The argument between active vs passive investing strategies can be thought of like this: All of us think we are above average drivers. We have seen the other fools on the road and figured we would never make the same mistakes as them: turning with no indicator, driving at night with no lights on, going to slow, too fast – you get the picture.

When it comes to investment strategies we have the same tendency. We tend to feel our knowledge is above average. In order to figure out what ‘average’ is, investment market data providers created indexes.

Table of Contents

Index Investing: Vanguard Index Funds

Initially indexes were designed to simply keep track of overall stock market gains and losses for a given day, month or year. Then, in September 1976, Jack Bogle created the first of many low cost Vanguard index funds based on the Standard and Poors index of the 500 largest US companies (S&P 500). The rest as they say is history as Vanguard grew to become one of the largest money managers in the world.

What is Passive Investing?

Passive investing is a strategy that tracks a standard market cap weighted index or portfolio. Passive management typically achieved through index funds or exchange traded funds (ETF) and ignores the valuations or future prospects of any given company. As long as a company meets the index criteria, it is included as part of the passive investment portfolio.

Passive investing is based on the Efficient Market Hypothesis, which proposes that all the possible known information about a stock is always fully factored into the current stock price, therefore no amount of additional analysis can give the individual investor any significant ‘edge’.

Active vs Passive Investing

At the other end of the spectrum are those who believe that applying their skills of analysis they can avoid the overpriced companies and buy those that have better prospects, and in the long run beat those indexes. Active management refers to an investment strategy where the portfolio manager makes specific investments with the goal of outperforming an investment benchmark index.

I don’t plan to dig into the depths of the active versus passive investing argument in this article, however if you are interested, there is a recent active versus passive investing white paper available here.

There are many examples of active investment managers who have been able to beat their comparable benchmarks, or at least match the benchmarks with lower volatility, which is a big consideration for portfolio construction and an often overlooked aspect of the active vs passive investing debate.

Is Passive Investing Sustainable?

The point I want to focus on is sustainability – and I’m not talking about the growing number of sustainable exchange traded funds (ETFs)! The core generic question you’re asking is:

‘If everyone in the world did this (the thing you are contemplating), would the world be a better place or a worse place?”

I want to ask that question about passive investing strategies.

Passive index investing only works when there is a cohort of people still asking questions about the investment merits of each individual company that exists. To put it another way, passive investment strategies need active investors to be able to work.

When capital is allocated without asking those deep questions, entrenched companies would get all the new capital, and the new innovative companies would have no access to capital.

Active vs Passive Investing Trends

How much money has flowed into passive investments such as the Vanguard index funds in recent years?

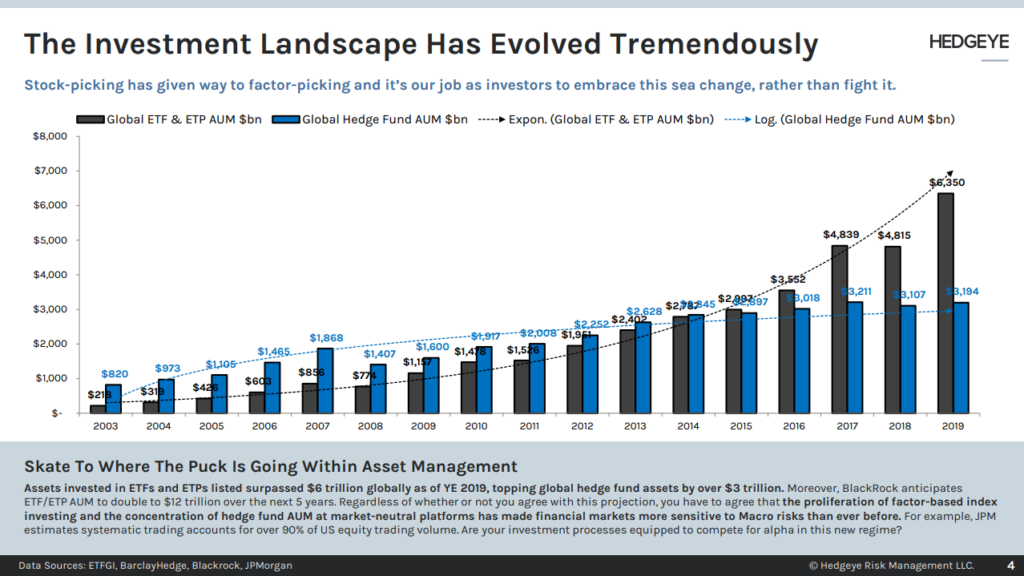

The chart below shows the amount of money invested globally in exchange traded funds (ETFs – i.e. passively managed) versus global hedge funds (i.e. actively managed) between 2003 and 2019.

In 2015 the amount of money invested passively, or in other words by ‘price and value agnostic’ investors, exceeded the amount actively invested by those who want to make an objective assessment of the future prospects of the underlying business.

To the casual observer, it might seem like a win for passive investment management, and just an indicator that everyone is catching on to the idea of low cost index investing through vehicles like ETFs and Vanguard index funds.

But if those in the black bars represent drivers with their eyes closed (passive investing), then the diminishing number of blue bars representing those who are driving with their eyes open (active investing) means that there are fewer analysts looking at what is fair value for any individual company.

Passive ETF Investing Bubble?

With more and more capital flowing into passive versus active investments, the companies which are already the largest, are going to get the lions share of future inflows to the stock market as the passive investment vehicles purchase more and more of their shares.

Given that prospect, it is informative that the biggest five companies in the S&P 500 have been the ones that have driven most of the recent returns during the current 2020 calendar year to date:

With most active investment managers holding those names being somewhat reluctant to sell in the current market – where COVID-19 defensive stocks like Facebook, Amazon, Apple, Microsoft and Google are seen to be less susceptible to the downturn – they have been pushed up to valuation heights that make the typical ‘value’ manager airsick.

Active vs Passive Investing: Which is Better?

Now, just because we can see a potential problem with passive investing, it doesn’t mean the game is anywhere near the end. But it is important for investors to understand the new rules of this game.

Quantitative easing, central banks buying stocks in some countries (I’m looking at you Japan, and you Switzerland), and this dominance of flows into passive investment strategies; active investment managers with their spreadsheets and attention to the regulatory filings may be left in the dust.

At present, indiscriminate buying by passive investors is helping markets. One day the reverse may happen, and passive investment liquidations will also be indiscriminate.

We all hope to be above average drivers with our eyes wide open when that day comes.

Definitions

The following are definitions to some of the more technical investment terms contained in this article for your reference:

Active Investing / Active Management

Active investing or active management is where the investment manager ‘picks stocks’ through buying and selling shares in specific companies with the goal of outperforming an investment benchmark index or target return.

Defensive Stocks / Defensive Investing

Defensive stocks are investments including shares in companies that provide consistent dividends and stable earnings that are typically not impacted by short-term stock market volatility.

Efficient Market Hypothesis

The efficient-market hypothesis is an investment theory that states that asset prices reflect all available information therefore it is impossible to “beat the market” consistently on a risk-adjusted basis since market prices should only react to new information.

ETF

Exchange-Traded Fund. An exchange-traded fund is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur.

Hedge Fund

A hedge fund is an investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction and risk management techniques to improve performance, such as short selling, leverage and derivatives. Similar in structure and operation to a mutual fund or managed fund.

Index

An index, stock index, or stock market index, is an unitised measurement of a stock market, or a subset / basket of the stock market, that helps investors compare current price levels with past prices to calculate overall market performance. It is computed from the prices of selected stocks that make up the index. Examples of indexes include the S&P 500 and ASX 200.

Index Funds

An index fund is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can track a specified basket of underlying investments.

Index Investing

Index investing is the process of using index funds or ETFs to build a passive investment strategy. Index investors decide which markets they want to invest in, how much of their money to put in each one, and use index funds and exchange traded funds to put that plan in place.

Investment Strategy

An investment strategy is a set of rules, behaviors or procedures, designed to guide an investor’s selection of an investment portfolio.

In the context of an self-managed super fund (SMSF) an investment strategy is a document that must be reviewed regularly (at least annually) and must cover items such as diversification, risk, cash flow, liquidity and insurance. SMSF Investment strategies have been a recent focus of the ATO.

Passive Investing

Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

Quantitative Easing

Quantitative easing is a monetary policy whereby a central bank buys government bonds or other financial assets in order to inject money into the economy to expand economic activity.

S&P 500

The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices, and many consider it to be one of the best representations of the U.S. stock market

Value Investing

Value investing is an investment paradigm that involves buying securities that appear under-priced by some form of fundamental analysis. Also known as active investing, active management or ‘stock picking’

Vanguard Index Funds

Vanguard pioneered the concept of indexing, introducing the first retail index fund in the US in 1976. Some popular Vanguard index funds in Australia include: Vanguard Australian Shares Index ETF (VAS) and the Vanguard Diversified High Growth Index ETF (VDHG) which is popular with devotees of the F.I.R.E. investment and lifestyle philosophy (Financial Independence / Retire Early)

Weighted Index

A weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares.