Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

There is no magic number to start planning but the simple answer is, the earlier you start, the more chance you have to achieve the retirement that you dream of having.

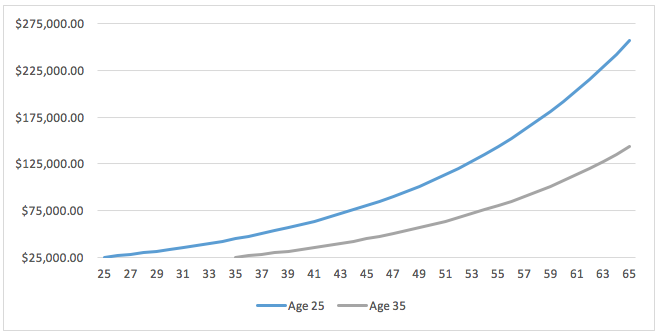

The reason for this is because of the compounding interest effect. Below are some simple graphs showing how powerful this effect can be.

The first graph shows a beginning balance of $25,000 and rate of return of 6%, with no extra payments. Starting at age 25, by age 65 the balance has grown to over $257,000. If you delay the start by 10 years, the end balance is $143,500.

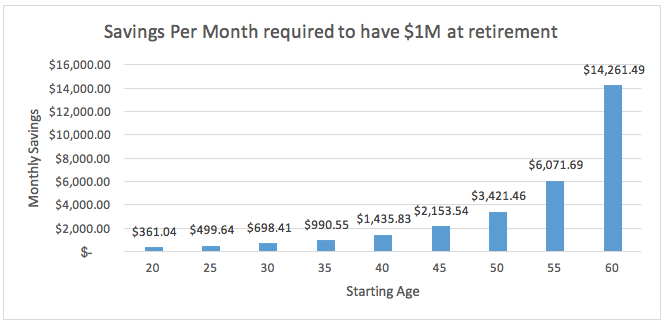

If you wanted to have $1 million at retirement age 65, the graph below shows how much you would have to save every month, using a 6% return, at different starting ages.

The table shows the amount that would have been personally contributed over the time to retirement and the compounded interest amount.

So what can you do to help achieve your retirement goals?

One of the easiest and tax-effective ways is through your superannuation. There is already a requirement for your employer to contribute 9.5% into super for you but you can add extra funds by either a non-concessional contribution (after-tax money) or by a concessional contribution (pre-tax money), salary sacrificing.

There are limits, caps and rules that apply to both contributions, so it is important to know these limits to ensure you don’t go over them as penalties apply to the amounts over these caps.

For concessional contributions, the cap is $25,000 per year and this includes the 9.5% from your employer contributions. Non-concessional contributions are capped at $100,000 per year. You may not have the capacity to contribute up to the maximum but every dollar helps. The important thing is not to leave retirement planning until you’re about to retire, the earlier the better.

Please visit the Australian Tax Office website for more information on the caps and rules. For more information, tools and calculators to assist in your planning, please visit ASIC’s MoneySmart website. If you require professional help, our team is capable and more than willing to provide bespoke advice for your situation.

It is one of the most important principles of investing and the chances are, you have heard it before “ensure you build a diversified portfolio” or “don’t put all your eggs in one basket”. However, most novice investors don’t really understand why diversification is so important to their investment strategy.

Here, we’ll take you through the fundamentals of diversification and a little look into the value it provides.

Firstly, how does diversification work?

Having a diversified portfolio doesn’t mean you are guaranteed to be protected against losses or guaranteed to have gains. It simply means you have a strategy in place to effectively manage the risk and reward trade off to help you achieve consistency in your returns over time.

For many reasons, the markets for different asset classes peak at different times and they don’t particularly move in exactly the same way. Different asset classes react differently to what’s happening in the economy and world around us. While one market can experience a surge, another can be on a downhill run.

To manage this risk, financial experts believe you should spread your funds across several markets. This may potentially offset any losses from a market downturn in one asset, by gains from another market that is performing better at that time. Spreading your funds across a number of different investment types means you will be well diversified and have limited your exposure to any single asset. In turn, your overall returns will be less volatile.

What constitutes as a diverse portfolio?

To diversify your portfolio, you need to invest across different asset classes. This should include a mix of growth assets and defensive assets:

Growth Assets

Investments that have a higher risk and reward – include investments that generally provide longer term capital gains such as shares or property.

Defensive Assets

Investments that have a lower risk and reward – include investments such as cash or fixed interest.

More characteristics of a diversified portfolio are:

- Investments are across different asset classes such as cash, property, fixed interest, Australian and international shares.

- Different types of investments are within asset classes. For example, having shares across different industry sectors.

- Investments are across different fund managers. Applicable if investing in managed funds.

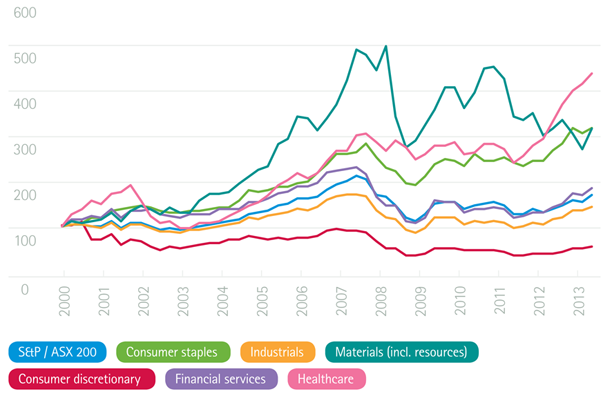

EXAMPLE: Diversification inside a particular asset class

Just to show you as an example, the below graph shows how different sectors of the Australian share market have performed over time. You can see that some sectors are more volatile than others.

Sectors of the Australian Sharemarket

Source: Australian Securities Exchange and Thomson Reuters 2013

The benefits of diversification

There are three main benefits to having a diversified portfolio:

Minimising risk of loss

As explained above, diversified portfolios have less risk than concentrated portfolios. If one investment performs poorly over a certain period, other investments may perform better over that same period. This reduces the potential losses of your investment portfolio.

Generating returns

We all know that sometimes investments don’t perform the way we expected them to. So, by diversifying your portfolio, you’re not merely relying upon one source for income. It also allows you to add riskier types of investments to your portfolio without increasing your overall risk levels.

Preserving capital

Some investors are not in the accumulation phase of life and are closer to retirement. These investors have a different set of investment goals which are oriented towards preservation of capital vs driving returns. Diversification can help protect their savings by reducing the overall risk in their portfolio.

Creating a portfolio for you

As you can see above, diversifying your portfolio can be beneficial but complicated. It depends on a host of factors including your appetite for risk, investment objectives, time frame and available capital. It requires a strong knowledge of the various asset classes, markets and sectors to ensure it is executed effectively.

To get the best results and create a portfolio suited to your particular needs and circumstances, it might be wise to talk to one of our financial planners.

For 23 years Dalbar Inc, the United States leading financial services research firm, has published it’s annual, Quantitative Analysis of Investor Behavior (QAIB) study.

The QAIB has been measuring the effects of investor decisions to buy, sell and switch into and out of United States mutual funds over both short and long-term time frames. The results have consistently shown that the average investor earns less and in many cases, much less than the mutual fund performance reports would suggest. The most recent study released for the calendar year to 31 December 2016, showed that the average investor is still their own worst enemy when it comes to investing. The study showed just how poorly investors perform relative to market benchmarks over time and the reasons for that underperformance.

The most recent QAIB study conducted in the United States by Dalbar Research (Boston, MA.), found that for the 2016 calendar year:

- The average US investor made a return in equity funds of 7.26% while the US share index, the S&P 500, returned 11.96%. An underperformance of 4.70%.

- In 2016, the 30-year annualised S&P 500 return was 10.16% while the 30-year annualised return for the average equity mutual fund investor was only 3.98%. An underperformance of 6.18% per annum.

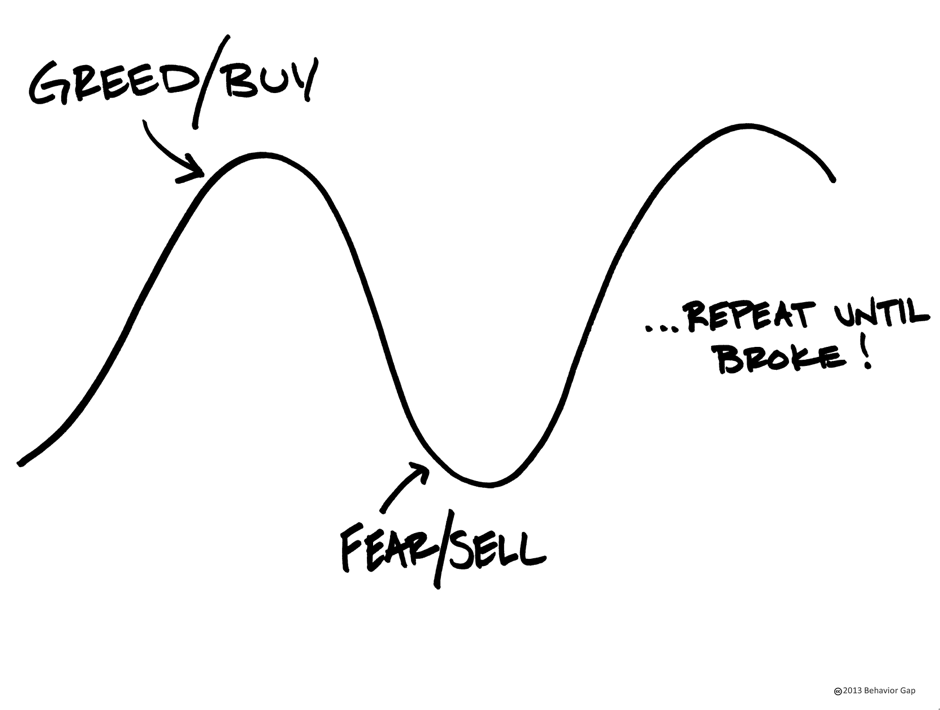

So why is it that the average US investor made (4.70%) less than the market? Put simply, the differential was lost due to bad timing of transactions by the average US investor. Bad timing of transactions generally driven by decisions based on EMOTION. The emotions of FEAR OR GREED. This is truly wealth destroying behavior!! So if investing success is about BEHAVIOR and not skill, then what does that mean to you? It means that emotion plays a huge role in the financial decisions you make.

EMOTION is so important, it can determine your success or failure as an investor. But the great news is that unlike the MARKET, your BEHAVIOR is something you can control!!

The wide-ranging superannuation reforms come into effect on 1 July 2017. With the changes come a series of issues that Trustees need to be across, even if they don’t immediately affect you or your fund:

Understand the value of assets at 30 June

At 30 June 2017, SMSF Trustees will need to know the total superannuation balance held by members. If you have assets such as real estate in your SMSF, and to an extent other assets such as collectables and artwork, you will need to have a current valuation of those assets. Real estate property values, in particular, may have varied dramatically over the last few years and should be reviewed. The value of the asset needs to be arrived at using a fair and reasonable process. Because of the extent of the changes, it is worth considering the use of an independent and qualified valuer for some assets.

Understanding ‘Total Value’ of your balance

Your total superannuation balance is the total value of your accumulation and retirement phase interests and any rollover amounts not included in those interests. The balance is valued at 30 June each year and it is this value that may determine what you can and can’t do during the following year. For example, if your total super balance is $1.6m or more at 30 June, you are restricted from making further non-concessional contributions in the next year as these contributions may create an excess contribution. And, if your balance is close to the $1.6m cap, then the fund can only accept limited non-concessional contributions.

Self-funded retirees – avoiding adverse tax outcomes

If you are receiving a pension or annuity, a $1.6m “transfer balance cap” applies to amounts in your tax-free pension accounts. The cap is essentially a limit on how much money a member can transfer into or hold in a tax-free account. If you have $1.6m or more in a pension phase account, you will need to reduce the pension value level back below the cap before 30 June 2017. If the excess amount is not removed from the pension phase account the amount will be subject to a transfer balance tax.

If you opt to sell fund assets to manage the cap, transitional capital gains tax relief may be available to manage any adverse tax outcomes.

How do you value SMSF assets?

One of the emerging problems for many superannuation fund members is understanding whether they are close to or are likely to exceed the $1.6m cap at 30 June 2017. For those with assets such as real estate, collectables or art, a current valuation that meets the ATO’s guidelines will be essential. Real estate, in particular, has substantially risen in value in some areas creating uncertainty about the real value.

Fund assets need to be valued at market value. While these assets do not have to be valued every year by an independent valuer, it will be important to have documentation validating the value assigned to the asset. A qualified and independent valuer is recommended if the asset is a significant part of the value of the fund – if the asset is real property, this could be as simple as an online real estate agent.

Should you update your SMSF trust deed?

Over the years, there have been continuous changes in superannuation legislation. While many of these changes do not require you to update your SMSF deed, where a deed has not been updated in at least the last 5 years, we suggest that the deed is updated to ensure it is compatible with current law.

If we have not already contacted you about your fund’s deed, we will be in contact shortly to discuss if an update is required.

As always, before buying, selling, transferring assets, or making any payments, make sure your trust deed allows you to complete the transactions in the way you intended.

Salary sacrificing concessional super contributions

If you have entered into a salary sacrifice agreement to make concessional super contributions, you will need to review these agreements to ensure your concessional contributions do not exceed the new $25,000 from 1 July 2017.

Tax time is almost upon us so it’s time to get prepared. Here’s your tax planning guide including an update of what’s changing this year, to help you get EOFY ready.

Update: Tax Planning 2020 Guide – Individual Tax Deductions

In this guide:

- Income tax changes for 2016/17

- General year end tax planning strategies

- Income tax changes – small businesses

- Income tax changes – individuals

- Superannuation – relevant thresholds

Income Tax Changes for 2016/17

Several tax changes apply in the 2016/17 income year. A brief summary is provided in this guide.

There may be some advantages in acting on some of these items before 30 June 2017.

If you think any of these changes may affect you, please contact us for more details.

General Year End Tax Planning Strategies

Here are a few strategies to consider before finalising your tax this year.

Definition of small business

The definition of a Small Business (SBE) has changed from having $2 million in turnover to $10 million in turnover. Many more businesses will now have access to the SBE tax concessions.

Business income and expenses

Subject to cash flow requirements, consider deferring income until after 30 June, especially if you expect lower income for 2017/18 compared to 2016/17.

Most businesses are taxed on income when it is invoiced. Some small businesses may be taxed only when income is received. Income from construction contracts is generally taxed when progress payments are invoiced or received.

Ensure that you have complied with the requirements to claim deductions in 2016/17:

- Bad debts must be written off in your accounts before 30 June

- Employer and/or self-employed superannuation contributions must be paid to, and received by, the super fund before 30 June and must be within the contributions cap ($35,000 for individuals aged 49 or over on 30 June 2017, otherwise $30,000)

- Depreciation can be claimed for assets first used, or installed ready for use, before 30 June

- Small businesses (turnover less than $10 million) can claim expenses prepaid up to 12 months in advance – for larger businesses, this is generally limited to expenses below $1,000

- Wages paid to your spouse or family members must be reasonable for the work performed.

Small businesses planning major purchases or replacements of capital equipment should contact us for advice. Careful timing of those transactions can result in substantial tax savings.

Review valuations of trading stock in the lead up to 30 June. Best practice is generally to value stock at the lower cost or market selling value. This may change if you expect a tax loss for 2016/17, or substantially higher income in 2017/18 compared to 2016/17.

Personal income, deductions and tax offsets

Subject to cash flow requirements, set term deposits to mature after 1 July, rather than before 30 June.

Consider realising capital losses if you have already realised capital gains on other assets during 2016/17. Conversely, consider realising capital gains if you have unrecouped capital losses, especially if you expect substantially higher income in 2017/18 compared to 2016/17.

If you expect lower income in 2017/18 due to retirement or any other reason, consider deferring income until after 1 July, when you will be in a lower tax bracket. If you are a primary producer and you expect a permanent reduction in income, consider withdrawing from the income averaging system.

Access to the Net Medical Expenses Tax Offset is restricted to medical expenses relating to disability aids, attendant care or aged care.

Arrange for deductible donations to be grouped in the higher income year, if you expect substantially higher or lower income in 2017/18 compared to 2016/17. Make all donations in the name of the higher income earner.

If you plan to purchase income-producing assets, consider acquiring assets that will generate positive cash flow in the name of the lower income earner. Conversely, consider acquiring negatively geared assets in the name of the higher income earner.

Residency changes

Contact us for advice if you have moved to or from Australia for an extended period. You may need to review your residency status for tax purposes. There are important tax consequences if you change residency.

Trusts

Trustees of trusts should ensure that all necessary documentation is completed before 30 June, where you intend to stream capital gains or franked distributions to specific beneficiaries.

Family discretionary trusts may need to make a family trust election if the trust has unrecouped losses, or has beneficiaries whose total franking credits for the year may exceed $5,000.

Tax shelter schemes

Be sceptical of year-end tax shelter schemes. You should not enter a scheme without advice regarding both its tax consequences and commercial viability.

Income Tax Changes – Small Business

Tax rate

The tax rate for small business entity (SBE) companies is 27.5% from 1 July 2016.

Individual small business taxpayers are entitled to 5% discount of the income tax payable on the business income received from a small business entity (other than a company), up to a maximum of $1,000 a year.

Accelerated Depreciation

An immediate deduction is available for an asset costing less than $20,000 acquired on or after 12 May 2016 and first used or installed ready for use between 12 May 2016 and 30 June 2017.

The balance of the general small business pool is also immediately deducted if the balance is less than $20,000 at 30 June.

Blackhole Expenditure

From 1 July 2016, start-up companies, trusts or partnerships can immediately deduct a range of professional expenses associated with starting a new business (e.g. professional, legal and accounting advice). This only applies to SBE’s.

Income Tax Changes – Individuals

Car expenses

From the 2015/16 tax year, the 1/3 of actual expenses and the 12% of original value method for claiming work related car expenses can no longer be used.

A single flat rate of 66 cents per kilometre is to be used for the cents per km method. Alternatively, a log book must be maintained for a 12 week period to determine the business percentage of all running costs.

Zone tax offset

From the 2015/16 tax year, the zone tax offset excludes ‘fly-in fly-out’ and ‘drive-in drive-out’ workers where their normal residence is not within a ‘zone’.

Superannuation – relevant thresholds

Super co-contribution

Super co-contribution helps eligible people boost their retirement savings.

If you’re a low or middle-income earner and make personal (after-tax) contributions to your super fund, the government also makes a contribution (called a co-contribution) up to a maximum amount of $500.

The full co-contribution rate applies for income up to $36,021 and the partial co-contribution applies for income up to $51,021 for the 2016/17 tax year.

Concessional Contributions

The concessional contribution caps for the 2016/2017 tax year are:

- $30,000 for people aged up to 48 years or under as at 30 June 2016;

- $35,000 for people aged 49 years and over.

These represent the limit on the amount of contributions you can make within the year, and include the Super Guarantee payments made on your behalf by your employer.

Should you wish to discuss your superannuation needs, please contact the team at Superfund Partners.

For help with any of the above information in our guide above, reach out and we’ll happily talk you through it step-by-step

No doubt you have already heard about the introduction of a $1.6 million transfer balance cap from 1 July.

When most people see that figure, they think of the asset balance in their account based pensions.

But did you know that this ‘transfer balance cap’ also includes a notional value for every income stream you receive via the superannuation system?

This includes:

- lifetime pensions, including the majority of defined benefit pensions commenced at any time (eg. Commonwealth or State Government defined benefit pensions)

- Complying lifetime annuities

- Complying life expectancy annuities and pensions

- Term allocated annuities and pensions (ie Market linked pensions).

It is important to remember that if you have a defined benefit pension you may need specialist advice to ensure that your account based pension/s are reduced by enough to bring you under the cap.

Therefore, please contact us immediately if you have one of these income streams, and/or have one or more account based pensions totalling $1.6m or more in value, and would like us to review your situation.

After months of speculation as to what the Government is planning to implement in the 2017 Federal Budget, finally, the budget changes have been released to the public. Implementation of changes is soon to commence.

There are certainly some “winners” and “losers” but overall, the aim of the budget is to positively impact our economy. And with a thriving economy, all Australians are winners.

As a millennial, my biggest focus around the budget is; housing affordability and student debt. So, let’s focus on these points.

First Home Buyers

There had been speculation over the previous months that the government was going to allow first home buyers access to their superannuation savings to fund their house deposit. Personally, I was horrified to hear this was a serious consideration. Such a scheme would influence further implications and retirement unaffordability issues down the track. Pleasing to hear, this scheme was dismissed.

The “First Home Super Savers Scheme” is being implemented from 1 July 2017. This effectively allows individuals to salary sacrifice savings towards a house deposit into their super. By salary sacrificing, a tax advantage is applied as these contributions are considered concessional contributions (pre-tax). Therefore, salary sacrificed contributions and earnings in super are taxed at 15% rather than the marginal tax rate.

Only the contributions to the First Home Savers Scheme will be available to withdraw for first home deposits. Until a condition of release is met, no other superannuation savings are accessible. If you do not end up purchasing a home, these additional contributions will not be accessible until retirement or a condition of release has been met.

It is important to note; the First Home Super Savers Scheme is capped at $30,000. However, as previously mentioned, these contributions are classified as concessional contributions which oblige to the annual cap of $25,000. Noting also that your Superannuation Guarantee Contributions also fall under this cap, you are limited to contributing a maximum of $15,000 (without exceeding the $25,000 cap) into the First Home Super Savers Scheme per annum.

15% tax is applied on each contribution into your First Home Super Savers Scheme account. For example, let’s say you contribute $10,000 in a financial year, only $8,500 hits your first home savers account as $1,500 of the contribution is paid in tax. As a comparison, let’s say you fit into the 34.5% tax bracket and decide to place this $10,000 pre-tax money into a bank account outside of super. This means you will pay $3,450 in tax opposed to $1,500.

Withdrawal of these contributions will be accessible by 1 July 2018 and will be calculated using a deemed rate of return. Upon withdrawal, the value of your savings will be added to your assessable income with a tax rebate of 30%. Therefore, if we use the same example above and assume with the withdrawal added to your assessable income that you remain in the 34.5% tax bracket, you will be liable to pay a further 4.5% tax on the withdrawal of your savings. It feels a bit like the government is double dipping here… nonetheless, it’s still a great tax saving strategy. For a detailed example of how the deemed rate and tax rebate is calculated, refer to Mark Beveridge’s blog.

Although the First Home Super Savers Scheme is capped at only $30,000, I think it’s a great opportunity to start saving. The government has provided a handy estimator tool to calculate the difference in savings when using the First Home Super Savers Scheme verses saving in a standard deposit account outside of super.

Investment Properties

Good news for some property investors! In a bid to make housing more affordable and appealing to Australian investors, the Capital Gains Tax (CGT) discount has increased from 50% to 60%. To be eligible for the 60% CGT discount, the residential property must;

- Be rented to low to moderate income tenants

- Be rented at a discounted rate

- Be managed through a registered community housing provider, and

- Held for a 3-year minimum.

During periods where the property is not used for affordable housing purposes, the additional discount will be pro-rated.

Unfortunately for property investors, reductions and eliminations of certain claimable tax deductions will be implemented. These changes affect previously claimable travel expenses and property plant and equipment depreciation deductions.

Not so great news for foreign property investors, but good news again for Australian investors as these new changes will provide Australians with increased opportunity to invest. Foreign ownership will be restricted to 50% in new property developments. They will also be liable to a minimum $5,000 annual levy if their properties are found to be unoccupied or not genuinely available to rent for at least 6 months per annum.

CGT main residence exemption will also no longer be available for foreign property owners. However, a grandfathering rule for the exemption will be implemented for existing owners up until 30 June 2019.

Foreign tax residents will also see the CGT withholding rate increased from 10% to 12.5% and the property value threshold will reduce from $2 million to $750,000 from 1 July 2017.

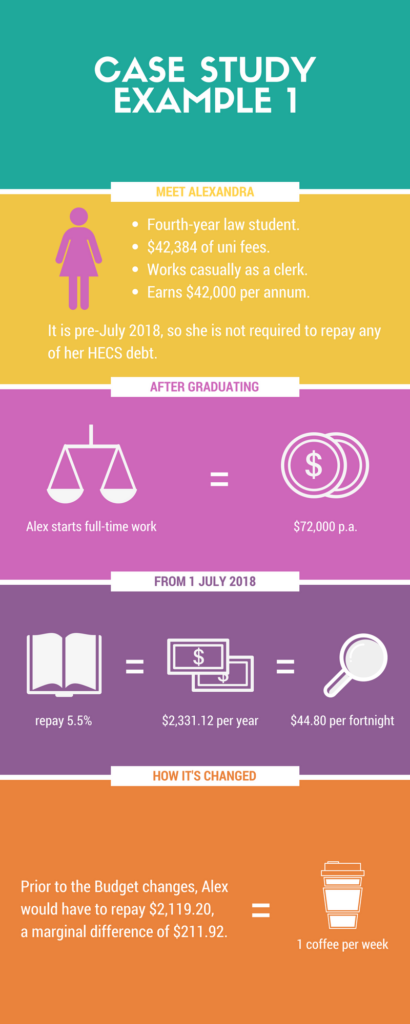

Student Loans

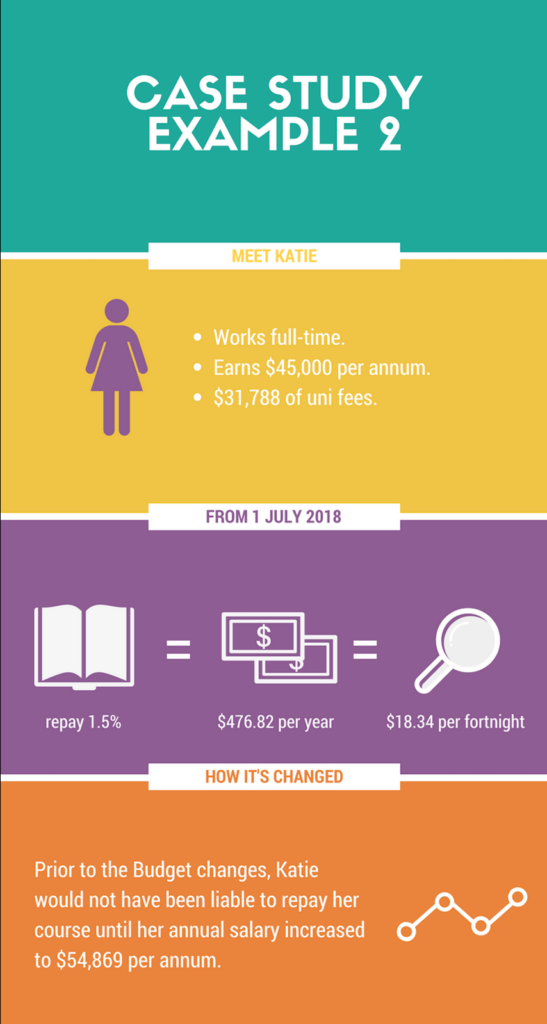

Bad luck for students. It seems to be getting progressively harder to afford study. Not only are university fees increasing, but the minimum income threshold to repay your HECS or HELP debt is now reduced to $42,000 per annum from $54,869 per annum.

Combine that with the average four-year course increasing in fees by approximately $2,200 to $3,600, it’s a scary outlook for existing and future students.

However, we can catch our breath (just a little). It’s not as bad as it sounds. Previously, once the threshold of $54,869 was reached, 4% of the course repayment was due payable. With the new minimum threshold reduction, only 1% is payable with annual income of $42,000. Once your salary reaches approximately $53,000 to $56,000, which is around the old threshold, you will be repaying between 3% and 3.5%.

Let’s do a case study or two to delve into this a little deeper.

It’s important to remember that although there is no interest accumulating on these student loans, they do increase with CPI (Consumer Price Index).

The increase in university fees and reduction in the repayment threshold isn’t the outcome any student was hoping for. But, as detailed in our first case study, the difference is about two cups of coffee (if that!) each fortnight. We will prevail!

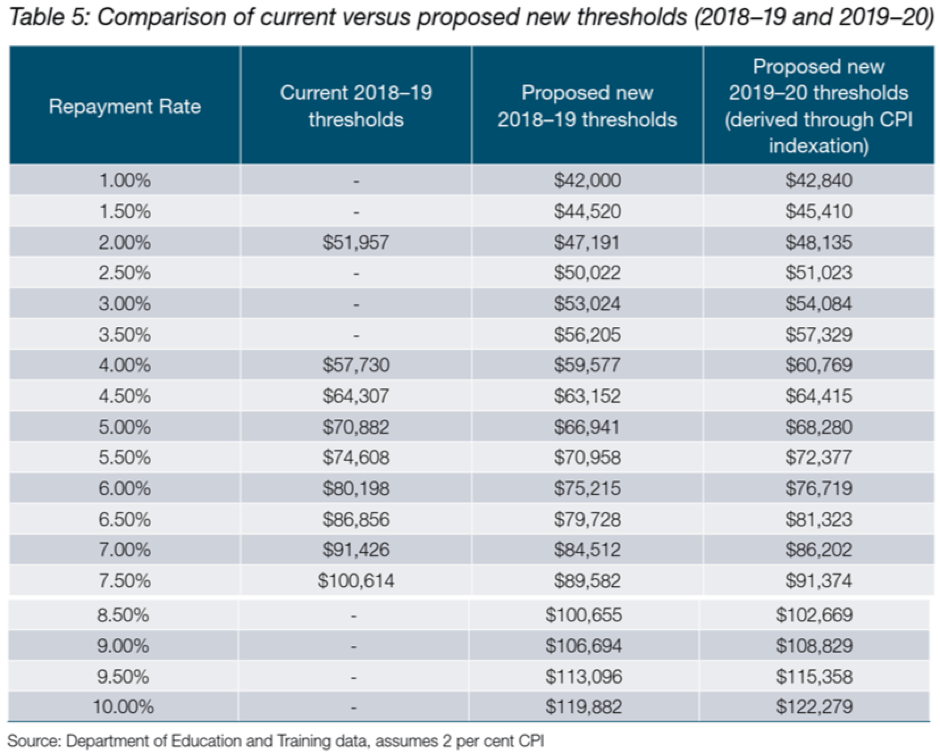

Refer to the Department of Education’s comparison table below for more information;

Current 2016-17 Repayment Income Thresholds and Rates:

| Repayment Income | Rate |

| Below $54,868 | NIL |

| $54,869 to $61,119 | 4.00% |

| $61,120 to $67,368 | 4.50% |

| $67,369 to $70,909 | 5.00% |

| $70,910 to $76,222 | 5.50% |

| $76,223 to $82,550 | 6.00% |

| $82,551 to $86,894 | 6.50% |

| $86,895 to $95,626 | 7.00% |

| $95,627 to $101,899 | 7.50% |

| $101,900 and above | 8.00% |

These changes are yet to be legislated, but if you would like to start planning or find out how it will affect you personally, call Quill today.

House Sale Proceeds for Over 65s

Let’s briefly touch base on this also, as you can pass on your knowledge to a family member which this may apply to. Previously, a person aged over 65 was unable to make any super contributions unless they were ‘gainfully employed’ and age 75 was the absolute cut-off age, even if they continued to work. However, with these new budget changes, individuals over age 65 can contribute up to $300,000 of their family home sale proceeds into their superannuation. However, conditions apply as they must have owned the family home for a minimum of 10 years. Fortunately, this type of contribution is not subject to the new $1.6 million superannuation caps.

There are also Centrelink implications to consider for those receiving a part pension under the assets test. If they sell down their home and contribute the funds into their super or retain it outside of super, they could see a reduction or elimination of their part pension. If this could affect someone you know, they can contact Quill to discuss their circumstances.

An article by Roger Montgomery, writing for the Weekend Australian, reminded me of something that we have been saying for several months now. Surging property prices in most capital cities and regional centres will end in tears for many that believe increasing prices and low interest rates are here to stay.

The alarm bells

Probably the scariest statistic is in Brisbane where not only did the supply of new units increase by 5,500 in 2016 but they are now set to increase by a whopping 13,300 this year. Buyer inducements, lower revaluations of up to 30%, higher vacancy rates, and, most recently, banks starting to tighten up on borrowing limits are all signs of a looming collapse.

The question we may now ask is how soon will this occur and what will be the flow-on effect for other areas of the property market?

Accessing super to fund a home deposit – let’s hope not!

One can only hope that the federal treasury is advising government to scrap the ridiculous idea that some politicians have been discussing about possible access to superannuation to fund a first home deposit.

This would only exacerbate the problem and potentially lead to a situation where a young person not only lost all the equity in their home but potentially their retirement savings as well.

Take a scenario where someone borrowed $450,000 to buy a $500,000 home, using $50,000 saved up in their superannuation fund as a deposit. Six months later, the property market corrects 20% and the property is revalued at $400,000. Even if the bank does not foreclose on the loan at this stage, there is still a high risk that the individual loses their job or interest rates rise. In this situation, a forced sale is likely which would lead to a position where all the money in super is lost and the individual still owes the bank $50,000.

This reads like a recipe for financial disaster which is one good reason why we don’t expect to see this initiative as part of the 2017 May budget.

Concessional contributions are those made with pre-tax income and can come in many forms, most commonly as

- Superannuation Guarantee contributions made by your employer,

- Salary sacrificed contributions made on your behalf, or

- Tax-deductible contributions if you are self-employed.

Below, we’ve summarised a few important considerations regarding the cap changes that became law on 29 November 2016.

-

A lower cap will apply from 1 July 2017

As part of the 2016 Federal Budget, the Coalition government announced plans to reduce the annual concessional contribution cap to $25,000 from 1 July 2017. The new cap will now apply to everyone regardless of age.

This will see the lowering of both the over-50s concessional (before-tax) contributions cap of $35,000 and the general concessional contributions cap (for under-50s) of $30,000. However, it’s important to note that the $35,000 and $30,000 caps still apply for the current (2016/2017) financial year.

-

Making the most of your caps

If you are looking to increase your pre-tax contributions to superannuation, now is a good time to ensure that you are making the most of your concessional contribution cap. This may involve investigating a salary sacrifice arrangement with your employer or reviewing an existing arrangement before the cap decreases in July. But it is equally important to ensure that you take action from 1 July 2017 to plan for the lower cap in the 2017/18 financial year.

Another important change to note is that from 1 July 2017, anyone who is eligible to make voluntary super contributions will also be eligible to make personal concessional (tax-deductible) contributions. Currently, people earning more than 10% of their income as an employee (i.e. salary and wages) cannot make a tax-deductible super contribution, so this recent change should provide greater flexibility with:

- end of year super top-ups by making personal concessional contributions to use up any remaining concessional contribution cap;

- deciding how to contribute bonuses, annual leave, and long service leave; or

- tax-effectively contributing lump sum leave payments received upon termination of employment.

-

Future indexation

While we will have to live with lower caps from now on, the government will continue the practice of indexing these in line with average wage growth. Therefore, we can expect the caps to increase every few years in increments of $2,500.

-

Carry-forward concessional contributions

There’s also good news for those with volatile or lumpy income, and those working intermittently. From 1 July 2018 onwards, if you fail to use your annual concessional contributions cap of $25,000, you can carry forward the unused portion for up to 5 years. Carry-forward concessional contributions may assist clients with breaks in employment to make ‘catch-up’ contributions when they return to work.

The provision applies on the condition that your total superannuation balance is less than $500,000 as at 30 June at the end of the financial year immediately preceding the financial year in which the contribution is to be made. Also bear in mind that as this new rule only takes effect from the 2018/19 financial year, you won’t be able to carry forward any unused concessional contributions cap until at least the 2019/2020 financial year.

-

Exceeding the cap

An important consideration is what happens if you do exceed the concessional contribution cap. Since the 2013/14 financial year, excess concessional contributions have not been subject to excess contributions tax. Therefore, if you do exceed the cap, the amount will be included in your assessable income and taxed at your marginal tax rate. In addition, the ATO imposes the Excess Concessional Contributions (ECC) charge so that a person does not obtain a financial advantage due to the delay in payment of tax on their ECC.

The ECC charge period is calculated from the start of the income year in which the excess concessional contributions were made and ends the day before the tax is due to be paid under your first income tax assessment for that year. The ECC charge rates are updated quarterly on the ATO website, with the current rate being 4.76% (Dec 2016 quarter).

What’s next?

So there’s plenty to think about in managing your concessional contributions this year and the next, so why not ask your financial adviser how you can make the most of the new rule changes?

Whether it’s for diversifying the investment pool or even for the trustees fearing the next financial ‘doomsday’ event, a common question we get asked is “can an SMSF buy gold? And are there any rules we need to be aware of?”.

In short, yes and yes!

The first thing to consider is what type of gold we are analysing; are they collectable gold coins or bullion bars? For the purpose of our blog, we look at bullion bars. Please refer to ‘collectable rules’ via the ATO website for more details on collectables.

Gold bullion bars

Since they are not defined as a collectable, when an SMSF buys bullion bars, the key issues to consider are as follows:

-

Where will it be stored?

- Whilst there are no specific rules around this, it’s the trustee’s responsibility to make sure the gold assets are securely protected. We recommend it is not stored in the trustee’s home and instead, stored in a dedicated vault service.

-

Does it need to be insured?

- Again, there are no specific rules around this so it comes down to the discretion of the trustee as to whether it is insured or not. If insurance is arranged, it cannot be part of a personal insurance policy, such as the home and contents.

-

What records need to be maintained?

- The trustees should keep a record of the purchase and sales documents (invoice etc) in the name of the SMSF as proof of ownership and for the calculation of (hopefully!) gains or losses.

When it comes to the annual accounts reporting, we will request for details on the above 3 matters. Then, for record keeping purposes, we will prepare an asset declaration for the trustees to sign confirming these key details.