Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

For the second time this year, sharemarkets are making major headlines for all the wrong reasons.

There is never any news coverage that tells you stocks are getting expensive.The only time that you hear about sharemarkets in popular news channels is when there have been some sizeable falls by which time it is usually too late to do anything.

From Wednesday October 3rd, through Thursday October 11th, the US sharemarket as measured by the S&P500 Index fell by 6.9%. Over the same period the Australian market fell by 3.9%.

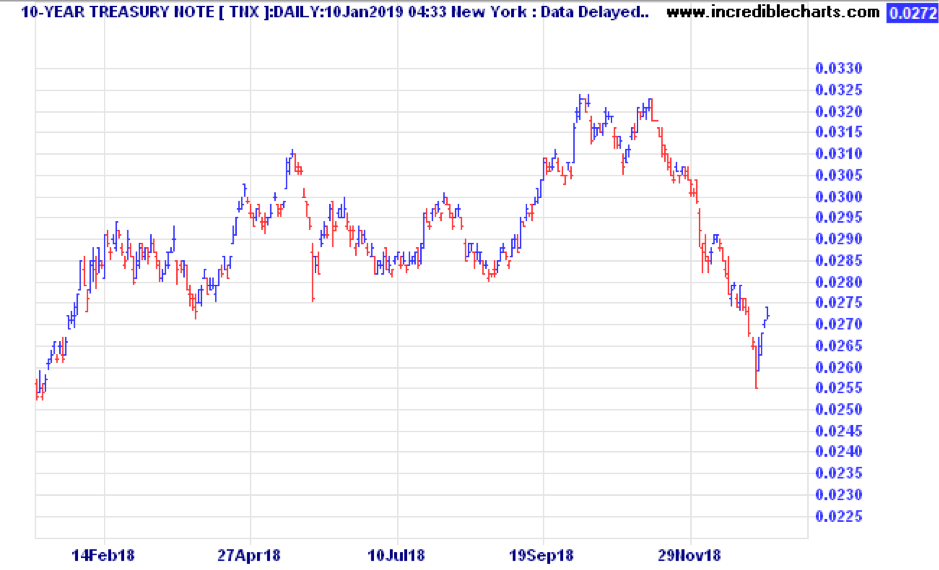

While the magnitude of the declines is nothing special, the speed of these falls was unusual. It was reminiscent of the falls back in February, which were also triggered by fears that interest rates in the US were going up faster than expected. The trigger then was a much better than expected jobs report card.

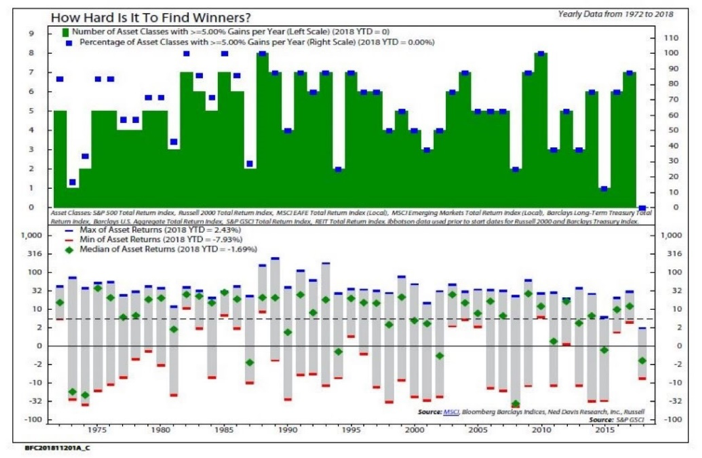

While the falls have generated plenty of headlines the fact is that no-one knows what next week will bring. We do know, and we have taken a view when setting asset allocations that equities are getting into the expensive territory, and also that this economic expansion is getting long in the tooth. Both of these factors make us inclined to have lower than normal allocations to sharemarkets.

However, even though markets have fallen suddenly, that doesn’t mean they will continue to fall, and in all probability, a bounce higher is more and more probably each day.

Many of you may have heard Warren Buffett’s folksy saying:

‘whether it’s socks or stocks, the Buffett family loves to go shopping when things are on sale’.

Of course the question that we all want to know is, will this be a 5% off sale, or a 50% off sale?

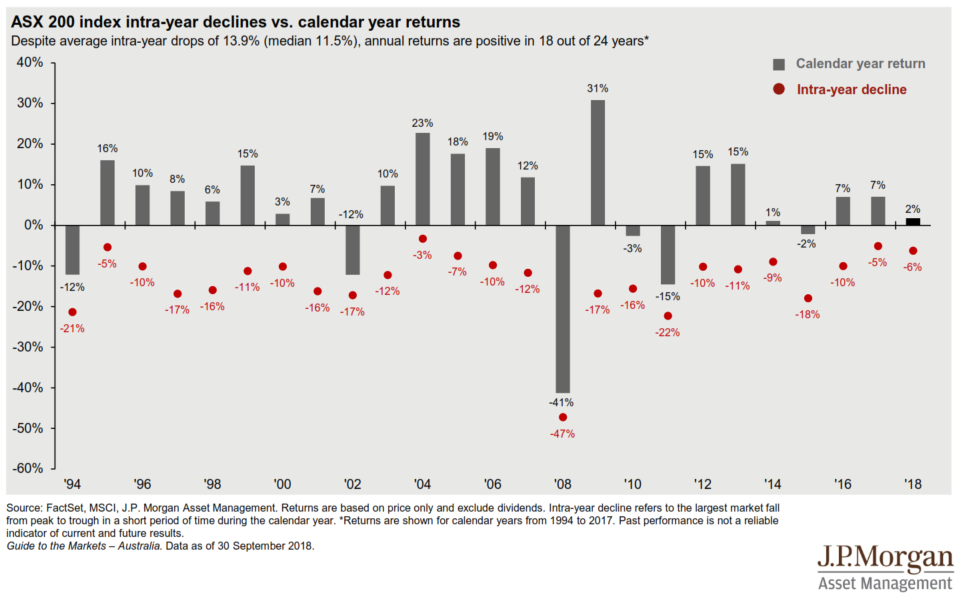

Reverting to history, it is worth re-visiting the chart below, thanks to JP Morgan, that shows how often Australian stocks go on sale, and how much ‘discount’ we can expect.

Note that the average sell-off is 13.9% at some point during a financial year. Only in five of the last 24 years has the decline in markets been less than 10% at some point during the year. That means the odds of a fall of 10% or more during any given calendar year are 80%.

Therefore, if this is a normal year, (and we are overdue for a 10% decline) there is probably more downside to come at some point.

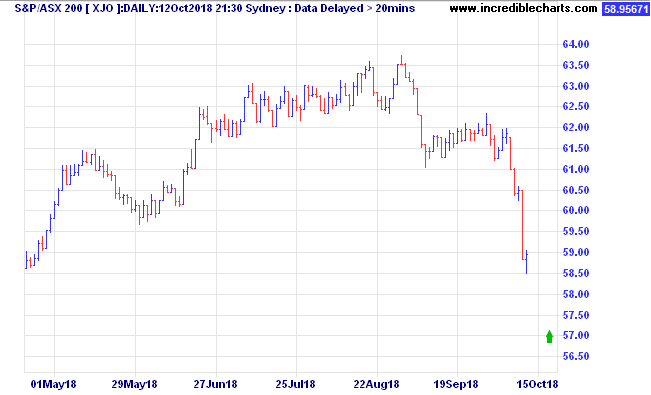

At the 5883 points mark (ASX/S&P200) from last Thursday (11 October) we are down 7.38% from the 6352 high that we made on August 29th.

To make the typical 10% sell-off we would need to see the ASX/S&P200 down another 2.8% downside to 5,716 points. If this is a typical ‘correction’ that would be your buying point.

Of course, there is a risk that the sell-off may go much deeper.

In the US, this is now the longest ‘bull run’ in history. The market has been rising for 114 months without a bear market (fall of more than 20%). The longest prior bull market was 113 months from October 1990 to March 2000. One fund manager who is represented in many of our portfolios believes there is a 50% probability on a fall in US markets of between 20% to 30%.

We take the view that unless you can commit to holding shares for at least five years then you ought not be in that asset class at all. Discuss this with your adviser if you are not sure that you are positioned correctly.

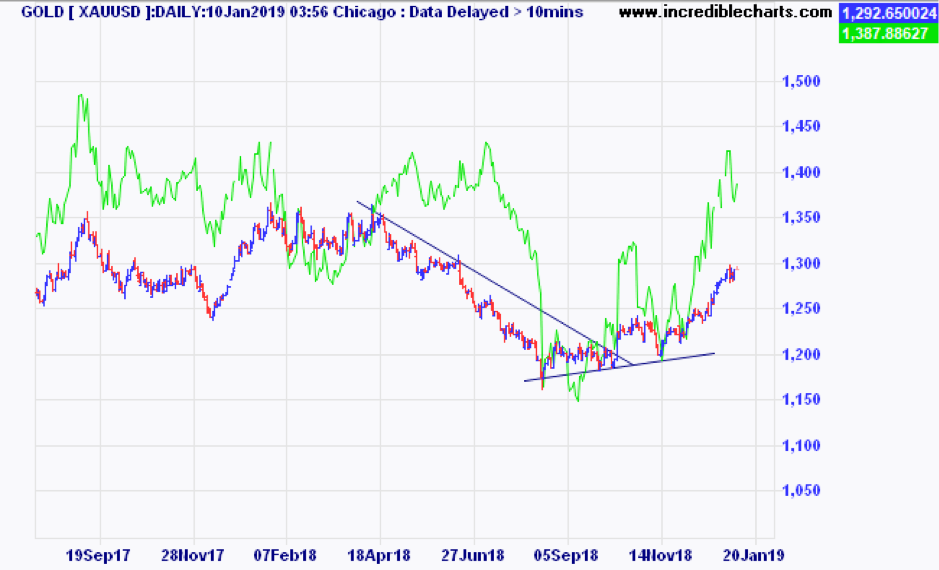

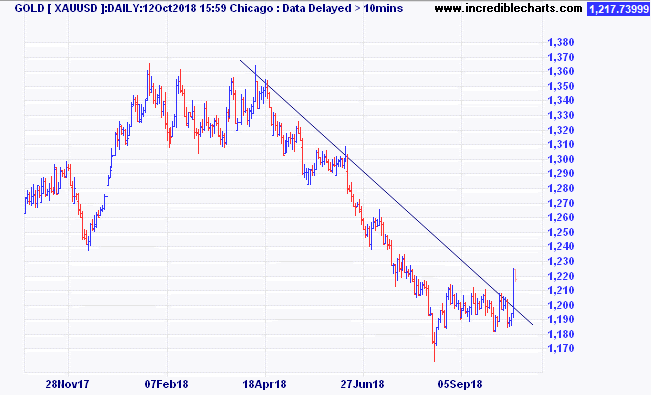

Another little fact that may be useful (and has not been mentioned in the media) is that during the last four US bear markets, (falls of more than 20%) the one asset that has done well every time was gold. It is also relevant that gold has just last week broken up through a six-month downtrend line. Normally a strong US dollar is bad for gold and that has been a drag on the performance of gold while stocks were doing well. But gold, along with the US dollar is also seen as a safe haven in times of stress in other assets and they may just start to rise in unison.

As an antidote to expensive sharemarkets, the Quill Group Investment Committee has recommended Equity Market Neutral funds and Hedge Fund exposures in our portfolios. We believe that although they have not performed as well as shares during the bull market, they will provide meaningful diversification in the event of further downside.

No one has the ability to accurately predict tops or bottoms in the market. Never act in haste. Today’s news is tomorrows fish and chips wrapper. Always discuss your feelings and fears with an adviser to ensure that your strategy is right for your circumstances.

Contact Quill Group today

Get in contact with Quill Group today to discover how we can help you navigate through your finances. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.

The S&P/ASX 200 Accumulation Index reached a new post GFC peak in the final days of August, at 6352. (The pre-GFC high was 6828 on 1 November). During September the index fell for the first five trading days, and then managed to rally to a close for the month that was only down 1.26%. Since then markets have come under heavy selling. Later we also take a look at the FANG stocks update – Facebook, Amazon, Netflix and Google.

International share markets were mixed, but showed a 0.55% gain after adjusting for the lower Australian dollar.

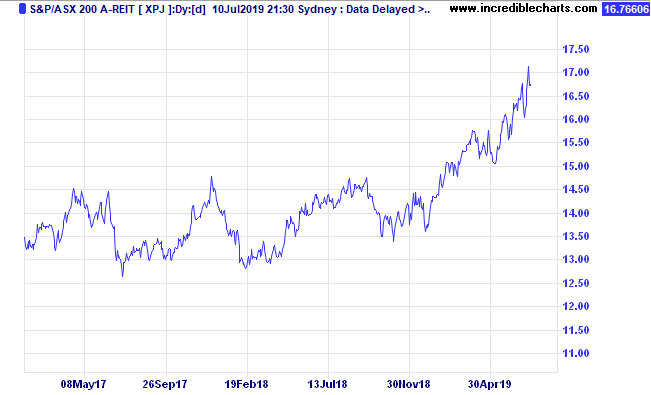

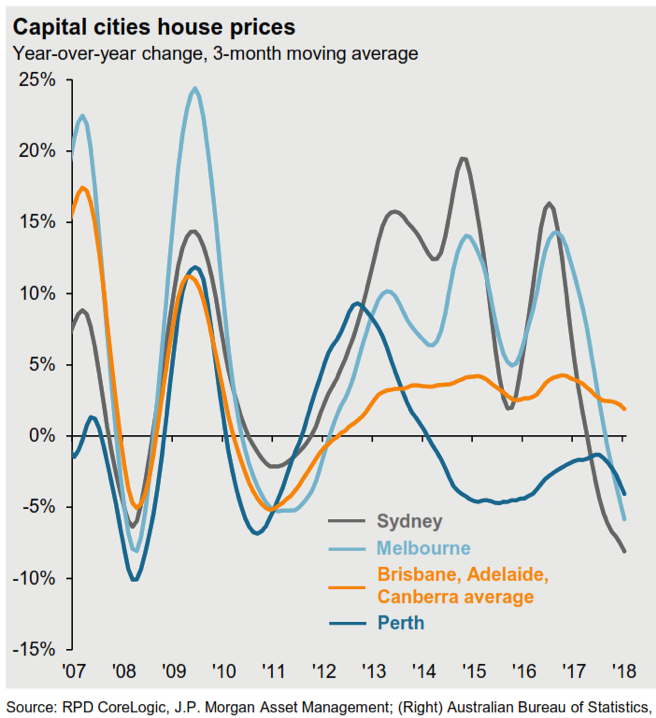

The Australian Real Estate Investment Trust (A-REIT) sector fell through September on fears of higher interest rates taking a bite out of earnings and distributions. We have been avoiding Global Listed Property for some time, with the outlook on US rates rising more rapidly than Australia, and hence more downside in those markets. The results in September backed up that view.

| INDEX RETURNS AS AT 30 September 2018 (%) | ||||

| 1 month | 3 months | 6 months | One year | |

| Australian Shares | -1.26 | 1.53 | 10.13 | 13.97 |

| International Shares | 0.55 | 7.32 | 13.57 | 21.29 |

| Domestic Listed Property | -1.55 | 1.98 | 12.00 | 13.25 |

| Global Listed Property | -1.84 | 0.30 | 7.63 | 5.63 |

| Australian Fixed Interest | -0.42 | 0.54 | 1.36 | 3.72 |

| International Fixed Int | -0.38 | -0.07 | 0.08 | 0.89 |

| Cash | 0.16 | 0.52 | 1.01 | 1.87 |

| Market Indices | ||||

| S&P/ASX 200 Accumulation Index | ||||

| MSCI World ex Aust TR Index $A | ||||

| S&P/ASX 300 Property Trusts Accum Index | ||||

| FTSE EPRA/NAREIT DEVELOP NR INDEX (A$ HEDGED) | ||||

| Bloomberg Composite 0 + Years | ||||

| BarCap Global Aggregate Index Hedged AUD | ||||

| Bloomberg Aus Bank Bill Index | ||||

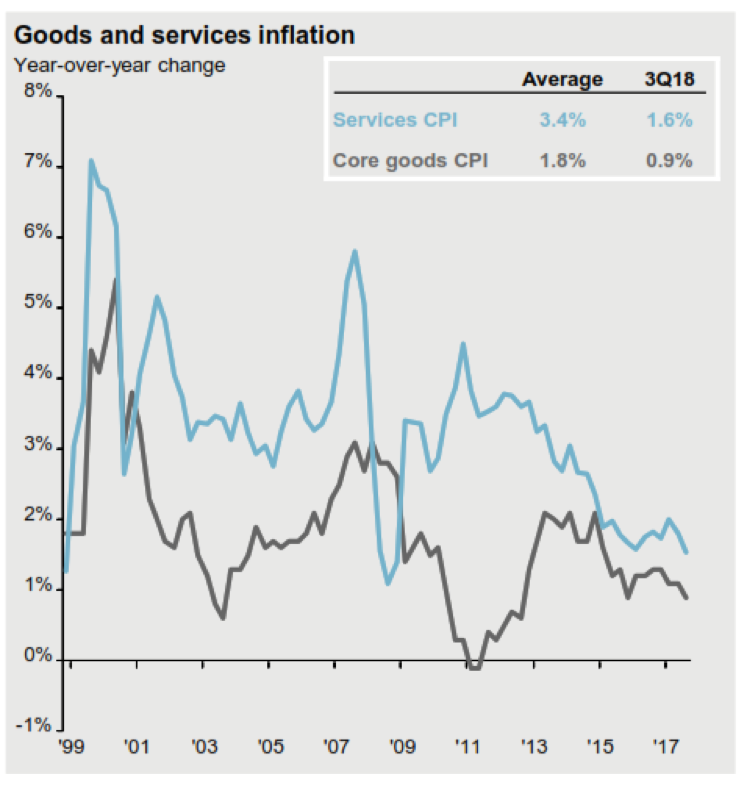

Fixed interest markets also lost money over September, as longer term rates, especially in the USA, continued to rise. Cash is not very attractive, but it is worth noting that it beat the return from Global Fixed interest over the last 12 months. During the month of September, the Australian 10 year government bond yield rose from 2.52% to 2.67%. For reference, over the same period, the US ten year bond yield rose from 2.85% to 3.05%.

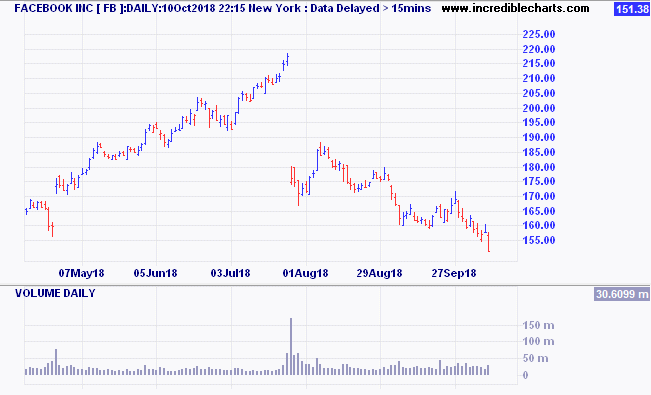

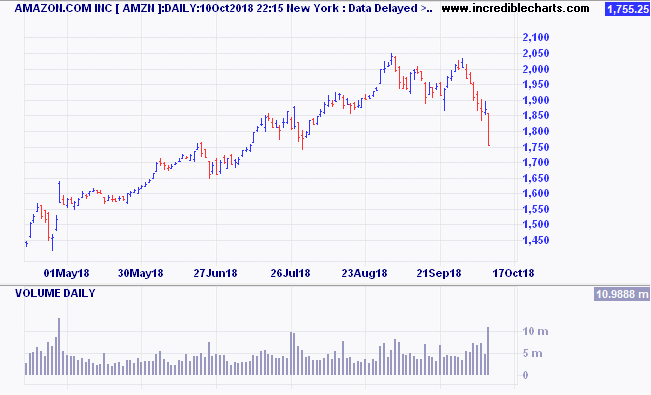

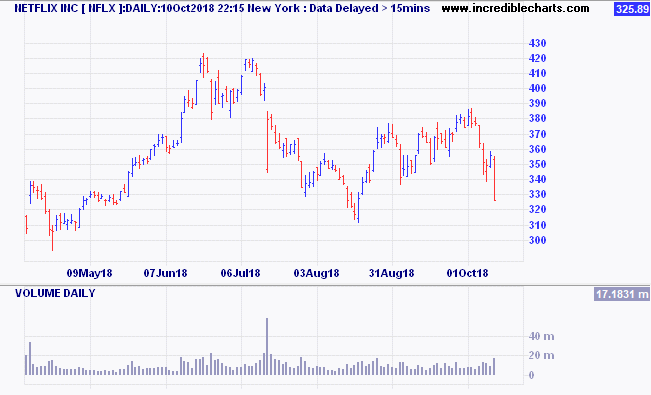

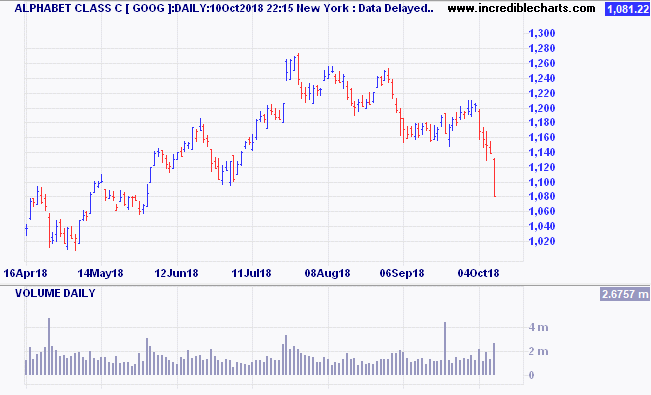

Regular readers will know that we have been cautious on sharemarkets and US markets in particular, on the basis that valuations of some of the leading stocks was very stretched, and that any change in sentiment would hit hard. Well, that is what has been happening in the last month or more.

FANG stock update – Facebook, Amazon, Netflix and Google

Here are the charts for Facebook, Amazon, Netflix and Google, the so-called FANG stocks.

Facebook:

Amazon:

Netflix:

Google:

There is no doubt these companies have achieved amazing growth and appear to have dominant market positions, but if you pay too much, then they won’t produce a good investment return. This is the conundrum that faces investment managers every day.

Contact Quill Group today

If you have concerns about your debt, financial structures or superannuation, please give us a call at Quill Group. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.