For 23 years Dalbar Inc, the United States leading financial services research firm, has published it’s annual, Quantitative Analysis of Investor Behavior (QAIB) study.

The QAIB has been measuring the effects of investor decisions to buy, sell and switch into and out of United States mutual funds over both short and long-term time frames. The results have consistently shown that the average investor earns less and in many cases, much less than the mutual fund performance reports would suggest. The most recent study released for the calendar year to 31 December 2016, showed that the average investor is still their own worst enemy when it comes to investing. The study showed just how poorly investors perform relative to market benchmarks over time and the reasons for that underperformance.

The most recent QAIB study conducted in the United States by Dalbar Research (Boston, MA.), found that for the 2016 calendar year:

- The average US investor made a return in equity funds of 7.26% while the US share index, the S&P 500, returned 11.96%. An underperformance of 4.70%.

- In 2016, the 30-year annualised S&P 500 return was 10.16% while the 30-year annualised return for the average equity mutual fund investor was only 3.98%. An underperformance of 6.18% per annum.

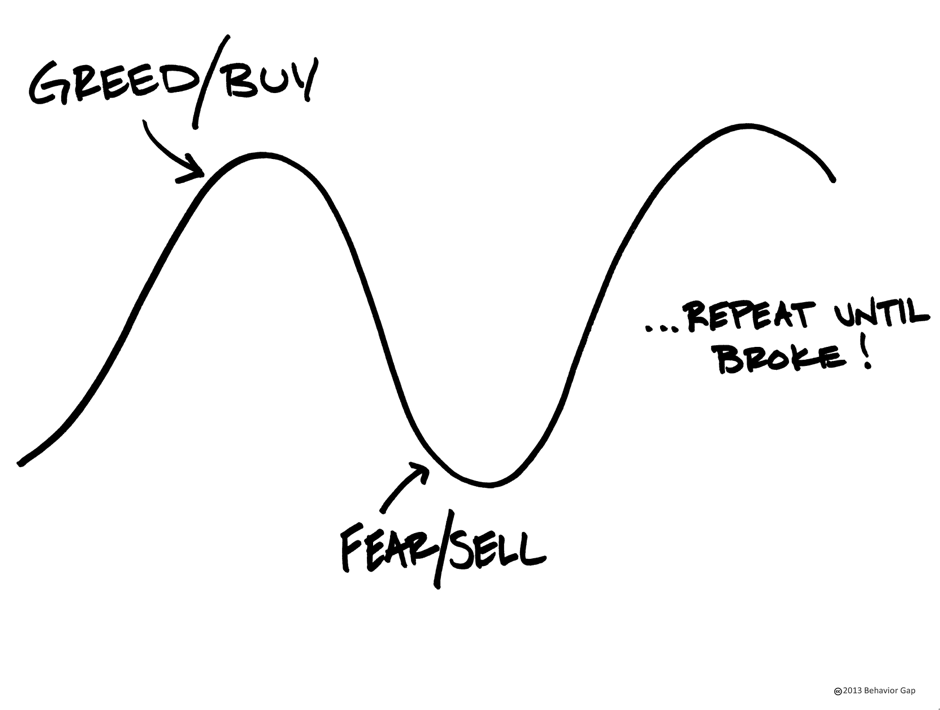

So why is it that the average US investor made (4.70%) less than the market? Put simply, the differential was lost due to bad timing of transactions by the average US investor. Bad timing of transactions generally driven by decisions based on EMOTION. The emotions of FEAR OR GREED. This is truly wealth destroying behavior!! So if investing success is about BEHAVIOR and not skill, then what does that mean to you? It means that emotion plays a huge role in the financial decisions you make.

EMOTION is so important, it can determine your success or failure as an investor. But the great news is that unlike the MARKET, your BEHAVIOR is something you can control!!