Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Daylight Saving Poll Urgently Needed

This time last year, I wrote a blog about daylight saving which received more likes than any blog I have ever written. That either says something about the quality of previous blogs, or hopefully shows that a lot of people in South East Queensland are passionate about this topic.

The complacency continues…

Unfortunately, twelve months on and Queensland is still in the dark ages despite the Billions in lost revenue to the State each year. So, what will it take to change the minds of the politicians in Queensland? Well, I recently had a chat to our local State member who indicated that whilst she believed most Queenslanders would support daylight saving, the farmers and folk up North would object. Clearly, the State Government prefers to take a low risk, steady as she goes approach which means that they will sit on their hands and nothing will happen.

What are we waiting for? Let’s create more jobs and boost the economy!

Judging from my random poll over the recent Christmas break I would safely say that 70% of South East Queenslanders would support daylight saving if only given the chance to have a vote. So, the big question is how to get the Government or media to take another major poll on the subject? With all the talk about creating jobs, the easiest thing to do to create a boost for our economy would be to run another daylight saving trial. We are about to have hundreds of thousands of overseas visitors come to the Gold Coast for the Commonwealth Games and whilst daylight saving officially ends on 1st April this could be extended till the 15th April in Queensland. Guaranteed to create more jobs and boost the State economy.

In January 2017, and having been 25 years since Queensland did it’s last trial, Brisbane City Council’s Deputy Major Adrian Schrinner believed it was time to give daylight saving a “fresh go”. He created a poll which had a large majority of over 80% of votes leaning towards yes. However, it took it a step further than that and an e-petition was made, which was then tabled at the end of February 2017 but most importantly had over 23,000 signatures. In December, Gold Coast Mayor Tom Tate spoke out about daylight saving time in Queensland stating he is for it because of the economic growth. So, what’s happening now?

How can we motivate other local politicians?

I’m looking for other suggestions as to how we can motivate the local politicians into action and get something happening. Maybe the local Government politicians on the Gold Coast and Brisbane have a bit more fire in the belly and are willing to listen to the majority of their constituents? After all, the old argument around cows, curtains and kids just does not stack up anymore and unless someone can explain how in NSW, Victoria and South Australia all those things work just fine then the only argument left for the minority of Queenslanders who object to daylight saving is the reluctance to change habits. This, like any change, will be well forgotten after two to three weeks and jobs and the economy will be the big winners in Queensland. #GOdaylightsavingsforQLD

What is the difference between cash flow and profit?

As a business owner, it is imperative to be aware of the difference between your profit and your cash flow. Both are important measures of how your business is performing.

While profit and cash flow are closely related, they are very different measures of your business.

Below we outline how profit and cash flow will affect your business.

Cash flow

Cash flow is the difference between the actual cash you receive and the actual cash used in the process of doing business. It is based on when the money has actually moved in and out of the business. Cashflow can come from net sales, debt or money injected into the business by a shareholder.

Profit

Profit is the revenue from the sale of products or services, minus your expenses.

Profit indicates whether a business is earning income (making more than it is spending), even if the cash hasn’t actually moved in or out of the business.

For this reason, businesses should not rely on their profit and loss statement to assess their cash flow position. The profit and loss statement may indicate a business is making a fortune, but leave owners wondering where all the cash is.

A business can also incur non-cash expenses such as depreciation, which reduces the profit without affecting the cash flow of the business. Conversely, investment in business assets, such as plant and equipment or motor vehicles, will decrease the cash available to the business, however, will not immediately affect profit.

Why cash flow is king

Without cash flow, a business may be unable to pay its bills.

Profitable businesses can suffer from poor cash flow, and can even go bankrupt from cash flow problems. For example, if a business needs equipment in February but won’t be paid until June and cannot get a loan, they may go out of business.

A company can also have a great cash flow, but not be profitable.

In the long-run, you must either become profitable or find investors to provide cash to make up for your losses.

What businesses can do

Where possible, collect payments sooner rather than later, pay suppliers slower (but on time) and cut costs where possible.

Most importantly, invest in a good accountant and business advisor who can help you remain financially on track.

Dealing with cash flow problems

Below are some suggestions for unlocking funds without affecting your operational capacity. Keep in mind that you should always seek professional guidance before making changes to your business if you are unsure of the repercussions or potential issues.

Hidden sources of finance

Most business owners immediately think of the bank or loans when they’re short of money. But there are many more resources you can tap before you ask for that expensive overdraft or for an overdraft extension. You can often free up funds from within your business by re-examining your business systems, and these funds might in themselves be sufficient for your immediate needs.

To free up funds from within your business, you could look closely at the following.

Assets

Your assets include debtors, stock, pre-paid expenses, vehicles, plant and equipment, fittings and property. Each of these is a possible source of funds.

Debtors

Are you letting some customers have the free use of your money for months?

Here’s how you fix the problem.

- Get invoices out promptly.

- Send the invoice with the goods, and date the invoice from the day the service was completed rather than following the standard ‘last day of the month’ date for invoices.

- Consider changing the terms for some of your customers, or for new customers.

- Follow up promptly when invoices aren’t paid by the due date.

- Establish the average age of your Accounts Receivable and set yourself the goal of reducing this age by a set target every month. It’s amazing the impact this will have on your cashflow, even collecting one day quicker.

- Consider offering a discount for prompt payment.

Stock

Do you have excessive capital tied up in stock? This can occur in two ways:

- Carrying high levels of items that you could obtain from suppliers at short notice.

- Having too many slow-moving items (and too few fast-moving items).

You need to regularly review your stock levels, your stock turnover rates and your purchasing policies. Can you free up money by reducing stock? What about moving out of the slow-moving lines or having a quick sale of the slow-moving stock? It might pay you to reduce some items quite heavily to get some money in quickly.

Pre-paid expenses

These pre-paid expenses often relate to services. For example, you might have always paid your insurance bill for the year all in one hit, but could you instead arrange to pay small monthly amounts?

Fixed assets

Fixed assets can often be the source of a significant amount of cash. Are your assets fully utilised? You might be able to sell off little-used assets and hire suitable replacements when you require them.

Suppliers

Finally, consider your suppliers as a possible source of funds. Ask for extended payment terms for a short period to give you the opportunity to sell the goods first before you have to pay. If the supplier won’t budge, try splitting the order in two and offer to pay normal credit terms (30 days) on one half of the order and 90 days on the other half. Your suppliers will be more likely to agree to this kind of arrangement if you’ve paid them promptly in the past.

Your customers

Don’t forget that your customers can be a source of business funds. In addition to the good debt collection tactics already discussed, consider the following:

- Ask some of your credit customers if they would be willing to use their bank credit cards for purchases from you, instead of using the account facility they have with you. They will more than likely have a credit card that offers 55 days interest free terms.

- If you’re starting a new business, consider establishing it on a cash-only basis to keep the funds inside your business rather than locked up in Accounts Receivable.

- If you supply goods over a period of time or if you’re a service business, ask if you can invoice for progress payments.

Next steps

- Identify exactly how much additional cash you’ll need – this is especially important if you decide you need additional finance from a lender.

- Seek professional help from an accountant, business mentor, or your bank manager.

- Reduce your expenses and tighten your credit policies based on the steps above.

- Research additional options for increasing your cash position, from low-interest bank loans and overdraft facilities, to equity assistance.

We have all heard the saying “Cash is King”. This phrase is often used to describe the amount of notes and coins that we carry in our wallets. However, how does this phrase now sit in our world with the increasing reliance on new payment technologies such as “Tap & Go” and “Apple Pay” to make cashless payments?

In recent times, we have seen the growth and success of a number of business models that only deal in “cashless” payment systems. A great example of how successful a business can be using the “cashless” business model is evidenced by the success of “Uber”. In 2016 Uber generated revenue of 6.5 billion (USD). Who would have thought that hiring an on-demand driver could be done at the press of a button on a smart phone device?

How has the importance of cash declined with the push towards a cashless society and how far away is Australia from being a truly “cashless” economy?

Australian consumers appear to be embracing the move towards a cashless society. The use of smart phones and tablets to enable transactions has resulted in around 82% of Australian payments being made using non-cash dollars. It is estimated that more than three out of four face-to-face transactions are tap-and-go.

This year the Reserve Bank plans to launch technology to facilitate the move towards enabling more cashless transactions. The New Platform System (NPP) will allow money to be transferred almost instantaneously, even when the payer and payee are with different banks.

The whole process of paying for services will become simpler and the transactions will be based on an email address or phone number.

The debate continues about Australia’s end date towards achieving the end goal of being cashless. Some commentators have touted that we may see a cashless society sometime after 2020.

What lessons can be learned from this?

Although “Uber” is often used to promote the success of the cashless business model it is interesting to note that they have not always strictly adhered to their cashless business model. One example of Uber deviating from their cashless business model is in India, where Uber introduced a country-specific initiative to accept cash. This initiative was driven partly by India’s banking regulations but also by understanding the cash economy in that country. Across all of India the cash method is the preferred method of payment by users and drivers. Uber’s understanding of the economic landscape in India lead them to adjusting their cashless business model.

How does this apply to you?

All businesses need to be flexible nowadays. It is important to look at the impact of how a cashless economy would impact on profitability and ultimately survivability.

- Does your business have the technology to handle cashless payments?

- Cash is still an important draw card for consumers around the world – How is your business placed to handle this?

- Most customers appear to adapt to cashless payment platforms but it’s important to educate them about the cashless platforms available within your business.

Main Benefits for Small businesses:

- Time saving in not having to handle cash and making physical deposits at banks; and

- The reduced risk of not having to keep cash on business premises.

How does this apply to your customers?

- The key benefits for consumers is the pure convenience of using these new payment platforms;

- No credit card fees for using a credit card to make purchases; and

- The main concerns for consumers is centred around privacy and fraud risk. Transaction history can be tracked in a cashless payments system.

How will this benefit the Australian Government?

The major advantage for governments operating in a cashless economy is the significantly reduced risk of tax evasion.

Only time will tell how successful the push towards a cashless economy will be in Australia. Will the concept of carrying cash be a dim memory of the past?

Sometimes you need to take the risk.

Recently, I had the opportunity to head to New Zealand for a holiday. It was definitely a holiday full of high adrenaline adventures. The ultimate experience for me was jumping from a canyon wall and free falling 60 metres down a rocky cliff face, to then swing 200m above a river. Sounds scary, doesn’t it?

I can tell you, during those few seconds when I was falling, it was incredibly scary. I was screaming the entire time, then as I reached the swing above the river I realised I had survived, and began giggling with joy!

Suddenly, after the major shock and thrill of the experience was gone, I could take in the birds’ eye view. The feeling took my breath away… so much so that I did it again! And the next time, I was strapped to a chair and fell backwards. It was exhilarating, and like nothing I had ever experienced in my life.

Do the research.

Before the trip, during the planning stage, I had researched the most thrilling jumps you could do in New Zealand. I researched the equipment and safety measures, the costs involved, history of the locations and even read reviews from previous customers about their experiences. Taking all this information into consideration, I then compiled my wish list for adventure.

However, if I hadn’t prepared myself to understand how the jump would work, how the swing operates, and the ins and outs of the entire jump, there is no way I would have enjoyed the experience as much as I did. Being able to understand everything and trust the people that would be operating the jump was very important to me as it meant I could relax into the process.

Here’s the photo evidence of me jumping into the canyon. See? I really did do it.

Doing the research meant that I was able to make the right choice in who to partner with to help me take the risk – and have the best outcome.

Whether it be jumping off a canyon, or taking a risk for your business, there can be many rewards and benefits. It is important to identify and evaluate potential risks, and of course to seek professional advice to develop a detailed plan before you take the leap of faith.

As in life, in business it is necessary to take calculated risks to uncover new possibilities, new markets, new directions and further success. And sometimes it’s about taking that risk to fulfil that business passion or dream you have.

Remember, today is a new day and a new opportunity for you to take ‘harness’ of your professional or business goals. All the best with your ‘jump’… Just as I did in New Zealand!

Is there such a thing?

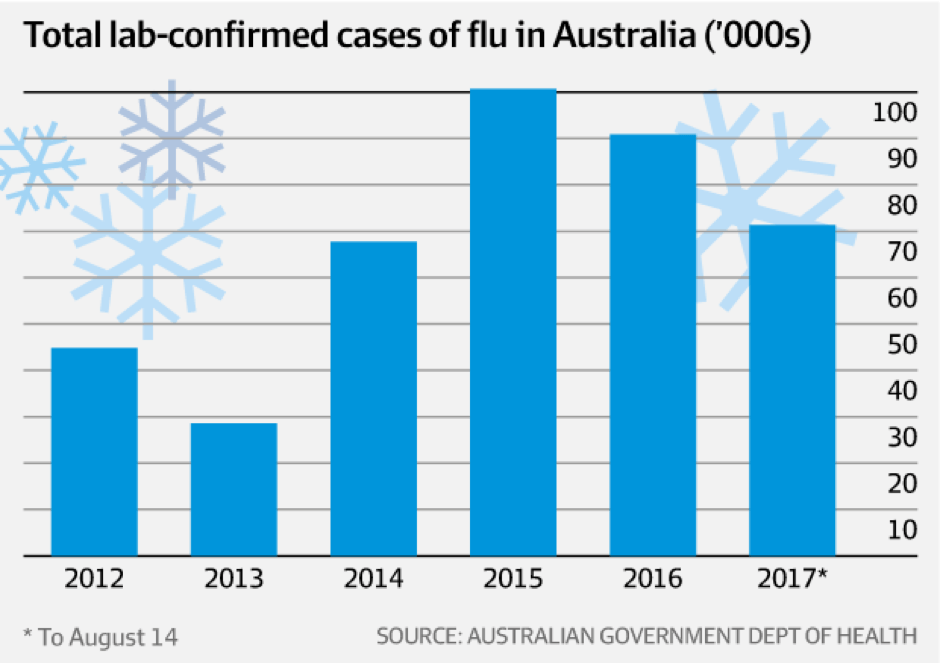

This year it seems that the flu virus has been worse than ever and staff absenteeism is on the rise. Every year hundreds of millions of dollars are lost by Australian companies as a result of the loss of productivity due to sickness and illness. According to an article on the Austratlian Financial Review, national health studies showed the flu alone accounted for about 10 per cent of all workplace absenteeism costing more than $2 billion a year.

This year, we have seen an additional 70,000+ workers off sick, costing businesses $30 million per day.

This is not unique to Australia, business and companies throughout the world are looking for ways to reduce illness and foster a healthier and more productive workplace.

The benefit of having healthy and active employees

Research by the University of Queensland suggests that people who exercise regularly experience better physical health, prone to less illness and experience a positive effect on their mental health. In a time when stress and depression is on the increase, crucial for employers to look for ways that can increase employee physical activity, boost confidence and encourage an overall positive outlook to life.

The return on investment from improved mental health alone can be as high as 15X with smaller organisations benefiting more than larger organisations. Healthier employees suffered lower risks of long term illnesses like heart failure, cancer and diabetes and displayed improved morale, reduced absenteeism and lower turnover rates.

What we are doing? (And you can too!)

Some larger organisations like Apple, Microsoft and Google spend millions every year on programs to encourage a healthier lifestyle for their employees. Gym membership, massage, healthy snacks, flu shots and access to wellness centres are just some of the benefits provided to their employees. Of course, most smaller companies don’t have the budget of these global giants. However, it is not difficult to make a start and build from there.

Employees need to be encouraged not coerced into making changes. We recently replaced the sweet biscuits in our office with fresh fruit, introduced free flu shots and are just about to launch a 10-week fitness challenge which has at its core a healthy diet and exercise program. There is both a fun and serious side to the program which offers team building activities as well as the opportunity to have a full body scan and understand more about your body, healthy foods and nutrition.

Everyone wins from this positive initiative. I encourage you to consider this for your business.

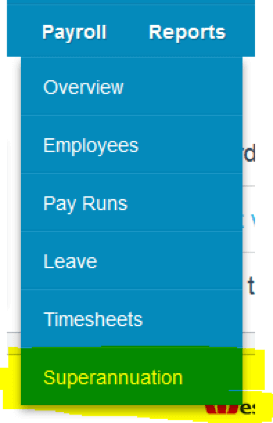

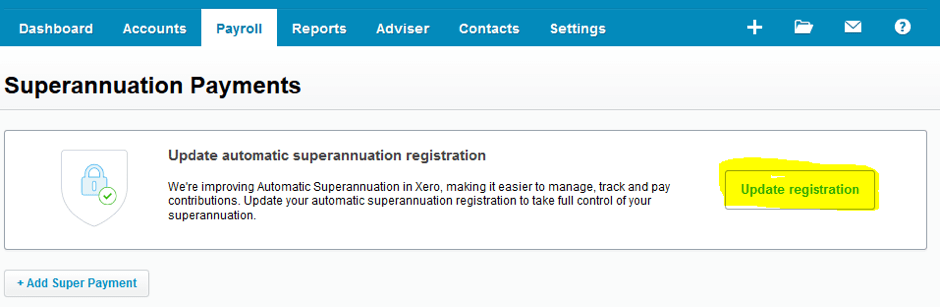

If you have been using auto super in Xero payroll prior to August 2017, you will need to update all your registration details and confirm the terms and conditions. Xero are improving the automatic superannuation function to make it easier for you to manage, track and pay your contributions. As a result, Xero is moving to a new superannuation payments clearing house. To make sure you can process super payments without any worries, you’ll need to update your superannuation registration in Xero by 28 August.

Updating your superannuation registration in Xero is simple and should take just a few minutes.

-

- Login to Xero.

- Navigate to the Superannuation tab.

- Make sure there are no batches in pending approval or approved pending processing.

- Click on the Update Registration button and follow the prompts below:

Update your registration

- In the Payroll menu, select Superannuation.

- Click Update Registration in the banner.

- Click Get Started.

- Check your ABN and Legal/Trading Name are correct and click Next.

- You can update these details in your organisation settings.

- Select and add authoriser details as needed including their name, Phone, and Email. Then click Next.

- Select the bank account you will use to make direct debit payments for super for your employees. Then click Next.

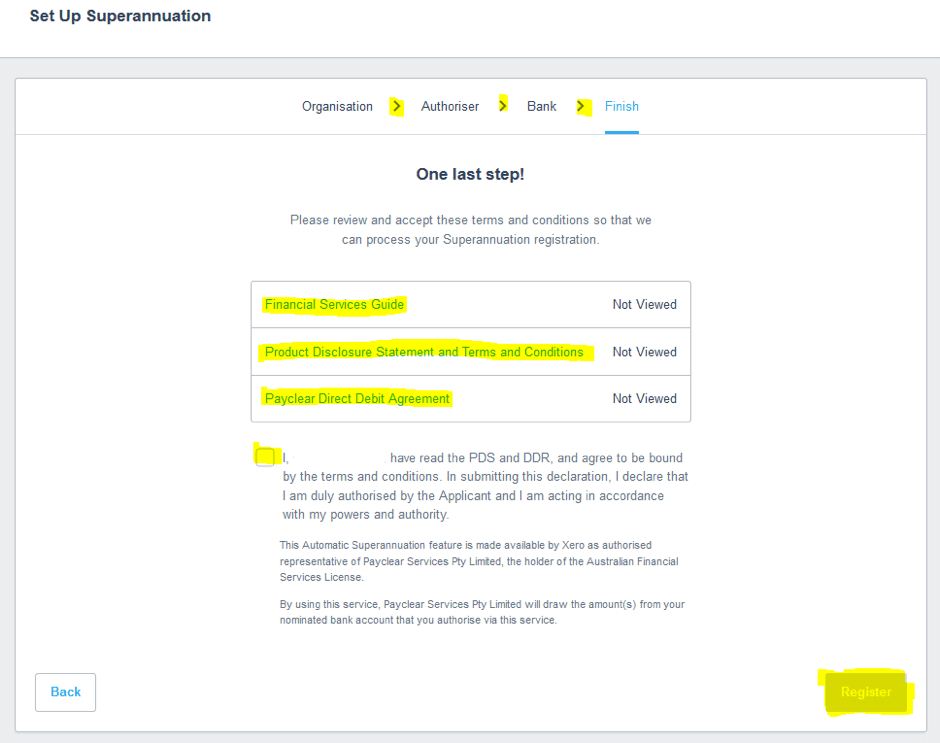

- Review the terms and conditions:

- Financial Services Guide

- Product Disclosure Statement and Terms and Conditions

- Payclear Direct Deposit Agreement

- Select the confirmation checkbox.

- Click Register.

- Once your registration has been reviewed, you will receive a notification about the outcome. This notification will also be sent to the subscriber and nominated authoriser. If your registration changeover is successful, you will be able to start making super payments using auto super straight away.

- For a demo of updating your registration, watch this video.

- If you need any assistance with this, please call our office on 07 5528 2000.

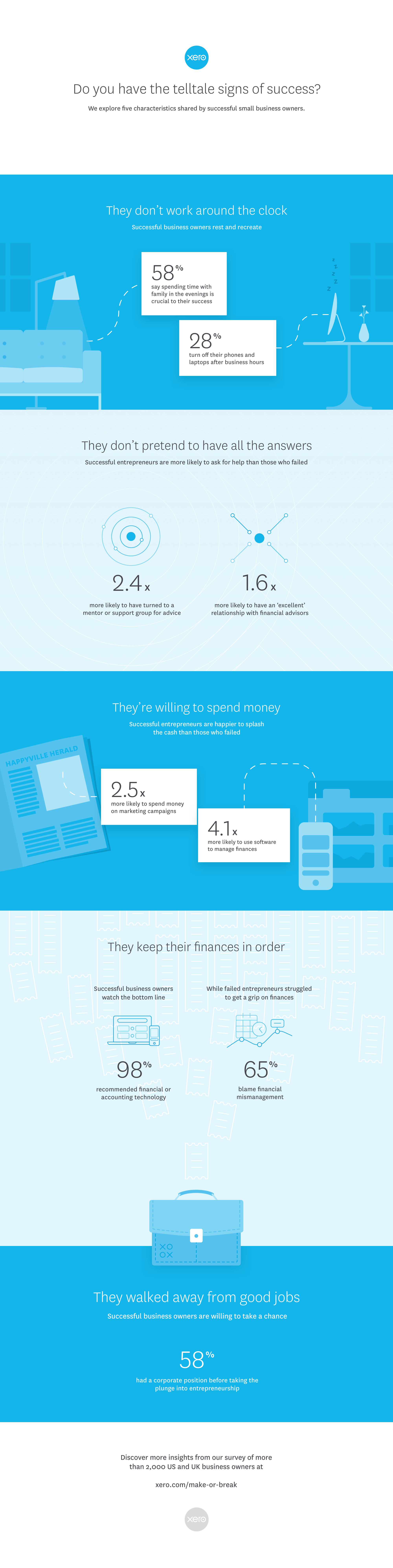

Not all business owners are created equal. They come from different geographic locations, upbringings, income brackets and social classes, as well as education levels. Regardless of your definition of success, there are a number of common characteristics that are shared by successful business owners.

Research by Xero

Xero surveyed 2,000 small business owners (current and former) from the United States and United Kingdom. Some were successful and others had failed. After analysing their answers and looking for patterns they found characteristics that defined the two groups.

Source: Xero

GST applies to services or digital products bought from overseas

From 1 July 2017, GST applies to imported services and digital products from overseas, including:

- digital products such as streaming or downloading of movies, music, apps, games and e-books; and

- services such as architectural, educational and legal.

Australian GST registered businesses will not be charged GST on their purchases from a non-resident supplier if they:

- provide their ABN to the non-resident supplier; and

- state they are registered for GST.

- However, if Australians purchase imported services and digital products only for personal use, they should not provide their ABN.

Imposition of GST on ‘low-value’ foreign supplies

Parliament has passed legislation which applies GST to goods costing $1,000 or less supplied from offshore to Australian consumers from 1 July 2018.

Using a ‘vendor collection model’, the law will require overseas suppliers and online marketplaces (such as Amazon and eBay) with an Australian GST turnover of $75,000 or more to account for GST on sales of low value goods to consumers in Australia.

The deferred start date gives industry participants additional time to make system changes to implement the measure.

Editor: It should be noted that this is a separate measure to that which applies GST to digital goods and services purchased from offshore websites, as outlined above.

From July 2017, any outstanding tax debts could have an impact on your business credit rating, as the Australian Taxation Office (ATO) will be allowed to disclose information to credit agencies.

The crackdown

This is central to an effort by the Government to recover the $19 billion of outstanding tax owed to the ATO. Small businesses, with earnings of less than $2 million, owe around two-thirds of this amount.

A credit rating note, which lasts five years, can affect the ability of a business to obtain finance from banks, secure suppliers, and access services such as equipment hire. For sole traders, personal credit ratings will also be at risk.

Central to the new regime, any tax debt over $10,000 that is at least 90 days overdue, will be reported to credit agencies.

Business who contacted the ATO before 30 June and put in place a payment plan will not be reported to credit agencies – the initiative is targeting those businesses that have not cooperated with the ATO.

Get out of debt

If you currently have any outstanding tax debt, it is essential that you contact the ATO to discuss your debt as soon as possible.

It’s best that you also address the underlying issues behind your tax debt, which will likely be related to your cash flow.

There are several steps to take control of your cash flow:

- Keep your net GST collected and any PAYG withheld from staff in a separate bank account;

- Have a procedure in place to chase up and keep on top of money owed to you;

- Review your pricing and costs to ensure you are making an acceptable profit;

- Have a budget and cash flow forecast in place;

We can help you and your business set up systems to aid with your cash flow monitoring. If you need assistance, please contact one of our team.