In most cases, the banks expect a 20% upfront deposit before they will consider approving you for a home loan. A 20% deposit for the Australian median house price of $660,000 equals $132,000! Fortunately for those of us living in Brisbane, the median house price here is just over $510,000. Unfortunately, that still means we are required to cough up $102,000 as a deposit!

For most of us, saving that kind of cash and purchasing a home in our 20s is almost impossible. According to recent reports, 57% of first home buyers are now aged between 30-40 years old.

How can Lenders Mortgage Insurance help?

The banks do however offer Lenders Mortgage Insurance (LMI) if you are unable to produce the full 20% deposit. However, this is not to be mistaken as insurance for you. LMI is security for the lender to ensure that they will not incur a loss should you default on your home loan. This is why banks request a 20% deposit prior to considering your loan.

The cost for LMI is most commonly added to your home loan. It is important to understand that once LMI is added to your home loan principal, you will be paying interest on top of the LMI amount and your minimum regular repayments will increase accordingly.

Alternatively, if you are fortunate enough to have parents (or a close relative) with equity in their own home, they may be eligible to become a guarantor for you. Becoming a guarantor on a loan essentially means becoming the security on the home owner’s loan. This is a strategy to avoid the cost of LMI if you have not saved the 20% required for a deposit. However, if you default on your home loan, your guarantor will be liable to repay the portion of the home loan they have become guarantor on. Most banks request the guarantor to seek financial advice before committing to this strategy.

To assist and encourage Australians to save towards their first home, the government has previously offered first home owners saving accounts. These had great incentives including an additional contribution of 17% for the first $6,000 deposited each financial year. Unfortunately, the government abolished these accounts as of 1 July 2015 and apart from the First Home Owners’ Grant, the government does not offer any other schemes to help first home owners.

Tips for saving a deposit

There are a couple of strategies you might consider to make saving for a deposit easier:

The Fixed Interest Approach: Through careful budgeting and serious consideration of your current spending habits, you may be surprised at just how much you can save. Is that coffee on your way to work really necessary, or could you perhaps make one at home and pop it in a travel mug? Is the Diet Coke you purchase each time you fill up your car really worth it? ASIC’s Money Smart have a useful budgeting tool called “TrackMySPEND” which could help you develop a personalized budget.

Bear in mind that careful budgeting and strict discipline go hand in hand. If you find yourself spending everything you earn, it might be a good idea to open a high interest savings account with low fees. Each time your pay is deposited into your everyday bank account, your first priority should be to transfer your savings straight into that high interest savings account, and leaving it there. You could even set up an automatic transaction so you don’t have to think about it.

Please carefully read the Product Disclosure Statements before opening any new accounts. High interest savings accounts may incur a fee if more than one withdrawal is made per month, and in some cases, you may lose your high interest rate for that month if withdrawals are made.

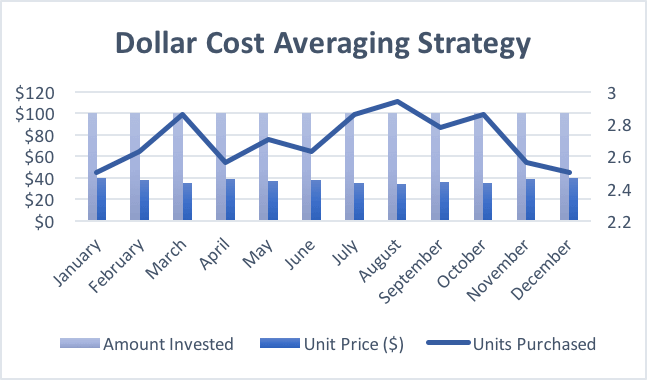

The Investment Approach: If you don’t mind a little bit of risk, this could be a viable option to consider. Investment strategies such as Dollar Cost Averaging (DCA) can dramatically increase your wealth over time. The purpose of this strategy is to reduce market timing risk. This essentially means that you are avoiding purchasing a lump sum of units at their peak price, but rather investing gradually over time to average out the price per unit.

The below table illustrates the benefit of Dollar Cost Averaging when $100 per month has been invested over a 12-month period.

| Month | Amount Invested | Unit Price ($) | Units Purchased |

| January | $100 | 40 | 2.5000 |

| February | $100 | 38 | 2.6316 |

| March | $100 | 35 | 2.8571 |

| April | $100 | 39 | 2.5641 |

| May | $100 | 37 | 2.7027 |

| June | $100 | 38 | 2.6316 |

| July | $100 | 35 | 2.8571 |

| August | $100 | 34 | 2.9412 |

| September | $100 | 36 | 2.7778 |

| October | $100 | 35 | 2.8571 |

| November | $100 | 39 | 2.5641 |

| December | $100 | 40 | 2.5000 |

| Total | $1,200 | 32.3844 |

Total Amount Invested: $1,200

Total End Value: $1,295*

Gross Capital Gain: $95

*Total Units Purchased X End Value Per Unit (rounded)

At the end of the investment period, the investor has increased their portfolio value by $95 without the unit price ever increasing more than the starting price.

Dollar Cost Averaging could be a suitable strategy for those who may have a tight budget or for those that are in no rush to get into the property market but are aiming to own their own home one day. However, it is important to understand the type of portfolio you are investing in.

Typically, balanced investors will let their portfolios grow for a minimum of 3 years before withdrawing any funds. On the other hand, those who are investing in more growth type assets (such as international shares) tend to let their portfolio grow for a minimum of 5-7 years before withdrawing any funds. The purpose of these timeframes is to allow the investments to run their natural course.

It is important to clearly understand your tolerance towards risk before considering this strategy. To discuss this in further detail, contact Quill today.

What impacts your borrowing power

While saving towards your deposit is essential for banks to seriously consider your eligibility for a home loan, other factors may impact your borrowing power. Credit card debt or a personal loan or car loan, may heavily impact on how much the bank will lend you. 10 years ago, my brother and his wife applied for a home loan and discovered that because of their $15,000 car loan, their borrowing power was reduced by approximately $80,000!

Generally, all banks will also require a credit history check. When I first spoke to the bank about applying for a home loan, they instructed me to take out a credit card as I had never had any debt before and therefore had no credit history.

Reducing or, even better, eliminating your current debt now will better prepare you for when you apply for a home loan. Strategizing how best to make your repayments plus increasing your savings can be a daunting task. But with a plan in place and strict discipline, it’s not impossible.

Please note, this is general advice only and does not take into account your personal circumstances. If you would like to find out the best strategy for you, or if you would like some extra tips, contact Quill today and start building your house deposit!