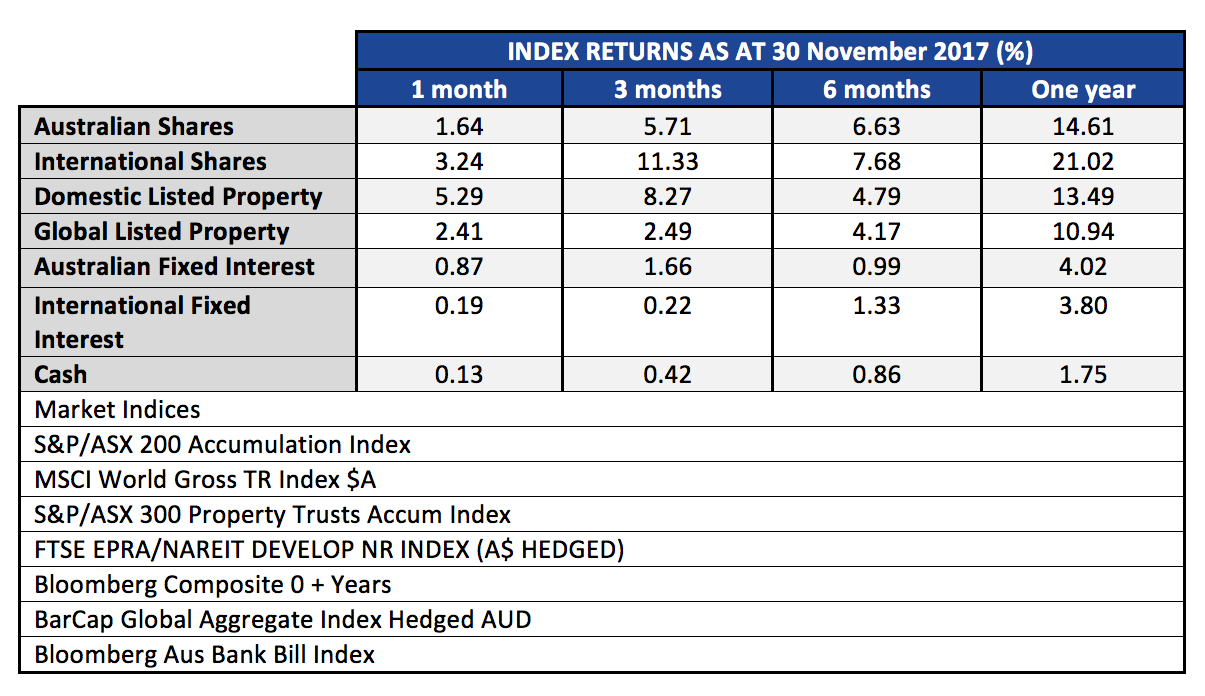

The S&P/ASX200 Accumulation has now put in two solid months, following the October gain of 4.01% with another 1.64% in November. Twelve month returns are 14.61%, almost double our expected annual 12 month returns of around 8.5%. This surge may have pulled forward some of the next twelve months expected gains.

Global Markets

Global markets also posted a good month, with gains of 3.24% and three month gains now at 11.33%. Emerging Markets, which we have favoured in our Managed Portfolios, are up 29.27% over the last year. We mentioned in the last update that Emerging Markets remain somewhat cheaper than developed markets, with arguably more to gain from structural reforms and demographic changes.

Real Estate Trusts

The A-REIT sector (real-estate trusts) saw gains of 5.29% for the month of November. This sector is coming back into favour after a sell-off based on concerns about higher bond rates and the arrival of Amazon which may (or may not) further hollow out the Australian retail sector.

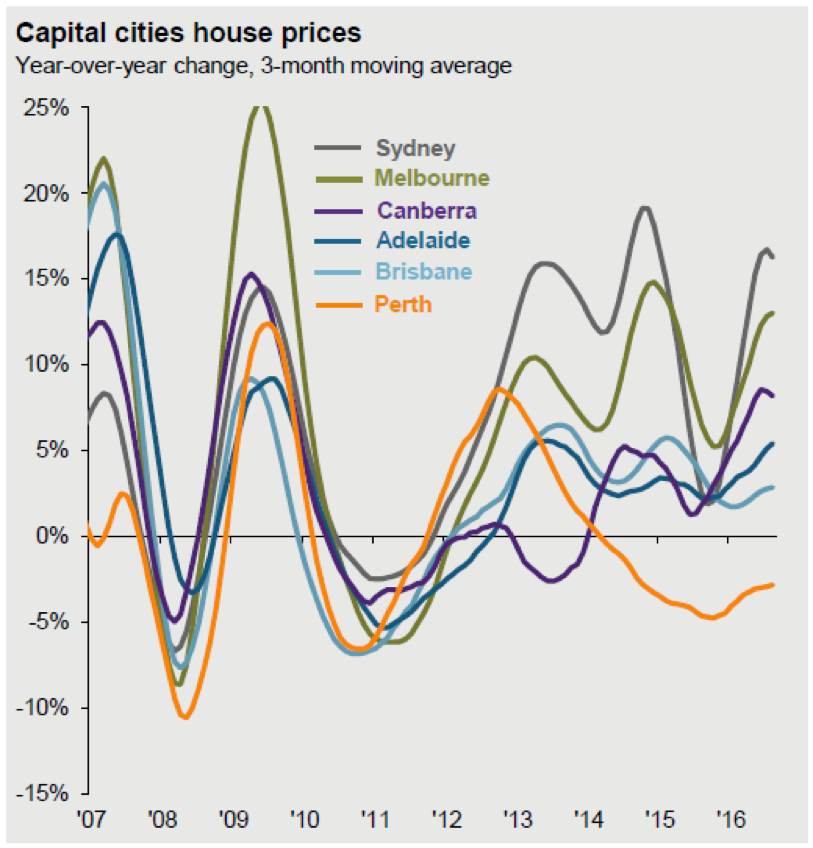

Real estate has many different sub-sectors and geographical differences, so please don’t mistake our view of fair value in parts of the A-REIT sector for any kind of enthusiasm about residential markets. We think it is fair to assume that for the most part the residential sector has peaked, and that is well illustrated in this chart from JP Morgan and CoreLogic.

Bond Markets

Bond markets remain one of the conundrums in the investment world. With rates at lifetime lows, and very little carry (income) in the highest grade government bonds, the diversification benefits of bonds are very much diminished. Studies from JP Morgan have shown that as bond yields fall below 4% the correlation of bonds and equities rises to above zero. For diversification benefits, you ideally want to add assets that have a negative correlation. Compounding the problem is that interest rates, while still subdued, are drifting higher, albeit at a slow pace, which creates a drag on returns from the typical long duration bond portfolios. Our preferred exposures in this sector are high grade corporate debt with short maturities, or active bond managers who can vary duration according to their outlook.

Official Cash Rate

The Official Cash Rate as controlled by the Reserve Bank, and affecting term deposit rates, doesn’t appear to have much potential for increasing in the next twelve months. We do have some concerns that if US rates do continue higher, with the expected 3 or 4 rate rises in 2018 while Australian rates remain unchanged, the downward pressure on the AUD will continue, creating some inflation in tradeable goods.