Recently released life and TPD insurance claims data has shown a significant rise in insurance payouts and has given insight into the leading causes of disability insurance claims in Australia.

The Financial Services Council (FSC) together with KPMG analysed over 71,000 insurance claims from insurance policies purchased through financial advisers between 2014 and 2018 covering 10 life insurance companies. Their report looks at the causes of claims, the difference in claims between men and women and the proportion of claims paid.

Proportion of claims paid by insurers

There is sometimes a misconception or stigma that life insurance companies go out of their way to NOT pay TPD insurance claims (total and permanent disability insurance) and other claims, however the statistics show a very high payout percentage.

Claims payout ratios:

- Life Insurance – 97%

- TPD Insurance – 90%

- Income Protection Insurance – 95%

- Critical Illness / Trauma Insurance – 86%

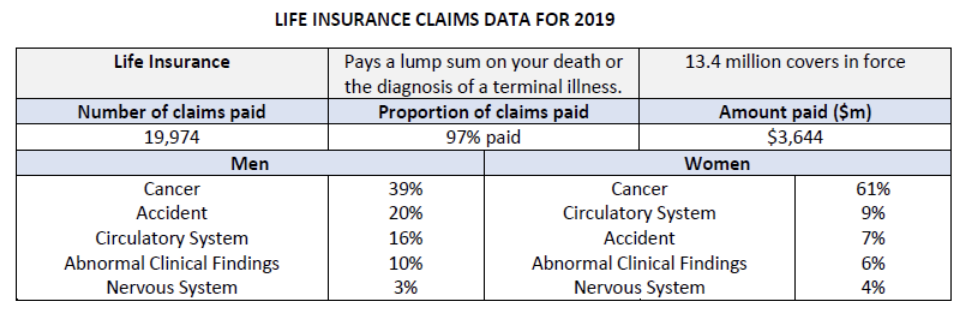

Life insurance claims

The life insurance industry paid out more than $12 billion to nearly 102,000 Australians during 2019 or almost $33 million to 279 Australians and their families every day of the year.

Cancer is by far the leading cause of death (and subsequent life insurance payouts) in both men and women (39% and 61% respectively).

Accidental death is much more prevalent in men (20%) compared to women (7%), even topping circulatory system claims (heart attacks etc.)

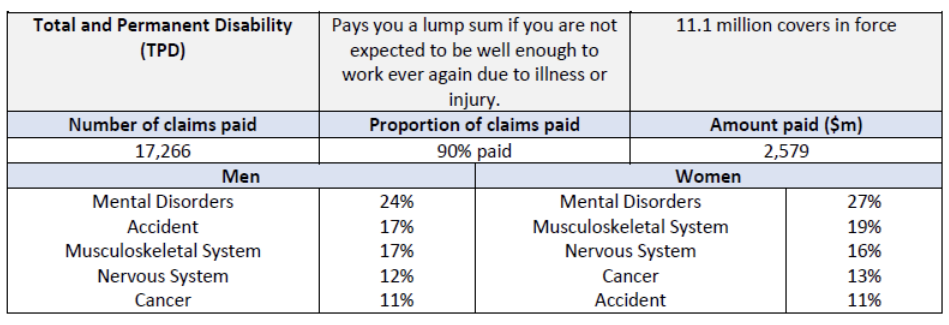

Total and permanent disability – TPD insurance claims

Mental health disorders tops the list for both men and women at 24% and 27% respectively. Accidents come second for men at 17%, but for women it’s a different story, with accidents down in fifth place at just 11%.

Mental health

There is an increased awareness and conversation about mental health in our society, especially in the current COVID-19 environment.

We note that in 2019 insurers paid $1.24 billion to more than 9,500 Australians for mental health claims. These claims cover an extremely wide and complex spectrum of conditions. The top five underlying conditions account for less than half (46.9%) of all claims for mental health conditions as follows:

- 16.5 % – depression, including single and recurrent episodes

- 13.4 % – unspecified anxiety disorders, for example panic or anxiety attacks

- 11.3 % – reaction to severe stress, for example post-traumatic stress disorder

- 3.6 % – Alzheimer’s disease

- 2.1 % – schizophrenia

It’s important to note that the above statistics are prior to COVID-19. Future reports will be interesting in regards to the impact the pandemic has had on our mental health.

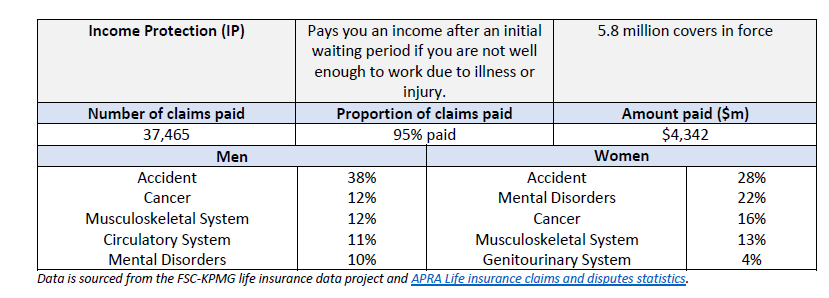

Income protection insurance claims

Accident is the top cause of claim across men (38%) and women (28%).

Mental health was only 5th on the list for men (10%), but a clear second for women (22%).

Critical illness / trauma insurance

For trauma insurance information was limited, the highest cause of claim was for cancer at 58 per cent.

This insurance type wasn’t broken down to gender, however its’ importance is clear given the role of cancer as a cause of claim across life insurance as well as being in the top five for TPD insurance.

Summary

Behind each of the data points above is a human, a family, a loved one getting financial support when they need it most.

Myself and the Quill team are strong advocates of insurance and the role it plays protecting your future and your families future.

As advisers we regularly provide assistance where a client has passed away or suffered a serious illness or injury. Fortunately, in most of these cases our clients have had insurance in place and were able to focus on grieving, treatment or rehabilitation without worrying about their financial situation.

If you have any questions or would like to learn more about how Quill can assist you in regards insurance, please get in touch with your Relationship Manager.