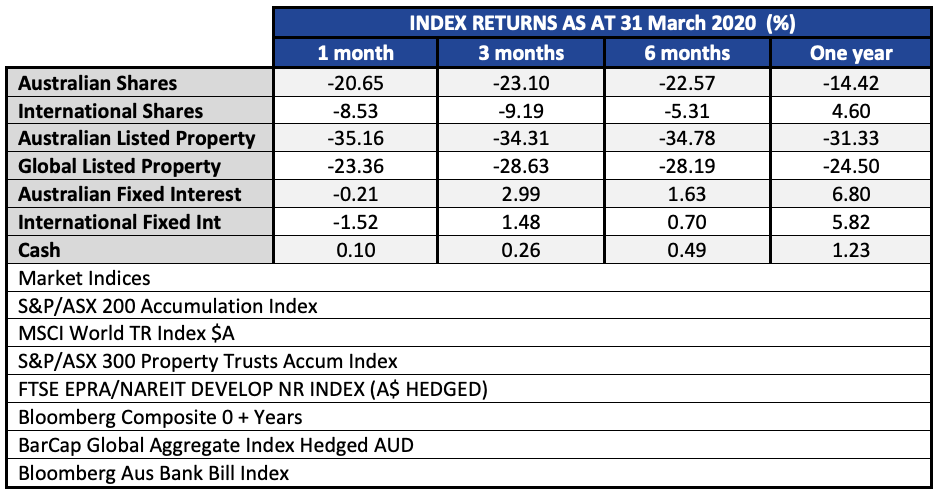

All the major asset classes had a torrid month in March with nothing but cash in positive territory. Even the fixed income markets posted a negative return in a divergence from the normal shock-absorber effect that the asset class is supposed to have in portfolios. Australian shares were down 20.65%, but at the worst of the intra-day peak to trough between 19 February and 23 March the decline was 38.8%.

International shares also had large falls, though when investing on an un-hedged basis the fall in the Australian dollar cushioned the falls to a large degree. While the S&P 500 had trimmed its intraday peak to trough loss of 35.4% (since February 19th) to minus 12.5% for the month of March, the USD gained 5.9% on the Australian dollar. Likewise the Euro gained 6.08% against the Aussie. These moves helped cushion the falls in International shares. While it is easy to favour Australian shares for the income and franking credit benefits, times like these remind us of the benefits of having a diversified portfolio.

Fixed interest markets were also in turmoil in March. The reasons were many, but one identified by the Bank of International Settlements was unwinding of ‘risk parity’ strategies. The concept is to use leverage to increase bond exposure within a balanced asset allocation. In normal times, when bonds usually rise in price as equities fall it works well. Until both shares and bonds start to fall at the same time, which does happen occasionally. This creates forced sales as the mathematical risk models demand that assets are sold to restore the ‘value at risk’ model to a comfortable position due to the increased volatility. When ever-larger amounts of money are invested in line with such a strategy, the rush for the exits create a wave of selling that in more rational times, (with an equal number of buyers and sellers) would not happen. Such is the risk of a strategy when it becomes too large in proportion to the size of the markets they invest in.

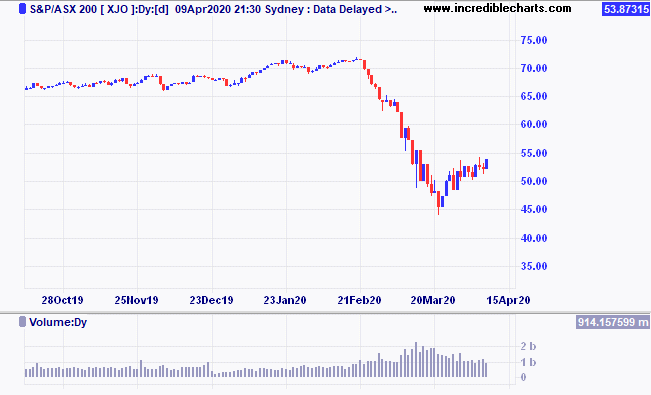

To provide some perspective on the falls in the Australian market we have the ASX200 chart below. The lower panel in the chart shows the daily trading volume, which almost doubled during the depths of the sell-off. The number of trades has settled somewhat but is still elevated.

We have commented in our intra-month updates about the amount of fiscal stimulus that has now been unleashed by governments around the world. An update to that figure shows that we now have promises of support for affected workers and businesses amounting to around US$6.5 trillion according to Chris Watling of Longview Economics. When we think about the global GDP is around US$85 trillion, the US$6.5 trillion represents around 7.5% of global GDP. The expectation of economist is for the second quarter GDP figures to fall by around 15%. If we were to assume two quarters of GDP at 15% below potential, then the annualised hit to GDP would be around 7.5% assuming we can get back to normal by the end of September.

In addition to the fiscal stimulus, the ‘big bazooka’ rolled out by the US Federal Reserve on March 23 was the announcement that they would facilitate unlimited support to buy up government and certain corporate debt. This monetary stimulus was just the circuit breaker that financial markets needed and marked the low in shares, and the peak in credit spreads so far. Today, on the 9th of April, the Federal Reserve announced a program of buying that would extend into sub-investment grade bonds and also the Exchange Traded Funds that hold these type of assets. This will be very positive for companies such as Ford, whose bonds have fallen into the sub investment grade category.

Overall we are seeing some positive signs emerge globally. However, we also need to be realistic to the facts that over the next month we will be seeing the fastest increase in the unemployment rate the world has ever seen. This carries risks of behavioural changes that we may not have yet fully anticipated. What the last two weeks since 23 March has reminded us of, is that just when things seem the darkest, markets can turn on a dime. For this reason alone it is best not to be over-reacting, either being too bullish or too bearish, but keep your emotions in check and realise the reality will likely be somewhere between your worst dreams and your best hopes.

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.