Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Ever since I was quite young, I have been enamoured with the idea of scoring the best deal. I have been obsessed with this idea of getting the best bang for my buck. Some have called me frugal at times, and yet I still stand by my thriving ability that has allowed me to save thousands of dollars by utilising sales, shopping around and keeping my eyes peeled for opportunities.

From the age of six, I can recall waking at the crack of dawn to accompany my father to garage sales when we were on holidays in North Queensland. With dust covered hands, I would spend hours on a Saturday morning peeling through items big and small. I looked among their trash, and yet I was always able to find a treasure. “Beauty is in the eye of the beholder.” In a lot of ways, this framed my financial mindset growing up.

Benjamin Franklin once said, “A penny saved is a penny earned.” This is what I have lived by.

Maybe it’s the dream holiday for your family, a brand-new watch you’ve been hanging out for, or even a great deal on a new phone (iPhone X anyone?)—it’s such a rewarding feeling when you know you have saved money on something of value.

The truth is, we spend a lot of our time working hard to support our family and our lifestyle. Most people would agree that there is a certain beauty, and value to that.

It wasn’t until my early twenties when I realised that a lot of the ‘beauty’ and value that I had seen in my finances, had been placed in the material things or purchases in the present. Obviously, I valued my family and my lifestyle, however I operated my finances out of a tunnel vision mindset.

To reiterate: I learnt that as the beholder, I needed to place my value (the ‘beauty’) on not just the money I could save in the present on a deal, but what could I do to set myself up for the future.

Setting a Financial Planning Goal

To reference another supposed Benjamin Franklin quote, “If you fail to plan, you are planning to fail.”

I’m of the opinion that it’s never too early to start planning. And whilst I’m not personally earning high net wealth yet, I know there are things I can set in motion now to be future-aware.

Recently, our marketing manager Fabs and myself went along to Business Squared, and had the privilege of hearing four times best-selling author and digital influencer, Gary Vaynerchuk, speak. What was delivered with a humble self-confidence, were these words:

“We play the game where we want to achieve short-term success to impress others when we should be thinking long term.”

There is power in the plan! In addition to this, there is power in partnership. When you come to a humble understanding and seek the help you need to organise your finances, that’s where the beauty and value is. The value is in the long term, especially for those of high net wealth.

Reviewing your Goals

Having financial goals should be your first step, yet what should never leave your checklist is the task of reviewing your goals. Financial check-ups are the bumper rails on the alley of your life journey. It is impossible to separate your personal life from your finances; they go hand in hand.

Whether your goal is buying your first home or your sixth investment property, partnering with a trusted financial professional can be the key to a successful financial, and life journey.

Remember, today is the best day for you to take your finances by the reins. It’s never too late to make the decision to shape your future by shaping your today.

If reading this raised any questions for your finances – like it did for myself writing it! – then please feel free to get in contact with our team. Our financial planners are highly trained to develop the strategies that are about more than just investing money.

Money know-how can come from anyone, young or old. When it comes to financial wisdom, author and speaker Kylie Travers has taken her lead from the previous generation.

Get serious about saving

You can’t avoid it. To get on top of your finances you need to save and to save means you have to have financial discipline. Kylie was taught by her parents and grandparents that if you want to look forward to a better financial future, you need to take a serious approach to saving.

“My parents raised me to save money, set big goals, work hard and think about the future,” says Kylie. “They were both very open about money and my Dad gave me a copy of “The Richest Man in Babylon” by George S. Clason to read when I was just 12. So I learnt early about what you could do with money if you were prepared to save. My parents invested in shares and property and that helped me realise how much more freedom you have with other sources of income, apart from your earnings or salary.”

Seek out advice – especially from experts

Kylie has enjoyed the benefits of family advice on their finances. Several of Kylie’s uncles ran businesses, which has given her plenty of advice and real experiences to draw on when setting up her own company and brand. But she was quick to learn that well meaning friends and family will only take you so far. “I didn’t just rely on my own knowledge or what friends were saying,” says Kylie. “I engaged a lawyer I could trust to help me in my business and personal affairs and through them, found an accountant and financial planner. Their advice has been essential for expanding my business.”

Plan for tomorrow, live for the now

Although baby boomers are often praised for keeping a tight hold on their purse strings, perhaps they have something to learn from the millennial trend for living in the moment. Something else Kylie learnt from her grandparents was how much you could be missing out on if you only plan and save for the future. “I had one set of grandparents who lost everything and struggled to live on the aged pension when they retired,” she says. “My other grandparents planned carefully for a long and happy retirement but they both died at 63. So they didn’t have the chance to enjoy all those savings they’d worked so hard for. My Mum also died very young at 37. While I might be careful with my finances and make sure my daughters and I will be provided for, I also take time to enjoy what I already have.”

Everyone has something to offer

Kylie has a live in the moment approach, particularly when it comes to offering the best of yourself to others. “Don’t underestimate the impact you can have on people you encounter in the world,” is her advice to the rest of her generation. “By bringing a bit of fun and positive energy you can help people feel motivated to succeed in a world that seems full of constraints and obstacles.”

Kylie also advises young people to keep an open mind. She appreciates just how much the financial wisdom of her parents, uncles and grandparents helped her make positive decisions for her finances. “The basics of finance have stayed the same,” she says. “Digital has changed how we manage our money day-to-day and there’s plenty more information available, but the principles are just the same. And that’s why it’s worth listening to a generation who’ve already been through the same challenges we face – trying to find a way to live our dreams, with the money we need to do that.”

We here at Quill can offer expert advice to help you make the most of your finances today, and into the future.

The Australian market had a fair month in August. Mark takes us through the performance across the board to prepare us for what’s to come.

Stockmarkets

The Australian market had a fair month in August, with the ASX 200 Accumulation Index posting a 0.71% return for the month, which annualises out to around 8.5% which is within a few points of our expected long term returns. The commodities price was the action sector with Energy shares (+6.07%) delivered the biggest gains.

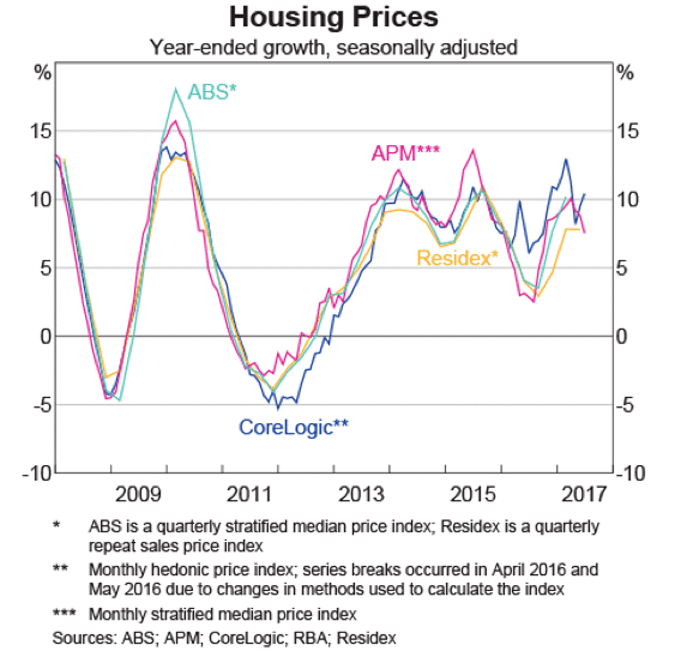

The rolling one year historic returns for the ASX200 Accumulation index is now 9.79%, rolling off some good periods in FY 2017 which saw a great return of 14.09%. Sentiment on Australia remains patchy. Banks, our largest sector have plenty of sceptics due to the high capital city house prices, and highly leveraged consumers. Our other big sector being materials, seems captive to sentiment about what China will do next.

Looking globally, the MSCI World Index gained 0.85% in AUD terms during August, supported by Asian markets which we favour as having the lowest valuations, and most room for improvement thanks to demographics and lower levels of current consumer debt. The rolling one year historic return for the MSCI World in AUD is now 10.71%, while the Emerging Markets gained 18% over the last twelve months.

Property

The S&P/ASX 300 A-REIT Accumulation Index gained 1.51% in August after coming under pressure in July. It has been a relatively good reporting season for listed property. Both of the giant Westfield entities are still under pressure as the market realises that there is a breaking point with retail rents. Add to that the Amazonian threat, and we are seeing the big malls trade closer to fair value.

While listed property prices have come off recently, direct commercial, industrial and retail property sales continue at higher levels. In some sectors it is possible to buy trusts at a discount to the value of their assets when like for like sales of direct assets are compared. In addition those listed trusts give you 3 day liquidity, and no stamp duty.

Residential markets appear to be softening in Sydney, but less so in Melbourne. Asking prices in Sydney fell by 2.5% over the last week, but are still up 12.5% year on year. Listing in Sydney rose 5% over the month of August, and will likely increase again going into spring. However, when we compare the August listings for Sydney, at 27,614 with Brisbane’s August listings at 29,587 it’s not hard to see why there is so much upward price pressure in Sydney. Melbourne listings have actually been falling, and that city had only 30,055 listings, down 15.3% on the year prior. The big fall is in Hobart, where listings have fallen 20.2% YoY, and asking prices have increased 2.2% over the week to 5 September, and 14.2% YoY. It looks like more Taswegians are hanging onto their cheaply priced little slices of paradise.

Interest Rates

Global yields fell in August as investors sought safer ground in bonds and gold. The Australian 10-year Treasury yield rose from 2.68% to 2.71%, but was still down on its March peak of 3.05%. This resulted in a flat return for the Bloomberg Australian Bond Composite 0+ years index and a -0.66% figure for the year to 31 August. This is due to bond rates being generally slightly higher than this time last year, and the lower mark to market value of longer dated bonds that come with that. The bank bill index did slightly better, with a gain of 0.14%. Global bonds as represented by the Barclays Global Bond Agg index gained 0.96%, and showing 1.04% for the year to the end of August. This gain was helped along by the US 10-year Treasury yield which fell from 2.30% to 2.12%. Clearly the bond market is not yet willing to hitch its wagon up to the Reflation train just yet.

The RBA kept the cash rate steady at 1.50% during the month. They did point to a more bullish employment outlook versus previous months. However, it is a challenge to achieve a balance between stimulatory monetary policy and the medium-term risk of high and rising household debt. Add to the mix an appreciating dollar over recent months, which will likely contribute to subdued price pressure, and it seems rates are destined to stay on hold for some time yet.

Household Finances

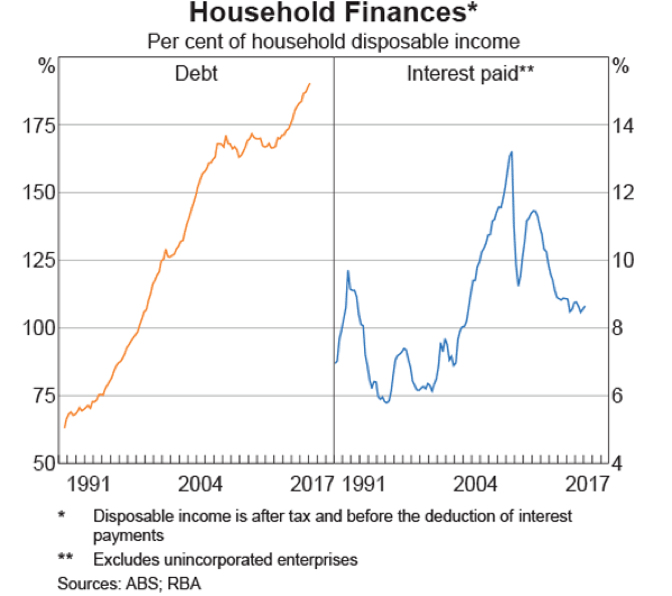

We include a chart of household finances this month to illustrate the rock on one side of the RBA, and the hard place on the other.

The hard place is the level of household indebtedness.

In the chart below we see how much debt has risen for the average household. The right-hand panel shows the amount of average income it takes to service that debt.

You will note that back when interest rates peaked in the late 80’s at around 18%, it took just over 9% of average after tax household income to service the average debt. Now that we have record low interest rates, it still takes almost 9% of average (and a whole lot more in the marginal borrowers) to service their debt. This is thanks to the now much higher household debt levels, which have also helped to push up house prices. At present, with benign inflation it is only the ‘rock’ that the RBA has to worry about. If ever inflation really starts to pick up, and interest rates need to rise will the RBA have to worry about the ‘hard place’. Food for thought if you are increasing debt right now.

On 1 January 2017, because of changes to the Age Pension assets test limit being lowered to $832,000, some clients had their pension payment cancelled.

Most clients had their Pensioner Concession Card replaced with a non-income tested Low Income Health Care Card. Unfortunately this card did not offer as many benefits as the Pensioner Concession Card, eg. train fares, help with hearing services, plus a range of other benefits offered by states, territories and private enterprise.

What’s the good news?

The good news is that from 9 October 2017, the Pensioner Concession Card will be reinstated to around 92,300 former pension recipients, including 3,600 Department of Veterans’ Affairs payment recipients.

Below is a snippet from the Australian Government Department of Human Services website:

Description of the measure

This measure restores the Pensioner Concession Card (PCC) to people who stopped being eligible for a pension payment due to changes to the assets test.

Pensioners who lost eligibility on 1 January 2017 were given:

- a non-income tested Low Income Health Care Card (LIC), and

- if they were over pension age, a non-income tested Commonwealth Seniors Health Card (CSHC).

This measure will allow these non-pensioners to access:

- hearing services from the Department of Health, and

- discounts and concessions offered by states, territories and private providers.

It will not be income-tested or assets-tested. PCC card holders will need to meet other eligibility requirements. These include portability conditions.

You can use this card in the same way you did before your pension payment was cancelled. Best of all you do not have to do anything as Centrelink will automatically reissue Pensioner Concession Cards to eligible recipients. The card is also exempt from the income and assets test.

Until your Pensioner Concession Card arrives in the mail, you can continue to use your non-income tested Low Income Health Care Card to access discounts and concessions. After you receive your new Pensioner Concession Card your Low Income Health Card will be deactivated.

The Commonwealth Seniors Health Card will remain the same.

For 23 years Dalbar Inc, the United States leading financial services research firm, has published it’s annual, Quantitative Analysis of Investor Behavior (QAIB) study.

The QAIB has been measuring the effects of investor decisions to buy, sell and switch into and out of United States mutual funds over both short and long-term time frames. The results have consistently shown that the average investor earns less and in many cases, much less than the mutual fund performance reports would suggest. The most recent study released for the calendar year to 31 December 2016, showed that the average investor is still their own worst enemy when it comes to investing. The study showed just how poorly investors perform relative to market benchmarks over time and the reasons for that underperformance.

The most recent QAIB study conducted in the United States by Dalbar Research (Boston, MA.), found that for the 2016 calendar year:

- The average US investor made a return in equity funds of 7.26% while the US share index, the S&P 500, returned 11.96%. An underperformance of 4.70%.

- In 2016, the 30-year annualised S&P 500 return was 10.16% while the 30-year annualised return for the average equity mutual fund investor was only 3.98%. An underperformance of 6.18% per annum.

So why is it that the average US investor made (4.70%) less than the market? Put simply, the differential was lost due to bad timing of transactions by the average US investor. Bad timing of transactions generally driven by decisions based on EMOTION. The emotions of FEAR OR GREED. This is truly wealth destroying behavior!! So if investing success is about BEHAVIOR and not skill, then what does that mean to you? It means that emotion plays a huge role in the financial decisions you make.

EMOTION is so important, it can determine your success or failure as an investor. But the great news is that unlike the MARKET, your BEHAVIOR is something you can control!!

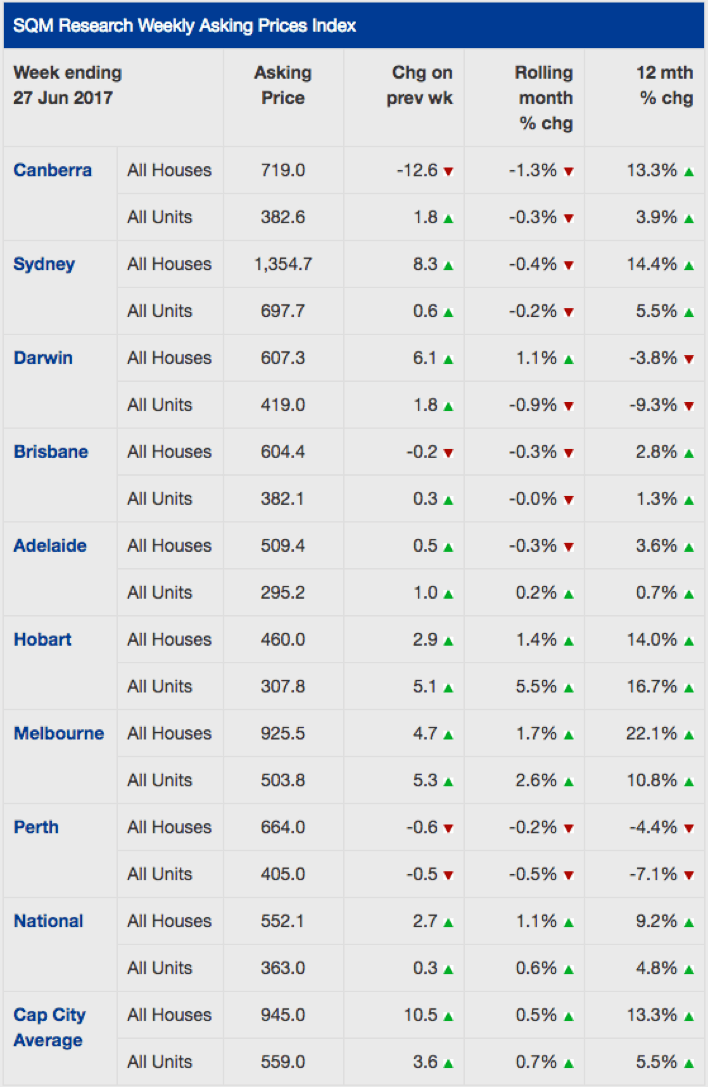

The property market, you will probably know that we don’t often comment on residential property. Due to it being such a heterogeneous asset class (the opposite to homogenous) there are pockets performing differently everywhere. However, given that most of us will have some exposure, we have included some observations from SQM Research to update you on the broader market.

Source: SQM Research

Perth and Darwin prices are the only ones showing year on year falls. We recall only 2 years ago being offered apartments in booming Darwin to ‘sell’ to our clients. Our scepticism and avoidance of conflicts of interest kept us well away from that disaster.

Over the month of June, Sydney prices are showing a small decline, though year on year was strong. Melbourne too was a standout, with even bigger gains than Sydney. Hobart off a low base showed strong gains as well.

While we are not local market experts in each suburb, we do caution that a lot of those rises have come from availability of credit, and ultra-low interest rates. With the APRA edict to limit interest only loans, the banks are taking the opportunity to re-price those loans to a much higher level. If they execute that well, then there will be extra profits for the banks, and not too much pain for residential investors. We hope!

After a big sell-off in May, (-4.01%) the S&P/ASX200 Accumulation index managed a small gain of 0.17% for the month of June.

That was better though than Global markets, where the MSCI World index (in Aust Dollars) lost 2.54% for the month.

Bond markets sold off during June as interest rates rose, and the A-REIT sector (real-estate trusts) also had a fall, losing 4.51% over the month.

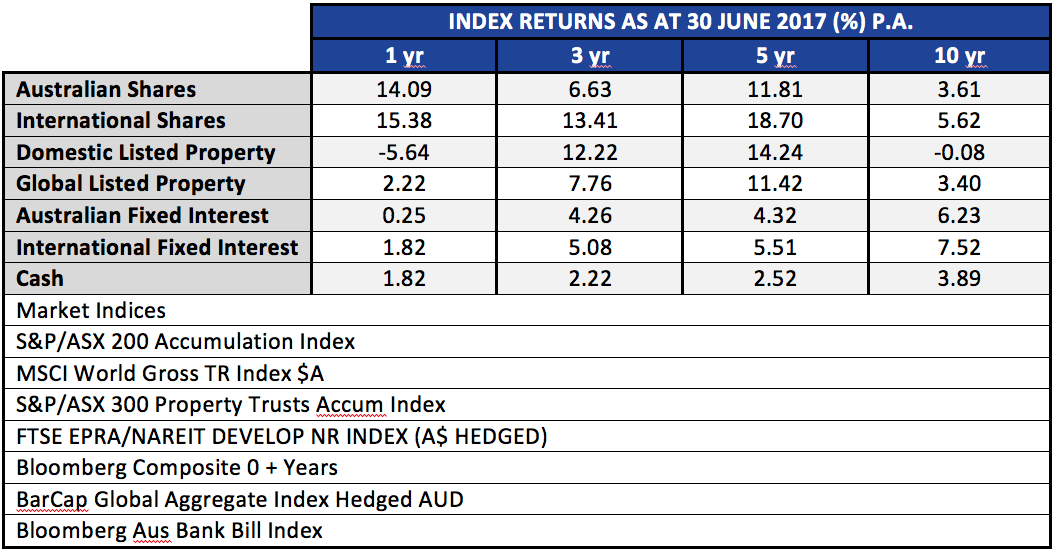

In spite of those falls, stepping back a bit to look at the whole year shows a much brighter picture of returns. The table below looks at the major liquid asset classes over the last ten years.

There are a few notable points here. The one, three and five year returns for Australian and International shares have been very positive overall. Yet, when looking at the 10 year numbers, the returns from those assets are below the Fixed Interest returns. And, when looking at fixed income returns we see that the returns this year have been low, lower in fact than a simple ‘buy term deposits’ strategy. Clearly timing is important, yet we are often told that ‘market timing’ is a fool’s errand. That debate is for another day, but we make the point that a thinking person needs to be able to bring into perspective the nuances of different rolling time frames.

As we now know from history, October/November 2007 was the peak of markets pre GFC. Markets all bottomed in about March 2009. These ten year numbers in the table above look sick now, but 18 months from now, they will start to look fantastic as we roll off the prior periods, and have a starting point that is very favourable.

But we must beware of extrapolating with no reasonable basis. Those five year numbers for the shares and property are unlikely to be repeated in the next five years. The temptation for in-experienced investors is to chase last year’s winner. Invariably rotation happens within markets.

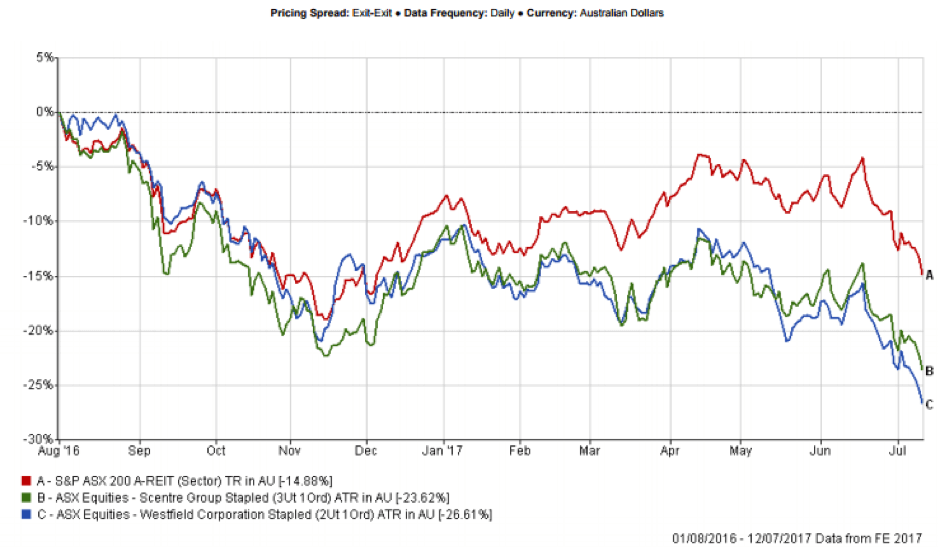

What piques our interest is that which is out of favour. And the A-REIT market falls into that camp being 11 months into a correction. Our general view last year was that it was hard to find compelling value in the sector. As a result our exposures have been relatively low. From 1 August to 12 July the A-REIT sector has declined 14.88%. Those kind of moves get us interested. Former market darling Westfield with global assets and Scentre Group holding the Australian Westfield centres, has been taken a big hit, down around 25% since the peak back in August 2016.

Make no mistake, Amazon will not kill the retail mall. And as the saying attributed to various wise men from King Solomon to Abraham Lincoln goes, “This too shall pass”!

Capital gains withholding, a new threshold

From 1 July 2017, where a foreign resident disposes of Australian real property with a market value of $750,000 or above, the purchaser will be required to withhold 12.5% of the purchase price and pay it to the ATO unless the seller provides a variation (this is referred to as ‘foreign resident capital gains withholding’).

However, Australian resident vendors who dispose of Australian real property with a market value of $750,000 or above will need to apply for a clearance certificate from the ATO to ensure amounts are not withheld from their sale proceeds.

Therefore, all transactions involving real property with a market value of $750,000 or above will need the vendor and purchaser to consider if a clearance certificate is required.

The following is from the ATO’s website:

- Australian resident vendors can avoid the 12.5% withholding by providing one of the following to the purchaser prior to settlement:

- for Australian real property, a clearance certificate obtained from the ATO

- for other asset types, a vendor declaration they are not a foreign resident.

- Foreign resident vendors may apply for a variation of the withholding rate or make a declaration that a membership interest is not an indirect Australian real property interest and therefore not subject to withholding.

- Purchasers must pay the amount withheld at settlement to the Commissioner of Taxation.

Bitcoin, Bitcoin, Bitcoin. The chant grew louder with every passing day!

Anyone who follows me on Twitter @marks_thinking will have seen my occasional tweets on Bitcoin and the closely related crypto currency called Ethereum or Ether. Now call me a dinosaur, but when I was a boy, ether came in a spray can and we used to help start old diesel engines on a cold frosty morning.

OK, so I might not be up with all the latest Bitcoin mining techniques, but I have been around through a few financial bubbles, studied many of the past financial bubbles and given enough advice to know about human nature.

That experience tells me that people are going to get hurt.

Why?

Let’s circle back to what Bitcoin claims to be. It is a crypto currency. Put simply it is another form of payment system, but instead of being able to be converted into secure bank notes, its allure is that it can be transmitted from person to person using a globally distributed ledger. Just as a bank has a ‘ledger’ to track who has cash on deposit and who owes the bank money, this global ledger does the same for Bitcoin. The difference is that no single bank or organisation ‘owns’ the Bitcoin ledger. The ledger is also referred to as a ‘blockchain’ system. The globally distributed ‘ledger’ is what enables anonymity of transactions using Bitcoin.

That last factor makes Bitcoin incredibly useful if you don’t want your transactions traced! Handy if you are dealing in drugs, arms or any other weird stuff that is usually outlawed. Perversely, in spite of toughening identity checks that banks are now required to do, the Federal Government just made it easier to deal in crypto currencies by announcing in the Federal Budget that from July 1, investors buying cryptocurrencies would no longer be paying GST on their initial purchase. Talk about double standards! Sorry, I digress.

So, let’s come back to the principal purpose of any currency. It is a means of exchanging labour for goods and a means of storing past labours for an indefinite time until we want to again convert that labour into current goods. One would assume therefore that there should be a stable relationship between the labour and the currency. Our Australian dollar does that fairly well. If we get $25 for an hour’s work, we know that we can buy five coffees or a kilo of average steak and so on. Of course when our buying power increases we are happy, not so much a decrease.

So how does Bitcoin stack up on terms of stability?

Well, had you taken all your salary as Bitcoin during 2016 you might be pretty happy today.

The chart below shows the explosive rise of Bitcoin since then.

Bitcoin’s absolute high (so far) was $3,003 USD per coin, back in early June. However, since then it has declined to $2,516 or a 16.2% decline in about a month. That hardly seems like a stable store of value. Back in 2013/14 Bitcoin halved in value following a series of exchange blow-ups. Again, not a very useful store of value. That could easily happen again!

In addition, the architecture of Bitcoin means it is on a slow road to gradual extinction. With a maximum of 21,000,000 Bitcoins can ever be created thanks to the way it was originally conceived. When that ceiling is met, the only reward to the participants who use huge amounts of computing power to maintain the ledgers will be transaction fees. Sometime before then Bitcoin will go into a death spiral as owners try to exchange into other crypto currencies, or heaven forbid, real assets.

However, with limited supply Bitcoin may still increase in value if the ‘value’ placed on anonymity increases. We cannot know for sure. While I have a healthy mistrust of Central Bankers, and banks in general, I trust them more than I to the shadowy geeks in dark rooms that control today’s crypto currencies.

Apart from speculative value as a trading item, (as you might trade tulip bulbs) I view Bitcoin as the principal currency of those who need their transactions to be absolutely secret and un-traceable.

Having said that, currencies like Bitcoin and Ethereum have contributed greatly to the advancements in using ‘blockchain’ or de-centralised ledgers to track ownership of assets. I think we will see huge changes to banking systems using this technology in coming years.

But for now, I’m old fashioned, drug free, don’t carry no illegal firearms, and I don’t need no crypto-currency.

Up until 30 June 2017, an individual (mainly those who are self-employed) could claim a deduction for personal super contributions where they meet certain conditions. One of these conditions is that less than 10% of their income is from salary and wages. This was known as the “10% test”.

From 1 July 2017, the 10% test has been removed. This means most people under 75 years old will be able to claim a tax deduction for personal super contributions (including those aged 65 to 74 who meet the work test).

Editor: Call our office if you need assistance in relation to the application of the work test for a client that is aged 65 to 74.

Eligibility rules

An individual can claim a deduction for personal super contributions made on or after 1 July 2017 if:

- A contribution is made to a complying super fund or a retirement savings account that is not a Commonwealth public sector superannuation scheme in which an individual has a defined benefit interest or a Constitutionally Protected Fund;

- The age restrictions are met;

- The fund member notifies their fund in writing of the amount they intend to claim as a deduction; and

- The fund acknowledges the notice of intent to claim a deduction in writing.

Concessional contributions cap

Broadly speaking, contributions to super that are deductible to an employer or an individual, count towards an individual’s ‘concessional contributions cap’.

The contributions claimed by an individual as a deduction will count towards their concessional contributions cap, which for the year commencing 1 July 2017 is $25,000, regardless of age. If an individual’s cap is exceeded, they will have to pay extra tax.

Call our office to discuss the eligibility criteria and tax consequences of claiming a tax deduction for a personal contribution to super for the year commencing 1 July 2017.