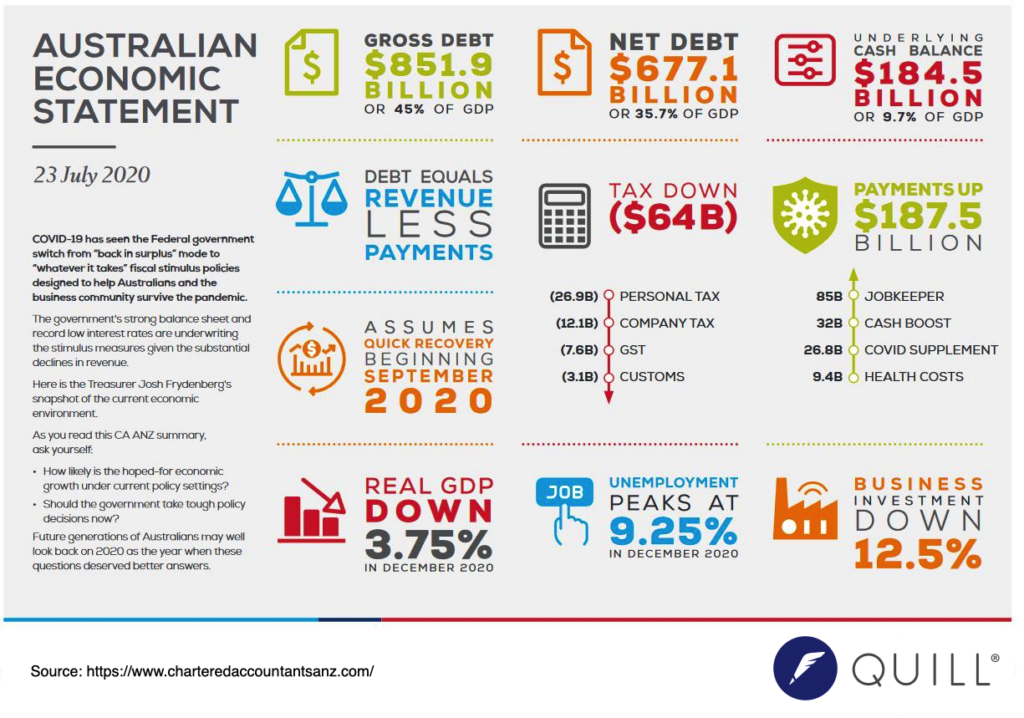

Treasurer Josh Frydenberg’s Australian Economic Statement on 23 July 2020 has revealed a major deterioration in the budget position as a result of the COVID-19 support, with estimated deficits of $85.8 billion in 2019-20 and $184.5 billion in 2020-21.

The economic and fiscal outlook remains highly uncertain as a result of the second wave of COVID-19 being experienced in Australia. The Government will provide forecasts and projections over the forward estimates period and medium term in the 2020-21 Budget to be delivered on 6 October 2020.

Most of the tax and superannuation measures detailed in the Economic and Fiscal Update have been previously announced and many enacted. However, some changes to superannuation and tax measures have slipped in.

View the Australian Economic Statement infographic

Source: charteredaccountantsanz.com

Early Super Release Extended to 31 December 2020

Individuals will now have an additional 98 days in which to apply for the second round of early release of super because of the economic impacts of the coronavirus. The end date to apply will move to 31 December 2020 from 23 September.

The government did not announce any alteration to the rules on early access and the ATO online only application via MyGov process to apply.

All withdrawals made under this policy are tax-free and do not affect Centrelink, Veteran Affairs or JobKeeper payments. Initially Treasury said this measure would cost the government $1.15 billion over the forward estimates. It now estimates this will cost $2.22 billion over the same period. More than $28 billion has been released so far under the scheme.

Treasury initially projected that this would total $30 billion, but clearly that estimate will be exceeded by a considerable margin, perhaps totalling as much as $60 billion.

Commentary from Quill Group

As we often hear, a week can be a long time in politics and so it seems that in a COVID-19 environment, a week can also be a long time in economics.

This week we witnessed the Prime minister announced an extension of the all-important JobKeeper program through to 28th March 2021. Whilst not all businesses will be able to benefit from the JobKeeper extension, support will be focused to those businesses and not for profits that continue to be significantly impacted by COVID-19.

Our recent article – JobKeeper Extension – provides a detailed look at the updated eligibility criteria.

During the week we also witnessed a revised Government projection for the federal budget deficit to peak at a record $184.5bn this financial year. The highest level of deficit (as a & of GDP) since the end of WW2. Whilst this is a huge number most economists are predicting this will peak somewhere between $200-$250bn. Probably the only good news that can be gleaned from this scenario is that borrowing costs are at record lows and public debt is equally relatively low, which means that this is unlikely to be a major problem for the Government. Having said that, PWC and others are suggesting that it may take twenty to thirty years to get back to surplus.

In other news, the race to the US election in November is well underway and the Trump administration rhetoric has started to ramp up with diversions away from economic news or Coronavirus very likely to continue. We saw the closure of the Chinese consulate in Houston this week as well as special forces redeployed in US cities to fight crime.

I think that it is safe to say we can expect more announcements in coming months that diverts attention away from jobs and the economy. This may not be good news in the short term for share markets looking for stability and therefore current market volatility is unlikely to ease, at least until after the election.

If you have any questions regarding how any of this economic news impacts you, please get in touch with your Quill Group Relationship Manager.