Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Whilst having dinner with friends recently, the topic of “charging your kids board” came up and it seems everyone has differing points of view on this.

The ‘anti-boarders’

One couple argued that they felt their kids would have time enough to pay their way once they moved out, and as long as they covered their other expenses like car and phone bills, lodgings and food would be free.

The ‘pro-boarders’

On the other hand, myself and others in the group felt it was just a “rite of passage” to becoming a grown up. It never hurt us when our parents charged board and so it was something we were passing on to our kids.

Is it just an outdated tradition?

While the discussion of pro and anti-boarding was going around the table, it did get me thinking – is it still relevant today or is it just an idea being passed down from one generation to another that bears no real financial learnings?

When our daughter commenced full-time work and the conversation was raised in our household about paying board, she argued the point of “why?”– what was different from when she was in school to now? Her thought was, nothing had changed at home and I can see where her argument was coming from; we provided a roof over her head and food on the table yesterday and we would still provide these things to her tomorrow, so why should she suddenly be paying for it?

So whilst it was a reality check for her, she acknowledged that it would be the cheapest “rent” she would ever have to pay. Where else would she get food, lodgings, free WiFi and Netflix for the small contribution we were expecting?

To us, it wasn’t about the $3,900 per year she would contribute towards the grocery bills or electricity bills. It was about teaching her a sense of responsibility and learning to budget in preparation for much bigger financial commitments ahead.

So much of what I’m surrounded by here at Quill, is financial planning and our advisers working with people to save for their first home, new car or simply managing their finances better. It’s not uncommon to see people stretching themselves and living outside of their means.

Australians in debt

An article I read recently about the amount of debt Australians live with, explained that we have the fifth highest debt levels in the world. Since 1988, the ratio of household debt to disposable income has blown out from 65% to 185%. This article discussed the various contributing factors and suggested that people need to rethink the way they manage their everyday finances and day-to-day cash flow.

As an adult, you have access to financial planners to help you create plans to manage your financial future. As a parent, I think you can start helping your kids learn about cash flow and managing their money before they reach that time. Whether it’s through paying board, or not, or even pocket money, maybe these are the little steps you can take to get them thinking about these kinds of things.

I would love to know your thoughts, did you pay board as a teenager, and do you think it helped prepare you better for the real world?

Politics. Sex. Religion. Money. For generations, we’ve been told to not talk about these subjects. Today, we probably talk about 2-3 of them more than we should, but we’re still really good at NOT talking about money. In many countries and cultures, we’ve been taught to NOT talk about money.

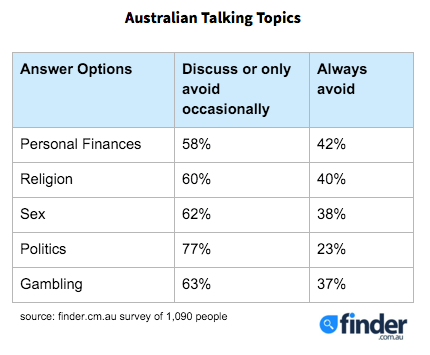

A 2016 research by finder.com.au has revealed that almost half of Australians would rather avoid the topic of money.

- 42% of those surveyed find personal finances the most difficult thing to talk about, even more than religion (40%), sex (38%) and politics (23%).

- Only 18% of Australians regularly discuss money and Gen Y (aged 18-34) appear to be the most comfortable talking about it when it does enter the conversation, with one in three (33%) often discussing personal finances.

- Baby Boomers (aged 55-74) are the least comfortable generation when it comes to talking about money, with 56% never discussing it.

But it’s so important that we break that taboo because failing to talk about money means we often fail to align the use of our money with what we say is most important to us. Even the “experts” can struggle to talk about money in their personal lives.

The 2016 survey also included three reasons for why it is important that money matters be discussed. These reasons are:

- Gain knowledge: Talking to someone who has more financial knowledge than you is a great way to learn new personal finance concepts.

- Take action: Having a conversation with a friend can prompt the listener to take action on financial matters like looking for a cheaper home loan rate or drinking one less coffee a day to boost savings.Take act

- Learn from their mistakes: Chances are that someone you know has learnt the hard way about a financial matter you are contemplating. By finding out what they would do differently, you then have a head start.

It is important that you help the people you love in your relationships and your family, to have these important money conversations, that will lead to quality decisions.

Finance related professionals are often described as analytical, detail focused and often good with numbers. Historically, people assume this is because their brain is geared more towards using the “left side”, the side of the brain that is apparently responsible for logical tasks. Neuroscientists, however, have long proclaimed that this view of “right and left” is, in fact, a myth.

By default, the right side of the brain is creative, artistic and perhaps free spirited. Apparently, as the myth goes, it’s got to do with which side of the brain is more active.

What do the experts say?

Recent research by The University of Utah has found no evidence that people preferentially use their left or right side of the brain. The University undertook an analysis of 1000 brains and found that each person used their entire brain equally.

Further still, the team found that all brain regions enable people to be both creative and analytical, that is, using all of our brain capacity to do things every day. Who knew that every person around used all of their brain to do things!

The simplistic approach to creativity

So, why do people persist in cultivating hobbies or downloading apps amongst other tools to engage what they perceive as the ‘other side’ of their brain? My thought process is that, if we are in a profession that predominately uses analytical skills, logical approaches and requires attention to detail, at some point in time we may want to do something that differs from our everyday life. That ‘something’ might be creative in nature! Maybe I’m being too simplistic in my approach, but maybe it is just that simple?

Why not take up painting landscapes, sculpting or cake decorating to change up your life a little bit. A change is good as a holiday and we all know how good holidays are for us!

Happiness is the key to life

Personally, I don’t think it matters at all if the painted landscape looks more like blobs of paint than a seascape, or the sculpture is a lump of clay; as long as doing the activity creates happiness in your life.

So, as I’m not a neurologist nor an expert in the field, I simply cannot comment on the validity of the recent research. Whether there is a specific ‘creative side’ of the brain or not, I’m of the opinion that if doing those typically creative things such as painting provides happiness in your life – do it!

It’s summer in Queensland and what better time to holiday with the family. This year, instead of our traditional Sunshine Coast family holiday, we decided to take a trip across the border to a great little spot in Northern NSW, Kingscliff. I hadn’t been to Kingscliff for many years but was pleasantly surprised with the holiday destination. Besides the nice beaches, good running/cycle paths and great restaurants, daylight savings was the big winner in my opinion.

Strange as it may sound to some, waking up at 5.30am for a morning run whilst it was still cool and finishing a round of golf at 7pm was a highlight for me. A short trip over the border to drop my son off at Coolangatta airport bought me back to the Queensland daylight saving reality…its non-existence. I needed to remember to wind back the clocks, adjust the time for pickup in Sydney and worst of all, coffee shops were not yet open!!!

I’m not sure if I have been reading the wrong newspapers but when did you last see a story about the justification for sticking with this ridiculous policy in Queensland? Maybe complacency has set in or the silent majority don’t have a loud enough voice to stir up our politicians.

Some recent surveys on daylight saving

The Courier Mail commissioned a survey that asked “Do you support a new trial being held?”, not surprisingly a resounding 88 per cent of the 7154 Survey Monkey respondents said yes. A Chamber of Commerce & Industry Queensland 2010 survey of over 2,250 businesses found that businesses located in South East Queensland expressed a significantly high level of support. 77.7% were FOR a trial.

I would love to see a survey done by Queensland Tourism interviewing interstate visitors and overseas guests regarding their views on this subject. No doubt our interstate cousins are basking in the daylight saving afternoon sun and Queensland business and tourism continues to be in the dark.

So just how much does it cost this State to retain the status quo?

Well a bit of internet research from indicated that the annual cost to Queensland is around $4 billion. Yes, that is $4,000,000,000pa and the curtains still appear to be good in NSW and cows are milking just fine. I find that interesting as the people who actually cared one way or the other would vote yes to daylight savings in Queensland.

So what am I missing?

Is the Queensland Government happy to give up $4bn every year and rely on a minority of people to stick with the current status or is there one politician out there willing to stand up for the obvious? For me, the experience of holidaying in a state with daylight savings was very appealing and so next year I think I will head to a state south of the border who has seen the light.