Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

With the new year here and the weeks flying by already, we’ve all been trying to keep our resolutions. Most of us set the usual each year; get fit, eat better, spend more time with the family. I hear the same kinds of things when I see clients each year; “I’ll keep cleaner records”, “I’ll come in earlier next year”, “I will keep track of my receipts”.

Without extreme motivation or an external driving force, both of these resolutions quickly fall back into the same habits of the year before.

I can’t help you stick to your New Year’s resolutions, but I can offer a little lifesaver when it comes to keeping track of your tax receipts for 2017.

Apps to keep track

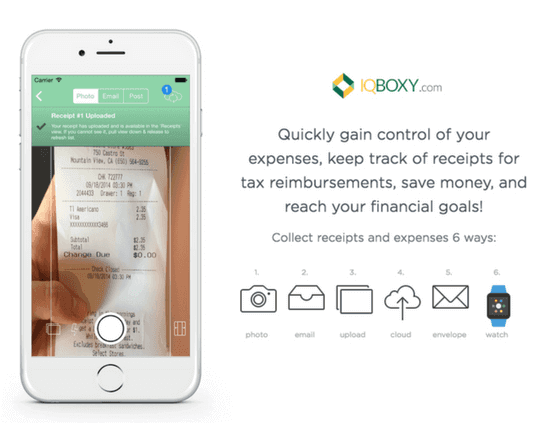

A few of us around the office have been playing with a few different apps on both iPhone and Android devices and there appears to be a clear standout. CamScanner (Android) or iqBoxy (iPhone) offers the ability to “scan in” receipts via the camera and sort into folders within the application.

You can add relevant notes to receipts, which can be useful come tax time and a whole 12 months or longer after some purchases have been made.

These folders can then be exported to pdf and sent straight to your accountant for year-end preparation. The app also has the functionality to add in an extra collaborator, up to 10 on the free version, which can be extremely useful for small businesses to speed up expense claims or substantiate business purchases.

I usually clean out my wallet once a week, scanning in all of my receipts and sorting them into the relevant folders. It’s much more manageable for me this way rather than trying to set aside time each day, and saves my receipts from fading if I wait until year end.

It’s not too late to start

Even if you haven’t set any resolutions, it’s never too late. There’s no time like the present.

There are more apps out there in the marketplace than the time available to explore them all. If you have any other app needs or have discovered a great one that could be useful to others in similar situations, please don’t hesitate to let us know.

Download our FBT and the Festive Season Fact Sheet! > CLICK HERE

It’s that time of year! Everybody is excited for the work Christmas Party and hoping that this year, they receive an even greater gift from the boss.

Now, we don’t mean to sound like the Grinch, but when it comes to the work Christmas party and Christmas gifts for staff, there’s more to think about than finding out who’s been naughty or nice.

One thing that some businesses forget to consider is if they will need to pay Fringe Benefits Tax (FBT). When rewarding your employees with gifts or parties this Christmas, this is something to be aware of.

When it comes to your work Christmas party, you’ll need to think about:

- how much it costs

- when and where it is held. Did you know that a party held at work on a normal work day is treated differently to an event outside of work?

- who is invited – is it just for employees or are their partners invited too? Are clients or suppliers also invited?

When it comes to gifting, you’ll need to think about:

- the amount you spend

- the type of gift – gifts such as wine or hampers are treated differently to gifts like tickets to a movie or a sporting event

- Also, who you are giving the gift to – different rules apply for employees and clients/suppliers.

We have put together a fact sheet that will help clear this up for you and give you a better understanding of some of the implications surrounding work Christmas parties and gifts.

DOWNLOAD THE FACT SHEET

Fringe Benefits Tax and the Festive Season

Fill out the form below to get your download link.

In today’s society, with advancement in communications technology, the use of scams to trick unsuspecting victims to part with their hard earned savings and personal details is becoming more prevalent.

The malicious impersonators behind these scams are collating the information to access bank accounts, take out loans in other people’s names, lodge false tax returns and claim Centrelink or other benefits.

A number of contact methods are used to trick people into providing this information including phone calls, emails, and SMS.

So how do you know if you are being targeted?

Phone Scams

The ATO will, on occasion, phone to speak to you, but be aware that they will never:

- ask you to pay money to receive a refund or payment from them

- ask you to pay a debt via a prepaid credit card or voucher

- ask you to provide personal information like your TFN or credit card number, via email or SMS

- request your credit card details to process a payment on your behalf.

These callers can be very convincing and intimidating. They can often catch you off guard if you are not ready for them so be aware!

The following is an example of a recent phone scam that has been going around:

You receive a call from a person saying they are from the ATO. They say that due to ‘errors’ on your tax return, there is a warrant for your arrest. The police will be called unless you attend the local post office and make an immediate payment.

In a variation of this scam, the caller asks you to buy a ‘Load and Go’ card, a pre-paid visa card or department store gift cards. Or pay into a personal bank account.

Key indicators of this scam:

- cold calling (unsolicited call)

- you are advised that there is a warrant for your arrest

- the callers use an aggressive tone

- you are asked to make a payment without having received any prior advice or correspondence from the ATO

- you are asked to pay via non-legitimate payment methods

- you are asked to make a payment without a personal payment slip.

Email Scams

Emails that claim to come from the ATO offering a tax refund are more than likely a scam. The email usually links to a fake website which will ask for your personal and credit details. If you receive an email from the ATO, do not respond, click on any links or open any attachments.

Emails that contain attachments can infect your computer with malicious software once opened.

SMS Scams

The ATO will, from time-to-time, contact you via SMS however, they will never contain links to click on or ask you to reply with your Tax File Number or your personal bank account and BSB number.

How can you avoid being scammed?

Unfortunately, this type of crime is on the increase so we all need to be more vigilant in protecting our personal information.

Your Tax File Number is used to identify you in your dealings with the ATO so always keep it safe.

Only give your Tax File Number to people with a legitimate reason for having it – your registered tax agent, your bank, or your employer after you begin work.

If you are ever in any doubt as to the legitimacy of a call, email or SMS, you can contact our office and we will assist you with the process for reporting the scammers, and provide you with further information on how to avoid them in the future.

Do you catch the bus to work? Are you caught up on the new tax rules?

The Australian Taxation Office (ATO) has released a ruling that would allow employees to salary package the cost of getting to and from work later this year (this only applies to bus travel so no train or city cat on the cards as yet!).

This will be available via employers or certain salary packaging providers like RemServ who have obtained a private ruling from the ATO. This benefit will be available on the TransLink network within South East Queensland (from Gympie down to Coolangatta and west to Helidon).

This will allow eligible employees to pay for their bus travel with pre-tax dollars, reducing their taxable income resulting in less tax to pay. The new TransLink smart card will be topped up with pre-tax dollars when the balance falls below $5 and can be used just like a regular go card.

RemServ has estimated that those who earn $70,000 per year and take 10 trips a week across four zones could save just under $1,500 a year under the plan – that’s a latte every day!

If you would like to know more about this scheme, please contact our office.

The Australian Taxation Office (ATO) generally imposes interest on unpaid tax liabilities including Income Tax, GST, FBT, and PAYGW to name a few. The ATO is fairly lenient in imposing interest or penalties on your tax liability for late payments. However, they are not as fair when the late payments or lodgements are multiple and continuous. The key to dealing with the ATO is regular communication and keeping them updated.

For the July 2016 quarter, the ATO’s General Interest Charge (GIC) rate is 9.01% p.a. Note that there are two types of interest charged by the ATO:

- General Interest Charge (GIC) – penalty for late payment and other obligations

- Shortfall Interest Charge (SIC) – usually a penalty from tax return amendment resulting to an increase of tax liability

Penalties imposed on tax accounts

The purpose of penalty provisions is to encourage taxpayers to take reasonable care in complying with their tax obligations. The ATO does take into account individual circumstances such as compliance history when deciding what action to take. This means that ‘regular offenders’ could receive stricter treatment than what a ‘first-timer’ would.

From the above penalties and interest charges that the ATO can impose on a taxpayer’s account, there are basic grounds and circumstances that the Commissioner may remit GIC, SIC or penalty.

Every taxpayer has the right to request remission of any interest imposed to their account. Remission is the reduction or cancellation of interest charged on the taxpayers account. The ATO generally remits interest charges and penalties where it is fair and reasonable in the circumstances.

Whether you are requesting remission over the phone, through the ATO Portal or via mail, we have listed common circumstances taxpayers face that lead to the need for remission:

- The tax shortfall amount occurred as a consequence of voluntary disclosure by the taxpayer

- The ATO’s completion time of an audit took longer than could reasonably be expected taking into account specific circumstances

- The ATO has, by instruction or action, contributed to the taxpayer’s error giving rise to shortfall

- Delays were caused by, and errors due to, the actions of a third party (i.e. incorrect information provided by a third party)

The last scenario, above, is an overly used reason in requesting remission. This is because the shortfall is outside the control of the taxpayer.

Requesting a remission for SIC is one of the more difficult to achieve, especially if it was detected during the ATO’s data matching. SIC can be easily granted by the Commissioner if the result of increase in tax liability was initiated by the taxpayer and the ATO were notified that a mistake had been made.

There are also other different grounds and circumstances where the ATO may remit interest and penalties. These are discussed in more detail in Practice Statement Law Administration PS LA 2006/8.

If you are unsure about your reason for remission, please contact Wendy from our office and she can assist you with this process and provide further information.

The big question!

Why do I have to pay tax in Australia?

“I only earn a pension overseas.”

“I have paid tax on my income in other countries or it wasn’t paid into my account in Australia; it is still in my overseas account.”

Firstly: Are you an Australian resident for tax purposes?

Your residency makes a big difference to how you are taxed in Australia. The Australian Taxation Office (ATO) uses different standards to the Department of Immigration and Border Protection to determine your residency for tax purpose. Because of this, you must ensure that wherever you reside, according to the ATO’s standards, you are taxed (and refunded) appropriately.

Generally, you are considered an Australian resident for tax purposes if you have always lived in Australia or have come to Australia to live. In addition, it also applies to those that have been in Australia for more than half of the income year (unless your usual home is overseas and you don’t intend to live in Australia), or you are an overseas student enrolled in a course of study of more than six months duration. You are also considered a resident for tax purposes if you have moved to Australia from overseas and intend to stay for the foreseeable future and make connections.

Determining residency

To determine your residency for tax purposes, there are a number of tests you can take. The first test is called a resides test. If you reside in Australia, you are considered an Australian resident for tax purposes and you don’t need to apply any other test.

If you don’t satisfy the resides test, you will still be considered a resident if you satisfy one of three statutory tests. These include the domicile test, the 183-day test and the superannuation test.

The domicile test requires you to show that your permanent home is in Australia. If it is, then you are considered an Australian resident for tax purposes.

The 183-day test requires that you have been present in Australia for half the income year (whether continuously or with breaks). If so, you are considered a resident.

The superannuation test is designed to ensure Commonwealth government employees working at Australian posts overseas are treated as Australian residents.

What’s the big deal anyway?

Residency makes a big difference to your tax situation. If you are an Australian resident you are generally taxed in Australia on your worldwide income from all sources. You are also entitled to the tax-free threshold and you must pay a Medicare levy.

If you are not a resident you are generally only taxed in Australia on your Australian-sourced income. Also, you are not entitled to the tax-free threshold. You do not pay the Medicare levy meaning you are not entitled to Medicare health benefits.

Does working overseas change your tax residency?

If you are an Australian resident going overseas to work you will generally remain an Australian resident for tax purposes. Residency is a question of fact that will be determined by your circumstances. You need to show that you have severed your connection with Australia for your status to change.

Your residency status will be considered primarily under the ‘resides’ test and if required the ‘domiciled’ test. The domicile test extends the concept of residence so that a person who is not resident in Australia under the ‘resides’ test may be an Australian resident under the domicile test.

What if your residency status changes?

If your status has changed from resident to foreign resident during the income year, answer ‘yes’ to the question ‘Are you an Australian resident?’ on your tax return.

This ensures you are taxed at resident rates for the tax year. Your foreign residency for part of the year is taken into account by a reduction in your tax-free threshold. You are entitled to a pro-rata tax-free threshold for the number of months you are an Australian resident.

To claim a tax offset for a dependent spouse, you must both be Australian residents for tax purposes. You will need to reduce your claim to take into account the period you were both foreign residents.

Foreign residents do not have to pay the Medicare levy. In your tax return you can claim the number of days in the income year that you are not an Australian resident as exempt days.

From the date you cease to be an Australian resident, there is no need to disclose your foreign-source income in your tax return. Also, all Australian-sourced interest, dividends and royalties derived after you ceased to be an Australian resident are subject to the withholding tax provisions as a final tax and should not be included in your tax return.

The Australian Taxation Office (ATO) has warned it is focusing more on taxpayers earning money from the sharing economy this tax time. The ATO has cautioned that it has in excess of 600 million pieces of third party data to track activity and income.

What is the sharing economy?

A sharing economy is one that connects buyers (users) and sellers (providers) through an enabler who usually operates an app or a website. Uber and Airbnb are examples of these popular sharing economy companies, driven by advances in technology. People that provide goods or services through such operators need to consider how GST and income tax apply to their earnings.

What is Tax Audit Insurance and how can it help?

The ATO and other government bodies continue to target individuals and businesses and are scrupulously pursuing taxpayers though their data matching ability.

With this in mind, Quill Group have in place a Tax Audit Insurance arrangement, underwritten by AAI Limited trading as Vero Insurance (a subsidiary of Suncorp Group Limited). This is designed to cover the professional fees incurred with the preparation of material and management of the response process. Despite honest and thorough declarations, taxpayers can still be targeted for an audit, enquiry, investigation or review by the ATO.

This is designed to cover the professional fees incurred with the preparation of material and management of the response process. Despite honest and thorough declarations, taxpayers can still be targeted for an audit, enquiry, investigation or review by the ATO.

The costs incurred with audits and such investigations can be significant even if lodgements are correct and no further adjustments are made. It is a common misconception that you will only be audited if you are not compliant. However, there is strong evidence to show that the ATO has reviewed many returns where no adjustments were required to be made.

As professionals, Quill can respond to queries and provide information to explain your position and we bring a skill in communicating with these government departments to advocate for your position. This means you can relax, knowing we are on your side and your costs are covered.

How do I get this insurance?

Our Audit Shield letters will be going out this month. They will include the Client Acceptance Forms, making it possible for our clients to take up this cover by the 31st August, or renew cover if already utilising this Quill service. These fees are tax deductible.

Should you have any queries relating to Audit Shield please call us to discuss.