Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

We have all heard the saying “Cash is King”. This phrase is often used to describe the amount of notes and coins that we carry in our wallets. However, how does this phrase now sit in our world with the increasing reliance on new payment technologies such as “Tap & Go” and “Apple Pay” to make cashless payments?

In recent times, we have seen the growth and success of a number of business models that only deal in “cashless” payment systems. A great example of how successful a business can be using the “cashless” business model is evidenced by the success of “Uber”. In 2016 Uber generated revenue of 6.5 billion (USD). Who would have thought that hiring an on-demand driver could be done at the press of a button on a smart phone device?

How has the importance of cash declined with the push towards a cashless society and how far away is Australia from being a truly “cashless” economy?

Australian consumers appear to be embracing the move towards a cashless society. The use of smart phones and tablets to enable transactions has resulted in around 82% of Australian payments being made using non-cash dollars. It is estimated that more than three out of four face-to-face transactions are tap-and-go.

This year the Reserve Bank plans to launch technology to facilitate the move towards enabling more cashless transactions. The New Platform System (NPP) will allow money to be transferred almost instantaneously, even when the payer and payee are with different banks.

The whole process of paying for services will become simpler and the transactions will be based on an email address or phone number.

The debate continues about Australia’s end date towards achieving the end goal of being cashless. Some commentators have touted that we may see a cashless society sometime after 2020.

What lessons can be learned from this?

Although “Uber” is often used to promote the success of the cashless business model it is interesting to note that they have not always strictly adhered to their cashless business model. One example of Uber deviating from their cashless business model is in India, where Uber introduced a country-specific initiative to accept cash. This initiative was driven partly by India’s banking regulations but also by understanding the cash economy in that country. Across all of India the cash method is the preferred method of payment by users and drivers. Uber’s understanding of the economic landscape in India lead them to adjusting their cashless business model.

How does this apply to you?

All businesses need to be flexible nowadays. It is important to look at the impact of how a cashless economy would impact on profitability and ultimately survivability.

- Does your business have the technology to handle cashless payments?

- Cash is still an important draw card for consumers around the world – How is your business placed to handle this?

- Most customers appear to adapt to cashless payment platforms but it’s important to educate them about the cashless platforms available within your business.

Main Benefits for Small businesses:

- Time saving in not having to handle cash and making physical deposits at banks; and

- The reduced risk of not having to keep cash on business premises.

How does this apply to your customers?

- The key benefits for consumers is the pure convenience of using these new payment platforms;

- No credit card fees for using a credit card to make purchases; and

- The main concerns for consumers is centred around privacy and fraud risk. Transaction history can be tracked in a cashless payments system.

How will this benefit the Australian Government?

The major advantage for governments operating in a cashless economy is the significantly reduced risk of tax evasion.

Only time will tell how successful the push towards a cashless economy will be in Australia. Will the concept of carrying cash be a dim memory of the past?

Sometimes you need to take the risk.

Recently, I had the opportunity to head to New Zealand for a holiday. It was definitely a holiday full of high adrenaline adventures. The ultimate experience for me was jumping from a canyon wall and free falling 60 metres down a rocky cliff face, to then swing 200m above a river. Sounds scary, doesn’t it?

I can tell you, during those few seconds when I was falling, it was incredibly scary. I was screaming the entire time, then as I reached the swing above the river I realised I had survived, and began giggling with joy!

Suddenly, after the major shock and thrill of the experience was gone, I could take in the birds’ eye view. The feeling took my breath away… so much so that I did it again! And the next time, I was strapped to a chair and fell backwards. It was exhilarating, and like nothing I had ever experienced in my life.

Do the research.

Before the trip, during the planning stage, I had researched the most thrilling jumps you could do in New Zealand. I researched the equipment and safety measures, the costs involved, history of the locations and even read reviews from previous customers about their experiences. Taking all this information into consideration, I then compiled my wish list for adventure.

However, if I hadn’t prepared myself to understand how the jump would work, how the swing operates, and the ins and outs of the entire jump, there is no way I would have enjoyed the experience as much as I did. Being able to understand everything and trust the people that would be operating the jump was very important to me as it meant I could relax into the process.

Here’s the photo evidence of me jumping into the canyon. See? I really did do it.

Doing the research meant that I was able to make the right choice in who to partner with to help me take the risk – and have the best outcome.

Whether it be jumping off a canyon, or taking a risk for your business, there can be many rewards and benefits. It is important to identify and evaluate potential risks, and of course to seek professional advice to develop a detailed plan before you take the leap of faith.

As in life, in business it is necessary to take calculated risks to uncover new possibilities, new markets, new directions and further success. And sometimes it’s about taking that risk to fulfil that business passion or dream you have.

Remember, today is a new day and a new opportunity for you to take ‘harness’ of your professional or business goals. All the best with your ‘jump’… Just as I did in New Zealand!

Is there such a thing?

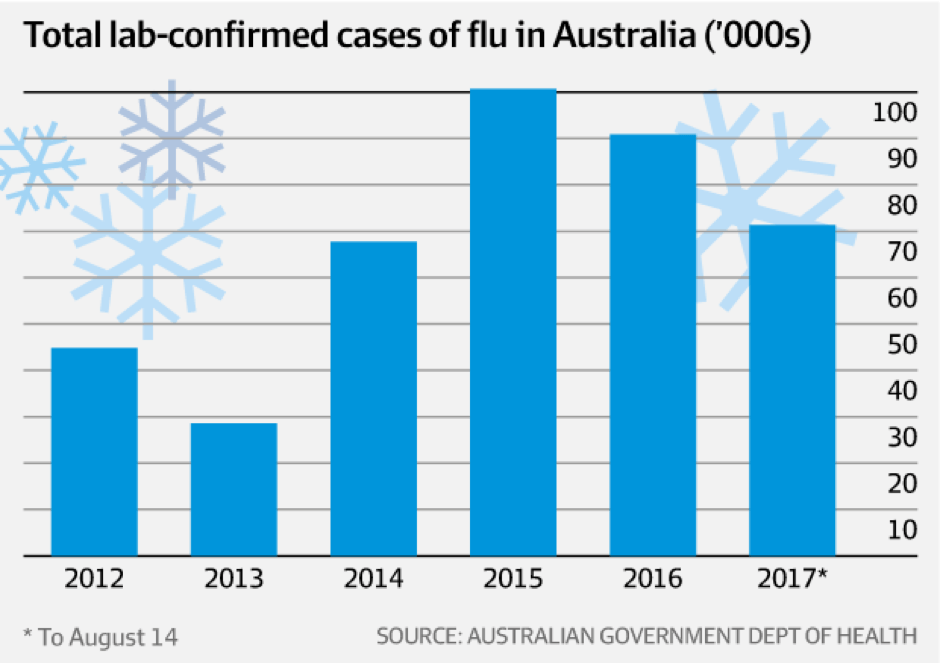

This year it seems that the flu virus has been worse than ever and staff absenteeism is on the rise. Every year hundreds of millions of dollars are lost by Australian companies as a result of the loss of productivity due to sickness and illness. According to an article on the Austratlian Financial Review, national health studies showed the flu alone accounted for about 10 per cent of all workplace absenteeism costing more than $2 billion a year.

This year, we have seen an additional 70,000+ workers off sick, costing businesses $30 million per day.

This is not unique to Australia, business and companies throughout the world are looking for ways to reduce illness and foster a healthier and more productive workplace.

The benefit of having healthy and active employees

Research by the University of Queensland suggests that people who exercise regularly experience better physical health, prone to less illness and experience a positive effect on their mental health. In a time when stress and depression is on the increase, crucial for employers to look for ways that can increase employee physical activity, boost confidence and encourage an overall positive outlook to life.

The return on investment from improved mental health alone can be as high as 15X with smaller organisations benefiting more than larger organisations. Healthier employees suffered lower risks of long term illnesses like heart failure, cancer and diabetes and displayed improved morale, reduced absenteeism and lower turnover rates.

What we are doing? (And you can too!)

Some larger organisations like Apple, Microsoft and Google spend millions every year on programs to encourage a healthier lifestyle for their employees. Gym membership, massage, healthy snacks, flu shots and access to wellness centres are just some of the benefits provided to their employees. Of course, most smaller companies don’t have the budget of these global giants. However, it is not difficult to make a start and build from there.

Employees need to be encouraged not coerced into making changes. We recently replaced the sweet biscuits in our office with fresh fruit, introduced free flu shots and are just about to launch a 10-week fitness challenge which has at its core a healthy diet and exercise program. There is both a fun and serious side to the program which offers team building activities as well as the opportunity to have a full body scan and understand more about your body, healthy foods and nutrition.

Everyone wins from this positive initiative. I encourage you to consider this for your business.

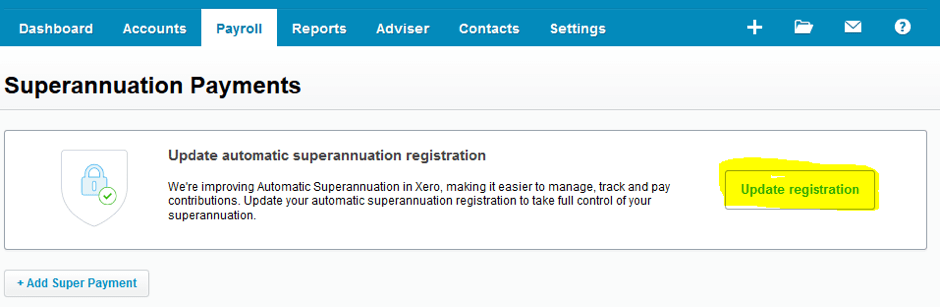

If you have been using auto super in Xero payroll prior to August 2017, you will need to update all your registration details and confirm the terms and conditions. Xero are improving the automatic superannuation function to make it easier for you to manage, track and pay your contributions. As a result, Xero is moving to a new superannuation payments clearing house. To make sure you can process super payments without any worries, you’ll need to update your superannuation registration in Xero by 28 August.

Updating your superannuation registration in Xero is simple and should take just a few minutes.

-

- Login to Xero.

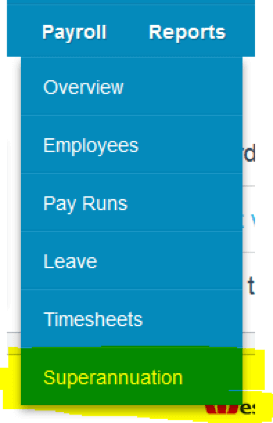

- Navigate to the Superannuation tab.

- Make sure there are no batches in pending approval or approved pending processing.

- Click on the Update Registration button and follow the prompts below:

Update your registration

- In the Payroll menu, select Superannuation.

- Click Update Registration in the banner.

- Click Get Started.

- Check your ABN and Legal/Trading Name are correct and click Next.

- You can update these details in your organisation settings.

- Select and add authoriser details as needed including their name, Phone, and Email. Then click Next.

- Select the bank account you will use to make direct debit payments for super for your employees. Then click Next.

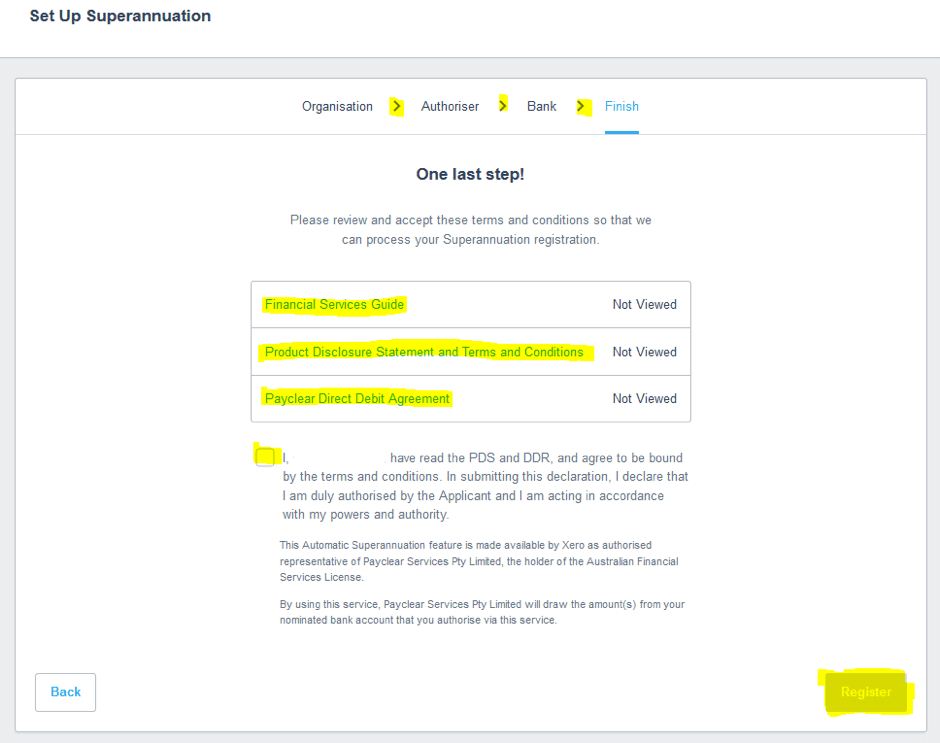

- Review the terms and conditions:

- Financial Services Guide

- Product Disclosure Statement and Terms and Conditions

- Payclear Direct Deposit Agreement

- Select the confirmation checkbox.

- Click Register.

- Once your registration has been reviewed, you will receive a notification about the outcome. This notification will also be sent to the subscriber and nominated authoriser. If your registration changeover is successful, you will be able to start making super payments using auto super straight away.

- For a demo of updating your registration, watch this video.

- If you need any assistance with this, please call our office on 07 5528 2000.

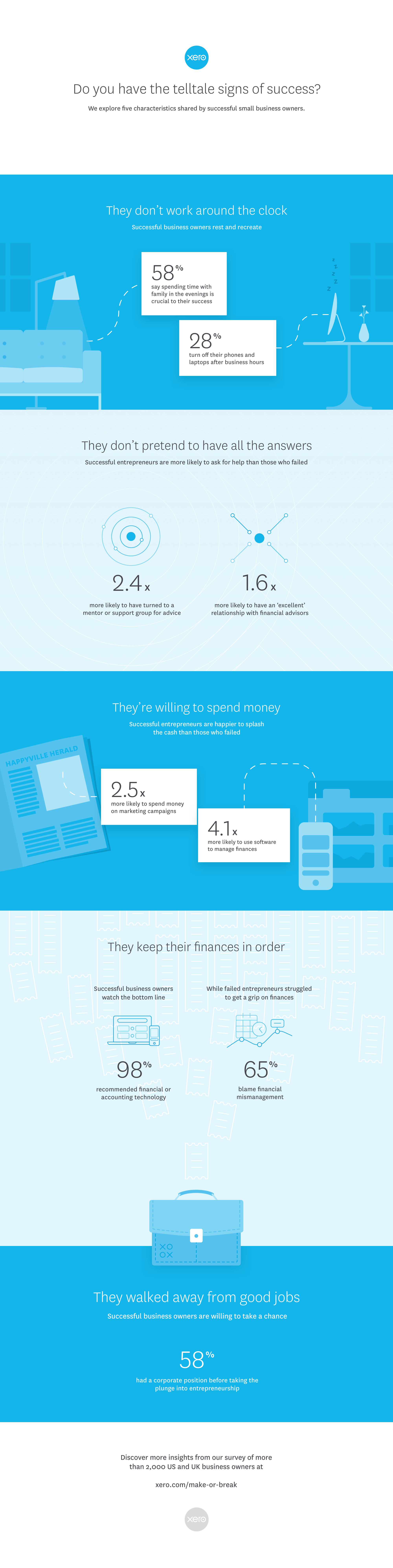

Not all business owners are created equal. They come from different geographic locations, upbringings, income brackets and social classes, as well as education levels. Regardless of your definition of success, there are a number of common characteristics that are shared by successful business owners.

Research by Xero

Xero surveyed 2,000 small business owners (current and former) from the United States and United Kingdom. Some were successful and others had failed. After analysing their answers and looking for patterns they found characteristics that defined the two groups.

Source: Xero

GST applies to services or digital products bought from overseas

From 1 July 2017, GST applies to imported services and digital products from overseas, including:

- digital products such as streaming or downloading of movies, music, apps, games and e-books; and

- services such as architectural, educational and legal.

Australian GST registered businesses will not be charged GST on their purchases from a non-resident supplier if they:

- provide their ABN to the non-resident supplier; and

- state they are registered for GST.

- However, if Australians purchase imported services and digital products only for personal use, they should not provide their ABN.

Imposition of GST on ‘low-value’ foreign supplies

Parliament has passed legislation which applies GST to goods costing $1,000 or less supplied from offshore to Australian consumers from 1 July 2018.

Using a ‘vendor collection model’, the law will require overseas suppliers and online marketplaces (such as Amazon and eBay) with an Australian GST turnover of $75,000 or more to account for GST on sales of low value goods to consumers in Australia.

The deferred start date gives industry participants additional time to make system changes to implement the measure.

Editor: It should be noted that this is a separate measure to that which applies GST to digital goods and services purchased from offshore websites, as outlined above.

From July 2017, any outstanding tax debts could have an impact on your business credit rating, as the Australian Taxation Office (ATO) will be allowed to disclose information to credit agencies.

The crackdown

This is central to an effort by the Government to recover the $19 billion of outstanding tax owed to the ATO. Small businesses, with earnings of less than $2 million, owe around two-thirds of this amount.

A credit rating note, which lasts five years, can affect the ability of a business to obtain finance from banks, secure suppliers, and access services such as equipment hire. For sole traders, personal credit ratings will also be at risk.

Central to the new regime, any tax debt over $10,000 that is at least 90 days overdue, will be reported to credit agencies.

Business who contacted the ATO before 30 June and put in place a payment plan will not be reported to credit agencies – the initiative is targeting those businesses that have not cooperated with the ATO.

Get out of debt

If you currently have any outstanding tax debt, it is essential that you contact the ATO to discuss your debt as soon as possible.

It’s best that you also address the underlying issues behind your tax debt, which will likely be related to your cash flow.

There are several steps to take control of your cash flow:

- Keep your net GST collected and any PAYG withheld from staff in a separate bank account;

- Have a procedure in place to chase up and keep on top of money owed to you;

- Review your pricing and costs to ensure you are making an acceptable profit;

- Have a budget and cash flow forecast in place;

We can help you and your business set up systems to aid with your cash flow monitoring. If you need assistance, please contact one of our team.

Tax time is almost upon us so it’s time to get prepared. Here’s your tax planning guide including an update of what’s changing this year, to help you get EOFY ready.

Update: Tax Planning 2020 Guide – Individual Tax Deductions

In this guide:

- Income tax changes for 2016/17

- General year end tax planning strategies

- Income tax changes – small businesses

- Income tax changes – individuals

- Superannuation – relevant thresholds

Income Tax Changes for 2016/17

Several tax changes apply in the 2016/17 income year. A brief summary is provided in this guide.

There may be some advantages in acting on some of these items before 30 June 2017.

If you think any of these changes may affect you, please contact us for more details.

General Year End Tax Planning Strategies

Here are a few strategies to consider before finalising your tax this year.

Definition of small business

The definition of a Small Business (SBE) has changed from having $2 million in turnover to $10 million in turnover. Many more businesses will now have access to the SBE tax concessions.

Business income and expenses

Subject to cash flow requirements, consider deferring income until after 30 June, especially if you expect lower income for 2017/18 compared to 2016/17.

Most businesses are taxed on income when it is invoiced. Some small businesses may be taxed only when income is received. Income from construction contracts is generally taxed when progress payments are invoiced or received.

Ensure that you have complied with the requirements to claim deductions in 2016/17:

- Bad debts must be written off in your accounts before 30 June

- Employer and/or self-employed superannuation contributions must be paid to, and received by, the super fund before 30 June and must be within the contributions cap ($35,000 for individuals aged 49 or over on 30 June 2017, otherwise $30,000)

- Depreciation can be claimed for assets first used, or installed ready for use, before 30 June

- Small businesses (turnover less than $10 million) can claim expenses prepaid up to 12 months in advance – for larger businesses, this is generally limited to expenses below $1,000

- Wages paid to your spouse or family members must be reasonable for the work performed.

Small businesses planning major purchases or replacements of capital equipment should contact us for advice. Careful timing of those transactions can result in substantial tax savings.

Review valuations of trading stock in the lead up to 30 June. Best practice is generally to value stock at the lower cost or market selling value. This may change if you expect a tax loss for 2016/17, or substantially higher income in 2017/18 compared to 2016/17.

Personal income, deductions and tax offsets

Subject to cash flow requirements, set term deposits to mature after 1 July, rather than before 30 June.

Consider realising capital losses if you have already realised capital gains on other assets during 2016/17. Conversely, consider realising capital gains if you have unrecouped capital losses, especially if you expect substantially higher income in 2017/18 compared to 2016/17.

If you expect lower income in 2017/18 due to retirement or any other reason, consider deferring income until after 1 July, when you will be in a lower tax bracket. If you are a primary producer and you expect a permanent reduction in income, consider withdrawing from the income averaging system.

Access to the Net Medical Expenses Tax Offset is restricted to medical expenses relating to disability aids, attendant care or aged care.

Arrange for deductible donations to be grouped in the higher income year, if you expect substantially higher or lower income in 2017/18 compared to 2016/17. Make all donations in the name of the higher income earner.

If you plan to purchase income-producing assets, consider acquiring assets that will generate positive cash flow in the name of the lower income earner. Conversely, consider acquiring negatively geared assets in the name of the higher income earner.

Residency changes

Contact us for advice if you have moved to or from Australia for an extended period. You may need to review your residency status for tax purposes. There are important tax consequences if you change residency.

Trusts

Trustees of trusts should ensure that all necessary documentation is completed before 30 June, where you intend to stream capital gains or franked distributions to specific beneficiaries.

Family discretionary trusts may need to make a family trust election if the trust has unrecouped losses, or has beneficiaries whose total franking credits for the year may exceed $5,000.

Tax shelter schemes

Be sceptical of year-end tax shelter schemes. You should not enter a scheme without advice regarding both its tax consequences and commercial viability.

Income Tax Changes – Small Business

Tax rate

The tax rate for small business entity (SBE) companies is 27.5% from 1 July 2016.

Individual small business taxpayers are entitled to 5% discount of the income tax payable on the business income received from a small business entity (other than a company), up to a maximum of $1,000 a year.

Accelerated Depreciation

An immediate deduction is available for an asset costing less than $20,000 acquired on or after 12 May 2016 and first used or installed ready for use between 12 May 2016 and 30 June 2017.

The balance of the general small business pool is also immediately deducted if the balance is less than $20,000 at 30 June.

Blackhole Expenditure

From 1 July 2016, start-up companies, trusts or partnerships can immediately deduct a range of professional expenses associated with starting a new business (e.g. professional, legal and accounting advice). This only applies to SBE’s.

Income Tax Changes – Individuals

Car expenses

From the 2015/16 tax year, the 1/3 of actual expenses and the 12% of original value method for claiming work related car expenses can no longer be used.

A single flat rate of 66 cents per kilometre is to be used for the cents per km method. Alternatively, a log book must be maintained for a 12 week period to determine the business percentage of all running costs.

Zone tax offset

From the 2015/16 tax year, the zone tax offset excludes ‘fly-in fly-out’ and ‘drive-in drive-out’ workers where their normal residence is not within a ‘zone’.

Superannuation – relevant thresholds

Super co-contribution

Super co-contribution helps eligible people boost their retirement savings.

If you’re a low or middle-income earner and make personal (after-tax) contributions to your super fund, the government also makes a contribution (called a co-contribution) up to a maximum amount of $500.

The full co-contribution rate applies for income up to $36,021 and the partial co-contribution applies for income up to $51,021 for the 2016/17 tax year.

Concessional Contributions

The concessional contribution caps for the 2016/2017 tax year are:

- $30,000 for people aged up to 48 years or under as at 30 June 2016;

- $35,000 for people aged 49 years and over.

These represent the limit on the amount of contributions you can make within the year, and include the Super Guarantee payments made on your behalf by your employer.

Should you wish to discuss your superannuation needs, please contact the team at Superfund Partners.

For help with any of the above information in our guide above, reach out and we’ll happily talk you through it step-by-step

You may think that if you don’t run a delivery business and your employees aren’t truck drivers, that as an employer you have no duty to check up on the driving of your staff. Unless they spend long hours driving, then is it really necessary? The answer is yes.

All employers should have a policy in place regarding road safety, if members of staff ever have to drive during their work. This includes driving to other sites, driving to meetings or to visit customers or clients.

FACT: It is estimated that a third of all road traffic accidents involve somebody who is at work at the time.

What can I do as an employer?

Now that you realise you do need to think about driver safety, here are some ways to make employees safer on the road.

Implement a policy

The first thing to do is to let staff know that when they are driving, they are still at work, and their safety is in your hands. You will probably need to write a driving at work policy for employees using their own vehicles. Make sure it is accessible to all staff and includes the key points for employees:

- If using your own vehicle for work purposes, it must be in a roadworthy condition

- Staff must have a valid driving licence

- Staff must have adequate insurance – employers can ask to see this annually

- Staff should ensure they are fit to drive. If they feel unwell or have recently changed their medication they must inform a manager

Other measures

Employers can take other steps to keep staff safe where driving is concerned.

For example, look at how many journeys employees are making in work hours – can these be reduced in any way?

Are face to face meetings essential, or can video conferencing be used instead? In certain cases, the particular job or service requires face to face contact, but for other business meetings there is usually an alternative. If it doesn’t compromise the customer experience, this might be a good one to look at.

Next, think about how local the journey is and is driving really necessary? Could you suggest your employees walk or catch the train to the next client meeting?

Help shape change

When all we seem to hear about on the news is road accidents, we should all help reduce this as much as possible and remember that change can start at work. By using the tips above as a starting point, employers can play their part.

By now, most are aware that the Federal Court ruled that the provision of transport by an Uber driver to an Uber rider is the supply of ‘taxi travel’ for the purposes of the GST Act, therefore requiring Uber drivers to be registered for GST.

The Fringe Benefits Tax (FBT)

Due to the complexities of our tax system, this ruling only applies to the GST Act, so how does the Fringe Benefits Tax Assessment Act apply to Uber travel and why does this matter? If you provide taxi travel to your employees and that travel begins at or ends at your employee’s place of work, or is provided as a result of sickness or injury, section 58Z of the FBT Act exempts the provision of that travel. So, if that travel is not deemed to be ‘taxi travel’, FBT may apply to the provision of that benefit.

Under section 136 of the FBT Act, a ‘taxi’ is defined as a motor vehicle that is licensed to operate as a taxi. Where vehicles used by Uber drivers are not subject to a taxi licensing regime, the travel provided by those vehicles may not qualify for the exemption.

To operate as a ‘taxi’ in Queensland, providers are required to have a taxi service licence. The licence authorises the holder to provide a taxi service in a specific area subject to certain conditions. These licences can only be obtained by buying or leasing an existing Taxi Service License or by tendering for new Taxi Service Licenses if and when they become available through public tender. The license holder, among other criteria, must hold driver authorisation which is also a requirement to be an Uber driver. Furthermore, there are requirements that do not apply to Uber drivers such as not picking up within another Taxi Service Area, displaying a distinctive registration plate and having a taximeter fitted to the vehicle.

The lowdown on FBT

It appears that in Queensland, Uber drivers, whilst requiring driver authorisation and annual safety inspections, are not licensed taxi service providers. Under the current FBT Act, it appears that Uber travel in Queensland may not be eligible for the taxi travel exemption. The state governments legislate taxi service licensing and therefore varying tax treatments among the states may apply.

When determining your liability to Fringe Benefits Tax, you should consider benefits provided by way of Uber travel.