The month of December capped off a great year for investment markets. Good returns with unusually low volatility provided ‘many happy returns’ for balanced and growth investors.

Australian fixed interest turned in a negative return, as longer term rates rose during the month. A widely expected rise in the US Federal Reserve rates pushed their Fed Funds rate up to 1.5%, the same as the Australian Official Cash Rate. The only negatives for the major asset classes for the month of December were International Shares, and Australian Fixed Interest. In fact, international shares were mostly positive in December, but the 3.0% rise in the Aussie dollar turned those gains into a negative return for the month.

On the currency front, the strong Australian dollar was in fact more about the US dollar which weakened by 10% versus a trade weighted basket of currencies over the 2017 year. This is a perverse outcome very few would have predicted given the US central bank was just about the only major global central bank raising rates during the year. (Hat tip to Larry Jeddeloh from The Institutional Strategist who did make the correct US Dollar call)

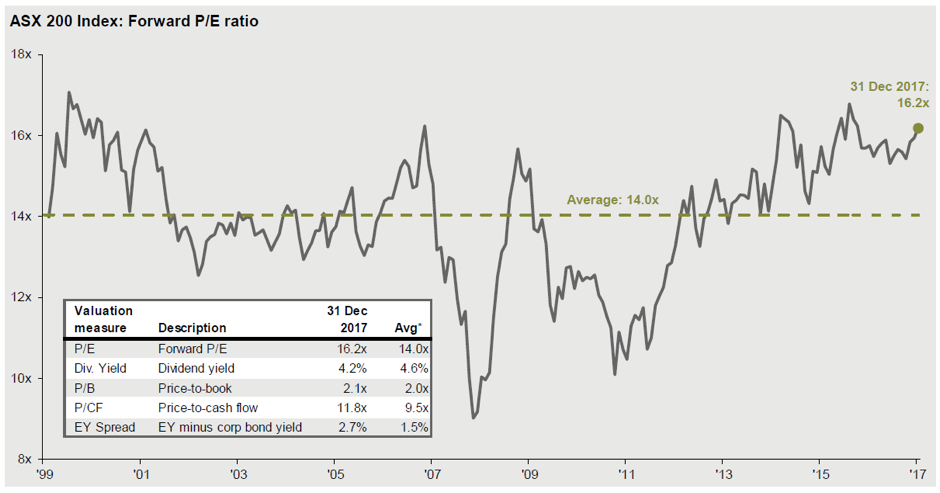

Australian equity market valuations end the year higher than historical averages, but with potential to push higher, which we will discuss in our 2018 Markets outlook.

The chart below provides some history of the Australian sharemarket forward Price to Earnings (P/E) ratio.

Source: JP Morgan – Guide to Markets

We are pushing into the same valuation territory as prior market peaks, albeit with much lower comparative interest rates at present. While not suggesting any imminent crash, it is important to understand that outsized gains in widely held asset classes are normally followed by lower than average gains in future.