Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

For 23 years Dalbar Inc, the United States leading financial services research firm, has published it’s annual, Quantitative Analysis of Investor Behavior (QAIB) study.

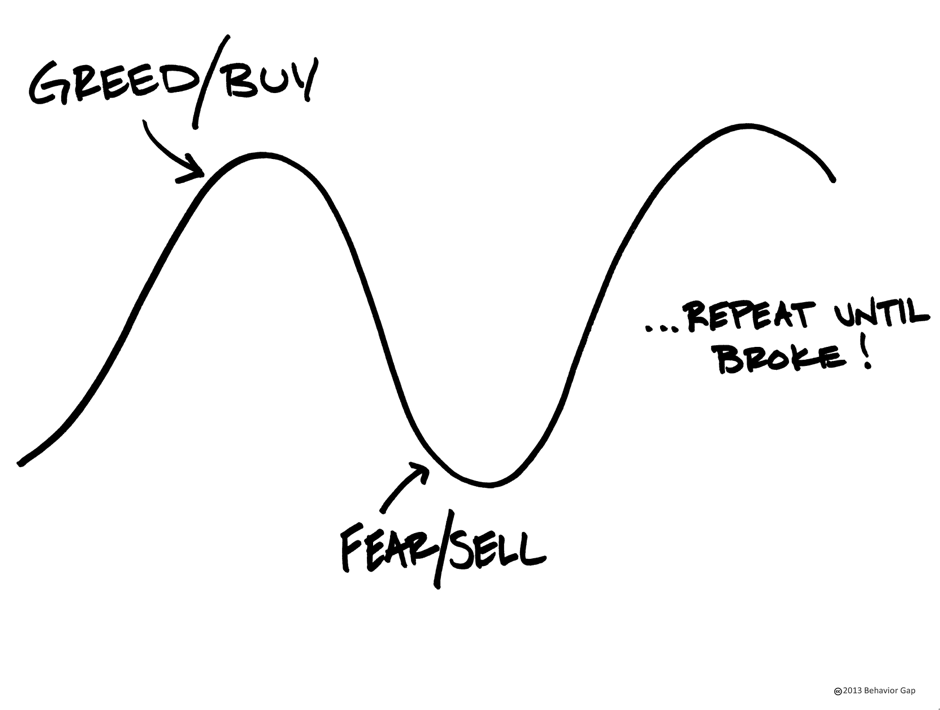

The QAIB has been measuring the effects of investor decisions to buy, sell and switch into and out of United States mutual funds over both short and long-term time frames. The results have consistently shown that the average investor earns less and in many cases, much less than the mutual fund performance reports would suggest. The most recent study released for the calendar year to 31 December 2016, showed that the average investor is still their own worst enemy when it comes to investing. The study showed just how poorly investors perform relative to market benchmarks over time and the reasons for that underperformance.

The most recent QAIB study conducted in the United States by Dalbar Research (Boston, MA.), found that for the 2016 calendar year:

- The average US investor made a return in equity funds of 7.26% while the US share index, the S&P 500, returned 11.96%. An underperformance of 4.70%.

- In 2016, the 30-year annualised S&P 500 return was 10.16% while the 30-year annualised return for the average equity mutual fund investor was only 3.98%. An underperformance of 6.18% per annum.

So why is it that the average US investor made (4.70%) less than the market? Put simply, the differential was lost due to bad timing of transactions by the average US investor. Bad timing of transactions generally driven by decisions based on EMOTION. The emotions of FEAR OR GREED. This is truly wealth destroying behavior!! So if investing success is about BEHAVIOR and not skill, then what does that mean to you? It means that emotion plays a huge role in the financial decisions you make.

EMOTION is so important, it can determine your success or failure as an investor. But the great news is that unlike the MARKET, your BEHAVIOR is something you can control!!

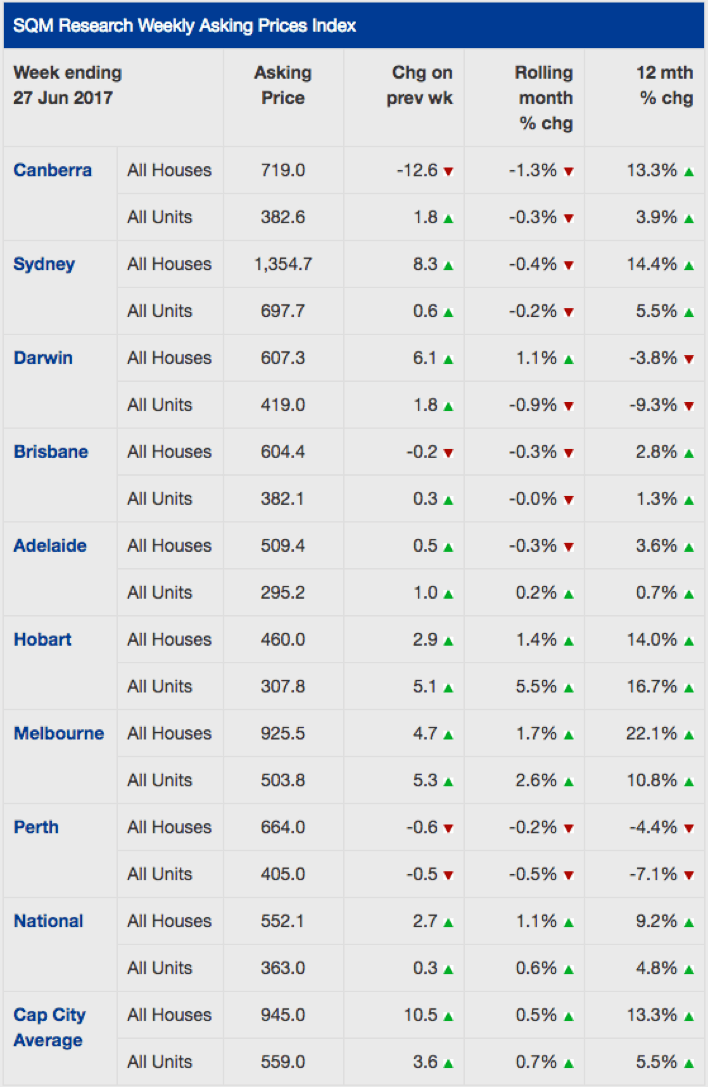

The property market, you will probably know that we don’t often comment on residential property. Due to it being such a heterogeneous asset class (the opposite to homogenous) there are pockets performing differently everywhere. However, given that most of us will have some exposure, we have included some observations from SQM Research to update you on the broader market.

Source: SQM Research

Perth and Darwin prices are the only ones showing year on year falls. We recall only 2 years ago being offered apartments in booming Darwin to ‘sell’ to our clients. Our scepticism and avoidance of conflicts of interest kept us well away from that disaster.

Over the month of June, Sydney prices are showing a small decline, though year on year was strong. Melbourne too was a standout, with even bigger gains than Sydney. Hobart off a low base showed strong gains as well.

While we are not local market experts in each suburb, we do caution that a lot of those rises have come from availability of credit, and ultra-low interest rates. With the APRA edict to limit interest only loans, the banks are taking the opportunity to re-price those loans to a much higher level. If they execute that well, then there will be extra profits for the banks, and not too much pain for residential investors. We hope!

After a big sell-off in May, (-4.01%) the S&P/ASX200 Accumulation index managed a small gain of 0.17% for the month of June.

That was better though than Global markets, where the MSCI World index (in Aust Dollars) lost 2.54% for the month.

Bond markets sold off during June as interest rates rose, and the A-REIT sector (real-estate trusts) also had a fall, losing 4.51% over the month.

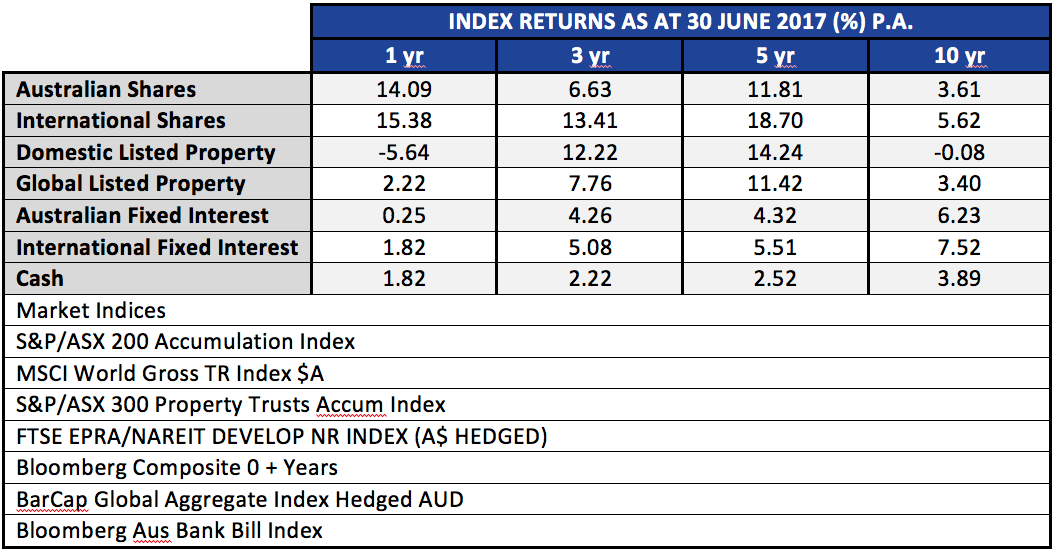

In spite of those falls, stepping back a bit to look at the whole year shows a much brighter picture of returns. The table below looks at the major liquid asset classes over the last ten years.

There are a few notable points here. The one, three and five year returns for Australian and International shares have been very positive overall. Yet, when looking at the 10 year numbers, the returns from those assets are below the Fixed Interest returns. And, when looking at fixed income returns we see that the returns this year have been low, lower in fact than a simple ‘buy term deposits’ strategy. Clearly timing is important, yet we are often told that ‘market timing’ is a fool’s errand. That debate is for another day, but we make the point that a thinking person needs to be able to bring into perspective the nuances of different rolling time frames.

As we now know from history, October/November 2007 was the peak of markets pre GFC. Markets all bottomed in about March 2009. These ten year numbers in the table above look sick now, but 18 months from now, they will start to look fantastic as we roll off the prior periods, and have a starting point that is very favourable.

But we must beware of extrapolating with no reasonable basis. Those five year numbers for the shares and property are unlikely to be repeated in the next five years. The temptation for in-experienced investors is to chase last year’s winner. Invariably rotation happens within markets.

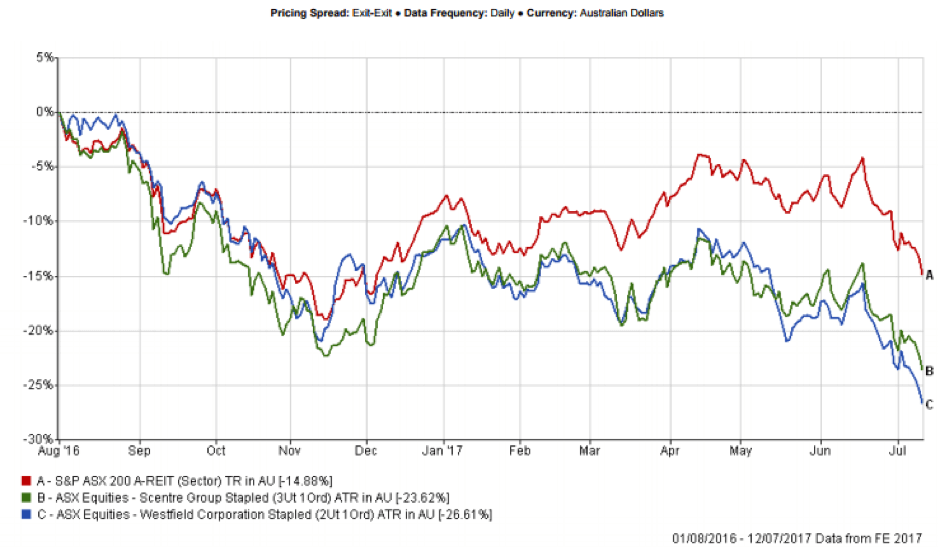

What piques our interest is that which is out of favour. And the A-REIT market falls into that camp being 11 months into a correction. Our general view last year was that it was hard to find compelling value in the sector. As a result our exposures have been relatively low. From 1 August to 12 July the A-REIT sector has declined 14.88%. Those kind of moves get us interested. Former market darling Westfield with global assets and Scentre Group holding the Australian Westfield centres, has been taken a big hit, down around 25% since the peak back in August 2016.

Make no mistake, Amazon will not kill the retail mall. And as the saying attributed to various wise men from King Solomon to Abraham Lincoln goes, “This too shall pass”!

Capital gains withholding, a new threshold

From 1 July 2017, where a foreign resident disposes of Australian real property with a market value of $750,000 or above, the purchaser will be required to withhold 12.5% of the purchase price and pay it to the ATO unless the seller provides a variation (this is referred to as ‘foreign resident capital gains withholding’).

However, Australian resident vendors who dispose of Australian real property with a market value of $750,000 or above will need to apply for a clearance certificate from the ATO to ensure amounts are not withheld from their sale proceeds.

Therefore, all transactions involving real property with a market value of $750,000 or above will need the vendor and purchaser to consider if a clearance certificate is required.

The following is from the ATO’s website:

- Australian resident vendors can avoid the 12.5% withholding by providing one of the following to the purchaser prior to settlement:

- for Australian real property, a clearance certificate obtained from the ATO

- for other asset types, a vendor declaration they are not a foreign resident.

- Foreign resident vendors may apply for a variation of the withholding rate or make a declaration that a membership interest is not an indirect Australian real property interest and therefore not subject to withholding.

- Purchasers must pay the amount withheld at settlement to the Commissioner of Taxation.

Bitcoin, Bitcoin, Bitcoin. The chant grew louder with every passing day!

Anyone who follows me on Twitter @marks_thinking will have seen my occasional tweets on Bitcoin and the closely related crypto currency called Ethereum or Ether. Now call me a dinosaur, but when I was a boy, ether came in a spray can and we used to help start old diesel engines on a cold frosty morning.

OK, so I might not be up with all the latest Bitcoin mining techniques, but I have been around through a few financial bubbles, studied many of the past financial bubbles and given enough advice to know about human nature.

That experience tells me that people are going to get hurt.

Why?

Let’s circle back to what Bitcoin claims to be. It is a crypto currency. Put simply it is another form of payment system, but instead of being able to be converted into secure bank notes, its allure is that it can be transmitted from person to person using a globally distributed ledger. Just as a bank has a ‘ledger’ to track who has cash on deposit and who owes the bank money, this global ledger does the same for Bitcoin. The difference is that no single bank or organisation ‘owns’ the Bitcoin ledger. The ledger is also referred to as a ‘blockchain’ system. The globally distributed ‘ledger’ is what enables anonymity of transactions using Bitcoin.

That last factor makes Bitcoin incredibly useful if you don’t want your transactions traced! Handy if you are dealing in drugs, arms or any other weird stuff that is usually outlawed. Perversely, in spite of toughening identity checks that banks are now required to do, the Federal Government just made it easier to deal in crypto currencies by announcing in the Federal Budget that from July 1, investors buying cryptocurrencies would no longer be paying GST on their initial purchase. Talk about double standards! Sorry, I digress.

So, let’s come back to the principal purpose of any currency. It is a means of exchanging labour for goods and a means of storing past labours for an indefinite time until we want to again convert that labour into current goods. One would assume therefore that there should be a stable relationship between the labour and the currency. Our Australian dollar does that fairly well. If we get $25 for an hour’s work, we know that we can buy five coffees or a kilo of average steak and so on. Of course when our buying power increases we are happy, not so much a decrease.

So how does Bitcoin stack up on terms of stability?

Well, had you taken all your salary as Bitcoin during 2016 you might be pretty happy today.

The chart below shows the explosive rise of Bitcoin since then.

Bitcoin’s absolute high (so far) was $3,003 USD per coin, back in early June. However, since then it has declined to $2,516 or a 16.2% decline in about a month. That hardly seems like a stable store of value. Back in 2013/14 Bitcoin halved in value following a series of exchange blow-ups. Again, not a very useful store of value. That could easily happen again!

In addition, the architecture of Bitcoin means it is on a slow road to gradual extinction. With a maximum of 21,000,000 Bitcoins can ever be created thanks to the way it was originally conceived. When that ceiling is met, the only reward to the participants who use huge amounts of computing power to maintain the ledgers will be transaction fees. Sometime before then Bitcoin will go into a death spiral as owners try to exchange into other crypto currencies, or heaven forbid, real assets.

However, with limited supply Bitcoin may still increase in value if the ‘value’ placed on anonymity increases. We cannot know for sure. While I have a healthy mistrust of Central Bankers, and banks in general, I trust them more than I to the shadowy geeks in dark rooms that control today’s crypto currencies.

Apart from speculative value as a trading item, (as you might trade tulip bulbs) I view Bitcoin as the principal currency of those who need their transactions to be absolutely secret and un-traceable.

Having said that, currencies like Bitcoin and Ethereum have contributed greatly to the advancements in using ‘blockchain’ or de-centralised ledgers to track ownership of assets. I think we will see huge changes to banking systems using this technology in coming years.

But for now, I’m old fashioned, drug free, don’t carry no illegal firearms, and I don’t need no crypto-currency.

Up until 30 June 2017, an individual (mainly those who are self-employed) could claim a deduction for personal super contributions where they meet certain conditions. One of these conditions is that less than 10% of their income is from salary and wages. This was known as the “10% test”.

From 1 July 2017, the 10% test has been removed. This means most people under 75 years old will be able to claim a tax deduction for personal super contributions (including those aged 65 to 74 who meet the work test).

Editor: Call our office if you need assistance in relation to the application of the work test for a client that is aged 65 to 74.

Eligibility rules

An individual can claim a deduction for personal super contributions made on or after 1 July 2017 if:

- A contribution is made to a complying super fund or a retirement savings account that is not a Commonwealth public sector superannuation scheme in which an individual has a defined benefit interest or a Constitutionally Protected Fund;

- The age restrictions are met;

- The fund member notifies their fund in writing of the amount they intend to claim as a deduction; and

- The fund acknowledges the notice of intent to claim a deduction in writing.

Concessional contributions cap

Broadly speaking, contributions to super that are deductible to an employer or an individual, count towards an individual’s ‘concessional contributions cap’.

The contributions claimed by an individual as a deduction will count towards their concessional contributions cap, which for the year commencing 1 July 2017 is $25,000, regardless of age. If an individual’s cap is exceeded, they will have to pay extra tax.

Call our office to discuss the eligibility criteria and tax consequences of claiming a tax deduction for a personal contribution to super for the year commencing 1 July 2017.

Stock Markets

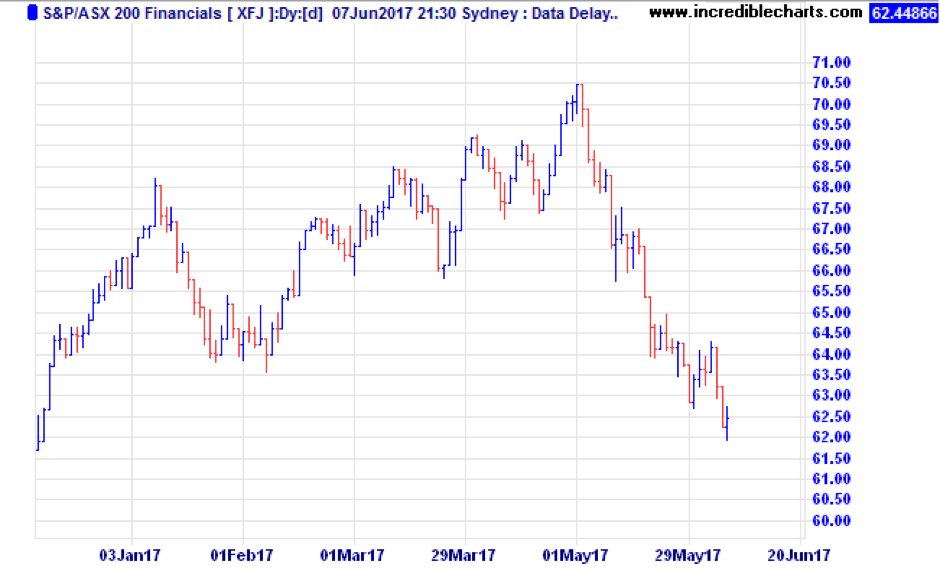

Our last update marked a short-term peak in the ASX200 which made a high at 5956 on May 1st. Since then, we had the release of the Federal Budget which was widely criticised as a ‘Labor lite’ budget, and plenty of international political events to keep us on edge.

The ASX200 was down 4.01% during May. The Financials index (XFJ) was down almost 10% as bank stocks were pummelled. All the talk of housing bubbles, the bank tax announced in the budget, and plummeting retail sales have finally converged to bring share prices down.

Offshore, however, the news was better. The S&P 500 index of US shares gained 1.1% in local currency terms, and converted to Australian dollars was up 1.87%.

The MSCI World index in AUD was up 2.68%, and the MSCI Emerging Markets gained 3.45%.

Europe was the big gainer, with that market up 5.31% in Australian dollar terms. It helped that the Australian dollar fell 2.8% against the Euro during the month.

The month of May was a great example of the benefits of portfolio diversification in action.

Commodities

As a country that makes most of our money digging holes and building houses, the commodity markets are very important. In terms of export dollars earned, the big ones are iron ore and coal. While not as important to the export earnings, oil certainly rates highly for the big Australian – BHP. Iron ore was down 15% over the month, to end at $57.90, while coal dropped 11.7% and oil was down 2%. The Materials stock sector held up remarkably well in the face of this, down less than 1%.

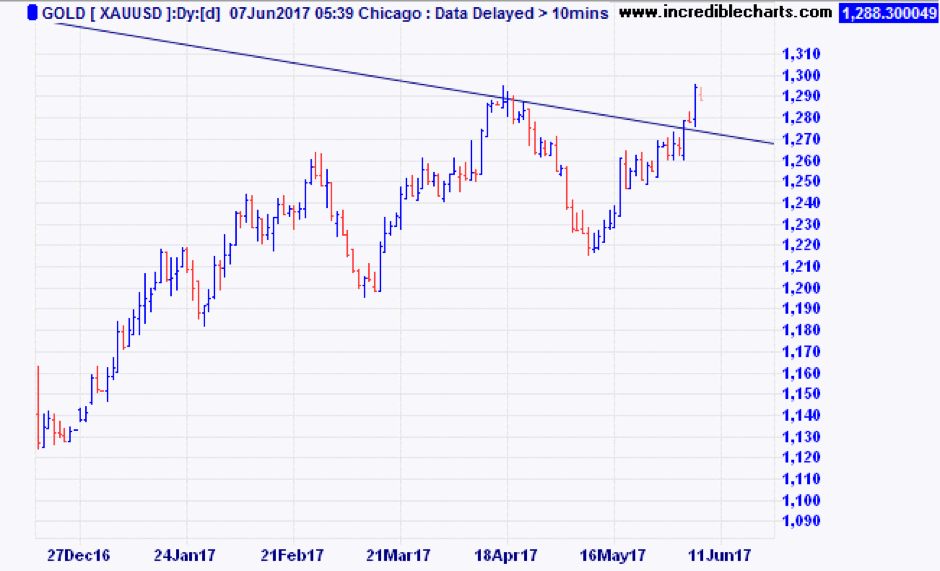

That other commodity we have in reasonable abundance, denounced by some as a ‘barbarous relic’ is gold. Gold is at an interesting juncture, as it has broken free of the recent correlation with such grubby commodities as iron, oil and coal, and has just broken above a downtrend line that goes back to the peak in September 2011 when gold peaked at $1,882 per ounce. Now, at $1,294, it is slowly grinding higher, helped by the fact that US interest rates look like they’re rising at a slower rate than previously expected.

If gold can sustain a rally into the $1,320 level, it will be looking good, and the next target to break would be $1,360.

Interest rates (updated to 7 June)

At the June meeting, the RBA decided to leave the cash rate at 1.50%, following the same decision in May. The decision was expected given underlying economic conditions still warrant an easy monetary policy.

Immediately post the announcement, equity markets had fallen (due to the RBA’s rather upbeat comments) whilst the Australian dollar was flat. The decision comes as no surprise, given we expect the RBA to be on hold this year and most of next year.

In spite of the RBA being on hold with interest rates, we do see banks becoming more selective in mortgage lending, and there is some risk of credit rationing in postcodes that are deemed high risk.

Comparing some of the rates from the big four lenders, owner-occupier loans seem to be mostly priced around 4.40% for variable rates less than 80% LVR, while investor loans are in the 4.80% to 5.20% range.

Borrowers should also be aware of APRA’s directive to the Australian banks to have less than 30% of new loans written as interest only and to keep below an overall 10% per annum growth in investor lending. If you want to get the inside story on the APRA directive, it is available here: APRA Sound Residential Lending Practices.

Despite the ongoing changes to super, it is still the best tax house to invest in.

Case study

Say you are in your mid-50s, earning $95,000 per year plus employer superannuation of $9,025, have a cash flow surplus of $10,000 a year and no debt.

Option A

You could invest the $10,000 in your own name and pay tax at 39% on the earnings.

OR

Option B

You could invest the $10,000 as a non-concessional superannuation contribution into your superannuation house, where the earnings will be taxed at 15%.

Now a new option

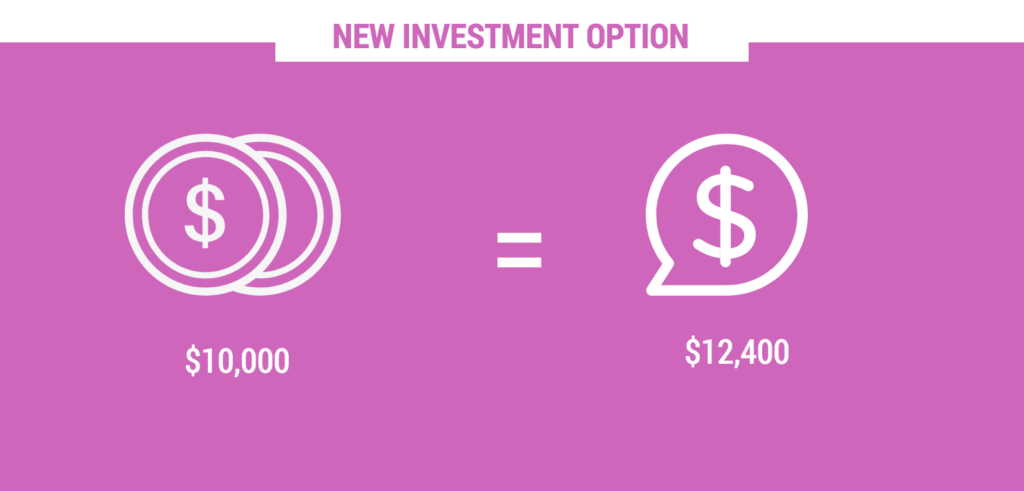

From 1 July 2017, you will have another option to invest the $10,000 as a concessional superannuation contribution in your superannuation house. You will lose $1,500 due to 15% contributions tax, but still have $8,500, invested in your superannuation house, where the earnings will be taxed at 15%.

Best of all, you get a tax deduction in your own name for the $10,000 you invested in your superannuation house, which will get you a tax refund of $3,900.

Say you are really smart and contribute your $3,900 tax refund as a non-concessional superannuation contribution into your superannuation house.

Your original $10,000 investment in your superannuation house, now becomes $12,400 in your superannuation house. This is a return of 24% in the first year!

Even with some changes in super legislation, it still seems to be a great investment option.

No doubt you have already heard about the introduction of a $1.6 million transfer balance cap from 1 July.

When most people see that figure, they think of the asset balance in their account based pensions.

But did you know that this ‘transfer balance cap’ also includes a notional value for every income stream you receive via the superannuation system?

This includes:

- lifetime pensions, including the majority of defined benefit pensions commenced at any time (eg. Commonwealth or State Government defined benefit pensions)

- Complying lifetime annuities

- Complying life expectancy annuities and pensions

- Term allocated annuities and pensions (ie Market linked pensions).

It is important to remember that if you have a defined benefit pension you may need specialist advice to ensure that your account based pension/s are reduced by enough to bring you under the cap.

Therefore, please contact us immediately if you have one of these income streams, and/or have one or more account based pensions totalling $1.6m or more in value, and would like us to review your situation.

After months of speculation as to what the Government is planning to implement in the 2017 Federal Budget, finally, the budget changes have been released to the public. Implementation of changes is soon to commence.

There are certainly some “winners” and “losers” but overall, the aim of the budget is to positively impact our economy. And with a thriving economy, all Australians are winners.

As a millennial, my biggest focus around the budget is; housing affordability and student debt. So, let’s focus on these points.

First Home Buyers

There had been speculation over the previous months that the government was going to allow first home buyers access to their superannuation savings to fund their house deposit. Personally, I was horrified to hear this was a serious consideration. Such a scheme would influence further implications and retirement unaffordability issues down the track. Pleasing to hear, this scheme was dismissed.

The “First Home Super Savers Scheme” is being implemented from 1 July 2017. This effectively allows individuals to salary sacrifice savings towards a house deposit into their super. By salary sacrificing, a tax advantage is applied as these contributions are considered concessional contributions (pre-tax). Therefore, salary sacrificed contributions and earnings in super are taxed at 15% rather than the marginal tax rate.

Only the contributions to the First Home Savers Scheme will be available to withdraw for first home deposits. Until a condition of release is met, no other superannuation savings are accessible. If you do not end up purchasing a home, these additional contributions will not be accessible until retirement or a condition of release has been met.

It is important to note; the First Home Super Savers Scheme is capped at $30,000. However, as previously mentioned, these contributions are classified as concessional contributions which oblige to the annual cap of $25,000. Noting also that your Superannuation Guarantee Contributions also fall under this cap, you are limited to contributing a maximum of $15,000 (without exceeding the $25,000 cap) into the First Home Super Savers Scheme per annum.

15% tax is applied on each contribution into your First Home Super Savers Scheme account. For example, let’s say you contribute $10,000 in a financial year, only $8,500 hits your first home savers account as $1,500 of the contribution is paid in tax. As a comparison, let’s say you fit into the 34.5% tax bracket and decide to place this $10,000 pre-tax money into a bank account outside of super. This means you will pay $3,450 in tax opposed to $1,500.

Withdrawal of these contributions will be accessible by 1 July 2018 and will be calculated using a deemed rate of return. Upon withdrawal, the value of your savings will be added to your assessable income with a tax rebate of 30%. Therefore, if we use the same example above and assume with the withdrawal added to your assessable income that you remain in the 34.5% tax bracket, you will be liable to pay a further 4.5% tax on the withdrawal of your savings. It feels a bit like the government is double dipping here… nonetheless, it’s still a great tax saving strategy. For a detailed example of how the deemed rate and tax rebate is calculated, refer to Mark Beveridge’s blog.

Although the First Home Super Savers Scheme is capped at only $30,000, I think it’s a great opportunity to start saving. The government has provided a handy estimator tool to calculate the difference in savings when using the First Home Super Savers Scheme verses saving in a standard deposit account outside of super.

Investment Properties

Good news for some property investors! In a bid to make housing more affordable and appealing to Australian investors, the Capital Gains Tax (CGT) discount has increased from 50% to 60%. To be eligible for the 60% CGT discount, the residential property must;

- Be rented to low to moderate income tenants

- Be rented at a discounted rate

- Be managed through a registered community housing provider, and

- Held for a 3-year minimum.

During periods where the property is not used for affordable housing purposes, the additional discount will be pro-rated.

Unfortunately for property investors, reductions and eliminations of certain claimable tax deductions will be implemented. These changes affect previously claimable travel expenses and property plant and equipment depreciation deductions.

Not so great news for foreign property investors, but good news again for Australian investors as these new changes will provide Australians with increased opportunity to invest. Foreign ownership will be restricted to 50% in new property developments. They will also be liable to a minimum $5,000 annual levy if their properties are found to be unoccupied or not genuinely available to rent for at least 6 months per annum.

CGT main residence exemption will also no longer be available for foreign property owners. However, a grandfathering rule for the exemption will be implemented for existing owners up until 30 June 2019.

Foreign tax residents will also see the CGT withholding rate increased from 10% to 12.5% and the property value threshold will reduce from $2 million to $750,000 from 1 July 2017.

Student Loans

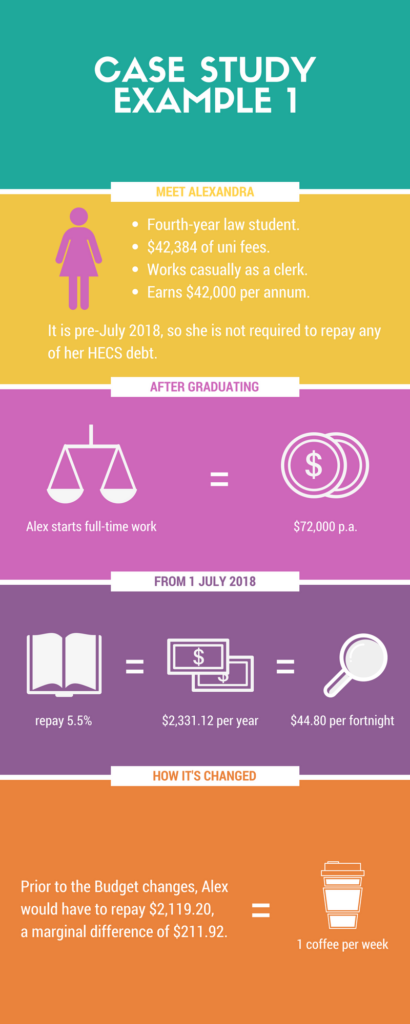

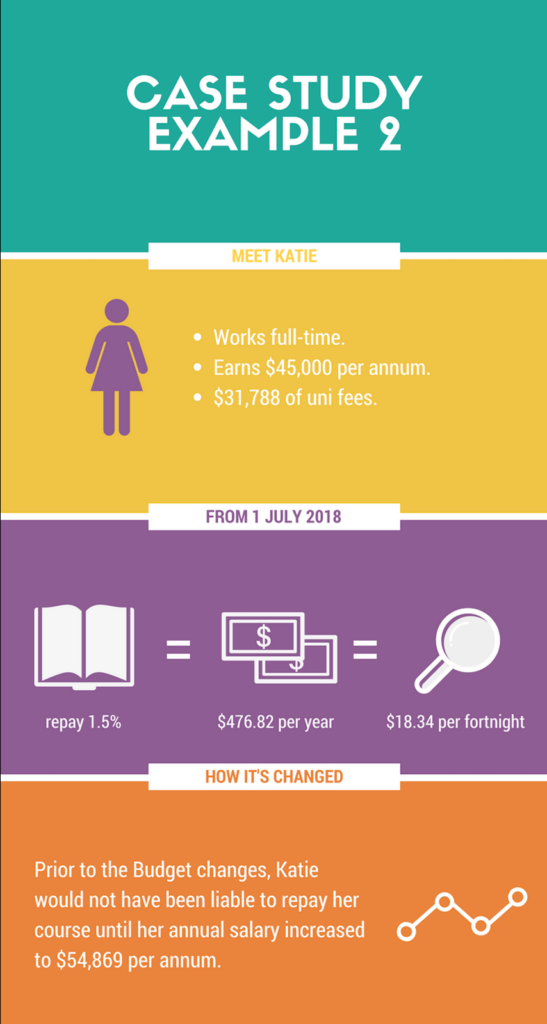

Bad luck for students. It seems to be getting progressively harder to afford study. Not only are university fees increasing, but the minimum income threshold to repay your HECS or HELP debt is now reduced to $42,000 per annum from $54,869 per annum.

Combine that with the average four-year course increasing in fees by approximately $2,200 to $3,600, it’s a scary outlook for existing and future students.

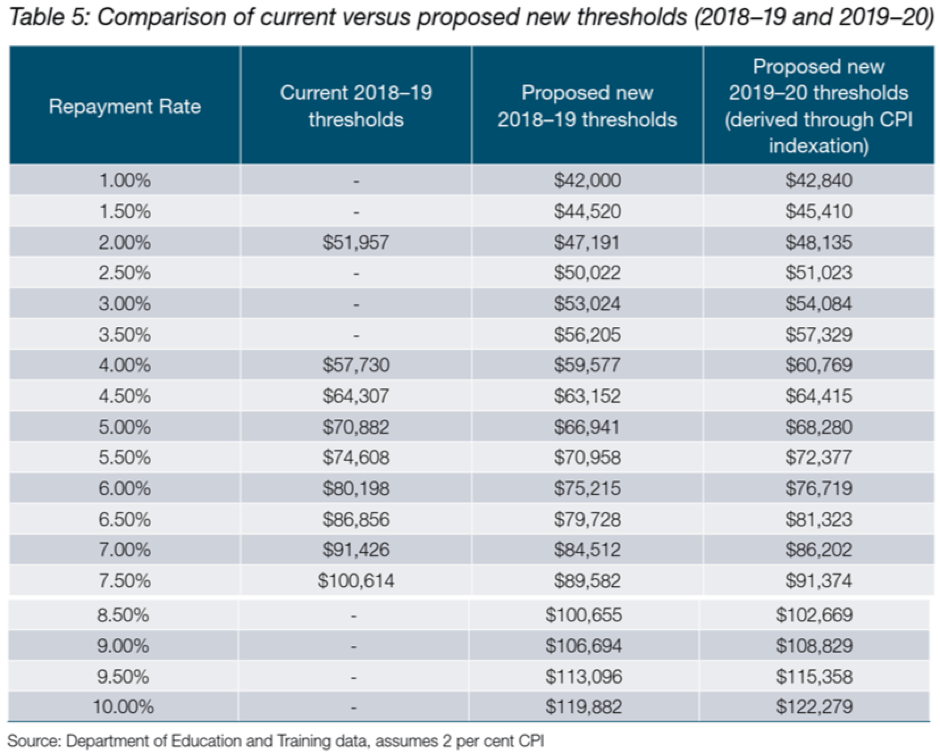

However, we can catch our breath (just a little). It’s not as bad as it sounds. Previously, once the threshold of $54,869 was reached, 4% of the course repayment was due payable. With the new minimum threshold reduction, only 1% is payable with annual income of $42,000. Once your salary reaches approximately $53,000 to $56,000, which is around the old threshold, you will be repaying between 3% and 3.5%.

Let’s do a case study or two to delve into this a little deeper.

It’s important to remember that although there is no interest accumulating on these student loans, they do increase with CPI (Consumer Price Index).

The increase in university fees and reduction in the repayment threshold isn’t the outcome any student was hoping for. But, as detailed in our first case study, the difference is about two cups of coffee (if that!) each fortnight. We will prevail!

Refer to the Department of Education’s comparison table below for more information;

Current 2016-17 Repayment Income Thresholds and Rates:

| Repayment Income | Rate |

| Below $54,868 | NIL |

| $54,869 to $61,119 | 4.00% |

| $61,120 to $67,368 | 4.50% |

| $67,369 to $70,909 | 5.00% |

| $70,910 to $76,222 | 5.50% |

| $76,223 to $82,550 | 6.00% |

| $82,551 to $86,894 | 6.50% |

| $86,895 to $95,626 | 7.00% |

| $95,627 to $101,899 | 7.50% |

| $101,900 and above | 8.00% |

These changes are yet to be legislated, but if you would like to start planning or find out how it will affect you personally, call Quill today.

House Sale Proceeds for Over 65s

Let’s briefly touch base on this also, as you can pass on your knowledge to a family member which this may apply to. Previously, a person aged over 65 was unable to make any super contributions unless they were ‘gainfully employed’ and age 75 was the absolute cut-off age, even if they continued to work. However, with these new budget changes, individuals over age 65 can contribute up to $300,000 of their family home sale proceeds into their superannuation. However, conditions apply as they must have owned the family home for a minimum of 10 years. Fortunately, this type of contribution is not subject to the new $1.6 million superannuation caps.

There are also Centrelink implications to consider for those receiving a part pension under the assets test. If they sell down their home and contribute the funds into their super or retain it outside of super, they could see a reduction or elimination of their part pension. If this could affect someone you know, they can contact Quill to discuss their circumstances.