Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Up until 30 June 2017, an individual (mainly those who are self-employed) could claim a deduction for personal super contributions where they meet certain conditions. One of these conditions is that less than 10% of their income is from salary and wages. This was known as the “10% test”.

From 1 July 2017, the 10% test has been removed. This means most people under 75 years old will be able to claim a tax deduction for personal super contributions (including those aged 65 to 74 who meet the work test).

Editor: Call our office if you need assistance in relation to the application of the work test for a client that is aged 65 to 74.

Eligibility rules

An individual can claim a deduction for personal super contributions made on or after 1 July 2017 if:

- A contribution is made to a complying super fund or a retirement savings account that is not a Commonwealth public sector superannuation scheme in which an individual has a defined benefit interest or a Constitutionally Protected Fund;

- The age restrictions are met;

- The fund member notifies their fund in writing of the amount they intend to claim as a deduction; and

- The fund acknowledges the notice of intent to claim a deduction in writing.

Concessional contributions cap

Broadly speaking, contributions to super that are deductible to an employer or an individual, count towards an individual’s ‘concessional contributions cap’.

The contributions claimed by an individual as a deduction will count towards their concessional contributions cap, which for the year commencing 1 July 2017 is $25,000, regardless of age. If an individual’s cap is exceeded, they will have to pay extra tax.

Call our office to discuss the eligibility criteria and tax consequences of claiming a tax deduction for a personal contribution to super for the year commencing 1 July 2017.

Anyone with investment property in Australia is probably feeling a little edgy with all the recent media attention on deductions, affordable housing, and negative gearing. We take a look at some of the key tax issues for investors pre and post 30 June:

No more deductions for travelling to and from your investment property

The days of writing-off the costs of travel to and from your residential investment property are about to end. From 1 July 2017, the Government intends to abolish deductions for travel expenses related to inspecting, maintaining, or collecting rent for a residential rental property.

Depreciation changes and how to maximise your deductions now

Investors who purchase residential rental property from Budget night (9 May 2017, 7:30pm) may not be able to claim the same tax deductions as investors who purchased property prior to this date. In the recent Federal Budget, the Government announced its intention to limit the depreciation deductions available.

Investors who directly purchase plant and equipment – such as ovens, air conditioning units, swimming pools, carpets etc., – for their residential investment property after 9 May 2017 will be able to claim depreciation deductions over the effective life of the asset. However, subsequent owners of a property will be unable to claim deductions for plant and equipment purchased by a previous owner of that property. If you are not the original purchaser of the item, you will not be able to use the depreciation rules to your advantage. This is very different to how the rules work now with successive owners being able to claim depreciation deductions.

Investors will still be able to claim capital works deductions including any additional capital works carried out by a previous owner. This is based on the original cost of the construction work rather than what a subsequent owner paid to purchase the property.

There are very limited details about how this Budget announcement will work but we will bring you more as soon as we know.

Business as usual for pre 9 May investment property owners

If you bought an investment property recently, are about to renovate, or have not had a depreciation schedule completed previously, you should consider having one completed.

As a property gets older the building and items within it wear out. Property owners of income producing buildings are able to claim a deduction for this wear and tear. Depreciation schedules are completed by quantity surveyors and itemise the depreciation deductions you can claim.

Higher immediate deductions for co-owners

It’s not uncommon to have multiple owners of an investment property. Co-ownership can, in some circumstances, quicken the rate depreciation deductions can be claimed for the same asset. This is because depreciation is claimed on each owner’s interest. If an owner’s interest in an asset is less than $300, they can claim an immediate deduction. In a situation where there are two owners split 50:50, both owners could potentially claim the immediate deduction, bringing the total immediate deduction available up to $600 for a single asset.

The same method can be used when applying low-value pooling. Where an owner’s interest in an asset is less than $1,000, these items will qualify to be placed in a low-value pool. This means they can be claimed at an increased rate of 18.75% in the first year regardless of the number of days owned and 37.5% from the second year onwards.

In a situation where ownership is split 50:50, by calculating an owner’s interest in each asset first, the owners will qualify to pool assets which cost less than $2,000 in total to the low-value pool.

The value of renovations

It’s best to get a depreciation schedule completed before you start renovations so the scrap value of any items you remove can be recognised and written-off as a 100% tax deduction in the year of removal. This is available for both plant and equipment depreciation and capital works deductions. When new work is completed as part of the renovations (i.e., a new roof, walls, or ceiling), this can also be depreciated going forward.

In some circumstances, there may be depreciation deductions available for renovations completed by a previous owner.

Deductions for older properties

Investors in older properties may still be able to claim depreciation costs. This is because a lot of the items in the house will not be the same age as the house or apartment. Hot water systems, ovens, carpets, curtains etc., have probably all been replaced over time. Additional works, extensions or internal refurbishments may also be deductible.

Further restrictions on foreign property investors

We have seen a number of measures over the years restricting access to tax concessions for foreign investors, particularly for residential property investments. The recent Federal Budget goes one step further, restricting access to tax concessions, increasing taxes, and penalising investors who leave property vacant.

Measures include:

Charge for leaving properties vacant

Foreign owners of residential Australian property will incur a charge if their property is not occupied or genuinely available on the rental market for at least 6 months each year. The charge, which is expected to be at least $5,000, does not appear to apply to existing investments but those made on or after Budget night, 7:30pm on 9 May 2017.

Excluded from main residence exemption

Foreign and temporary residents will be excluded from the main residence exemption. The main residence exemption excludes private homes from capital gains tax (CGT). Existing properties held prior to 9 May will be grandfathered until 30 June 2019. However, it remains to be seen whether partial relief will be available to those who have been residents of Australia for part of the period they owned the property and whether this change will apply to Australian residents who were classified as a foreign resident for part of the ownership period.

Increase in CGT withholding tax

When someone buys Australian real property (i.e., land and buildings) they are currently required to remit 10% of the purchase price directly to the ATO as part of the settlement process unless the vendor provides a certificate from the ATO indicating that they are an Australian resident. These rules do not currently apply if the property is worth less than $2 million. From 1 July 2017, the CGT withholding rate under these rules will increase by 2.5% to 12.5%. Also, the CGT withholding threshold for foreign tax residents will reduce from $2 million to $750,000, capturing a much wider pool of taxpayers and property transactions.

Rules tighten for property purchased through companies or trusts

Australian property held through companies or trusts by non-residents or temporary residents is also being targeted by expanding the principal assets test to include associates. The move is to prevent foreign residents avoiding Australian CGT liability by splitting indirect interests in Australian real property.

Level of foreign investment in developments capped

A 50% cap is being placed on foreign ownership in new developments.

The push for affordable housing

The Government is very keen to ensure that investment is directed into ‘affordable housing.’

The 2017-18 Budget announced an increase in the CGT discount for individuals who choose to invest in affordable housing. The current 50% discount will increase by 10% to 60% for Australian resident individuals who elect to invest in qualifying affordable housing.

In addition, the Government is creating investment opportunities for Managed Investment Trusts (MIT) to set up to acquire, construct or redevelop property to hold as affordable housing. In order for investors to receive concessional taxation treatment through an MIT, the affordable housing must be available for rent for at least 10 years. For foreign investors, MITs are one area where the Government is actively encouraging participation rather than restricting it.

Tax time is almost upon us so it’s time to get prepared. Here’s your tax planning guide including an update of what’s changing this year, to help you get EOFY ready.

Update: Tax Planning 2020 Guide – Individual Tax Deductions

In this guide:

- Income tax changes for 2016/17

- General year end tax planning strategies

- Income tax changes – small businesses

- Income tax changes – individuals

- Superannuation – relevant thresholds

Income Tax Changes for 2016/17

Several tax changes apply in the 2016/17 income year. A brief summary is provided in this guide.

There may be some advantages in acting on some of these items before 30 June 2017.

If you think any of these changes may affect you, please contact us for more details.

General Year End Tax Planning Strategies

Here are a few strategies to consider before finalising your tax this year.

Definition of small business

The definition of a Small Business (SBE) has changed from having $2 million in turnover to $10 million in turnover. Many more businesses will now have access to the SBE tax concessions.

Business income and expenses

Subject to cash flow requirements, consider deferring income until after 30 June, especially if you expect lower income for 2017/18 compared to 2016/17.

Most businesses are taxed on income when it is invoiced. Some small businesses may be taxed only when income is received. Income from construction contracts is generally taxed when progress payments are invoiced or received.

Ensure that you have complied with the requirements to claim deductions in 2016/17:

- Bad debts must be written off in your accounts before 30 June

- Employer and/or self-employed superannuation contributions must be paid to, and received by, the super fund before 30 June and must be within the contributions cap ($35,000 for individuals aged 49 or over on 30 June 2017, otherwise $30,000)

- Depreciation can be claimed for assets first used, or installed ready for use, before 30 June

- Small businesses (turnover less than $10 million) can claim expenses prepaid up to 12 months in advance – for larger businesses, this is generally limited to expenses below $1,000

- Wages paid to your spouse or family members must be reasonable for the work performed.

Small businesses planning major purchases or replacements of capital equipment should contact us for advice. Careful timing of those transactions can result in substantial tax savings.

Review valuations of trading stock in the lead up to 30 June. Best practice is generally to value stock at the lower cost or market selling value. This may change if you expect a tax loss for 2016/17, or substantially higher income in 2017/18 compared to 2016/17.

Personal income, deductions and tax offsets

Subject to cash flow requirements, set term deposits to mature after 1 July, rather than before 30 June.

Consider realising capital losses if you have already realised capital gains on other assets during 2016/17. Conversely, consider realising capital gains if you have unrecouped capital losses, especially if you expect substantially higher income in 2017/18 compared to 2016/17.

If you expect lower income in 2017/18 due to retirement or any other reason, consider deferring income until after 1 July, when you will be in a lower tax bracket. If you are a primary producer and you expect a permanent reduction in income, consider withdrawing from the income averaging system.

Access to the Net Medical Expenses Tax Offset is restricted to medical expenses relating to disability aids, attendant care or aged care.

Arrange for deductible donations to be grouped in the higher income year, if you expect substantially higher or lower income in 2017/18 compared to 2016/17. Make all donations in the name of the higher income earner.

If you plan to purchase income-producing assets, consider acquiring assets that will generate positive cash flow in the name of the lower income earner. Conversely, consider acquiring negatively geared assets in the name of the higher income earner.

Residency changes

Contact us for advice if you have moved to or from Australia for an extended period. You may need to review your residency status for tax purposes. There are important tax consequences if you change residency.

Trusts

Trustees of trusts should ensure that all necessary documentation is completed before 30 June, where you intend to stream capital gains or franked distributions to specific beneficiaries.

Family discretionary trusts may need to make a family trust election if the trust has unrecouped losses, or has beneficiaries whose total franking credits for the year may exceed $5,000.

Tax shelter schemes

Be sceptical of year-end tax shelter schemes. You should not enter a scheme without advice regarding both its tax consequences and commercial viability.

Income Tax Changes – Small Business

Tax rate

The tax rate for small business entity (SBE) companies is 27.5% from 1 July 2016.

Individual small business taxpayers are entitled to 5% discount of the income tax payable on the business income received from a small business entity (other than a company), up to a maximum of $1,000 a year.

Accelerated Depreciation

An immediate deduction is available for an asset costing less than $20,000 acquired on or after 12 May 2016 and first used or installed ready for use between 12 May 2016 and 30 June 2017.

The balance of the general small business pool is also immediately deducted if the balance is less than $20,000 at 30 June.

Blackhole Expenditure

From 1 July 2016, start-up companies, trusts or partnerships can immediately deduct a range of professional expenses associated with starting a new business (e.g. professional, legal and accounting advice). This only applies to SBE’s.

Income Tax Changes – Individuals

Car expenses

From the 2015/16 tax year, the 1/3 of actual expenses and the 12% of original value method for claiming work related car expenses can no longer be used.

A single flat rate of 66 cents per kilometre is to be used for the cents per km method. Alternatively, a log book must be maintained for a 12 week period to determine the business percentage of all running costs.

Zone tax offset

From the 2015/16 tax year, the zone tax offset excludes ‘fly-in fly-out’ and ‘drive-in drive-out’ workers where their normal residence is not within a ‘zone’.

Superannuation – relevant thresholds

Super co-contribution

Super co-contribution helps eligible people boost their retirement savings.

If you’re a low or middle-income earner and make personal (after-tax) contributions to your super fund, the government also makes a contribution (called a co-contribution) up to a maximum amount of $500.

The full co-contribution rate applies for income up to $36,021 and the partial co-contribution applies for income up to $51,021 for the 2016/17 tax year.

Concessional Contributions

The concessional contribution caps for the 2016/2017 tax year are:

- $30,000 for people aged up to 48 years or under as at 30 June 2016;

- $35,000 for people aged 49 years and over.

These represent the limit on the amount of contributions you can make within the year, and include the Super Guarantee payments made on your behalf by your employer.

Should you wish to discuss your superannuation needs, please contact the team at Superfund Partners.

For help with any of the above information in our guide above, reach out and we’ll happily talk you through it step-by-step

After months of speculation as to what the Government is planning to implement in the 2017 Federal Budget, finally, the budget changes have been released to the public. Implementation of changes is soon to commence.

There are certainly some “winners” and “losers” but overall, the aim of the budget is to positively impact our economy. And with a thriving economy, all Australians are winners.

As a millennial, my biggest focus around the budget is; housing affordability and student debt. So, let’s focus on these points.

First Home Buyers

There had been speculation over the previous months that the government was going to allow first home buyers access to their superannuation savings to fund their house deposit. Personally, I was horrified to hear this was a serious consideration. Such a scheme would influence further implications and retirement unaffordability issues down the track. Pleasing to hear, this scheme was dismissed.

The “First Home Super Savers Scheme” is being implemented from 1 July 2017. This effectively allows individuals to salary sacrifice savings towards a house deposit into their super. By salary sacrificing, a tax advantage is applied as these contributions are considered concessional contributions (pre-tax). Therefore, salary sacrificed contributions and earnings in super are taxed at 15% rather than the marginal tax rate.

Only the contributions to the First Home Savers Scheme will be available to withdraw for first home deposits. Until a condition of release is met, no other superannuation savings are accessible. If you do not end up purchasing a home, these additional contributions will not be accessible until retirement or a condition of release has been met.

It is important to note; the First Home Super Savers Scheme is capped at $30,000. However, as previously mentioned, these contributions are classified as concessional contributions which oblige to the annual cap of $25,000. Noting also that your Superannuation Guarantee Contributions also fall under this cap, you are limited to contributing a maximum of $15,000 (without exceeding the $25,000 cap) into the First Home Super Savers Scheme per annum.

15% tax is applied on each contribution into your First Home Super Savers Scheme account. For example, let’s say you contribute $10,000 in a financial year, only $8,500 hits your first home savers account as $1,500 of the contribution is paid in tax. As a comparison, let’s say you fit into the 34.5% tax bracket and decide to place this $10,000 pre-tax money into a bank account outside of super. This means you will pay $3,450 in tax opposed to $1,500.

Withdrawal of these contributions will be accessible by 1 July 2018 and will be calculated using a deemed rate of return. Upon withdrawal, the value of your savings will be added to your assessable income with a tax rebate of 30%. Therefore, if we use the same example above and assume with the withdrawal added to your assessable income that you remain in the 34.5% tax bracket, you will be liable to pay a further 4.5% tax on the withdrawal of your savings. It feels a bit like the government is double dipping here… nonetheless, it’s still a great tax saving strategy. For a detailed example of how the deemed rate and tax rebate is calculated, refer to Mark Beveridge’s blog.

Although the First Home Super Savers Scheme is capped at only $30,000, I think it’s a great opportunity to start saving. The government has provided a handy estimator tool to calculate the difference in savings when using the First Home Super Savers Scheme verses saving in a standard deposit account outside of super.

Investment Properties

Good news for some property investors! In a bid to make housing more affordable and appealing to Australian investors, the Capital Gains Tax (CGT) discount has increased from 50% to 60%. To be eligible for the 60% CGT discount, the residential property must;

- Be rented to low to moderate income tenants

- Be rented at a discounted rate

- Be managed through a registered community housing provider, and

- Held for a 3-year minimum.

During periods where the property is not used for affordable housing purposes, the additional discount will be pro-rated.

Unfortunately for property investors, reductions and eliminations of certain claimable tax deductions will be implemented. These changes affect previously claimable travel expenses and property plant and equipment depreciation deductions.

Not so great news for foreign property investors, but good news again for Australian investors as these new changes will provide Australians with increased opportunity to invest. Foreign ownership will be restricted to 50% in new property developments. They will also be liable to a minimum $5,000 annual levy if their properties are found to be unoccupied or not genuinely available to rent for at least 6 months per annum.

CGT main residence exemption will also no longer be available for foreign property owners. However, a grandfathering rule for the exemption will be implemented for existing owners up until 30 June 2019.

Foreign tax residents will also see the CGT withholding rate increased from 10% to 12.5% and the property value threshold will reduce from $2 million to $750,000 from 1 July 2017.

Student Loans

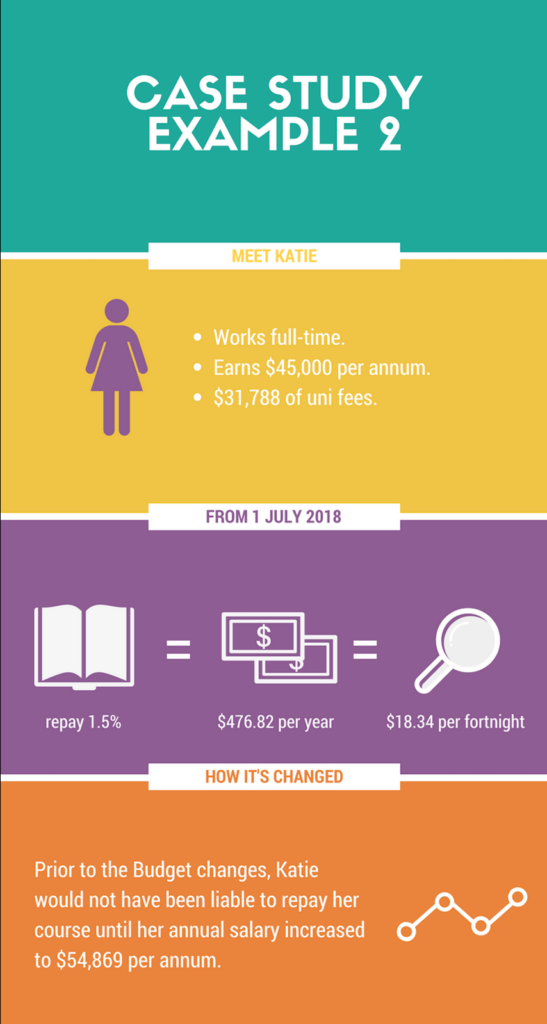

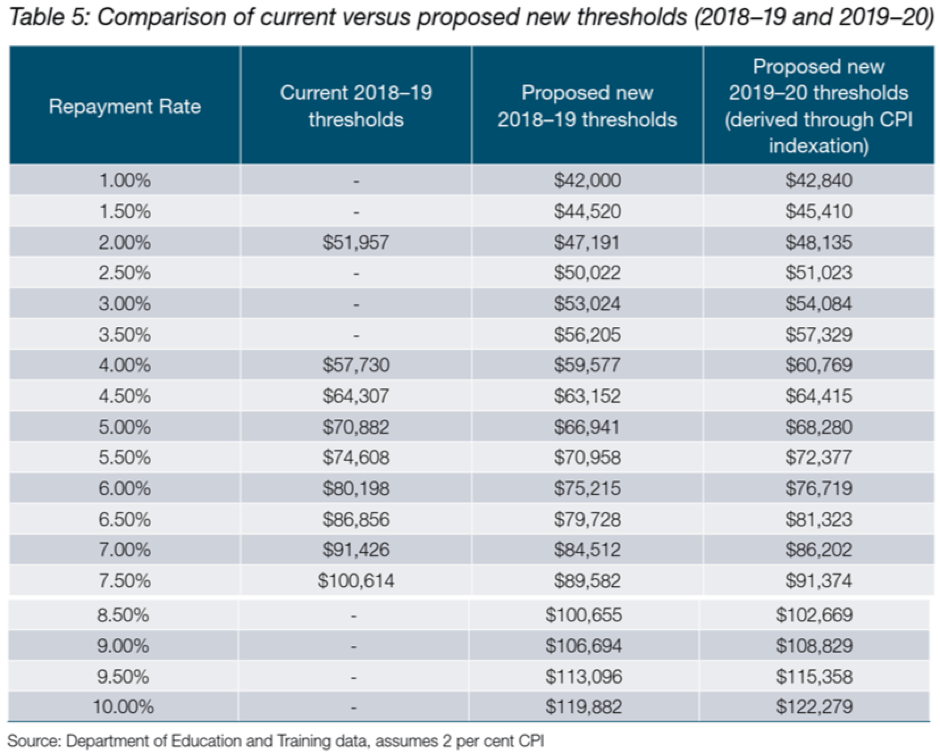

Bad luck for students. It seems to be getting progressively harder to afford study. Not only are university fees increasing, but the minimum income threshold to repay your HECS or HELP debt is now reduced to $42,000 per annum from $54,869 per annum.

Combine that with the average four-year course increasing in fees by approximately $2,200 to $3,600, it’s a scary outlook for existing and future students.

However, we can catch our breath (just a little). It’s not as bad as it sounds. Previously, once the threshold of $54,869 was reached, 4% of the course repayment was due payable. With the new minimum threshold reduction, only 1% is payable with annual income of $42,000. Once your salary reaches approximately $53,000 to $56,000, which is around the old threshold, you will be repaying between 3% and 3.5%.

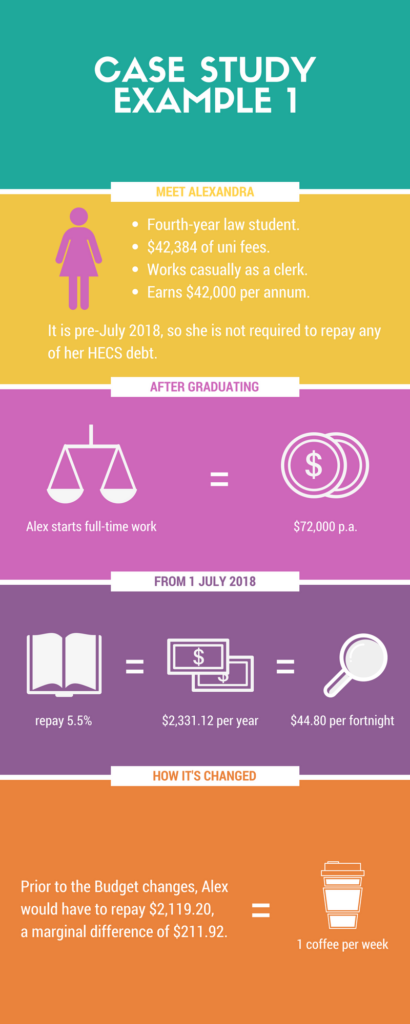

Let’s do a case study or two to delve into this a little deeper.

It’s important to remember that although there is no interest accumulating on these student loans, they do increase with CPI (Consumer Price Index).

The increase in university fees and reduction in the repayment threshold isn’t the outcome any student was hoping for. But, as detailed in our first case study, the difference is about two cups of coffee (if that!) each fortnight. We will prevail!

Refer to the Department of Education’s comparison table below for more information;

Current 2016-17 Repayment Income Thresholds and Rates:

| Repayment Income | Rate |

| Below $54,868 | NIL |

| $54,869 to $61,119 | 4.00% |

| $61,120 to $67,368 | 4.50% |

| $67,369 to $70,909 | 5.00% |

| $70,910 to $76,222 | 5.50% |

| $76,223 to $82,550 | 6.00% |

| $82,551 to $86,894 | 6.50% |

| $86,895 to $95,626 | 7.00% |

| $95,627 to $101,899 | 7.50% |

| $101,900 and above | 8.00% |

These changes are yet to be legislated, but if you would like to start planning or find out how it will affect you personally, call Quill today.

House Sale Proceeds for Over 65s

Let’s briefly touch base on this also, as you can pass on your knowledge to a family member which this may apply to. Previously, a person aged over 65 was unable to make any super contributions unless they were ‘gainfully employed’ and age 75 was the absolute cut-off age, even if they continued to work. However, with these new budget changes, individuals over age 65 can contribute up to $300,000 of their family home sale proceeds into their superannuation. However, conditions apply as they must have owned the family home for a minimum of 10 years. Fortunately, this type of contribution is not subject to the new $1.6 million superannuation caps.

There are also Centrelink implications to consider for those receiving a part pension under the assets test. If they sell down their home and contribute the funds into their super or retain it outside of super, they could see a reduction or elimination of their part pension. If this could affect someone you know, they can contact Quill to discuss their circumstances.

One of the key challenges for people approaching retirement is adequately preparing for it. The other big challenge is gaining greater confidence in how their finances might look once retired.

Getting the right advice helps enormously with this, and likewise beginning the planning process earlier rather than later will reap rewards.

What are the stats?

A recent survey conducted by Vanguard of more than 5,500 people aged 55-75, across Australia, US, UK and Canada, showed that many reported that they experienced an increased level of satisfaction with their financial position upon retirement.

One contributor to this result was the higher incidence of people within the first 10 years of retirement seeking financial advice, compared with those still up to 10 years away.

Even amongst those who had access to some form of financial advice during the lead up to retiring, some still experienced regret about how well they prepared.

People’s biggest regrets

The biggest regrets of recent retirees included:

- Not saving enough

- Not starting the planning process early enough

- Not spending enough time planning for it

- Not learning enough about superannuation – in Australia, this included those with SMSFs

- Not learning enough about the government benefits available to them

How ready are Australians?

Another recent study by Colonial First State set out to assess how ready Australians are for retirement. While the results indicated that about half (53%) of those surveyed should have enough money during retirement, this included income support from the Age Pension. Once this Age Pension support is removed from the equation, the adequacy of retirement funding dropped significantly to around 17%, a huge difference.

Colonial used the Association of Superannuation Funds of Australia’s (ASFA) comfortable retirement standard, which is currently $43,372 pa for singles and $59,619 pa for couples, to define adequate retirement income.

Again, this emphasises the need for longer term planning and getting the right advice to ensure you give yourself the best chance of having enough in retirement.

Where to start

Some things you should consider to get this underway include:

- How much retirement income you will need

- How much of this will be provided by your current savings

- The risks and opportunities you will face in the lead up to retirement, and how to deal with them

- How to structure your wealth to your best advantage both before and after retirement

- Protecting your assets in the event of adversity

So, take positive action and get a head start on your retirement, and call your financial adviser today!

An article by Roger Montgomery, writing for the Weekend Australian, reminded me of something that we have been saying for several months now. Surging property prices in most capital cities and regional centres will end in tears for many that believe increasing prices and low interest rates are here to stay.

The alarm bells

Probably the scariest statistic is in Brisbane where not only did the supply of new units increase by 5,500 in 2016 but they are now set to increase by a whopping 13,300 this year. Buyer inducements, lower revaluations of up to 30%, higher vacancy rates, and, most recently, banks starting to tighten up on borrowing limits are all signs of a looming collapse.

The question we may now ask is how soon will this occur and what will be the flow-on effect for other areas of the property market?

Accessing super to fund a home deposit – let’s hope not!

One can only hope that the federal treasury is advising government to scrap the ridiculous idea that some politicians have been discussing about possible access to superannuation to fund a first home deposit.

This would only exacerbate the problem and potentially lead to a situation where a young person not only lost all the equity in their home but potentially their retirement savings as well.

Take a scenario where someone borrowed $450,000 to buy a $500,000 home, using $50,000 saved up in their superannuation fund as a deposit. Six months later, the property market corrects 20% and the property is revalued at $400,000. Even if the bank does not foreclose on the loan at this stage, there is still a high risk that the individual loses their job or interest rates rise. In this situation, a forced sale is likely which would lead to a position where all the money in super is lost and the individual still owes the bank $50,000.

This reads like a recipe for financial disaster which is one good reason why we don’t expect to see this initiative as part of the 2017 May budget.

Whilst having dinner with friends recently, the topic of “charging your kids board” came up and it seems everyone has differing points of view on this.

The ‘anti-boarders’

One couple argued that they felt their kids would have time enough to pay their way once they moved out, and as long as they covered their other expenses like car and phone bills, lodgings and food would be free.

The ‘pro-boarders’

On the other hand, myself and others in the group felt it was just a “rite of passage” to becoming a grown up. It never hurt us when our parents charged board and so it was something we were passing on to our kids.

Is it just an outdated tradition?

While the discussion of pro and anti-boarding was going around the table, it did get me thinking – is it still relevant today or is it just an idea being passed down from one generation to another that bears no real financial learnings?

When our daughter commenced full-time work and the conversation was raised in our household about paying board, she argued the point of “why?”– what was different from when she was in school to now? Her thought was, nothing had changed at home and I can see where her argument was coming from; we provided a roof over her head and food on the table yesterday and we would still provide these things to her tomorrow, so why should she suddenly be paying for it?

So whilst it was a reality check for her, she acknowledged that it would be the cheapest “rent” she would ever have to pay. Where else would she get food, lodgings, free WiFi and Netflix for the small contribution we were expecting?

To us, it wasn’t about the $3,900 per year she would contribute towards the grocery bills or electricity bills. It was about teaching her a sense of responsibility and learning to budget in preparation for much bigger financial commitments ahead.

So much of what I’m surrounded by here at Quill, is financial planning and our advisers working with people to save for their first home, new car or simply managing their finances better. It’s not uncommon to see people stretching themselves and living outside of their means.

Australians in debt

An article I read recently about the amount of debt Australians live with, explained that we have the fifth highest debt levels in the world. Since 1988, the ratio of household debt to disposable income has blown out from 65% to 185%. This article discussed the various contributing factors and suggested that people need to rethink the way they manage their everyday finances and day-to-day cash flow.

As an adult, you have access to financial planners to help you create plans to manage your financial future. As a parent, I think you can start helping your kids learn about cash flow and managing their money before they reach that time. Whether it’s through paying board, or not, or even pocket money, maybe these are the little steps you can take to get them thinking about these kinds of things.

I would love to know your thoughts, did you pay board as a teenager, and do you think it helped prepare you better for the real world?

This is a story about a very successful and astute businessman. This man owned a number of successful businesses in a range of industries over a number of years. This man never worked for anybody else. He was a family man, a man who prided himself on being able to provide for his family. He always said to his wife “you look after the family; I’ll look after the money”.

As clever and successful as this man was, there was one thing he could not do and that was predict the future.

This man was my Grandfather. He was diagnosed with Alzheimer’s in his early 70s.

I could write for days on the impact that this has had on my family. But I would rather stress the importance of estate planning to you all.

Whilst we had a Will and a Power of Attorney, the family had never thought about what to do with money, because he always looked after the money. How would the money continue to come in?

The implications of him not being able to control the money became very difficult for the family, things such as whose names the properties were in had an impact on a number of things which have caused a lot of headaches.

Having this happen so close to home means that I now think of things, particularly estate planning, in a different light. So, my questions to you are:

- What would happen to your family if something unforeseen happened and you were no longer here?

- How would your business fare if you were unable to continue to run its operations?

Sometimes it isn’t practical to take care of everything yourself. You need to delegate, you need to inform your loved ones of your financial affairs, as it does involve them too, especially if something were to happen to you.

Most importantly, it is imperative to seek advice from the professionals. You need to know that should anything happen to you, your loved ones will be taken care of and that your business will continue to run. We have several professionals in our office that can look at your current situation and work with you in planning for your future, your family’s future and the future of your business.

Ahhh the household budget… I may loathe it but I must also be in control of it!! Which suits my husband down to the ground as he wants no part but to tell me I’m doing an amazing job.

Recently, my husband’s pay cycle changed from fortnightly to monthly whilst mine remained fortnightly. This brought me to the realisation that I would likely need to draw up two budgets, one for my husband’s income and one for mine. As a family of five, with three sons who eat us out of house and home, I need to be diligent about every dollar.

The old jar system

This then brought me back to the principles that made my grandfather’s budgeting, although simple, so very powerful. Yes, gone are the days where we tucked away our pay in a collection of jars in the cupboard but the principles to Pa’s system remain the same and as effective.

Each pay cycle, Pa would sit down and list all expenses and how much he would need to put away into each jar. Although in today’s budget there may be quite a few more “jars”, the theory is still exactly the same.

How I tweaked our family’s budget

As most bills are monthly, I completely restructured our budget to monthly, leaving my fortnightly income for mortgage and childcare (ouch!). I quickly learned that a successful part of family budgeting is to be able to reconcile your budget with your bank account, far easier when this process can be done to line up with the end of each month.

Each month, I ensure money is set aside for the expenses we don’t like to think about until they are upon us and we have no choice. For example, things like but not limited to:

- Annual vehicle registration

- Six monthly council rates

- Body corporate fees

- Beginning of the year schooling expenses

- Christmas!

Again, it’s back to the jar system or rather in today’s terms – our allocated bank accounts. I also find keeping a log and tally in an app or notepad on my smartphone of what funds I have allocated to which expense a necessity.

The importance of taking the time to thoroughly identify all my expenses proved imperative. Additionally, so is the importance of the cost of each expense, how frequently it occurs, and (where applicable) the next due date.

In a nutshell, once I got my head around the two budgets, identifying all my expenses and back to Pa’s jar theory, this all began to work!

What works for you and your family?

How can Quill assist?

The ATO has issued an information sheet to let taxpayers know that money earned from renting out a room in a house is rental income.

This applies to rooms rented by traditional means or through a sharing economy website or app.

Also, taxpayers can only claim expenses related to the part of the house they rent out (so expenses will need to be apportioned accordingly).

Example: renting out part of a unit or house

The following example illustrates how the ATO would expect rental deductions to be calculated.

Jane has a two-bedroom unit with two bathrooms. She lives alone and only uses her spare room as an occasional home office, for storage and when she has guests.

Jane mainly uses the ensuite bathroom. The second bathroom is accessible from the main areas and mainly used by visitors.

Jane decides to rent out the spare room on a sharing economy website to earn extra income.

When paying guests come to stay, Jane removes all excess items from the room and does not access the area.

She also gives paying guests access to common areas including the second bathroom, kitchen, living area and balcony, and to her wi-fi. For the period guests are staying and have access to these, Jane can claim 50% of associated costs.

Jane had the room available and occupied 150 days in the year. When she is not renting out the room she uses it as storage and a home office.

Claiming Rental Deductions

Jane calculates what she can claim based on the following additional factors:

- The room is 10 square metres

- The house is 80 square metres

- The common areas are 50 square metres

She works out she can claim 17.9% oI her general expenses (such as electricity, interest on her mortgage, internet expenses, rates and body corporate fees) after adding the following two calculations together:

- room occupancy:

(10/80 x 150/365) x 100 = 5.13% - common areas:

((50/80 x 1s0/365) x 50%) x 1oo = 12.84%.

She can claim 100% of the expenses associated solely with renting out the room, such as the facilitator’s commission or administration fee.

Note: that CGT may also apply if a property used to generate rental income is sold.