If last year was the year of shocks and surprises, this will be the year of discovery as to what those surprises deliver. Britons voting with their feet to leave the European Union and the star of a Celebrity Apprentice show getting the gig as the most powerful man on the planet are two of the biggest surprises. Yet the biggest surprise of all is how well markets have handled these two surprises and the uncertainty they bring.

Before we start to consider what may be in store for 2017 it is worth looking back at the winners and losers in 2016.

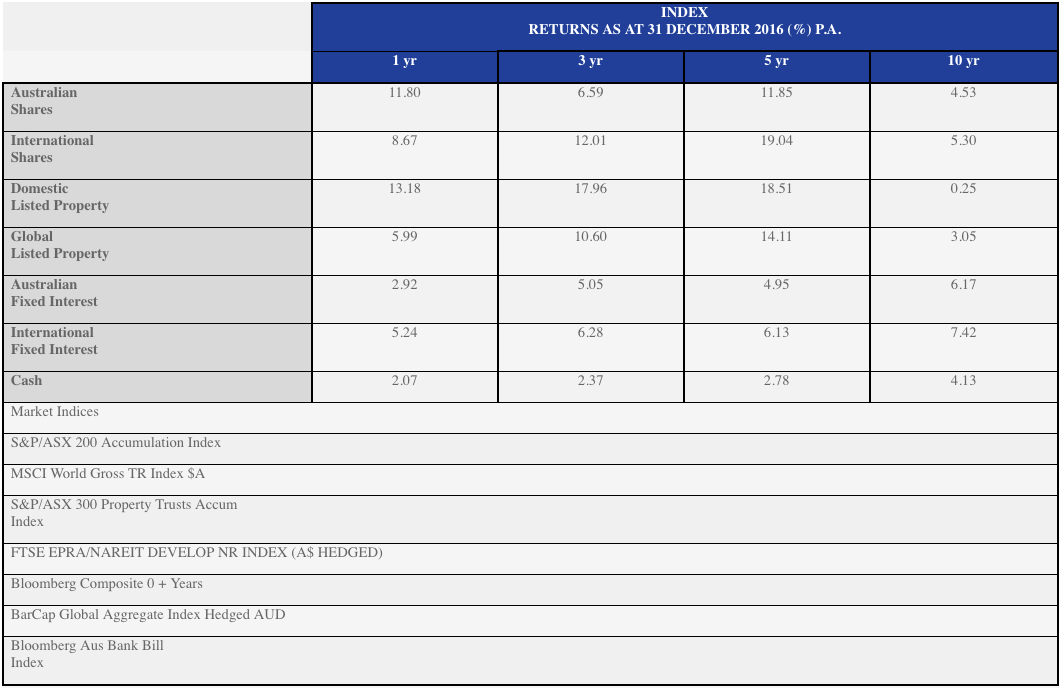

2016 Market Returns

Looking at the table below, one could be thinking that 2016 was a fairly benign year, with double digit returns in Australian Shares and listed property, and nothing in the negative. But looking only at the ‘year to year’ figures within those top performers hides some large intra year divergences. For example, from 1 January, the ASX 200 fell around 10% into early February. That level of decline is actually slightly less than the median 11.7% drawdown that the ASX200 has suffered in the last 23 calendar years. From the peak in April 2015 to the low in February 2016, the ASX200 was down by 18.9%.

From early August to mid-November, the A-REIT sector (listed property trusts) fell 19.2% along with other interest rate sensitive sectors as bond yields started to rise. Even the fixed interest sector was not exempt from losses. Although the full year showed a return of 2.92%, the index of Australian Government bonds lost 3.8% in the last quarter as interest rates rose and bond prices fell.

So what could happen in 2017?

President Trump

Trump becomes 50% politician 50% businessman. He fails to keep many promises, including the building of a great Mexican wall. He is brought to heel on some of the trade agreements he promised to tear up. But with the compromise, his Republican members come around to the idea of running up more debt to stimulate the economy and re-build the country’s infrastructure. This helps with more construction jobs, but fails to bring back the manufacturing jobs that were lost to Mexico and China. A confrontation is likely. Be it North Korea, China or Russia, one of these is going to push the boundaries and Trump is likely to relish the fight. Let’s hope it’s just words and doesn’t escalate.

Europe

The rest of Europe starts to weigh the benefits of remaining in a currency union, when possibly a trade bloc would be almost as good. It won’t happen in 2017, but the voices will grow louder. There will be winners and losers out of this, but keep in mind that whether you are German or Greek, you still like to eat, drive, sleep in a house, take occasional vacations; so life and the economy will go on.

US Interest Rates

US Interest rates move higher but only gradually. The rises are still less than the forward looking estimates of the Federal Reserve committee (which are made public, and often referred to as the ‘dot plots’). The move is limited to two hikes this year taking the Fed Funds rate up to a target of 1.00% to 1.25%. Australian longer term interest rates also rise, but again, it is likely to be modest. Currently the difference between yields on the Australian ten year bond and the two year bond stand at 0.80% (80 basis points). Only on 4 occasions in the last 20 years has this spread spiked to above 100 basis points. So unless you see a case for the short end (RBA Official Cash) rising dramatically, then the long end should only move up modestly. However, long duration fixed income funds will continue to face headwinds.

More volatility

As mentioned, this is not unusual. Trends do not go on forever and the worst strategy is loading up on last year’s winner. In fact LVX Research recently published a paper showing stellar returns from picking the five ASX100 stocks with the worst 5 year trailing returns.

The rally since the Trump Election could well be coming to an inflection point and some have postulated that his inauguration will prove to be the turning point. One doubts that it would be that obvious, and as we have learned last year, expect the un-expected. Whenever it happens, given the strong run-up, it should not surprise anyone if we see ten percent decline in shares. In fact, there is an 82% chance that during the year we will see an equities decline of that magnitude. (Only 3 years in the last 23 have had intra-year declines of less than 10%).

China

China continues to be the ‘swing factor’ in our sharemarket. Stimulus there has driven coal and iron ore prices higher, providing strong gains in our bulk commodity exporters. Overall Chinese corporate and SEO (State Owned Enterprise) debt as a percentage of gross domestic product (GDP) remains higher than the US, but since the Communist regime makes it much more palatable to have governments bail out SEO’s and Municipal Governments, a debt crisis there is likely to have a lesser impact than in the Eurozone.

Valuations

The 2017 Outlook won’t be complete without a mention of valuations. At 31 December, the ASX200 estimated forward Price to Earnings (P/E) ratio stood at 16.6. The 10 year average has been 14.3. You could say that compared to history the Australian sharemarket needs to be 13% lower to be at the average P/E ratio. However, those 10 years were at interest rates much higher than today, so maybe the current valuation can be justified.

Global equities are at 16.1x expected forward earnings, and the ten year average is 13.8x. A similar overvaluation case can be made there. And the US market, at 17x forward earnings, has about 14.5% of downside to hit the 10 year average of 14.5x. Perhaps the cheapest market in the world is Russia, which trades at only 6.6x earnings, and 80% of book value. Buying Russia might be a bit extreme, but Korea is interesting at 9.7x earnings and a price to cashflow of only 5.1x. As you can see, though many markets are expensive, there are pockets that are cheap. We find a similar situation in banks. Australian banks are now relatively expensive, but there are ‘digital disrupter’ banks in Europe that trade on very attractive valuations, without the baggage of the larger established banks.

Conclusion

As always, diversification and quality asset selection are the keys to success. It is fairly easy to identify quality assets, but knowing the right price to pay for those companies is what requires experience and skill.

Not chasing winners – but rather being willing to buy last year’s loser could be a good trade. It worked this year with the Metals and Mining index up 52.7% for the year. For the record, the worst sector in 2016 was Telecoms, down 7.1%, followed by Healthcare which managed only a 1.9% gain. The Asia (ex Japan) index had a poor return in 2016, but as a result now trades at only 13X forward earnings, versus 14.2X historically. Although this area disappointed us in 2016, we maintain a positive five year view on the region based on demographics and valuations.

Ensuring capital is available to invest during those inevitable market sell-offs should also be a rewarding strategy.

Remember, investing is a marathon, not a sprint, so don’t let the volatility get the better of you, rather make it work for you. All the best for 2017!