Arnold Horshack was the character in “Welcome Back Kotter”, who famously said, “when you least expect it – expect it!”.

It seems like 2016 will go down as the year of getting what we least expected, with outcomes that were even less expected!

Brexit and Trump were the two least expected outcomes, with grave concerns of what would happen to financial markets in either event.

Turns out the least expected outcomes are those that have come to pass.

Last weekend, Italy voted on changes to the constitution for the purpose of strengthening the lower house of parliament against the Senate. The government would then have some hope of actually passing some laws that would modernise the labour markets and other areas of sorely needed economic reform.

After a resounding NO, Prime Minister Matteo Renzi has resigned. There were concerns that the resulting political instability would turn attention back to the plight of Italian banks. Estimates are that Italy’s banks have EUR380 billion of bad loans, and continued political instability will make it less attractive for private capital to provide further support. But no, markets have completely taken that in their stride, and barely missed a beat. The Euro crashed to USD1.05 but then rebounded the same day to USD1.075.

The Austrian elections have installed a Green Party leader. Voters have turned their backs on major parties, and that market was up 2.5% in the following two days.

Next year, the big event is the first round of voting for the next French President on 23 April. Socialist president, Hollande, has decided not to run, leaving many questions open and the far right ‘National Front’ leader, Marine Le Pen, gaining in popularity.

Whatever the outcome, we do need to be prepared for, and not spooked by, the accompanying volatility.

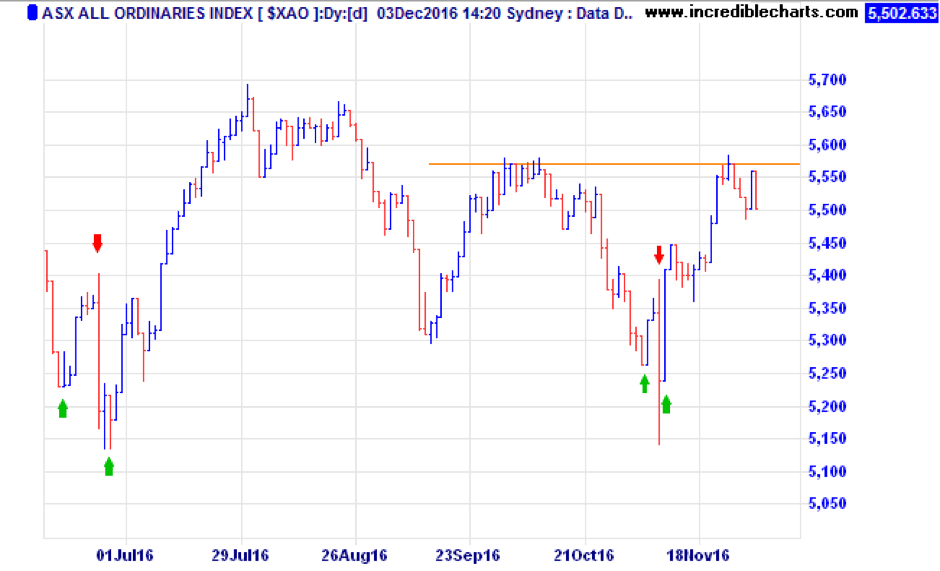

Our first chart helps to visualise the impacts of the Brexit and Trump surprises.

A familiar pattern shows up. Polls favouring the ‘expected’ result in a buoy in the market in the days leading up to the event (first green arrows). Then, the unexpected shock hits the market (down arrows in red). Lastly, we get the realisation that maybe it ‘won’t be so bad after all’ and markets get back on track.

As an aside, right now the market is having a struggle breaking through the highs that were made after the post Brexit rally. A move above 5500 on the ASX200 or 5580 on the All Ords is required to confirm the rally that is underway.

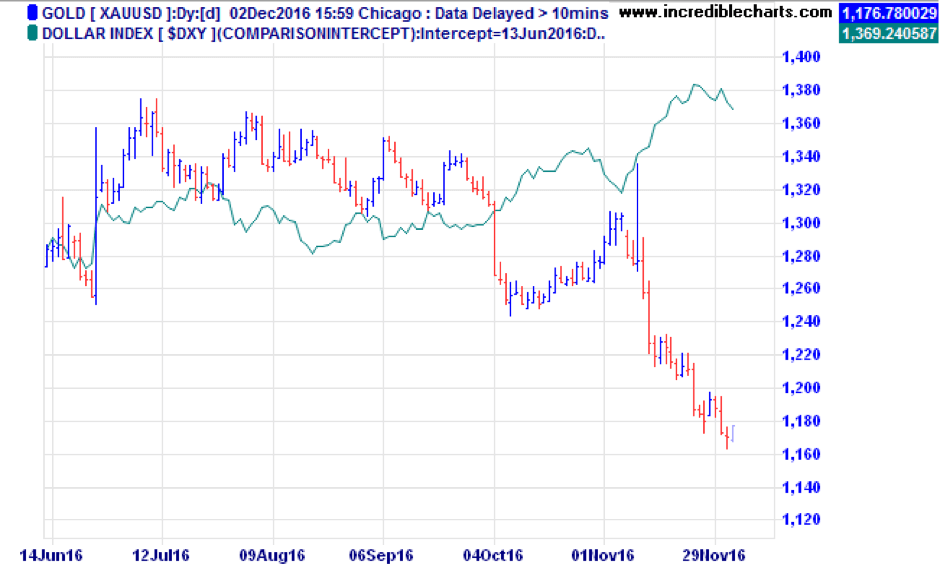

Another chart we want to share this month is the USD index (basket of the USD vs trade weighted currencies) and its relationship to the gold price.

Since the Trump win, the USD has strengthened (again – unexpectedly) while gold has sold off. The strong dollar/weak gold is a traditional relationship, and you can see this very emphatically since the early November Trump surprise. The strong dollar run does however show some early signs of easing. Australian gold stocks have sold off heavily in the last three weeks, so it will be interesting to see if the dollar is topping and whether gold can find a bottom at these levels.

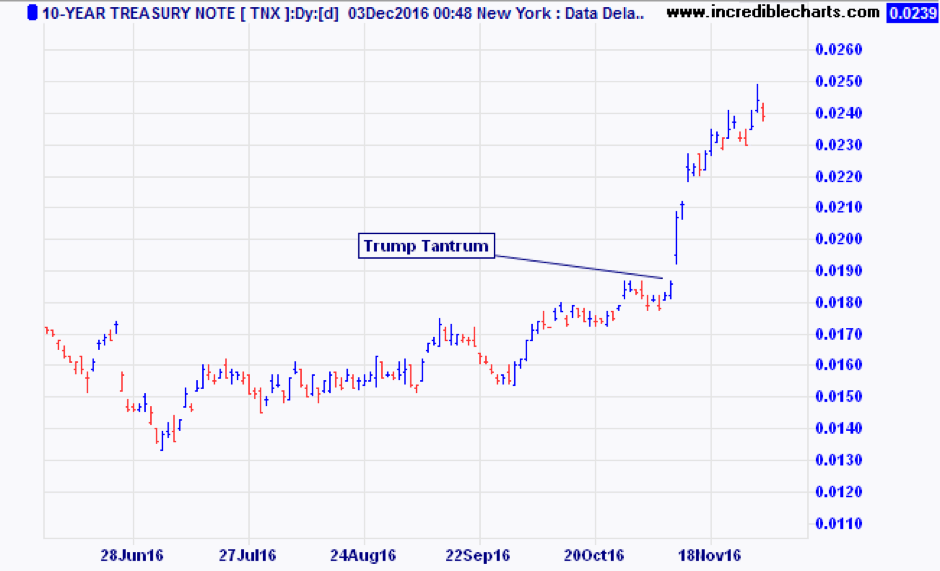

The other chart we wanted to share is that of the ten year US Treasury bond, where the rise in yields has resulted in a sell-off in yield sensitive sectors. We (and others) previously identified these as the ‘expensive defensives’ that we wanted to avoid, or at least restrict to low exposures to in our portfolios.

In our fixed interest portfolios, the primary position has been to hold short maturities in preparation for this exact risk. The funds we use in this sector generally have a mandate to shorten or lengthen the duration, taking advantage of sell-offs like these.

The other big event that is yet to come this year is the Fed meeting on 15/16 December. It is widely expected (92% odds) that the US Federal Reserve will hike the short term rate to 0.50% at that meeting. That rate hike is fully factored into markets already. It will be a matter of how many hikes follow in 2017 that dictates whether the sell-off in yield assets is a buying opportunity, or just the start of a larger rotation into cyclical stocks.

All we can say is, “expect the unexpected’ or, in the words of Arnold Horshack “when you least expect it – expect it!”.

Our portfolio management strategies are positioned to be resilient in the face of volatility, and in many cases to take advantage of it.