First September, then October, and now November – that’s three down months in a row, and so far December is not shaping up to be any better!

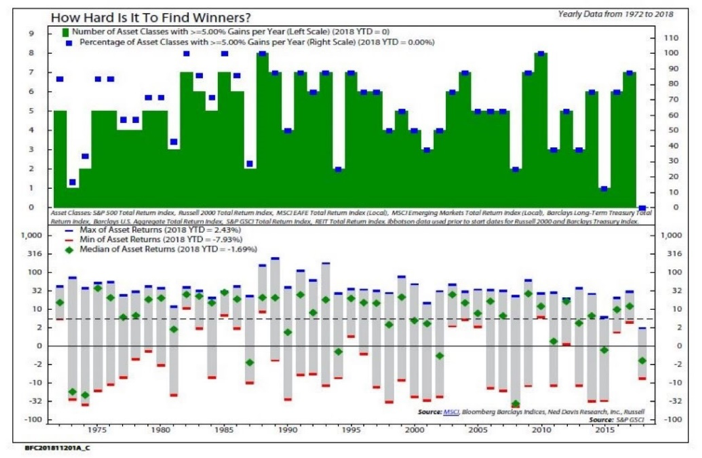

To illustrate just how tough the 2018 year has been, we include below a chart from Ned Davis Research twitter feed, showing the number of asset classes with returns above 5% for the year to date (left hand axis – zero), and the percentage of asset classes that did better than 5% on the right hand side – again, the number is a big fat zero. That is quite a feat. Even in 2008 there were two asset classes, The Barclays Treasury index, and the U.S. Aggregate total return bond index that did better than 5%.

While the chart above is not comprehensive of all assets, Australian investors high exposure to residential property was also likely to have resulted in returns of less than 5% – in some cases a LOT less than 5%.

Why have returns been so poor?

Quite simply, asset prices started the year quite elevated, and in many cases, (corporate and government bonds) pushed up by Central Banks creating an artificially low interest rate environment.

Now that the central banks are trying gradually to exit these positions where they own trillions of dollars of bonds, (and in the case of the Swiss and Japanese central banks – shares as well) it is adding to the oversupply of bonds. When supply exceeds demand then prices either stop going up, or start to fall.

| INDEX RETURNS AS AT 30 November 2018 (%) | ||||

| 1 month | 3 months | 6 months | One year | |

| Australian Shares | -2.21 | -9.28 | -3.67 | -0.96 |

| International Shares | -1.46 | -6.48 | 1.19 | 3.57 |

| Domestic Listed Property | -0.44 | -5.25 | 0.41 | 1.45 |

| Global Listed Property | 3.21 | -1.64 | 3.79 | 3.71 |

| Australian Fixed Interest | 0.24 | 0.30 | 1.76 | 2.45 |

| International Fixed Interest | 0.45 | -0.16 | 0.32 | 0.45 |

| Cash | 0.15 | 0.48 | 0.99 | 1.91 |

| Market Indices | ||||

| S&P/ASX 200 Accumulation Index | ||||

| MSCI World ex Aust TR Index $A | ||||

| S&P/ASX 300 Property Trusts Accum Index | ||||

| FTSE EPRA/NAREIT DEVELOP NR INDEX (A$ HEDGED) | ||||

| Bloomberg Composite 0 + Years | ||||

| BarCap Global Aggregate Index Hedged AUD | ||||

| Bloomberg Aus Bank Bill Index | ||||

Is this a signal that we should be battening down the hatches? There is certainly no shortage of things to worry about.

- Slowing US growth

- Falling oil prices

- Trade wars

- China slowing

- $1 trillion per annum US budget deficits

- Quantitative Tapering (central banks ceasing bond purchases and unloading)

- Central banks being stuck at near zero interest rates, with traditional recession fighting ammunition depleted

- European banks in a fragile state

- Sydney and Melbourne housing finally rolling over

The problem is, that if you know this, and I know this, and the rest of the world knows this, then the whole range of probabilities are already factored into current asset prices.

It is in the gloomiest of circumstances that market bottoms arrive.

What is smart is to avoid investments that can go to zero. That might seem obvious, but to channel the Oracle of Omaha, we cannot avoid market volatility and surprises, but we can try to avoid assets that can bring us a permanent loss of capital. Those assets would be speculative, like crypto currencies that have no established tangible value. Highly leveraged companies, these can be forced into dilutive capital raisings, or if capital is unavailable, simply be bankrupted. Companies with a flawed business model. We saw many examples in 2008 of financial companies that didn’t survive.

Companies with modest borrowings and good business models will survive, and in many cases thrive at the end of any recession as weaker competitors collapse.

The key to successfully riding out volatility is not to become a forced seller. This can happen when you are living on your capital and are overcommitted to shares or property. Try to make sure that you either have so much in shares that the dividends more than cover the income you need, or else hold five years of income needs in cash and high grade fixed interest.

Learn more about understanding market volatility here.

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.