Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

From 1 July 2017, Simpler BAS is the default reporting method for small businesses with a GST turnover of less than $10 million. If you are a small business, you will now have less GST information required to be reported on your BAS.

The Simpler BAS will only require you to report:

- G1 Total sales

- 1A GST on sales

- 1B GST on purchases

The following GST information is no longer required:

- G2 Export sales

- G3 GST-free sales

- G10 Capital purchases

- G11 Non-capital purchases

What do you need to do?

If you are eligible, you don’t need to do anything as the ATO will automatically transition you. However, if your estimated annual GST turnover is $10 million or more, you will still be required to use the full reporting method.

- Online lodger:You don’t need to do anything to set up for Simpler BAS reporting. The ATO will automatically send you a BAS with requesting less information.

- Paper lodger:You only need to complete Total sales (G1), GST on sales (1A) and GST on purchases (1B).

If your software is cloud based, there will be an update to enable Simpler BAS. There is nothing you need to do.

So, is it really much simpler?

If you lodge your own BAS or do your own bookkeeping, then yes, you will no longer have to determine between GST on Purchases and GST Capital purchases, etc. The GST categories will be simplified. However, you will still need to determine if a purchase has a GST-free component and separate these as per the tax invoice. The difference is, you will no longer have to report the GST-free portion of your purchases and sales on the BAS lodged to the ATO. Essentially, correct GST and account allocation will still be required. You will still need to keep records, such as tax invoices, as proof of any claims you make in your BAS and income tax return lodgements. To be honest, you may not notice a lot of change as the bookkeeping in your file remains the same.

Simpler BAS does not affect how other taxes are reported (e.g. PAYG income tax instalments or PAYG tax withheld), or how often you lodge your BAS. If you report annually now, you will continue to report annually after 1 July 2017.

If you learn better by watching, following is a link to the ATO video about Simpler BAS.

https://www.ato.gov.au/Business/Business-activity-statements-(BAS)/Goods-and-services-tax-(GST)/Simpler-BAS/

Still have questions or need a hand? Let us help you, contact us on 07 5528 2000

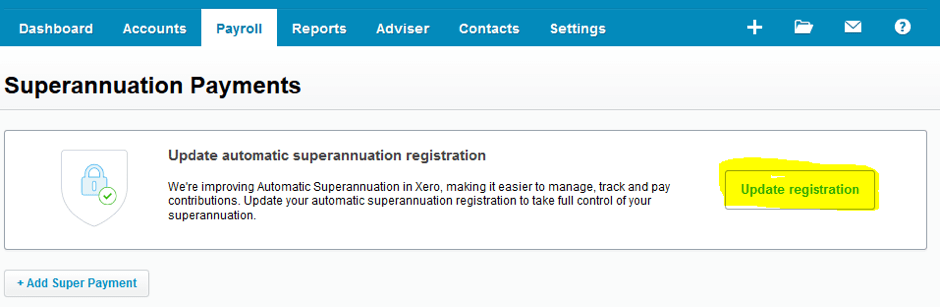

If you have been using auto super in Xero payroll prior to August 2017, you will need to update all your registration details and confirm the terms and conditions. Xero are improving the automatic superannuation function to make it easier for you to manage, track and pay your contributions. As a result, Xero is moving to a new superannuation payments clearing house. To make sure you can process super payments without any worries, you’ll need to update your superannuation registration in Xero by 28 August.

Updating your superannuation registration in Xero is simple and should take just a few minutes.

-

- Login to Xero.

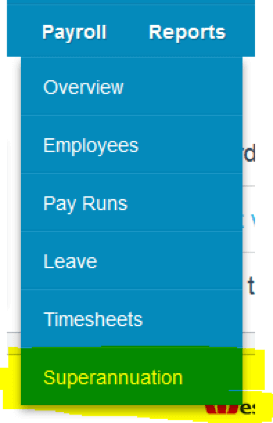

- Navigate to the Superannuation tab.

- Make sure there are no batches in pending approval or approved pending processing.

- Click on the Update Registration button and follow the prompts below:

Update your registration

- In the Payroll menu, select Superannuation.

- Click Update Registration in the banner.

- Click Get Started.

- Check your ABN and Legal/Trading Name are correct and click Next.

- You can update these details in your organisation settings.

- Select and add authoriser details as needed including their name, Phone, and Email. Then click Next.

- Select the bank account you will use to make direct debit payments for super for your employees. Then click Next.

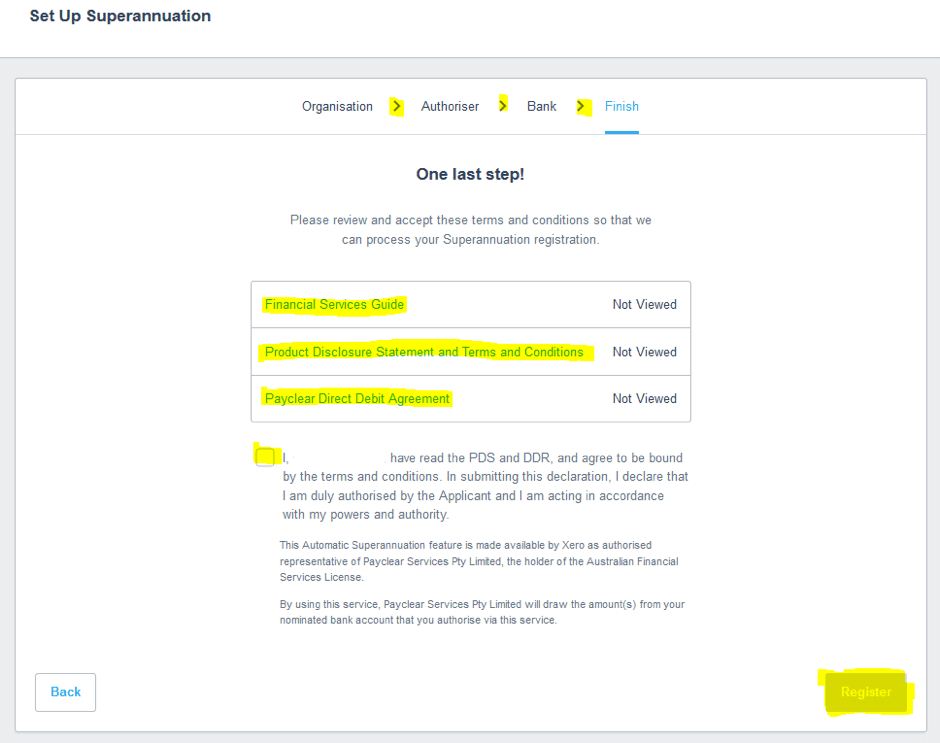

- Review the terms and conditions:

- Financial Services Guide

- Product Disclosure Statement and Terms and Conditions

- Payclear Direct Deposit Agreement

- Select the confirmation checkbox.

- Click Register.

- Once your registration has been reviewed, you will receive a notification about the outcome. This notification will also be sent to the subscriber and nominated authoriser. If your registration changeover is successful, you will be able to start making super payments using auto super straight away.

- For a demo of updating your registration, watch this video.

- If you need any assistance with this, please call our office on 07 5528 2000.

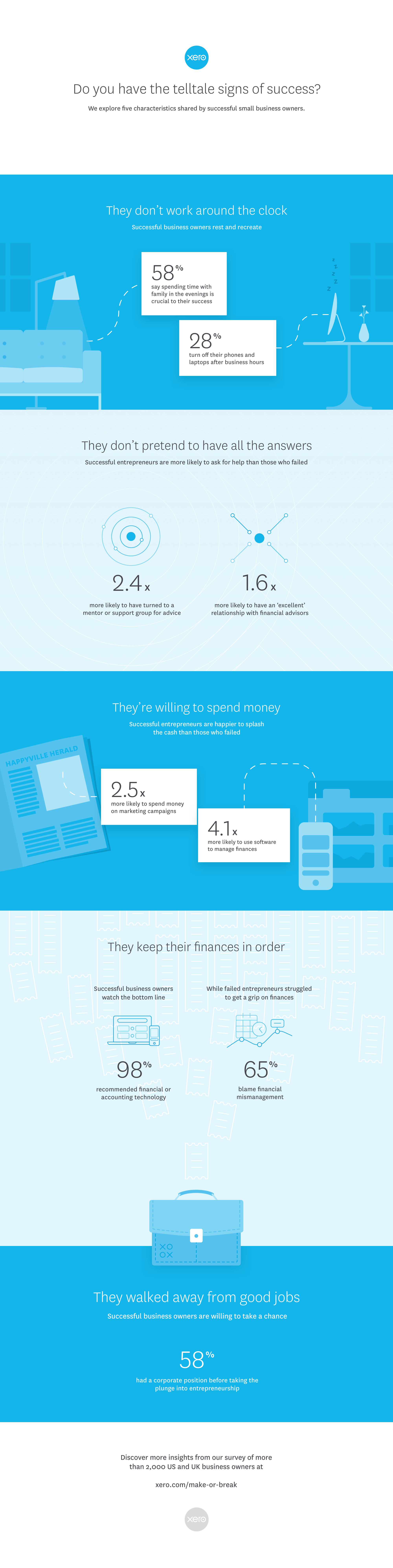

Not all business owners are created equal. They come from different geographic locations, upbringings, income brackets and social classes, as well as education levels. Regardless of your definition of success, there are a number of common characteristics that are shared by successful business owners.

Research by Xero

Xero surveyed 2,000 small business owners (current and former) from the United States and United Kingdom. Some were successful and others had failed. After analysing their answers and looking for patterns they found characteristics that defined the two groups.

Source: Xero

GST applies to services or digital products bought from overseas

From 1 July 2017, GST applies to imported services and digital products from overseas, including:

- digital products such as streaming or downloading of movies, music, apps, games and e-books; and

- services such as architectural, educational and legal.

Australian GST registered businesses will not be charged GST on their purchases from a non-resident supplier if they:

- provide their ABN to the non-resident supplier; and

- state they are registered for GST.

- However, if Australians purchase imported services and digital products only for personal use, they should not provide their ABN.

Imposition of GST on ‘low-value’ foreign supplies

Parliament has passed legislation which applies GST to goods costing $1,000 or less supplied from offshore to Australian consumers from 1 July 2018.

Using a ‘vendor collection model’, the law will require overseas suppliers and online marketplaces (such as Amazon and eBay) with an Australian GST turnover of $75,000 or more to account for GST on sales of low value goods to consumers in Australia.

The deferred start date gives industry participants additional time to make system changes to implement the measure.

Editor: It should be noted that this is a separate measure to that which applies GST to digital goods and services purchased from offshore websites, as outlined above.

The ATO is increasing attention, scrutiny and education on work-related expenses (WREs) this tax time.

Assistant Commissioner Kath Anderson said: “We have seen claims for clothing and laundry expenses increase around 20% over the last five years. While this increase isn’t a sign that all of these taxpayers are doing the wrong thing, it is giving us a reason to pay extra attention.”

Ms Anderson said common mistakes the ATO has seen include people claiming ineligible clothing, claiming for something without having spent the money, and not being able to explain the basis for how the claim was calculated.

“I heard a story recently about a taxpayer purchasing everyday clothes who was told by the sales assistant that they could claim a deduction for the clothing if they also wore them to work,” Ms Anderson said.

“This is not the case. You can’t claim a deduction for everyday clothing you bought to wear to work, even if your employer tells you to wear a certain colour or you have a dress code.”

Ms Anderson said it is a myth that taxpayers can claim a standard deduction of $150 without spending money on appropriate clothing or laundry. While record keeping requirements for laundry expenses are “relaxed” for claims up to this threshold, taxpayers do need to be able to show how they calculated their deduction.

The main message from the ATO was for taxpayers to remember to:

- Declare all income;

- Do not claim a deduction unless the money has actually been spent;

- Do not claim a deduction for private expenses; and

- Make sure that the appropriate records are kept to prove any claims.

Capital gains withholding, a new threshold

From 1 July 2017, where a foreign resident disposes of Australian real property with a market value of $750,000 or above, the purchaser will be required to withhold 12.5% of the purchase price and pay it to the ATO unless the seller provides a variation (this is referred to as ‘foreign resident capital gains withholding’).

However, Australian resident vendors who dispose of Australian real property with a market value of $750,000 or above will need to apply for a clearance certificate from the ATO to ensure amounts are not withheld from their sale proceeds.

Therefore, all transactions involving real property with a market value of $750,000 or above will need the vendor and purchaser to consider if a clearance certificate is required.

The following is from the ATO’s website:

- Australian resident vendors can avoid the 12.5% withholding by providing one of the following to the purchaser prior to settlement:

- for Australian real property, a clearance certificate obtained from the ATO

- for other asset types, a vendor declaration they are not a foreign resident.

- Foreign resident vendors may apply for a variation of the withholding rate or make a declaration that a membership interest is not an indirect Australian real property interest and therefore not subject to withholding.

- Purchasers must pay the amount withheld at settlement to the Commissioner of Taxation.

Up until 30 June 2017, an individual (mainly those who are self-employed) could claim a deduction for personal super contributions where they meet certain conditions. One of these conditions is that less than 10% of their income is from salary and wages. This was known as the “10% test”.

From 1 July 2017, the 10% test has been removed. This means most people under 75 years old will be able to claim a tax deduction for personal super contributions (including those aged 65 to 74 who meet the work test).

Editor: Call our office if you need assistance in relation to the application of the work test for a client that is aged 65 to 74.

Eligibility rules

An individual can claim a deduction for personal super contributions made on or after 1 July 2017 if:

- A contribution is made to a complying super fund or a retirement savings account that is not a Commonwealth public sector superannuation scheme in which an individual has a defined benefit interest or a Constitutionally Protected Fund;

- The age restrictions are met;

- The fund member notifies their fund in writing of the amount they intend to claim as a deduction; and

- The fund acknowledges the notice of intent to claim a deduction in writing.

Concessional contributions cap

Broadly speaking, contributions to super that are deductible to an employer or an individual, count towards an individual’s ‘concessional contributions cap’.

The contributions claimed by an individual as a deduction will count towards their concessional contributions cap, which for the year commencing 1 July 2017 is $25,000, regardless of age. If an individual’s cap is exceeded, they will have to pay extra tax.

Call our office to discuss the eligibility criteria and tax consequences of claiming a tax deduction for a personal contribution to super for the year commencing 1 July 2017.

The wide-ranging superannuation reforms come into effect on 1 July 2017. With the changes come a series of issues that Trustees need to be across, even if they don’t immediately affect you or your fund:

Understand the value of assets at 30 June

At 30 June 2017, SMSF Trustees will need to know the total superannuation balance held by members. If you have assets such as real estate in your SMSF, and to an extent other assets such as collectables and artwork, you will need to have a current valuation of those assets. Real estate property values, in particular, may have varied dramatically over the last few years and should be reviewed. The value of the asset needs to be arrived at using a fair and reasonable process. Because of the extent of the changes, it is worth considering the use of an independent and qualified valuer for some assets.

Understanding ‘Total Value’ of your balance

Your total superannuation balance is the total value of your accumulation and retirement phase interests and any rollover amounts not included in those interests. The balance is valued at 30 June each year and it is this value that may determine what you can and can’t do during the following year. For example, if your total super balance is $1.6m or more at 30 June, you are restricted from making further non-concessional contributions in the next year as these contributions may create an excess contribution. And, if your balance is close to the $1.6m cap, then the fund can only accept limited non-concessional contributions.

Self-funded retirees – avoiding adverse tax outcomes

If you are receiving a pension or annuity, a $1.6m “transfer balance cap” applies to amounts in your tax-free pension accounts. The cap is essentially a limit on how much money a member can transfer into or hold in a tax-free account. If you have $1.6m or more in a pension phase account, you will need to reduce the pension value level back below the cap before 30 June 2017. If the excess amount is not removed from the pension phase account the amount will be subject to a transfer balance tax.

If you opt to sell fund assets to manage the cap, transitional capital gains tax relief may be available to manage any adverse tax outcomes.

How do you value SMSF assets?

One of the emerging problems for many superannuation fund members is understanding whether they are close to or are likely to exceed the $1.6m cap at 30 June 2017. For those with assets such as real estate, collectables or art, a current valuation that meets the ATO’s guidelines will be essential. Real estate, in particular, has substantially risen in value in some areas creating uncertainty about the real value.

Fund assets need to be valued at market value. While these assets do not have to be valued every year by an independent valuer, it will be important to have documentation validating the value assigned to the asset. A qualified and independent valuer is recommended if the asset is a significant part of the value of the fund – if the asset is real property, this could be as simple as an online real estate agent.

Should you update your SMSF trust deed?

Over the years, there have been continuous changes in superannuation legislation. While many of these changes do not require you to update your SMSF deed, where a deed has not been updated in at least the last 5 years, we suggest that the deed is updated to ensure it is compatible with current law.

If we have not already contacted you about your fund’s deed, we will be in contact shortly to discuss if an update is required.

As always, before buying, selling, transferring assets, or making any payments, make sure your trust deed allows you to complete the transactions in the way you intended.

Salary sacrificing concessional super contributions

If you have entered into a salary sacrifice agreement to make concessional super contributions, you will need to review these agreements to ensure your concessional contributions do not exceed the new $25,000 from 1 July 2017.

Anyone with investment property in Australia is probably feeling a little edgy with all the recent media attention on deductions, affordable housing, and negative gearing. We take a look at some of the key tax issues for investors pre and post 30 June:

No more deductions for travelling to and from your investment property

The days of writing-off the costs of travel to and from your residential investment property are about to end. From 1 July 2017, the Government intends to abolish deductions for travel expenses related to inspecting, maintaining, or collecting rent for a residential rental property.

Depreciation changes and how to maximise your deductions now

Investors who purchase residential rental property from Budget night (9 May 2017, 7:30pm) may not be able to claim the same tax deductions as investors who purchased property prior to this date. In the recent Federal Budget, the Government announced its intention to limit the depreciation deductions available.

Investors who directly purchase plant and equipment – such as ovens, air conditioning units, swimming pools, carpets etc., – for their residential investment property after 9 May 2017 will be able to claim depreciation deductions over the effective life of the asset. However, subsequent owners of a property will be unable to claim deductions for plant and equipment purchased by a previous owner of that property. If you are not the original purchaser of the item, you will not be able to use the depreciation rules to your advantage. This is very different to how the rules work now with successive owners being able to claim depreciation deductions.

Investors will still be able to claim capital works deductions including any additional capital works carried out by a previous owner. This is based on the original cost of the construction work rather than what a subsequent owner paid to purchase the property.

There are very limited details about how this Budget announcement will work but we will bring you more as soon as we know.

Business as usual for pre 9 May investment property owners

If you bought an investment property recently, are about to renovate, or have not had a depreciation schedule completed previously, you should consider having one completed.

As a property gets older the building and items within it wear out. Property owners of income producing buildings are able to claim a deduction for this wear and tear. Depreciation schedules are completed by quantity surveyors and itemise the depreciation deductions you can claim.

Higher immediate deductions for co-owners

It’s not uncommon to have multiple owners of an investment property. Co-ownership can, in some circumstances, quicken the rate depreciation deductions can be claimed for the same asset. This is because depreciation is claimed on each owner’s interest. If an owner’s interest in an asset is less than $300, they can claim an immediate deduction. In a situation where there are two owners split 50:50, both owners could potentially claim the immediate deduction, bringing the total immediate deduction available up to $600 for a single asset.

The same method can be used when applying low-value pooling. Where an owner’s interest in an asset is less than $1,000, these items will qualify to be placed in a low-value pool. This means they can be claimed at an increased rate of 18.75% in the first year regardless of the number of days owned and 37.5% from the second year onwards.

In a situation where ownership is split 50:50, by calculating an owner’s interest in each asset first, the owners will qualify to pool assets which cost less than $2,000 in total to the low-value pool.

The value of renovations

It’s best to get a depreciation schedule completed before you start renovations so the scrap value of any items you remove can be recognised and written-off as a 100% tax deduction in the year of removal. This is available for both plant and equipment depreciation and capital works deductions. When new work is completed as part of the renovations (i.e., a new roof, walls, or ceiling), this can also be depreciated going forward.

In some circumstances, there may be depreciation deductions available for renovations completed by a previous owner.

Deductions for older properties

Investors in older properties may still be able to claim depreciation costs. This is because a lot of the items in the house will not be the same age as the house or apartment. Hot water systems, ovens, carpets, curtains etc., have probably all been replaced over time. Additional works, extensions or internal refurbishments may also be deductible.

Further restrictions on foreign property investors

We have seen a number of measures over the years restricting access to tax concessions for foreign investors, particularly for residential property investments. The recent Federal Budget goes one step further, restricting access to tax concessions, increasing taxes, and penalising investors who leave property vacant.

Measures include:

Charge for leaving properties vacant

Foreign owners of residential Australian property will incur a charge if their property is not occupied or genuinely available on the rental market for at least 6 months each year. The charge, which is expected to be at least $5,000, does not appear to apply to existing investments but those made on or after Budget night, 7:30pm on 9 May 2017.

Excluded from main residence exemption

Foreign and temporary residents will be excluded from the main residence exemption. The main residence exemption excludes private homes from capital gains tax (CGT). Existing properties held prior to 9 May will be grandfathered until 30 June 2019. However, it remains to be seen whether partial relief will be available to those who have been residents of Australia for part of the period they owned the property and whether this change will apply to Australian residents who were classified as a foreign resident for part of the ownership period.

Increase in CGT withholding tax

When someone buys Australian real property (i.e., land and buildings) they are currently required to remit 10% of the purchase price directly to the ATO as part of the settlement process unless the vendor provides a certificate from the ATO indicating that they are an Australian resident. These rules do not currently apply if the property is worth less than $2 million. From 1 July 2017, the CGT withholding rate under these rules will increase by 2.5% to 12.5%. Also, the CGT withholding threshold for foreign tax residents will reduce from $2 million to $750,000, capturing a much wider pool of taxpayers and property transactions.

Rules tighten for property purchased through companies or trusts

Australian property held through companies or trusts by non-residents or temporary residents is also being targeted by expanding the principal assets test to include associates. The move is to prevent foreign residents avoiding Australian CGT liability by splitting indirect interests in Australian real property.

Level of foreign investment in developments capped

A 50% cap is being placed on foreign ownership in new developments.

The push for affordable housing

The Government is very keen to ensure that investment is directed into ‘affordable housing.’

The 2017-18 Budget announced an increase in the CGT discount for individuals who choose to invest in affordable housing. The current 50% discount will increase by 10% to 60% for Australian resident individuals who elect to invest in qualifying affordable housing.

In addition, the Government is creating investment opportunities for Managed Investment Trusts (MIT) to set up to acquire, construct or redevelop property to hold as affordable housing. In order for investors to receive concessional taxation treatment through an MIT, the affordable housing must be available for rent for at least 10 years. For foreign investors, MITs are one area where the Government is actively encouraging participation rather than restricting it.

Tax time is almost upon us so it’s time to get prepared. Here’s your tax planning guide including an update of what’s changing this year, to help you get EOFY ready.

Update: Tax Planning 2020 Guide – Individual Tax Deductions

In this guide:

- Income tax changes for 2016/17

- General year end tax planning strategies

- Income tax changes – small businesses

- Income tax changes – individuals

- Superannuation – relevant thresholds

Income Tax Changes for 2016/17

Several tax changes apply in the 2016/17 income year. A brief summary is provided in this guide.

There may be some advantages in acting on some of these items before 30 June 2017.

If you think any of these changes may affect you, please contact us for more details.

General Year End Tax Planning Strategies

Here are a few strategies to consider before finalising your tax this year.

Definition of small business

The definition of a Small Business (SBE) has changed from having $2 million in turnover to $10 million in turnover. Many more businesses will now have access to the SBE tax concessions.

Business income and expenses

Subject to cash flow requirements, consider deferring income until after 30 June, especially if you expect lower income for 2017/18 compared to 2016/17.

Most businesses are taxed on income when it is invoiced. Some small businesses may be taxed only when income is received. Income from construction contracts is generally taxed when progress payments are invoiced or received.

Ensure that you have complied with the requirements to claim deductions in 2016/17:

- Bad debts must be written off in your accounts before 30 June

- Employer and/or self-employed superannuation contributions must be paid to, and received by, the super fund before 30 June and must be within the contributions cap ($35,000 for individuals aged 49 or over on 30 June 2017, otherwise $30,000)

- Depreciation can be claimed for assets first used, or installed ready for use, before 30 June

- Small businesses (turnover less than $10 million) can claim expenses prepaid up to 12 months in advance – for larger businesses, this is generally limited to expenses below $1,000

- Wages paid to your spouse or family members must be reasonable for the work performed.

Small businesses planning major purchases or replacements of capital equipment should contact us for advice. Careful timing of those transactions can result in substantial tax savings.

Review valuations of trading stock in the lead up to 30 June. Best practice is generally to value stock at the lower cost or market selling value. This may change if you expect a tax loss for 2016/17, or substantially higher income in 2017/18 compared to 2016/17.

Personal income, deductions and tax offsets

Subject to cash flow requirements, set term deposits to mature after 1 July, rather than before 30 June.

Consider realising capital losses if you have already realised capital gains on other assets during 2016/17. Conversely, consider realising capital gains if you have unrecouped capital losses, especially if you expect substantially higher income in 2017/18 compared to 2016/17.

If you expect lower income in 2017/18 due to retirement or any other reason, consider deferring income until after 1 July, when you will be in a lower tax bracket. If you are a primary producer and you expect a permanent reduction in income, consider withdrawing from the income averaging system.

Access to the Net Medical Expenses Tax Offset is restricted to medical expenses relating to disability aids, attendant care or aged care.

Arrange for deductible donations to be grouped in the higher income year, if you expect substantially higher or lower income in 2017/18 compared to 2016/17. Make all donations in the name of the higher income earner.

If you plan to purchase income-producing assets, consider acquiring assets that will generate positive cash flow in the name of the lower income earner. Conversely, consider acquiring negatively geared assets in the name of the higher income earner.

Residency changes

Contact us for advice if you have moved to or from Australia for an extended period. You may need to review your residency status for tax purposes. There are important tax consequences if you change residency.

Trusts

Trustees of trusts should ensure that all necessary documentation is completed before 30 June, where you intend to stream capital gains or franked distributions to specific beneficiaries.

Family discretionary trusts may need to make a family trust election if the trust has unrecouped losses, or has beneficiaries whose total franking credits for the year may exceed $5,000.

Tax shelter schemes

Be sceptical of year-end tax shelter schemes. You should not enter a scheme without advice regarding both its tax consequences and commercial viability.

Income Tax Changes – Small Business

Tax rate

The tax rate for small business entity (SBE) companies is 27.5% from 1 July 2016.

Individual small business taxpayers are entitled to 5% discount of the income tax payable on the business income received from a small business entity (other than a company), up to a maximum of $1,000 a year.

Accelerated Depreciation

An immediate deduction is available for an asset costing less than $20,000 acquired on or after 12 May 2016 and first used or installed ready for use between 12 May 2016 and 30 June 2017.

The balance of the general small business pool is also immediately deducted if the balance is less than $20,000 at 30 June.

Blackhole Expenditure

From 1 July 2016, start-up companies, trusts or partnerships can immediately deduct a range of professional expenses associated with starting a new business (e.g. professional, legal and accounting advice). This only applies to SBE’s.

Income Tax Changes – Individuals

Car expenses

From the 2015/16 tax year, the 1/3 of actual expenses and the 12% of original value method for claiming work related car expenses can no longer be used.

A single flat rate of 66 cents per kilometre is to be used for the cents per km method. Alternatively, a log book must be maintained for a 12 week period to determine the business percentage of all running costs.

Zone tax offset

From the 2015/16 tax year, the zone tax offset excludes ‘fly-in fly-out’ and ‘drive-in drive-out’ workers where their normal residence is not within a ‘zone’.

Superannuation – relevant thresholds

Super co-contribution

Super co-contribution helps eligible people boost their retirement savings.

If you’re a low or middle-income earner and make personal (after-tax) contributions to your super fund, the government also makes a contribution (called a co-contribution) up to a maximum amount of $500.

The full co-contribution rate applies for income up to $36,021 and the partial co-contribution applies for income up to $51,021 for the 2016/17 tax year.

Concessional Contributions

The concessional contribution caps for the 2016/2017 tax year are:

- $30,000 for people aged up to 48 years or under as at 30 June 2016;

- $35,000 for people aged 49 years and over.

These represent the limit on the amount of contributions you can make within the year, and include the Super Guarantee payments made on your behalf by your employer.

Should you wish to discuss your superannuation needs, please contact the team at Superfund Partners.

For help with any of the above information in our guide above, reach out and we’ll happily talk you through it step-by-step