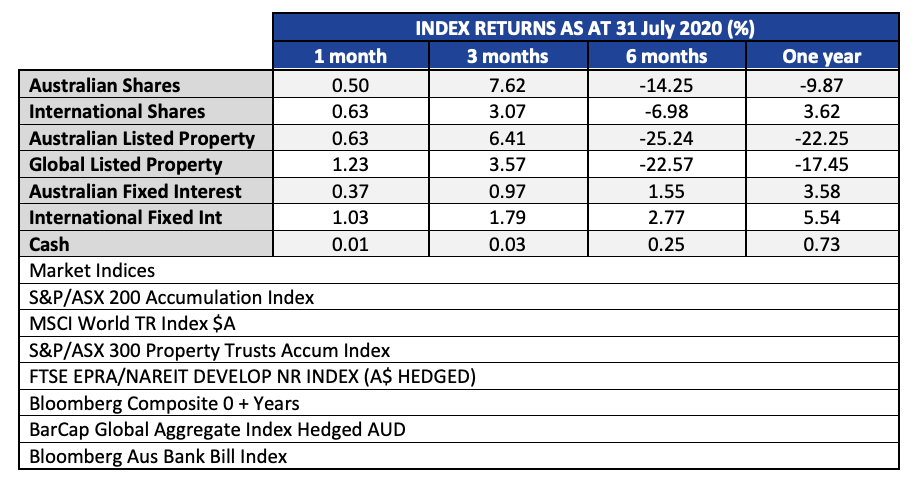

All major asset classes finished positive in the month of July. Equities posted modest returns, and when measured on a monthly basis mostly in line with longer term expectations.

A strong bounce back in equities during April, May and June held through July in spite of the release of statistics that indicate the worst slump in economic output since the Great Depression. The rise in the Australian dollar masked a larger return from global shares which actually gained 3.5% in local currency terms. Base metals like copper (+7.3%), bulk commodities like iron ore (+4.95%) and precious metals like gold (+10.9%) all helped to draw money into the Australian Dollar. Not that it is all about commodities. The USD itself fell 4% measured on a trade weighted basis vs other currencies, finally reflecting perhaps that the US federal deficit, on track for $3.7 trillion in 2020, is 17.6% of GDP.

Fixed income markets continued a positive trend. Yields in the longer duration bonds fell, and credit spreads (the difference in yield between the highest rated bonds and lower grades) continued to contract, providing a positive boost for bond markets. No joy however for term deposits. Those investors continue to be the silent victims of the global central bank obsession with stoking inflation, and supporting financial markets.

Currently, the highest one year rate we are seeing is 1.30% with Judo Bank, and everyone else is below 1.00%. Going out to the five year deposit horizon is even worse, with Judo Bank offering 1.55% and everyone else at 1.00% or below. The world is awash with money, and apparently they don’t need any more of yours, thanks to Central Banks ballooning their own balance sheets!

The current yield to maturity of a broad index of investment grade Australian corporate bonds with a five year maturity is around 1.94% currently. Against this backdrop the Australian five year government bond currently yields 0.40%. The difference between these two is the ‘credit spread’. It indicates that presently, market participants require an additional 1.54% per annum, to be lending to the average investment grade company in Australia. We call this a 154 basis points credit spread.

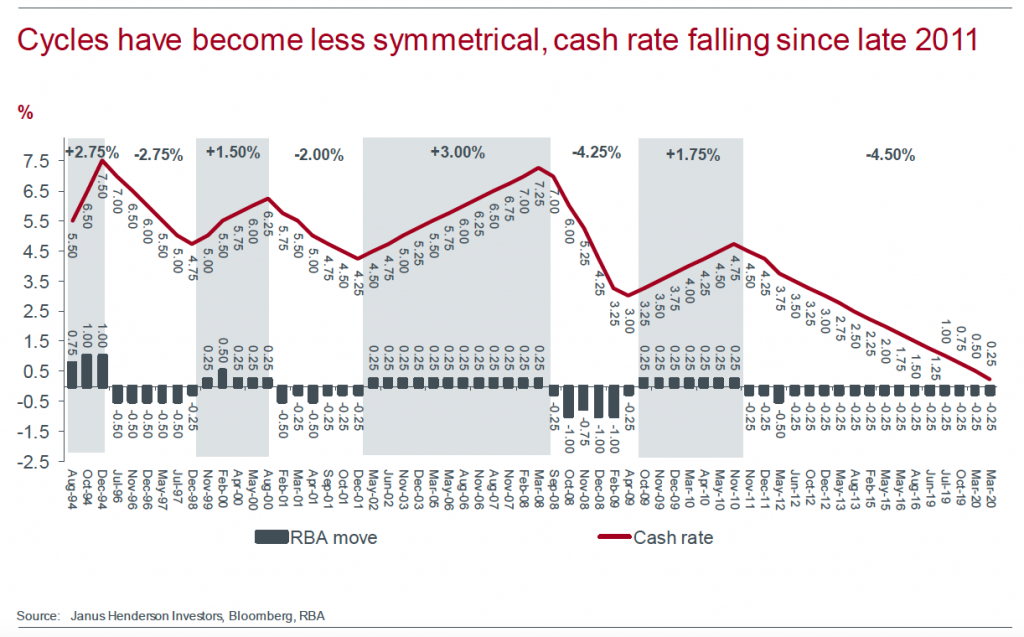

Our table below illustrates how official interest rates in Australia have moved over the last 26 years.

Borrowers for the last 9 years have known nothing but falling interest rates. However that takes a toll on frugal savers who in earlier decades provided ‘scarce capital’ to fund borrowers. Global central bank largesse has deprived those investors of their natural market.

With interest rates at what the industry refers to as the ‘zero bound’ it forces all investors up the risk curve in order to just keep up with inflation. This is where setting realistic expectations, and having a cashflow plan so that you can remain invested in appropriate assets, for the appropriate time horizon, becomes vitally important.

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.