The Government is extending the JobKeeper Payment by a further six months to 28 March 2021. Under the JobKeeper extension, support will be targeted to businesses and not-for-profits that continue to be significantly impacted by the Coronavirus. The payment rate will be reduced and a lower payment rate will be introduced for those who work fewer hours. Other eligibility rules remain unchanged.

Article Contents

UPDATE: 7 August 2020

Treasurer Josh Frydenberg has announced businesses will only need to show that their GST turnover had fallen over one quarter (September 2020), instead of multiple (June and September 2020), to be eligible for the scheme’s extension from 27 September 2020.

Workers will also qualify if they were employed on July 1, rather than March 1.

We have updated this article in regards to eligibility criteria as at 07/08/2020 based on the latest information on the Treasury Website.

JobKeeper Extension Summary

- JobKeeper has been extended to eligible businesses until 28 March 2021;

- Eligible businesses will need to reassess their eligibility based on their September 2020 quarterly income (the requirement for BOTH June and September 2020 quarterly income to be impacted has been removed);

- A second eligibility assessment must also be made to receive JobKeeper between 4 January and 28 March 2021 (based on actual turnover for the December 2020 quarter);

- JobKeeper payment rates will be reduced and lower payments will apply to part-time employees who worked less than 20 hours per week prior to COVID-19;

- Eligibility and payments remained unchanged for any business already receiving JobKeeper for eligibile employees up to 27 September 2020.

JobKeeper Extension Eligibility

From 28 September 2020, businesses will be required to reassess their eligibility with reference to their actual GST turnover in the September 2020 quarter.

Businesses will need to demonstrate that they have met the relevant decline in turnover test in the September quarter to be eligible for the JobKeeper Payment from 28 September 2020 to 3 January 2021.

It was originally announced that to be eligible for Jobkeeper beyond 28 September 2020 a business would had to have experienced a 30% decline in turnover for BOTH the June and September 2020 quarters, however Treasurer Josh Frydenberg announced on the 7th of August that only the September quarter would now be measured. This change is to account for businesses who have had their turnover improve across the June 2020 quarter however have been significantly impacted in the September 2020 quarter (namely in Victoria) due to the second-wave of COVID-19.

From 4 January 2021, businesses will need to further reassess their turnover to be eligible for the JobKeeper Payment.

They will need to demonstrate that they have met the relevant decline in turnover test with reference to their actual GST turnover in the December quarter 2020 to remain eligible for the JobKeeper Payment from 4 January 2021 to 28 March 2021.

JobKeeper additional decline in turnover tests are also available from 28 September 2020. See below.

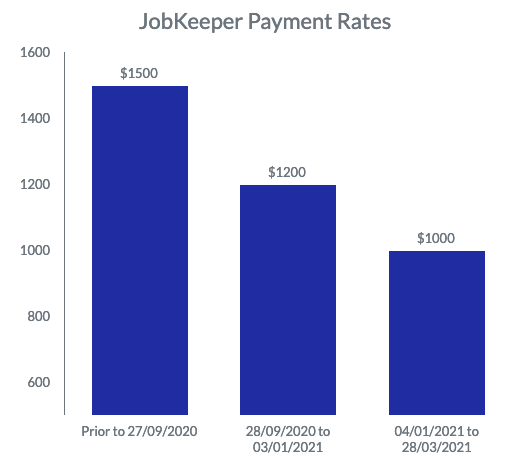

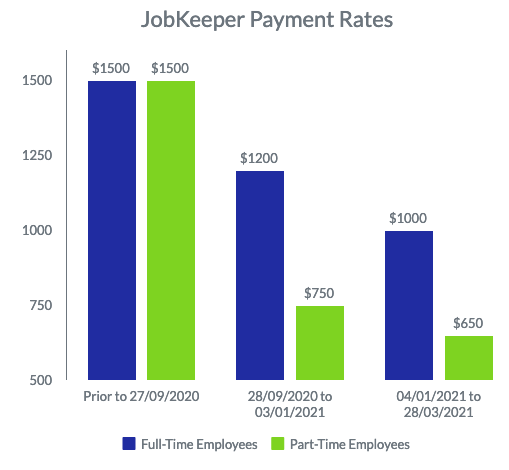

JobKeeper 2.0 Payment Rates

- Prior to 27 September 2020 – $1500 per fortnight

- 28 September 2020 to 3 January 2021 – $1200 per fortnight

- 4 January 2021 to 28 March 2021 – $1000 per fortnight

JobKeeper Payments for Part-Time and Casual Employees

As part of the JobKeeper extension, from 28 September 2020, lower payment rates will apply for employees and business participants that worked fewer than 80 hours in the preceding 28 day period.

The JobKeeper extension payment rates for part-time eligible employees will be:

- Prior to 27 September 2020 – $1500 per fortnight

- 28 September 2020 to 3 January 2021 – $750 per fortnight

- 4 January 2021 to 28 March 2021 – $650 per fortnight

The reference period for employees is the 28 days ending at the end of the pay cycle that finished immediately before 1 March 2020 or 1 July 2020.

The hours include actual hours worked, and any hours for which the employee received paid leave, including annual, long service, sick, carers and other forms of paid leave, or paid absence for public holidays.

JobKeeper Full-Time Employee

Definition of a full-time employee or eligible business participant for JobKeeper payments is based on whether they’ve worked more than 80 hours in the preceding 28 day period.

For an employee to be determined as being full-time they need have to have worked more than 80 hours in the previous 28 days.

The Commissioner of Taxation will have discretion to set out alternative tests for those situations where an employee’s or business participant’s hours were not usual during February 2020. Also, the ATO will provide guidance on how this will be dealt with when pay periods are not weekly.

JobKeeper Extension Employee Eligibility

There are some important changes to JobKeeper employee eligibility that apply from 3 August 2020 which impacts BOTH the original JobKeeper program as well as JobKeeper 2.0.

Please refer to our updated article here: JobKeeper Employee Eligibility

Employees are eligible in the extension period if they:

- are currently employed by an eligible employer (including if you were stood down or rehired)

- were for the eligible employer (or another entity in their wholly-owned group) either:

- a full-time, part-time or fixed-term employee at 1 July 2020; or

- a long-term casual employee (employed on a regular and systematic basis for at least 12 months) as at 1 July 2020 and not a permanent employee of any other employer.

- were aged 18 years or older at 1 July 2020 (if you were 16 or 17 you can also qualify if you are independent or not undertaking full time study).

- were either:

- an Australian resident (within the meaning of the Social Security Act 1991); or

- an Australian resident for the purpose of the Income Tax Assessment Act 1936 and the holder of a Subclass 444 (Special Category) visa as at 1 March 2020.

- were not in receipt of any of these payments during the JobKeeper fortnight:

- government parental leave or Dad and partner pay under the Paid Parental Leave Act 2010; or

- a payment in accordance with Australian worker compensation law for an individual’s total incapacity for work.

Additional JobKeeper Extension Decline in Turnover Tests

To receive JobKeeper payments from 28 September 2020, businesses will need to meet the basic eligibility tests and an extended decline in turnover test based on actual GST turnover.

| 30 March to 27 September 2020 | 28 September to 3 January 2021 | 4 January 2021 to 28 March 2021 | |

| Decline in turnover | Projected GST turnover for a relevant month or quarter is expected to fall by at least 30% compared to the same period in 2019.* | Actual GST turnover in the September 2020 quarter fell by at least 30% compared to the same periods in 2019. The decline for both of the quarters needs to be met to continue receiving JobKeeper payments. | Actual GST turnover in the December 2020 quarter fell by at least 30% compared to the same periods in 2019. The decline for all three of the quarters needs to be met to continue receiving JobKeeper payments. |

*The alternative tests will apply where a business fails the basic test and does not have a relevant comparison period.

The 30% decline in turnover test for JobKeeper is adjusted to 15% for ACNC-registered charities (excluding universities, or schools within the meaning of the GST Act – these entities need to meet the basic turnover test) and 50% for large businesses with an annual turnover of $1 billion or more.

The ATO will have discretion to set out alternative tests that would establish eligibility in specific circumstances where it is not appropriate to compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019. These alternative JobKeeper eligibility tests will be in line with the existing discretion from the ATO. More information from the ATO is available here: How to determine a fall in turnover

Assessing JobKeeper 2.0 Eligibility

Most businesses will generally use their Business Activity Statement (BAS) reporting to assess eligibility.

However, as the BAS deadlines are generally not due until the month after the end of the quarter, eligibility for JobKeeper will need to be assessed in advance of the BAS reporting deadlines to meet the wage condition for eligible employees.

The ATO will have discretion to extend the time an entity has to pay employees in order to meet the wage condition.

Alternative arrangements are expected to be put in place for businesses and not-for-profits that are not required to lodge a BAS (for example, if the entity is a member of a GST group).

JobKeeper Prior to 27 September 2020

Eligibility and payments remained unchanged for any business already receiving JobKeeper for eligible employees up to 27 September 2020.

The “once you’re in, you’re in” approach still applies up to 27 September 2020. Provided your business met the eligibility test once since the commencement of JobKeeper, you continue to be eligible through to 27 September 2020 providing your fulfill the monthly statistical reporting and wage payment requirement.

Re-assessment is only necessary to receive JobKeeper after 27 September 2020 and then again after 3 January 2020.

Other JobKeeper Related Resources

Treasury Factsheet – Update 7 August 2020

How to Apply for JobKeeper 1.0 Payment

How do the JobKeeper 1.0 Payments work?

Your Eligible Employees (ATO)

If you have any questions, please get in touch with your Quill Relationship Manager or reach out to our team for assistance.