Australian Equities rose in October, but international shares fell, with the S&P500 index declining 2.66% and the FTSE100 UK index falling 4.75% in local currency terms. The slide was muted somewhat by currency translation where the Aussie fell from 71.6 US cents to 70.26 at month end.

To a large degree the global markets have been holding their collective breath until the US Election is firmly in the rear-view mirror. We may need to wait a few more days for any certainty on passing that milestone!

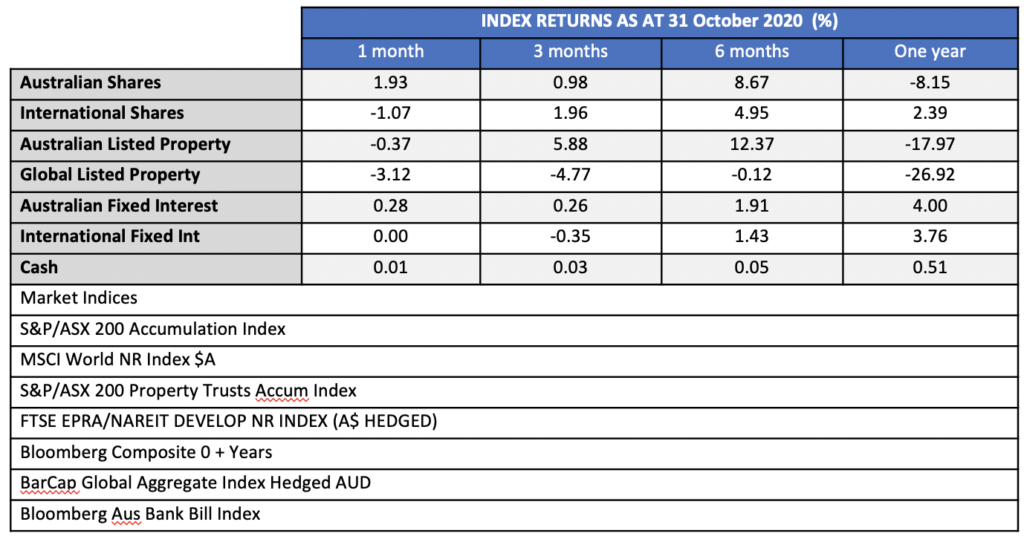

It was interesting to see that Australian Property, as represented by listed Real Estate Trusts, (A-REITs) were the best 6 month performer in our table below. Looking across at the one year column though shows that there is a still a long way to make up the -17.97% return for the last 12 months.

Fixed Income in Australia was slightly positive for the month and showed a decent return on an annualised basis. The ten year government bond yield fell from 0.87% to 0.83% providing a slight increase to the market price. Three year government bonds started the month at 0.17% and finished at 0.13% also providing a bit of capital gain. US three year bonds on the other hand started at 0.15% and finished at 0.19% creating a small capital loss.

The Reserve Bank held its meeting on November 3rd and the results of the meeting could be said to be just as unusual as a Melbourne Cup without the spectators. Cutting rates from 0.25% to 0.10% may not have generated that much excitement among mortgage holders, but the RBA didn’t want to take a risk that a positive interest rate attracted too much capital, thereby pushing the currency higher. The general approach by the Reserve Bank is that “everyone is doing it” so they need to be on the front foot as global central banks all pursue ‘un-conventional’ monetary policies.

They also announced a bond buying program to buy up to $100 million of ‘second hand’ bonds. We say second hand because that means someone else has to first buy newly issued government bonds, but the RBA is standing ready to take them over if institutions and banks want to sell. The day after the announcement, the ten year government bond yield fell from 0.86% to 0.76%.

While it had a short term effect on pushing down the Australian dollar, which fell from 71.6 cents to 70.48 cents, the following hours saw it rally back up to 72 cents.

US Elections are the big news in November. On the day of the election (Nov 3) markets were volatile, but no more than a normal day. Naturally market commentators had to find a reason for every wriggle in the tape, but it seemed no different from any other day. On Wednesday, the S&P500 seemed to just get on with an upward move in spite of the fact that there was still uncertainty on the outcome.

If, as it appears at the time of writing this, the Americans end up with a Democrat president, and a Republican controlled Senate, it is likely to be positive for financial markets.

The train of thought expressed by some going into the election was that a Democrat president, and Senate, would see increases to corporate tax rates and an increase in capital gains taxes. Both are excuses to sell equities and crystalise gains at a lower tax rate, prior to any reduction in profits through higher corporate tax rates.

With Republicans in control of the Senate, it would seem less likely that tax increases, either on corporate profits or capital gains, will be enacted. It may also be harder for the Democrats to push through their proposed $2.2 trillion stimulus bill, which may be why tech did better than cyclical stocks the day after the election.

An additional angle on the outcome of a Democrat president combined with a Republican Congress, is that anti-trust regulation against the tech behemoths is less likely to be enacted. Perhaps that’s a further reason why the FAANG stocks had a great rally the day after the election with Facebook gaining 8.32%, Amazon up 6.32% and Google up 6.09%.

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.