Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Insights

- All

- Accounting

- Announcements

- Blog Category: Polls & Surveys

- Business

- COVID-19

- Education

- Estate Planning

- Event Wrap Up

- Financial Market Update

- Financial Planning

- Government Grants

- Insurance

- Investing

- Marketing

- Personal Development

- Personal Finance

- Quill News

- Retirement

- Scam & Fraud Alerts

- Social & Community Engagement

- Superannuation & SMSF

- Taxation

- Thought Provoking

ATO Client to Agent Linking and Authorisation Changes

The Electronic Signing Process via Annature

Have you Considered the .au domain for your Firm? Small Business Urged to consider .au domain Before September 21

Investment Markets June 2022

Market Update – December 2021

How to Set Up a Company

How to apply for a

Director Identification Number

Director Identification Number

Director Identification Numbers now required from November 2021

Elston Quarterly Update

China’s Evergrande and broader China issues

Market Update – August 2021

COVID-19 Business Support Grants

What lockdown support is available in Queensland?

Market Update – July 2021

Business Boost Grants Program

End of Financial Year Considerations

Federal Budget 2021-22

FBT 2021: What you need to know

Market Update – March 2021

Market Update – February 2021

Aged Care – make the right retirement living choice

Market Update – December 2020

Market Update – October 2020

The dust has not yet settled

Successful Investing

2020-21 Budget Summary

Small Business Tax Concessions Expanded

Stapled super accounts to become default

CGT Exemption for Granny Flats

Estate Planning: Introducing Christina Wolfsbauer

Home Prices to Jump, Bonds & The Fed

Queensland Payroll Tax Refunds

Total Superannuation Balance Cap Complexities

August 2020 Financial Market Review

Australian Property Market Outlook

Share Market Recovery Despite Recession

Superannuation Choice: Your Super Your Choice

Life and TPD Insurance Claims

Jobkeeper Employee Eligibility

July 2020 Financial Market Review

Rachel Hunter – Women in Finance Awards 2020 Finalist

August 2020 – Economic Note

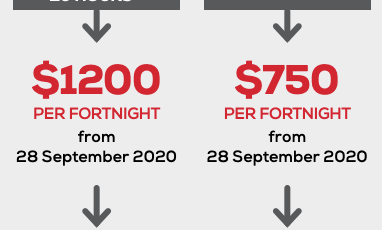

JobKeeper Extension

How to Set Up a Family Trust

Active vs Passive Investing: Passive ETF Investing Bubble?

Australian Economic Statement

JobTrainer Scheme Eligibility for Employers

JobKeeper 2.0 Infographic

July 2020 – Investment Outlook Post COVID-19

Superannuation Guarantee Amnesty

Jobkeeper and Superannuation Guarantee

Homebuilder Grant Updated FAQs

What big super funds can learn from SMSFs

Financial Market Update | 10 July 2020

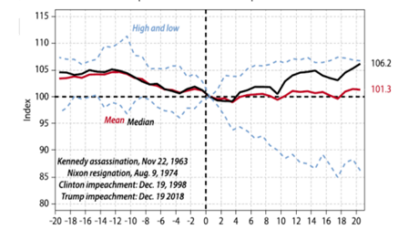

US Presidential Election – Implications for Investors

New Financial Year Super Contribution Strategies

Financial Market Update | 1 July 2020

Are Permanent Residents Eligible for the HomeBuilder Grant?

HomeBuilder $25,000 Grant Eligibility for Building and Renovation

Director Identification Number system to be launched in 2021

Small Business Grants QLD COVID-19 Adaption Program

Why Emotion is the Enemy of Successful Investing

ASIC Fee Increases 2020 – Indexation 1 July 2020

Superannuation Due Dates 2020

Instant Asset Write-Off $150,000 Extended to 31 December 2020

Financial Market Update | May 2020

Superannuation and SMSF End of Financial Year Checklist 2020

Outlook: 10 Medium & Long-Term Financial Market Impacts of Coronavirus

Family Trusts 2020 – End of Financial Year Actions

2020 Business Tax Planning – Companies, Trusts and Partnerships

Tax Planning 2020 – Individual

Queensland Government $10,000 COVID-19 Small Business Grants

Financial Market Update 15 May 2020

JobKeeper Business Declaration Monthly

Rachel Hunter – Australian Accounting Awards 2020 Finalist

Business Interruption Insurance and COVID-19 Check Your Policy!

Market Update: What Investors Need to Focus On

Financial Market Update | April 2020

Coronavirus: Light at the End of the Tunnel for Investors

Working from Home Tax Deductions 2020

Land tax relief Queensland – COVID-19

ALERT: Increase in Scams Targeting Superannuation

Planning on Switching your Super to Cash? Think Again.

How to Apply for JobKeeper Payment

JobKeeper Employer Eligibility

Financial Market Update | March 2020

JobKeeper Payment – FAQs

How do the JobKeeper Payments work?

Cash flow boost for employers – what you need to know

ATO Tax Relief and Assistance – Separate from other support packages

ACT rebates and waivers for COVID-19 affected businesses

Tasmania COVID-19 stimulus package

WA Payroll tax COVID-19 stimulus measures

Victoria payroll tax refunds in COVID-19 stimulus package

NSW releases COVID-19 business support package

QLD releases COVID-19 business support package

The Second $66.1 bn Stimulus Package: What You Need To Know

Payroll Tax Deferrals and Fair Work Guidance

Market Update for your Portfolios | Coronavirus

The Stimulus Package: What You Need To Know

The Impact of Coronavirus | Stock Market

Changes in Income Protection | 31 March 2020

Financial Market Update | November 2019

Financial Market Update | September 2019

Financial Market Update | August 2019

Financial Market Update | June 2019

May Financial Market Update

Australian Federal Election 2019 – the unlosable election

Superannuation Changes That Impact You in 2019

What the Federal Budget means for Business Owners and Professionals

Activity Statements | When is BAS due 2019

Setting Financial Goals with your Teenagers

Market Recap for 2018 and 2019 Outlook

9 Critical Payroll Tax Mistakes you could be Making

Director Recommends: The Best Weekend (or next Holiday) Reads

Financial Market Update | November 2018

Late BAS Lodgement | What to do, and what are the penalties? 2019

Why your advisory board is crucial to success

October Financial Markets update

Super for employers and directors | Employer Superannuation Contributions

Is your Accountant the right fit for you? Should you consider changing?

‘Direct Life Insurance’ vs. ‘Retail Life Insurance’

Perspective on recent sharemarket volatility

September Market Report

What is Single Touch Payroll? | For Business owners

Business trading names to be phased out

Tax Audit Insurance – Are You Covered for the Unexpected?

Financial Market Update: August

Could I benefit from using the services of a Financial Planner?

How do I set up a SMSF?

Bookkeeping Tips for Small Businesses

Should I consolidate super?

What is diversification? How much diversification is too much?

Financial Market Update | July

Growing your Business without fear

Financial Market Update: June

The top 12 tax savings strategies every business needs to utilise

Financial Market Update | May Market

Financial Market Update | April

What do Self Managed Super Fund (SMSF) trustees need to check before EOFY?

Look before you leap – some analysis of an under-reported feature of the Federal Budget

How to save money | Australians show how and why they save

Tax effective investment structures when super is maxed out

Financial Market Update | March

My volunteer experience at the Gold Coast 2018 Commonwealth Games

How to create a budget in excel

Fringe Benefits Tax (FBT) | What you need to know

Financial Market Update | February

Understanding Market Volatility

What Steve Baxter has to say about success

Should I have life insurance? Is it necessary?

Financial Market Update | January

Improve your LinkedIn profile and get the most out of your network

Downsizing into Retirement

What is Social Media?

Financial Market Update: A review of December 2017

What is Social Media for Small Business?

Government Energy Efficient Appliance Rebate

The five things you need to do for yourself.

When is the right time to start planning for retirement?

2018: Analyse your business spending in 10 minutes

Queensland yet to emerge from the Dark Ages

Financial Market Update: A Review of November’s Performance

Understand The Difference Between Cash Flow and Profit

How to deal with cash flow problems – a quick guide

The Importance of Having a Diversified Portfolio

Is your SMSF’s Estate Plan up to speed?

Finance Market Update: A Review of October’s Performance

Financial Planning insight for all generations from a Millennial

How far away is Australia from being a “cashless” society?

The Essential Step Before You Take The Risk

The Healthy Work-Life Balance

Financial Market Update for September 2017

Sharing financial wisdom between the generations

Financial Market Update: A review of August’s performance

An update on what older Australians are spending their money on?

Southport Cellar Door Wine Tasting Night – September 2017

Are you taking Employee Engagement seriously? We are!

Benefits of a healthy workplace

What you need to know about the Simpler BAS

Important Update for Xero Automatic Superannuation Registration 2017

Pension Concession Card Reinstatement 2017

FEAR or GREED – do you still stink at investing?

5 Characteristics shared by successful small business owners

GST Updates from the Australian Taxation Office (ATO)

ATO warning regarding work-related expense claims for 2017

Property Market Update July 2017

Financial Market Update July 2017

Capital gains withholding, a new threshold – What you need to know

Bitcoin – do I need Bitcoin if I’m not a drug dealer?

Did you know your tax debt can impact your business credit rating?

Change to deductions for personal super contributions

Financial Market Update: sold in May and went away?

Is super still the best place to put your money in 2017?

Super reform: what SMSFs absolutely need to consider before 30 June

ATO issues notices to outlaw motorcycle gang members

Investment property: pre and post 30 June

Your tax planning guide for 2017

Warning – Hidden danger in pension income streams!

A Millennial’s view: Federal Budget changes 2017

Do I need to think about driver safety for my staff?

Fringe Benefits Tax and Uber travel

Join the Quill team on The Color Run Gold Coast 2017

Watch out! Google Docs phishing scam is making the rounds

Quill South Brisbane has moved to Eight Mile Plains

MoneyWise Poll – Should young people have restricted access to their super to help them enter the property market?

Financial Market Update: how did April fare?

With growing challenges in the dental industry, this research report is a must-have

Why winning isn’t the only benefit of entering business awards

Are you ready for retirement?

Two quick ways to get productive with emails

2017 North GC Business Expo

MoneyWise Poll – Do you think a housing market crash is looming for 2017?

Surging house prices – when will it end?

How to create a Facebook Business page

Pros and cons of starting a Facebook page for your business

6 ways to help get the most out of your team meetings

SCAM ALERT: Australian businesses targeted by ASIC impersonation fraud

US Interest Rate Rise – Buy the Rumour. Sell the Fact.

Teaching teens money management: does charging them board do that?

The importance of Estate Planning

Budgeting for families: getting it right

Renting out a room is rental income

Is your business website deductible? Updated 2017

Why your business needs a new website

Why don’t we want to talk about money

Concessional contribution cap changes: points to consider

MoneyWise Poll – Do credit cards play a big role in your day-to-day money habits?

When is the credit card balance panic button pushed?

Financial Market Update: The January Effect

Engaging our ‘creative side’…or so we thought!

Say goodbye to your shoebox

The Challenges of Managing Multiple Locations

2017 Investment Markets Outlook: What you need to know

MoneyWise Poll – Do you think Queensland should have Daylight Saving?

New Year’s Resolutions: Only 25% Survive 1 Week

Five simple tips to get your business off to a healthy start for 2017

The daylight saving debacle. Queensland…what time is it?

Our End of Year Video Message

November Financial Markets Update

Fringe Benefits Tax, Work Christmas parties & gifts – what you need to know!

Secret to free graphic design for small business

Lessons learned from the USA election

Manage your expenses with Receipt Bank

Can an SMSF have a ‘pot of gold’ as an investment?

Never too old to learn – 5 tips to make it easier

Starting a business on the Gold Coast

Small Business Digital Grants Now Open

5 Ways to stay composed in times of stress

MoneyWise Poll – Trump impact on the Australian economy

Brexit II – Preparing for the Trumpact on your wealth

Can you tick one important task off your list before Australia Day 2017?

3 Money apps for Millennials

ATO scams – don’t get caught by the fraudsters!

Tax Lodgement Date is Near, Here’s What You Need To Know

Have you paid your superannuation late?

Australian Housing Market Update for October 2016

September Financial Markets Update

Lord Mayor’s Budding Entrepreneurs Program round 7 is closing soon!

Compound Interest: A free kick for your portfolio

The importance of caring about your staff and their wellbeing

How the world is changing and learning

Workplace disputes: tips from Acumen Lawyers’ Brad Petley, part 2.

Fraud and the impact it has on small business

Finding the right balance

Trust: the currency of the future

Death benefit nominations for superannuation and SMSFs

Don’t get thrown under the bus next tax time

Non-Concessional Super Contributions – Where are we now?

A look at interest and penalties charged by the ATO

Australian resident for tax purposes, explained.

Choosing the right accountant

Workplace Disputes: tips from Acumen Lawyers’ Brad Petley, part 1.

Giving and Receiving Criticism at Work

Interesting Things Claimed on Tax

July Performance Summary and Other Key Points

Saving for a House Deposit?

ATO cracking down on popular Sharing Economy

Improving adult financial literacy

WorkCover and Income Protection: From a Personal Experience

Tax Benefits for Repairs and Improvements on Investment Properties

Working for yourself? Learn about Personal Services Income and how it applies

Income Protection and why it’s important to hold it in your name

[VIDEO] Claiming Meal Expenses in your tax return

When can you claim donations made to a charity or cause

Market Update for July: The dust has settled but has the market?

How a Change in Software Can Save You Time and Money

4 Tips for Effective Delegation

How to Write a Professional Email

FATCA Self Certification

[VIDEO] Claiming Work-Related Motor Vehicle Expenses

BREXIT UPDATE – Don’t just do SOMETHING; stand there!!

Brexit’s effect on the Australian Market and Economy

Stock market rally continues into April and May – Financial Market Update

The Pros and Cons to Negative Gearing

What you need to know about Free Trade Agreements and Export Loans

The Benefits of a Positive Attitude in the Workplace

Two-steps to a safer cloud with Xero Two-Step Authentication

3 ways to boost your savings – it is not too late to start!

Client Service – not just nouns but verbs

Luxury car tax and how it works

Easing cash-flow for small business owners

Admin Extraordinaire

Super is still Super. A Post Budget Review

Reserve Bank cuts the Official Cash Rate to 1.75%

5 Social Media Tips for Small Businesses

Financial Market Update – March 2016

Why you should give up your New Year’s resolutions and start setting goals

Should you be giving mates rates to your friends? Money Matters on Juice 107.3

The end of another Fringe Benefits Tax year

Going into business with family? Here are some guidelines you should follow

What is SuperStream and how does SuperStream work?

Business South Bank march networking function 2016

Private health insurance increase is coming

February Market Update

Retirement – The impossible dream

CommUnsure: What you need to know about Life insurance

GST adjustment: Colloquial for mistake

Changing Business Structure? Roll-over relief is available

7 Tips On How To Save Money Effectively

How to claim work-related motor vehicle expenses

Why the Australian Economy is a Winner

How to get some extra dollars in your pocket – Money Matters on Juice 107.3

China volatility in front of G20

Common Tax Questions Explained Simply

Did someone say #UBERPUPPIES!!

It’s official – ASX Bear Market! Does it portend something much worse?

The Coffee Shop Experiment. A Lesson for Business Owners.

Velocity to exit or a deflationary spiral? Here’s my 2016 Financial Markets outlook.

Innovation & Technology

Preparing for the milennial tidal wave

When can tradies claim?

Money: How does it speak to you?

The Working Mum

Hospitality Super Threshold

Quill Contact Details

Building Rapport through Effective Communication

Trauma & TPD – What’s the Difference?

Making the most of your business

Disposal of Pre-CGT Property in the Company

The Importance of Adhering to a Payment Arrangement with the ATO

Get connected with big Projects

Business fitness – healthy body and healthy mind!!!

Insurance- Do you know your whole deal?

Audit Insurance

Autopia

HECS HELP Benefits

Deskercise

SuperStream rolled out

How The Latest Legislative Changes Will Impact Older Australians

Envy of International Shares Last Year

Adding children to your SMSF?

Tax scams / Fraud are on the rise

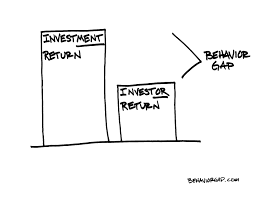

Behaviour Gap

Are you on track to make Budget this month?

The Role of an ASIC Registered Agent and Registered Office

Weird Strange Tax Deductions? Only if you think so

Sign Up To Receive Our Insights blog

"*" indicates required fields

Gold Coast

Brisbane

Sunshine Coast

Gold Coast

Phone

(07) 5528 2000Postal Address

PO Box 10466, Southport BC,

QLD 4215Brisbane

Phone

(07) 3840 4700Postal Address

PO Box 4557, Eight Mile Plains, QLD 4113Sunshine Coast

Team Qualifications

©2024 Quill Group All Rights Reserved

Give yourself the peace of mind you deserve – today!