Well, that’s it! I am never going to trust an opinion poll again. EVER.

It seems to be the year for underdogs and populist candidates.

You can’t help but get a feeling of Brexit dejavu when you reflect on the events of this week.

As we write, markets are going berserk, because the consensus view was WRONG.

What can we do? If the pattern that followed the Brexit surprise is anything to go by, probably nothing. Taking a look at the sequence of events back then, it is remarkably similar.

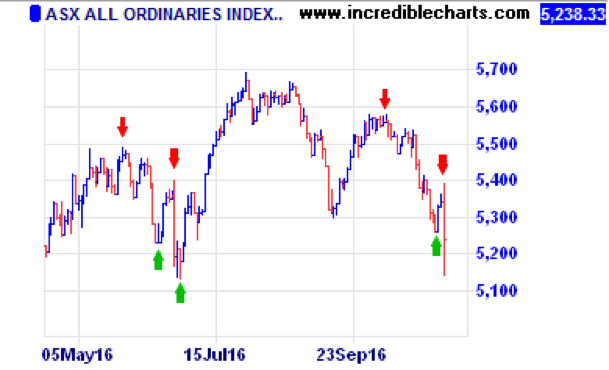

In late May, the markets start to pay attention to this looming Brexit vote. The sell off began as position traders squared their books, cautious of what might happen. A week out from the vote though, the pollsters were confident in a STAY vote, so traders started putting on risk again in anticipation of a relief rally.

But lo and behold, the vote was to LEAVE, and all that position risk came off again in the next 72 hours. But then what? An even greater relief rally took the market up 9% in the following 5 weeks.

Fast forward to US Elections

With 4 weeks to go, a sell off commences based on the risk of a Trump Election (the big moves in the Mexican Peso confirmed the Trump odds as the main driver). Then, on Sunday the 6th we get news that Hillary Clinton is in the clear with the FBI, and a risk-on rally starts in the first markets that open after the announcement. Australia leads a 1.25% rise on the basis that odds were again leaning heavily towards Hillary. OOPS! Those darn pollsters were wrong again! With the Asian markets trading during the hours when the result became apparent, we got hammered. (see last bar on the chart above).

Trump: I congratulated Hillary Clinton “on a very, very hard-fought campaign” https://t.co/StZ7fgTy0W #ElectionNight https://t.co/kzfNHZC3Ic

— CNN (@CNN) November 9, 2016

So, what will happen now? Frankly, we don’t know. A rally the likes of what happened following Brexit is a very big possibility, and something to contemplate before selling anything. You only have to look at the chart above to see what can follow on from events that had previously been contemplated, but were then discounted.

No doubt the next few days will bring lists of winners and losers from economists, but here are a few to get us started. Big Pharma companies were fearful of Clinton’s pricing threats, so they will rally right out of the gate. Hospital stocks on the other hand could fall if there is a repeal of aspects of Obamacare. Companies with a big stash of offshore cash may rally, as Trump is likely to implement changes to the tax code to incentivise repatriation of that cash, which could then fund re-investment, stock buybacks, or higher dividends. Financials and Insurers are certain to get some relief, as they had been sold off in fear of Clinton regulations.

The US Dollar may lose some of its safe haven status, but will still likely remain the ‘second cleanest’ shirt behind the Japanese Yen which is already rising on this news, with a commensurate slump in Japanese equities.

In commodities, gold may be the big winner as a truly global ‘currency’. Trump’s climate change denial will likely favour coal companies over natural gas.

In the short term oil will be down, but the potential of Trump to turn his back on the Middle East, increasing tensions there, could spur an oil price rally in the longer term.

The Impact on us

The biggest impact on Australia is potentially an indirect effect of protectionist policies against China, weakening that economy, in turn reducing demand for coal and iron.

But at the moment it is all a bit too early to contemplate which of these should have the highest weighting. Further, reacting in the midst of a panic has never been a good idea.

Pros and Cons for your finances

Below is an outline of pros and cons for the finances of everyday Australians based on what’s been said by local economists and financial commentators.

| Estimated Pros | Estimated Cons |

|---|---|

|

|

Source: Canstar, 2016