The winning streak continued in April, despite a war footing in Syria and North Korea, and the first round of the French elections which soundly booted the two mainstream contestants and set up a run-off between Marine Le Pen and Emmanuel Macron.

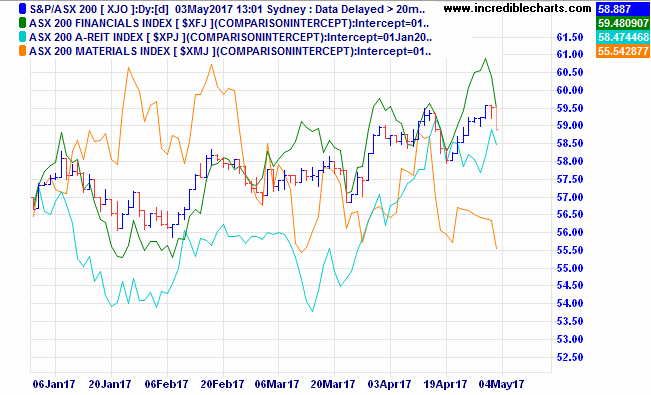

The ASX200 accumulation index gained 1.03% during April. The bigger gains were in the banks, while miners were off about 2.2%. The positive result masked a few shockers during the month, like Telstra down 8.7% and upstart competitor Vocus which lost 22.4%.

Over in the A-REITs (listed property trusts), the gain was 2.61%. This was helped by falling interest rates, with the Australian ten-year government bond starting the month at 2.70%, sliding to 2.47% mid-month before settling at 2.56% at month end. The prices of listed property trusts are highly sensitive to changes in interest rates, especially in this period where the general consensus is that US rates are on the rise. The A-REIT sector current yield is around 4.7% and the sector trades at a 23% premium to net asset values.

Turning to global markets, the S&P 500 index of US stocks gained 1.03% in April in local currency terms, but when converted back to Australian dollars the gain was 3.05% as the Australian dollar fell against the US Dollar over the month. The broader MSCI World index gained 1.33% in local currency terms, and 3.64% when converted back to AUD. In other regions, the MSCI Europe index gained 5.76% in AUD terms, as investors flocked back into the main Euro markets following the first round of French elections. The MSCI Asia ex Japan region gained 4.23% in spite of the serious tensions in North Korea.

Interest rates have been mentioned earlier, with reference to bond yields falling, which in turn increases the price of bonds, and the longer the term to maturity the higher the increase. The Bloomberg AusBond 0+ years index gained 0.69% during April. This was a turnaround from the previous six months (Oct ’16 to March ’17) when the index lost 1.21% in value thanks to rising interest rates that followed the surprise Trump election. We thought it would be useful here to comment on the impact of rising interest rates on the ‘average’ index tracking fixed income fund. In the period between 1 October 2016 to 16 December 2016, the US ten-year bond yield rose from 1.6% to 2.6%, an increase in nominal yield of 1.00%. The Bloomberg AusBond 0+ years index lost 2.66% of its value over that period. It is important to understand how fixed income, with longer durations to maturity, can suffer losses in a rising rate environment. Further, relating this to our earlier comments on A-REITs, that sector lost 6.17% during that period when US rates rose by 1.00%.

Overall, April was a fairly good month, in spite of the intra-month volatility.

Coming next week is our Australian Federal Budget. As we write this, the RBA board is meeting, but no-one is expecting any change to rates. Also this week, the RBA Governor speaks on “Household Debt, Housing Prices, and Resilience”. We all know that as the person at the head of the organisation charged with ‘financial stability’, he will most likely avoid the word ‘bubble’, but we would expect him to try to hose down people’s price expectations.

In late news over the weekend, we are watching closely the situation of a Canadian lender, Home Capital. It has about $20B in total assets, with about $15B of lending into the red-hot Canadian residential real estate market. The bank has just set up lines of credit for about $2B to replace depositor funds that sources say are leaving at over $200M per day. An old-fashioned bank run. Apparently, there has been some fraud among the brokers that wrote loans for the bank. As if that is not enough, there is also some shenanigans with the funding of this latest line of credit, which reportedly may be costing between 18 and 22%. Clearly, that is a whole lot higher than the rate Home Capital are earning on their home loans.

Our next update will be a summary of the Federal Budget.