Stock Markets

Our last update marked a short-term peak in the ASX200 which made a high at 5956 on May 1st. Since then, we had the release of the Federal Budget which was widely criticised as a ‘Labor lite’ budget, and plenty of international political events to keep us on edge.

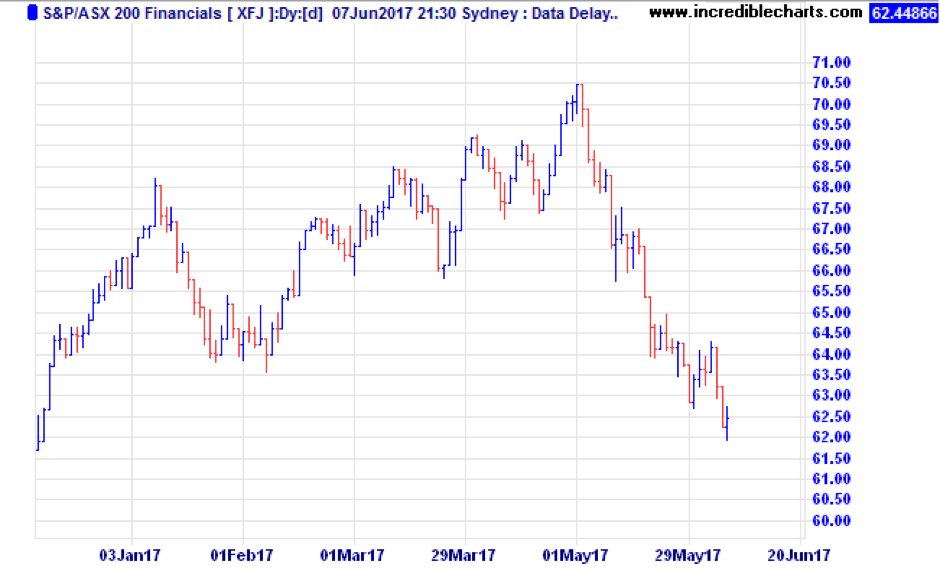

The ASX200 was down 4.01% during May. The Financials index (XFJ) was down almost 10% as bank stocks were pummelled. All the talk of housing bubbles, the bank tax announced in the budget, and plummeting retail sales have finally converged to bring share prices down.

Offshore, however, the news was better. The S&P 500 index of US shares gained 1.1% in local currency terms, and converted to Australian dollars was up 1.87%.

The MSCI World index in AUD was up 2.68%, and the MSCI Emerging Markets gained 3.45%.

Europe was the big gainer, with that market up 5.31% in Australian dollar terms. It helped that the Australian dollar fell 2.8% against the Euro during the month.

The month of May was a great example of the benefits of portfolio diversification in action.

Commodities

As a country that makes most of our money digging holes and building houses, the commodity markets are very important. In terms of export dollars earned, the big ones are iron ore and coal. While not as important to the export earnings, oil certainly rates highly for the big Australian – BHP. Iron ore was down 15% over the month, to end at $57.90, while coal dropped 11.7% and oil was down 2%. The Materials stock sector held up remarkably well in the face of this, down less than 1%.

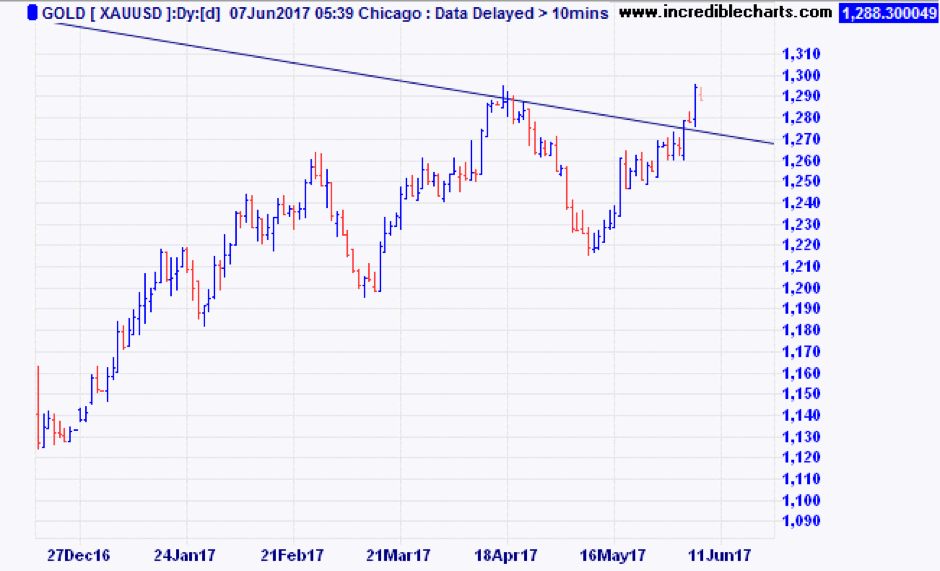

That other commodity we have in reasonable abundance, denounced by some as a ‘barbarous relic’ is gold. Gold is at an interesting juncture, as it has broken free of the recent correlation with such grubby commodities as iron, oil and coal, and has just broken above a downtrend line that goes back to the peak in September 2011 when gold peaked at $1,882 per ounce. Now, at $1,294, it is slowly grinding higher, helped by the fact that US interest rates look like they’re rising at a slower rate than previously expected.

If gold can sustain a rally into the $1,320 level, it will be looking good, and the next target to break would be $1,360.

Interest rates (updated to 7 June)

At the June meeting, the RBA decided to leave the cash rate at 1.50%, following the same decision in May. The decision was expected given underlying economic conditions still warrant an easy monetary policy.

Immediately post the announcement, equity markets had fallen (due to the RBA’s rather upbeat comments) whilst the Australian dollar was flat. The decision comes as no surprise, given we expect the RBA to be on hold this year and most of next year.

In spite of the RBA being on hold with interest rates, we do see banks becoming more selective in mortgage lending, and there is some risk of credit rationing in postcodes that are deemed high risk.

Comparing some of the rates from the big four lenders, owner-occupier loans seem to be mostly priced around 4.40% for variable rates less than 80% LVR, while investor loans are in the 4.80% to 5.20% range.

Borrowers should also be aware of APRA’s directive to the Australian banks to have less than 30% of new loans written as interest only and to keep below an overall 10% per annum growth in investor lending. If you want to get the inside story on the APRA directive, it is available here: APRA Sound Residential Lending Practices.