The S&P/ASX 200 Accumulation Index reached a new post GFC peak in the final days of August, at 6352. (The pre-GFC high was 6828 on 1 November). During September the index fell for the first five trading days, and then managed to rally to a close for the month that was only down 1.26%. Since then markets have come under heavy selling. Later we also take a look at the FANG stocks update – Facebook, Amazon, Netflix and Google.

International share markets were mixed, but showed a 0.55% gain after adjusting for the lower Australian dollar.

The Australian Real Estate Investment Trust (A-REIT) sector fell through September on fears of higher interest rates taking a bite out of earnings and distributions. We have been avoiding Global Listed Property for some time, with the outlook on US rates rising more rapidly than Australia, and hence more downside in those markets. The results in September backed up that view.

| INDEX RETURNS AS AT 30 September 2018 (%) | ||||

| 1 month | 3 months | 6 months | One year | |

| Australian Shares | -1.26 | 1.53 | 10.13 | 13.97 |

| International Shares | 0.55 | 7.32 | 13.57 | 21.29 |

| Domestic Listed Property | -1.55 | 1.98 | 12.00 | 13.25 |

| Global Listed Property | -1.84 | 0.30 | 7.63 | 5.63 |

| Australian Fixed Interest | -0.42 | 0.54 | 1.36 | 3.72 |

| International Fixed Int | -0.38 | -0.07 | 0.08 | 0.89 |

| Cash | 0.16 | 0.52 | 1.01 | 1.87 |

| Market Indices | ||||

| S&P/ASX 200 Accumulation Index | ||||

| MSCI World ex Aust TR Index $A | ||||

| S&P/ASX 300 Property Trusts Accum Index | ||||

| FTSE EPRA/NAREIT DEVELOP NR INDEX (A$ HEDGED) | ||||

| Bloomberg Composite 0 + Years | ||||

| BarCap Global Aggregate Index Hedged AUD | ||||

| Bloomberg Aus Bank Bill Index | ||||

Fixed interest markets also lost money over September, as longer term rates, especially in the USA, continued to rise. Cash is not very attractive, but it is worth noting that it beat the return from Global Fixed interest over the last 12 months. During the month of September, the Australian 10 year government bond yield rose from 2.52% to 2.67%. For reference, over the same period, the US ten year bond yield rose from 2.85% to 3.05%.

Regular readers will know that we have been cautious on sharemarkets and US markets in particular, on the basis that valuations of some of the leading stocks was very stretched, and that any change in sentiment would hit hard. Well, that is what has been happening in the last month or more.

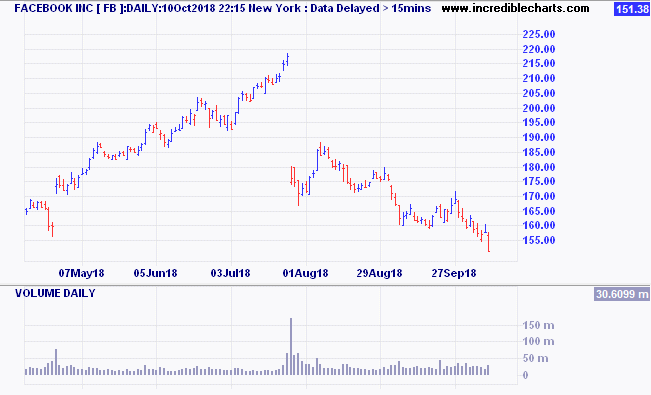

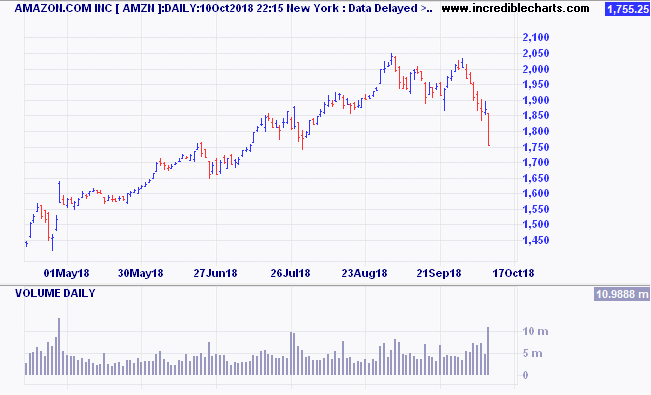

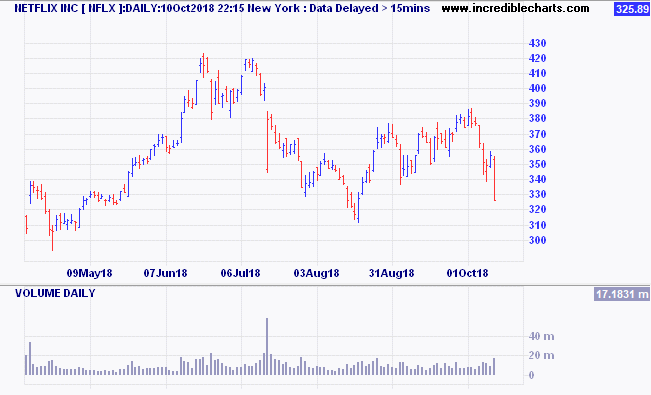

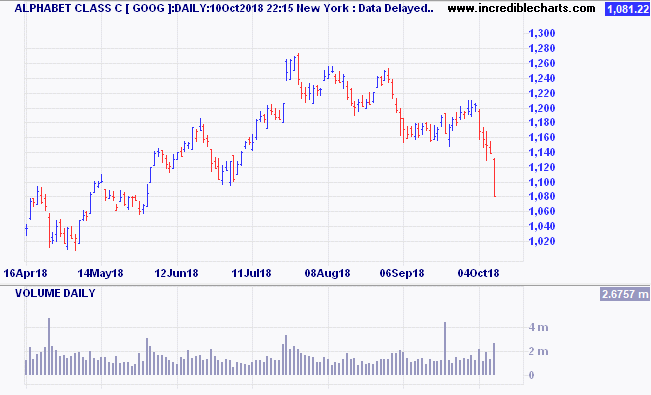

FANG stock update – Facebook, Amazon, Netflix and Google

Here are the charts for Facebook, Amazon, Netflix and Google, the so-called FANG stocks.

Facebook:

Amazon:

Netflix:

Google:

There is no doubt these companies have achieved amazing growth and appear to have dominant market positions, but if you pay too much, then they won’t produce a good investment return. This is the conundrum that faces investment managers every day.

Contact Quill Group today

If you have concerns about your debt, financial structures or superannuation, please give us a call at Quill Group. At Quill, we are passionate advocates for all of our clients and our team is focussed on providing an experience, not just great service. As the largest multi-disciplined financial services practice on the Gold Coast we provide a high touch personalised service delivered with competence, confidence and amazing results.