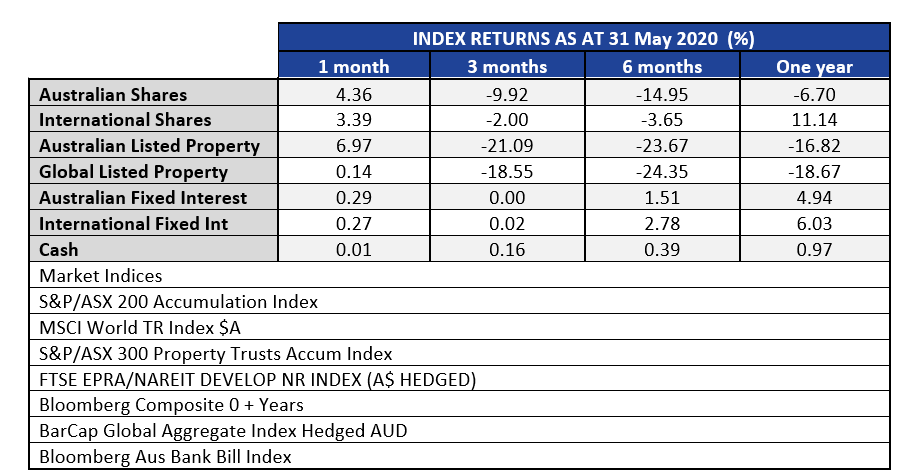

All major asset classes finished positive in the month of May, with equities in particular staging strong rallies. This came in spite of record unemployment, major US cities struggling to contain looting and destruction and another flare up in tensions between China and the US, with Australia also copping some retaliation from China.

The US dollar started falling from mid May versus the trade weighted index, and this has helped Emerging Markets and even the local US markets.

International shares pared their losses for the last three months back to -2.00% reflecting the diversification benefits of holding international assets. This benefit is not only because of the shock absorber effect of the falling Aussie dollar, but also because those foreign markets are less concentrated in financial companies than Australia. The defensive sectors such as drugs, consumer staples and tech all held up much better than banks and property.

Concerns over how well the massive fiscal and monetary stimulus would work held back the performance of banks and finance companies in Australia, but that changed late in May. For the eight weeks from 23 March, the ASX300 Banks index managed to rise only 8.00%. However, from the 22nd, of May until the date of writing (5 June) the Bank index has rallied 23.1% in just two weeks.

Fixed interest markets continued to return to normal in May, with companies again being able to tap the markets for new debt raisings.

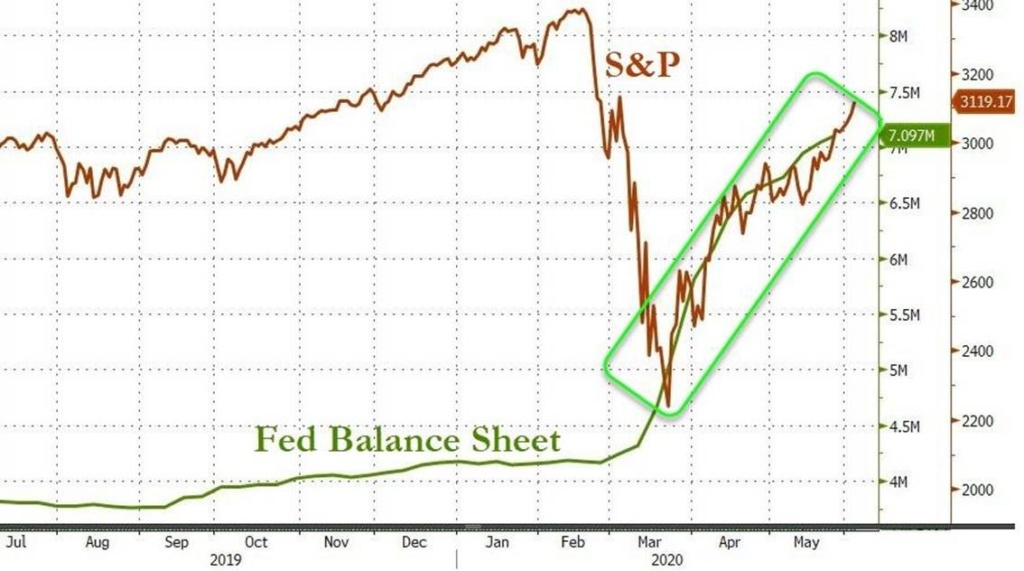

To provide some perspective on why the markets have rallied so strongly in spite of the fact that we are in the middle of a recession, not only here in Australia but likely globally, we need to look at only one chart. The US Federal Reserve Balance sheet overlaid with the S&P500 stock index.

The word ‘un-precedented’ has been used a lot lately. Even Aldi are slinging off at the overuse of the word in their latest ads. However, when it comes to the expansion of budget deficits and central bank balance sheets, there is no other word that springs to mind for describing what has happened.

The US Federal reserve balance sheet has exploded by 2.5 trillion dollars from $4.66Tn to $7.16Tr in the ten weeks since March 18, 2020. While this rate of change has some implications for inflation down the track the immediate goal is to arrest the asset price deflation and central bankers have been very successful at that.

While the central bank balance sheet expansions are alarming, and at some point will have greater consequences, those consequences may not unfold in the time frames that some may expect. One only has to look at Japan as an example of what could be in our future. The Japanese ten year government bond has been below 1% for over 8 years, and for most of the last four years has been at or below 0%.

Whether that is to be outcome here we do not know for sure. But what we do know is that the price of money is likely to be very low for a long time into the future. If looking at Japan as a model we observe that the Nikkei 225 index made a total return of 1.4% per annum in the 20 years since June 2000. Over the last 20 years, the P/E multiple in Japan has averaged 18x even with such low interest rates. In those market conditions, digging deeper to invest in stocks that still had earnings growth prospects and avoid the stagnant secular losers was the only way to make money. We also think that will be important going forward in Australia.