Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

If you are thinking about switching your super to cash due to recent market volatility, it’s important to understand that doing so locks-in losses and that even the savviest investors will have trouble figuring out when to re-enter the market so as to fully capture the rebound.

For the second time this year, sharemarkets are making major headlines for all the wrong reasons.

There is never any news coverage that tells you stocks are getting expensive.The only time that you hear about sharemarkets in popular news channels is when there have been some sizeable falls by which time it is usually too late to do anything.

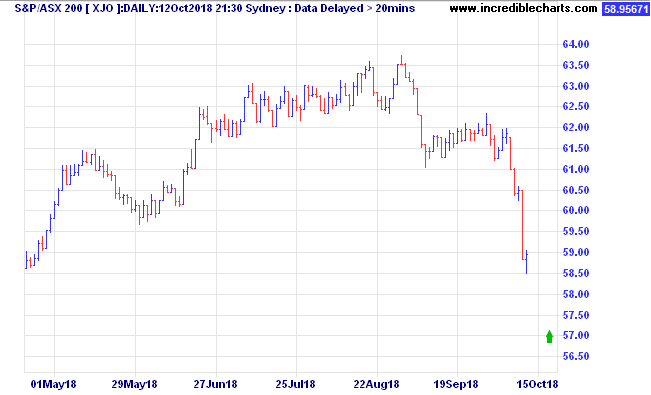

From Wednesday October 3rd, through Thursday October 11th, the US sharemarket as measured by the S&P500 Index fell by 6.9%. Over the same period the Australian market fell by 3.9%.

While the magnitude of the declines is nothing special, the speed of these falls was unusual. It was reminiscent of the falls back in February, which were also triggered by fears that interest rates in the US were going up faster than expected. The trigger then was a much better than expected jobs report card.

While the falls have generated plenty of headlines the fact is that no-one knows what next week will bring. We do know, and we have taken a view when setting asset allocations that equities are getting into the expensive territory, and also that this economic expansion is getting long in the tooth. Both of these factors make us inclined to have lower than normal allocations to sharemarkets.

However, even though markets have fallen suddenly, that doesn’t mean they will continue to fall, and in all probability, a bounce higher is more and more probably each day.

Many of you may have heard Warren Buffett’s folksy saying:

‘whether it’s socks or stocks, the Buffett family loves to go shopping when things are on sale’.

Of course the question that we all want to know is, will this be a 5% off sale, or a 50% off sale?

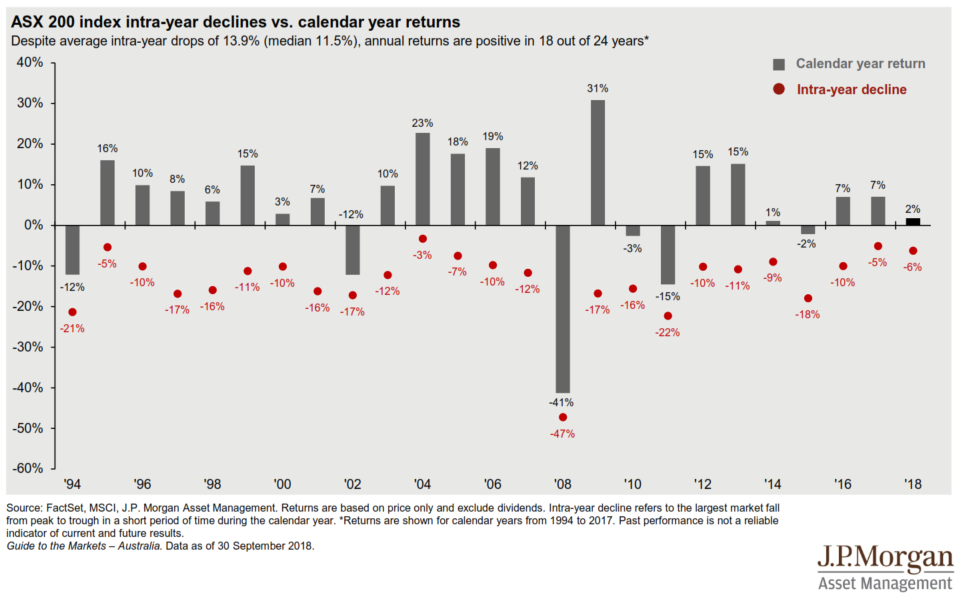

Reverting to history, it is worth re-visiting the chart below, thanks to JP Morgan, that shows how often Australian stocks go on sale, and how much ‘discount’ we can expect.

Note that the average sell-off is 13.9% at some point during a financial year. Only in five of the last 24 years has the decline in markets been less than 10% at some point during the year. That means the odds of a fall of 10% or more during any given calendar year are 80%.

Therefore, if this is a normal year, (and we are overdue for a 10% decline) there is probably more downside to come at some point.

At the 5883 points mark (ASX/S&P200) from last Thursday (11 October) we are down 7.38% from the 6352 high that we made on August 29th.

To make the typical 10% sell-off we would need to see the ASX/S&P200 down another 2.8% downside to 5,716 points. If this is a typical ‘correction’ that would be your buying point.

Of course, there is a risk that the sell-off may go much deeper.

In the US, this is now the longest ‘bull run’ in history. The market has been rising for 114 months without a bear market (fall of more than 20%). The longest prior bull market was 113 months from October 1990 to March 2000. One fund manager who is represented in many of our portfolios believes there is a 50% probability on a fall in US markets of between 20% to 30%.

We take the view that unless you can commit to holding shares for at least five years then you ought not be in that asset class at all. Discuss this with your adviser if you are not sure that you are positioned correctly.

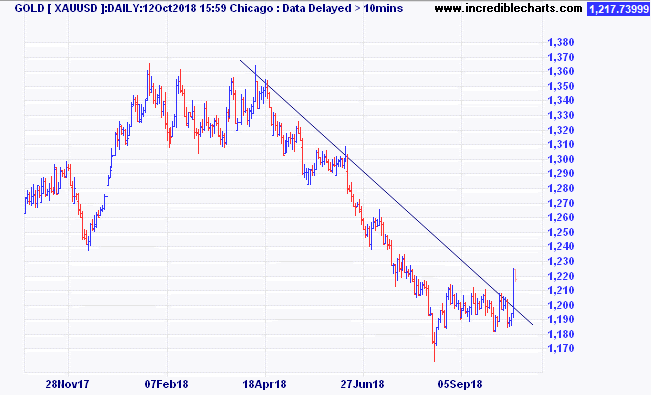

Another little fact that may be useful (and has not been mentioned in the media) is that during the last four US bear markets, (falls of more than 20%) the one asset that has done well every time was gold. It is also relevant that gold has just last week broken up through a six-month downtrend line. Normally a strong US dollar is bad for gold and that has been a drag on the performance of gold while stocks were doing well. But gold, along with the US dollar is also seen as a safe haven in times of stress in other assets and they may just start to rise in unison.

As an antidote to expensive sharemarkets, the Quill Group Investment Committee has recommended Equity Market Neutral funds and Hedge Fund exposures in our portfolios. We believe that although they have not performed as well as shares during the bull market, they will provide meaningful diversification in the event of further downside.

No one has the ability to accurately predict tops or bottoms in the market. Never act in haste. Today’s news is tomorrows fish and chips wrapper. Always discuss your feelings and fears with an adviser to ensure that your strategy is right for your circumstances.

Contact Quill Group today

Get in contact with Quill Group today to discover how we can help you navigate through your finances. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.

Most people get to a stage in their lives when they think they may need some professional guidance, like a financial adviser, in helping them navigate their financial path and lay out what some people refer to as a financial journey map.

Like any successful journey in life, this is often preceded by a well thought-out plan of where you want to be at different stages of your journey (goals and objectives), what means do you have to get there (income, assets and liabilities), what risks if any are you prepared to take in order to get there sooner(risk tolerance) and the strategy and vehicle required to help you get there, taking into consideration all that could go wrong (insurance, tax structure, investment and retirement product, estate plan and well documented advice document).

Unfortunately, our industry is riddled with jargon and terms people find difficult to understand, and this does nothing to allay fears of what to expect when seeing a financial planner or financial adviser for the first time.

So, what are the 4 simple questions you could ask yourself in order to help determine whether you could benefit from seeing a financial planner in the first place?

Are you concerned that if things don’t go to plan due to sickness or injury you and your family will be adequately protected?

Do you earn a relatively good salary but seem unable to save on a regular basis and concerned that any investment is structured in such a way as to minimise tax?

Would you like to ensure that when you are no longer around, your assets pass on those people or organisations you really care about?

Are you planning to retire on an income above that of the current single or combined age pension (currently $23,597pa or $35,568pa respectively) and unsure whether you will have sufficient savings to achieve this?

Whilst this list does not cover many of the other complexities often looked at in comprehensive advice such as tax structures, Centrelink benefits, and aged care solutions, it does provide you a starting point. Many people go through life without too much consideration for the future but one simple step that anyone can use to improve their current financial position is to take account of their existing financial position and then write down the things that you would like to achieve and timeframes to achieve these. This simple step can go a long way to helping you on your way toward financial success and would be essential to consider before a financial planner could assist you map out your future.

You decide to engage the services of a financial planner but unsure how the process works?

Typically, a financial planner will offer a complimentary first appointment to determine whether you could benefit from the services they offer. This gives you the opportunity of asking questions regarding their experience, qualifications, services and ownership interests. It also allows them to determine whether you are a right match for the planner and their organisation, as many planners now specialise in particular areas and may refer you to others who would be better suited to your circumstances.

Once both parties agree to proceed to the next stage then they would collect information from you relating to your goals and objectives, assets, liabilities, income and expenditure as well as your risk tolerance. This is an important step as the planner needs to ensure they know and understand your circumstances before providing any advice. This will also assist the planner with scoping their advice to suit your requirements as well as determine an appropriate fee for advice.

So how much will financial advice cost?

This is ultimately something agreed on between the financial planner and yourself and will depend on the scope of work involved but as a rule of thumb, the initial advice fee is typically between $3000 and $6000 depending on the scale and complexity involved.

What about ongoing advice?

To ensure that you remain on track to meet your objectives, and provide additional advice on any new developments, the financial planner will generally offer a choice of ongoing advice packages to regularly review your circumstances and hold everyone accountable. These fees are typically paid in monthly instalments, and the cost depends upon the level of service you want.

How do I find the right financial planner near me?

Many clients rely on the advice of friends, family or other professionals to guide them. Finding the right planner is a bit like finding a good doctor. Sure, they need to be qualified, but qualifications alone are not good enough. They also need to be good communicators, listen to your concerns, have some experience in dealing with similar issues and have a specialist support team around them. This is especially important, particularly to busy people who like to have all their financial affairs catered for by one person (trusted advisor) with a team of specialist professionals supporting them. In the case of a financial planner acting in the role of trusted adviser the support team may consist of an accountant, bookkeeper, insurance specialist, mortgage broker, estate planning lawyer and even an SMSF specialist.

Contact Quill Group today

Get in contact with Quill Group today to discover how we can help you navigate through your finances. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.

The Australian Bureau of Statistics (ABS) released data in 2017 showing the increase of 2.3% for the average full time adult weekly earnings. With the average level of income rising every year, does this correlate to the average household expenditure, and how to save money?

The ABS has commented that their captured data of Australians and household expenditure doesn’t necessarily capture a household or families response to prices increasing. ‘Shrinkflation’, where the physical weight and package size is reduced by the manufacturer but the price remains the same, causes the price to rise and the increase in inflation, but is masked. Other factors may be where households choose to buy alternative, cheaper products, therefore not increasing their spending.

Household Spending in Australia | How to save money

The below graph details the breakdown of weekly household expenditure.

However, how does this compare to household expenditure in previous years? The graph below details the expenditure for each of the categories for the years 1984, 2009-10, and 2015-16.

How to save money | Australians show how and why they’re saving

The detailed infographic below breaks down exactly how and why Australians are saving their money.

We’re here to help

To see how you can start utilising your savings goals, find out more at ASIC’s savings goals calculator. If you require assistance with managing your finances, please do not hesitate to get in touch with us. We would be more than happy to assist you.

Some time ago, my daughter was lamenting that she didn’t have enough money to pay her phone bill and the rest of her bills. I suggested she should create a budget in excel. Her reply was ‘How can I create a budget when I don’t have enough money?’.

Now at 23, and living interstate, she asked me how to create a budget in excel so she can save for all the things she wants to do, and still be able to pay her bills. I must say, living by themselves and paying their own way changes a child’s attitude. While staying with her on a recent trip, I was chastised for leaving the bathroom light on! Yet only a few years ago I remember continually turning off lights and fans well after the room was vacated. How the tables turn.

1. Look at and categorise your expenses

The first step to creating a budget is to look at your expenses. You can use your receipts, or use a budgeting app. If you’re with Macquarie or Commonwealth Bank, they have excellent avenues to track your spending via their apps. An excel spread sheet can also help – you can write down where and what the expense was, and the amount. This starts to build a picture of where your money goes.

To take it to the next level, you can separate these expenses into 2 basic categories – ‘needs’ and ‘wants’. Make sure you put the take-aways and dining out in the ‘wants’ category. These I classify as reward items.

Now you have a clearer picture of where your money goes, let’s start on the budget. You can download various budget tools, but I find they tend to work on monthly and annual amounts. I’ve created my own excel spread sheet which I update each week.

Nominate a regular time to go through your past week’s expenses and bills due to be paid in the coming week.

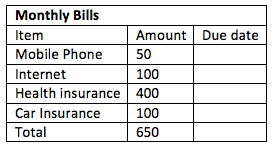

2. What are your regular/monthly bills?

Look at your monthly bills and list them out. Such as:

Add all those other little things (‘wants’) like Spotify, Netflix, etc.

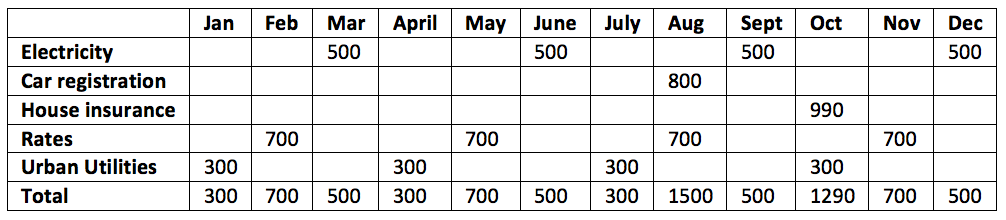

3. Other bills

What are your other bills and when are they due? Look at what you pay during the year. Such as:

So, you need 12 times your monthly expenses plus your annual and quarterly bills. In this example we have a total of $15,590 minimum per annum to pay the bills each year. Divide this total by the number of pay days in the year. For example, fortnightly, $15,590/26 = 599.61. In this instance, you need to set aside at least $600 per fortnight to pay your bills.

Put this amount in a separate account. I call mine ‘bill’ and put in place an automatic direct debit for the day after payday. You can set up direct debits for bill payments from this account. Direct debits for bill payments ensures the bill is paid on time and you don’t end up paying late fees. Also, some companies give you a discount for direct debits.

Whenever you receive a bill, update this spread sheet and adjust the amount you need to put aside.

Now that the bills are paid, let’s look at your other expenses.

4. Other expenses

You should now have an idea what you are spending each week. If you are wanting to save or increase mortgage repayments, this is the area you need to review.

Your expenses should be trimmed to essential items, plus an extra amount for those unforeseen expenses or treats (‘wants’), such as lunch with friends. You should then be able to formulate how much you can save.

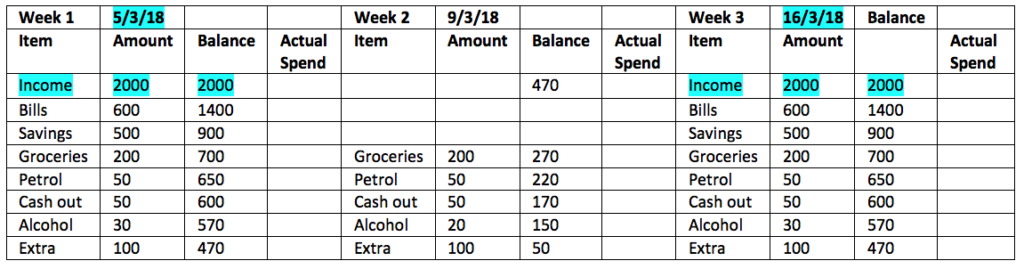

Start a new tab in your spreadsheet. The table below is broken up into weeks in the month with paydays highlighted.

You can update your spreadsheet each week with the amount you actually spend, to compare to your budgeted amount. This will determine if you need to make further adjustments.

5. Set goals and stick to it

Once you have set your saving goals, the most important thing is to stick to your budget!

When you start out, it can take a little time to form new spending habits. You will need to review and monitor your expenses until you are comfortable with your budget. You will also need to monitor your bills account especially in the beginning when funds are building. You may have to fund some bills from your weekly expenditure instead of the bill account if there are insufficient funds.

Remember to reward yourself now and then. If you want, you can add another account and deposit a few dollars each week.

Speak to your adviser

If you have any questions, or would like to talk to anyone, we would be more than happy to talk to you about your financial goals. You can make an appointment with our Eight Mile Plains or our Southport office, or get in contact via our website.

A common concern amongst investors arises when the value of their portfolio suddenly falls due to market volatility. Understanding market volatility becomes especially relevant for those who are close to retirement, or recently retired.

Typically, listed shares drive much of this volatility, and portfolios with larger allocations to shares are most affected. In times like these, it’s important to understand the causes of market movements and how to minimise your risk.

Understanding Market Volatility | Why do markets move so much?

Whenever there is significant uncertainty about the future, or a sudden and unexpected economic, financial, or political event, financial markets may experience volatility until the repercussions are more fully understood.

For example, consumer and business confidence affect spending and therefore company profits. Global trade and production naturally affect economic growth. Political and fiscal decisions in larger economies such as the US can have far reaching consequences globally. And of course, natural disasters can cause major damage to any economy without warning.

Is market volatility normal?

It is important to remember that markets move in cycles, and volatility is a natural part of the economic cycle.

The Australian Securities & Investments Commission (ASIC) agrees that, ‘negative returns from time to time are not inconsistent with successful long-term investment’. History demonstrates that over the long term, the general trend of share markets has been upward.

The question therefore is not if it will happen, but how to best plan for when it does happen.

Look at the bigger picture and have a Plan

1. Develop a long-term investment strategy and stick to it. A sound investment strategy to address your spending priorities will consider how much to invest, how long to invest for, and what return is required. Your financial adviser can help you to formulate a well-considered strategy. This will need regular review to ensure it continues to meet your needs and objectives.

2. Understand how much risk you are willing to accept. If market volatility has caused you to reassess the way you feel about risk, it’s important that you see your financial adviser to discuss any necessary changes to your financial plan.

3. Your investment may benefit by being spread across a variety of asset classes, including shares (domestic and global), fixed income, cash, direct and listed property and alternatives. This diversification should help soften the effects of any share market falls as some asset classes often tend to do well whilst others are struggling.

4. Take the emotion out of decisions. When your portfolio value suddenly falls, it may be tempting to temporarily or permanently withdraw your remaining funds. This creates a number of difficulties:

– Looking to re-enter the market by buying back later is a risky strategy that rarely results in investors coming out ahead.

– Crystallising losses. If the value of your investment is falling, you are technically only making a loss on paper. A rise in prices could soon return your investment to profit without you doing anything. Selling your investment makes any losses real and irreversible.

– Incurring capital gains tax (CGT). Make sure you know what your CGT position will be before selling any asset.

– Losing the benefits of compounding. If you’re thinking about making a partial withdrawal from an investment, remember that it’s not just the withdrawal you lose, but all future earnings and interest on that amount.

Need advice?

Your financial adviser can provide the guidance you need to put in place a well-rounded investment strategy designed to meet your needs.

Is life insurance necessary?

Before considering ‘Should I have life insurance’, you need to determine what’s important to you. For most people, the most important thing in life is the welfare of their loved ones. Sometimes life doesn’t go as planned, so it’s important to consider the impact on your family’s future if you were to suffer a major injury or illness, or an untimely death.

Australia’s life underinsurance gap

However, a large proportion of Australians remain relatively unprepared for these possibilities, where their family income after the event may be substantially lower than it is now. Where this income shortfall cannot be funded from existing assets, it will need to come from another source such as a life insurance benefit. This difference represents a life insurance gap. In many cases, the gap will be significant due to the inability or reduced ability to earn an income while incurring additional expenses such as medical costs, and making provision for planned future expenditure such as children’s education.

Recent research from Rice Warner underlines the serious underinsurance problem that persists in Australia, including the following key findings:

o The median level of life cover meets only 47% per cent of basic needs.

o The median level of life cover meets just 28% of the amount needed to ensure that family members and dependants can maintain their standard of living after the death of a parent or partner.

o The median level of TPD cover meets only 14% of needs.

o The median income-protection cover meets 21% of needs.

o Only a third of the working age population have income-protection cover.

Finding out what life insurance coverage you need

A common misperception is that the default cover within superannuation funds will be sufficient to meet the need should it arise. However, Rice Warner indicated that the average level of default life cover within superannuation is around $200,000, whereas the average young family is estimated to require $700,000. Trustees need to strike a balance between the level of default cover provided and the associated costs and the long-term impact on member’s retirement savings. Therefore, as the evidence suggests, default cover within superannuation should be viewed strictly as a starting point.

Similarly, the safety net provided by government benefit payments or WorkCover is limited at best. Safe Work Australia reports that the median compensation paid from WorkCover following an injury at work is only about $10,000. This is for “serious” claims where one or more weeks of time off work was required. For all else, most government payments are means tested, relatively modest, and do not correlate with individual expenditure requirements.

Choosing the right life insurance

The best approach is to put the right amount of cover in place for your family’s circumstances, and ensure it is structured in the right way to save money and deliver the best outcome in the event you need to claim. This can get fairly complicated so it’s a good idea to discuss it with your financial adviser first. Talk to our specialist team about organising a life insurance plan that will suit your circumstances.

There is no magic number to start planning but the simple answer is, the earlier you start, the more chance you have to achieve the retirement that you dream of having.

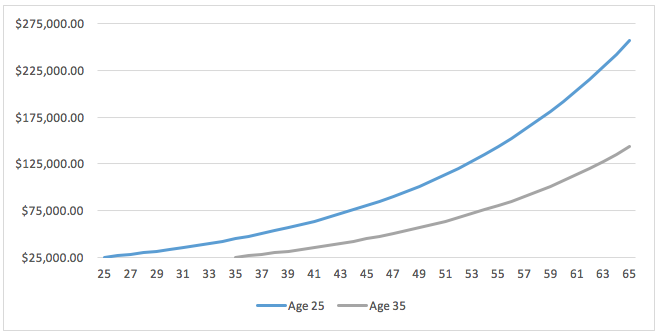

The reason for this is because of the compounding interest effect. Below are some simple graphs showing how powerful this effect can be.

The first graph shows a beginning balance of $25,000 and rate of return of 6%, with no extra payments. Starting at age 25, by age 65 the balance has grown to over $257,000. If you delay the start by 10 years, the end balance is $143,500.

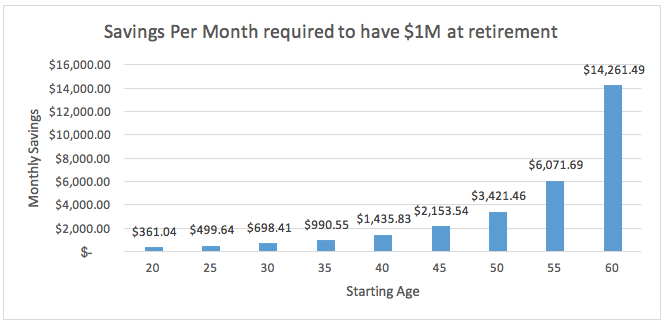

If you wanted to have $1 million at retirement age 65, the graph below shows how much you would have to save every month, using a 6% return, at different starting ages.

The table shows the amount that would have been personally contributed over the time to retirement and the compounded interest amount.

So what can you do to help achieve your retirement goals?

One of the easiest and tax-effective ways is through your superannuation. There is already a requirement for your employer to contribute 9.5% into super for you but you can add extra funds by either a non-concessional contribution (after-tax money) or by a concessional contribution (pre-tax money), salary sacrificing.

There are limits, caps and rules that apply to both contributions, so it is important to know these limits to ensure you don’t go over them as penalties apply to the amounts over these caps.

For concessional contributions, the cap is $25,000 per year and this includes the 9.5% from your employer contributions. Non-concessional contributions are capped at $100,000 per year. You may not have the capacity to contribute up to the maximum but every dollar helps. The important thing is not to leave retirement planning until you’re about to retire, the earlier the better.

Please visit the Australian Tax Office website for more information on the caps and rules. For more information, tools and calculators to assist in your planning, please visit ASIC’s MoneySmart website. If you require professional help, our team is capable and more than willing to provide bespoke advice for your situation.

It is one of the most important principles of investing and the chances are, you have heard it before “ensure you build a diversified portfolio” or “don’t put all your eggs in one basket”. However, most novice investors don’t really understand why diversification is so important to their investment strategy.

Here, we’ll take you through the fundamentals of diversification and a little look into the value it provides.

Firstly, how does diversification work?

Having a diversified portfolio doesn’t mean you are guaranteed to be protected against losses or guaranteed to have gains. It simply means you have a strategy in place to effectively manage the risk and reward trade off to help you achieve consistency in your returns over time.

For many reasons, the markets for different asset classes peak at different times and they don’t particularly move in exactly the same way. Different asset classes react differently to what’s happening in the economy and world around us. While one market can experience a surge, another can be on a downhill run.

To manage this risk, financial experts believe you should spread your funds across several markets. This may potentially offset any losses from a market downturn in one asset, by gains from another market that is performing better at that time. Spreading your funds across a number of different investment types means you will be well diversified and have limited your exposure to any single asset. In turn, your overall returns will be less volatile.

What constitutes as a diverse portfolio?

To diversify your portfolio, you need to invest across different asset classes. This should include a mix of growth assets and defensive assets:

Growth Assets

Investments that have a higher risk and reward – include investments that generally provide longer term capital gains such as shares or property.

Defensive Assets

Investments that have a lower risk and reward – include investments such as cash or fixed interest.

More characteristics of a diversified portfolio are:

- Investments are across different asset classes such as cash, property, fixed interest, Australian and international shares.

- Different types of investments are within asset classes. For example, having shares across different industry sectors.

- Investments are across different fund managers. Applicable if investing in managed funds.

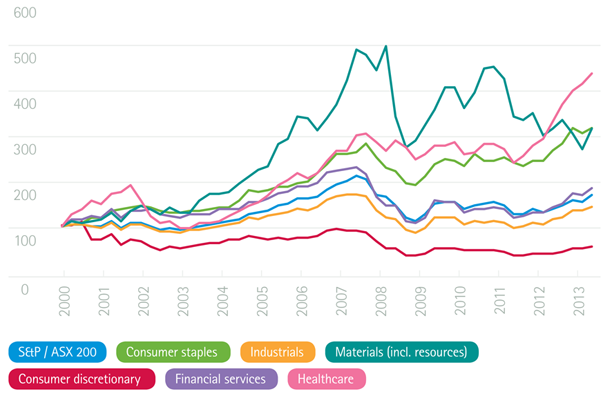

EXAMPLE: Diversification inside a particular asset class

Just to show you as an example, the below graph shows how different sectors of the Australian share market have performed over time. You can see that some sectors are more volatile than others.

Sectors of the Australian Sharemarket

Source: Australian Securities Exchange and Thomson Reuters 2013

The benefits of diversification

There are three main benefits to having a diversified portfolio:

Minimising risk of loss

As explained above, diversified portfolios have less risk than concentrated portfolios. If one investment performs poorly over a certain period, other investments may perform better over that same period. This reduces the potential losses of your investment portfolio.

Generating returns

We all know that sometimes investments don’t perform the way we expected them to. So, by diversifying your portfolio, you’re not merely relying upon one source for income. It also allows you to add riskier types of investments to your portfolio without increasing your overall risk levels.

Preserving capital

Some investors are not in the accumulation phase of life and are closer to retirement. These investors have a different set of investment goals which are oriented towards preservation of capital vs driving returns. Diversification can help protect their savings by reducing the overall risk in their portfolio.

Creating a portfolio for you

As you can see above, diversifying your portfolio can be beneficial but complicated. It depends on a host of factors including your appetite for risk, investment objectives, time frame and available capital. It requires a strong knowledge of the various asset classes, markets and sectors to ensure it is executed effectively.

To get the best results and create a portfolio suited to your particular needs and circumstances, it might be wise to talk to one of our financial planners.