Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

Article Contents

The HomeBuilder $25,000 grant eligibility requires those building a new home or undertaking significant renovations to spend at least $150,000 (but not more than $750,000) on the project. In addition the pre-renovation value of the property must be $1.5m or less, which rules out adding that extra wing to your Vaucluse mansion.

Further information on the HomeBuilder $25,000 grants and details around eligibility will be updated as the Government released more detail.

Updated Frequently Asked Questions: 14 July 2020

Scott Morrison’s Announcement on the HomeBuilder $25,000 Grant

Prime Minister Scott Morrison said HomeBuilder would save jobs at a time when the industry was facing extreme uncertainty.

“This is about targeted taxpayer support for a limited time using existing systems to ensure the money gets used how it should by families looking for that bit of extra help to make significant investments themselves,” he said.

“If you’ve been putting off that renovation or new build, the extra $25,000 we’re putting on the table, along with record-low interest rates, means now’s the time to get started.”

Renovation work will not include structures separate to the main property, such as swimming pools, tennis courts and sheds.

The Treasury website has further information here: https://treasury.gov.au/coronavirus/homebuilder

HomeBuilder $25,000 Grant Eligibility Means Testing

In addition the HomeBuilder $25,000 grant eligibility is means tested. Only singles who earned no more than $125,000 the previous financial year and couples who earned up to $200,000 will be eligible for the grants. More details will be released soon on whether these thresholds are taxable income or adjusted taxable income.

Image courtesy of news.com.au

Can Investors Access HomeBuilder $25,000 Grant?

No. The HomeBuilder $25,000 grant eligibility requires the grant to be spent on a principal place of residence so therefore cannot be spent on investment properties. In addition, companies or trusts who own residential property will not be eligible.

Eligible Project Types and Time-frames

Sheds, yurts, granny flats, pools, tennis courts and any other structure not attached to the home will not be eligible. The $25,000 HomeBuilder grant will be available from June 4 until December 31.

Unfortunately DIY renovators are not eligible for the $25,000 HomeBuilder grant. Only projects undertaken by licensed builders will be eligible for the $25,000 grant.

There had been concern from some in the industry that the Government money would incentivise “cowboys” to rush into the market with little regard for health and safety, which the scheme takes steps to address.

They include requiring that all eligible builders be licensed or registered before the Government’s announcement, keeping the timeframe for the scheme to six months, and having tighter eligibility for the program.

HomeBuilder Frequently Asked Questions (FAQs)

What is HomeBuilder?

HomeBuilder is a time-limited, tax-free grant program to help the residential construction market to get through the Coronavirus pandemic. HomeBuilder will provide eligible owner-occupiers (including first home buyers) with a grant of $25,000 to build a new home or substantially renovate an existing home.

When can I access HomeBuilder?

HomeBuilder will be available for building contracts signed between 4 June 2020 and 31 December 2020.

How can I access HomeBuilder? How do I apply?

You will be able to apply for HomeBuilder through your relevant State or Territory revenue office or equivalent authority, once the State or Territory Government that you live in (or plan to live in) signs the National Partnership Agreement.

States and Territories will backdate acceptance of HomeBuilder applications to 4 June 2020 once the National Partnership Agreement is signed.

You should contact your relevant State or Territory revenue office for more information about when and how you will be able to apply for HomeBuilder.

When will I receive HomeBuilder?

HomeBuilder grants will be paid by the relevant State or Territory authority provided the applicant meets the eligibility criteria. The exact timing and who the grant is paid to us unknown, however we expect the grant will be paid directly to the builder / developer.

When will the HomeBuilder Grant be paid?

HomeBuilder is being implemented in partnership with States and Territories. For new builds, grants will be paid in line with the timing of payments for first home owner grants or at the discretion of your State and Territory if there is no first home owner grant schemes in place. For substantial renovations, grants will be paid once at least $150,000 of the contract price has been paid in respect of the renovation.

Who pays HomeBuilder and who receives it?

It is expected that the relevant State or Territory revenue office will distribute the $25,000 grant directly to the applicant.

Am I eligible to receive HomeBuilder?

To access HomeBuilder, owner-occupiers must meet the following eligibility criteria:

- you are a natural person (not a company or trust)

- you are aged 18 years or older;

- you are an Australian citizen (at this stage permanent residents are NOT eligible);

- you meet one of the following two income caps:

- $125,000 per annum for an individual applicant based on your 2018-19 tax return or later; or

- $200,000 per annum for a couple based on both 2018-19 tax returns or later;

- you enter into a building contract between 4 June 2020 and 31 December 2020 to either:

- build a new home as a principal place of residence, where the property value (house and land) does not exceed $750,000; or

- substantially renovate your existing home as a principal place of residence, where the renovation contract is between $150,000 and $750,000, and where the value of your existing property (house and land) does not exceed $1.5 million;

Owner-builders and those seeking to build a new home which will be used as an investment property, or renovate an existing home which is an investment property, will not be eligible for HomeBuilder.

The registered or licensed builder (depending on the state or territory) must demonstrate that the contract price for the new build or substantial renovation is no more than a comparable product (measured by quality, location and size) as at 1 July 2019, if requested by the purchaser.

Are the HomeBuilder income caps based on gross taxable income or adjusted taxable income?

It is not definitive whether income caps are measured against an person or couples their gross taxable income or adjusted taxable income. More will be known when the various States release their application processes.

At this it’s most likely that the income caps for the Homebuilder grant will be based on gross taxable income (excluding superannuation) which is the same criteria as the First Home Loan Deposit Scheme (FHLDS).

Your gross taxable income can be found on your ATO issued Notice of Assessment.

How do I prove my taxable income?

Taxable income is shown on your notice of assessment. The notice of assessment is issued by the Australian Taxation Office once your tax return for an income year is processed and this can be used to demonstrate your taxable income.

Note: Taxable income is your gross income less allowable deductions and represents the amount of income you pay tax on. More information on taxable income can be found at:https://www.ato.gov.au/Individuals/Lodging-your-tax-return/In-detail/What-is-income-/#Taxableincome

What if I don’t lodge a tax return?

If you didn’t earn any income or you earned below the tax free threshold you may be able to lodge a ‘nil tax return’ or a ‘non lodgement advice’ to the Australian Taxation Office. Evidence of a nil tax return or non- lodgement advice is appropriate evidence of your income in the relevant financial year. Additional information on requirements for lodging a tax return is available on the Australian Taxation Office website.

Will the tax return have to match the name on the building contract and land title?

Yes, the applicant must be the person(s) who is/are listed on the certificate of title of the property, and the notice of assessment.

What is the definition of ‘couple’?

This will be determined by the relevant State or Territory authority. Generally this would include couples in a registered domestic relationship, or those living as a couple on a genuine domestic basis.

What proof do I need to provide to show that I reside or intend to reside at the property?

This will be determined by the relevant State or Territory authority. Implementation of the HomeBuilder program is currently being considered by States and Territories. It is expected that, where possible, States and Territories will align the HomeBuilder application processes with existing processes for First home owner grants (or similar).

My partner and I jointly own our home. I am an Australian citizen but my partner is not. Can I apply even though the home is jointly owned?

The Scheme is only open to Australian citizens. Eligible owner-occupier(s) must be listed on the property’s certificate of title, and they must meet the eligibility criteria of the program. Permanent residents are not eligible for the Scheme.

Also read: Are permanent residents eligible to apply for the $25,000 building and renovation grant?

Am I able to apply for a second HomeBuilder grant for my property as I wish to undertake two substantial renovations on my property?

No. A property is only eligible for one HomeBuilder grant. The eligible applicant can only receive the HomeBuilder grant once.

I already own land but haven’t signed a contract to build a new house – am I still eligible?

Yes, if you meet the following criteria:

- If you own a property (house and land), and knock the house down to rebuild – this will be counted as a substantial renovation, and therefore subject to the renovation price range of $150,000 to $750,000 provided the total value (house and land) of the property does not exceed $1.5 million pre- renovation;

- If you own vacant land before 4 June 2020, and then build, the total value of the land and new build cannot exceed $750,000; or

- If you buy the land after announcement, and then build, the total value of the land and build cannot exceed $750,000.

What is the definition of an owner-builder?

A licensed or registered builder cannot undertake building or substantial renovation work on their own property. An owner-builder is intended to mean a person who is the registered or licensed builder and who takes legal responsibility for domestic building work carried out on their own land/property. Further detail will be made available through the relevant State or Territory administrative authority.

What if I renovate my house and then want to sell? Is there a limit on how long I need to live there?

It is expected that you will continue to live at the property (as your principal place of residence) for at least 6 months. However, this will be confirmed by the relevant state or territory authority, noting that implementation of the HomeBuilder program is currently being considered by States and Territories.

A family member or relative is a Builder. Can they help me build my new house under HomeBuilder?

Details regarding implementation of the HomeBuilder program are currently being considered by States and Territories to ensure it can be implemented effectively. It is expected that, in negotiating the contract, the parties must deal with each other at arm’s length. This means the contract must be made by two parties acting freely and independently of each other, and without offering favour for some special relationship, such as being a relative. The terms of the contract should be commercially reasonable and the contract price should not be inflated compared to the fair market price.

Is there a limit to how many people can get HomeBuilder?

No. HomeBuilder is an uncapped, time-limited grant.

Are permanent residents eligible for the $25,000 HomeBuilder Grant?

No. As per the eligibility requirements released by Treasury, only Australian Citizens are eligible to apply for the $25,000 HomeBuilder Grant.

At this stage it appears likely that the eligibility for the Homebuilder grant will be the same as the First Home Loan Deposit Scheme and only open to Australian citizens.

Also read: Are permanent residents eligible to apply for the $25,000 building and renovation grant?

Can a joint application for the HomeBuilder grant be made where one applicant is an Australian citizen and the other a permanent resident or holder of a different visa type?

No. Both applications must be Australian citizens. This is outlined in the Treasury fact sheet:

“Carla and Andrew apply for HomeBuilder via the relevant revenue office which conducts the eligibility checks and confirms that both Carla and Andrew are Australian citizens.”

Assuming the eligibility criteria for the $25,000 HomeBuilder grant is the same as the First Home Loan Deposit Scheme then BOTH members of a couple would need to be Australian citizens.

Are New Zealand citizens eligible for the $25,000 HomeBuilder grant?

No, sorry bro, as per the above, to be eligible for the HomeBuilder the applicant(s) must be Australian citizens.

I already own land but haven’t signed a contract to build a new house – am I still eligible?

Yes, if you meet the following criteria:

- If you own a property (house and land), and knock the house down to rebuild – this will be counted as a substantial renovation, and therefore subject to the renovation price range of $150,000 to $750,000 provided the total value (house and land) of the property does not exceed $1.5 million pre-renovation;

- If you own vacant land before 4 June 2020, and then build, the total value of the land and new build cannot exceed $750,000; or

- If you buy the land after announcement, and then build, the total value of the land and build cannot exceed $750,000.

I’ve already entered into a contract to renovate or build, or constructions is already underway – am I eligible?

No. As per the eligibility requirements, the HomeBuilder grant can only be applied for new contacts entered into between 4 June and 31 December 2020.

I’ve signed a contract to build or renovate before 4 June 2020, what are my options?

The HomeBuilder grant can only be applied for new contacts entered into between 4 June and 31 December 2020.

If construction has not commenced but you’ve signed a contract prior to 4 June 2020, speak to your builder about your options.

What type of dwellings are eligible under HomeBuilder?

All dwelling types (house, apartment, house and land package, off-the-plan, etc) are eligible under HomeBuilder, in accordance with the requirement that the owner-occupier must contract to build a new dwelling or substantially renovate their existing dwelling. The applicant must also meet the eligibility requirements outlined above.

Are off the plan apartments eligible for the Homebuilder grant?

Yes. As per the FAQs included in the treasury documents, a contact for the off the plan apartment will be eligible provided the other eligibility criteria is met:

- you enter into a building contract between 4 June 2020 and 31 December 2020 to build a new home (including an off the plan apartment) as a principal place of residence, where the property value (house and land) does not exceed $750,000;

It is unknown whether HomeBuilder will be available for an off the plan apartment where construction has already commenced as the grant is to incentivise and stimulate new construction in the short term.

What are the price caps associated with HomeBuilder?

HomeBuilder is subject to two prices: a contract price cap (for new builds and renovations) and an income cap for applicants.

Contract price cap

A national price cap of $750,000 will apply for new home builds. This means that the value of new builds (house and land), house and land packages, and off-the-plan purchases must not exceed $750,000 to be eligible for HomeBuilder.

For renovations, a building contract price range of between $150,000 and $750,000 will apply and the total value of your property before renovation must not exceed $1.5 million.

The $150,000 minimum building contract cannot include the cost of the land. The HomeBuilder grant is specifically targeted to stimulate building activity.

Income price cap

Eligible applicants must meet one of the following two income caps:

- $125,000 per annum for an individual applicant based on the 2018-19 tax return or later; or

- $200,000 per annum for a couple based on their combined 2018-19 tax return or later.

The income price cap, as well as the eligibility criteria for the applicant, were chosen to reduce complexity as they align with the Commonwealth Government’s First Home Loan Deposit Scheme.

Is the HomeBuilder grant taxed?

No – a HomeBuilder grant will not be taxed. This is consistent with existing state and territory First Home Owner Grant programs.

What if I want to buy a recently built home that has never been lived in before? (eg spec build)

No. HomeBuilder is intended to support activity and provide a pipeline of work for the residential construction sector in the second half of 2020. An existing home that has already been completed, or started construction before 4 June, does not qualify for HomeBuilder.

Further, where construction commences on or after 4 June 2020, provided the contract is signed between 4 June and 31 December 2020, then the property purchase may be eligible for HomeBuilder.

What if I want to buy an off-the-plan apartment or townhouse?

Off-the-plan apartments or town houses are eligible for HomeBuilder.

If you sign the contract to buy the off-the-plan dwelling on or after 4 June 2020 and on or before 31 December 2020 and construction commences on or after 4 June 2020 then the property purchase may be eligible for HomeBuilder.

However, if you sign the contract to buy the dwelling after 4 June 2020, and construction on the home commenced before 4 June 2020, then the home does not qualify for HomeBuilder.

I want to build a new home in a land lease community or retirement village. Is my property eligible for HomeBuilder?

Eligible owner-occupier(s) must be listed on the property’s certificate of title. The owner-occupier must also be a natural person (not a company or trust), and meet the other eligibility criteria of the program.

What about pre-fabricated houses? Are they considered construction and eligible for HomeBuilder?

Construction must be undertaken by a registered or licensed building service ‘contractor’ who is named as a builder on the building licence or permit. Provided the construction is undertaken by a licensed builder and meets all other eligibility requirements, it will be eligible for HomeBuilder.

What happens if approvals to build my dwelling are delayed?

Initially the construction pursuant to the contract must have commenced within three months of the contract date, however this requirement has been removed from the scheme.

Can the HomeBuilder grant be used to build or renovate an investment property?

No. To be eligible for the $25,000 HomeBuilder grant the building contract must be for a property that is or will be a the principal residence of the applicant(s).

There is nothing preventing or restricting the home becoming an investment in the future, however applicants need to be mindful of schemes to artificially class an investment property as a principal residence.

Are properties owned by self-managed super funds (SMSFs) or trusts eligible for the HomeBuilder grant?

No. To be eligible for the $25,000 HomeBuilder grant the building contract must be for a property that is or will be a the principal residence of the applicant(s).

Investment properties held by trusts including self-managed superannuation funds will not be eligible.

What renovations will be eligible

To be eligible for HomeBuilder, the value of renovations must be within the price range of $150,000 and $750,000, the total value of your existing house and land must not exceed $1.5 million.

Renovations must improve the accessibility, live-ability and safety of the property. This excludes building a tennis court, pool or shed for the renovation contract for eligibility purposes.

Renovations must be completed by a licenced or registered builder (depending on the state or territory). In addition, any building or renovation contract entered into must be at arm’s length. This means the contract must be made by two parties freely and independently of each other. The terms of the contract should be commercially reasonable and the contract price should not be inflated compared to the fair market place.

Are knock-down rebuilds considered “renovations”?

Yes. Knock-down rebuilds are considered substantial renovations for the purposes of HomeBuilder.

Is landscaping considered a substantial renovation?

Substantial renovations are not expected to include renovations that are primarily cosmetic in purpose, such as landscaping. A renovation must substantially alter the existing dwelling.

Are granny flats eligible for HomeBuilder?

No, standalone granny flats are not eligible for the HomeBuilder grant. A granny flat built as an extension to an existing house may be eligible.

The renovation works must be to improve the accessibility or safety or liveability of the dwelling. It cannot be for standalone granny flats, swimming pools, tennis courts, and structures that are not connected to the property (i.e. outdoor spas and saunas, sheds or standalone garages).

Is the building of a granny flat eligible for the HomeBuilder grant?

Renovations must be “attached to the home” to the eligible. This means construction of a separate granny flat would not be eligible however an attached extension physically connected to an existing home may be eligible under the HomeBuilder scheme.

I am not a first home buyer – can I access HomeBuilder?

Yes. Provided you meet the eligibility criteria, you can apply for a HomeBuilder grant. However, HomeBuilder is not available for investment properties or to owner-builders.

Is the $25,000 HomeBuilder Grant only for first home buyers?

No. Provided you meet the eligibility criteria, you can apply for a HomeBuilder grant. You do not need to be a first home buyer. However, if you are a first home buyer additional State based incentives such as reduced or nil stamp duty may apply if you are builder a new home (house and land packages etc).

Can the $25,000 HomeBuilder amount be used as part of a deposit to build a new home?

No, however it will likely reduce the amount you need to borrow if you are looking at purchasing a new house and land contract. The $25,000 HomeBuilder grant if approved will not be paid to you personally, therefore it cannot be used to fund part of your home deposit.

Also, if you are a first home buyer there are likely other first home owner grants, nil or discounted stamp duty as well as the First Home Loan Deposit Scheme (FHLDS) you can access.

How do I apply for HomeBuilder?

As at 19 June 2020, applications are not currently open for any State or Territory.

Information on how to apply will be made available when the National Partnership Agreement is finalised. It is expected that, where possible, States and Territories will align the HomeBuilder application processes with existing processes for first home owner grants (or similar). Applicants will be able to apply in relation to eligible contracts that are entered into from 4 June 2020 up to 31 December 2020.

States and Territories will backdate acceptance of HomeBuilder applications to 4 June 2020 once the National Partnership Agreement is signed.

Home Builder Grant Application by State

The below table provides links to the relevant application forms (both online applications and PDFs) by State and Territory.

| State or Territory | Status | Application Form |

| NSW | OPEN | |

| VIC | OPEN | |

| QLD | OPEN | |

| SA | OPEN | |

| TAS | OPEN | |

| WA | OPEN | |

| ACT | OPEN | |

| NT | OPEN |

You should contact your relevant State or Territory revenue office for more information about when and how you will be able to apply for HomeBuilder. We will update the following links and provide information on State based applications as they become available.

Apply for HomeBuilder Grant NSW

Update 11/08/2020

Revenue NSW is now accepting applications for the Commonwealth HomeBuilder Grant.

For further information on eligibility and the application process, please refer to the HomeBuilder guidelines and application form available on the Revenue NSW website.

You can also contact Revenue NSW at Home.Builder@revenue.nsw.gov.au or call 1300 130 624.

Apply for HomeBuilder Grant VIC

Update 10/08/2020

State Revenue Office Victoria is now accepting applications for the Commonwealth HomeBuilder Grant. For further information on eligibility and the application process, please refer to the HomeBuilder guidelines and application form available on the State Revenue Office Victoria website.

To provide certainty and confidence to Victorian HomeBuilder participants, the construction commencement timeframe will be extended to six months given the unique COVID-19 restrictions throughout the state. For further information see the HomeBuilder Grant Guidelines.

Apply for HomeBuilder Grant QLD

Update 04/08/2020

The Queensland Office of State Revenue (OSR) is now accepting applications for the Commonwealth HomeBuilder grant. For further information on eligibility and the application process, please refer to the OSR website.

You can also contact the OSR at HomeBuilderGrant@treasury.qld.gov.au or call 1300 300 734.

It is expected that an online application will be available from 10 August 2020. Further information from the Queensland Government in regards to the HomeBuilder Grant:

- Applying for the Hombuilder grant QLD

- Building a home and HomeBuilder QLD

- Buying a home and HomeBuilder QLD

- Renovating a home and HomeBuilder QLD

You can download the PDF application form here: HomeBuilder Grant QLD Application Form

QLD – The Office of State Revenue

Apply for HomeBuilder Grant SA South Australia

Update 17/07/2020

South Australian residents can now apply for the HomeBuilder Grant via RevenueSA.

HomeBuilder Grant – South Australia

HomeBuilder Grant – South Australia Application Form (PDF)

Apply for HomeBuilder Grant Tasmania

Update 06/07/2020

Applications for both the State and Federal HomeBuilder grants are now open. The Tasmanian Government’s $20,000 grant and the Morrison Government’s $25,000 grant means Tasmanians can potentially access up to $45,000 for their new home build.

A. Tasmanian HomeBuilder Grant (State Government) Updated 6 July 2020

Tasmanian HomeBuilder Grant is a grant of $20 000 available to owner-occupiers for eligible new home builds where the contract is signed between 4 June 2020 and 31 December 2020 inclusive.

For the eligibility criteria, building and contract requirements and the application process for both the Tasmanian and Commonwealth Grants, refer to the HomeBuilder Grant Guideline.

B. Commonwealth HomeBuilder Grant (Commonwealth Government) Updated 6 July 2020

Commonwealth HomeBuilder Grant is a grant of $25 000 for eligible owner-occupiers (including first home buyers) building a new home, or substantially renovating an existing home, where the contract is signed between 4 June 2020 and 31 Dec 2020 inclusive.

For the eligibility criteria, building and contract requirements and the application process for both the Commonwealth and Tasmanian Grants, refer to the HomeBuilder Grant Guideline.

Application form – Commonwealth $25,000 HomeBuilder Grant (Tasmanian Residents)

Apply for HomeBuilder Grant NT

Update 04/08/2020

The Northern Territory Revenue Office is now accepting applications for the Commonwealth HomeBuilder grant.

For further information on eligibility and the application process, please refer to the HomeBuilder Grant Application Form and Lodgement Guide.

HomeBuilder Grant Application Form and Lodgement Guide PDF (393.5 KB)

Apply for HomeBuilder Grant WA

Update 29/07/2020

Revenue WA is now accepting applications for the Commonwealth HomeBuilder grant.

For further information on eligibility and the application process please refer to the application form.

Apply for HomeBuilder Grant ACT

Update 29/07/2020

Information on the application processes for those wishing to access the Commonwealth HomeBuilder grant is available through the Australian Capital Territory’s Revenue Office, the ACT Revenue Office. The ACT has a two-part application process.

Applicants can now complete Part A by registering their interest for HomeBuilder. Applicants must lodge the Part A form by 31 December 2020 for their application to be considered. If you register your interest you will be advised of updates to application forms and supporting materials. Completing the registration form does not in any way constitute eligibility for the grant.

A comprehensive application form will soon be available for applicants to complete Part B of their application. This form requires detailed information about the applicant, their builder, type of construction, as well as detailed supporting documentation.

What documentation will I need to provide?

The State or Territory revenue office will require certain documents to process your application. It is expected that you will need to provide the following at a minimum:

- proof of identity;

- a copy of the contract, dated and signed by you and the nominated registered or licenced builder;

- a copy of the builder’s registration or licence (depending on the state you live in);

- a copy of your 2018-19 or 2019-20 tax return or ATO issued Notice of Assessment to demonstrate your eligibility against the income cap; and

- documents such as council approvals, building contracts or occupation certificates and evidence of land value.

More information on the documentation you will need to provide will become available through the relevant State or Territory authority.

When will I know if my HomeBuilder application is successful?

The relevant state or territory administering agent will notify you of the outcome.

What happens if my HomeBuilder application is not successful?

If you are dissatisfied with the outcome of your HomeBuilder application, you can request that the matter is referred to the relevant state or territory dispute resolution body. More information on the appeals process will become available in due course.

What happens if there is a change in circumstance and I’m no longer eligible?

If your circumstances change after you have applied for HomeBuilder but have not yet received the payment, and no longer meet the eligibility criteria, you will need to notify your State or Territory revenue office immediately.

Who pays HomeBuilder and who receives it?

The relevant State or Territory revenue office will distribute the $25,000 grant directly to the applicant.

Other Related Articles

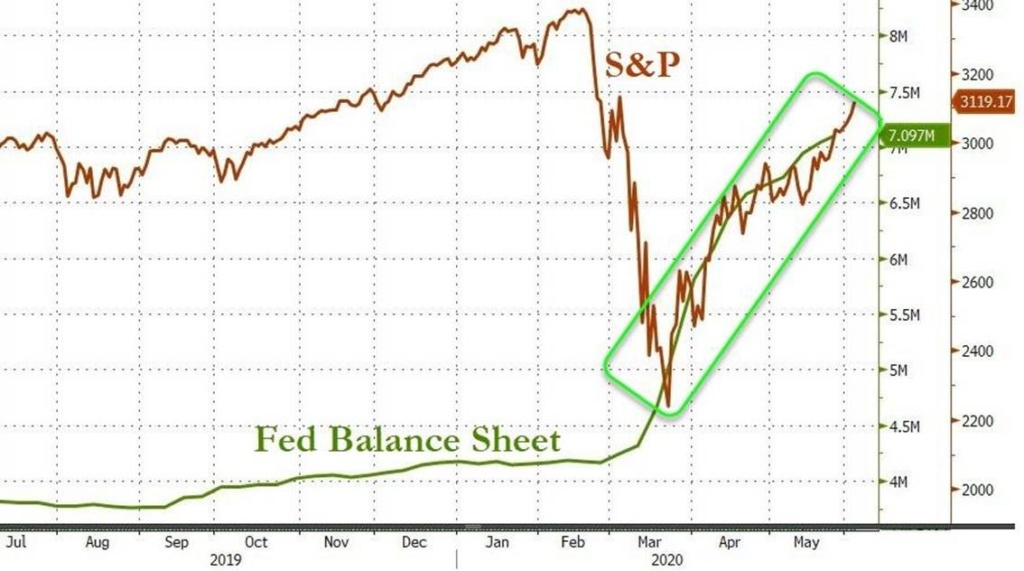

The $25,000 HomeBuilder grant is one of a number of COVID-19 Government stimulus measures to boost the Australian economy.

To view more related articles on COVID-19 from Quill, please browse our blog.