There’s always a moment, when I start a new task, where I wonder, “What’s the consequence or what effect will this have on my time?”.

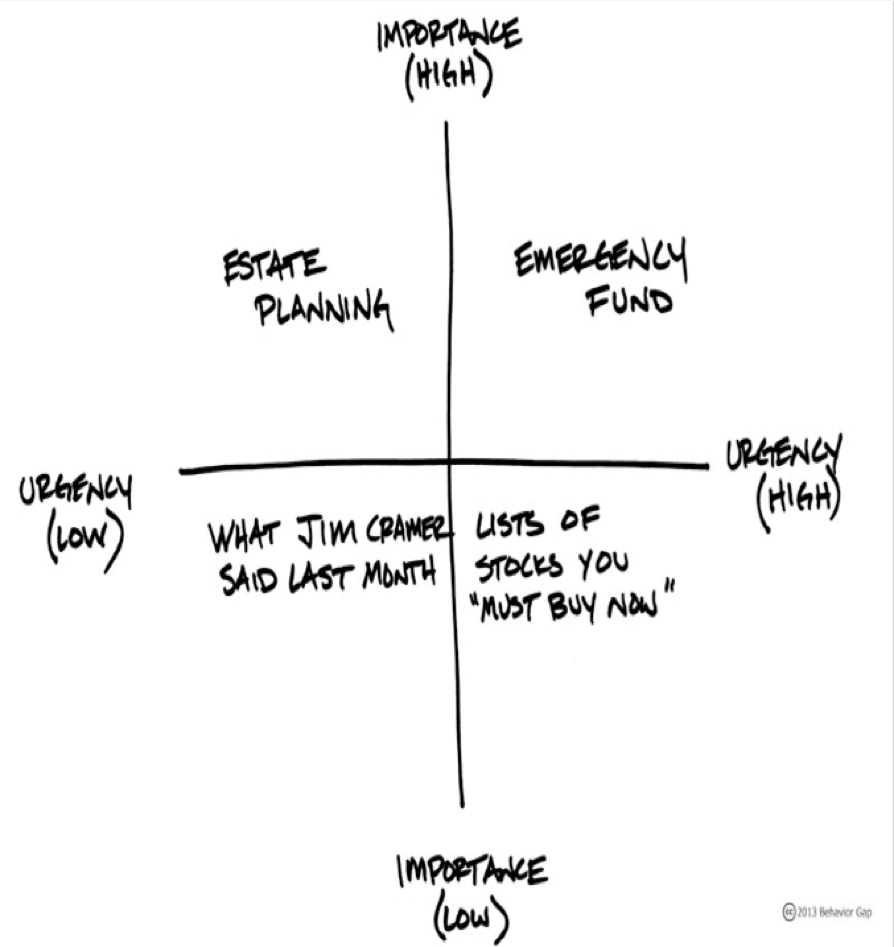

Specifically, does my decision to work on that new task create a conflict between what’s urgent and what’s important?

As we work through our daily “to do” list, the urgent things demand our attention RIGHT NOW, however, in the process, we defer other important and usually personal tasks. I see this situation quite frequently when clients are trying to organise their financial lives but other day-to-day tasks take priority.

Prioritising can be tricky

Every day, we are faced with a list of urgent demands for our attention and I know from personal experience just how difficult it can be to prioritise.

In the interim, we set aside those personal things that are so important to our personal and family’s needs. We defer implementing or updating our will, insuring our income, or rebalancing our investment plan, and the list goes on and on.

All these things are vitally important to us, however, inevitably they never get our attention until something happens.

Take advantage of the holiday period

I know that December and January are holiday months and you may have blocked out a week or even a few weeks for a holiday during this period. I am sure that the last thing you want to think about is any important decisions and you’re looking forward to turning the brain off and catching up on some much-needed R&R. However, it could be the perfect time to check one important thing off your list;

Consider using this time to talk about one important financial matter with your partner that you have set aside for other reasons. Agree that it is important to both of you and that when you return from your holidays, you will take action to get that important something checked off your list by Australia Day 2017.