How to sign documents electronically via Annature?

Where you have agreed to receive documents from Quill Group that require your electronic signature, we will now send these via Annature.

These steps will take you through the new electronic signing process and what to expect.

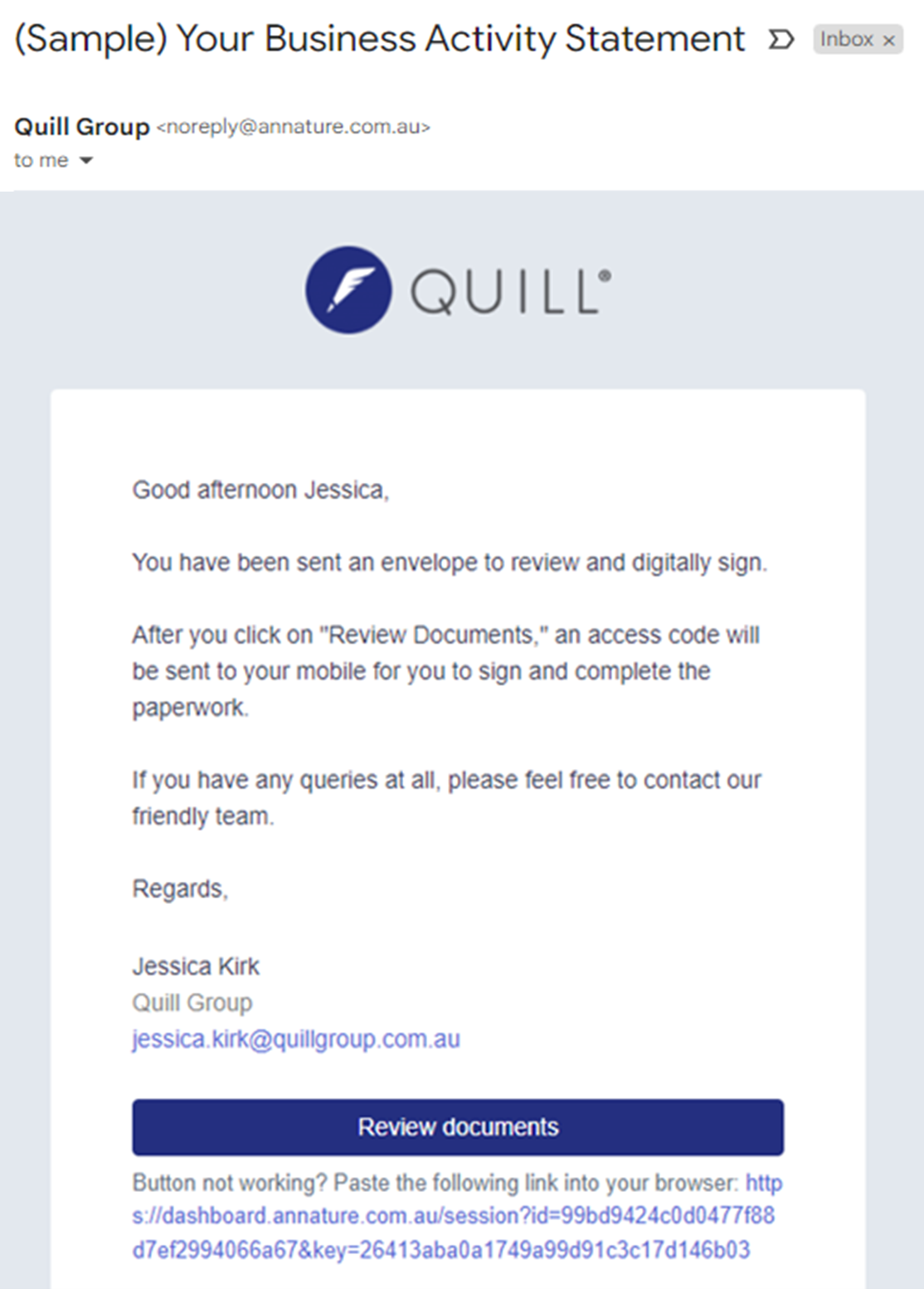

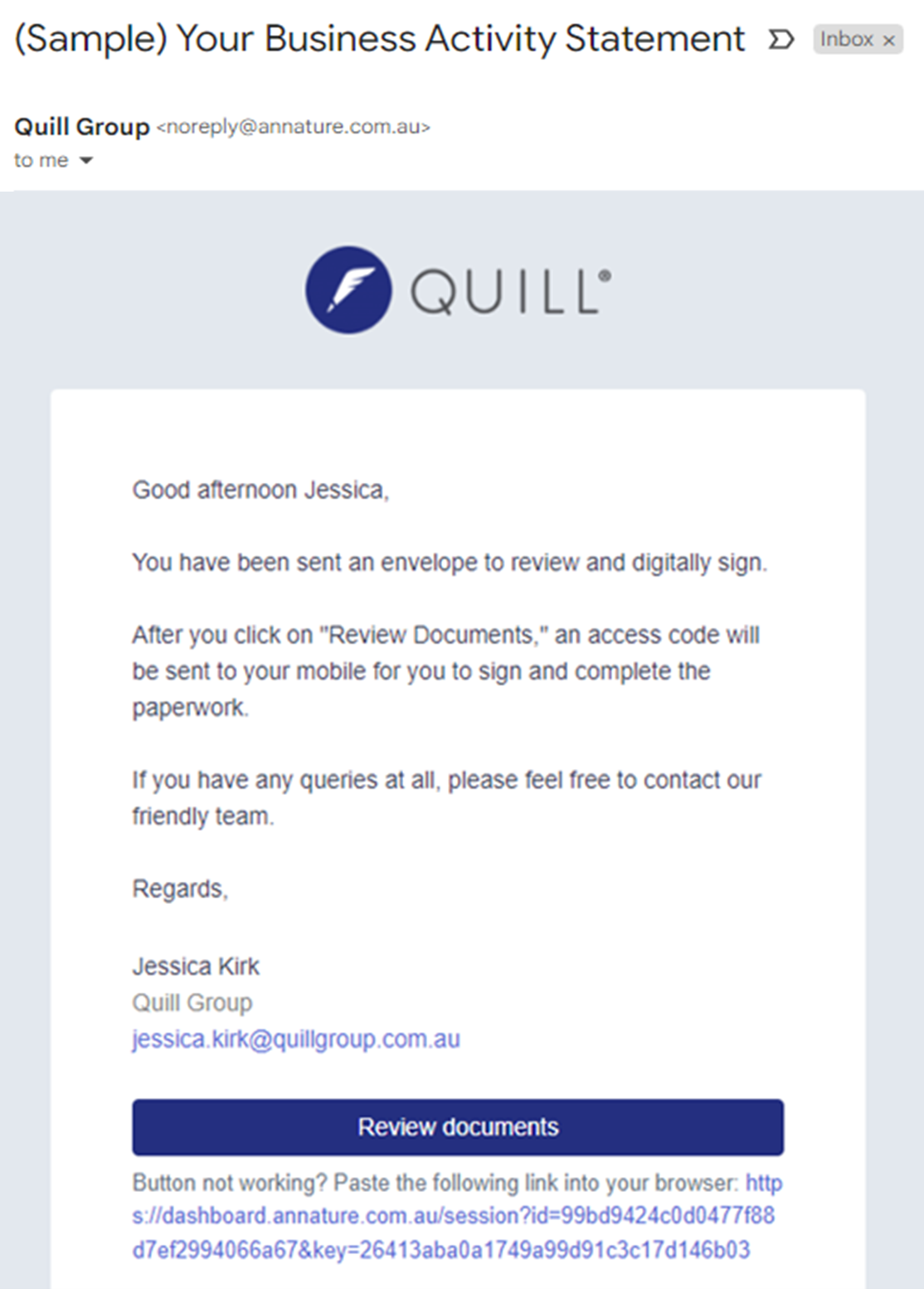

Step 1:

You will receive an email from Quill Group with your documents to sign. Click on review documents to open the envelope.

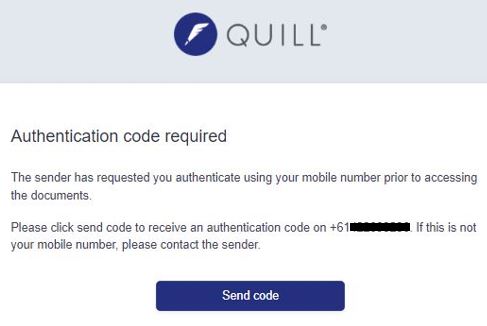

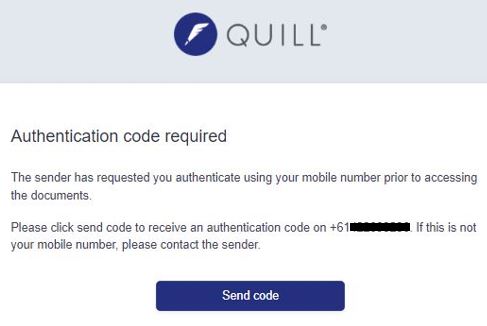

Step 2:

A new window will open, requiring a two-factor authentication with either your mobile number or a password to be entered before you are given access to view the documents and sign.

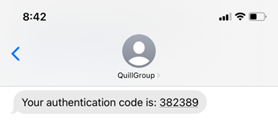

In this example, an authentication code is sent using a mobile number. Click on send code to receive the 6-digit authentication code on your mobile device.

If you are required to enter a password, we will advise you of these details to ensure the password is entered in the correct format.

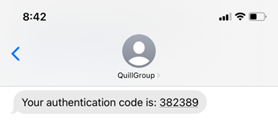

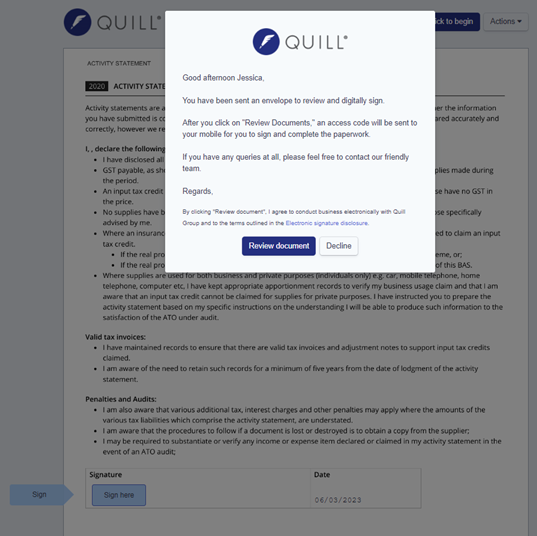

Step 3:

Click on review documents and Annature will guide you through the sections you need to review and sign.

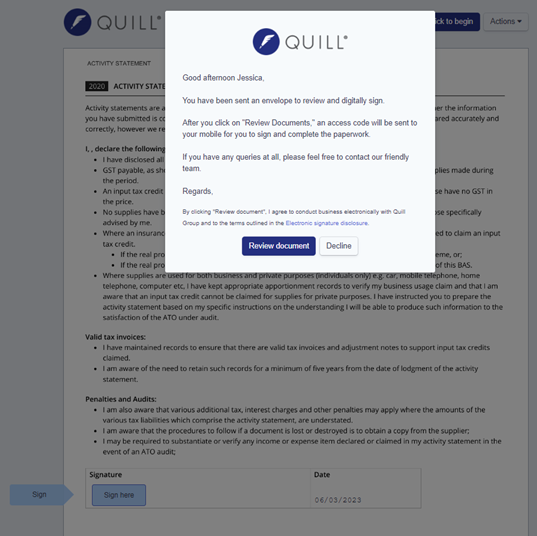

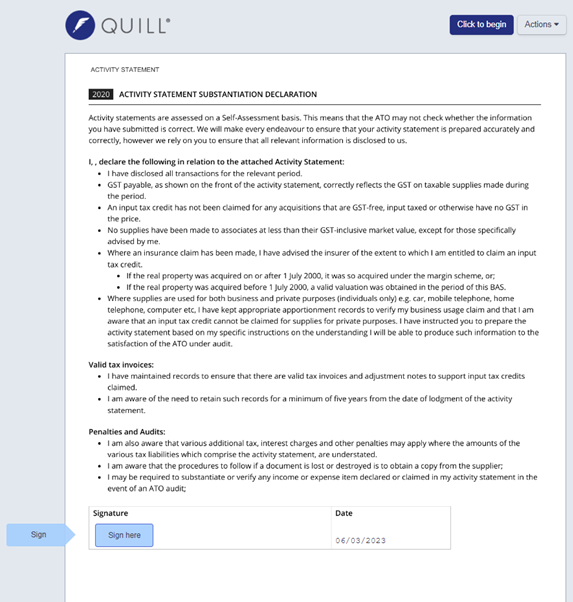

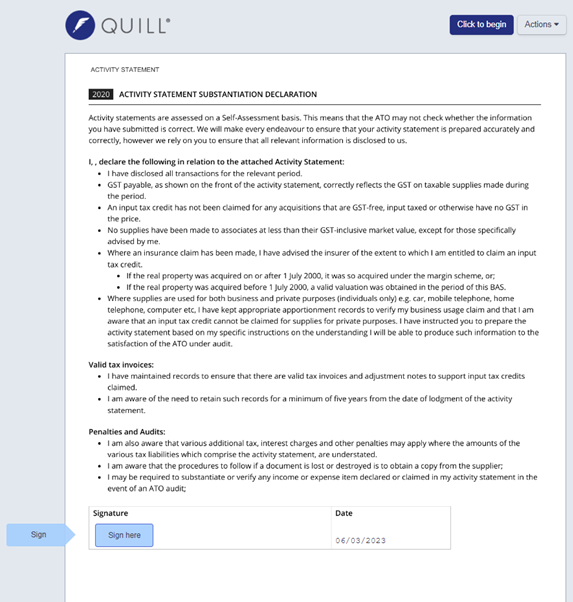

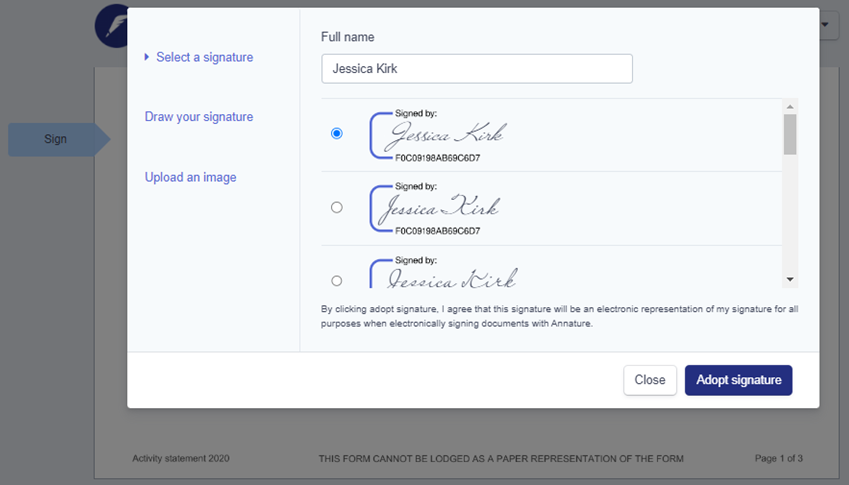

Step 4:

You will then click to begin which will bring up the documents and you can scroll through to find the first position where your signature is required.

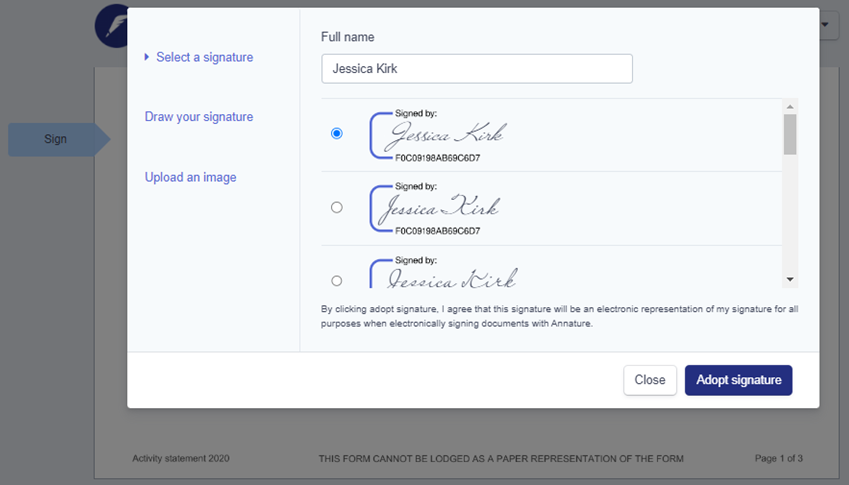

Step 5:

Simply click on a sign here tab which will open a pop-up window where you will be asked to adopt an e-signature. You can choose a signature from the list, draw or upload a signature you wish.

To complete this, click on adopt signature.

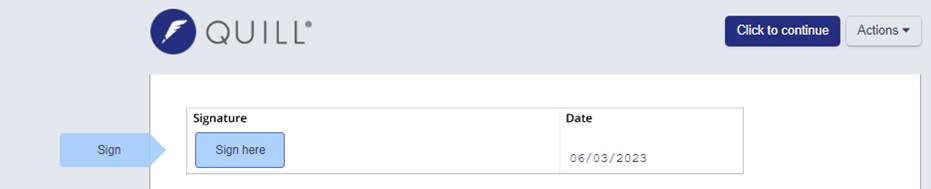

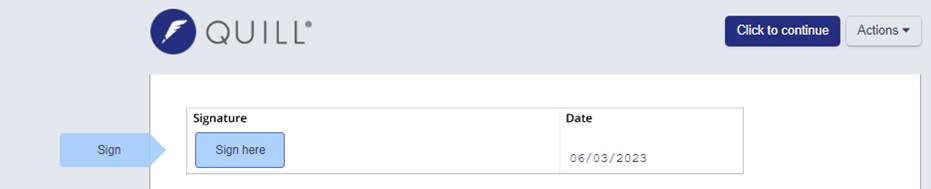

Step 6:

You will need to click to continue to finish all sections of the document.

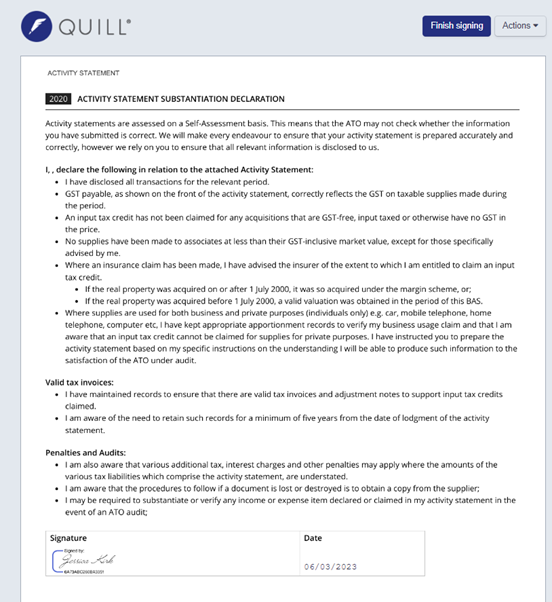

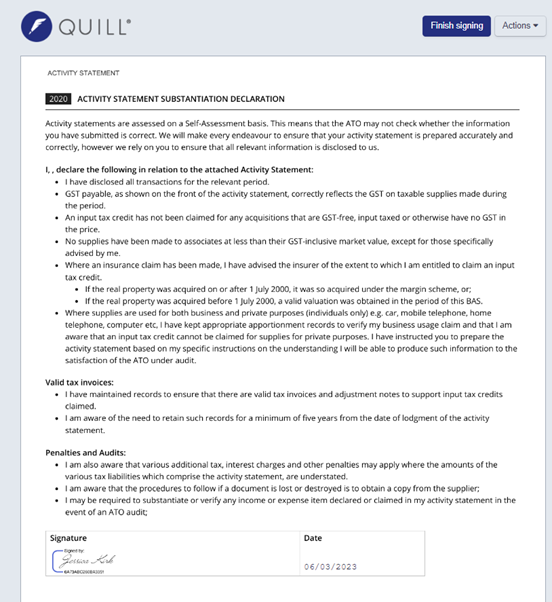

Step 7:

Once all sections are signed, click finish signing. By clicking this you will be notified in a pop-up that you have finished.

Step 8:

Once all recipients have signed, you will receive a confirmation email titled envelope complete with your executed documents and certificate of completion for your records enclosed.

Step 9:

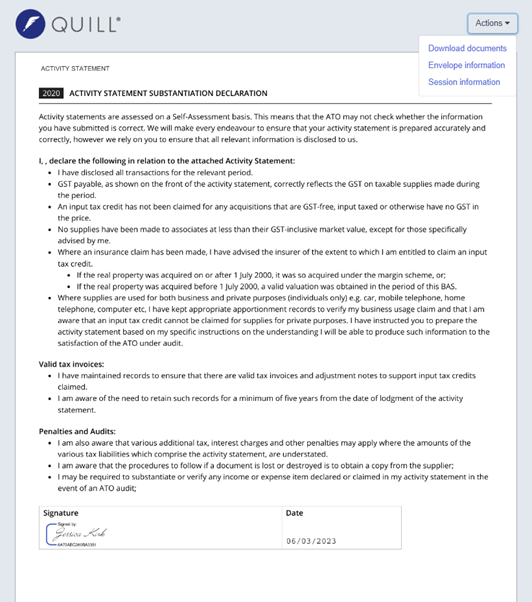

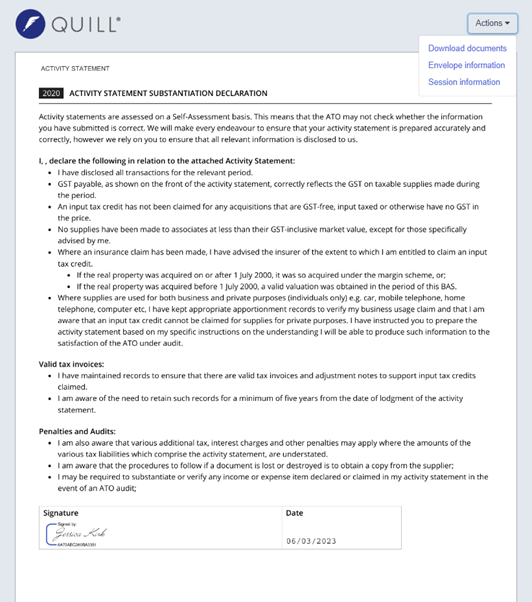

Click on view documents which will open a pop-up window, then go to actions in the top right-hand corner and click download documents.

Step 10:

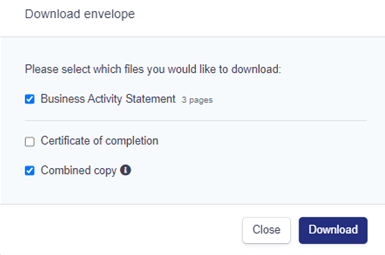

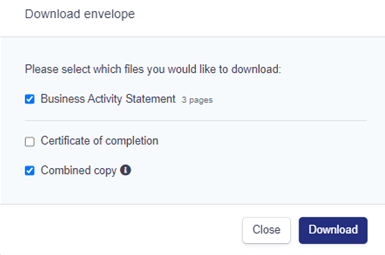

Select the files you would like to download and click download.

If you have any further queries in relation to this or require our assistance with the electronic signing process, please feel free to contact our friendly team.

In March this year, a new category of domain name was made available to Australian businesses.

Instead of ending with .com.au, .net.au, asn.au, you can now also register .au related to your existing URLs.

Up until September 21, Australian businesses can register ‘xxx.au’ domains for existing .com.au domain names. Thereafter, anyone else can register the new, shorter URLs. This means competitors, or URL ‘campers’ or cybercriminals can register a domain name that’s very similar and possibly, mistakable for your own.

In order to protect URLs related to your existing .com.au domains, the Australian Small Business and Family Enterprise Ombudsman, Bruce Billson has urged small business to take urgent action by the September deadline to safeguard their identity.

“The consequences of not registering your existing business name by this deadline could be catastrophic for a business if a rival or someone else took their online name,” Billson warned.

“I implore all small business owners to take a few minutes to work out if they want the shortened .au domain or will be unhappy for someone else to have it,” Billson said.

“If you want it, small business owners, I urge you to take a few minutes and few dollars to register it or potentially face someone else grabbing it and using it to digitally ambush your business, to demand big dollars later to surrender it to you, or misuse it to masquerade as you or to help them engage in cyber-crime.”

The .au Domain Administration (auDA) is a non-government regulator, and recently rejected Billson’s letter requesting an extension to the deadline.

The following summary will hopefully shed some insights on why we are seeing such an extreme level of market volatility across all levels of investment at present.

Falling stock and bond markets, along with the rising volatility which has gripped global markets since the start of the year, has intensified in recent days. Last week’s announcement of annual US inflation of 8.6%, the highest in 40 years, was the primary cause.

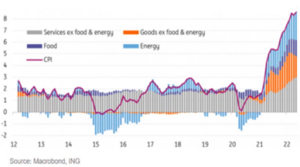

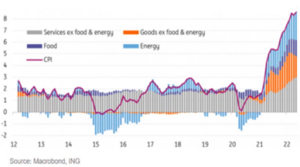

The chart below illustrates both the recent increase of CPI as well as the composition of contributions to US inflation.

Sourced : June 2022

Energy, food, and services have all contributed to the rise in US inflation. Reduced supply and increasing demand factors are pushing prices higher. Regarding energy, there has been significant supply constraints due to the conflict in Ukraine along with greater demand as the US holiday driving season ramps up. Food prices have also been affected by the costs of production (increased fertiliser costs) and transportation. Services costs have risen as demand increases as the economy reopens and consumers recommence travel and other related activities. In the last three months alone, airfares have risen 48%.

US Federal Reserve (Fed)

In response to the rising inflation the central bank, the Fed, has made it clear that they seek to return inflation to its target of 2% p.a. The Fed is also aware that if inflation continues to rise, workers will likely seek additional wage rises to compensate for the higher costs of living. The danger then becomes a wage price spiral. If wages increase too quickly then the producers of goods and services raise their prices to maintain their profit margin, which then feeds into further wage rises. This potentially results in higher inflation becoming entrenched.

The Fed has just made the decision to raise rates by a further 75 basis points or 0.75%

Reserve Bank of Australia (RBA)

At its June meeting the Australian central bank, The RBA, also responded to higher-than-expected domestic inflation, with an increase of 0.5% in the official cash rate target. It was the largest upward move since February 2000. This brings the cash rate target to 0.85%. In its statement following the decision, the RBA also called out rising power and petrol prices, as contributing to inflation from the previous month.

Both the Fed and RBA, along with other central banks, have made it clear that they will continue to raise rates to tame inflation and bring it down to the targets they have set.

Market Reaction

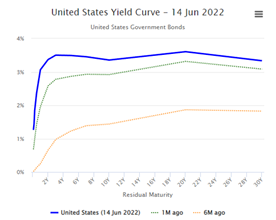

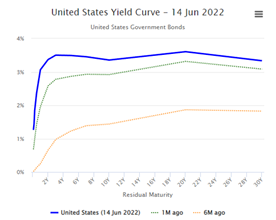

Following these central bank’s statements, markets are increasingly concerned that the rate hikes required to tame inflation could depress economic growth, resulting in a recession. One indicator that has preceded recessions in the past is an inverted yield curve. This simply means that longer term interest rates fall below shorter term rates. This is illustrated by the blue line in the chart below, where the current 2-year government bond rate is above the 10-year rate. Historically, an inverted yield curve has been a good, albeit not infallible predictor of a recession 12-18 months later.

Sourced : http://www.worldgovernmentbonds.com (June 2022)

International Equities

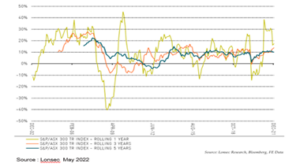

Markets that were already under stress prior to last week’s inflation rate, responded quickly and sold down further as the market reassessed company’s future earnings prospects in a higher inflation, higher interest rate environment. The following charts show both the Nasdaq and S&P 500, over 1 week and 6 months, with their corresponding drawdown.

S&P 500 – 1 week (to 14 June 2022)

S&P 500 – 6 months (to 14 June 2022)

Sourced : http://www.tradingeconomics.com (June 2022)

Falls in recent days have seen the S&P 500 move officially into a “bear market” (market falls of 20% or more). The NASDAQ, which comprises predominantly “growth” stocks, has been particularly hard-hit. The main reason for this is that growth stocks are expected to deliver a higher proportion of future cashflows in the distant future and are therefore more sensitive to interest rate rises. The future cash flows are worth less in today’s terms as interest rates (discount rates) increase.

Australian Equities

Both global markets and domestic factors influence the Australian stock market. Whilst earlier in the year the market fared relatively better to its overseas counterparts, market sentiment began to change following the April RBA meeting. At this meeting, the RBA began to suggest that rates may have to move higher as inflationary pressures were building. These market concerns were realised in the May meeting, when the official cash rate rose by a quarter of a percent, and then in June with the half a percentage rise.

The following charts show the ASX 200, over 1 week and 6 months, with their corresponding drawdown. The one-week drawdown was compounded by the US market falls. Overall, the market has fallen around 12.5% from its peak 6 months ago.

ASX 200 – 1 week (to 14 June 2022)

ASX 200 – 6 months (to 14 June 2022)

Sourced : http://www.tradingeconomics.com (June 2022)

Fixed Income

Fixed income markets have also responded to rising inflation and interest rates. If yields rise rapidly (responding to higher interest rates), the value of a fixed interest investment falls. This is because the fixed yield on an existing investment, is now lower on a relative basis, and therefore considered less attractive, than a new investment which attracts a higher yield.

Australian and US yields have surged in 2022, with both 10-year Government Bond rates rising to well over 3%. In Australia the Ausbond Composite Index, which is the most common measure of the Australian Fixed Interest market, is down approximately 10.8% from the start of the year to 10 June, whilst the global equivalent, the Bloomberg Global Aggregate (AUD Hedged), is down approximately 11.5% from the start of the year until 10 June 2022. These are the largest corrections seen in this asset class in the last 40 years and eclipses the 1994 bond market sell-off.

The following charts illustrate the rise in Australian and US yields over the past year, and the drawdown in the Ausbond Composite Index since 1990.

US 10 Year Yield (1 Year)

Australian 10 Year Yield (1 Year)

Sourced: http://www.tradingeconomics.com (June 2022)

Outlook

We appreciate that the current environment looks concerning given falls in markets and likely further interest rate rises. There have also been reports comparing the current period to previous episodes of rising inflation and interest rates. It is worth examining two previous periods of rising inflation and interest rates. These two periods are the 1970’s through to the early 1980’s, and 1994. Whilst it is difficult to make direct comparisons as the global economy and markets have evolved since these periods, it is still worthwhile to identify similarities and differences which can assist in thinking about the market outlook.

In the 1970’s, economies were impacted by oil price shocks, causing inflation to surge. Geopolitical issues in the 1970’s were mainly responsible. As a result, central banks at the time were much more strident in taming inflation, and rates moved well into the double digits. In the US interest rates reached 20% by late 1980. This resulted in the recession of 1981-1982, and US unemployment reached nearly 11% in late 1982. However, economies were much more rigid at that time and the rising inflation resulted in significant wage rises becoming much more entrenched. This is not the case today. As labour markets have become more flexible in recent decades the likelihood of wages increasing at the same rate is diminished.

The Fed also embarked on a series of interest rate increases primarily to ward off inflation in 1994. However, there are a few key differences with now. In 1994, whilst inflation was rising, it had not risen to the current levels. Policymakers, however, fretted that a strong economy would translate into much higher inflation. The Fed doubled interest rates over a 12-month period to 6% – at one point executing a three quarters of a percent hike. The speed and degree of the rate rises took markets by surprise and resulted in significant drawdown in fixed income markets.

Current economic conditions today are more sensitive to interest rate movements, given higher indebted levels, an ageing demographic, slower population growth, and lower economic growth. Central banks are aware of these conditions and as a result, whilst seeking to reduce inflation, will also likely be conscious of the market impacts.

Importantly, we do see inflation likely moderating over the next 12 months. A range of factors particularly around supply side constraints such as ongoing Covid impacts particularly in China and energy prices have been key drivers in the current inflation numbers. We expect these constraints to ease in coming months. This in turn would likely improve the outlook for rates, bond markets, and equities.

In addition to Geopolitical factors listed above, we see that the current inflation environment has been largely caused by massive increases in the money supply just after the Covid crisis. Two and a half years later, the lagged impacts of those money supply increases are showing up in rising prices for goods, services, real assets and commodities.

As the Covid crisis unfolded and the world controlled the situation, the growth rate in money supply was drastically reduced. This may mean that large increases in inflation this year may be followed by a moderation in prices in 2023 and beyond, as the lagged effect of those subsequent money supply decreases flow through next year.

What to do?

The volatility that we have seen over the last six months, while significant, is not an unusual occurrence for a normal and healthy functioning market. Despite being an uncomfortable experience in the short term, equity markets will continue to be an important contributor to overall long-term returns.

It is important to continue to stay invested and manage your portfolio in line with your long-term objectives, aligned to your risk tolerance. We would encourage investors to discuss their portfolio with their adviser to ensure that it meets their personal needs, objectives and is in line with their risk tolerance.

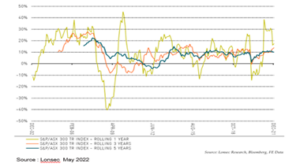

One of the important lessons in investing is that time in the market, is more important than timing the market. The following chart demonstrates that whilst short term movements in markets (in this case the ASX 200) can be extremely volatile (as we have witnessed in the past 6 months), investing for the longer term (the blue line) provides a much more stable outcome. As we continue working through this period of heightened volatility, keeping the longer-term in mind remains important.

You need to apply for your own director ID. Unfortunately we are unable to do this on your behalf, however, please know that we are here to assist you through the process if needed.

The fastest way to do this is online using the myGovID app.

To complete your online application, you will need:

- A standard or strong identity strength myGovID. If you don’t have one, please visit How to Set up myGov ID.

- An individual Australian tax file number (TFN). Providing your TFN is optional but it will speed up the process.

- Your residential address, as recorded by the Australian Taxation Office (ATO).

- Answers to two questions based on details we know about you from the following documents:

- Bank Account Details

- Notice of Assessment

- Dividend Statement

- Centrelink Payment Summary

- PAYG Payment Summary

There are also options to apply for a Director ID application via phone and paper (these two options are more time consuming) Application Options.

Step 1 – Set up myGovID

You will need a myGovID with a Standard or Strong identity strength to apply for your director ID online. If you live outside Australia and can’t get a myGovID with a Standard or Strong identity strength, you will need to apply with a paper form and provide certified copies of your identity documents. If you live in Australia and:

- don’t have a myGovID, you can find information on how to download the app at

- already have a myGovID, you can apply for your director ID now.

myGovID is different from myGov

- myGovID is an app. You download the myGovID app to your smart device. It lets you prove who you are and log in to a range of government online services, including myGov.

- myGov is an account. Your myGov account lets you link to and access online services provided by the Australian Taxation Office (ATO), Centrelink, Medicare and more.

Step 2 – Gather your documents

You will need to have some information the ATO knows about you when you apply for your director ID:

Examples of the documents you can use to verify your identity include:

- bank account details

- an ATO notice of assessment

- super account details

- a dividend statement

- a Centrelink payment summary

- PAYG payment summary.

Step 3 – Complete your application

Once you have a myGovID with a Standard or Strong identity strength, and information to verify your identity, you can log in and apply for your director ID. The application process should take less than 5 minutes.

Apply now

Once your myGovID is setup, or if you already have a myGovID, go to the below link to start your application

https://www.abrs.gov.au/director-identification-number/apply-director-identification-number

Click Apply now with myGovID and follow the prompts.

If you have any queries regarding this process, please do not hesitate to contact us.