In this week’s short market commentary “ the dust has not settled” we hear from the team at Macquarie regarding their thoughts on the impact of growing Covid case numbers in the US and Europe, as well as the all important US election next week.

Global equity markets were down sharply overnight as escalating COVID-19 cases throughout Europe and the US combined with another stalled round of US fiscal stimulus plans drove a bout of broad profit taking. We entered October and the final run-up to the US presidential election with a tactically cautious outlook so are not particularly concerned with overnight weakness. We think the current set of factors affecting markets and confidence – primarily US presidential election uncertainty, another wave of COVID-19 outbreaks in Europe/UK/US, stalled US fiscal stimulus plans and extended equity market valuations – are all likely to remain short term drags which drive an attitude adjustment rather than a shift in cyclical recovery hopes.

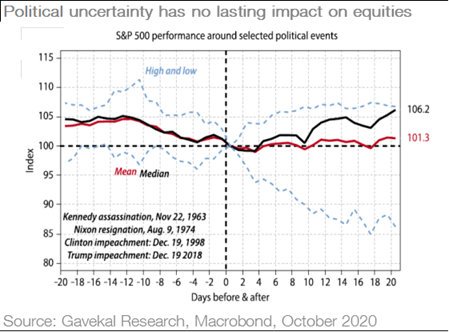

In the near term, uncertainty is on the rise. This is because the eventual winner of the US presidential election might not be known for some time, the timing of a COVID-19 vaccine remains indeterminate and because political infighting is clearly delaying further US fiscal stimulus (potentially until early 2021). We still don’t think these risks are insurmountable. They simply require investors remain patient and focused on the broad underlying trends rather than getting caught up in the noise, which usually is not news. We do know that a vaccine is on its way, that US presidential elections have not led to an extended period of equity market weakness or a sustained rise in bond yields and that governments are better prepared for dealing with further COVID-19 scares and these are all positive.

We still hold the view that targeted rather than broad lock-downs will be used to address the latest COVID-19 spikes. Further lock down restrictions will likely shift baseline economic growth expectations lower in coming months (Europe is already sagging and leading this trend lower), but the assumption that most economies can avoid a return to the most severe of social containment policies still holds. This might seem at odds with latest COVID-19 cases, but there are a few key differences. First, hospitalization rates, have for the most part, remained low despite the rise in cases. Second, governments and health authorities are better prepared with tracing and therapeutics that can help mitigate the spread / impacts. And third, it’s hard to use the first wave outbreak as a benchmark given testing rates have dramatically improved (and broadened) over the past 6 month period. Nevertheless, conditions are fluid and downside risks to economic momentum are clearly on the rise – driving asymmetry and greater divergence between economies and markets into 2021 (i.e. China is booming, Europe & US look to be weakening while Australia should begin to benefit from successful containment and reopening of internal borders).

Ultimately, monetary and fiscal policy support should remain in place, but if the pace of this support slows (or is delayed) while economic momentum is already flattening, then this begins to undermine the V-shaped recovery built into risk assets. We think investors should focus on the medium-term outlook rather than getting overly concerned with near term outcomes which are more uncertain. We are confident that the combination of central bank and government policy support alongside a COVID-19 vaccine will underpin a stronger economic backdrop into 2021 and that this will be positive for equity markets, credit and alternative asset strategies. Rising volatility is expected and extended equity market valuations exacerbate profit taking, but, the path towards stronger growth should not be more than temporarily interrupted.

We don’t think the equity bull market is over and investors should remain positioned for further upside, be prepared to hold cash and wait till the dust settles. We don’t see bond yields going much lower, but limited inflation risk suggests an increase will be gradual and potentially modest. This drives our continued preference for credit over sovereign bonds and investment grade over high yield due to rising delinquency risk. Investors should look through this period of uncertainty with the intention of being positioned for a more normalized economic environment. This means taking advantage of any weakness to position portfolios in line with longer term objectives and in a pro-cyclical way.

Disclaimer:

This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to their objectives, financial situation and needs.