name)

Before setting up a family trust to buy property it’s important to seek both taxation and legal advice.

To set up a family trust to purchase property as an investment, please refer above for the detailed steps.

Land tax when buying property in a trust name

Advice should also be sought on the land tax implications of buying property in a trust name. From 1 July 2020, the land tax headlines across the country can be summarised as follows:

| State | Tax-free Threshold | Top Threshold | Top Rate | Trust Surcharge Regime | Foreign Owner Land Tax Surcharge |

| ACT | Nil | $2,000,000 | 1.10% | No | Yes |

| NSW | $734,000 | $4,488,000 | 2.00% | Yes | Yes |

| NT | The Northern Territory does not currently impose land tax on property owners | ||||

| QLD | $600,000 | $10,000,000 | 2.25% | Yes | Yes |

| SA | $450,000 | $1,350,000 | 2.40% | Yes | No |

| TAS | $25,000 | $350,000 | 1.50% | No | No |

| VIC | $250,000 | $3,000,000 | 2.25% | Yes | Yes |

| WA | $300,000 | $11,000,000 | 2.67% | No | No |

States such as New South Wales, South Australia, Tasmania and Victoria have aggregation or grouping rules when it comes to property ownership which can increase the amount of land tax payable.

Typically, land held on trust has not been dragged into these grouping provisions. This is because determining who ultimately controls or benefits from a trust can, in practice, be very difficult. For this reason, NSW, Victoria and Queensland have introduced a surcharge regime to impose land tax on trusts at a higher rate.

| State | Tax-free threshold for land held on trust | Surcharge Rate |

| NSW | Nil | Rates are unchanged for trusts as the elimination of the tax-free threshold significantly increases the land tax burden on trustees |

| QLD | $350,000 | 0.5% |

| SA | $25,000 | 0.5% – Surcharge phases out such that the top rate does not exceed 2.4% |

| VIC | $25,000 | 0.375% – Surcharge phases out when the total value of the taxable land is between $1.8m and $3m. For land holdings valued over $3m, the surcharge rate is the same as the general rate. |

There are also additional surcharges applicable in ACT, NSW, QLD and Victoria where there is a foreign owner of a property.

Land tax and family trusts is a complex area so it’s essential appropriate taxation and legal advice is sought before a family trust is set up to purchase property as an investment.

How long does it take to set up a family trust?

Provided all parties (i.e. trustees and settlor) are available and agreeable to set up the family trust, it’s a quick process to legally establish the trust. It’s possible to set up a family trust within 1-2 business days in normal circumstances which includes an allowance for taxation and legal advice to be sought.

Although there are online providers who will ‘instantly’ set up the trust, this is purely the provision of documents. Trusts can be complex structures therefore it’s important to take a little time and seek advice prior to setting up a trust in Australia.

A trustee company can be registered instantly with ASIC provided the company registration fee is paid. The trust can be settled on the same day the trustee company is incorporated. Once the trust is settled (through the settlor providing the settlement sum and the settlor and trustee(s) executing the trust deed) the trust is legally established and the trustee is able to enter into contracts and acquire assets on behalf of the trust.

It may still take up to 28 days for the ATO to issue an ABN and TFN for the newly established trust, and the trustee also needs to make the time to set up the bank account of the trust.

How to transfer assets into a trust Australia?

Although its possible to transfer existing assets such as shares, managed funds and property into a family trust, the major drawback is that the change of legal ownership will potentially trigger both capital gains tax as well as stamp duty.

There may be long-term income tax and asset protection advantages to transfer investments already owned into a family trust and these advantages may outweigh the upfront capital gains and stamp duty costs associated with the transfers.

Once again, transferring assets such as property into a family trust is a complex area. Legal and tax advice should be sought.

More questions?

Quill Group can assist you with both the initial set up of a family trust as well as the ongoing accounting and taxation work for your family trust.

In addition to taxation expertise Quill Group has in-house legal expertise in family trusts via Intello Legal.

Please get in touch with our team if you have any questions regarding the contents of this article or the services mentioned.2,