Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

This is a story about a very successful and astute businessman. This man owned a number of successful businesses in a range of industries over a number of years. This man never worked for anybody else. He was a family man, a man who prided himself on being able to provide for his family. He always said to his wife “you look after the family; I’ll look after the money”.

As clever and successful as this man was, there was one thing he could not do and that was predict the future.

This man was my Grandfather. He was diagnosed with Alzheimer’s in his early 70s.

I could write for days on the impact that this has had on my family. But I would rather stress the importance of estate planning to you all.

Whilst we had a Will and a Power of Attorney, the family had never thought about what to do with money, because he always looked after the money. How would the money continue to come in?

The implications of him not being able to control the money became very difficult for the family, things such as whose names the properties were in had an impact on a number of things which have caused a lot of headaches.

Having this happen so close to home means that I now think of things, particularly estate planning, in a different light. So, my questions to you are:

- What would happen to your family if something unforeseen happened and you were no longer here?

- How would your business fare if you were unable to continue to run its operations?

Sometimes it isn’t practical to take care of everything yourself. You need to delegate, you need to inform your loved ones of your financial affairs, as it does involve them too, especially if something were to happen to you.

Most importantly, it is imperative to seek advice from the professionals. You need to know that should anything happen to you, your loved ones will be taken care of and that your business will continue to run. We have several professionals in our office that can look at your current situation and work with you in planning for your future, your family’s future and the future of your business.

Ahhh the household budget… I may loathe it but I must also be in control of it!! Which suits my husband down to the ground as he wants no part but to tell me I’m doing an amazing job.

Recently, my husband’s pay cycle changed from fortnightly to monthly whilst mine remained fortnightly. This brought me to the realisation that I would likely need to draw up two budgets, one for my husband’s income and one for mine. As a family of five, with three sons who eat us out of house and home, I need to be diligent about every dollar.

The old jar system

This then brought me back to the principles that made my grandfather’s budgeting, although simple, so very powerful. Yes, gone are the days where we tucked away our pay in a collection of jars in the cupboard but the principles to Pa’s system remain the same and as effective.

Each pay cycle, Pa would sit down and list all expenses and how much he would need to put away into each jar. Although in today’s budget there may be quite a few more “jars”, the theory is still exactly the same.

How I tweaked our family’s budget

As most bills are monthly, I completely restructured our budget to monthly, leaving my fortnightly income for mortgage and childcare (ouch!). I quickly learned that a successful part of family budgeting is to be able to reconcile your budget with your bank account, far easier when this process can be done to line up with the end of each month.

Each month, I ensure money is set aside for the expenses we don’t like to think about until they are upon us and we have no choice. For example, things like but not limited to:

- Annual vehicle registration

- Six monthly council rates

- Body corporate fees

- Beginning of the year schooling expenses

- Christmas!

Again, it’s back to the jar system or rather in today’s terms – our allocated bank accounts. I also find keeping a log and tally in an app or notepad on my smartphone of what funds I have allocated to which expense a necessity.

The importance of taking the time to thoroughly identify all my expenses proved imperative. Additionally, so is the importance of the cost of each expense, how frequently it occurs, and (where applicable) the next due date.

In a nutshell, once I got my head around the two budgets, identifying all my expenses and back to Pa’s jar theory, this all began to work!

What works for you and your family?

How can Quill assist?

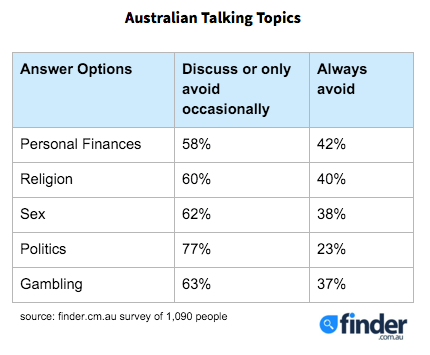

Politics. Sex. Religion. Money. For generations, we’ve been told to not talk about these subjects. Today, we probably talk about 2-3 of them more than we should, but we’re still really good at NOT talking about money. In many countries and cultures, we’ve been taught to NOT talk about money.

A 2016 research by finder.com.au has revealed that almost half of Australians would rather avoid the topic of money.

- 42% of those surveyed find personal finances the most difficult thing to talk about, even more than religion (40%), sex (38%) and politics (23%).

- Only 18% of Australians regularly discuss money and Gen Y (aged 18-34) appear to be the most comfortable talking about it when it does enter the conversation, with one in three (33%) often discussing personal finances.

- Baby Boomers (aged 55-74) are the least comfortable generation when it comes to talking about money, with 56% never discussing it.

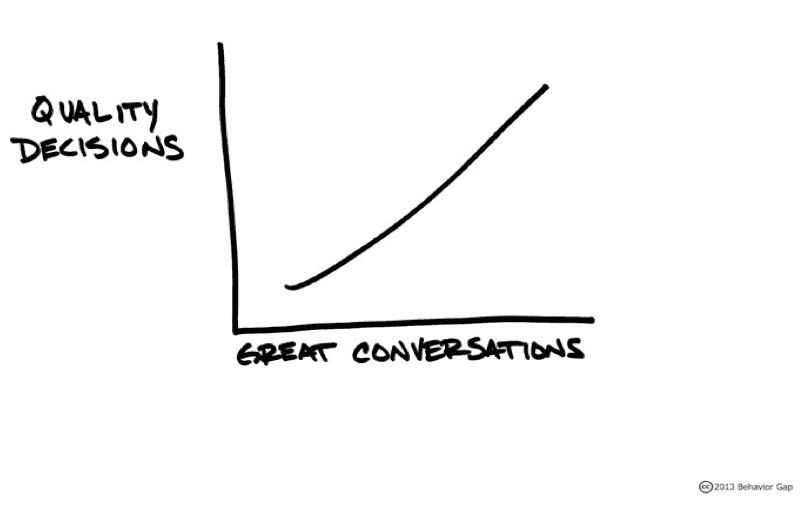

But it’s so important that we break that taboo because failing to talk about money means we often fail to align the use of our money with what we say is most important to us. Even the “experts” can struggle to talk about money in their personal lives.

The 2016 survey also included three reasons for why it is important that money matters be discussed. These reasons are:

- Gain knowledge: Talking to someone who has more financial knowledge than you is a great way to learn new personal finance concepts.

- Take action: Having a conversation with a friend can prompt the listener to take action on financial matters like looking for a cheaper home loan rate or drinking one less coffee a day to boost savings.Take act

- Learn from their mistakes: Chances are that someone you know has learnt the hard way about a financial matter you are contemplating. By finding out what they would do differently, you then have a head start.

It is important that you help the people you love in your relationships and your family, to have these important money conversations, that will lead to quality decisions.

Concessional contributions are those made with pre-tax income and can come in many forms, most commonly as

- Superannuation Guarantee contributions made by your employer,

- Salary sacrificed contributions made on your behalf, or

- Tax-deductible contributions if you are self-employed.

Below, we’ve summarised a few important considerations regarding the cap changes that became law on 29 November 2016.

-

A lower cap will apply from 1 July 2017

As part of the 2016 Federal Budget, the Coalition government announced plans to reduce the annual concessional contribution cap to $25,000 from 1 July 2017. The new cap will now apply to everyone regardless of age.

This will see the lowering of both the over-50s concessional (before-tax) contributions cap of $35,000 and the general concessional contributions cap (for under-50s) of $30,000. However, it’s important to note that the $35,000 and $30,000 caps still apply for the current (2016/2017) financial year.

-

Making the most of your caps

If you are looking to increase your pre-tax contributions to superannuation, now is a good time to ensure that you are making the most of your concessional contribution cap. This may involve investigating a salary sacrifice arrangement with your employer or reviewing an existing arrangement before the cap decreases in July. But it is equally important to ensure that you take action from 1 July 2017 to plan for the lower cap in the 2017/18 financial year.

Another important change to note is that from 1 July 2017, anyone who is eligible to make voluntary super contributions will also be eligible to make personal concessional (tax-deductible) contributions. Currently, people earning more than 10% of their income as an employee (i.e. salary and wages) cannot make a tax-deductible super contribution, so this recent change should provide greater flexibility with:

- end of year super top-ups by making personal concessional contributions to use up any remaining concessional contribution cap;

- deciding how to contribute bonuses, annual leave, and long service leave; or

- tax-effectively contributing lump sum leave payments received upon termination of employment.

-

Future indexation

While we will have to live with lower caps from now on, the government will continue the practice of indexing these in line with average wage growth. Therefore, we can expect the caps to increase every few years in increments of $2,500.

-

Carry-forward concessional contributions

There’s also good news for those with volatile or lumpy income, and those working intermittently. From 1 July 2018 onwards, if you fail to use your annual concessional contributions cap of $25,000, you can carry forward the unused portion for up to 5 years. Carry-forward concessional contributions may assist clients with breaks in employment to make ‘catch-up’ contributions when they return to work.

The provision applies on the condition that your total superannuation balance is less than $500,000 as at 30 June at the end of the financial year immediately preceding the financial year in which the contribution is to be made. Also bear in mind that as this new rule only takes effect from the 2018/19 financial year, you won’t be able to carry forward any unused concessional contributions cap until at least the 2019/2020 financial year.

-

Exceeding the cap

An important consideration is what happens if you do exceed the concessional contribution cap. Since the 2013/14 financial year, excess concessional contributions have not been subject to excess contributions tax. Therefore, if you do exceed the cap, the amount will be included in your assessable income and taxed at your marginal tax rate. In addition, the ATO imposes the Excess Concessional Contributions (ECC) charge so that a person does not obtain a financial advantage due to the delay in payment of tax on their ECC.

The ECC charge period is calculated from the start of the income year in which the excess concessional contributions were made and ends the day before the tax is due to be paid under your first income tax assessment for that year. The ECC charge rates are updated quarterly on the ATO website, with the current rate being 4.76% (Dec 2016 quarter).

What’s next?

So there’s plenty to think about in managing your concessional contributions this year and the next, so why not ask your financial adviser how you can make the most of the new rule changes?

If last year was the year of shocks and surprises, this will be the year of discovery as to what those surprises deliver. Britons voting with their feet to leave the European Union and the star of a Celebrity Apprentice show getting the gig as the most powerful man on the planet are two of the biggest surprises. Yet the biggest surprise of all is how well markets have handled these two surprises and the uncertainty they bring.

Before we start to consider what may be in store for 2017 it is worth looking back at the winners and losers in 2016.

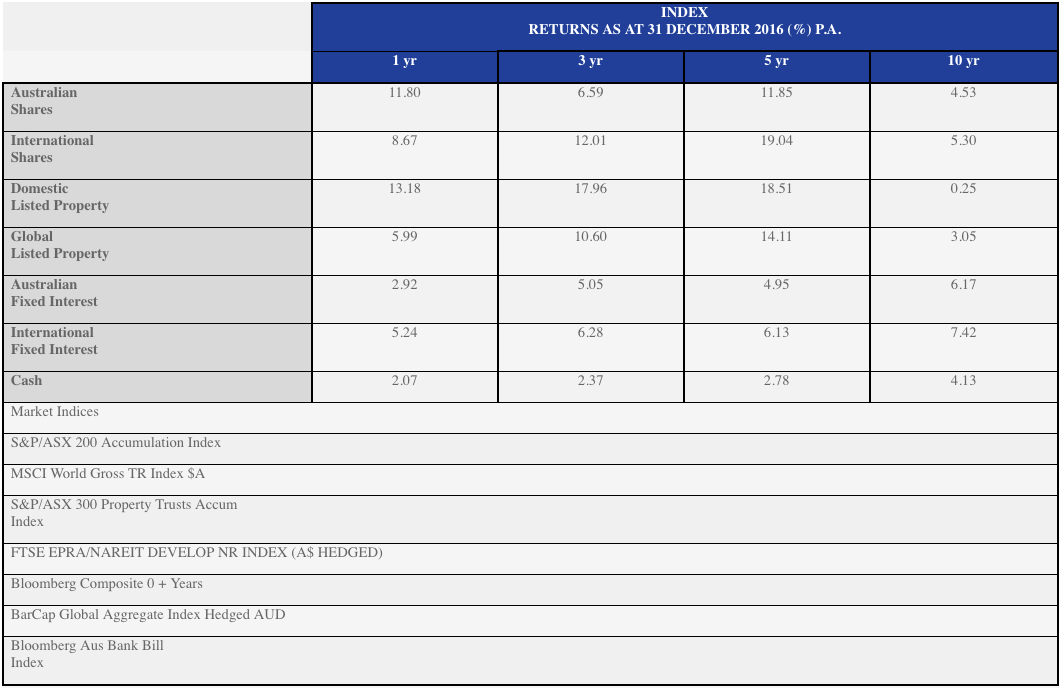

2016 Market Returns

Looking at the table below, one could be thinking that 2016 was a fairly benign year, with double digit returns in Australian Shares and listed property, and nothing in the negative. But looking only at the ‘year to year’ figures within those top performers hides some large intra year divergences. For example, from 1 January, the ASX 200 fell around 10% into early February. That level of decline is actually slightly less than the median 11.7% drawdown that the ASX200 has suffered in the last 23 calendar years. From the peak in April 2015 to the low in February 2016, the ASX200 was down by 18.9%.

From early August to mid-November, the A-REIT sector (listed property trusts) fell 19.2% along with other interest rate sensitive sectors as bond yields started to rise. Even the fixed interest sector was not exempt from losses. Although the full year showed a return of 2.92%, the index of Australian Government bonds lost 3.8% in the last quarter as interest rates rose and bond prices fell.

So what could happen in 2017?

President Trump

Trump becomes 50% politician 50% businessman. He fails to keep many promises, including the building of a great Mexican wall. He is brought to heel on some of the trade agreements he promised to tear up. But with the compromise, his Republican members come around to the idea of running up more debt to stimulate the economy and re-build the country’s infrastructure. This helps with more construction jobs, but fails to bring back the manufacturing jobs that were lost to Mexico and China. A confrontation is likely. Be it North Korea, China or Russia, one of these is going to push the boundaries and Trump is likely to relish the fight. Let’s hope it’s just words and doesn’t escalate.

Europe

The rest of Europe starts to weigh the benefits of remaining in a currency union, when possibly a trade bloc would be almost as good. It won’t happen in 2017, but the voices will grow louder. There will be winners and losers out of this, but keep in mind that whether you are German or Greek, you still like to eat, drive, sleep in a house, take occasional vacations; so life and the economy will go on.

US Interest Rates

US Interest rates move higher but only gradually. The rises are still less than the forward looking estimates of the Federal Reserve committee (which are made public, and often referred to as the ‘dot plots’). The move is limited to two hikes this year taking the Fed Funds rate up to a target of 1.00% to 1.25%. Australian longer term interest rates also rise, but again, it is likely to be modest. Currently the difference between yields on the Australian ten year bond and the two year bond stand at 0.80% (80 basis points). Only on 4 occasions in the last 20 years has this spread spiked to above 100 basis points. So unless you see a case for the short end (RBA Official Cash) rising dramatically, then the long end should only move up modestly. However, long duration fixed income funds will continue to face headwinds.

More volatility

As mentioned, this is not unusual. Trends do not go on forever and the worst strategy is loading up on last year’s winner. In fact LVX Research recently published a paper showing stellar returns from picking the five ASX100 stocks with the worst 5 year trailing returns.

The rally since the Trump Election could well be coming to an inflection point and some have postulated that his inauguration will prove to be the turning point. One doubts that it would be that obvious, and as we have learned last year, expect the un-expected. Whenever it happens, given the strong run-up, it should not surprise anyone if we see ten percent decline in shares. In fact, there is an 82% chance that during the year we will see an equities decline of that magnitude. (Only 3 years in the last 23 have had intra-year declines of less than 10%).

China

China continues to be the ‘swing factor’ in our sharemarket. Stimulus there has driven coal and iron ore prices higher, providing strong gains in our bulk commodity exporters. Overall Chinese corporate and SEO (State Owned Enterprise) debt as a percentage of gross domestic product (GDP) remains higher than the US, but since the Communist regime makes it much more palatable to have governments bail out SEO’s and Municipal Governments, a debt crisis there is likely to have a lesser impact than in the Eurozone.

Valuations

The 2017 Outlook won’t be complete without a mention of valuations. At 31 December, the ASX200 estimated forward Price to Earnings (P/E) ratio stood at 16.6. The 10 year average has been 14.3. You could say that compared to history the Australian sharemarket needs to be 13% lower to be at the average P/E ratio. However, those 10 years were at interest rates much higher than today, so maybe the current valuation can be justified.

Global equities are at 16.1x expected forward earnings, and the ten year average is 13.8x. A similar overvaluation case can be made there. And the US market, at 17x forward earnings, has about 14.5% of downside to hit the 10 year average of 14.5x. Perhaps the cheapest market in the world is Russia, which trades at only 6.6x earnings, and 80% of book value. Buying Russia might be a bit extreme, but Korea is interesting at 9.7x earnings and a price to cashflow of only 5.1x. As you can see, though many markets are expensive, there are pockets that are cheap. We find a similar situation in banks. Australian banks are now relatively expensive, but there are ‘digital disrupter’ banks in Europe that trade on very attractive valuations, without the baggage of the larger established banks.

Conclusion

As always, diversification and quality asset selection are the keys to success. It is fairly easy to identify quality assets, but knowing the right price to pay for those companies is what requires experience and skill.

Not chasing winners – but rather being willing to buy last year’s loser could be a good trade. It worked this year with the Metals and Mining index up 52.7% for the year. For the record, the worst sector in 2016 was Telecoms, down 7.1%, followed by Healthcare which managed only a 1.9% gain. The Asia (ex Japan) index had a poor return in 2016, but as a result now trades at only 13X forward earnings, versus 14.2X historically. Although this area disappointed us in 2016, we maintain a positive five year view on the region based on demographics and valuations.

Ensuring capital is available to invest during those inevitable market sell-offs should also be a rewarding strategy.

Remember, investing is a marathon, not a sprint, so don’t let the volatility get the better of you, rather make it work for you. All the best for 2017!

Arnold Horshack was the character in “Welcome Back Kotter”, who famously said, “when you least expect it – expect it!”.

It seems like 2016 will go down as the year of getting what we least expected, with outcomes that were even less expected!

Brexit and Trump were the two least expected outcomes, with grave concerns of what would happen to financial markets in either event.

Turns out the least expected outcomes are those that have come to pass.

Last weekend, Italy voted on changes to the constitution for the purpose of strengthening the lower house of parliament against the Senate. The government would then have some hope of actually passing some laws that would modernise the labour markets and other areas of sorely needed economic reform.

After a resounding NO, Prime Minister Matteo Renzi has resigned. There were concerns that the resulting political instability would turn attention back to the plight of Italian banks. Estimates are that Italy’s banks have EUR380 billion of bad loans, and continued political instability will make it less attractive for private capital to provide further support. But no, markets have completely taken that in their stride, and barely missed a beat. The Euro crashed to USD1.05 but then rebounded the same day to USD1.075.

The Austrian elections have installed a Green Party leader. Voters have turned their backs on major parties, and that market was up 2.5% in the following two days.

Next year, the big event is the first round of voting for the next French President on 23 April. Socialist president, Hollande, has decided not to run, leaving many questions open and the far right ‘National Front’ leader, Marine Le Pen, gaining in popularity.

Whatever the outcome, we do need to be prepared for, and not spooked by, the accompanying volatility.

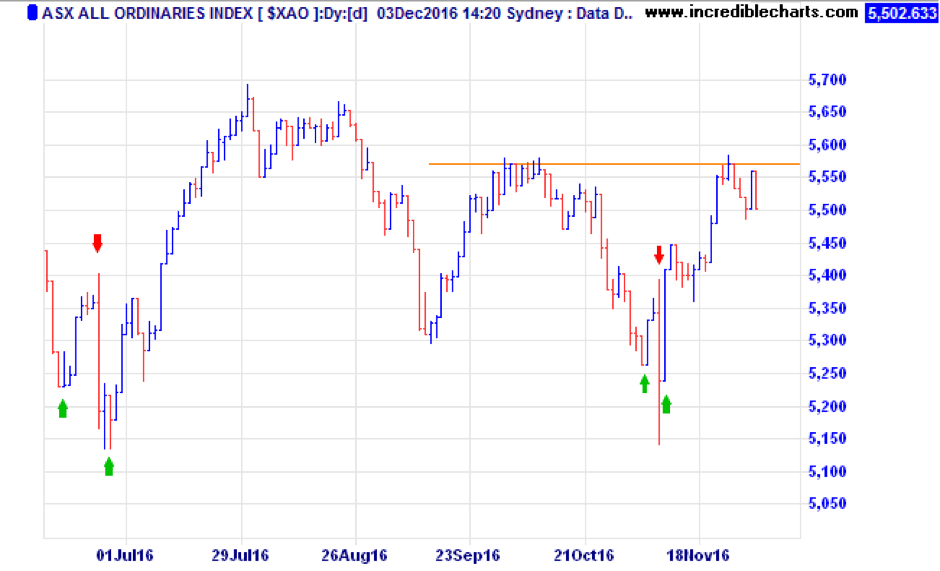

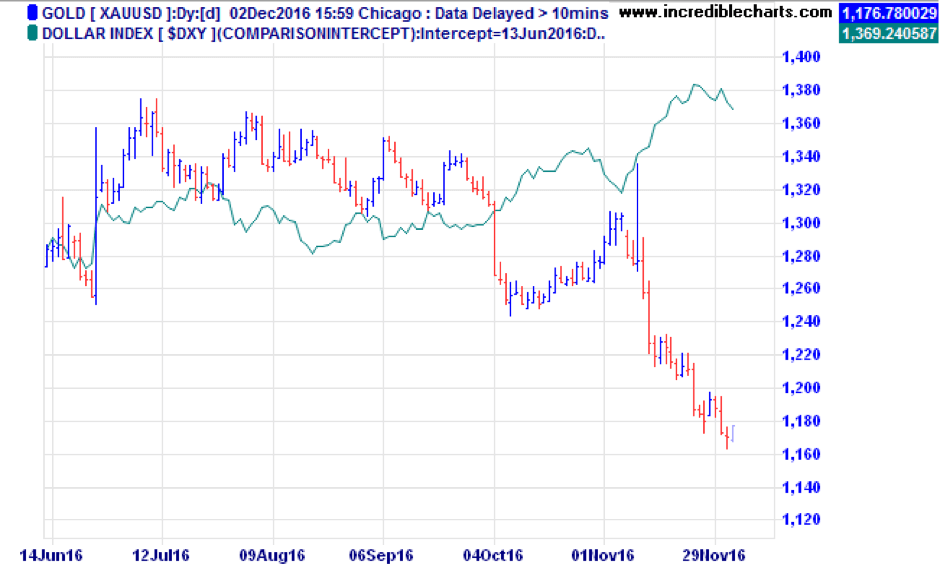

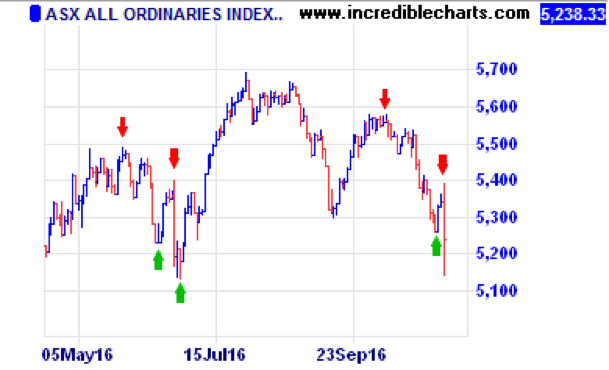

Our first chart helps to visualise the impacts of the Brexit and Trump surprises.

A familiar pattern shows up. Polls favouring the ‘expected’ result in a buoy in the market in the days leading up to the event (first green arrows). Then, the unexpected shock hits the market (down arrows in red). Lastly, we get the realisation that maybe it ‘won’t be so bad after all’ and markets get back on track.

As an aside, right now the market is having a struggle breaking through the highs that were made after the post Brexit rally. A move above 5500 on the ASX200 or 5580 on the All Ords is required to confirm the rally that is underway.

Another chart we want to share this month is the USD index (basket of the USD vs trade weighted currencies) and its relationship to the gold price.

Since the Trump win, the USD has strengthened (again – unexpectedly) while gold has sold off. The strong dollar/weak gold is a traditional relationship, and you can see this very emphatically since the early November Trump surprise. The strong dollar run does however show some early signs of easing. Australian gold stocks have sold off heavily in the last three weeks, so it will be interesting to see if the dollar is topping and whether gold can find a bottom at these levels.

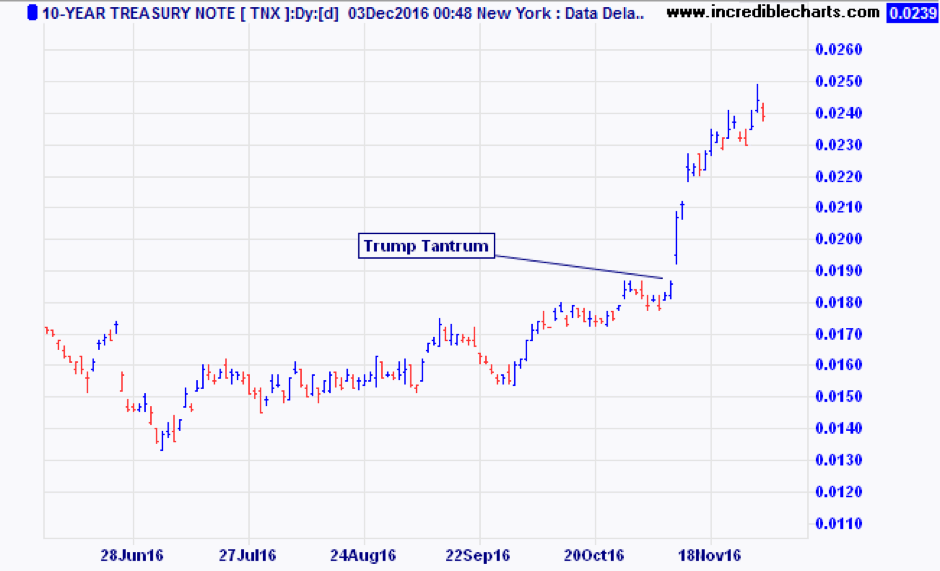

The other chart we wanted to share is that of the ten year US Treasury bond, where the rise in yields has resulted in a sell-off in yield sensitive sectors. We (and others) previously identified these as the ‘expensive defensives’ that we wanted to avoid, or at least restrict to low exposures to in our portfolios.

In our fixed interest portfolios, the primary position has been to hold short maturities in preparation for this exact risk. The funds we use in this sector generally have a mandate to shorten or lengthen the duration, taking advantage of sell-offs like these.

The other big event that is yet to come this year is the Fed meeting on 15/16 December. It is widely expected (92% odds) that the US Federal Reserve will hike the short term rate to 0.50% at that meeting. That rate hike is fully factored into markets already. It will be a matter of how many hikes follow in 2017 that dictates whether the sell-off in yield assets is a buying opportunity, or just the start of a larger rotation into cyclical stocks.

All we can say is, “expect the unexpected’ or, in the words of Arnold Horshack “when you least expect it – expect it!”.

Our portfolio management strategies are positioned to be resilient in the face of volatility, and in many cases to take advantage of it.

It has been an extraordinary 12 months of media in Australia covering the USA election. I have been around for a long time and am very interested in politics, but I cannot remember another election which received so much Australian media attention. With daily media saturation, you could be forgiven for wondering if we had become just another United State of America.

But, what can we learn? It seems everyone was shocked by the outcome. For some reason, I wasn’t. I had been watching the outrageous circus that Mr Trump’s campaign became. I also watched and questioned Mrs Clinton’s extraordinary election budget and a degree of premature victory in her campaign, which obviously didn’t resonate in middle America.

Mr Trump would offend minorities every day and Mrs Clinton tried to follow suit by offending half of the American public calling them deplorable. Well, that obviously backfired so I guess there is a lesson in that.

Lesson: Mr Trump offered hope and the promise to “Make America Great Again” and Mrs Clinton promised “more of the same”.

I still have trouble understanding their election process. They have Primary votes where the public attends polling booths to vote for their candidate by ballot. Then they have Caucus votes which take place in a public hall after listening to evangelistic community debates. This culminates in the respective candidates who ultimately run for President. Then, rather than the President being elected on a populous vote, the Founding Fathers established what is called the Electoral College made up of Congressmen and Senators from each state (the bigger the state, the more electors it has). In the end, these 270 people decide on the President. That is how Americans ended up with a choice between The Bad and The Mad.

Lesson: Maybe the Aussie electoral process isn’t that bad after all.

Both candidates were very well known to the American public with significant public profiles. Maybe the difference was Mr Trump became entertainment fodder to the media with his outrageous “snackable” media bites. He would say anything for attention. He just played the media every day. Mrs Clinton had no option other than following his lead by rebutting his ridiculous comments. Everyone knew Mr Trump was “Mad”. Ultimately, Mrs Clinton failed to defend her character of being “Bad”. The hint of corruption became a stench when the FBI became involved. Who knows where the truth lies but the mud obviously stuck and millions of people who would not normally vote were disrupted enough to make the effort.

Lesson: Maybe compulsory voting in Australia reduces the degree of swing which caught their polls off guard.

Time in office will define Mr Trump. He has the top job. He has already toned down his insults and comments on Twitter. I suspect he will be forced to be more moderate and become more centre right by his advisers and the “Establishment” (another scary group of people in the shadows). However, he will be President and he will hold the nuclear codes (even more scary).

Lesson: You can say and do anything in an election campaign and get away with it.

Not only did Mr Trump get away with it but the Republicans won both houses of parliament. Now they were the real winner.

On or before 18 May 2019, Australia will go to the polls. If Mr Turnbull promises “more of the same”, he will get smashed. If Mr Shorten (or possibly Mr Albanese) learns from the USA election, we can look forward to outrageous quotes and antics.

Final Lesson: May 2019 sounds like a nice time to book an overseas holiday to get away from our next circus.

Whether it’s for diversifying the investment pool or even for the trustees fearing the next financial ‘doomsday’ event, a common question we get asked is “can an SMSF buy gold? And are there any rules we need to be aware of?”.

In short, yes and yes!

The first thing to consider is what type of gold we are analysing; are they collectable gold coins or bullion bars? For the purpose of our blog, we look at bullion bars. Please refer to ‘collectable rules’ via the ATO website for more details on collectables.

Gold bullion bars

Since they are not defined as a collectable, when an SMSF buys bullion bars, the key issues to consider are as follows:

-

Where will it be stored?

- Whilst there are no specific rules around this, it’s the trustee’s responsibility to make sure the gold assets are securely protected. We recommend it is not stored in the trustee’s home and instead, stored in a dedicated vault service.

-

Does it need to be insured?

- Again, there are no specific rules around this so it comes down to the discretion of the trustee as to whether it is insured or not. If insurance is arranged, it cannot be part of a personal insurance policy, such as the home and contents.

-

What records need to be maintained?

- The trustees should keep a record of the purchase and sales documents (invoice etc) in the name of the SMSF as proof of ownership and for the calculation of (hopefully!) gains or losses.

When it comes to the annual accounts reporting, we will request for details on the above 3 matters. Then, for record keeping purposes, we will prepare an asset declaration for the trustees to sign confirming these key details.

There’s no doubt the Gold Coast offers a great lifestyle, but what can it offer businesses starting out?

The City of Gold Coast provides strong support for business with access to State and Federal support. Below are a few programs available to Gold Coast businesses.

Growth Accelerator Program

Assists businesses in identifying the critical steps needed to achieve the next phase of growth. It’s targeted at businesses with high growth potential that are looking to accelerate growth, businesses experiencing high growth and are unaware of financial and other risk factors associated with growth, and business owners building a business that’s not reliant on them.

Online Business Program

Provides businesses with an understanding of the fundamental tools for conducting online business to achieve increased online sales and leads. It also assists to identify opportunities and make improvements to digital assets to enable business growth. You may consider this program if you currently do business online and are looking for opportunities to grow, if you are looking to offer products or services online, or if you are looking to gain a better understanding of online marketing.

Emerging Exports Program

There are two programs that assist businesses new to export and emerging exporters breaking into overseas markets.

The Emerging Exporters Program – Driving Export Growth guides businesses in:

How and why to export

Where to export

Market entry strategies

Critical success factors

Marketing and sales overseas

Visiting overseas

Launching a product

The Emerging Exporters Program – Exporting Online assists businesses in:

Driving international website traffic

Processing and fulfilling international payments and delivery

Regulations, documentation and legal issues for online export sales

Automating trade show follow-up and partner training

Launching a product in a market online and offline

Markets focus – USA, Japan and Korea

Launching a product – offline and leveraging online tools

Export Assistance Scheme

The scheme provides financial support to emerging and existing exporters who are export ready and have identified international markets for their products and services. It’s designed to encourage SME Gold Coast companies to develop export markets, assist export businesses to be sustainable and increase export sales, and assist emerging and existing export businesses in entering new growth and emerging markets.

If your business is eligible and your export relates to Northeast Asia, Southeast Asia, New Zealand and the Pacific Islands, you can be funded $1,500. For Europe, the Middle East, Africa and the Americas, you can be funded $3,000.

The funding is limited to one payment of either amount per year for up to 3 years.

Further information about the programs and support for starting a business on the Gold Coast can be found on the More Gold Coast website.

Well, that’s it! I am never going to trust an opinion poll again. EVER.

It seems to be the year for underdogs and populist candidates.

You can’t help but get a feeling of Brexit dejavu when you reflect on the events of this week.

As we write, markets are going berserk, because the consensus view was WRONG.

What can we do? If the pattern that followed the Brexit surprise is anything to go by, probably nothing. Taking a look at the sequence of events back then, it is remarkably similar.

In late May, the markets start to pay attention to this looming Brexit vote. The sell off began as position traders squared their books, cautious of what might happen. A week out from the vote though, the pollsters were confident in a STAY vote, so traders started putting on risk again in anticipation of a relief rally.

But lo and behold, the vote was to LEAVE, and all that position risk came off again in the next 72 hours. But then what? An even greater relief rally took the market up 9% in the following 5 weeks.

Fast forward to US Elections

With 4 weeks to go, a sell off commences based on the risk of a Trump Election (the big moves in the Mexican Peso confirmed the Trump odds as the main driver). Then, on Sunday the 6th we get news that Hillary Clinton is in the clear with the FBI, and a risk-on rally starts in the first markets that open after the announcement. Australia leads a 1.25% rise on the basis that odds were again leaning heavily towards Hillary. OOPS! Those darn pollsters were wrong again! With the Asian markets trading during the hours when the result became apparent, we got hammered. (see last bar on the chart above).

Trump: I congratulated Hillary Clinton “on a very, very hard-fought campaign” https://t.co/StZ7fgTy0W #ElectionNight https://t.co/kzfNHZC3Ic

— CNN (@CNN) November 9, 2016

So, what will happen now? Frankly, we don’t know. A rally the likes of what happened following Brexit is a very big possibility, and something to contemplate before selling anything. You only have to look at the chart above to see what can follow on from events that had previously been contemplated, but were then discounted.

No doubt the next few days will bring lists of winners and losers from economists, but here are a few to get us started. Big Pharma companies were fearful of Clinton’s pricing threats, so they will rally right out of the gate. Hospital stocks on the other hand could fall if there is a repeal of aspects of Obamacare. Companies with a big stash of offshore cash may rally, as Trump is likely to implement changes to the tax code to incentivise repatriation of that cash, which could then fund re-investment, stock buybacks, or higher dividends. Financials and Insurers are certain to get some relief, as they had been sold off in fear of Clinton regulations.

The US Dollar may lose some of its safe haven status, but will still likely remain the ‘second cleanest’ shirt behind the Japanese Yen which is already rising on this news, with a commensurate slump in Japanese equities.

In commodities, gold may be the big winner as a truly global ‘currency’. Trump’s climate change denial will likely favour coal companies over natural gas.

In the short term oil will be down, but the potential of Trump to turn his back on the Middle East, increasing tensions there, could spur an oil price rally in the longer term.

The Impact on us

The biggest impact on Australia is potentially an indirect effect of protectionist policies against China, weakening that economy, in turn reducing demand for coal and iron.

But at the moment it is all a bit too early to contemplate which of these should have the highest weighting. Further, reacting in the midst of a panic has never been a good idea.

Pros and Cons for your finances

Below is an outline of pros and cons for the finances of everyday Australians based on what’s been said by local economists and financial commentators.

| Estimated Pros | Estimated Cons |

|---|---|

|

|

Source: Canstar, 2016