Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Last night the Treasurer, Josh Frydenberg, handed down the Federal Budget 2019-20. Whilst some would suggest that this a typical pre-election budget, there are some significant benefits for the majority of our clients.

Forecast Surplus

The most significant announcement was that the budget is “back in the black” with a forecast surplus in the 2019/20 year of $7.1b. This is significant as it has been a long time coming and amounts to a significant interest bill reduction to be able to fund essential services, infrastructure projects and help expand the overall economy to the benefit of all.

Other significant changes in the Federal Budget

Other significant changes that will impact people, are lower tax rates, an increase in the Medicare low income threshold, and the expansion of the instant asset write off for most businesses. All of which should have a positive impact on a slowing economy and allow Australia to maintain a competitive tax position in a Global economy where countries are increasingly competing for our most talented individuals and businesses.

Professionals Tax Cuts

Australians are able to earn more and keep more of what they earn, and even professionals on higher incomes can make the most of this.

The highest tax band has been expanded to incomes over $200,000, up from those over $180,000. This means that all taxpayers on salaries between $45,0001 and $200,000 would be taxed at the lower rate of 30 per cent.

Good news for Businesses and Business Owners

The good news for businesses is that more will be eligible for an instant asset write-off on purchases valued at up to $30,000, which will also see substantial tax cuts introduced.

- Originally introduced as a temporary measure for purchases under $25,000 in value, then increased to $25,000, it has now been increased again to $30,000

- These eligibility requirements have been updated to businesses with an annual turnover of up to $50 million which enables 220,000 in addition to access the write-off

- The government also noted that it has “legislated to bring forward the increases to the unincorporated small business tax discount rate, rising from 8 per cent currently to 13 per cent in 2020–21 and to 16 per cent from 2021–22 (up to the existing cap of $1,000)

- The government said it would direct $525 million to ‘upgrade and modernise’ Vocational Education and Training (VET)

- Further resource was allocated to establishing Training Hubs to facilitate better connections between employers and school students, targeting skills shortage

Additional business incentives

In addition to the asset write-off for businesses, other incentives that are of benefit to your business include:

- The roll out of e-invoicing with the aim of reducing transaction costs by $28 billion over the next decade

- Reducing the number of BAS GST questions by education to streamline GST reporting for small businesses

- $60 million in funding for export development grants

- Reaffirmed commitment to the establishment of a $2 billion Australian Business Securitisation Fund which will focus on enhancing small businesses’ access to finance

Superannuation

Unlike many previous budgets there were fortunately not many changes to superannuation. I say fortunately as on most previous occasions there has usually been a sting in the tail. However, this time there appears to be only positive news for those 65 or 66 years of age who will no longer have to meet a work test to be able to contribute to super. Also, the spouse contribution rules will be extended to those between ages 70 to 74.

Positive news for South East Queensland

Finally, for those of us who live in the SE corner there was some very positive news on the infrastructure front. Additional funding for the M1 corridor, light rail expansion on the Gold Coast and fast rail business case for Brisbane to Gold and Sunshine Coasts.

Keep up to date

It will be interesting to see how Labour responds in coming days as it is going to be difficult to explain away the negative effects of their proposed franking credit changes, capital gains tax and negative gearing proposed changes. With an election just around the corner we will update you in coming months on how and when these changes will likely impact you should there be a change in government which the poles are currently predicting.

Quill is a team of financial specialists, working with professionals and entrepreneurs to take their financial and business growth to the next level. Get in touch with the Quill team today.

We know that most employers want to do the right thing. To help you meet your obligations, we have put together this list of areas to watch out for when calculating payroll tax.

Taxable wages

Make sure you include and correctly declare your taxable wages, including:

• allowances

• remuneration

• bonuses

• salary

• commissions

• superannuation

• contractor payments

• wages (cash and non-cash)

• fringe benefits

Superannuation contributions

All superannuation contributions are taxable, including payments to non-employee directors. Make sure you include any superannuation payments paid outside your payroll system (e.g. top-up payments to a director’s superannuation fund).

Directors remuneration

Directors remuneration is taxable and may include payments to a director’s trust or incorporated entity.

Fringe benefits

Fringe benefits are taxable, calculated on the Type 1 and Type 2 aggregate amounts grossed up by the Type 2 gross-up factor.

Fringe benefits that have a nil taxable value under the Fringe Benefits Tax Assessment Act 1986 will also have a nil taxable value for payroll tax purposes.

Read the public ruling on fringe benefits {PTA003} for more information on this topic and how to apportion the Queensland component of your fringe benefits.

Contractor payments

Any payments you make to contractors, subcontractors and consultants are taxable unless they meet one of the 9 contractor exemptions. You should also consider if your contractor is a common law employee.

Use our contractor provisions interactive help to determine if your contractor payments are taxable.

Apprentices and trainees

Payments to apprentices employed under the Further Education and Training Act 2014 (FET Act) are exempt.

Payments to trainees registered under the FET Act are exempt; unless before commencing the traineeship, the trainees worked for you for 3 months or more full time or for 12 months or more part time or casually.

The exemption applies for any certificate registered under the FET Act, including certificate IV. Other rules apply for certificates II and III.

You may also be entitled to a payroll tax rebate.

Group relationships

Related businesses are treated as a group for payroll tax purposes. One business, the designated group employer (DGE), claims any deduction entitlement on behalf of the whole group. The deduction is based on the total Australian wages of all group members. All other group members pay 4.75% of all taxable wages. The DGE and all group members must lodge separate returns.

Interstate employees

Use our taxable wages interactive help to determine if you should declare your wages in Queensland or another state or territory.

See also the public ruling on payroll tax nexus provisions {PTA049}.

Allowances

Accommodation and motor vehicle allowances have an exempt rate. If an allowance paid to an employee exceeds the exempt rate, the excess amount is taxable.

To claim a motor vehicle allowance exemption, records must be kept to prove business kilometres.

Talk to Quill Group Today

Get in touch with us today to find out how we can assist you in navigating your payroll taxation for your business. We’re a team of over 60 specialists, here and ready to help you with your specific business needs.

The responsibilities associated with successfully running a business have never been more extensive or stringent than today. One area which is often put to the ‘back of the pack’ for most is their Business Activity Statement (BAS) and Taxation obligations. However, the ATO do not subscribe to this notion and have prioritised increasing their effectiveness at regulating these lodgements. They have frequently enhanced their penalty system under the Crimes Amendment (Penalty Unit) Bill and from December 2012 these units have increased astronomically by 91%. Therefore, it is more important than ever to make sure you have all your BAS reporting and Tax affairs in order. However, if you have submitted a late BAS statement, here’s what to do.

ATO DUE DATES

Income Tax Returns

Tax return for all individuals and trusts where one or more prior year tax returns were outstanding as at 30 June 2019. Tax return for clients prosecuted for non-lodgment of prior year tax returns and advised of a lodgment due date of 31 October 2019.

Click here to see further information about individuals and trust return due dates in 2019 and 2020.

Business Activity Statements (BAS’s)

Click here for our latest information regarding Business Activity Statements.

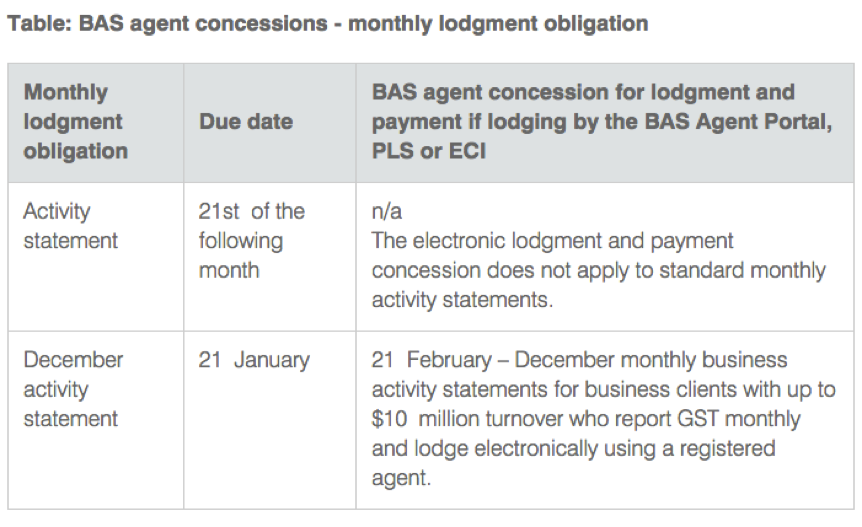

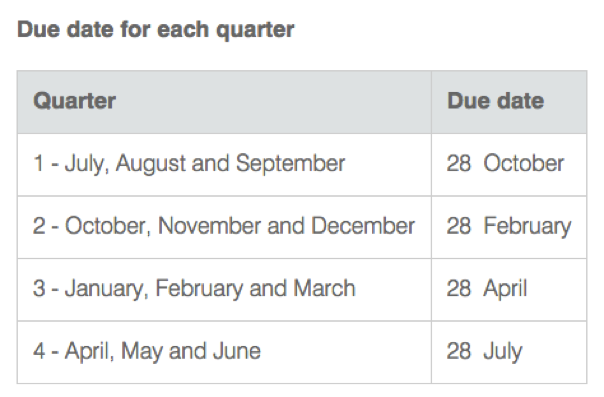

Quarterly BAS’s are due for lodgement the 28th day following the respective BAS period (e.g. March 2018 Quarter BAS’s are due 28 April 2018). However, if lodged through a BAS agent you will be granted an extended due date of the 25th day two months following the respective BAS period (e.g. March 2018 Quarter BAS’s are due 26 May 2018). Businesses lodging Monthly BAS’s have a due date of 21st day following the BAS period and do not receive the extended due date concessions afforded to Quarterly lodgers. If you are currently lodging BAS’s on a monthly-basis and wish to change to quarterly reporting for the convenience and extended lodgement periods, you must have sales turnover less than 20 million and contact the ATO to make the switch as long as they haven’t previously determined you must lodge monthly for other reasons.

PENALTIES AND GENERAL INTEREST CHARGES

If any of the above mentioned due dates are breached, you may be subject to the ATO’s penalty system for which they issue Penalty Units (currently $210 per unit) depending on the infraction and period outstanding. ‘Failure to lodge’ penalties are calculated based on the size of the entity and each 28-day period the tax return or BAS statement is overdue. ‘Small Entities’ which have a turnover of less than 1 million are issued one penalty unit per period overdue which is capped at a maximum of five penalty units being $1,050. ‘Medium Entities’ which have a turnover of 1 million and below $20 million or have PAYG withheld amounts totalling between $25,001 and 1 million in a previous year (medium withholders) are issued two penalty units per periods overdue. ‘Large Entities’ with a turnover of 20 million and above or PAYG withheld amounts totalling 1 million in a previous year (large withholders) are issued five penalty units per periods overdue. In addition to this the ATO applies a general interest charge (GIC) for any unpaid tax liability or BAS statements from the date it was due to be paid until which time the amount in question is settled (including the associated penalties and interest charges).

YOU’RE LATE – WHAT TO DO NOW?

The ATO generally does not apply penalties in isolated cases of late lodgement where an entity has maintained a good lodgement history. Also, if you were subject to extenuating circumstances impacting your ability to lodge (i.e. natural disaster or serious illness) you can apply to have the penalty and interest charges remitted. If neither of the above applies then you will need to lodge and pay your Income Tax Return or BAS Statement (including any penalty and interest) as quickly as possible. If you are unable to make immediate payment then it is in your best interests to enter into a payment arrangement with the ATO which can avoid or reduce your penalty consequences, however general interest charges will still be applied.

If you’d like to make an appointment to speak to one of our accountants, get in touch.

Have you ever run into a speed bump when tackling a tough task that at first seems impossible to solve but after dropping and revisiting it with ‘fresh eyes’, realise the answer is simple and right in front of you? Fundamentally this is what an Advisory Board can offer in the modern-day business world, a ‘fresh-eyed approach’ to your business operations. A well-structured advisory board can not only bring a much needed outside perspective, but also critical advice and networking opportunities to complement your existing skills and assist in achieving business goals.

What is an advisory board?

An advisory board is essentially a group of people carefully selected by an entrepreneur with the sole intent of providing non-binding strategic advice and support to the businesses’ many stakeholders (owners, shareholders or directors etc). When compared to the traditional ‘Board of Directors’ arrangement, it provides entrepreneurs with a safe haven to express their thoughts as it is structured to be informal and flexible. While they may not make decisions for the business, they are still legally required to fulfil their obligations with care and due diligence.

What services can an advisory board provide?

Every business’s journey is unique, this means their expectations in respect to an advisory board must be handled differently and be specifically tailored to the business needs. A few general examples of where an advisory board can assist a business include:

- Requiring additional funds to be raised

- Where rapid growth has occurred

- Wanting to access a larger network or establish strategic partnerships

- Major changes in mission statement, core values or strategic direction

- Smoothing the transition between different business cycles

- Manoeuvring through complex succession issues

- Enhancing market reputation and creditability

- Implementing a better business culture

- Generating new business ideas or identification of overlooked issues

What is the selection process of an advisory board?

The selection process of your advisory board must be handled with great care. A business should evaluate itself honestly and identify what areas of the business are strengths and weaknesses and determine how best utilisation of external support can supplement or complement existing skills. Common areas for business skill gaps include strategy, legal, taxation, finance, technology, marketing and human resources. Advisory board members are usually compensated with a daily fee for each meeting, however if more is required than these occasional meetings a periodic retainer can be negotiated. In high profile arrangements company equity is also another option, usually being 0.25% (but can vary 0.10% to 2%) depending on the value of the advisor, time commitment to the role and length of the contract.

In today’s global economy and rapid progressing technology front, advisory boards are being mass adopted for their unparalleled flexibility and wide-spread application to all business’s regardless of size, industry or lifecycle stage.

How can we help?

Quill is the largest multi-disciplined financial services practice on the Gold Coast, with an extension office in Brisbane. We provide a high touch personalised service delivered with competence, confidence and amazing results.

At Quill we are passionate advocates for our clients, and our team focus is always to provide an amazing experience, not just great service.

To ensure your business is receiving the service it requires, talk to Quill today to find out what we can do for you. Get in touch with us here.

“We now hold our Board meetings at their office and they have become an integral part of those meetings. All reports for the Board are prepared and distributed in a timely manner. We have no hesitation in recommending the Quill Group to anyone looking for professional accounting services at a fair and reasonable rate.”

– Ian Overett

The Government introduced Treasury Laws Amendment (2018 Measures No. 4) Bill 2018 into Parliament on 28 March 2018 which affects employer superannuation contributions. This Bill introduces very serious consequences for employers who break the law by short changing their employees. The ATO will have access to new enforcement and collection provisions, including strengthened arrangements for director penalty notices. Some of the proposed amendments are to:

- enable the Commissioner of Taxation to issue directions to employers to pay unpaid superannuation guarantee

- undertake superannuation guarantee education courses

- to disclose more information about superannuation guarantee non-compliance to affected employees;

- extend Single Touch Payroll reporting to all employers;

- require more regular reporting by superannuation funds

- strengthen the commissioner’s ability to collect superannuation guarantee charge and pay as you go withholding liabilities

As an employer, specifically as a Director of a company where employer superannuation contributions and obligations have not been met, you may find yourself personally liable for unpaid superannuation. This is because Director penalties can apply to Directors of companies where the company does not meet its Superannuation Guarantee Charge (SGC) obligations.

Proposed Superannuation Guarantee Amnesty

The Government introduced Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018. The Bill makes numerous amendments to superannuation and related tax laws, including to encourage the recovery of unpaid Superannuation Guarantee (SG) by introducing a temporary amnesty from late payment penalties for employers who disclose that they have underpaid SG in the past.

It is estimated that in 2014-15, around 2.85 billion in SG payments went unpaid. Of particular concern is that this estimate only relates to one income year!

The Bill complements measures proposed in Treasury Laws Amendment (2018 Measures No. 4) Bill 2018 into Parliament on 28 March that seeks to strengthen the penalty regime for SG non-compliance.

The Amnesty is proposed to last for 12 months, commencing on Thursday 24 May 2018 and ending on Thursday 23 May 2019.

The Amnesty applies only to disclosures of previously undeclared SG shortfall amounts that are made during the 12-month amnesty period and the disclosures relate to the quarters starting when the SG regime commenced and all subsequent quarters until and including the quarter starting on 1 January 2018 — that is, the period from 1 July 1992 to 31 March 2018. This is an astonishing 26 years.

The benefits of the Amnesty will not be available for SG non-compliance that occurs on or after 1 April 2018.

When is an employer eligible for the Amnesty?

To be eligible for the Amnesty, an employer must:

- voluntarily disclose SG shortfall amounts, relating to any period from 1 July 1992 to 31 March 2018, within the Amnesty period (24 May 2018 to 23 May 2019);

- disclose SG shortfall amounts that have not previously been disclosed;

- make the payment of the SG shortfall amount during the 12-month Amnesty period; and

- not have been previously informed that the ATO is examining (or that it intends to examine) the employer’s SG compliance for the relevant quarter.

An employer may still qualify for the Amnesty if it has previously made disclosures about an SG shortfall for a quarter but comes forward with information about additional amounts of SG shortfall for that quarter.

The benefits for employers who take part in the amnesty are:

- Administration component for SG shortfalls will be waived (currently $20 per SG statement lodged)

- the Part 7 penalty for failing to lodge an SG statement, equal to double the amount of the SGC, i.e. 200 per cent of the SGC payable will not apply

- Catch-up SG payments made between 24 May 2018 and 23 May 2019 will be tax deductible (generally, late payments of SG are not deductible for tax purposes)

The measures are aimed to incentivise employers to get up to date with their obligations and assist the Government in tackling the SG gap problem.

We are your business accounting specialists.

Get in touch with us or give our office a call on 07 5528 2000 to discuss registration in more detail. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast, we provide a high touch personalised service delivered with competence, confidence and amazing results.