Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

The following is from Chris Lioutas from Insight Investment Consultants who sits on the Quill Group Investment Committee. Although relatively technical in nature, we thought it was worthwhile sharing his commentary on where markets are at currently and what headwinds they are facing.

Introduction

It’s fair to say that we finally have alignment between markets and economics with both in a state of flux at present. That alignment could be short-lived (in either direction) or it could be the status quo for the remainder of the year given the uncertainties that lie ahead.

Key will be some milestones ahead, namely government fiscal (stimulus) cliffs, virus waves and the proximity of a vaccine, and the US presidential race. De-globalisation and US-China relations are a close 4th and 5th.

Market immunity

Since the March lows, investment markets, particularly equities, have taken most of the bad news, fears and concerns in their stride. You could say equity markets have built up a level of immunity (pardon the pun) since the GFC which has only continued and been somewhat exacerbated by the extraordinary central bank and government stimulus we’ve seen since lock-downs began.

This can be evidenced by the extremely sharp rally we saw in April, on almost little to no new positive news, and also again a few weeks back where equity markets fell sharply (circa 6%) for all of one day before investors were ready to buy back in yet again.

Central bank action

The reason for this is what central banks have done to cash rates and government bond yields, which in the developed world are all between 0-1%, and what central banks are currently doing in asset markets (i.e. buying large amounts of bonds, and equities in some instances, support asset prices).

“Don’t fight the Fed” is a catchphrase used regularly in investment markets and for now it could be extended to don’t fight the RBA, BOJ, ECB, BOE, and PBOC, and which ever other central bank that is easing.

But will central bank action be enough? It’s possible in the very short term, but in the medium to longer term governments will need to step up and take the lead from central banks as they are best placed to put stimulus into the hands of consumers and small business, which today power most economies.

Equity markets this month are showing a tendency to be range-bound – i.e. trade within a band – with prices falling on concerns regarding the milestones mentioned above, before prices then rising when equity markets get “too cheap” relative to the returns on cash and bonds.

The key consideration then is what those milestones look like now, and more importantly, what they’re likely to look like as we get closer to each one. Two of the milestones have a fixed date (i.e. fiscal cliffs and the US presidential race) whilst virus waves and a potential vaccine have a variable date. Over the last 5 years or so, markets have better navigated concerns / risks with a fixed date, whilst struggling and taking a little longer to overcome those with a variable date.

Upcoming fiscal cliffs

In a nutshell, the fiscal cliffs are the upcoming dates we have for the expiry of certain government measures put in place during the depths of March. For the US, many of these end in July and August, whilst for Australia they largely end in August and September.

In addition, locally, the bank freeze on mortgage repayments also ends in September. Absent an extension, or some other new stimulus to fill the void, unemployment will rise significantly and likely remain high for multiple years.

Locally, many businesses don’t have the cash flow and/or balance sheets to continue to meet some of the highest wages in the world (i.e. the minimum wage was increased again last week whilst we already had the highest minimum wage in the world) given the drop in demand for goods and services since the lock-downs began.

Other businesses will have taken the last 2-3 months to either make their business more efficient / productive and/or figure out which roles they really need in the weaker economic period ahead. That all doesn’t relate well to employment. It means higher unemployment, higher underemployment, less hours worked, and lower wages.

Right now, it’s fair to say markets are betting that governments either extend and/or provide fresh new stimulus over the coming months. But we really don’t know. We’re assuming they do, because they have to, given the economic consequences, but we can make a fairly rational argument for not doing so as well.

Impact of second waves and outbreaks

Virus waves and a vaccine are really a function of the pace of reopening (i.e. easing restrictions) and the government response / narrative to each. As much as we’d like, lock-down won’t make the virus disappear. Even a vaccine won’t make the virus disappear. Governments need to be very careful about their response to waves of the virus.

The first lock-downs in March were to allow governments and health authorities to get prepared and to not overburden the health system. Considering preparations have all been made and considering many of the hospitals locally and globally are now relatively empty, re-initiating restrictions and/or going into lock-down again makes absolutely no sense whatsoever. All it would do is make the economic contraction deeper and more prolonged, crippling more businesses, instilling more fear, and decimating consumer and business confidence and sentiment.

We are currently seeing a 2nd wave of sorts in the US, China, and closer to home in Victoria. It’s important to note that these waves are an increase in virus cases, not an increase in virus deaths, with daily deaths continuing to reduce all around the world. These waves are to be expected as greater easing of restrictions are lifted and as more testing takes place. These waves shouldn’t be ignored, but nor should they be a source of panic or fear, and any form of government overreaction will simply set us back on both the health (i.e. herd immunity) and economic fronts.

Until there is a readily available vaccine that is effective in the majority of the population, the virus will be prevalent. Recent studies have confirmed a few effective treatments for the virus for those more adversely affected by it (i.e. those with significant pre-existing conditions, usually 2 or more). These treatments will help save lives, may shorten how long a person is contagious, and will remove some fears and concerns for the public.

US elections

The US elections take place in November and right now it’s a fairly open race. As it stands, we have a Democrat led lower house, a Republican led upper house, and a Republican President in Donald Trump. Recent polling has been less favourable to Trump and the Republicans, which is in stark contrast to pre-virus polling which had Trump winning the election fairly easily. Polls haven’t been as effective over the last few years largely because the polling has been conducted poorly and/or with bias and voters have changed their voting intentions right up until the day of the vote.

Currently we’re seeing political warfare play out in almost civil war-like conditions with the Left (Democrats) taking full advantage of the situation started by lock-down and exacerbated by a death caused by police at the time of arrest. This has coincided in a surge in support for the Democrats, but has it gone too far? There has been little to no Republican response date, almost like the strategy is to let the Left take it too far, expose themselves, and then implode, which would push swing voters and states firmly in favour of Trump (similar to the last election).

But it’s a dangerous ploy this time around as the Republicans risk alienating their own voter base through lack of action, which together with the help of news and social media could result in a clean sweep for the Democrats (i.e. the House, the Senate, and the Presidency), which would set the Republican party back years.

Why is this important? Democrat policies are generally negative for share markets, generally involve higher taxes (hampering the economic recovery), and generally involve significant expenditure (which would put the US budget, and hence the US government bond market, at serious risk) but would actually aid in the economic recovery assuming the expenditure was appropriate and productive. The US remains the lead economy and the lead share market globally, hence the importance of a recovering US economy and a healthy US equity market.

The US political outcome also lends itself to the 4thand 5th milestones mentioned above, namely de-globalisation and US-China relations. Both are significant risk events and well worth watching and monitoring but won’t be of impact until after the US elections.

Summary

For now, equity markets continue to be forward looking, focusing on next year’s likely earnings, whilst bond markets are still operating with some trepidation given risks have not yet passed and plenty of unknowns remain. Property and Infrastructure fortunes are closely linked to the easing of restrictions, whilst the oil price has risen on faster than expected reopening and strong levels of compliance in relation to production cuts from oil producing countries. The Aussie dollar has also risen, breaking through the US70c mark, before weakening a little more recently.

We continue to believe that diversification and selectivity remain key. In general, we wouldn’t advocate adding a whole lot of risk into portfolios right now, but we also wouldn’t advocate taking a whole lot of risk out of portfolios right now. We remain very watchful of the milestones mentioned above as these will dictate investor behaviour in the short term, whilst looking for opportunities with the medium to longer term in mind.

If you have any questions regarding this commentary and how it impacts your investment portfolio, please get in touch with your Quill Relationship Manager.

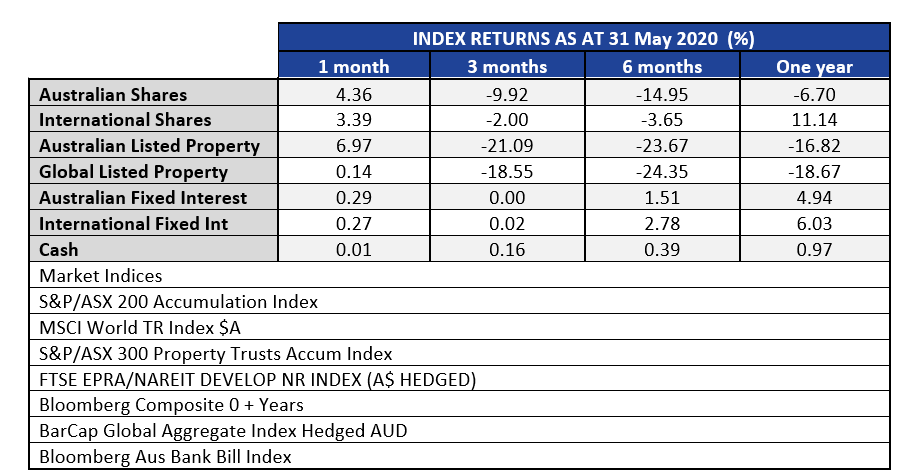

All major asset classes finished positive in the month of May, with equities in particular staging strong rallies. This came in spite of record unemployment, major US cities struggling to contain looting and destruction and another flare up in tensions between China and the US, with Australia also copping some retaliation from China.

The US dollar started falling from mid May versus the trade weighted index, and this has helped Emerging Markets and even the local US markets.

International shares pared their losses for the last three months back to -2.00% reflecting the diversification benefits of holding international assets. This benefit is not only because of the shock absorber effect of the falling Aussie dollar, but also because those foreign markets are less concentrated in financial companies than Australia. The defensive sectors such as drugs, consumer staples and tech all held up much better than banks and property.

Concerns over how well the massive fiscal and monetary stimulus would work held back the performance of banks and finance companies in Australia, but that changed late in May. For the eight weeks from 23 March, the ASX300 Banks index managed to rise only 8.00%. However, from the 22nd, of May until the date of writing (5 June) the Bank index has rallied 23.1% in just two weeks.

Fixed interest markets continued to return to normal in May, with companies again being able to tap the markets for new debt raisings.

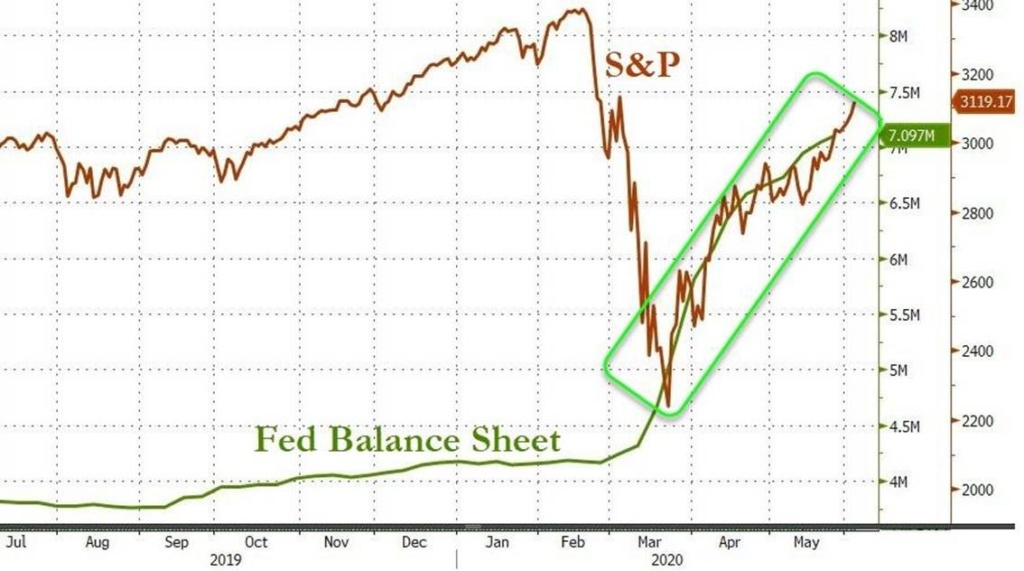

To provide some perspective on why the markets have rallied so strongly in spite of the fact that we are in the middle of a recession, not only here in Australia but likely globally, we need to look at only one chart. The US Federal Reserve Balance sheet overlaid with the S&P500 stock index.

The word ‘un-precedented’ has been used a lot lately. Even Aldi are slinging off at the overuse of the word in their latest ads. However, when it comes to the expansion of budget deficits and central bank balance sheets, there is no other word that springs to mind for describing what has happened.

The US Federal reserve balance sheet has exploded by 2.5 trillion dollars from $4.66Tn to $7.16Tr in the ten weeks since March 18, 2020. While this rate of change has some implications for inflation down the track the immediate goal is to arrest the asset price deflation and central bankers have been very successful at that.

While the central bank balance sheet expansions are alarming, and at some point will have greater consequences, those consequences may not unfold in the time frames that some may expect. One only has to look at Japan as an example of what could be in our future. The Japanese ten year government bond has been below 1% for over 8 years, and for most of the last four years has been at or below 0%.

Whether that is to be outcome here we do not know for sure. But what we do know is that the price of money is likely to be very low for a long time into the future. If looking at Japan as a model we observe that the Nikkei 225 index made a total return of 1.4% per annum in the 20 years since June 2000. Over the last 20 years, the P/E multiple in Japan has averaged 18x even with such low interest rates. In those market conditions, digging deeper to invest in stocks that still had earnings growth prospects and avoid the stagnant secular losers was the only way to make money. We also think that will be important going forward in Australia.

Key medium to longer-term financial market impacts of coronavirus shock include: lower for longer interest rates; a further blow to globalisation; another leg up in the US/China cold war; bigger government and public debt; a long-term risk of higher inflation; consumer & investor caution; faster embrace of technology; bad for airlines; another test for the Eurozone; and lower immigration.

Some of these will constrain economic growth but the faster embrace of technology is positive for growth.

This article was original post on the AMP Capital website 25 May 2020 by Dr Shane Oliver: Head of Investment Strategy and Economics, Chief Economist. You can view the original article here.

Introduction

There has been much debate about the short-term financial market impacts of coronavirus – on economic activity, unemployment, interest rates, house prices, shares, etc.

However, the magnitude of the shock means there will be medium to longer-term financial market impacts of Coronavirus as well. Of course, there is a danger in placing too much weight on current circumstances in assessing the future. Given this, we need to be a bit cautious, but here are 10 medium to longer-term impacts.

Lower interest rates for even longer

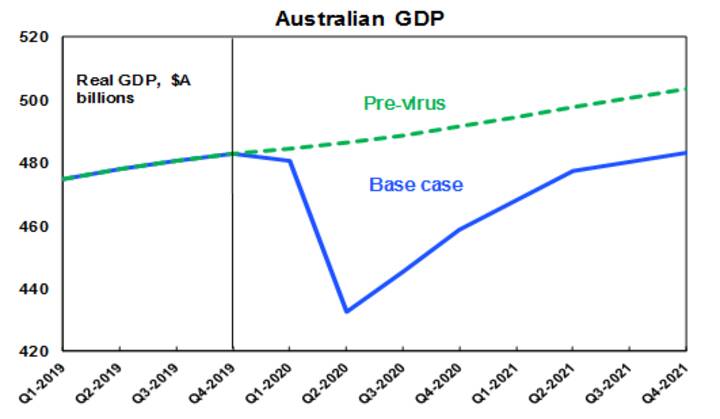

The hit to economic activity has been huge, resulting in a lot of spare capacity that will take years to be used up. We don’t see global and Australian economic activity getting back to pre-coronavirus levels until late next year or 2022.

Unemployment will take even longer to fall – it tends to go up via the lifts and down via the stairs. This will mean low inflation or deflationary pressure for the next three years at least. Which will mean central banks will be biased towards low interest rates for several years which will keep bond yields ultra-low.

Another way of looking at this is that given the hit to economic activity, interest rates would normally fall a lot further. In the GFC the Australian cash rate was cut by 4.25%. But because rates are already at or near zero, they can’t – so monetary easing is being achieved by quantitative easing. But an unconstrained cash rate for Australia would see it fall to around -3% not getting back to 0.25% until 2023 at the earliest. In the meantime, it means several years of very low rates. It’s little wonder the RBA is targeting a 3-year bond yield of 0.25% and its low-cost funding rate for banks is also 0.25% for three years.

Implications– Low rates mean very low returns from bank deposits and ultimately bonds but they make higher yielding shares and assets like property and infrastructure relatively attractive to investors once the hit to earnings and rents passes.

A further blow to globalisation

Recent years have seen a backlash against globalisation evident in the rise of Trump, Brexit and a backlash in some countries against immigration. The coronavirus disruption has added to this. Worries about the supply of medical items have led to pressure for their domestic supply. This could move on to food security and looks to be morphing into a push to bring supply chains “back home”. Borders have been closed for health reasons and it is unclear when they will all reopen.

Implications– While the outcome may simply be a diversification in reliance away from China to other emerging countries, the risk is that this all leads to reduced growth potential for the emerging world generally. Longer term it could reduce productivity if supply chains are managed on other than economic grounds and could remove a key source of disinflationary pressure from the global economy.

Another leg up in the US/China “cold war”

The trade war of 2018 and 2019 turned into a truce with the mini Phase One deal signed in January. However, with the coronavirus-driven shutdown, China is behind in its agreed purchases of US goods. What’s more, President Trump now faces a difficult task in winning the November presidential election – US presidents have not been re-elected when there is a recession and rising unemployment. This has been made worse by Trump’s inept handling of the crisis. This has left Trump keen to shift the blame over the virus and China is an easy target. He has already made some threats on this front and imposed some minor sanctions on China.

At present Trump’s approval rating is around where it’s always been and is not weak enough for him to conclude that he has nothing to lose by taking big risks on this front (such as tearing up the trade deal and imposing more tariffs). But if his prospects start deteriorating dramatically, he may conclude that he has nothing to lose, particularly with 66% of Americans now having a negative view of China, up from 48% in 2018. The latter also suggests a Democrat president may also take a tough stance with China – although likely with more of a diplomatic focus. The point is that the US/China trade war risks ramping up.

Implications– this could act as a negative for growth, work against multinationals and become a rising negative for shares. It also poses a threat to Australia but if Australia remains broadly neutral it may be minor (despite recent tensions around barley and beef) given that most Australian exports to China are for domestic use, not for reexport to the US.

Bigger government and bigger public debt

The GFC brought an end to economic rationalism and support for smaller government and was associated with a leg up in public debt levels. Fading memories of the problems of too much government intervention added to this. The coronavirus crisis has likely added to support for bigger government intervention in economies and the tolerance of higher levels of public debt. Particularly given that it may have enhanced perceptions of inequality with well-paid white-collar workers being able to isolate and work at home whereas lower paid workers have been stood down or have to continue working in less safe conditions. Safety regulations to ensure distancing will also add to business costs, although hopefully this will just be for the short term if a medical solution to coronavirus is found.

Implications– bigger government and aggressive measures to address inequality could reduce productivity growth and hence economic growth. Although it’s worth noting that if the Australia adopts a productivity enhancing agenda it may buck this trend.

Higher inflation with money printing

While it’s hard to see inflation becoming an issue in the next three years, the combination of rising public debt, money printing and more protectionism risks a longer term pick-up in inflation to say above 4%, particularly if central banks don’t reverse easy money quickly once spare capacity is used up.

Implications– a resurgence in inflation to high levels would be bad for productivity and negative for assets that benefited from the “search for yield”. But it’s a much longer-term issue.

Consumer and investor caution reinforced

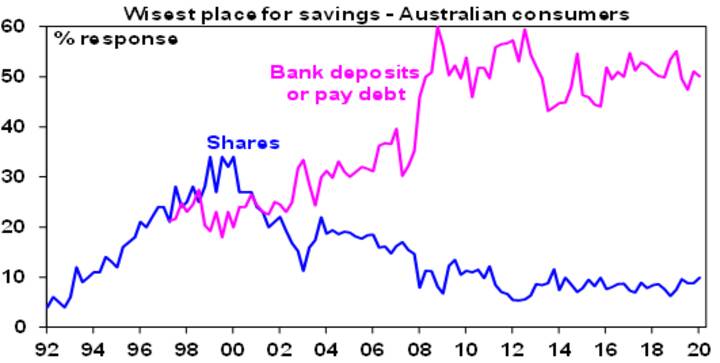

The GFC led to a wariness and a degree of investor caution on the part of households. This has been evident in around 50% of Australians nominating bank deposits and paying down debt as the “wisest place” for their savings compared to around 30% before the GFC, and scepticism of shares.

The pandemic and its hit to incomes and job security has likely reinforced this caution as one of the key financial market impacts of Coronavirus. Some even argue that the period of self-isolation will drive a rethink in terms of what’s important in life resulting in more mindful consumers focused on “do I really need it?” I am not so sure about the latter beyond the short term as people have short memories, but it is likely that household caution will remain, resulting in higher precautionary saving and more conservative investment strategies.

Implications – this will weigh on discretionary retailers, banks and wealth managers.

Faster embrace of technology

Self-isolation has dramatically accelerated the move to a digital world. Workers, consumers, businesses, schools, universities, health professionals, young & old have been forced to embrace new online ways of doing things. Many more have now embraced on-line retail, working from home & virtual meetings.

Implications – there are six big implications from this:

- The challenge to traditional retailing has been ramped up dramatically putting more pressure on traditional retailers and shopping centre owners to improve their offering.

- Less office space demand – but this may be offset if more space per person is needed in the absence of a vaccine.

- A shift from cities to suburbs/regions – as the shutdown shows that a “sea or tree change” is viable for many.

- This in turn may mean the beginning of the end for peak hour traffic congestion (although it could spike in the short term as people prefer to drive as long as Covid is still a risk).

- Virtual meetings may see less demand for business travel.

- This is positive for IT tech stocks facilitating online activity.

Bad for airlines

Which brings us to airlines. Less business demand for travel points to lasting damage. Some say the same may apply to tourists – but if a medical solution is found or the virus just dies out I suspect tourism will bounce back but based on the experience after 9/11 it may take a decade to fully recover.

Implications – airlines have already taken a big hit, but they are likely to be the slowest industry to recover.

Another test for the Eurozone?

Slow progress towards providing support for Italy has led to renewed concerns that the Euro area may break up. Populist anti Euro leaders may get a boost from the crisis, particularly if there is a new wave of migrants from Libya. However, Europe seems to be doing what it always does – gradually heading towards a solution with Germany agreeing with France for the common issuance of bonds and shifting in favour of fiscal stimulus. The pressures to keep the Eurozone together (safety in numbers, a high degree of identification as Europeans, solid public support for the Euro, Germany benefitting from the EU and Germany’s huge exposure to Italian bonds via the ECB) remain far stronger than the forces pulling it apart.

Implications – I wouldn’t bet on the Euro breaking apart.

Lower immigration

This is already a reality in Australia with travel bans and since immigration normally accounts for around 1 percentage point of population growth in Australia its absence knocks up to 1% off economic growth. The issue is how long immigration remains low. Australia would likely be a popular destination for migrants and students given its success in limiting coronavirus. And a rigorous testing/quarantine regime could allow both back sooner rather than later. That said I suspect while students will return faster, political pressures associated with higher unemployment will allow only a gradual recovery in immigration.

Implications – this is bad for home building & home prices as the hit to immigration has cut underlying dwelling demand by 80,000pa. But I suspect it creeps back over the next five years.

Concluding comments on financial market impacts of Coronavirus

Several of these longer-term implications will constrain economic growth and hence potential investor returns – notably the reversal of globalisation, bigger government, consumer caution & lower immigration. The faster embrace of technology will work in the other direction though to boost productivity and lower for longer interest rates are positive for growth assets.

Finally, a word of caution – anyone who got too negative for the long term in the last really major pandemic of 1918-19 might have missed out entirely on the “Roaring Twenties!” It’s much easier to think up negative things.

You can read more our our financial market updates here.

This roundup has been provided by Christopher Lioutas who is Director of Insight Investment Consultants. Chris is a member of the Quill Group Investment Committee as an external consultant.

Economic Update

The value of Australian retail trade rose strongly in March, surging by 8.5%, which was the strongest monthly rise on record. Spending on food and household goods was incredibly strong, with eating out, clothing, and department stores incredibly weak. The problem is in the rush to hoard and work from home, we got gouged: Retail trade volumes are only marginally positive, so we paid a lot more for the same goods we always buy under the guise of limited supply.

The Australian unemployment rate rose to 6.2%, coming in much better than expectations. The problem is the headline number doesn’t come close to telling the real state of affairs. The participation rate (those in work and those actively looking for work) fell through the floor as almost 500,000 left the labour force, thus masking a much higher unemployment number, which would’ve been above 9% had the pre-virus participation rate been used.

Around 1 in 5 employed people have either left employment or had their hours reduced, with the underemployment rate rising almost 5% to 13.7%. Absent JobKeeper and JobSeeker, the numbers would be even worse (circa 15% plus unemployment).

The RBA is forecasting a sharp drop in economic growth this year before a rather sharp rebound in ’21 and ’22. The sharp rebound is anyone’s guess right now. They also have inflation remaining low and below target out to ’22 which means we won’t see any upward pressure on rates until at least 2023. Lastly, they are forecasting a sharp rising in unemployment to 10% this year, with falls back down to 6.5% in 2022. The unemployment rate was 5.2% pre-virus.

US jobs data continues to worsen with more than 36 million now having filled claims for unemployment benefits. The unemployment rate rose to almost 15% and that was with the participation rate falling, which means the unemployment rate is much worse than the 15% suggests. Analysis shows that 40% of households earning less than $40,000 a year lost a job in March.

The US central bank chairman Jerome Powell has maintained that negative interest rates aren’t being considered. This is in stark contrast to market pricing which is implying that the bank will cut rates to below zero next year. The Australian central bank chair has also maintained that negative rates aren’t being considered, but chairs are in a position to rule anything out right now.

Chinese data showed a sharp drop in their factory prices, which was to be expected. Whilst factories are back almost full capacity, limited to no demand from the West (given we’re still in lockdown) will result in massive amounts of supply unless factory output is curbed. Problems for China.

Political Update

Anti-China rhetoric ramped up geo-political risks this week, with China threatening, and in some cases carrying through, with the threats to boycott Australian barley and meat. Education could be next.

US President Trump ramped up his anti-China rhetoric by asking the federal pension fund to exclude Chinese equities from its holdings and pushing the securities regulator to look at banning and potentially removing Chinese listings on US stock exchanges. Whilst abandoning the phase 1 trade deal looks unlikely, President Trump has asked for ways to raise tariffs without breaking promises in the trade 1 deal. He may also be looking at strict enforcement of the phase 1 deal which would be significantly difficult for China to meet without hurting their economy.

In contrast, China is opening up its financial markets further to foreign investors and trade talks between US and Chinese officials have begun and look relatively healthy at this point. China might be playing hardball on the anti-China front, but they will need to significantly open their economy and their financial markets ahead if they are to prosper and meet their targets.

Countries that have begun to re-open have reported an increase in new Covid-19 infections. This is to be expected. The virus can’t and won’t disappear. Even a vaccine won’t assist as vaccines aren’t mandatory and vaccine safety takes considerable time to achieve. The actions of governments are now even more critical – ie. if they stall the re-opening, or go back to lockdown, no amount of stimulus will stop the economic carnage that will take place.

Summary

What does all this mean for investors? Our views have not changed at this time: Stay invested, expect some short-term volatility, but be cautiously optimistic and focus on the long-term.

If you have any questions or would like further information, please contact your relationship manager.

You can view more of our market updates here.

Introduction

In the last few weeks we have certainly seen more stability return to investment markets along with many countries, including Australia, talking about a return to work and some easing of restrictions which have plagued investment markets over the last three months.

In some recent communications we discussed the “Light at the end of the Coronavirus tunnel” and then the sharp rise in the ASX200 during the month of April.

However, in our view there is certainly still the need to remain cautious despite this recent optimism.

In Europe and in particular the UK we are still not seeing a significant drop in Coronavirus cases. In some cases we are also seeing a so called “second wave” of cases appear and therefore whilst everyone would like to see a return to normality as soon as possible, it could still be some time off.

Likelihood of a recession in Australia

Markets have almost certainly already priced in the expectation of a recession, in the USA, Australia and most other countries. Nevertheless, the question still remains as to how bad and how long a recession will last?

The answer will most likely depend on the availability of new antiviral drugs and ultimately a vaccine. In the mean time it is most likely we will continue to see small improvements on the path to recovery and likewise in some sectors of the market we will see V-shaped recovery whilst in others it will be a slower U-shaped recovery.

What investors need to focus on

Given these market conditions are so unusual, in that they are completely dependent on a health crisis, what can investors do?

During volatile periods like we are experiencing, investors can sometimes make sub-optimal decisions when emotions take over, tending to buy out of excitement when the market is going up and sell out of fear when the market is falling. Markets do ultimately normalise, and when they do, those who stay invested may benefit more than those who don’t.

Therefore for those already invested the message is to stay invested and try limit the draw-down of capital so that when market conditions improve you are best placed to participate in that growth.

For those looking to invest, the strategy of “dollar cost averaging” is worthwhile considering. This is where the amount you are looking to invest is divided into smaller parcels and invested over a period of time rather than all at once.

Disclaimer

This article contains general information only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Before acting on any information in this report, you should seek financial advice taking into consideration your own personal objectives, financial situation and needs.

The ASX 200 just had its best month ever, up 8.8%. The rise in April, together with the last week of March has the Australian market up 21.5% from the low that was made on 23 March. In some terminology that might constitute a new bull market – though it may not yet feel like it since Australian shares are still 23% below the high point in February.

The fact that the ASX 200 just had the best month in in 28 years, (that specific index commenced in May 1992) illustrates how financial markets tend to price to where we might be in 6 to 12 months, rather than where we are right now. Who would have thought we could see this in the midst of the biggest ever spike in unemployment.

The month of April saw the release of all manner of dire economic data – none more dire than the news that claims for unemployment benefits have topped 30 million in the USA since mid March. Yet in spite of that, the S&P 500 index has risen by 12.7% in April, and a total of 30% in the 27 trading days since 23 March.

These strong market moves were in a large part due to the fast moving government fiscal responses. However, we also need to recognise the fact that the normal alternative to equities – government bonds – bear almost a guarantee of inflation adjusted losses if held to maturity. This means that bonds appear very unattractive compared to previous share market downturns, and this may also be a big factor in shaping investors responses in this downturn. Investors are virtually forced to take on risk if they wish to make some kind of return that exceeds inflation.

What the month of April has reinforced is that market bottoms are usually made when the outlook is the most pessimistic and gloomy. Similarly market tops are made when economic outlooks are rosy. The economic reality is that we will no doubt have more gloom to come, however there appears to be reasonable hope that our freedom to work and move about may be getting back to normal soon.

Preface by Peter Kirk – Executive Director

The below article from Dr Shane Oliver, head of investment strategy and chief economist at AMP Capital looks at whether there are some signs of a light at the end of the Coronavirus tunnel and what this may mean for investors?

This happens to be a lengthy article but for those that are interested and have the time, we think that it is a worthwhile read.

However, for those that are time poor these are the key points:

- After a strong share market rally in April from their March lows, shares in the short-term are vulnerable to bleak economic and earnings news as has been evident in the last week.

- However, positive news on the coronavirus outbreak is starting to get the upper hand – with evidence of curve flattening, an easing in lockdowns and massive policy stimulus pointing to a possible return to growth in the second half of the year, which should ultimately underpin a rising trend in share markets beyond short-term uncertainties.

This article was original published on the AMP Capital website 22 April 2020: Light at the end of the coronavirus tunnel – what does it mean for investors?

Introduction

The blanket coverage of coronavirus and its impact on the economy can lead to a lot of confusion right now. Some reports are hopeful of anti-viral drugs, others say a vaccine is at least a year away. There is talk of curve flattening but still rising cases and deaths. There is news of an easing in lockdowns but also worries about “second waves”. All this against a backdrop of collapsing economic data and surging unemployment.

Some prognosticators say now is a great buying opportunity for investors whereas others see more financial pain ahead. This is a horrible time for humanity and particularly those directly affected by coronavirus, but I must say if ever there was a time to turn down the noise and listen to The Carpenters or Taylor Swift, this is it. Here is a summary of where we are currently at. First the bad news and then the good. I will keep it simple.

The bad news

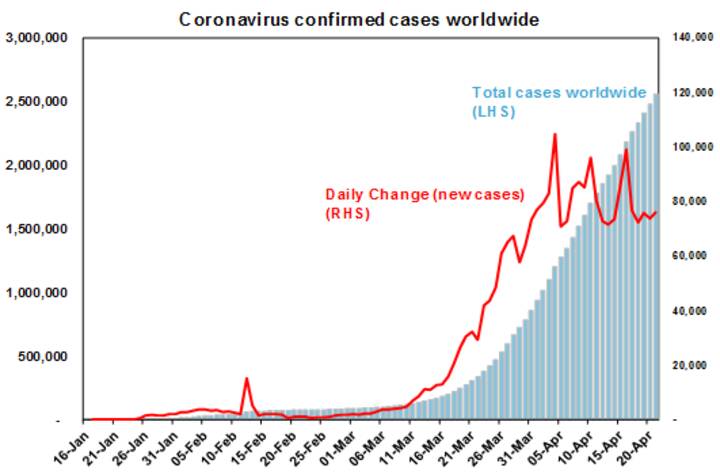

- The reported number of coronavirus cases globally is still rising and has now gone through 2.5 million.

- The reported death rate is still rising and is now up to 6.9%.

- Many worry about a “second wave” of cases. This occurred in the 1918 Spanish flu outbreak, and Singapore and Japan which had been cited as models for containment are now cited as examples of this (although they really still seem to be in part of a first wave as their quarantining efforts failed).

- Most medical experts still say a vaccine may be a year or more away. I remember around 1984-85 constantly hearing a vaccine for HIV was a year away – but we are still waiting.

- In the absence of a vaccine some worry about coronavirus outbreaks every winter as it migrates around the world.

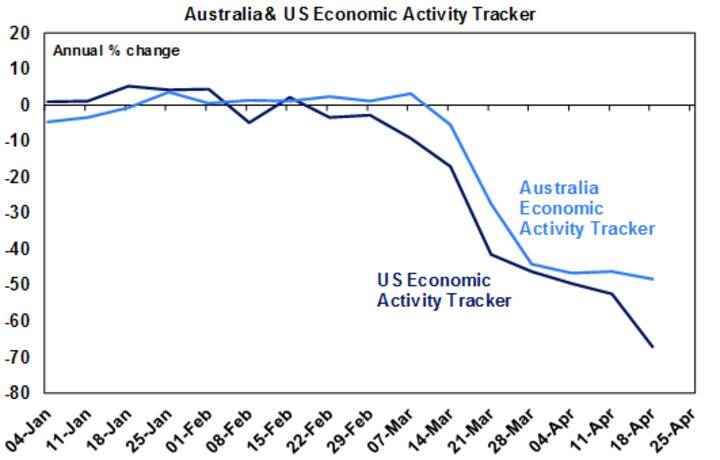

- Economic activity data is literally falling off a cliff. This was highlighted last week by the IMF’s forecast for a contraction in the global economy of 3% this year and in advanced economies of around 6%. And this masks a likely 10 to 15% slump in GDP centred on the June quarter. Falls of that magnitude have not been seen since the Great Depression. The collapse in economic activity in the US and Australia is highlighted by weekly economic activity trackers we have constructed based on data for things like restaurant bookings, energy usage, confidence, foot traffic and jobs.

- We are constantly hearing forecasts of unemployment going to 10%, 15% and maybe even 30% in the US (which does not have the benefit of Australian JobKeeper wage subsidies – if you are having a salary paid by JobKeeper then you will not be unemployed).

- This in turn is creating much consternation around whether there will be an economy left once the shutdowns end and/or how governments will get their debt down.

- Finally, the blame game is on. While partly politically motivated, US China tensions seem on the rise again.

The good news

- While the total number of Coronavirus cases is rising, new cases appear to be leveling off or in decline.

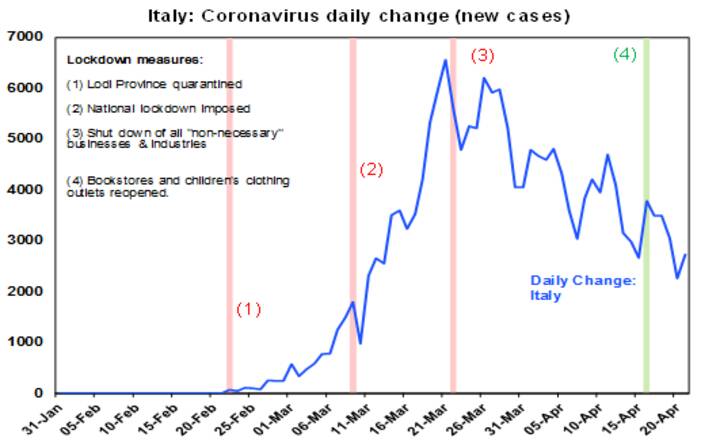

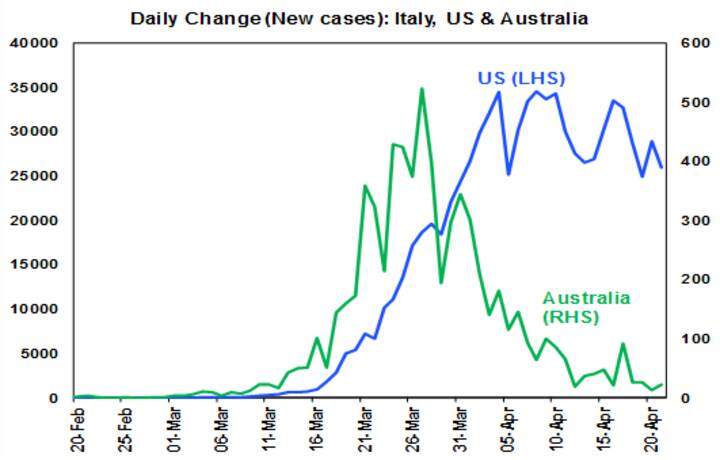

- Numerous European countries, led by Italy, look to be following the same path as China which saw a blowout in new cases, a lockdown followed 2-3 weeks later by a peak in new cases and then falling new cases. Australia appears to have been very successful in following this path (with the peak coming faster) and the US now seems to be following the same path, albeit its yet to show a decent downtrend in new cases. Social distancing clearly works! (Just out of interest – with various countries following the same pattern China has reported it makes me think the Chinese data on new cases is roughly right despite emerging skepticism.)

- Following this, the focus is shifting towards an easing of lockdowns. Various European countries and New Zealand have already announced some easing, allowing some shops to open/activities to occur. The US has released guidelines for states to move through a three phased reopening if they meet various criteria (in terms of falling new cases & hospitals coping) before moving to each new phase.

- While Australia’s PM Scott Morrison has indicated that current restrictions will remain broadly in place for another few weeks, he has indicated three criteria for an easing in restrictions: better testing; better contact tracing; and confidence in containing outbreaks all of which makes sense given the risks Australia faces coming into winter. Of course, successful anti-virals and/or a vaccine would make it all a lot easier, but we can’t rely on either just yet.

- Most countries talking of easing are well aware of the risk of a second wave (although President Trump’s bravado about “liberating” states is worrying). Hence a focus on phased easing only once certain criteria – around testing, new cases and quarantining – have been met. This is very different to what happened in relation to Spanish influenza where there really wasn’t any testing. For Australia this is likely to mean a gradual opening up from May. In the absence of a vaccine, full international travel is likely to be the last thing to return. That’s not great but given that in net terms its worth less than 0.5% of GDP to the Australian economy, it’s trivial compared to the 10-15% hit that’s come from shutting or partially shutting about 25% of the economy as it would be this mainly domestically driven activity that would bounce back as the shutdown is eased.

- Fiscal and monetary stimulus has been ramped up to the point that they should help minimise second round effects on economies enabling them to bounce back faster. This is particularly the case in Australia where the focus has been on job subsidies to preserve jobs, support businesses and low-cost RBA funding has enabled banks to offer loan payment holidays. Yes, there may be longer term issues in paying down debt, but they are small compared to the cost of allowing a bigger and deeper hit to the economy from not protecting businesses and incomes through the shutdown.

If, as appears likely, an easing of the lockdowns becomes common place in May/June, then April or maybe May should be the low point in economic data much as February was in China. This does not mean that things will quickly bounce back to normal – some businesses will not reopen, uncertainty will linger, debt levels will be higher and business models will have to adapt to different ways of doing things around working and shopping. On our forecasts it will look like a deep V recovery in terms of growth rates, but looked at in terms of the level of economic activity it will take a lot longer to get back to normal and this will mean that it will take a while to get unemployment down – from a likely peak in Australia of around 10%. But at least growth will be able to return and spare capacity and high unemployment will mean that it will take a while for inflation to pick up and so low rates will be with us for a long time.

This is all very different to five or six weeks ago when there was talk of six-month lockdowns, no confidence as to whether they would work and the policy response was seen as inadequate.

What does it mean for investors?

From their high in February to their low around 23 March, global shares fell 34% and Australian shares lost 37% as all the news was bleak. Since that low to their recent high, shares have had a 20% plus rally helped by policy stimulus and signs of coronavirus curve flattening. But this strong rally has left them a bit vulnerable in the short term – particularly as we have now entered a period which is likely to be see very weak economic data and news on profits. The ongoing dislocation in oil prices – to a “record low” of -$40 a barrel for West Texas Intermediate – has added to this, although lower petrol prices are ultimately more of a help than a hindrance to a recovery in economic activity. So, the very short-term outlook for shares is uncertain and a re-test of the March low cannot be ruled out.

However, shares are likely to be higher on a 1-2 year horizon as evidence of curve flattening, easing shutdowns combined with policy stimulus ultimately see a return to growth against a background of still very low interest rates and bond yields.

From a fundamental investment point of view the historical experience that covers recessions, wars and even pandemics (in 1918) tells us that the long-term trend in shares and other growth assets is up and that trying to time bottoms is always very hard. No one will ring the bell at the bottom, which by definition will come at a time of maximum bearishness when all the news is horrible. Maybe the low was back in March, maybe it wasn’t. To borrow from John Kenneth Galbraith’s famous quote on forecasters I will admit that I know that I don’t know1. So a good approach for long-term investors is to average into markets after bear market falls over several months.

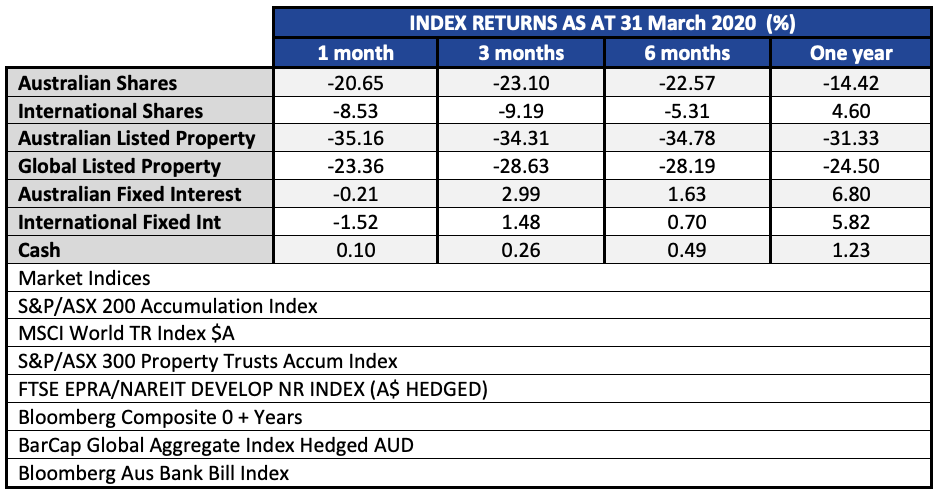

All the major asset classes had a torrid month in March with nothing but cash in positive territory. Even the fixed income markets posted a negative return in a divergence from the normal shock-absorber effect that the asset class is supposed to have in portfolios. Australian shares were down 20.65%, but at the worst of the intra-day peak to trough between 19 February and 23 March the decline was 38.8%.

International shares also had large falls, though when investing on an un-hedged basis the fall in the Australian dollar cushioned the falls to a large degree. While the S&P 500 had trimmed its intraday peak to trough loss of 35.4% (since February 19th) to minus 12.5% for the month of March, the USD gained 5.9% on the Australian dollar. Likewise the Euro gained 6.08% against the Aussie. These moves helped cushion the falls in International shares. While it is easy to favour Australian shares for the income and franking credit benefits, times like these remind us of the benefits of having a diversified portfolio.

Fixed interest markets were also in turmoil in March. The reasons were many, but one identified by the Bank of International Settlements was unwinding of ‘risk parity’ strategies. The concept is to use leverage to increase bond exposure within a balanced asset allocation. In normal times, when bonds usually rise in price as equities fall it works well. Until both shares and bonds start to fall at the same time, which does happen occasionally. This creates forced sales as the mathematical risk models demand that assets are sold to restore the ‘value at risk’ model to a comfortable position due to the increased volatility. When ever-larger amounts of money are invested in line with such a strategy, the rush for the exits create a wave of selling that in more rational times, (with an equal number of buyers and sellers) would not happen. Such is the risk of a strategy when it becomes too large in proportion to the size of the markets they invest in.

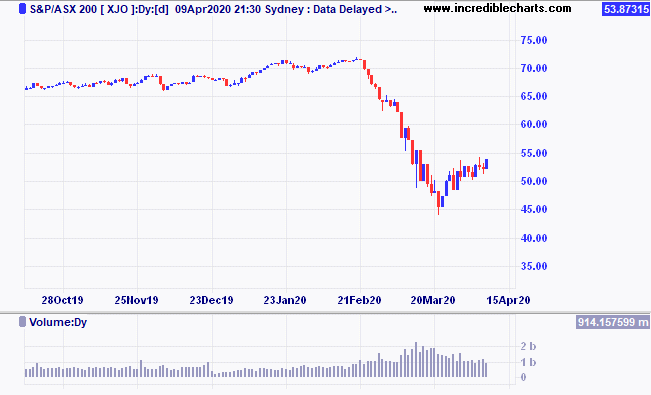

To provide some perspective on the falls in the Australian market we have the ASX200 chart below. The lower panel in the chart shows the daily trading volume, which almost doubled during the depths of the sell-off. The number of trades has settled somewhat but is still elevated.

We have commented in our intra-month updates about the amount of fiscal stimulus that has now been unleashed by governments around the world. An update to that figure shows that we now have promises of support for affected workers and businesses amounting to around US$6.5 trillion according to Chris Watling of Longview Economics. When we think about the global GDP is around US$85 trillion, the US$6.5 trillion represents around 7.5% of global GDP. The expectation of economist is for the second quarter GDP figures to fall by around 15%. If we were to assume two quarters of GDP at 15% below potential, then the annualised hit to GDP would be around 7.5% assuming we can get back to normal by the end of September.

In addition to the fiscal stimulus, the ‘big bazooka’ rolled out by the US Federal Reserve on March 23 was the announcement that they would facilitate unlimited support to buy up government and certain corporate debt. This monetary stimulus was just the circuit breaker that financial markets needed and marked the low in shares, and the peak in credit spreads so far. Today, on the 9th of April, the Federal Reserve announced a program of buying that would extend into sub-investment grade bonds and also the Exchange Traded Funds that hold these type of assets. This will be very positive for companies such as Ford, whose bonds have fallen into the sub investment grade category.

Overall we are seeing some positive signs emerge globally. However, we also need to be realistic to the facts that over the next month we will be seeing the fastest increase in the unemployment rate the world has ever seen. This carries risks of behavioural changes that we may not have yet fully anticipated. What the last two weeks since 23 March has reminded us of, is that just when things seem the darkest, markets can turn on a dime. For this reason alone it is best not to be over-reacting, either being too bullish or too bearish, but keep your emotions in check and realise the reality will likely be somewhere between your worst dreams and your best hopes.

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.

Warren Buffet once said, “Be Fearful when others are greedy and be greedy when others are fearful.”

The world has certainly become much more uncertain in the last 24 hours. In the space of 90 minutes we had Prime Minister Morrison and Treasurer Frydenberg present the Australian Governments stimulatory packages to help offset the economic effects of the Coronavirus, followed by President Trump who delivered the US Government’s response and the ‘underwhelming’ response from the Europe Union (ECB).

Your Portfolio

For our positioning in your portfolios, we started the year very defensively, in quality assets across a diversified range of market sectors and security positions. We haven’t altered our general approach but have been tactically adjusting our positioning to adapt to the changing market circumstances and opportunities.

The quality of our portfolios is very high and the risk protection we have incorporated to guard against volatility has served us very well in recent weeks. We will continue to be tactical, adapting to the moves in markets. The Investment Committee’s macro positioning more broadly remains on the cautious side.

As the situation in equity markets is extremely fluid with political and economic responses changing on the hour, offering a definitive response or advice to you is difficult. Equity prices are significantly lower than the recent record highs, but the world is also dealing with a series of events that is to unknown to all of us, there may well be further deterioration in equity values in the coming months. Until there is a period of consolidation in global equity markets, and the flow of information from individual companies on the impact of recent events on their business is announced, currently trying to establish valuations for equities is very difficult.

Investors who sell shares now could lock in a ‘paper loss’ and lose the dividend income from Australian companies, which may be more attractive than the returns available on cash and some fixed interest investments, thanks to monetary policy. Then there is the problem of timing a return to the market, that would be “very difficult” given the volatile and uncertain climate. This could lead to missed opportunities that could erode long-term portfolio returns.

There is a lot of debate among market experts on whether it’s too early to start investing. While it’s extremely difficult to pick the bottom of the market, there sure is a lot of fear out there.

Get in Touch

Either way, in these times the value of getting investment advice is at its greatest. So if you have any concerns or wish to discuss your portfolio in more detail, get in touch with your Relationship Manager.

“History doesn’t repeat itself, but it often rhymes”. That was Mark Twain’s quote on what we can learn from history, and in the context of the impact of Coronavirus on the stock market, we can look to the past to analyse history and how that might impact on our future.

The world has experienced epidemic cases like Ebola and SARS and MERS before and the reaction to those crises can give us an idea of what impact we might see from COVID2019 as it is officially called.

Some questions in these dire circumstances might be:

- What is the impact of Coronavirus on the stock market?

- What is the impact of Coronavirus on my portfolio?

- Are there investment opportunities in the wake of Coronavirus?

At the time of writing this article, the death toll is 1,115 with 45,000 infected, and 28 countries reporting cases. For the most up to date stats, check here.

In the video below, Director Mark Beveridge talks us through the impact of Coronavirus on the stock market and your portfolio.

We are grateful to Nick Maggiulli, a Data Scientist for Ritholtz Wealth Management for some of the charts within this video.

Read his full story here, including stats on other virus outbreaks.

Excerpt here:

“That is why this post will investigate an epidemic’s impact on the market by looking at the returns that occurred immediately before and immediately after that epidemic’s peak. Of course, this will never prove that the market reacted solely because of the epidemic, but it may provide a clearer picture than what prior analyses have shown.

In total, the three modern epidemics discussed (Ebola, SARS, and Swine flu) all coincided with minor declines in global equity markets (-5% to -10% range) that quickly recovered. Note that this is slightly smaller than the -6% to -13% cited in the Citi study quoted earlier despite me cherry-picking the local market tops/bottoms to try and match their narrative.

Any deviation from this cherry-picking strategy and the results are even less noteworthy. For example, Dow Jones Market data found that in 11 out of the 12 epidemics they studied, the S&P 500 was up 6 months after the first case was reported.

Therefore, if we assume that coronavirus will be similar in deadliness to Ebola, SARS, or Swine flu, then I wouldn’t worry about the long term impact on my portfolio.

But, I already know what you’re thinking. What if coronavirus ends up being worse than these modern epidemics?”