With the new year here and the weeks flying by already, we’ve all been trying to keep our resolutions. Most of us set the usual each year; get fit, eat better, spend more time with the family. I hear the same kinds of things when I see clients each year; “I’ll keep cleaner records”, “I’ll come in earlier next year”, “I will keep track of my receipts”.

Without extreme motivation or an external driving force, both of these resolutions quickly fall back into the same habits of the year before.

I can’t help you stick to your New Year’s resolutions, but I can offer a little lifesaver when it comes to keeping track of your tax receipts for 2017.

Apps to keep track

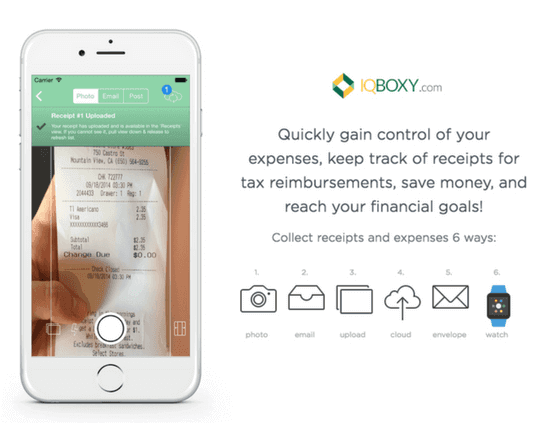

A few of us around the office have been playing with a few different apps on both iPhone and Android devices and there appears to be a clear standout. CamScanner (Android) or iqBoxy (iPhone) offers the ability to “scan in” receipts via the camera and sort into folders within the application.

You can add relevant notes to receipts, which can be useful come tax time and a whole 12 months or longer after some purchases have been made.

These folders can then be exported to pdf and sent straight to your accountant for year-end preparation. The app also has the functionality to add in an extra collaborator, up to 10 on the free version, which can be extremely useful for small businesses to speed up expense claims or substantiate business purchases.

I usually clean out my wallet once a week, scanning in all of my receipts and sorting them into the relevant folders. It’s much more manageable for me this way rather than trying to set aside time each day, and saves my receipts from fading if I wait until year end.

It’s not too late to start

Even if you haven’t set any resolutions, it’s never too late. There’s no time like the present.

There are more apps out there in the marketplace than the time available to explore them all. If you have any other app needs or have discovered a great one that could be useful to others in similar situations, please don’t hesitate to let us know.