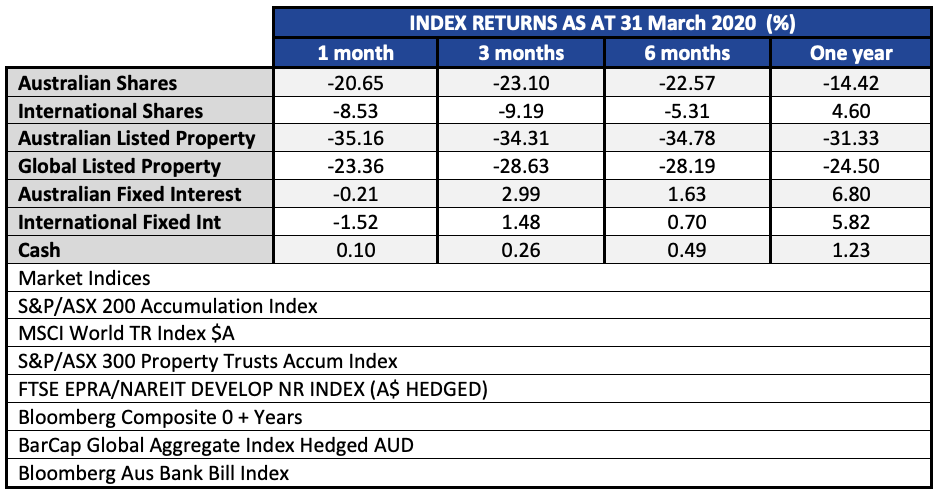

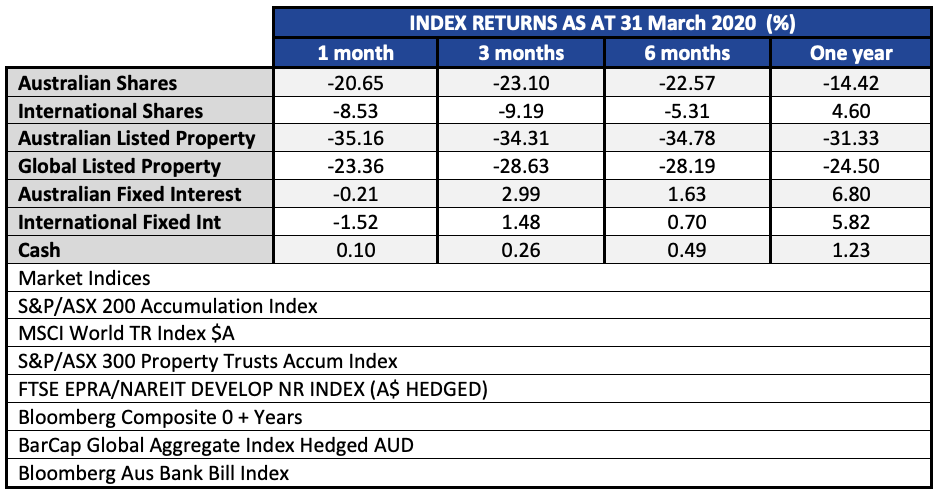

All the major asset classes had a torrid month in March with nothing but cash in positive territory. Even the fixed income markets posted a negative return in a divergence from the normal shock-absorber effect that the asset class is supposed to have in portfolios. Australian shares were down 20.65%, but at the worst of the intra-day peak to trough between 19 February and 23 March the decline was 38.8%.

International shares also had large falls, though when investing on an un-hedged basis the fall in the Australian dollar cushioned the falls to a large degree. While the S&P 500 had trimmed its intraday peak to trough loss of 35.4% (since February 19th) to minus 12.5% for the month of March, the USD gained 5.9% on the Australian dollar. Likewise the Euro gained 6.08% against the Aussie. These moves helped cushion the falls in International shares. While it is easy to favour Australian shares for the income and franking credit benefits, times like these remind us of the benefits of having a diversified portfolio.

Fixed interest markets were also in turmoil in March. The reasons were many, but one identified by the Bank of International Settlements was unwinding of ‘risk parity’ strategies. The concept is to use leverage to increase bond exposure within a balanced asset allocation. In normal times, when bonds usually rise in price as equities fall it works well. Until both shares and bonds start to fall at the same time, which does happen occasionally. This creates forced sales as the mathematical risk models demand that assets are sold to restore the ‘value at risk’ model to a comfortable position due to the increased volatility. When ever-larger amounts of money are invested in line with such a strategy, the rush for the exits create a wave of selling that in more rational times, (with an equal number of buyers and sellers) would not happen. Such is the risk of a strategy when it becomes too large in proportion to the size of the markets they invest in.

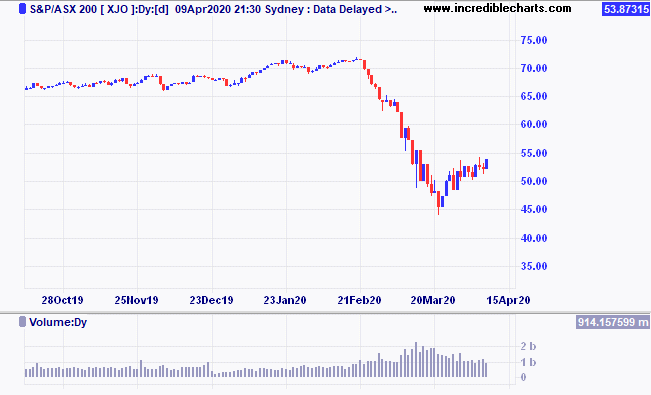

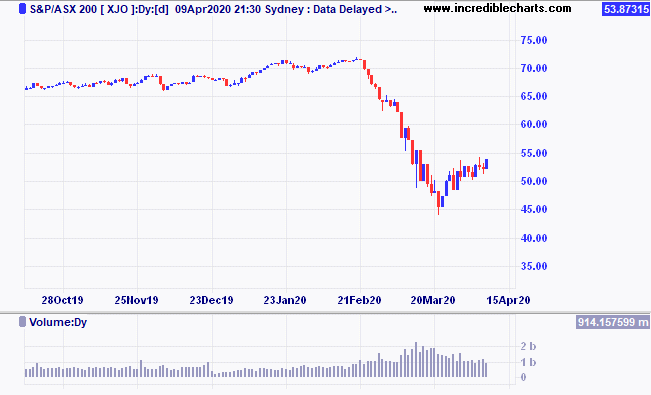

To provide some perspective on the falls in the Australian market we have the ASX200 chart below. The lower panel in the chart shows the daily trading volume, which almost doubled during the depths of the sell-off. The number of trades has settled somewhat but is still elevated.

We have commented in our intra-month updates about the amount of fiscal stimulus that has now been unleashed by governments around the world. An update to that figure shows that we now have promises of support for affected workers and businesses amounting to around US$6.5 trillion according to Chris Watling of Longview Economics. When we think about the global GDP is around US$85 trillion, the US$6.5 trillion represents around 7.5% of global GDP. The expectation of economist is for the second quarter GDP figures to fall by around 15%. If we were to assume two quarters of GDP at 15% below potential, then the annualised hit to GDP would be around 7.5% assuming we can get back to normal by the end of September.

In addition to the fiscal stimulus, the ‘big bazooka’ rolled out by the US Federal Reserve on March 23 was the announcement that they would facilitate unlimited support to buy up government and certain corporate debt. This monetary stimulus was just the circuit breaker that financial markets needed and marked the low in shares, and the peak in credit spreads so far. Today, on the 9th of April, the Federal Reserve announced a program of buying that would extend into sub-investment grade bonds and also the Exchange Traded Funds that hold these type of assets. This will be very positive for companies such as Ford, whose bonds have fallen into the sub investment grade category.

Overall we are seeing some positive signs emerge globally. However, we also need to be realistic to the facts that over the next month we will be seeing the fastest increase in the unemployment rate the world has ever seen. This carries risks of behavioural changes that we may not have yet fully anticipated. What the last two weeks since 23 March has reminded us of, is that just when things seem the darkest, markets can turn on a dime. For this reason alone it is best not to be over-reacting, either being too bullish or too bearish, but keep your emotions in check and realise the reality will likely be somewhere between your worst dreams and your best hopes.

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.

Below are some frequently asked questions about the JobKeeper payments. The JobKeeper payment is yet to be legislated. Parliament is due to sit on the 8th of April 2020. We will endeavour to update our responses as further information becomes available.

I am Self-Employed. Am I eligible for the JobKeeper Payment?

Yes. People who are self-employed will be eligible for the payment provided, at the time of applying, they:

- estimate their turnover has or will reduce by 30 per cent or more;

- had an ABN on or before 12 March 2020, and

- either had an amount included in its assessable income for the 2018-19 year and it was included in their income tax return lodged on or before 12 March 2020, or

- made a supply during the period 1 July 2018 to 12 March 2020 and provided this information to the Commissioner on or before 12 March 2020;

- were actively engaged in the business;

- are not entitled to another JobKeeper Payment (either as a nominated business participant of another business or as an eligible employee);

- were aged at least 16 years of age as at 1 March 2020; and

- were an Australian citizen, the holder of a permanent visa, or a Special Category (Subclass 444) Visa Holder at 1 March 2020.

My Business operates through a Partnership. Can each partner receive the JobKeeper Payment?

No. Only one partner can be nominated to receive a JobKeeper Payment along with any eligible employees, noting a partner cannot be an employee.

Can Trusts receive the JobKeeper Payment?

Trusts can receive JobKeeper payments for any eligible employees. Where beneficiaries of a trust only receive distributions, rather than being paid salary and wages for work done, one individual beneficiary (that is, not a corporate beneficiary) can be nominated to receive the JobKeeper Payment.

I am a Company Director that receives Directors Fees. Am I eligible?

An eligible business can nominate only one director to receive the payment, as well as any eligible employees. Only one person in a director capacity may receive the payment and that individual may not receive the payment as an employee.

I am paid as a Shareholder of a company. Am I eligible?

An eligible business that pays shareholders that provide labour in the form of dividends will only be able to nominate one shareholder to receive the JobKeeper Payment.

I receive rental income as a landlord but am not registered as a business. Am I eligible?

No. Only businesses with employees or self-employed people are eligible for the JobKeeper Payment.

I am Self-Employed. How can I apply for the JobKeeper Payment?

The ATO will administer the program with an online application process. You may be asked to provide your ABN and a single Tax File Number for the eligible recipient of the JobKeeper Payment, and a declaration of business activity.

I am Self-Employed and also have a job. Am I eligible for the JobKeeper Payment?

An individual can only receive JobKeeper Payments from one source. However, if you are eligible for a JobKeeper Payment, you can also receive income from other sources including another job.

My Business has only just started, or my business has ‘lumpy’ income. How can I self-assess that my turnover has fallen 30 per cent?

To establish that a business has faced or is likely to face a 30 per cent or more or 50 per cent or more fall in turnover, most businesses would be expected to establish that their turnover has fallen in the relevant month or quarter (depending on the Business Activity Statement reporting period of that business) relative to their turnover in a corresponding period a year earlier.

Where a business was not in operation a year earlier, or where their turnover a year earlier was not representative of their usual or average turnover, (e.g. because there was a large interim acquisition, they were newly established, were scaling up, or their turnover is typically highly variable), the Tax Commissioner will have discretion to consider additional information that the business can provide to establish that they have been adversely affected by the impacts of the Coronavirus.

The Tax Commissioner will also have discretion to set out alternative tests that would establish eligibility in specific circumstances (e.g. eligibility may be established as soon as a business ceases or significantly curtails its operations). There will be some tolerance where employers, in good faith, estimate a 30 per cent or more or 50 per cent or more fall in turnover but actually experience a slightly smaller fall.

My Turnover has not decreased by 30 per cent this month, but I believe it will in the coming month. Am I eligible?

You can apply for the payment if you reasonably expect that your turnover will fall by 30 per cent or more relative to your turnover in a corresponding period a year earlier. The ATO will provide guidance about self-assessment of actual and anticipated falls in turnover.

It is unlikely that my turnover will decrease by 30 per cent in the coming month, but can I apply later if my turnover decreased in one of the subsequent months?

If a business does not meet the turnover test at the start of the JobKeeper scheme on 30 March 2020, the business can start receiving the JobKeeper Payment at a later time once the turnover test has been met. In this case, the JobKeeper Payment is not backdated to the commencement of the scheme. Businesses can receive JobKeeper Payments up to 27 September 2020.

Will the ATO use the JobKeeper Payments to offset a Business Activity Statement debt?

The payment will generally be paid directly to the employer and not used to offset tax liabilities, as the intent is that it is a payment that facilitates employers to pay their employees.

Can Employers receive both the JobKeeper Payment and the Supporting Apprentices and Trainees wage subsidy?

Eligible small businesses can receive the 50 per cent wage subsidy for apprentices and trainees in the Supporting Apprentices and Trainees measure from 1 January to 31 March 2020, and the JobKeeper Payment. Where small businesses receive the JobKeeper Payment, they are not eligible to receive the apprentice and trainee wage subsidy from 1 April 2020 onwards.

Further information on the Supporting Apprentices and Trainees measure is available on the Treasury website at treasury.gov.au/coronavirus/businesses.

What will be done to ensure compliance?

This program will be subject to ATO compliance and audit activities. There will be a positive obligation on employers to establish their eligibility and that of their employees. In addition, the ATO will cross-check payments with Services Australia data, and data from other government agencies, and undertake activities designed to identify multiple or ineligible payments to individuals.

What is the Government going to do to ensure Companies don’t manipulate their turnover to ensure they qualify?

The ATO will provide guidance to help businesses self-assess their eligibility. This will include for circumstances that do not fit neatly into more general circumstances that the majority of businesses are in.

The Government will include appropriate integrity rules to prevent employers from entering into artificial schemes in order to get inappropriate access to payments.

There are serious consequences, including large penalties and possible imprisonment, for those trying to illegally get benefits under the scheme.

Under the JobKeeper Payment, businesses impacted by the Coronavirus will be able to access a subsidy from the government to continue paying their employees. Affected employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

Am I eligible for the JobKeeper Payments?

Eligible employers

Employers will be eligible for the subsidy if:

- their turnover has or will be reduced by more than 30 per cent relative to a comparable period a year ago (of at least a month); or

- The employer must have been in an employment relationship with eligible employees as at 1 March 2020, and confirm that each eligible employee is currently engaged in order to receive JobKeeper Payments.

- Not-for-profit entities (including charities) and self-employed individuals (businesses without employees) that meet the turnover tests that apply for businesses are eligible to apply for JobKeeper Payments.

Eligible employees

Eligible employees are employees who:

- are currently employed by the eligible employer (including those stood down or re-hired);

- were employed by the employer at 1 March 2020;

- are full-time, part-time, or long-term casuals (a casual employed on a regular basis for longer than 12 months as at 1 March 2020);

- are at least 16 years of age;

- are an Australian citizen, the holder of a permanent visa, a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder; and

- are not in receipt of a JobKeeper Payment from another employer.

If your employees receive the JobKeeper Payment, this may affect their eligibility for payments from Services Australia as they must report their JobKeeper Payment as income.

How do I measure my percentage decline in turnover?

- Ensure you have an accurate record of your revenue for the 2018-19 income year and for the 2019-20 year to date

- Ensure you keep an accurate record of revenue from March 2020 onwards

- Compare your revenue for the whole of March 2019 with the whole of March 2020

- Measure the % decline in your revenue and ensure it has declined by more than 30%

- If you are not eligible in March, you may become eligible in another month

What do I have to do to get the JobKeeper Payments?

Initially, employers can register their interest in applying for the JobKeeper Payment here from 30 March 2020.

Subsequently, eligible employers will be able to apply for the scheme by means of an online application.

How much are the JobKeeper Payments?

For each eligible employee the employer will receive $1,500 per fortnight per employee for a maximum period of 6 months. The employer must pass the full amount of the JobKeeper payment on to the employee.

For employees that were already receiving $1,500 per fortnight before tax from their employer as wages then their income will not change. For employees that have been receiving less than $1,500 per fortnight, the employer will need to top up the payment to the employee up to $1,500, before tax. For those employees earning more than this amount, the employer is able to provide them with a top-up to their normal salary.

Do I still have to pay super and if so, on which amount?

Yes, the business is still required to pay superannuation guarantee on the amount of the employee’s normal wage. If the employee earned under the $1,500 per fortnight, then it will be up to the employer if they want to pay superannuation on any additional wage paid over and above their normal wage because of the JobKeeper Payment.

When will I start to receive the money?

The payments will be calculated from 30 March 2020, with the first payment to be received by employers from the ATO in the first week of May and will continue to be received monthly in arrears.

Eligible employers will need to identify eligible employees for JobKeeper Payments and must provide monthly updates to the ATO (via Single Touch Payroll) to confirm their continued eligibility.

What if I am self-employed?

Businesses without employees, such as the self-employed can still register, they will need to provide an ABN for their business, nominate an individual to receive the payment and provide that individual’s Tax File Number and provide a declaration as to recent business activity.

People who are self-employed will need to provide a monthly update to the ATO to declare their continued eligibility for the payments. Payment will be made monthly to the individual’s bank account.

Further details will be provided on the ATO website when it becomes available.

Read more on the Treasury fact sheet here.

See the latest updates on COVID-19 and how it may affect you here.

The laws setting out the Federal Government’s response to Coronavirus were introduced into Parliament on 23 March 2020, the bill has now been passed by both just awaiting royal assent, with one measure being the cash flow boost for eligible employers who may receive up to $100,000 tax-free.

Am I eligible for the cash flow boost?

A business (including a charity or not-for-profit) will be eligible for the cash flow boost if it meets the following conditions.

- The business must make a payment that is subject to the withholding tax provisions – the most common example will be payments of salary or wages.

- The business must be one of the following:

(a) a small business entity – which generally means carrying on business in the relevant income year and with an aggregated turnover of less than $10 million

(b) a medium business entity – which generally means carrying on business in the relevant income year and with aggregated turnover of less than $50 million

(c) a charity or other not-for-profit entity of an equivalent size. The legislation tests turnover for the most recent income year that the business has received an income tax notice of assessment.

If this is not possible, which may be relevant for charities and other entities that are exempt from income tax, the alternative is for the Commissioner to be satisfied that there is a reasonable possibility the business will meet the criteria for the relevant income year (either the 2020 income year or the 2021 income year).

- The business must have notified the Commissioner of the payment that was subject to withholding tax in the approved form. This will usually be done by lodging the relevant Business Activity Statement (BAS).

- The payment must relate to either:

(a) for monthly withholders – the months of March 2020, April 2020, May 2020 or June 2020

(b) for quarterly withholders – the quarters ending March 2020 or June 2020.

- The business must have held an ABN on 12 March 2020. This is not relevant for charities.

- The business must have either:

(a) derived assessable income from carrying on a business in the 2019 income year

(b) made supplies in the course of carrying on its enterprise within Australia after 1 July 2018 and before 12 March 2020.

What if the business has not historically paid salary or wages?

We have received good questions about helping clients access the boosts – in some cases where the client has not made payments subject to withholding. This may be because the owners have historically taken dividends or drawings.

The legislation contains integrity rules that prevent businesses from trying to manoeuvre into the eligibility conditions.

One condition for getting the boosts is that the client (and their agents and associates) did not enter into an arrangement for the sole or dominant purpose of getting the boosts, or getting increased boosts.

We will update this article if we receive any guidance as to whether switching from drawings/ dividends to salary, for example, when all of the other conditions are satisfied, will trigger the anti-avoidance provisions.

What do I have to do to get the cash flow boost?

Businesses will need to lodge their BASs showing the payments that are subject to withholding.

If the business is a charity or not-for-profit with no income tax notices of assessment, it will need to notify the Commissioner that it should satisfy the small to medium business entity requirement.

How much are the cash flow boosts?

There are two cash flow boosts. The minimum amount for each cash flow boost is $10,000 – so $20,000 in total. The maximum cap for each cash flow boost is $50,000 – so $100,000 in total.

Subject to the minimum amount and maximum cap, the cash flow boost is 100% of the amount that has been withheld for the period.

However, if the payment is for the month (not quarter) of March 2020, the cash flow boost is 300% of the amount that has been withheld. This means there is no difference between monthly and quarterly reporting.

How do I get the first cash flow boost?

The tax-free payment will broadly be calculated and paid by the ATO as an automatic credit to an employer, upon the lodgment of activity statements from 28 April 2020, with any resulting refund being paid to the employer. This means that:

- – quarterly lodgers will be eligible to receive the payment for the quarters ending March 2020 and June 2020; and

- – monthly lodgers will be eligible to receive the payment for the March 2020, April 2020, May 2020 and June 2020 lodgments. However, the payment for the March 2020 activity statement will be calculated as being three times the actual amount withheld.

Note that, the minimum payment of $10,000 will be applied to an entity’s first activity statement lodgment (whether for the month of March or the March quarter) from 28 April 2020.

How do I get the second cash flow boost?

The second cash flow boost is the same amount as the first cash flow boost. There are further eligibility conditions, but most will be satisfied if the business remains in business.

For employers that continue to be active, an additional (tax-free) payment will be available in respect of the June to October 2020 period, basically as follows:

- – Quarterly lodgers will be eligible to receive the additional payment for the quarters ending June 2020 and September 2020, with each payment being equal to 50% of their total initial (or Stage 1) payment (up to a maximum of $50,000).

- – Monthly lodgers will be eligible to receive the additional payment for the June 2020, July 2020, August 2020 and September 2020 activity statement lodgements, with each additional payment being equal to a 25% of their total initial (or Stage 1) payment (up to a maximum of $50,000).

The ATO will automatically calculate and pay the additional (tax-free) payment as a credit to an employer upon the lodgement of their activity statements from July 2020, with any resulting refund being paid to the employer.

If you have any questions, please contact a member of our team to discuss.

See more on the ATO Website here regarding boosting cash flow for businesses.

See the latest updates on COVID-19 and how it may affect you here.

The ATO has set out ways it can help taxpayers deal with COVID-19. This is not to be confused with the Federal or State Government’s stimulus packages. Taxpayers will have to apply to the ATO for tax relief.

What types of relief are available from the ATO?

The ATO has provided the following options as possible ways to obtain tax relief.

- The ATO may allow payments for income tax, GST, PAYG instalments, FBT and excise to be deferred – for up to six months.

- Taxpayers may get quicker access to GST refunds by changing from quarterly to monthly reporting. If a change is made now, the first monthly tax period will be the one starting on 1 April 2020.

Changing reporting periods has other consequences – if taxpayers are considering changing before 1 April 2020, please check that these other consequences are acceptable before changing.

- Taxpayers can vary their quarterly PAYG instalment for the March 2020 quarter. The ATO says it will not apply penalties or charge interest to varied instalments for the 2020 income year.

- The ATO may remit interest and penalties incurred after 23 January 2020.

- The ATO may be prepared to enter into ‘low interest’ payment plans.

Taxpayers who are employers need to continue to meet their compulsory superannuation obligations. The ATO does not have the power to defer or vary any superannuation contribution dates and cannot waive the superannuation guarantee charge.

How to apply to the ATO?

Taxpayers will need to apply to the ATO for relief. We expect the ATO will be willing to help taxpayers affected by COVID-19 as much as possible. However, it will be important to explain to the ATO how COVID-19 is affecting the business, and how the relief that is being asked for will help.

Please contact a member of our team if you would like any assistance.

Support if you are experiencing difficulties.

See the latest updates on COVID-19 and how it may affect you here.

On Friday, 20 March 2020, the ACT government announced a series of measures which will provide businesses with rebates and waivers to combat the global pandemic downturn.

These measures include a waiver of payroll tax for businesses in hospitality, creative arts and entertainment industries. Also, deferrals will be available for all other small and medium-sized businesses.

Small business will also receive a $750 rebate on their next power bill. Businesses will also be entitled to a credit on commercial rates of $2,622.

Payroll tax deferral

All ACT businesses with Group Australia-wide wages of up to $10 million can defer their 2020-21 payroll tax, interest free until 1 July 2022. These rebates and waivers will provide relief for COVID-19 affected businesses in ACT. Businesses will need to complete a simple online application form (which will be available soon on the ACT Revenue Office website at: www.revenue.act.gov.au) to confirm their eligibility.

Eligible businesses will need to lodge their payroll tax returns as normal but will not be required to make the associated payment at the usual time. If the deferred amount is paid before 1 July 2022, no interest will be charged. Interest will be applied to any outstanding deferred amounts from 1 July 2022.

- – For those who lodge their payroll tax assessment monthly, deferral can commence for their July 2020 payroll tax liability, which is usually payable by 7 August.

- – For those who lodge their payroll tax assessment annually, they can defer payment of their full 2020-21 payroll tax liability, which is usually payable in July 2021.

Six month waiver of payroll tax

Hospitality (cafes, pubs, hotels, clubs and restaurants), creative arts and entertainment industries will receive a one-off, six-month waiver of payroll tax from April to September 2020.

Businesses will need to complete a simple online application form to confirm their eligibility by visiting the ACT Revenue Office website (available soon) at: www.revenue.act.gov.au

For those who lodge their payroll tax assessment monthly, the first credit will be applied to the April payroll tax liability, which is usually payable by 7 May.

For those who lodge their payroll tax assessment annually, the credit will be applied to their account when their assessment is received at the end of the 2019-20 financial year.

More here:

https://apps.treasury.act.gov.au/budget/covid-19-economic-survival-package/local-business-and-industry

See the latest updates on COVID-19 and how it may affect you here.

Recently, the Tasmanian state government announced stimulus measures designed to assist businesses in crucial state-based industries who could be decimated by the COVID-19 pandemic.

These measures include interest-free loans, waived payroll tax liabilities and incentives to hire a new staff member.

Specifically, businesses in hospitality, tourism, seafood production and export sectors are directly targeted. Also, any other small business who is directly affected due to COVID-19 will get some payroll tax support.

Details:

Interest Free Business Loans for Small Business | Tasmania COVID-19 stimulus package

- – $20 million in loans to small businesses in the hospitality, tourism, seafood production, and exports sectors. The loans will be available to businesses with a turnover of less than $5 million to purchase equipment or restructuring business operations and will be interest free, for three years.

Payroll Tax Waivers Reduction | Tasmania COVID-19 stimulus package

- – Payroll tax liabilities will be waived for hospitality, tourism and seafood industry businesses for the last four months of 2019-20.

- – Other businesses with payrolls of up to $5 million will be able to apply, based on the impact of virus, to have their payroll tax waived for April to June 2020.

Improving Small Business Cash Flows |Tasmania COVID-19 stimulus package

- – To assist with small business cash flow, the Tasmanian Government will:

- – Pay bills sooner: unless otherwise required by contractual arrangements, payment terms by Government agencies will be reduced from 30 days to 14 days; and

- – Give small businesses more time to pay their bills: unless otherwise required by contractual arrangements, small businesses will be provided extended payment terms to Government from 30 days to 90 days.

Targeted Small Business Grants Program for Apprenticeships and Traineeships | Tasmania COVID-19 stimulus package

- – The targeted Small Business Grants Program provides a $5,000 grant for businesses that hire an apprentice or trainee in the tourism, hospitality, building and construction, and manufacturing industries. Funding for this measure has been brought forward.

Youth Employment Scheme | Tasmania COVID-19 stimulus package

- – The Scheme provides a payroll tax rebate for one year, to businesses that employ a young person aged 24 and under, between April and December 2020. Human Resource and Industrial Relations Assistance

- – $80,000 will be provided to the Tasmanian Chamber of Commerce and Industry (TCCI) to provide Human Resources and Industrial Relations assistance associated with the coronavirus to businesses.

Government Maintenance Program | Tasmania COVID-19 stimulus package

- – $50 million allocated to fast track maintenance on public buildings over the next 12 months. This will provide an injection into local trades around the state and continue to support confidence in local communities.

See the latest updates on COVID-19 and how it may affect you here.

WA Payroll tax COVID-19: A range of payroll tax stimulus measures are being implemented in Western Australia to assist business with cash flow issues resulting from COVID-19.

In particular, certain businesses in WA will receive grants, while others will be allowed to defer payments of payroll tax for months.

Also, the future uplift of payroll tax thresholds will be brought forward to assist some businesses with their future obligations.

- – Small businesses that pay payroll tax will receive a one-off grant of $17,500

- – $1 million payroll tax threshold brought forward by six months to July 1, 2020

- – Businesses impacted by COVID-19 can defer payroll tax payments until July 21, 2020

Read more:

https://www.mediastatements.wa.gov.au/Pages/McGowan/2020/03/COVID-19-economic-response-Relief-for-businesses-and-households.aspx

See the latest updates on COVID-19 and how it may affect you here.