Despite the ongoing changes to super, it is still the best tax house to invest in.

Case study

Say you are in your mid-50s, earning $95,000 per year plus employer superannuation of $9,025, have a cash flow surplus of $10,000 a year and no debt.

Option A

You could invest the $10,000 in your own name and pay tax at 39% on the earnings.

OR

Option B

You could invest the $10,000 as a non-concessional superannuation contribution into your superannuation house, where the earnings will be taxed at 15%.

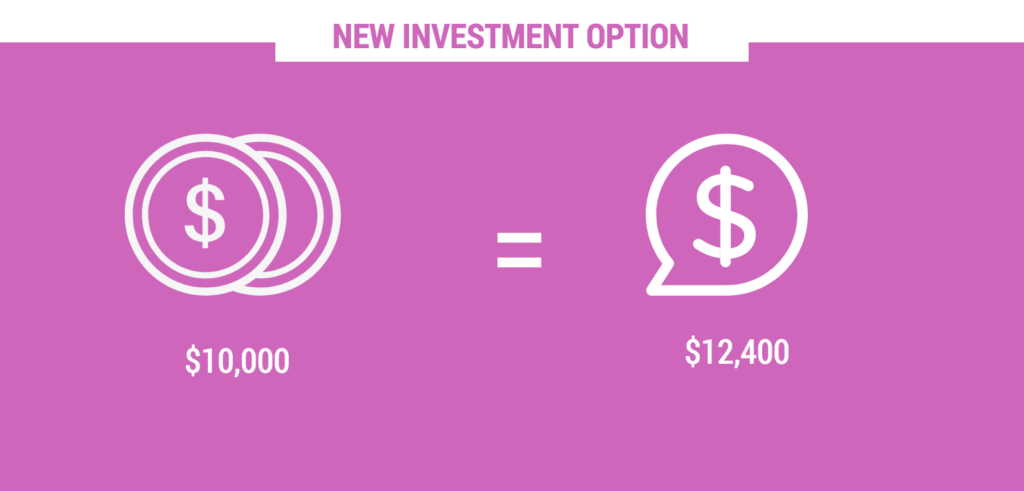

Now a new option

From 1 July 2017, you will have another option to invest the $10,000 as a concessional superannuation contribution in your superannuation house. You will lose $1,500 due to 15% contributions tax, but still have $8,500, invested in your superannuation house, where the earnings will be taxed at 15%.

Best of all, you get a tax deduction in your own name for the $10,000 you invested in your superannuation house, which will get you a tax refund of $3,900.

Say you are really smart and contribute your $3,900 tax refund as a non-concessional superannuation contribution into your superannuation house.

Your original $10,000 investment in your superannuation house, now becomes $12,400 in your superannuation house. This is a return of 24% in the first year!

Even with some changes in super legislation, it still seems to be a great investment option.