Quill is a financial services business with a team of passionate professionals who are committed to working with family businesses, working families and retired families.

In this week’s investment article I take a closer look at Shane Oliver’s nine keys to successful investing.

Whilst I’m sure many of you have read or heard of some of these gems before, I think this is a timely reminder in times when debt is increasing and the gap between those that have and those that don’t widens.

These principles of investment carry through to all generations and apply equally to young adults entering the workforce, young families paying off a mortgage or those in retirement.

In many years of experience as an adviser, I have witnessed many very successful investors who have amassed large amounts of savings simply by starting off with as little as $100pm in a savings plan and building from there.

As they say, the most important step is just getting started. Once a disciplined savings pattern is established then regardless of the amounts, the power of compounding interest kicks in and over time a small initial sum can grow to a large nest egg. Superannuation is a great example of this strategy that largely relies on a combination of compound interest, regular ongoing contributions and time to achieve a good end result.

Young people are often put off by superannuation due to the inflexible long term nature of this savings vehicle. However, the inflexibility is generally the thing that determines that they will have sufficient set aside for a comfortable retirement. The recent early access to superannuation, whilst necessary for some is bound to have a significant impact on final super balances. Superannuation is simply one form of savings vehicle and whilst very tax effective I think a potentially smarter strategy combines super with other investment options that may be more flexible and cater better in periods of uncertainty like those we are currently facing. Very few people can say that they have a job for life regardless of external factors and therefore good planning and a diversified investment approach can take some of the short term risk away by allowing access to funds in tough times. I don’t believe that there is any one investment strategy that can guarantee success, rather a combination of strategies that utilises one or more of the nine keys highlighted in this article are less likely to fail. Some investors will only invest in shares, others in property and others prefer to stick to cash. Regardless of the choice of investment vehicle the principles ultimately remain the same. Step 5 which talks about “turning down the noise” is possible one of the biggest traps that new investors make. In the graphic illustration showing share market performance over days, months, years and decades we can see the impact that time can have. Here the share market risk or volatility is significantly higher over shorter time frames and yet often people will make short term decisions to buy or sell volatile assets like shares based on a positive or negative press release.

Finally point 9 talks about seeking advice. Those of us with perhaps a few more years of experience under the belt will know that you can’t be an expert in everything. Many people go to a gym and engage the services of a personal trainer, not because they don’t know how to use the equipment but rather to keep them accountable, on track to achieve their goals and importantly to avoid mistakes which could end up causing an injury. These days there is no end to the amount of information that can be gleaned off the internet, but if I’m sick I want to see a doctor or if I have a tax query I want to talk to an accountant. In the same way a good adviser should be able to help you achieve your goals as you pass through the many stages of life and importantly also help you to avoid some of traps and pitfalls that many investors fall into.

Disclaimer:

This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to their objectives, financial situation and needs.

Paul Xiradis is the Chief Investment Officer at Ausbil Investment Management Limited

In this commentary Paul talks about some of the themes arising from COVID-19 that we have previously touched on in recent notes and he expands on what the impact that these changes may have on the economy in the later half of 2020 and beyond.

Investment Outlook

Q: At the middle of 2020, where do we stand with COVID-19 from a macro viewpoint, and has your outlook changed?

It has been quite an incredible ride over the past few months. Back in March, we were looking into the unknown with a pandemic that was both unpredictable and dangerous. Incredibly, almost in unison, governments and central banks across the world’s markets scrambled together the biggest stimulus package in history, over 10% of world GDP in value. Until then, things seemed bleak, but after this wave of stimulus, focus turned to containment and recovery.

We felt that in the second half of this year there would be a recovery, we said this early. A few months on, we are experiencing a far better outcome than most expected. This is largely due to the decisive global stimulus that supported the world economy in hibernation, and the fact that this period of hibernation has been a lot shorter than expected. Australia and New Zealand, in particular, have tackled the virus a lot better than the rest of the world.

What began as panic, with people hoarding toilet paper, and people and companies alike hoarding cash, has seen cash balances across the board grow dramatically. When there has been any softening of the disastrous view, we have seen some of this cash put into action. It is only a matter of time before this pent-up demand is allowed to express itself in spending and investment as the Covid risks begin to subside.

Retail spending has been a lot stronger than anticipated. Activity in construction and trade activity was a lot stronger than expected. We are seeing e-commerce driving activity levels, allowing people to continue to operate, and as a result we saw sales move up, not down. Unemployment did not peak anywhere near, at this stage at least, what the market was anticipating. The JobKeeper stimulus package was under-subscribed by some $60 billion. Most commentators are readjusting their forecasts back to levels nowhere near as dire as first anticipated. I think this provides greater confirmation that we will see a recovery in the second half of this year, that the recession will be shallower to what most were anticipating, and will be shallower to what we were anticipating.

While COVID-19 re-infection risk remains high, developed markets are succeeding with lock-downs. In Australia, we have got COVID-19 relatively under control, and that has allowed the authorities to respond by opening the economy faster, further supporting our view that the economy will begin to recover in the second half of 2020.

In Victoria, locally acquired cases are sharply rising in Melbourne, and will see Stage 3 restrictions reinstated for 6 weeks until 19th August for Metropolitan Melbourne and the Shire of Mitchell, and the closing of the Victorian and NSW state border. The swift containment measures implemented by authorities is reassuring. At this stage, this will probably be a temporary drag on economic activity through the September quarter. Meanwhile, we expect the remaining Australian states to continue with their scheduled reopening dates, enabling activity to resume, which should help to cushion, to some degree, the impact on GDP growth. We continue to monitor this specific development closely as new information comes out but, at this stage, it does not change our current medium-term outlook on the expected ‘U-shaped’ economic recovery profile for Australia.

How COVID will change some sectors long term

Q: Do you think COVID-19 has changed many sectors for good?

What COVID-19 has done is fast-forward some of the super trends which were already emerging, some of which will now become a permanent way of life. The use of technology to run our lives on a day-to-day basis was forced on us by necessity, and now it could become the norm. Where there was reluctance by individuals to use electronic banking, through necessity everyone has moved to self-service banking. The same with goods and services, people had no choice but to use e-commerce as a way of conducting their lives and obtaining life’s staples. We also saw that in a lot of discretionary retailing as well. These trends were developing anyway, but the inescapable global experiment triggered by COVID-19 has proved that society can operate in lock-down, and a lot of this is down to technology. As a consequence of being shown another way, there is likely to be a high degree of permanency in these behavioural changes.

Another thing we learnt is that there are businesses that can thrive in such environments. A lot of retailers have realised that they can operate using e-channels for sales, and that they don’t need to have such a large bricks-and-mortar footprint. This has accelerated the trend giving retailers an upper-hand in negotiating with landlords, this was not the case ten years ago. The shift from bricks-and-mortar retail is not a fad, it is structural.

Australian technology sector

Q: Australia seems to have a burgeoning tech sector. How has this gone in the face of COVID-19?

Technology companies have outperformed during COVID-19 on the explosion in work-from-home demand, related entertainment, demand for home-based tech, and more fundamentally, in proving-up online sales and distribution for both essential and discretionary spending. People have increasingly learned to trust tech and online.

Under Covid, we have seen an acceleration in purchasing through online platforms. One beneficiary across these platforms has been Afterpay (ASX: APT), the buy-now-pay-later platform. Afterpay has grown dramatically, as reflected in its share price which has recovered almost eight times from its low point in March. People are now conducting their lives through online platforms and paying with it through services like Afterpay.

We have seen this in other technology stocks as well. Demand for data centres has grown dramatically. NextDC (ASX: NXT) is one of the groups that actually experienced upgrades in earnings during Covid, with the level of inquiry and demand growing significantly since the outbreak. Again, we believe the pull-forward of demand is not only structural, it is accelerating.

We are seeing that global leadership in tech now, and Covid has played its part in accelerating some of the super trends these firms are riding. In addition to Afterpay and NextDC, you have Appen (ASX: APX) who specialise in providing test data for machine learning and artificial intelligence, Altium (ASX: ALU) that develops design software, and Audinate (AD8) that leads the audio data transformation market. Atlassian (NASDAQ: TEAM) is another example of Australian tech leadership, though it is listed in the US.

These tech companies are familiar to us because we have nurtured many of these, researched them extensively, and invested in them when they were micro-cap and small-cap stocks. When they become bigger companies, we are fully aware of their performance and potential, and these companies now feature in our mid and large cap portfolios.

You can liken these tech leaders to the health care sector a few years ago. We have produced some incredibly strong global health care companies out of Australia, from Ramsay Health Care (ASX: RHC) to Sonic Healthcare (ASX: SHL), ResMed (ASX: RMD), CSL (ASX: CSL) and Cochlear (ASX: COH), these are all Australian-born companies and they are world beaters. The tech sector now seems to be following the same path.

Resources sector and COVID

Q: How are resources going with COVID-19, especially with the recent geopolitical tensions?

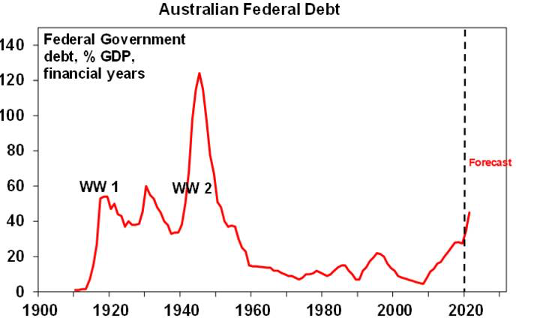

One of the things we have said from the beginning is that, globally, there has been an incredible response by governments in terms of fiscal stimulus. By contrast, if you go back to the GFC it was more about austerity than spending, and it was up to the monetary authorities to do the heavy lifting. This time around, we have seen both monetary and fiscal stimulus applied in concert with plans to bring forward activity and infrastructure projects. This is happening globally as a means of reigniting growth, in China, recently in Australia, and we are likely to see it in other parts of the world.

On the basis of fiscal stimulus and accelerated infrastructure spending, the outlook for resources, and particularly steelmaking resources, is pretty strong. Iron ore, the most important of these for Australia’s terms of trade, is seeing renewed demand as Covid-driven supply constraints shift demand to Australian ore. Companies like diversified miners, BHP (ASX: BHP) and Rio Tinto (ASX: RIO), and specialist iron ore miner, Fortescue Metals (ASX: FMG), are beneficiaries of this strong demand, as are the mining services companies contracted to help deliver this supply to world markets.

Electric vehicles (EVs) is another theme that is looking stronger. During the shutdown, traditional car manufacturers were retooling towards the production of electric vehicles, creating further demand for selective metals. The changing trend towards EVs will see increased demand for copper from companies like OZ Minerals (ASX: OZL), as well as nickel and lithium in the next 12-months.

Banking sector and COVID

Q: How are the banks faring, and how do you see them as we move through COVID-19?

If you are optimistic about Australian and New Zealand economic recovery, and we are, you have to be comfortable with the banks. The banks are most leveraged to an improving environment. We are seeing that already. Again, the dire expectations of three months ago, even two months ago, have improved markedly. Banks were provisioning for an economy with far higher unemployment levels than we have experienced, a deeper negative growth experience than has occurred, and a more elongated recovery than we are seeing at this juncture.

We believe that the depths of the downturn are not going to be anywhere near as bad as initially expected, and the recovery is not going to take as long as was expected. If this remains the case, it is a fantastic opportunity for investors to reweight back into the banks. We increased our exposure through the Covid sell-down, and we are now the most overweight we have been in banks for a number of years. This is on the basis that we think earnings will exceed expectations, bad and doubtful debts may not be nearly as bad as the market has been pricing, and if that is the case, they have strong balance sheets, and banks will return to paying an ongoing sustainable dividend, albeit at a lower payout ratio.

Most commentators were incredibly negative on banks, and most institutions were underweight the banks based on some pretty ordinary and dire forecasts in the market. All of a sudden, the banks have become a pretty attractive proposition, and the market is still underweight, so the setup is for the banks to trade up as we move into the second half of 2020.

More information

To read more market updates from Quill Group, you can do so on our blog here: Quill Group Blog – Financial Market Updates

If you have any questions regarding this update, please speak to your Relationship Manager.

The following is from Chris Lioutas from Insight Investment Consultants who sits on the Quill Group Investment Committee. Although relatively technical in nature, we thought it was worthwhile sharing his commentary on where markets are at currently and what headwinds they are facing.

Markets

- Local and global equity markets fell this week on continued concerns regarding rising virus cases and potential further lockdown measures.

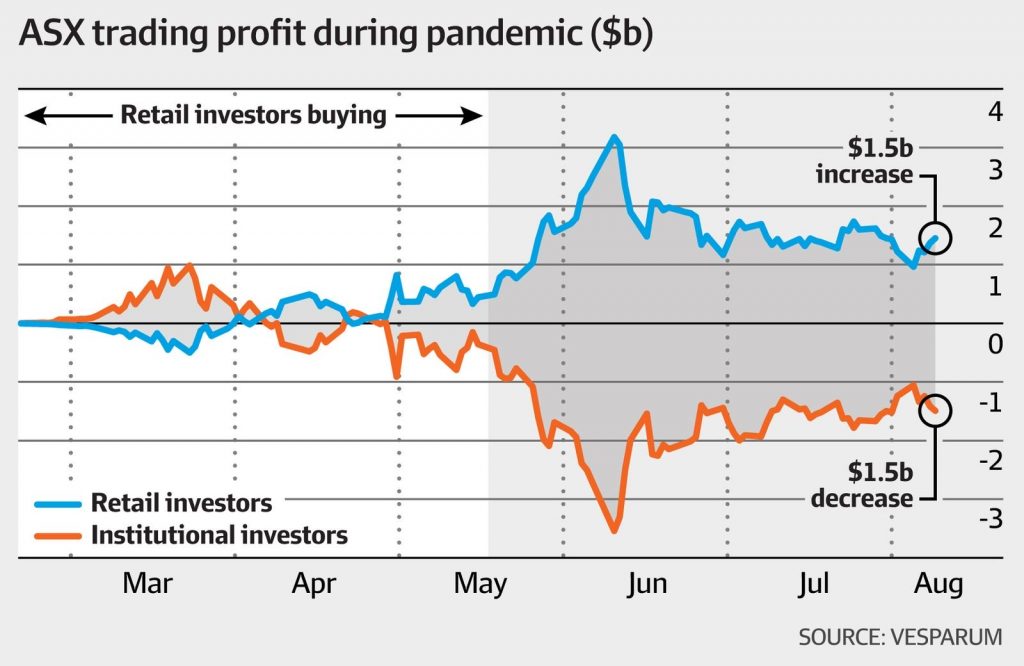

- US S&P 500 companies slashed or suspended over $40bn in dividends in the 2nd quarter, the deepest quarterly drop since 2009. In contrast, the US tech-heavy NASDAQ index rose to all-time highs whilst the S&P 500 is up more than 40% from its March lows.

- Chinese equity markets rose very strongly this week on a wave of retail investor buying following a government directive encouraging the need to foster a healthy bull market in domestic stocks.

- In local stock news, the banks announced they would be extending their deferral of mortgage repayments by another 4 months. Hardly surprising given pressure from the government, given no banks wants to take residential property onto their balance sheet, and given banks make money as long as there is a customer with a loan accruing interest.

Economics

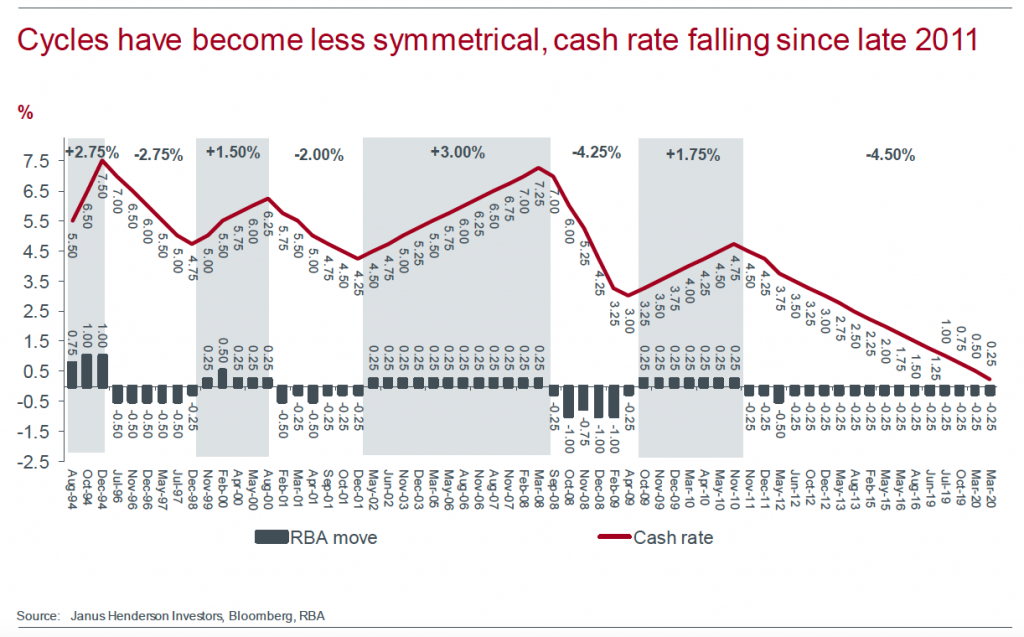

- The RBA kept rates on hold at their historic low of 0.25%, pledging their continued support and maintaining that fiscal and monetary support will be required for some time.

- More than 1 million Australians have lost their jobs since the start of the virus and 10% of the labour force are working less hours than they wish. That means that 3.45 million workers are unemployed and underemployed, which represents almost a quarter of the total workforce. PM Morrison will have no choice but to extend virus stimulus measures.

- Australian private sector credit growth fell for the first time since 2011 with a contraction in May. Business loans, personal loans, and investor housing loans all fell, whilst owner-occupier loans continued to grow steadily.

- The value of Australian lending for housing excluding refinancing fell 11.6% in May, whilst refinancing was activity was strong as borrowers locked in low fixed rates. The value of lending was down sharply for both owner-occupiers and investors.

- Sydney’s rental market has recorded its steepest quarterly decline in 15 years, with median rents falling 3.8%, with tenants seeing the lowest rental prices in 5 years. About 30% of all properties listed for rent have reduced rents in the past 30 days. More than 22,000 rental properties lay empty across the city, with declines in immigration and foreign students hurting the most.

- Data showed a record rebound in Eurozone retail sales in May, whilst unexpected growth in the US services sector last month, which surged to pre-Covid levels, further bolstered sentiment.

- The European Commission is forecasting a contraction of 8.7% in economic growth before a rise of 6.1% in 2021, worse than its previous forecast.

- A private survey showed that China’s services sector expanded at the fastest pace in over a decade in June as the easing of lockdown measures saw consumer demand recover. However, companies continue to shed jobs.

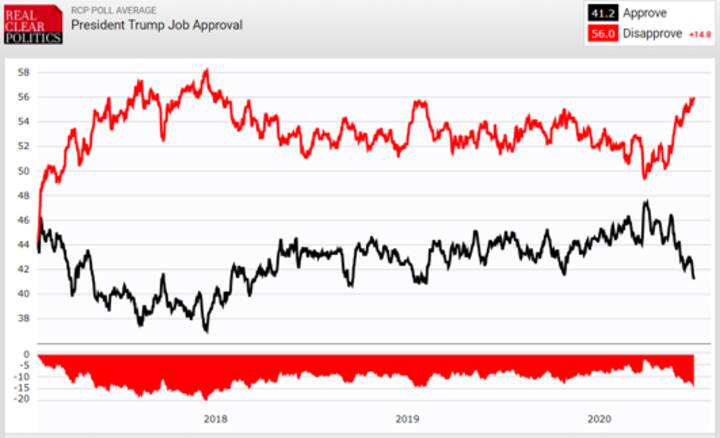

Politics:

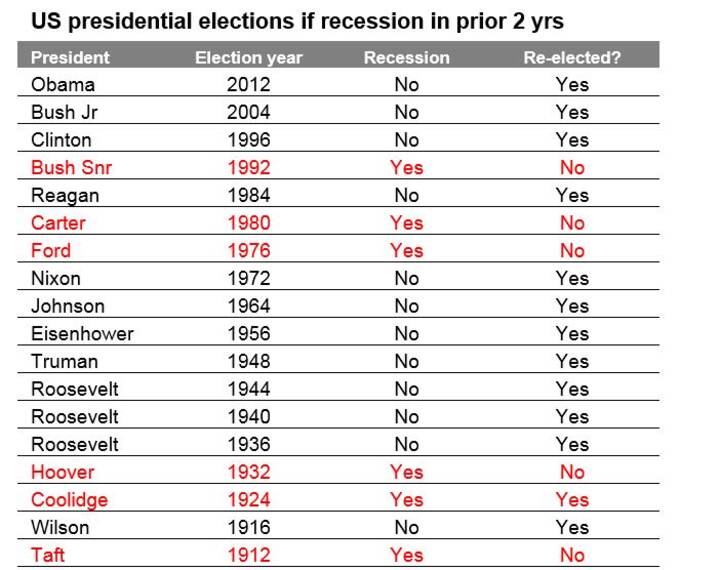

- With virus cases rising in the US, particularly in Texas, Florida, and California, over 40% of the US has now reversed or delayed reopening measures. Whilst cases are rising, there has only been a very slight uptick in death rates. Time will tell whether increase in cases translates into a spike in deaths. At this stage, that looks unlikely given hospitals are better prepared, treatments are now available, and the predominance of new cases has come from those aged 20-39 with more testing.

- Australia has formally suspended its extradition agreement with Hong Kong and the Chinese authorities. Prime Minister Scott Morrison said that new national security laws brought in by China represented a fundamental change. He also addressed that Australia would be willing to accept Hong Kong citizens looking to relocate to another country. Temporary visa holders in Australia will be granted an additional 5 years on their visas.

- The NSW-Victoria border closed following a spike in cases in Victoria which has seen the state go back into lockdown for 6 weeks, possibly longer. The border closure is being handled by NSW. The NSW Premier took the opportunity to tell other states to open their borders in the national interest, with NSW given the action NSW is now taking to protect itself and the rest of the states.

- Prime Minister Scott Morrison has flagged another round of stimulus measures ahead of September’s fiscal cliff, with the government looking at extending a modified form of JobKeeper as well as bringing forward tax cuts and the possible extension of insolvency protections. Those sectors hardest hit by lockdown (tourism, airlines, hospitality) will also see significantly more support.

- British PM Boris Johnson has told the German government that the UK was prepared to accept a no deal scenario on trade with the EU at the end of the current post-Brexit transition period at the end of this year.

If you have any questions regarding this commentary and how it impacts your investment portfolio, please get in touch with your Quill Relationship Manager.