Most people are now aware that scammers are unfortunately ever present in our modern-day life and the frequent use of the internet has only served to increase this risk. We noticed an increase in this activity during the initial roll out of the NBN and other Government programs or initiatives. Covid 19 is yet another opportunity for increased scam activity including scams targeting superannuation.

ScamWatch, a division of the Australian Competition and Consumer Commission (ACCC) that helps protect Australians from scams, has recently reported an increase in scams since the Coronavirus crisis began.

The ACCC has advised that scammers are taking advantage of people financially impacted by the Coronavirus crisis by falsely selling products or services online and using fake emails or text messages to try and obtain personal data.

There are also reports of scammers offering to check if a person’s superannuation account is eligible for various benefits (such as the early release of superannuation) or claiming new schemes will lock people out of their accounts.

In 2019, Australians lost over $6 million to superannuation scams with people aged 45–54 losing the most amount of money.

Please remember, never give any personal information about your superannuation, bank accounts or other financial information to anyone who has contacted you by phone or email. You should first confirm who has contacted you and make sure they are a legitimate company or government representative. Hang up and call the organisation directly by doing an independent search for their contact details. Better still, check with your relationship manager if you have any doubts to their legitimacy.

Steps you can take

If you think you may have provided information about your superannuation account to a scammer, please contact our office immediately. You can also contact www.idcare.org, a free Government-supported service which will work with you to develop a specific response plan to your situation and support you through the process.

More information on Coronavirus scams is available on the Scamwatch website (https://www.scamwatch.gov.au).

Quill is here to support you if you have any further questions, please contact our office.

About COVID-19 scams

Scamwatch has received over a thousand coronavirus-related scam reports since the outbreak. Common scams include phishing for personal information, online shopping, and scams targeting superannuation.

If you have been scammed or have seen a scam, you can make a report on the Scamwatch website, and find more information about where to get help.

Scamwatch urges everyone to be cautious and remain alert to coronavirus-related scams. Scammers are hoping that you have let your guard down. Do not provide your personal, banking or superannuation details to strangers who have approached you.

Scammers may pretend to have a connection with you. So it’s important to stop and check, even when you are approached by what you think is a trusted organisation.

Visit the Scamwatch news webpage for general warnings and media releases on COVID-19 scams.

Below are some examples of what to look out for.

These are a few examples, but there are many more. If your experience does not match any of the examples provided, it could still be a scam. If you have any doubts at all, don’t proceed.

Phishing – Government impersonation scams

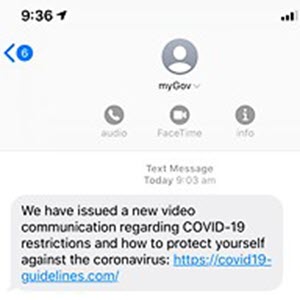

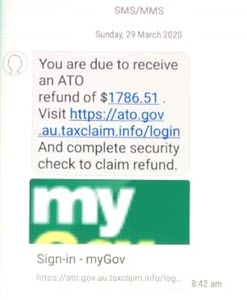

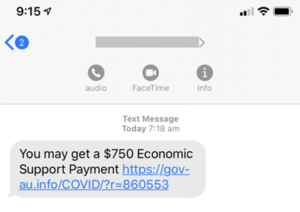

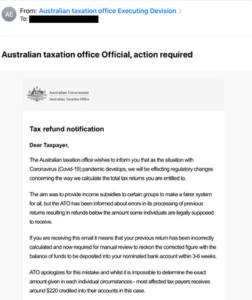

Scammers are pretending to be government agencies providing information on COVID-19 through text messages and emails ‘phishing’ for your information. These contain malicious links and attachments designed to steal your personal and financial information.

In the examples below the text messages appear to come from ‘GOV’ and ‘myGov’, with a malicious link to more information on COVID-19.

Examples of phishing scams impersonating government agencies

Scammers are also pretending to be Government agencies and other entities offering to help you with applications for financial assistance or payments for staying home (Click for larger version).

Tips to protect yourself from these types of scams:

- Don’t click on hyperlinks in text/social media messages or emails, even if it appears to come from a trusted source.

- Go directly to the website through your browser. For example, to reach the MyGov website type ‘my.gov.au’ into your browser yourself.

- Never respond to unsolicited messages and calls that ask for personal or financial details, even if they claim to be a from a reputable organisation or government authority — just press delete or hang up.

Scams targeting superannuation

Scammers are taking advantage of people in financial hardship due to COVID-19 by attempting to steal their superannuation or by offering unnecessary services and charging a fee.

The majority of these scams start with an unexpected call claiming to be from a superannuation or financial service.

The scammers use a variety of excuses to request information about your superannuation accounts, including:

- offering to help you access the money in your superannuation

- ensuring you’re not locked out of your account under new rules.

- checking whether your superannuation account is eligible for various benefits or deals.

Example of a scam targeting superannuation

A scammer will call pretending to be from a superannuation or financial service. They may refer to the government’s superannuation early release measures, and ask questions such as:

- Have you worked full time for the last 5 years?

- Are you going to apply for the $10 000 superannuation package?

Or falsely claim:

- Inactive super accounts will be locked if not merged immediately.

Tips to protect yourself from these types of scams:

- Never give any information about your superannuation to someone who has contacted you — this includes offers to help you access your superannuation early under the government’s new arrangements.

- Hang up and verify their identity by calling the relevant organisation directly — find them through an independent source such as a phone book, past bill or online search.

- See our Scamwatch media release warning about superannuation scams.

- For more information on superannuation scams visit ASIC’s MoneySmart website.