Is the pain of the bear market easing?

Australian equities officially hit bear market numbers in February, with the S&P/ASX 200 Index down more than 20% since its April 2015 highs. The one-year trailing return (end of Feb ’15 to Feb ’16) for the ASX300 Accumulation index is -13.45%. Not a happy place for investors.

However, it is quite possible that what we are experiencing now is that feeling you get after a visit to the dentist. Your lip is numb, you can’t speak properly, but you get some comfort in thinking that maybe the worst is over. Certainly the action in the Materials sector (up 9.12% during February) gave an inkling of that. Continuing the analogy, don’t be surprised if you get different pain sensations as the anaesthetic wears off.

What February brought to the Market

February saw the half-yearly reporting season. Earnings expectations had been hosed down well in advance and when the dust had settled, 77% of companies beat or exceeded expectations, while 23% came in below. The decline in earnings per share was about 12% overall, but when the non-mining sector is removed, earnings were approximately flat with last year.

Thinking about that relationship, a 12% fall in earnings, and a 20% fall in the sharemarket, basically means that there is already more downside in earnings being priced at current market levels.

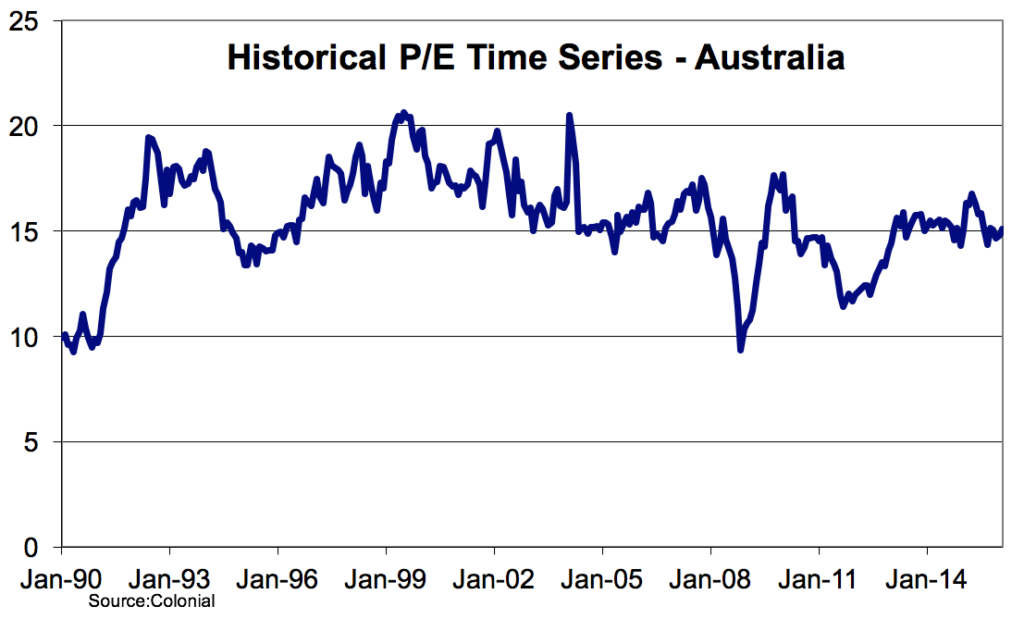

The trailing Price/Earnings (P/E) ratio of the ASX200 sits at a multiple of 15.09, well in line with historical averages and arguably cheap in the context of low-interest rates.

The dividend yield on the Australian market is at 5.25% (end of Feb pricing) and with franking credits added (est. 70% franked), that takes yields up to around 6.82%. In a low growth environment, we think that is a decent return and that risks are reasonably balanced with returns currently.

Turning to interest rates, we think that there will remain a wait and see approach from the RBA. One recent development that will have the board a little concerned though is the strength of the Aussie dollar, as iron ore, oil and other commodities rebound. On the back of that, you have a US Federal Reserve backing away from imminent rate rises, and that suddenly puts an Australian dollar with interest rates well above US levels in the spotlight as an attractive carry trade again.

With the housing market cooling, thanks to APRA putting the screws on the banks to jack up rates on investment housing loans, and all the talk about changes to negative gearing, it is possible that this may give the RBA the latitude to deliver a rate cut at some point this year.

The Westpac Melbourne Institute of Consumer Confidence rose by 4.2% in February, with reasonable confidence about the employment outlook. Certainly the lower cost of filling the tank of the family SUV has finally helped lately.

What may lie ahead

Maybe we really are adapting to the end of the resources boom and starting to see the benefits of tourism and exports. In January, our exports rose by $260M in spite of a seasonal fall in rural goods exports. Some comfort can be drawn from the fact that it takes a lot more employees to produce $500M of tourism and agricultural goods than it does to produce $500M of iron ore.

As long as our currency remains at fair value levels below USD$0.75 or thereabouts, we can expect to see the benefits flow through to industry sectors that employ many more people than mining.

It will take time, but it is happening. So take a Panadol and try to relax. Hopefully, the worst is over, but if not it shouldn’t be too much longer.