Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Stock Markets

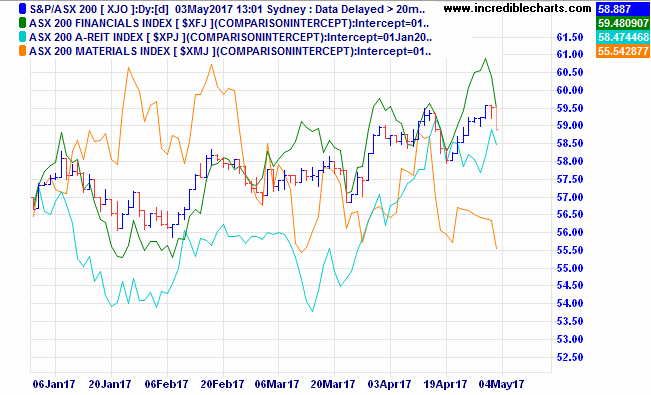

Our last update marked a short-term peak in the ASX200 which made a high at 5956 on May 1st. Since then, we had the release of the Federal Budget which was widely criticised as a ‘Labor lite’ budget, and plenty of international political events to keep us on edge.

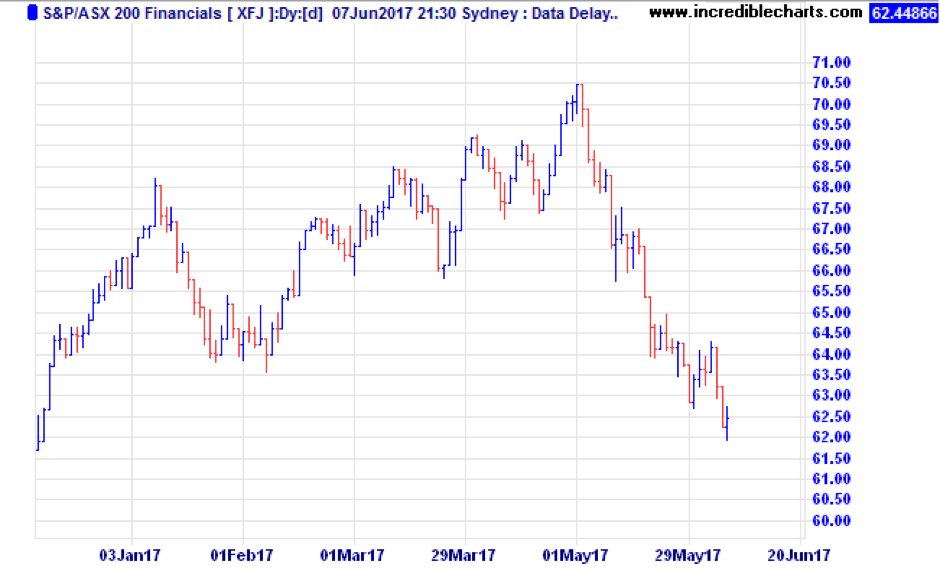

The ASX200 was down 4.01% during May. The Financials index (XFJ) was down almost 10% as bank stocks were pummelled. All the talk of housing bubbles, the bank tax announced in the budget, and plummeting retail sales have finally converged to bring share prices down.

Offshore, however, the news was better. The S&P 500 index of US shares gained 1.1% in local currency terms, and converted to Australian dollars was up 1.87%.

The MSCI World index in AUD was up 2.68%, and the MSCI Emerging Markets gained 3.45%.

Europe was the big gainer, with that market up 5.31% in Australian dollar terms. It helped that the Australian dollar fell 2.8% against the Euro during the month.

The month of May was a great example of the benefits of portfolio diversification in action.

Commodities

As a country that makes most of our money digging holes and building houses, the commodity markets are very important. In terms of export dollars earned, the big ones are iron ore and coal. While not as important to the export earnings, oil certainly rates highly for the big Australian – BHP. Iron ore was down 15% over the month, to end at $57.90, while coal dropped 11.7% and oil was down 2%. The Materials stock sector held up remarkably well in the face of this, down less than 1%.

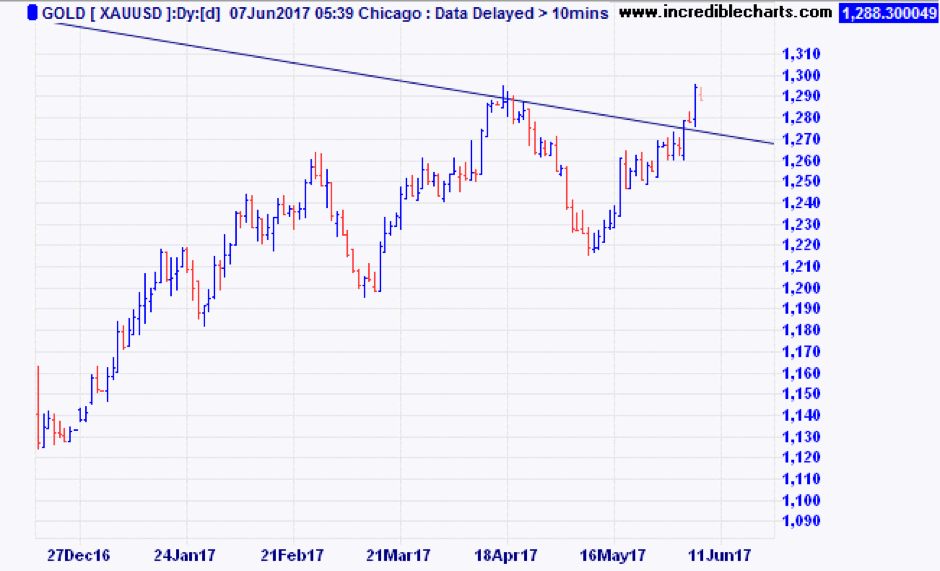

That other commodity we have in reasonable abundance, denounced by some as a ‘barbarous relic’ is gold. Gold is at an interesting juncture, as it has broken free of the recent correlation with such grubby commodities as iron, oil and coal, and has just broken above a downtrend line that goes back to the peak in September 2011 when gold peaked at $1,882 per ounce. Now, at $1,294, it is slowly grinding higher, helped by the fact that US interest rates look like they’re rising at a slower rate than previously expected.

If gold can sustain a rally into the $1,320 level, it will be looking good, and the next target to break would be $1,360.

Interest rates (updated to 7 June)

At the June meeting, the RBA decided to leave the cash rate at 1.50%, following the same decision in May. The decision was expected given underlying economic conditions still warrant an easy monetary policy.

Immediately post the announcement, equity markets had fallen (due to the RBA’s rather upbeat comments) whilst the Australian dollar was flat. The decision comes as no surprise, given we expect the RBA to be on hold this year and most of next year.

In spite of the RBA being on hold with interest rates, we do see banks becoming more selective in mortgage lending, and there is some risk of credit rationing in postcodes that are deemed high risk.

Comparing some of the rates from the big four lenders, owner-occupier loans seem to be mostly priced around 4.40% for variable rates less than 80% LVR, while investor loans are in the 4.80% to 5.20% range.

Borrowers should also be aware of APRA’s directive to the Australian banks to have less than 30% of new loans written as interest only and to keep below an overall 10% per annum growth in investor lending. If you want to get the inside story on the APRA directive, it is available here: APRA Sound Residential Lending Practices.

Despite the ongoing changes to super, it is still the best tax house to invest in.

Case study

Say you are in your mid-50s, earning $95,000 per year plus employer superannuation of $9,025, have a cash flow surplus of $10,000 a year and no debt.

Option A

You could invest the $10,000 in your own name and pay tax at 39% on the earnings.

OR

Option B

You could invest the $10,000 as a non-concessional superannuation contribution into your superannuation house, where the earnings will be taxed at 15%.

Now a new option

From 1 July 2017, you will have another option to invest the $10,000 as a concessional superannuation contribution in your superannuation house. You will lose $1,500 due to 15% contributions tax, but still have $8,500, invested in your superannuation house, where the earnings will be taxed at 15%.

Best of all, you get a tax deduction in your own name for the $10,000 you invested in your superannuation house, which will get you a tax refund of $3,900.

Say you are really smart and contribute your $3,900 tax refund as a non-concessional superannuation contribution into your superannuation house.

Your original $10,000 investment in your superannuation house, now becomes $12,400 in your superannuation house. This is a return of 24% in the first year!

Even with some changes in super legislation, it still seems to be a great investment option.

No doubt you have already heard about the introduction of a $1.6 million transfer balance cap from 1 July.

When most people see that figure, they think of the asset balance in their account based pensions.

But did you know that this ‘transfer balance cap’ also includes a notional value for every income stream you receive via the superannuation system?

This includes:

- lifetime pensions, including the majority of defined benefit pensions commenced at any time (eg. Commonwealth or State Government defined benefit pensions)

- Complying lifetime annuities

- Complying life expectancy annuities and pensions

- Term allocated annuities and pensions (ie Market linked pensions).

It is important to remember that if you have a defined benefit pension you may need specialist advice to ensure that your account based pension/s are reduced by enough to bring you under the cap.

Therefore, please contact us immediately if you have one of these income streams, and/or have one or more account based pensions totalling $1.6m or more in value, and would like us to review your situation.

After months of speculation as to what the Government is planning to implement in the 2017 Federal Budget, finally, the budget changes have been released to the public. Implementation of changes is soon to commence.

There are certainly some “winners” and “losers” but overall, the aim of the budget is to positively impact our economy. And with a thriving economy, all Australians are winners.

As a millennial, my biggest focus around the budget is; housing affordability and student debt. So, let’s focus on these points.

First Home Buyers

There had been speculation over the previous months that the government was going to allow first home buyers access to their superannuation savings to fund their house deposit. Personally, I was horrified to hear this was a serious consideration. Such a scheme would influence further implications and retirement unaffordability issues down the track. Pleasing to hear, this scheme was dismissed.

The “First Home Super Savers Scheme” is being implemented from 1 July 2017. This effectively allows individuals to salary sacrifice savings towards a house deposit into their super. By salary sacrificing, a tax advantage is applied as these contributions are considered concessional contributions (pre-tax). Therefore, salary sacrificed contributions and earnings in super are taxed at 15% rather than the marginal tax rate.

Only the contributions to the First Home Savers Scheme will be available to withdraw for first home deposits. Until a condition of release is met, no other superannuation savings are accessible. If you do not end up purchasing a home, these additional contributions will not be accessible until retirement or a condition of release has been met.

It is important to note; the First Home Super Savers Scheme is capped at $30,000. However, as previously mentioned, these contributions are classified as concessional contributions which oblige to the annual cap of $25,000. Noting also that your Superannuation Guarantee Contributions also fall under this cap, you are limited to contributing a maximum of $15,000 (without exceeding the $25,000 cap) into the First Home Super Savers Scheme per annum.

15% tax is applied on each contribution into your First Home Super Savers Scheme account. For example, let’s say you contribute $10,000 in a financial year, only $8,500 hits your first home savers account as $1,500 of the contribution is paid in tax. As a comparison, let’s say you fit into the 34.5% tax bracket and decide to place this $10,000 pre-tax money into a bank account outside of super. This means you will pay $3,450 in tax opposed to $1,500.

Withdrawal of these contributions will be accessible by 1 July 2018 and will be calculated using a deemed rate of return. Upon withdrawal, the value of your savings will be added to your assessable income with a tax rebate of 30%. Therefore, if we use the same example above and assume with the withdrawal added to your assessable income that you remain in the 34.5% tax bracket, you will be liable to pay a further 4.5% tax on the withdrawal of your savings. It feels a bit like the government is double dipping here… nonetheless, it’s still a great tax saving strategy. For a detailed example of how the deemed rate and tax rebate is calculated, refer to Mark Beveridge’s blog.

Although the First Home Super Savers Scheme is capped at only $30,000, I think it’s a great opportunity to start saving. The government has provided a handy estimator tool to calculate the difference in savings when using the First Home Super Savers Scheme verses saving in a standard deposit account outside of super.

Investment Properties

Good news for some property investors! In a bid to make housing more affordable and appealing to Australian investors, the Capital Gains Tax (CGT) discount has increased from 50% to 60%. To be eligible for the 60% CGT discount, the residential property must;

- Be rented to low to moderate income tenants

- Be rented at a discounted rate

- Be managed through a registered community housing provider, and

- Held for a 3-year minimum.

During periods where the property is not used for affordable housing purposes, the additional discount will be pro-rated.

Unfortunately for property investors, reductions and eliminations of certain claimable tax deductions will be implemented. These changes affect previously claimable travel expenses and property plant and equipment depreciation deductions.

Not so great news for foreign property investors, but good news again for Australian investors as these new changes will provide Australians with increased opportunity to invest. Foreign ownership will be restricted to 50% in new property developments. They will also be liable to a minimum $5,000 annual levy if their properties are found to be unoccupied or not genuinely available to rent for at least 6 months per annum.

CGT main residence exemption will also no longer be available for foreign property owners. However, a grandfathering rule for the exemption will be implemented for existing owners up until 30 June 2019.

Foreign tax residents will also see the CGT withholding rate increased from 10% to 12.5% and the property value threshold will reduce from $2 million to $750,000 from 1 July 2017.

Student Loans

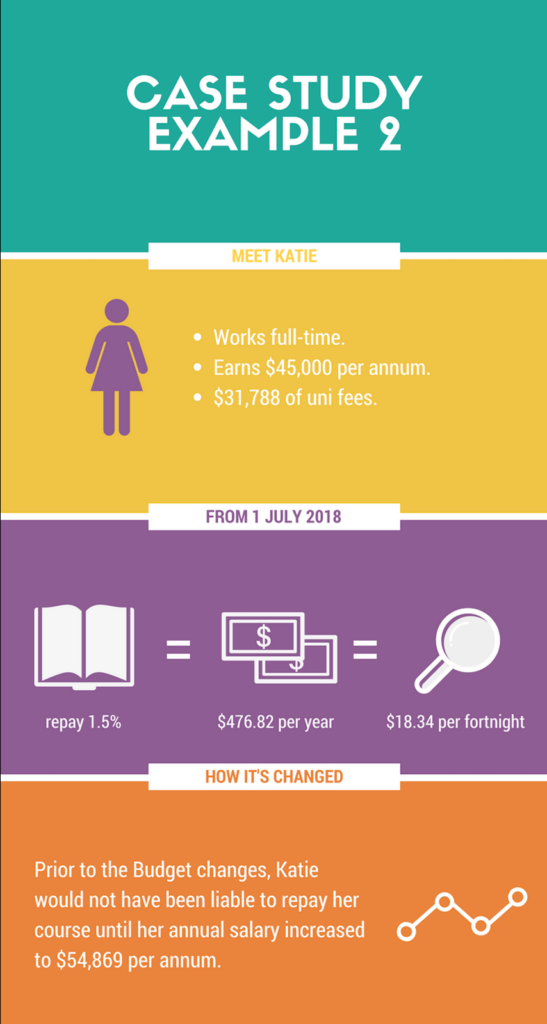

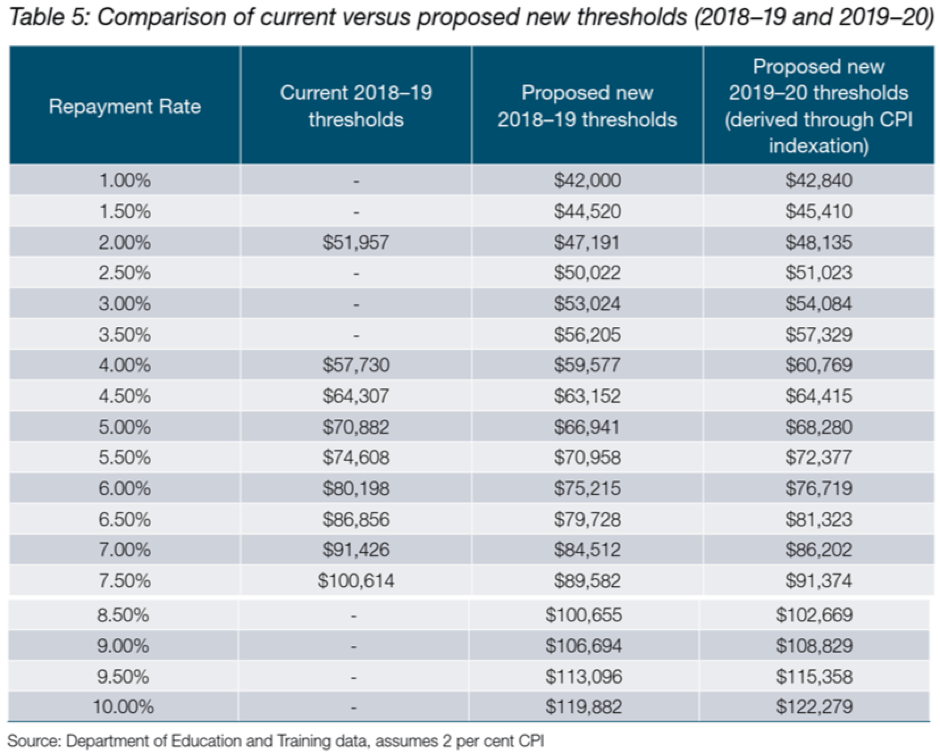

Bad luck for students. It seems to be getting progressively harder to afford study. Not only are university fees increasing, but the minimum income threshold to repay your HECS or HELP debt is now reduced to $42,000 per annum from $54,869 per annum.

Combine that with the average four-year course increasing in fees by approximately $2,200 to $3,600, it’s a scary outlook for existing and future students.

However, we can catch our breath (just a little). It’s not as bad as it sounds. Previously, once the threshold of $54,869 was reached, 4% of the course repayment was due payable. With the new minimum threshold reduction, only 1% is payable with annual income of $42,000. Once your salary reaches approximately $53,000 to $56,000, which is around the old threshold, you will be repaying between 3% and 3.5%.

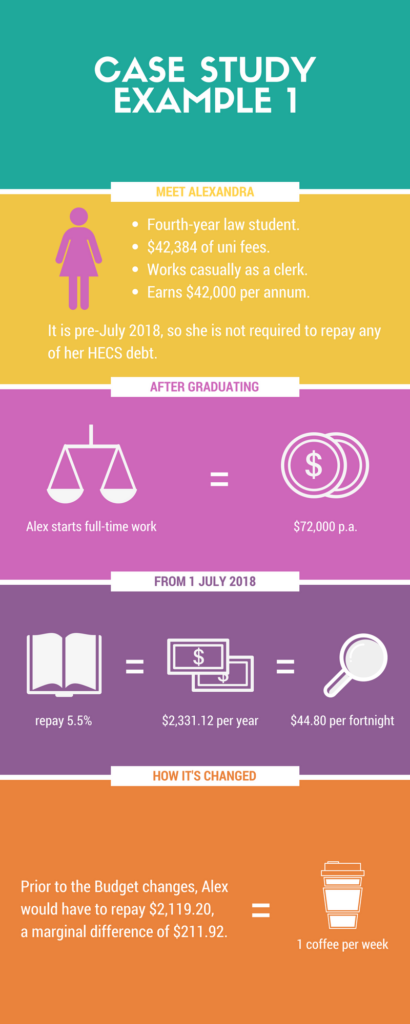

Let’s do a case study or two to delve into this a little deeper.

It’s important to remember that although there is no interest accumulating on these student loans, they do increase with CPI (Consumer Price Index).

The increase in university fees and reduction in the repayment threshold isn’t the outcome any student was hoping for. But, as detailed in our first case study, the difference is about two cups of coffee (if that!) each fortnight. We will prevail!

Refer to the Department of Education’s comparison table below for more information;

Current 2016-17 Repayment Income Thresholds and Rates:

| Repayment Income | Rate |

| Below $54,868 | NIL |

| $54,869 to $61,119 | 4.00% |

| $61,120 to $67,368 | 4.50% |

| $67,369 to $70,909 | 5.00% |

| $70,910 to $76,222 | 5.50% |

| $76,223 to $82,550 | 6.00% |

| $82,551 to $86,894 | 6.50% |

| $86,895 to $95,626 | 7.00% |

| $95,627 to $101,899 | 7.50% |

| $101,900 and above | 8.00% |

These changes are yet to be legislated, but if you would like to start planning or find out how it will affect you personally, call Quill today.

House Sale Proceeds for Over 65s

Let’s briefly touch base on this also, as you can pass on your knowledge to a family member which this may apply to. Previously, a person aged over 65 was unable to make any super contributions unless they were ‘gainfully employed’ and age 75 was the absolute cut-off age, even if they continued to work. However, with these new budget changes, individuals over age 65 can contribute up to $300,000 of their family home sale proceeds into their superannuation. However, conditions apply as they must have owned the family home for a minimum of 10 years. Fortunately, this type of contribution is not subject to the new $1.6 million superannuation caps.

There are also Centrelink implications to consider for those receiving a part pension under the assets test. If they sell down their home and contribute the funds into their super or retain it outside of super, they could see a reduction or elimination of their part pension. If this could affect someone you know, they can contact Quill to discuss their circumstances.

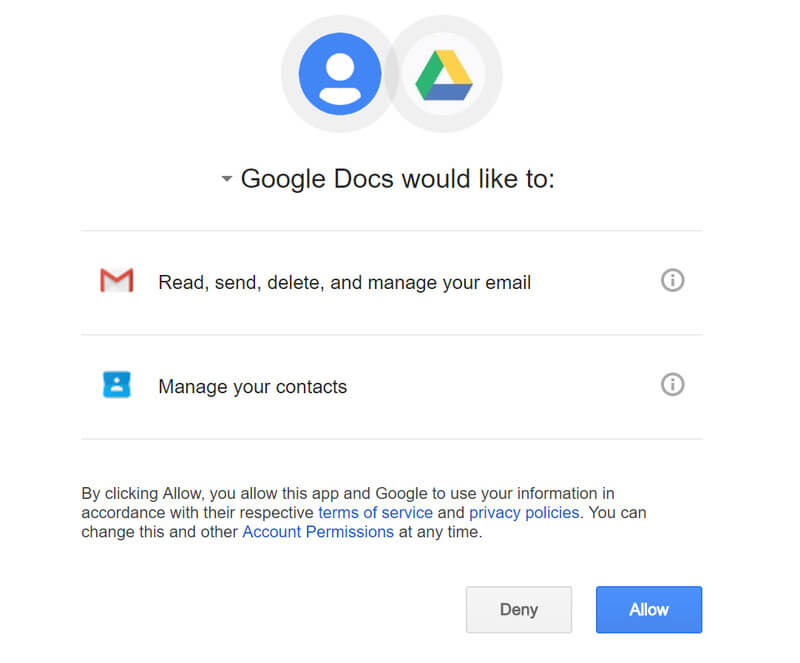

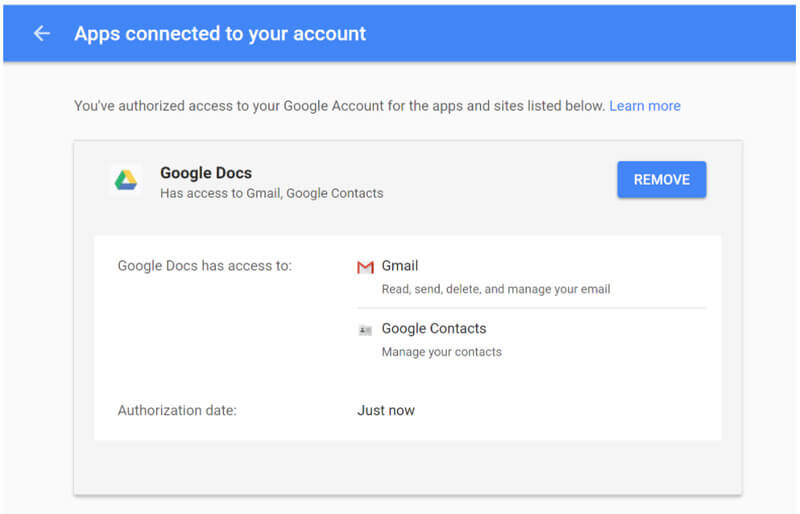

Do you use Google Docs in your business or home? I do. We also utilise Google Docs internally. What is Google Docs? More than letters and words. Google Docs brings your documents to life with smart editing and styling tools to help you easily format text and paragraphs. It’s Google’s version of Word.

If you do use Google Docs, Smart Online has issued a warning to users about a reported phishing scam involving a fake invitation to share a Google Docs document.

The way the scam works is that a user receives a legitimate-looking email that looks like it’s from a trusted person inviting them to share a document on Google Docs.

The users who click on the link are then directed to permission screens. These permission screens then activate a malicious service to access their email account, contacts and other sensitive information, if permission is granted by clicking on the button. If a user grants permission, the malicious service can impersonate the user when sending messages on to other Google email users.

Users may also face the risk of having information and messages from their email accounts compromised.

How does it work?

The scam reportedly targets Google personal and corporate email accounts.

Google Docs has released a statement via their Twitter account saying:

“we have taken action to protect users against an email impersonating Google Docs, and have disabled offending accounts.”

“We’ve removed the fake pages, pushed updates through Safe Browsing, and our abuse team is working to prevent this kind of spoofing from happening again.”

If you’ve clicked the link, your account may have already sent spam messages to the people in your address book. But you can revoke future access through Google’s “Connected Apps and Sites” page; where it will appear as “Google Docs”.

Spoofing occurs when emails are altered to appear to have come from a different source and is a method attackers commonly use to gain users’ trust and increase the likelihood of a successful attack.

Here is the whole process captured on video:

Phishing (or malware) Google Doc links that appear to come from people you may know are going around. DELETE THE EMAIL. DON’T CLICK. pic.twitter.com/fSZcS7ljhu

— Zeynep Tufekci (@zeynep) May 3, 2017

How to stay safe

If you are unsure of the legitimacy of any message you receive, you should avoid clicking on any links or opening any attachments. You should check with the purported sender using contact details sourced from legitimate sources (not from the suspect message itself).

If you have clicked on the link or inadvertently granted permission to the malicious service, you should immediately revoke that permission using the steps recommended by Google Docs.

You should also check your account details to confirm that nothing has been changed and as an extra precaution, change your Google passwords immediately.

Content from the post was originally published on Smart Online.

The winning streak continued in April, despite a war footing in Syria and North Korea, and the first round of the French elections which soundly booted the two mainstream contestants and set up a run-off between Marine Le Pen and Emmanuel Macron.

The ASX200 accumulation index gained 1.03% during April. The bigger gains were in the banks, while miners were off about 2.2%. The positive result masked a few shockers during the month, like Telstra down 8.7% and upstart competitor Vocus which lost 22.4%.

Over in the A-REITs (listed property trusts), the gain was 2.61%. This was helped by falling interest rates, with the Australian ten-year government bond starting the month at 2.70%, sliding to 2.47% mid-month before settling at 2.56% at month end. The prices of listed property trusts are highly sensitive to changes in interest rates, especially in this period where the general consensus is that US rates are on the rise. The A-REIT sector current yield is around 4.7% and the sector trades at a 23% premium to net asset values.

Turning to global markets, the S&P 500 index of US stocks gained 1.03% in April in local currency terms, but when converted back to Australian dollars the gain was 3.05% as the Australian dollar fell against the US Dollar over the month. The broader MSCI World index gained 1.33% in local currency terms, and 3.64% when converted back to AUD. In other regions, the MSCI Europe index gained 5.76% in AUD terms, as investors flocked back into the main Euro markets following the first round of French elections. The MSCI Asia ex Japan region gained 4.23% in spite of the serious tensions in North Korea.

Interest rates have been mentioned earlier, with reference to bond yields falling, which in turn increases the price of bonds, and the longer the term to maturity the higher the increase. The Bloomberg AusBond 0+ years index gained 0.69% during April. This was a turnaround from the previous six months (Oct ’16 to March ’17) when the index lost 1.21% in value thanks to rising interest rates that followed the surprise Trump election. We thought it would be useful here to comment on the impact of rising interest rates on the ‘average’ index tracking fixed income fund. In the period between 1 October 2016 to 16 December 2016, the US ten-year bond yield rose from 1.6% to 2.6%, an increase in nominal yield of 1.00%. The Bloomberg AusBond 0+ years index lost 2.66% of its value over that period. It is important to understand how fixed income, with longer durations to maturity, can suffer losses in a rising rate environment. Further, relating this to our earlier comments on A-REITs, that sector lost 6.17% during that period when US rates rose by 1.00%.

Overall, April was a fairly good month, in spite of the intra-month volatility.

Coming next week is our Australian Federal Budget. As we write this, the RBA board is meeting, but no-one is expecting any change to rates. Also this week, the RBA Governor speaks on “Household Debt, Housing Prices, and Resilience”. We all know that as the person at the head of the organisation charged with ‘financial stability’, he will most likely avoid the word ‘bubble’, but we would expect him to try to hose down people’s price expectations.

In late news over the weekend, we are watching closely the situation of a Canadian lender, Home Capital. It has about $20B in total assets, with about $15B of lending into the red-hot Canadian residential real estate market. The bank has just set up lines of credit for about $2B to replace depositor funds that sources say are leaving at over $200M per day. An old-fashioned bank run. Apparently, there has been some fraud among the brokers that wrote loans for the bank. As if that is not enough, there is also some shenanigans with the funding of this latest line of credit, which reportedly may be costing between 18 and 22%. Clearly, that is a whole lot higher than the rate Home Capital are earning on their home loans.

Our next update will be a summary of the Federal Budget.

One of the key challenges for people approaching retirement is adequately preparing for it. The other big challenge is gaining greater confidence in how their finances might look once retired.

Getting the right advice helps enormously with this, and likewise beginning the planning process earlier rather than later will reap rewards.

What are the stats?

A recent survey conducted by Vanguard of more than 5,500 people aged 55-75, across Australia, US, UK and Canada, showed that many reported that they experienced an increased level of satisfaction with their financial position upon retirement.

One contributor to this result was the higher incidence of people within the first 10 years of retirement seeking financial advice, compared with those still up to 10 years away.

Even amongst those who had access to some form of financial advice during the lead up to retiring, some still experienced regret about how well they prepared.

People’s biggest regrets

The biggest regrets of recent retirees included:

- Not saving enough

- Not starting the planning process early enough

- Not spending enough time planning for it

- Not learning enough about superannuation – in Australia, this included those with SMSFs

- Not learning enough about the government benefits available to them

How ready are Australians?

Another recent study by Colonial First State set out to assess how ready Australians are for retirement. While the results indicated that about half (53%) of those surveyed should have enough money during retirement, this included income support from the Age Pension. Once this Age Pension support is removed from the equation, the adequacy of retirement funding dropped significantly to around 17%, a huge difference.

Colonial used the Association of Superannuation Funds of Australia’s (ASFA) comfortable retirement standard, which is currently $43,372 pa for singles and $59,619 pa for couples, to define adequate retirement income.

Again, this emphasises the need for longer term planning and getting the right advice to ensure you give yourself the best chance of having enough in retirement.

Where to start

Some things you should consider to get this underway include:

- How much retirement income you will need

- How much of this will be provided by your current savings

- The risks and opportunities you will face in the lead up to retirement, and how to deal with them

- How to structure your wealth to your best advantage both before and after retirement

- Protecting your assets in the event of adversity

So, take positive action and get a head start on your retirement, and call your financial adviser today!

An article by Roger Montgomery, writing for the Weekend Australian, reminded me of something that we have been saying for several months now. Surging property prices in most capital cities and regional centres will end in tears for many that believe increasing prices and low interest rates are here to stay.

The alarm bells

Probably the scariest statistic is in Brisbane where not only did the supply of new units increase by 5,500 in 2016 but they are now set to increase by a whopping 13,300 this year. Buyer inducements, lower revaluations of up to 30%, higher vacancy rates, and, most recently, banks starting to tighten up on borrowing limits are all signs of a looming collapse.

The question we may now ask is how soon will this occur and what will be the flow-on effect for other areas of the property market?

Accessing super to fund a home deposit – let’s hope not!

One can only hope that the federal treasury is advising government to scrap the ridiculous idea that some politicians have been discussing about possible access to superannuation to fund a first home deposit.

This would only exacerbate the problem and potentially lead to a situation where a young person not only lost all the equity in their home but potentially their retirement savings as well.

Take a scenario where someone borrowed $450,000 to buy a $500,000 home, using $50,000 saved up in their superannuation fund as a deposit. Six months later, the property market corrects 20% and the property is revalued at $400,000. Even if the bank does not foreclose on the loan at this stage, there is still a high risk that the individual loses their job or interest rates rise. In this situation, a forced sale is likely which would lead to a position where all the money in super is lost and the individual still owes the bank $50,000.

This reads like a recipe for financial disaster which is one good reason why we don’t expect to see this initiative as part of the 2017 May budget.

The US Federal Reserve lifted interest rates by a quarter of a percent this week. According to normal expectations this was supposed to result in:

- Falling stock prices

- Rising bond yields

- Rising dollar and;

- Falling gold prices.

Guess what happened? None of the above. In fact, in all four assets the opposite happened.

- Stocks rose by almost 1%.

- The 10-year bond went from 2.6% down to 2.5%.

- The US dollar fell by more than 1% against the Euro and Yen and almost 2% against the Australian dollar.

Rising interest rates were supposed to make the US dollar stronger! And rising interest rates were supposed to make gold less attractive. Yet gold rallied by $20 or 1.7% on the night.

All four of those major markets went the opposite direction to what economic theory would tell you.

Why is this so?

It’s all about ‘buy the rumour – sell the fact’.

When an event is expected so widely as this Fed rate hike was, traders get themselves positioned well before the event. Sometimes the trade is so crowded that once the rumour becomes fact, everyone is positioned on the same side of the trade.

The interest rate rise at this month’s Fed meeting was indeed widely expected.

The minutes of the meeting confirmed what we had been thinking for some time, that interest rates, whilst increasing, would be at a moderate pace compared to previous cycles.

The global debt load, which has only increased since the GFC, means any little ‘pull of the lever’ (moving interest rates) can have a big effect, and as a result central banks around the world will continue to be cautious about the pace of raising interest rates.

What next?

Based on the market reaction to the Fed increase on March 15, we would expect that another two rate hikes this year in America could be absorbed without requiring the Reserve Bank of Australia (RBA) to make any increases at all.

We suspect the RBA would like to raise interest rates to fire shots across the bow of property investors, reminding them that rates can go up as well as down, before speculation gets out of hand. However the still weak economy and the risk of pushing the dollar higher is likely preventing that in the short-term. APRA and the RBA are more likely to wait and see if there are some adjustments to negative gearing and CGT in the budget to rein in property speculation.

What’s the lesson?

The lesson from the market reaction to the Fed rate increase is that positioning is best done well before market events. Market participants tend to look at least 6 months ahead and get well positioned before announcements of things like GDP and inflation numbers, and often when the expectations are correct, markets move opposite to what might be expected, because the marginal buyer and seller is already well positioned for the event.

Whilst having dinner with friends recently, the topic of “charging your kids board” came up and it seems everyone has differing points of view on this.

The ‘anti-boarders’

One couple argued that they felt their kids would have time enough to pay their way once they moved out, and as long as they covered their other expenses like car and phone bills, lodgings and food would be free.

The ‘pro-boarders’

On the other hand, myself and others in the group felt it was just a “rite of passage” to becoming a grown up. It never hurt us when our parents charged board and so it was something we were passing on to our kids.

Is it just an outdated tradition?

While the discussion of pro and anti-boarding was going around the table, it did get me thinking – is it still relevant today or is it just an idea being passed down from one generation to another that bears no real financial learnings?

When our daughter commenced full-time work and the conversation was raised in our household about paying board, she argued the point of “why?”– what was different from when she was in school to now? Her thought was, nothing had changed at home and I can see where her argument was coming from; we provided a roof over her head and food on the table yesterday and we would still provide these things to her tomorrow, so why should she suddenly be paying for it?

So whilst it was a reality check for her, she acknowledged that it would be the cheapest “rent” she would ever have to pay. Where else would she get food, lodgings, free WiFi and Netflix for the small contribution we were expecting?

To us, it wasn’t about the $3,900 per year she would contribute towards the grocery bills or electricity bills. It was about teaching her a sense of responsibility and learning to budget in preparation for much bigger financial commitments ahead.

So much of what I’m surrounded by here at Quill, is financial planning and our advisers working with people to save for their first home, new car or simply managing their finances better. It’s not uncommon to see people stretching themselves and living outside of their means.

Australians in debt

An article I read recently about the amount of debt Australians live with, explained that we have the fifth highest debt levels in the world. Since 1988, the ratio of household debt to disposable income has blown out from 65% to 185%. This article discussed the various contributing factors and suggested that people need to rethink the way they manage their everyday finances and day-to-day cash flow.

As an adult, you have access to financial planners to help you create plans to manage your financial future. As a parent, I think you can start helping your kids learn about cash flow and managing their money before they reach that time. Whether it’s through paying board, or not, or even pocket money, maybe these are the little steps you can take to get them thinking about these kinds of things.

I would love to know your thoughts, did you pay board as a teenager, and do you think it helped prepare you better for the real world?