After months of speculation as to what the Government is planning to implement in the 2017 Federal Budget, finally, the budget changes have been released to the public. Implementation of changes is soon to commence.

There are certainly some “winners” and “losers” but overall, the aim of the budget is to positively impact our economy. And with a thriving economy, all Australians are winners.

As a millennial, my biggest focus around the budget is; housing affordability and student debt. So, let’s focus on these points.

First Home Buyers

There had been speculation over the previous months that the government was going to allow first home buyers access to their superannuation savings to fund their house deposit. Personally, I was horrified to hear this was a serious consideration. Such a scheme would influence further implications and retirement unaffordability issues down the track. Pleasing to hear, this scheme was dismissed.

The “First Home Super Savers Scheme” is being implemented from 1 July 2017. This effectively allows individuals to salary sacrifice savings towards a house deposit into their super. By salary sacrificing, a tax advantage is applied as these contributions are considered concessional contributions (pre-tax). Therefore, salary sacrificed contributions and earnings in super are taxed at 15% rather than the marginal tax rate.

Only the contributions to the First Home Savers Scheme will be available to withdraw for first home deposits. Until a condition of release is met, no other superannuation savings are accessible. If you do not end up purchasing a home, these additional contributions will not be accessible until retirement or a condition of release has been met.

It is important to note; the First Home Super Savers Scheme is capped at $30,000. However, as previously mentioned, these contributions are classified as concessional contributions which oblige to the annual cap of $25,000. Noting also that your Superannuation Guarantee Contributions also fall under this cap, you are limited to contributing a maximum of $15,000 (without exceeding the $25,000 cap) into the First Home Super Savers Scheme per annum.

15% tax is applied on each contribution into your First Home Super Savers Scheme account. For example, let’s say you contribute $10,000 in a financial year, only $8,500 hits your first home savers account as $1,500 of the contribution is paid in tax. As a comparison, let’s say you fit into the 34.5% tax bracket and decide to place this $10,000 pre-tax money into a bank account outside of super. This means you will pay $3,450 in tax opposed to $1,500.

Withdrawal of these contributions will be accessible by 1 July 2018 and will be calculated using a deemed rate of return. Upon withdrawal, the value of your savings will be added to your assessable income with a tax rebate of 30%. Therefore, if we use the same example above and assume with the withdrawal added to your assessable income that you remain in the 34.5% tax bracket, you will be liable to pay a further 4.5% tax on the withdrawal of your savings. It feels a bit like the government is double dipping here… nonetheless, it’s still a great tax saving strategy. For a detailed example of how the deemed rate and tax rebate is calculated, refer to Mark Beveridge’s blog.

Although the First Home Super Savers Scheme is capped at only $30,000, I think it’s a great opportunity to start saving. The government has provided a handy estimator tool to calculate the difference in savings when using the First Home Super Savers Scheme verses saving in a standard deposit account outside of super.

Investment Properties

Good news for some property investors! In a bid to make housing more affordable and appealing to Australian investors, the Capital Gains Tax (CGT) discount has increased from 50% to 60%. To be eligible for the 60% CGT discount, the residential property must;

- Be rented to low to moderate income tenants

- Be rented at a discounted rate

- Be managed through a registered community housing provider, and

- Held for a 3-year minimum.

During periods where the property is not used for affordable housing purposes, the additional discount will be pro-rated.

Unfortunately for property investors, reductions and eliminations of certain claimable tax deductions will be implemented. These changes affect previously claimable travel expenses and property plant and equipment depreciation deductions.

Not so great news for foreign property investors, but good news again for Australian investors as these new changes will provide Australians with increased opportunity to invest. Foreign ownership will be restricted to 50% in new property developments. They will also be liable to a minimum $5,000 annual levy if their properties are found to be unoccupied or not genuinely available to rent for at least 6 months per annum.

CGT main residence exemption will also no longer be available for foreign property owners. However, a grandfathering rule for the exemption will be implemented for existing owners up until 30 June 2019.

Foreign tax residents will also see the CGT withholding rate increased from 10% to 12.5% and the property value threshold will reduce from $2 million to $750,000 from 1 July 2017.

Student Loans

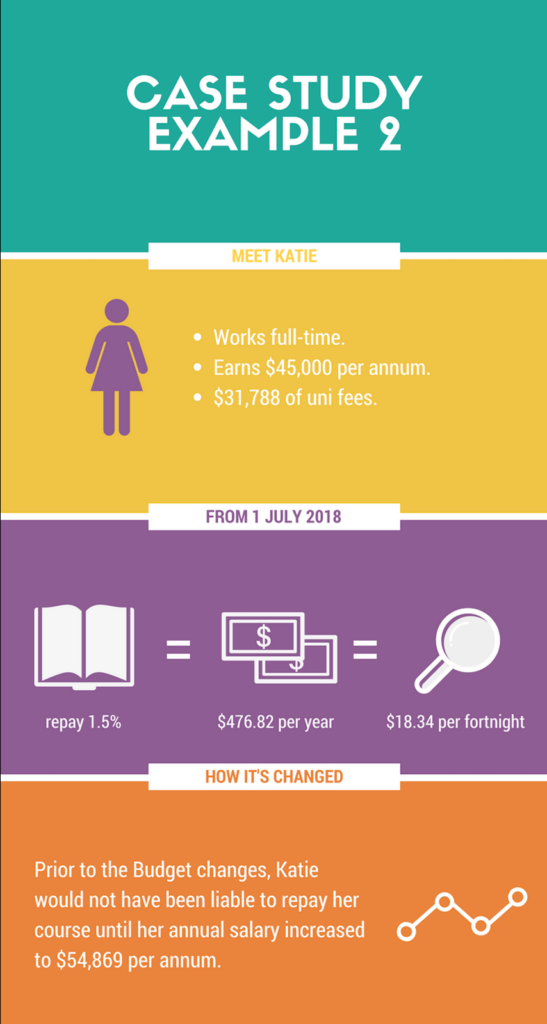

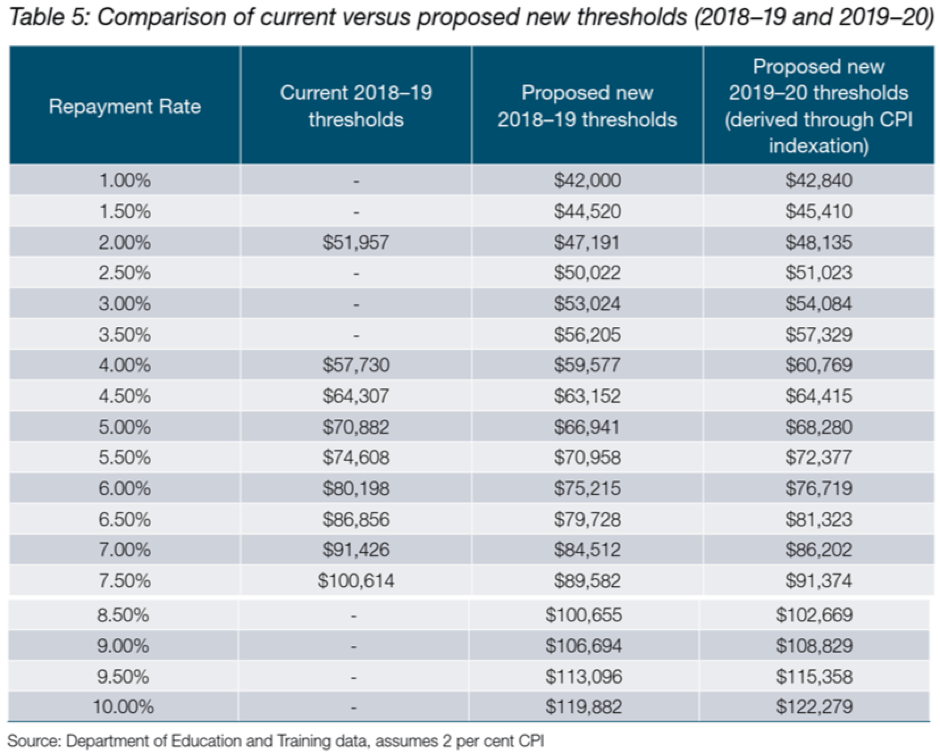

Bad luck for students. It seems to be getting progressively harder to afford study. Not only are university fees increasing, but the minimum income threshold to repay your HECS or HELP debt is now reduced to $42,000 per annum from $54,869 per annum.

Combine that with the average four-year course increasing in fees by approximately $2,200 to $3,600, it’s a scary outlook for existing and future students.

However, we can catch our breath (just a little). It’s not as bad as it sounds. Previously, once the threshold of $54,869 was reached, 4% of the course repayment was due payable. With the new minimum threshold reduction, only 1% is payable with annual income of $42,000. Once your salary reaches approximately $53,000 to $56,000, which is around the old threshold, you will be repaying between 3% and 3.5%.

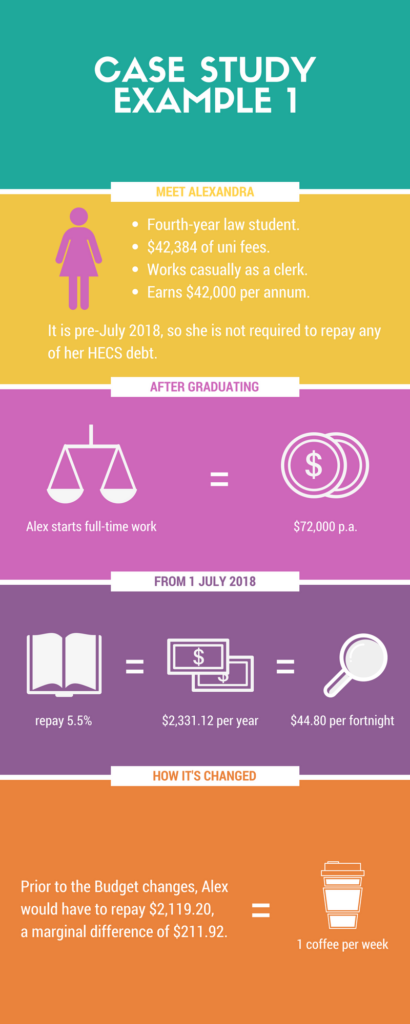

Let’s do a case study or two to delve into this a little deeper.

It’s important to remember that although there is no interest accumulating on these student loans, they do increase with CPI (Consumer Price Index).

The increase in university fees and reduction in the repayment threshold isn’t the outcome any student was hoping for. But, as detailed in our first case study, the difference is about two cups of coffee (if that!) each fortnight. We will prevail!

Refer to the Department of Education’s comparison table below for more information;

Current 2016-17 Repayment Income Thresholds and Rates:

| Repayment Income | Rate |

| Below $54,868 | NIL |

| $54,869 to $61,119 | 4.00% |

| $61,120 to $67,368 | 4.50% |

| $67,369 to $70,909 | 5.00% |

| $70,910 to $76,222 | 5.50% |

| $76,223 to $82,550 | 6.00% |

| $82,551 to $86,894 | 6.50% |

| $86,895 to $95,626 | 7.00% |

| $95,627 to $101,899 | 7.50% |

| $101,900 and above | 8.00% |

These changes are yet to be legislated, but if you would like to start planning or find out how it will affect you personally, call Quill today.

House Sale Proceeds for Over 65s

Let’s briefly touch base on this also, as you can pass on your knowledge to a family member which this may apply to. Previously, a person aged over 65 was unable to make any super contributions unless they were ‘gainfully employed’ and age 75 was the absolute cut-off age, even if they continued to work. However, with these new budget changes, individuals over age 65 can contribute up to $300,000 of their family home sale proceeds into their superannuation. However, conditions apply as they must have owned the family home for a minimum of 10 years. Fortunately, this type of contribution is not subject to the new $1.6 million superannuation caps.

There are also Centrelink implications to consider for those receiving a part pension under the assets test. If they sell down their home and contribute the funds into their super or retain it outside of super, they could see a reduction or elimination of their part pension. If this could affect someone you know, they can contact Quill to discuss their circumstances.